The Determinant and Trade Potential of Export of the ... - Wbiaus.org

The Determinant and Trade Potential of Export of the ... - Wbiaus.org

The Determinant and Trade Potential of Export of the ... - Wbiaus.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

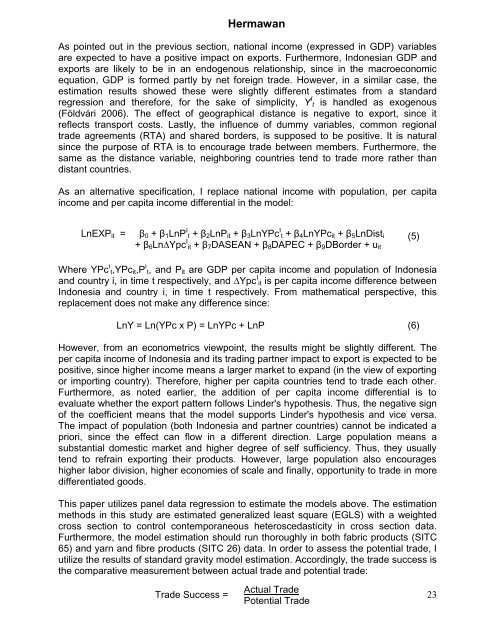

HermawanAs pointed out in <strong>the</strong> previous section, national income (expressed in GDP) variablesare expected to have a positive impact on exports. Fur<strong>the</strong>rmore, Indonesian GDP <strong>and</strong>exports are likely to be in an endogenous relationship, since in <strong>the</strong> macroeconomicequation, GDP is formed partly by net foreign trade. However, in a similar case, <strong>the</strong>estimation results showed <strong>the</strong>se were slightly different estimates from a st<strong>and</strong>ardregression <strong>and</strong> <strong>the</strong>refore, for <strong>the</strong> sake <strong>of</strong> simplicity, Y I t is h<strong>and</strong>led as exogenous(Földvári 2006). <strong>The</strong> effect <strong>of</strong> geographical distance is negative to export, since itreflects transport costs. Lastly, <strong>the</strong> influence <strong>of</strong> dummy variables, common regionaltrade agreements (RTA) <strong>and</strong> shared borders, is supposed to be positive. It is naturalsince <strong>the</strong> purpose <strong>of</strong> RTA is to encourage trade between members. Fur<strong>the</strong>rmore, <strong>the</strong>same as <strong>the</strong> distance variable, neighboring countries tend to trade more ra<strong>the</strong>r th<strong>and</strong>istant countries.As an alternative specification, I replace national income with population, per capitaincome <strong>and</strong> per capita income differential in <strong>the</strong> model:LnEXP it =β 0 + β 1 LnP I t + β 2 LnP it + β 3 LnYPc I t + β 4 LnYPc it + β 5 LnDist i+ β 6 Ln∆Ypc I it + β 7 DASEAN + β 8 DAPEC + β 9 DBorder + u it(5)Where YPc I t,YPc it ,Pβ 6 I t, LnDIST <strong>and</strong> P i it+ are β 7 DASEAN GDP per + capita β 8 DAPEC income + β 9 <strong>and</strong> DBorder population + u it <strong>of</strong> Indonesia<strong>and</strong> country i, in time t respectively, <strong>and</strong> ∆Ypc I it is per capita income difference betweenIndonesia <strong>and</strong> country i, in time t respectively. From ma<strong>the</strong>matical perspective, thisreplacement does not make any difference since:LnY = Ln(YPc x P) = LnYPc + LnP (6)However, from an econometrics viewpoint, <strong>the</strong> results might be slightly different. <strong>The</strong>per capita income <strong>of</strong> Indonesia <strong>and</strong> its trading partner impact to export is expected to bepositive, since higher income means a larger market to exp<strong>and</strong> (in <strong>the</strong> view <strong>of</strong> exportingor importing country). <strong>The</strong>refore, higher per capita countries tend to trade each o<strong>the</strong>r.Fur<strong>the</strong>rmore, as noted earlier, <strong>the</strong> addition <strong>of</strong> per capita income differential is toevaluate whe<strong>the</strong>r <strong>the</strong> export pattern follows Linder's hypo<strong>the</strong>sis. Thus, <strong>the</strong> negative sign<strong>of</strong> <strong>the</strong> coefficient means that <strong>the</strong> model supports Linder's hypo<strong>the</strong>sis <strong>and</strong> vice versa.<strong>The</strong> impact <strong>of</strong> population (both Indonesia <strong>and</strong> partner countries) cannot be indicated apriori, since <strong>the</strong> effect can flow in a different direction. Large population means asubstantial domestic market <strong>and</strong> higher degree <strong>of</strong> self sufficiency. Thus, <strong>the</strong>y usuallytend to refrain exporting <strong>the</strong>ir products. However, large population also encourageshigher labor division, higher economies <strong>of</strong> scale <strong>and</strong> finally, opportunity to trade in moredifferentiated goods.This paper utilizes panel data regression to estimate <strong>the</strong> models above. <strong>The</strong> estimationmethods in this study are estimated generalized least square (EGLS) with a weightedcross section to control contemporaneous heteroscedasticity in cross section data.Fur<strong>the</strong>rmore, <strong>the</strong> model estimation should run thoroughly in both fabric products (SITC65) <strong>and</strong> yarn <strong>and</strong> fibre products (SITC 26) data. In order to assess <strong>the</strong> potential trade, Iutilize <strong>the</strong> results <strong>of</strong> st<strong>and</strong>ard gravity model estimation. Accordingly, <strong>the</strong> trade success is<strong>the</strong> comparative measurement between actual trade <strong>and</strong> potential trade:<strong>Trade</strong> Success =Actual <strong>Trade</strong><strong>Potential</strong> <strong>Trade</strong>23