SME QIANG - Singapore Manufacturing Federation

SME QIANG - Singapore Manufacturing Federation

SME QIANG - Singapore Manufacturing Federation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

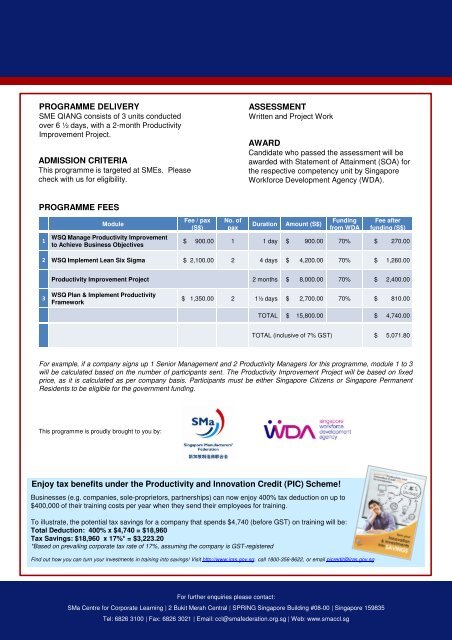

MODULE OUTLINEPROGRAMME DELIVERY<strong>SME</strong> <strong>QIANG</strong> consists of 3 units conductedover 6 ½ days, with a 2-month ProductivityImprovement Project.ADMISSION CRITERIAThis programme is targeted at <strong>SME</strong>s. Pleasecheck with us for eligibility.ASSES<strong>SME</strong>NTWritten and Project WorkAWARDCandidate who passed the assessment will beawarded with Statement of Attainment (SOA) forthe respective competency unit by <strong>Singapore</strong>Workforce Development Agency (WDA).PROGRAMME FEES1ModuleWSQ Manage Productivity Improvementto Achieve Business ObjectivesFee / pax(S$)No. ofpaxDurationAmount (S$)Fundingfrom WDAFee afterfunding (S$)$ 900.00 1 1 day $ 900.00 70% $ 270.002 WSQ Implement Lean Six Sigma $ 2,100.00 2 4 days $ 4,200.00 70% $ 1,260.00Productivity Improvement Project 2 months $ 8,000.00 70% $ 2,400.003WSQ Plan & Implement ProductivityFramework$ 1,350.00 2 1½ days $ 2,700.00 70% $ 810.00TOTAL $ 15,800.00 $ 4,740.00TOTAL (inclusive of 7% GST) $ 5,071.80For example, if a company signs up 1 Senior Management and 2 Productivity Managers for this programme, module 1 to 3will be calculated based on the number of participants sent. The Productivity Improvement Project will be based on fixedprice, as it is calculated as per company basis. Participants must be either <strong>Singapore</strong> Citizens or <strong>Singapore</strong> PermanentResidents to be eligible for the government funding.This programme is proudly brought to you by:Enjoy tax benefits under the Productivity and Innovation Credit (PIC) Scheme!Businesses (e.g. companies, sole-proprietors, partnerships) can now enjoy 400% tax deduction on up to$400,000 of their training costs per year when they send their employees for training.To illustrate, the potential tax savings for a company that spends $4,740 (before GST) on training will be:Total Deduction: 400% x $4,740 = $18,960Tax Savings: $18,960 x 17%* = $3,223.20*Based on prevailing corporate tax rate of 17%, assuming the company is GST-registeredFind out how you can turn your investments in training into savings! Visit http://www.iras.gov.sg, call 1800-356-8622, or email picredit@iras.gov.sgFor further enquiries please contact:SMa Centre for Corporate Learning | 2 Bukit Merah Central | SPRING <strong>Singapore</strong> Building #08-00 | <strong>Singapore</strong> 159835Tel: 6826 3100 | Fax: 6826 3021 | Email: ccl@smafederation.org.sg | Web: www.smaccl.sg