Do emotions matter? Coherent preferences under anchoring and ...

Do emotions matter? Coherent preferences under anchoring and ...

Do emotions matter? Coherent preferences under anchoring and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

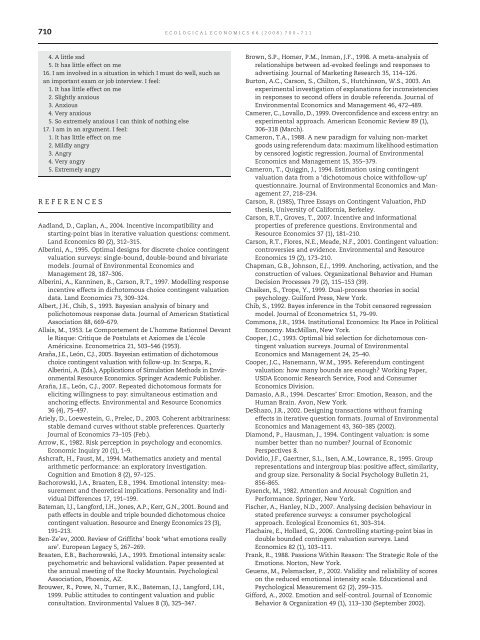

710 ECOLOGICAL ECONOMICS 66 (2008) 700– 7114. A little sad5. It has little effect on me16. I am involved in a situation in which I must do well, such asan important exam or job interview. I feel:1. It has little effect on me2. Slightly anxious3. Anxious4. Very anxious5. So extremely anxious I can think of nothing else17. I am in an argument. I feel:1. It has little effect on me2. Mildly angry3. Angry4. Very angry5. Extremely angryREFERENCESAadl<strong>and</strong>, D., Caplan, A., 2004. Incentive incompatibility <strong>and</strong>starting-point bias in iterative valuation questions: comment.L<strong>and</strong> Economics 80 (2), 312–315.Alberini, A., 1995. Optimal designs for discrete choice contingentvaluation surveys: single-bound, double-bound <strong>and</strong> bivariatemodels. Journal of Environmental Economics <strong>and</strong>Management 28, 187–306.Alberini, A., Kanninen, B., Carson, R.T., 1997. Modelling responseincentive effects in dichotomous choice contingent valuationdata. L<strong>and</strong> Economics 73, 309–324.Albert, J.H., Chib, S., 1993. Bayesian analysis of binary <strong>and</strong>polichotomous response data. Journal of American StatisticalAssociation 88, 669–679.Allais, M., 1953. Le Comportement de L'homme Rationnel Devantle Risque: Critique de Postulats et Axiomes de L'écoleAméricaine. Econometrica 21, 503–546 (1953).Araña, J.E., León, C.J., 2005. Bayesian estimation of dichotomouschoice contingent valuation with follow-up. In: Scarpa, R.,Alberini, A. (Eds.), Applications of Simulation Methods in EnvironmentalResource Economics. Springer Academic Publisher.Araña, J.E., León, C.J., 2007. Repeated dichotomous formats foreliciting willingness to pay: simultaneous estimation <strong>and</strong><strong>anchoring</strong> effects. Environmental <strong>and</strong> Resource Economics36 (4), 75–497.Ariely, D., Loewestein, G., Prelec, D., 2003. <strong>Coherent</strong> arbitrariness:stable dem<strong>and</strong> curves without stable <strong>preferences</strong>. QuarterlyJournal of Economics 73–105 (Feb.).Arrow, K., 1982. Risk perception in psychology <strong>and</strong> economics.Economic Inquiry 20 (1), 1–9.Ashcraft, H., Faust, M., 1994. Mathematics anxiety <strong>and</strong> mentalarithmetic performance: an exploratory investigation.Cognition <strong>and</strong> Emotion 8 (2), 97–125.Bachorowski, J.A., Braaten, E.B., 1994. Emotional intensity: measurement<strong>and</strong> theoretical implications. Personality <strong>and</strong> IndividualDifferences 17, 191–199.Bateman, I.J., Langford, I.H., Jones, A.P., Kerr, G.N., 2001. Bound <strong>and</strong>path effects in double <strong>and</strong> triple bounded dichotomous choicecontingent valuation. Resource <strong>and</strong> Energy Economics 23 (3),191–213.Ben-Ze'ev, 2000. Review of Griffiths' book ‘what <strong>emotions</strong> reallyare’. European Legacy 5, 267–269.Braaten, E.B., Bachorowski, J.A., 1993. Emotional intensity scale:psychometric <strong>and</strong> behavioral validation. Paper presented atthe annual meeting of the Rocky Mountain. PsychologicalAssociation, Phoenix, AZ.Brouwer, R., Powe, N., Turner, R.K., Bateman, I.J., Langford, I.H.,1999. Public attitudes to contingent valuation <strong>and</strong> publicconsultation. Environmental Values 8 (3), 325–347.Brown, S.P., Homer, P.M., Inman, J.F., 1998. A meta-analysis ofrelationships between ad-evoked feelings <strong>and</strong> responses toadvertising. Journal of Marketing Research 35, 114–126.Burton, A.C., Carson, S., Chilton, S., Hutchinson, W.S., 2003. Anexperimental investigation of explanations for inconsistenciesin responses to second offers in double referenda. Journal ofEnvironmental Economics <strong>and</strong> Management 46, 472–489.Camerer, C., Lovallo, D., 1999. Overconfidence <strong>and</strong> excess entry: anexperimental approach. American Economic Review 89 (1),306–318 (March).Cameron, T.A., 1988. A new paradigm for valuing non-marketgoods using referendum data: maximum likelihood estimationby censored logistic regression. Journal of EnvironmentalEconomics <strong>and</strong> Management 15, 355–379.Cameron, T., Quiggin, J., 1994. Estimation using contingentvaluation data from a ‘dichotomous choice withfollow-up'questionnaire. Journal of Environmental Economics <strong>and</strong> Management27, 218–234.Carson, R. (1985), Three Essays on Contingent Valuation, PhDthesis, University of California, Berkeley.Carson, R.T., Groves, T., 2007. Incentive <strong>and</strong> informationalproperties of preference questions. Environmental <strong>and</strong>Resource Economics 37 (1), 181–210.Carson, R.T., Flores, N.E., Meade, N.F., 2001. Contingent valuation:controversies <strong>and</strong> evidence. Environmental <strong>and</strong> ResourceEconomics 19 (2), 173–210.Chapman, G.B., Johnson, E.J., 1999. Anchoring, activation, <strong>and</strong> theconstruction of values. Organizational Behavior <strong>and</strong> HumanDecision Processes 79 (2), 115–153 (39).Chaiken, S., Trope, Y., 1999. Dual-process theories in socialpsychology. Guilford Press, New York.Chib, S., 1992. Bayes inference in the Tobit censored regressionmodel. Journal of Econometrics 51, 79–99.Commons, J.R., 1934. Institutional Economics: Its Place in PoliticalEconomy. MacMillan, New York.Cooper, J.C., 1993. Optimal bid selection for dichotomous contingentvaluation surveys. Journal of EnvironmentalEconomics <strong>and</strong> Management 24, 25–40.Cooper, J.C., Hanemann, W.M., 1995. Referendum contingentvaluation: how many bounds are enough? Working Paper,USDA Economic Research Service, Food <strong>and</strong> ConsumerEconomics Division.Damasio, A.R., 1994. Descartes' Error: Emotion, Reason, <strong>and</strong> theHuman Brain. Avon, New York.DeShazo, J.R., 2002. Designing transactions without framingeffects in iterative question formats. Journal of EnvironmentalEconomics <strong>and</strong> Management 43, 360–385 (2002).Diamond, P., Hausman, J., 1994. Contingent valuation: is somenumber better than no number? Journal of EconomicPerspectives 8.<strong>Do</strong>vidio, J.F., Gaertner, S.L., Isen, A.M., Lowrance, R., 1995. Grouprepresentations <strong>and</strong> intergroup bias: positive affect, similarity,<strong>and</strong> group size. Personality & Social Psychology Bulletin 21,856–865.Eysenck, M., 1982. Attention <strong>and</strong> Arousal: Cognition <strong>and</strong>Performance. Springer, New York.Fischer, A., Hanley, N.D., 2007. Analysing decision behaviour instated preference surveys: a consumer psychologicalapproach. Ecological Economics 61, 303–314.Flachaire, E., Hollard, G., 2006. Controlling starting-point bias indouble bounded contingent valuation surveys. L<strong>and</strong>Economics 82 (1), 103–111.Frank, R., 1988. Passions Within Reason: The Strategic Role of theEmotions. Norton, New York.Geuens, M., Pelsmacker, P., 2002. Validity <strong>and</strong> reliability of scoreson the reduced emotional intensity scale. Educational <strong>and</strong>Psychological Measurement 62 (2), 299–315.Gifford, A., 2002. Emotion <strong>and</strong> self-control. Journal of EconomicBehavior & Organization 49 (1), 113–130 (September 2002).