HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

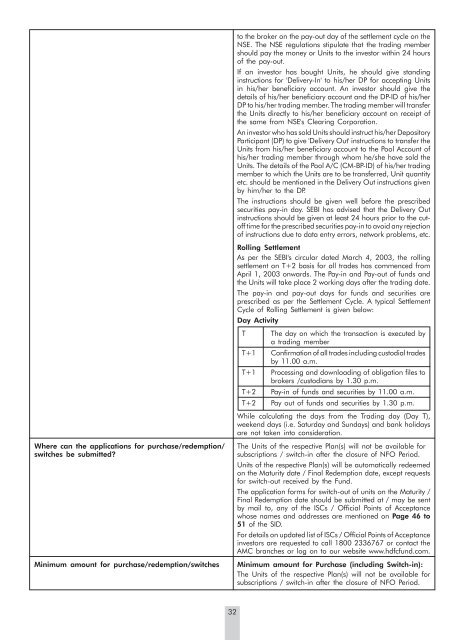

Where can the applications for purchase/redemption/switches be submitted?Minimum amount for purchase/redemption/switchesto the broker on the pay-out day of the settlement cycle on theNSE. The NSE regulations stipulate that the trading membershould pay the money or Units to the investor within 24 hoursof the pay-out.If an investor has bought Units, he should give st<strong>and</strong>inginstructions for 'Delivery-In' to his/her DP for accepting Unitsin his/her beneficiary account. An investor should give thedetails of his/her beneficiary account <strong>and</strong> the DP-ID of his/herDP to his/her trading member. The trading member will transferthe Units directly to his/her beneficiary account on receipt ofthe same from NSE's Clearing Corporation.An investor who has sold Units should instruct his/her DepositoryParticipant (DP) to give 'Delivery Out' instructions to transfer theUnits from his/her beneficiary account to the Pool Account ofhis/her trading member through whom he/she have sold theUnits. The details of the Pool A/C (CM-BP-ID) of his/her tradingmember to which the Units are to be transferred, Unit quantityetc. should be mentioned in the Delivery Out instructions givenby him/her to the DP.The instructions should be given well before the prescribedsecurities pay-in day. SEBI has advised that the Delivery Outinstructions should be given at least 24 hours prior to the cutofftime for the prescribed securities pay-in to avoid any rejectionof instructions due to data entry errors, network problems, etc.Rolling SettlementAs per the SEBI's circular dated March 4, 2003, the rollingsettlement on T+2 basis for all trades has commenced fromApril 1, 2003 onwards. The Pay-in <strong>and</strong> Pay-out of funds <strong>and</strong>the Units will take place 2 working days after the trading date.The pay-in <strong>and</strong> pay-out days for funds <strong>and</strong> securities areprescribed as per the Settlement Cycle. A typical SettlementCycle of Rolling Settlement is given below:Day ActivityT The day on which the transaction is executed bya trading memberT+1 Confirmation of all trades including custodial tradesby 11.00 a.m.T+1 Processing <strong>and</strong> downloading of obligation files tobrokers /custodians by 1.30 p.m.T+2 Pay-in of funds <strong>and</strong> securities by 11.00 a.m.T+2 Pay out of funds <strong>and</strong> securities by 1.30 p.m.While calculating the days from the Trading day (Day T),weekend days (i.e. Saturday <strong>and</strong> Sundays) <strong>and</strong> bank holidaysare not taken into consideration.The Units of the respective Plan(s) will not be available forsubscriptions / switch-in after the closure of NFO Period.Units of the respective Plan(s) will be automatically redeemedon the <strong>Maturity</strong> date / Final Redemption date, except requestsfor switch-out received by the Fund.The application forms for switch-out of units on the <strong>Maturity</strong> /Final Redemption date should be submitted at / may be sentby mail to, any of the ISCs / Official Points of Acceptancewhose names <strong>and</strong> addresses are mentioned on Page 46 to51 of the SID.For details on updated list of ISCs / Official Points of Acceptanceinvestors are requested to call 1800 2336767 or contact theAMC branches or log on to our website www.hdfcfund.com.Minimum amount for Purchase (including Switch-in):The Units of the respective Plan(s) will not be available forsubscriptions / switch-in after the closure of NFO Period.32