HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

HDFC Fixed Maturity Plans - Series XIX - Securities and Exchange ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

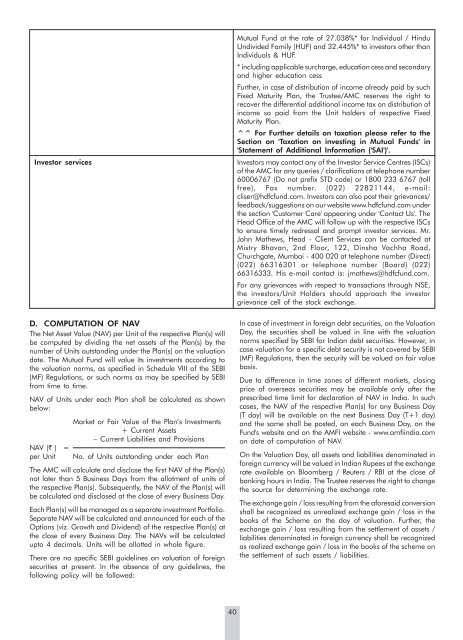

Investor servicesD. COMPUTATION OF NAVThe Net Asset Value (NAV) per Unit of the respective Plan(s) willbe computed by dividing the net assets of the Plan(s) by thenumber of Units outst<strong>and</strong>ing under the Plan(s) on the valuationdate. The Mutual Fund will value its investments according tothe valuation norms, as specified in Schedule VIII of the SEBI(MF) Regulations, or such norms as may be specified by SEBIfrom time to time.NAV of Units under each Plan shall be calculated as shownbelow:NAV (M ) =per UnitMarket or Fair Value of the Plan’s Investments+ Current Assets– Current Liabilities <strong>and</strong> ProvisionsNo. of Units outst<strong>and</strong>ing under each PlanThe AMC will calculate <strong>and</strong> disclose the first NAV of the Plan(s)not later than 5 Business Days from the allotment of units ofthe respective Plan(s). Subsequently, the NAV of the Plan(s) willbe calculated <strong>and</strong> disclosed at the close of every Business Day.Each Plan(s) will be managed as a separate investment Portfolio.Separate NAV will be calculated <strong>and</strong> announced for each of theOptions (viz. Growth <strong>and</strong> Dividend) of the respective Plan(s) atthe close of every Business Day. The NAVs will be calculatedupto 4 decimals. Units will be allotted in whole figure.There are no specific SEBI guidelines on valuation of foreignsecurities at present. In the absence of any guidelines, thefollowing policy will be followed:Mutual Fund at the rate of 27.038%* for Individual / HinduUndivided Family (HUF) <strong>and</strong> 32.445%* to investors other thanIndividuals & HUF.* including applicable surcharge, education cess <strong>and</strong> secondary<strong>and</strong> higher education cessFurther, in case of distribution of income already paid by such<strong>Fixed</strong> <strong>Maturity</strong> Plan, the Trustee/AMC reserves the right torecover the differential additional income tax on distribution ofincome so paid from the Unit holders of respective <strong>Fixed</strong><strong>Maturity</strong> Plan.^^ For Further details on taxation please refer to theSection on 'Taxation on investing in Mutual Funds' in'Statement of Additional Information ('SAI')'.Investors may contact any of the Investor Service Centres (ISCs)of the AMC for any queries / clarifications at telephone number60006767 (Do not prefix STD code) or 1800 233 6767 (tollfree), Fax number. (022) 22821144, e-mail:cliser@hdfcfund.com. Investors can also post their grievances/feedback/suggestions on our website www.hdfcfund.com underthe section 'Customer Care' appearing under 'Contact Us'. TheHead Office of the AMC will follow up with the respective ISCsto ensure timely redressal <strong>and</strong> prompt investor services. Mr.John Mathews, Head - Client Services can be contacted atMistry Bhavan, 2nd Floor, 122, Dinsha Vachha Road,Churchgate, Mumbai - 400 020 at telephone number (Direct)(022) 66316301 or telephone number (Board) (022)66316333. His e-mail contact is: jmathews@hdfcfund.com.For any grievances with respect to transactions through NSE,the investors/Unit Holders should approach the investorgrievance cell of the stock exchange.In case of investment in foreign debt securities, on the ValuationDay, the securities shall be valued in line with the valuationnorms specified by SEBI for Indian debt securities. However, incase valuation for a specific debt security is not covered by SEBI(MF) Regulations, then the security will be valued on fair valuebasis.Due to difference in time zones of different markets, closingprice of overseas securities may be available only after theprescribed time limit for declaration of NAV in India. In suchcases, the NAV of the respective Plan(s) for any Business Day(T day) will be available on the next Business Day (T+1 day)<strong>and</strong> the same shall be posted, on each Business Day, on theFund's website <strong>and</strong> on the AMFI website - www.amfiindia.comon date of computation of NAV.On the Valuation Day, all assets <strong>and</strong> liabilities denominated inforeign currency will be valued in Indian Rupees at the exchangerate available on Bloomberg / Reuters / RBI at the close ofbanking hours in India. The Trustee reserves the right to changethe source for determining the exchange rate.The exchange gain / loss resulting from the aforesaid conversionshall be recognized as unrealized exchange gain / loss in thebooks of the Scheme on the day of valuation. Further, theexchange gain / loss resulting from the settlement of assets /liabilities denominated in foreign currency shall be recognizedas realized exchange gain / loss in the books of the scheme onthe settlement of such assets / liabilities.40