English - PRAVASI BHARATIYA - Overseas Indian

English - PRAVASI BHARATIYA - Overseas Indian

English - PRAVASI BHARATIYA - Overseas Indian

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

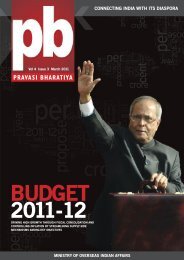

COVER STORYBUDGET 2010-11WAY FORWARD: Finance Minister Pranab Mukherjee leaves for Parliament House to present Budget 2010-11, inNew Delhi on February 26. Ministers of State for Finance S.S. Palanimanickam and Namo Narain Meena, andother officials are seen.GROWTH, PRUDENCEFinance Minister Pranab Mukherjee does a deft balancing act to table agrowth-oriented but fiscally prudent Budget — the fourth of his careerIndia’s Finance Minister, 74-year old veteran politicianPranab Mukherjee, is known to be a man ofmany parts. But that he was also an expert intight- rope walking became evident on February26, 2010 when he presented the fourth Union budget ofhis career as Finance Minister and the second for theUnited Progressive Alliance (UPA) government in itssecond straight term after being voted back to office inMay last year.“Given the global as well as domestic circumstances,this is a very well-balanced budget,” said JagannadhamBUDGEThighlightsThunuguntla, equity head of India’s fourth-largestshare broking firm, the Delhi-based SMC Capitals Ltd.“While the budget is growth oriented with publicexpenditure slated to go into all the right areas, it alsolays down a roadmap for bringing down the budgetdeficit to prudent levels,” Thunuguntla said.Mukherjee had a tough task on hand. On one hand,he had to ensure that the budget was growth oriented(high public expenditure on infrastructure and socialsectors and lower taxes to ensure higher disposableincome in the hands of citizens) and on the other fisvPetrol and diesel prices to go up as basic dutyof 5 percent on crude petroleum, 7.5 percenton diesel and petrol and 10 percent on otherrefined products restored; central excise dutyon petrol and diesel enhanced by Re. 1 per litrev Taxes on large cars and SUVs increased 2 percentto 22 percentv Income up to Rs. 160,000 per year exemptfrom income tax; up to Rs. 500,000 to betaxed at 10 percent; income of Rs. 500,000-800,000 to be taxed at 20 percent and incomeabove Rs. 800,000 to be taxed at 30 percentv If tax is deducted on payment by way of anyexpense and is paid before the due date of filingthe return, such expense to be allowed fordeduction; interest charged on tax deductedbut not deposited by the specified date to beincreased from 12 to 18 percent per yearv Total budget expenditure Rs. 11,087.49 billion,an increase of 8.6 percent over last yearv Plan allocation for power sector, excludingRajiv Gandhi rural electrification programme,doubled from Rs. 22.30 billion in 2009-10 toRs. 51.30 billion in 2010-11v Spending on social sector increased to Rs.1,376.74 billion, which is 37 percent of thetotal plan outlayv Rs. 1,473.44 billion allocated for defencev Allocation on primary education raised fromRs. 268 billion to Rs. 313 billionv Forty-six percent of allocations will be forinfrastructure developmentcally prudent (lower fiscal deficit and government borrowing).The tasks were contradictory and Mukherjeehad to do extensive tight rope walking to meet both thecontradictory objectives.“In the circumstances he seems to have squared somecircles,” said noted economist and fellow of the DelhibasedCentre for Policy Research, Dr. ParthaMukhopadhya. “This budget is also influenced by slowdownfears — hence, government spending will remainhigh enough despite reigning in the fiscal deficit somewhat,while there are tax reliefs which should spurdomestic demand and help the recovery process.”The key features of this year’s $221.75 billion budgethas been a sizeable tax relief for individuals, thebeginning of a gradual phase out of the three roundsof stimulus packages announced by the governmentduring the last fiscal through hikes in excise rates andminimum alternate tax, stepped up outlays for infrastructuredevelopment and social welfare schemes andseveral measures aimed at ensuring high but inclusivegrowth.Individuals stand to gain on account of a revision intax slabs. But they will have to pay more for cars,BUDGET ALLOCATIONSTOTAL BUDGET EXPENDITURE2009-2010 2010-2011Rs. 10208.38 billion Rs. 11087.49 billionRAJIV AWAS YOGANA2009-2010 2010-2011Rs. 1.5 billion Rs. 12.70 billionNEW & RENEWABLE ENERGY SECTOR2009-2010 2010-2011Rs. 6.2 billion Rs. 10 billionPRIMARY EDUCATION2009-2010 2010-2011Rs. 268 billion Rs. 313 billionPOWER SECTOR2009-2010 2010-2011Rs. 22.3 billion Rs. 51.3 billionWOMEN & CHILD DEVELOPMENT2009-2010 2010-2011Rs. 73.5 billion Rs. 110 billionROADS & HIGHWAYS CONSTRUCTION2009-2010 2010-2011Rs. 175.2 billion Rs. 198.94 billionNATIONAL RURAL HEALTH MISSION2009-2010 2010-2011Rs. 139.3 billion Rs. 154.4 billionDEFENCE2009-2010 2010-2011Rs. 1417.03 billion Rs. 1473.44 billionNATIONAL RURAL EMPLOYMENT SCHEME2009-2010 2010-2011Rs. 391 billion Rs. 401 billion8.6%746%61%16.79%130%49.6%13.5%10.83%4%2.6%We hope to breachthe 10 percentgrowth mark in thenot-too-distantfuturecigarettes, petrol, diesel, cement, jewellery and a hostof consumer goods, even as they will shoulder higherairfares owing to the new service tax on air travel.Presenting the Budget in the Lok Sabha, the LowerHouse of the <strong>Indian</strong> Parliament, Finance MinisterPranab Mukherjee also estimated a lower fiscal deficitof 5.5 percent of gross domestic product, against therevised estimates of 6.7 percent for this fiscal (See Charton page 14).He said 46 percent of the plan allocation will be setaside for infrastructure alone and 37 percent for socialwelfare programmes, while outlays for rural and urbandevelopment schemes, as also for education and healthcarehave been substantially hiked.“Today, as I stand before you, I can say with someconfidence that we have weathered the crisis well,”Mukherjee said in his 100-minute speech. He proposedthe following tax slabs for individuals: No tax for anannual income of up to Rs. 160,000, a rate of 10 percentfor up to Rs. 500,000, then 20 percent for up to Rs.800,000 and finally 30 percent on anything higher.At the peak rate this will entail a saving of up to Rs.50,000, and an overall hit of $5.2 billion for the exchequer.“The proposal to reduce the tax slab will benefit60 percent of all tax payers,” Mukherjee said, bringingcheer to people.But he also sought to hike the minimum alternate taxto 18 percent of book profits from the present 15 percent,though he lowered the surcharge from 10 percentto 7.5 percent, which will have a direct impact on thebottomlines of large companies.The Finance Minister also sought to restore the 5percent basic duty on oil and 7.5 percent each onpetrol and diesel, and imposed a Rs. 1 excise on thesetwo fuels.On augmenting resources, he said $5 billion wasraised by way of divestment in state-run companiesduring the current fiscal, adding that he was budgetingfor $8 billion for the ensuing year.With regard to major policy reforms, the FinanceMinister promised to implement the direct tax code(DTC) and the goods and services tax (GST) from Aprilnext year and assured a simplified foreign investmentpolicy soon, even as excise rates were hiked across theboard by 200 basis points.He said three challenges remained for the economy— to quickly revert to high growth of 9 percent andcross to double-digit expansion through high publicinvestment in such areas as infrastructure whileensuring fiscal consolidation; make growth more inclusiveand improve governance to ensure a better publicdelivery mechanism.12 Pravasi Bharatiya March 2010 Pravasi Bharatiya March 2010 13

![flaxkiqj feuh izoklh Hkkjrh; fnol] vDVwcj 9&11 - Overseas Indian](https://img.yumpu.com/43977040/1/184x260/flaxkiqj-feuh-izoklh-hkkjrh-fnol-vdvwcj-911-overseas-indian.jpg?quality=85)