English - PRAVASI BHARATIYA - Overseas Indian

English - PRAVASI BHARATIYA - Overseas Indian

English - PRAVASI BHARATIYA - Overseas Indian

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

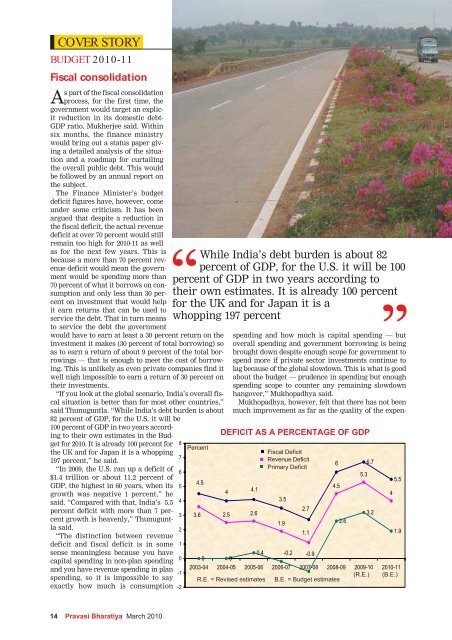

COVER STORYBUDGET 2010-11Fiscal consolidationAs part of the fiscal consolidationprocess, for the first time, thegovernment would target an explicitreduction in its domestic debt-GDP ratio, Mukherjee said. Withinsix months, the finance ministrywould bring out a status paper givinga detailed analysis of the situationand a roadmap for curtailingthe overall public debt. This wouldbe followed by an annual report onthe subject.The Finance Minister’s budgetdeficit figures have, however, comeunder some criticism. It has beenargued that despite a reduction inthe fiscal deficit, the actual revenuedeficit at over 70 percent would stillremain too high for 2010-11 as wellas for the next few years. This isbecause a more than 70 percent revenuedeficit would mean the governmentwould be spending more than70 percent of what it borrows on consumptionand only less than 30 percenton investment that would helpit earn returns that can be used toservice the debt. That in turn meansto service the debt the governmentwould have to earn at least a 30 percent return on theinvestment it makes (30 percent of total borrowing) soas to earn a return of about 9 percent of the total borrowings— that is enough to meet the cost of borrowing.This is unlikely as even private companies find itwell nigh impossible to earn a return of 30 percent ontheir investments.“If you look at the global scenario, India’s overall fiscalsituation is better than for most other countries,”said Thunuguntla. “While India’s debt burden is about82 percent of GDP, for the U.S. it will be100 percent of GDP in two years accordingto their own estimates in the Budgetfor 2010. It is already 100 percent forthe UK and for Japan it is a whopping197 percent,” he said.“In 2009, the U.S. ran up a deficit of$1.4 trillion or about 11.2 percent ofGDP, the highest in 60 years, when itsgrowth was negative 1 percent,” hesaid. “Compared with that, India’s 5.5percent deficit with more than 7 percentgrowth is heavenly,” Thunuguntlasaid.“The distinction between revenuedeficit and fiscal deficit is in somesense meaningless because you havecapital spending in non-plan spendingand you have revenue spending in planspending, so it is impossible to sayexactly how much is consumptionWhile India’s debt burden is about 82percent of GDP, for the U.S. it will be 100percent of GDP in two years according totheir own estimates. It is already 100 percentfor the UK and for Japan it is awhopping 197 percent876543210-1-2Percent4.53.64DEFICIT AS A PERCENTAGE OF GDP4.12.5 2.6Fiscal DeficitRevenue DeficitPrimary Deficit3.51.90 00.4 -0.2 -0.92003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11R.E. = Revised estimates B.E. = Budget estimates(R.E.) (B.E.)2.71.164.52.65.36.73.245.51.9THE GROWTH TURNPIKE: A highway recently convertedinto a four-lane expressway. Stepped up spending on roadprojects is a key instrument of boosting growth throughhigh public spending.spending and how much is capital spending — butoverall spending and government borrowing is beingbrought down despite enough scope for government tospend more if private sector investments continue tolag because of the global slowdown. This is what is goodabout the budget — prudence in spending but enoughspending scope to counter any remaining slowdownhangover,” Mukhopadhya said.Mukhopadhya, however, felt that there has not beenmuch improvement as far as the quality of the expenditureis concerned. Far too much is still being spenton consumption and less on projects that would bringin benefits in terms of returns to government or interms of alleviating poverty, he said.Improving investmentenvironmentWhile pointing out that foreign direct investmentflows at $20.9 billion during April-December, 2009against $21.1 billion for the same period the previousyear was steady despite the decline in global capitalflows, the Finance Minister said the government willmake FDI policy more user-friendly by consolidatingall prior regulations and guidelines into one comprehensivedocument. “This would enhance clarity andpredictability of our FDI policy to foreign investors,”he said.The government would also set up an apex levelFinancial Stability and Development Council with aview to strengthen and institutionalise the mechanismfor maintaining financial stability.The government would also increase the capitalisationof public sector and regional rural banks so thatthey can maintain a comfortable capital to risk weightedasset ratio and have adequate capital base to supportincreased lending.Recognising that the global recovery was still veryfragile, the finance minister announced that the 2 percentinterest subvention on pre-shipment export creditwould be extended for one more year till March 31,2011, for exports covering handicrafts, carpets, handloomsand small and medium enterprises.Mukherjee announced that to spur agriculturalECONOMIC SURVEYEncouraged by reforms and the strong macro-economicfundamentals, the Economic Survey haspredicted that India would return to a high 9percent growth in 2011-12 towards becoming theworld’s fastest growing economy in four years. The prebudgetEconomic Survey (2009-10), presented byFinance Minister Pranab Mukherjee in Parliament, alsorecommended a “gradual rollback” of stimulusmeasures after assessing sectoral impact.Projecting economic growth to touch up to 8.75percent in 2010-11 and 9 percent in the next year, theSurvey said: “It is entirely possible for India to move intothe rarefied domain of double digit growth and evenattempt to don the mantle” of the fastest growingeconomy in the world within the next four years.Some highlights:n Outlook for India’s trade sector in 2010 hasbrightenedn Bank credit to the commercial sector shows revivalsince November 2009n Proposal to double rural houses to12 million through the IndiraAwaas Yojana in the next five yearsn Core industries, infrastructure servicesshow recovery signs in themiddle of overall industrial growthn Employment increases by 500,000 in July-Septemberquarter compared to first quarter of current fiscaln Gross domestic product expected to grow 8.25-8.75percent in 2010-11n Centre, states need to begin fiscal consolidation, capdebt levelsn Food subsidy should be given to households, insteadof routing through the publicdistribution systemn Poor families should be given foodcoupons to buy at discount fromany shopn Liberalise foreign investment norms in education,healthcare sectorsn Sustaining current levels of domestic petroleumprices not viablen Expenditure restraint can help contain deficit atbudgeted levelsn High inflation due to supply-side bottlenecksn Growth in telecom to continue withmonthly additions exceeding 17.6 millionconnectionsn Share of central government expenditureon social services up by 19.46percent in the current fiscaln Foreign exchange reserves rise to $31.5billion in current fiscal to $283.5 billion till endDecember 2009n Balance of payment situation improves due to surgein capital flows and rise in foreign exchange reserves,accompanied by rupee appreciation14 Pravasi Bharatiya March 2010 Pravasi Bharatiya March 2010 15

![flaxkiqj feuh izoklh Hkkjrh; fnol] vDVwcj 9&11 - Overseas Indian](https://img.yumpu.com/43977040/1/184x260/flaxkiqj-feuh-izoklh-hkkjrh-fnol-vdvwcj-911-overseas-indian.jpg?quality=85)