Navigator - Prudential Annuities

Navigator - Prudential Annuities

Navigator - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

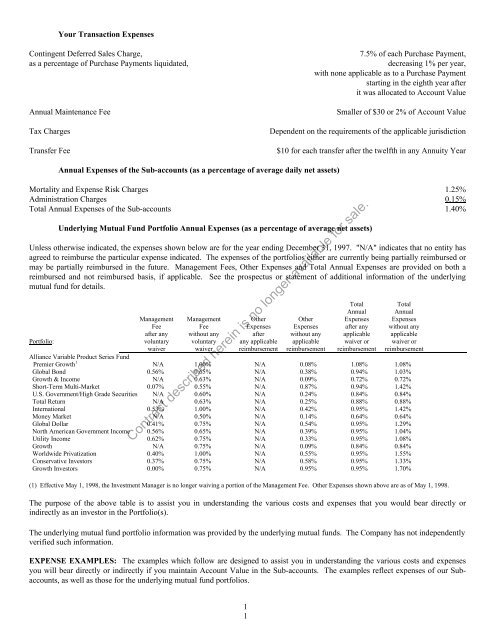

Your Transaction ExpensesContingent Deferred Sales Charge,as a percentage of Purchase Payments liquidated,Annual Maintenance FeeTax ChargesTransfer Fee7.5% of each Purchase Payment,decreasing 1% per year,with none applicable as to a Purchase Paymentstarting in the eighth year afterit was allocated to Account ValueSmaller of $30 or 2% of Account ValueDependent on the requirements of the applicable jurisdiction$10 for each transfer after the twelfth in any Annuity YearAnnual Expenses of the Sub-accounts (as a percentage of average daily net assets)Mortality and Expense Risk Charges 1.25%Administration Charges 0.15%Total Annual Expenses of the Sub-accounts 1.40%Underlying Mutual Fund Portfolio Annual Expenses (as a percentage of average net assets)Unless otherwise indicated, the expenses shown below are for the year ending December 31, 1997. "N/A" indicates that no entity hasagreed to reimburse the particular expense indicated. The expenses of the portfolios either are currently being partially reimbursed ormay be partially reimbursed in the future. Management Fees, Other Expenses and Total Annual Expenses are provided on both areimbursed and not reimbursed basis, if applicable. See the prospectus or statement of additional information of the underlyingmutual fund for details.TotalTotalAnnual AnnualManagement Management Other Other Expenses ExpensesFee Fee Expenses Expenses after any without anyafter any without any after without any applicable applicablePortfolio: voluntary voluntary any applicable applicable waiver or waiver orwaiver waiver reimbursement reimbursement reimbursement reimbursementAlliance Variable Product Series FundPremier Growth 1 N/A 1.00% N/A 0.08% 1.08% 1.08%Global Bond 0.56% 0.65% N/A 0.38% 0.94% 1.03%Growth & Income N/A 0.63% N/A 0.09% 0.72% 0.72%Short-Term Multi-Market 0.07% 0.55% N/A 0.87% 0.94% 1.42%U.S. Government/High Grade Securities N/A 0.60% N/A 0.24% 0.84% 0.84%Total Return N/A 0.63% N/A 0.25% 0.88% 0.88%International 0.53% 1.00% N/A 0.42% 0.95% 1.42%Money Market N/A 0.50% N/A 0.14% 0.64% 0.64%Global Dollar 0.41% 0.75% N/A 0.54% 0.95% 1.29%North American Government Income 0.56% 0.65% N/A 0.39% 0.95% 1.04%Utility Income 0.62% 0.75% N/A 0.33% 0.95% 1.08%Growth N/A 0.75% N/A 0.09% 0.84% 0.84%Worldwide Privatization 0.40% 1.00% N/A 0.55% 0.95% 1.55%Conservative Investors 0.37% 0.75% N/A 0.58% 0.95% 1.33%Growth Investors 0.00% 0.75% N/A 0.95% 0.95% 1.70%Contract described herein is no longer available for sale.(1) Effective May 1, 1998, the Investment Manager is no longer waiving a portion of the Management Fee. Other Expenses shown above are as of May 1, 1998.The purpose of the above table is to assist you in understanding the various costs and expenses that you would bear directly orindirectly as an investor in the Portfolio(s).The underlying mutual fund portfolio information was provided by the underlying mutual funds. The Company has not independentlyverified such information.EXPENSE EXAMPLES: The examples which follow are designed to assist you in understanding the various costs and expensesyou will bear directly or indirectly if you maintain Account Value in the Sub-accounts. The examples reflect expenses of our Subaccounts,as well as those for the underlying mutual fund portfolios.11