Download the brochure - Business Underwriters Associates

Download the brochure - Business Underwriters Associates

Download the brochure - Business Underwriters Associates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

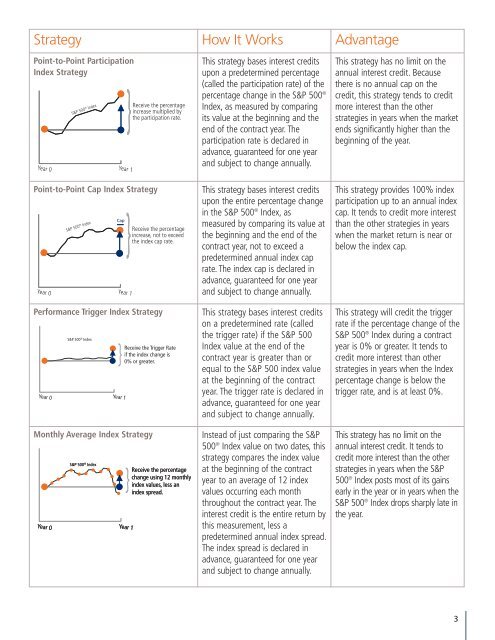

Strategy How It Works AdvantagePoint-to-Point ParticipationIndex Strategy}This strategy bases interest creditsupon a predetermined percentage(called <strong>the</strong> participation rate) of <strong>the</strong>percentage change in <strong>the</strong> S&P 500 ®Index, as measured by comparingits value at <strong>the</strong> beginning and <strong>the</strong>end of <strong>the</strong> contract year. Theparticipation rate is declared inadvance, guaranteed for one yearand subject to change annually.This strategy has no limit on <strong>the</strong>annual interest credit. Because<strong>the</strong>re is no annual cap on <strong>the</strong>credit, this strategy tends to creditmore interest than <strong>the</strong> o<strong>the</strong>rstrategies in years when <strong>the</strong> marketends significantly higher than <strong>the</strong>beginning of <strong>the</strong> year.Point-to-Point Cap Index StrategyPerformance Trigger Index StrategyMonthly Average Index StrategyYear 0S&P 500 ® Index}Year 1Receive <strong>the</strong> percentagechange using 12 monthlyindex values, less anindex spread.This strategy bases interest creditsupon <strong>the</strong> entire percentage changein <strong>the</strong> S&P 500 ® Index, asmeasured by comparing its value at<strong>the</strong> beginning and <strong>the</strong> end of <strong>the</strong>contract year, not to exceed apredetermined annual index caprate. The index cap is declared inadvance, guaranteed for one yearand subject to change annually.This strategy bases interest creditson a predetermined rate (called<strong>the</strong> trigger rate) if <strong>the</strong> S&P 500Index value at <strong>the</strong> end of <strong>the</strong>contract year is greater than orequal to <strong>the</strong> S&P 500 index valueat <strong>the</strong> beginning of <strong>the</strong> contractyear. The trigger rate is declared inadvance, guaranteed for one yearand subject to change annually.Instead of just comparing <strong>the</strong> S&P500 ® Index value on two dates, thisstrategy compares <strong>the</strong> index valueat <strong>the</strong> beginning of <strong>the</strong> contractyear to an average of 12 indexvalues occurring each monththroughout <strong>the</strong> contract year. Theinterest credit is <strong>the</strong> entire return bythis measurement, less apredetermined annual index spread.The index spread is declared inadvance, guaranteed for one yearand subject to change annually.This strategy provides 100% indexparticipation up to an annual indexcap. It tends to credit more interestthan <strong>the</strong> o<strong>the</strong>r strategies in yearswhen <strong>the</strong> market return is near orbelow <strong>the</strong> index cap.This strategy will credit <strong>the</strong> triggerrate if <strong>the</strong> percentage change of <strong>the</strong>S&P 500 ® Index during a contractyear is 0% or greater. It tends tocredit more interest than o<strong>the</strong>rstrategies in years when <strong>the</strong> Indexpercentage change is below <strong>the</strong>trigger rate, and is at least 0%.This strategy has no limit on <strong>the</strong>annual interest credit. It tends tocredit more interest than <strong>the</strong> o<strong>the</strong>rstrategies in years when <strong>the</strong> S&P500 ® Index posts most of its gainsearly in <strong>the</strong> year or in years when <strong>the</strong>S&P 500 ® Index drops sharply late in<strong>the</strong> year.3