Download the brochure - Business Underwriters Associates

Download the brochure - Business Underwriters Associates

Download the brochure - Business Underwriters Associates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

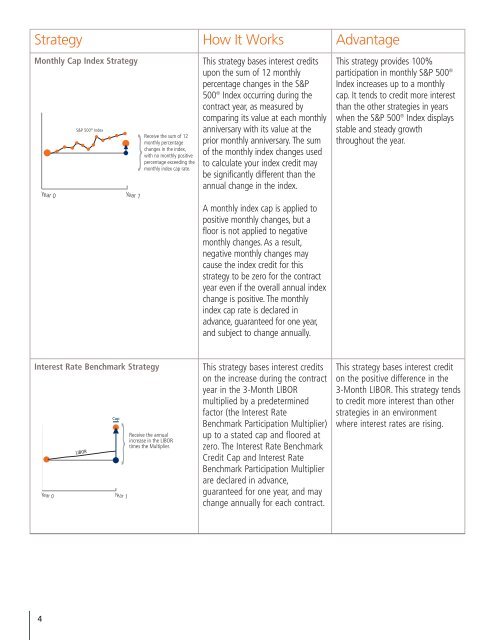

Strategy How It Works AdvantageMonthly Cap Index StrategyThis strategy bases interest creditsupon <strong>the</strong> sum of 12 monthlypercentage changes in <strong>the</strong> S&P500 ® Index occurring during <strong>the</strong>contract year, as measured bycomparing its value at each monthlyanniversary with its value at <strong>the</strong>prior monthly anniversary. The sumof <strong>the</strong> monthly index changes usedto calculate your index credit maybe significantly different than <strong>the</strong>annual change in <strong>the</strong> index.A monthly index cap is applied topositive monthly changes, but afloor is not applied to negativemonthly changes. As a result,negative monthly changes maycause <strong>the</strong> index credit for thisstrategy to be zero for <strong>the</strong> contractyear even if <strong>the</strong> overall annual indexchange is positive. The monthlyindex cap rate is declared inadvance, guaranteed for one year,and subject to change annually.This strategy provides 100%participation in monthly S&P 500 ®Index increases up to a monthlycap. It tends to credit more interestthan <strong>the</strong> o<strong>the</strong>r strategies in yearswhen <strong>the</strong> S&P 500 ® Index displaysstable and steady growththroughout <strong>the</strong> year.Interest Rate Benchmark StrategyThis strategy bases interest creditson <strong>the</strong> increase during <strong>the</strong> contractyear in <strong>the</strong> 3-Month LIBORmultiplied by a predeterminedfactor (<strong>the</strong> Interest RateBenchmark Participation Multiplier)up to a stated cap and floored atzero. The Interest Rate BenchmarkCredit Cap and Interest RateBenchmark Participation Multiplierare declared in advance,guaranteed for one year, and maychange annually for each contract.This strategy bases interest crediton <strong>the</strong> positive difference in <strong>the</strong>3-Month LIBOR. This strategy tendsto credit more interest than o<strong>the</strong>rstrategies in an environmentwhere interest rates are rising.4