NETWORK DEVELOPMENT STATEMENT - Gaslink

NETWORK DEVELOPMENT STATEMENT - Gaslink

NETWORK DEVELOPMENT STATEMENT - Gaslink

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>NETWORK</strong><strong>DEVELOPMENT</strong><strong>STATEMENT</strong>2011/12 to 2020/2021

DISCLAIMER<strong>Gaslink</strong> has followed accepted industry practice in the collection and analysis of data available. However, prior to taking businessdecisions, interested parties are advised to seek separate and independent opinion in relation to the matters covered by the presentNetwork Development Statement (NDS) and should not rely solely upon data and information contained therein. Information inthis document does not purport to contain all the information that a prospective investor or participant in Ireland’s gas marketmay need.

Contents<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>1. Introduction 22. Executive Summary 32.1 Key Messages 32.2 Gas Demand 42.3 Gas Supplies 42.4. Network Development 53. The BGÉ ROI Network 63.1 Overview of the Existing BGÉ ROI Gas Network 63.2 New Towns and New Connections 63.3 System Reinforcement 83.4 System Refurbishment 84. Demand 104.1 Points of Interest 104.2 Historic Peak Day Demand – 2006/07 to 2011/12 104.3 Historic Annual Demand – 2006/07 to 2011/12 124.4 Forecast ROI Gas Demand 154.5 Sensitivity Analysis 185. Gas Supply Outlook 205.1 Historical Gas Supplies 205.2 Future Gas Supply Outlook 206. Network Analysis 246.1 Overview of Network Analysis 246.2 Network Analysis Results 246.3 Strategic Network Reinforcement & Future Analysis 336.4 Conclusions 347 Networks Asset Management & Development 357.1 Compressor Stations 357.2 AGIs & DRIs 377.3 Meters 387.4 Communications and Instrumentation 407.5 Pipelines 427.6 Asset Integrity 427.7 Gas Quality 447.8 Natural Gas as a Transport Fuel 448. Security of Supply 468.1 Overview of Legal Framework 468.2 Existing Operational and Planning Arrangements 469. Commercial Market Developments 489.1 <strong>Gaslink</strong>: Independent System Operator 489.2 European Developments 489.3 New Connections 499.4 Moffat 499.5 CAG Summary 509.6 Gormanston Exit Point 50Appendix 1: Demand Forecasts 51Appendix 2: Historic Demand 53Appendix 3: Energy Efficiency Assumptions 55Appendix 4: Transmission Network Modelling 57Glossary 581

1. IntroductionThis Network Development Statement (NDS) covers the 10 yearperiod from 2011/12 to 2020/21. It is published by <strong>Gaslink</strong> (theIndependent Gas System Operator), with assistance from BordGáis Networks (BGN).Condition 11 of <strong>Gaslink</strong>’s Transmission System OperatorLicence requires it to produce a long term developmentplan. The publication of the NDS is designed to meetthis obligation. The NDS serves as the <strong>Gaslink</strong> input intothe Joint Gas Capacity Statement (JGCS) consultationprocess, which is directed by the Commission for EnergyRegulation (CER) and the Northern Ireland UtilityRegulator (UREGNI).Natural gas continues to play a very important role inthe energy mix of Republic of Ireland (ROI). Naturalgas brings considerable economic and environmentalbenefits. It is cheaper than oil, has the lowest CO 2emissions of any fossil fuel and provides the mostefficient form of thermal power generation.The NDS informs market participants about gas usage,and thereby, maximise the resulting economic andenvironmental benefits to the Republic of Ireland (ROI)economy. It provides existing and potential users of theROI system with an overview of future demand, likelyfuture sources of supply and the capacity of the existingsystem.The NDS focuses mainly on the ROI transmission system,which is defined to include both the onshore ROItransmission system and the BGÉ Interconnector (“IC”)system, which includes:• The two subsea interconnectors from Loughshinnyand Gormanston in Ireland, to Brighouse Bay inScotland; and• The Brighouse Bay and Beattock compressor stationsand connecting transmission pipeline, which connectthe two subsea interconnectors to the Great Britain(GB) National Transmission System (NTS) at Moffat inScotland.The NDS also discusses other assets in the ROI systemand reports on significant projects completed on thedistribution system.The Northern Ireland (“NI”) and Isle of Man (“IOM”)peak day and annual demands are also included in theNDS demand forecasts for completeness, as they have amaterial impact on the capacity of the IC system. Theseforecasts are based on information provided by UREGNI inNI and the Manx Electricity Authority (MEA) on the IOM.In order to complete the detailed analysis and modellingrequired to produce this document, the demand andsupply scenarios were defined in March 2012, based onthe most up to date information at that time.July 20122

2. ExecutiveSummary<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>2.1 Key Messages• Gas demand is anticipated to grow over the next10 years, despite increasing renewable generationcapacity, increasing gas prices and greater energyefficiency.• The ROI will continue to depend on the MoffatEntry Point and Interconnector System to provideapproximately 93% of its gas demand until Corribcommences production. The Moffat Entry Pointand Interconnector system may be required tofully meet ROI gas demand post Corrib, shouldsupplies cease at existing indigenous Entry Pointsand no other future supply sources materialise.This demonstrates the strategic importance of thisInterconnector System to the ROI.• Shell E&P Ireland, the Corrib field operators, haveindicated that Corrib supply is anticipated tocommence full commercial operation in April 2015.Shannon LNG have indicated 2017 as the earliestpotential date for commercial operations.• The NDS forecasted peak day Moffat flows indicatethe capacity limits of the Moffat Entry Point willbe reached in 2014/15 and any subsequent yearsCorrib is delayed, regardless of how the gas flowsare profiled. The ongoing presence of non-uniformflow profiles at the Moffat Entry Point increasesthe likelihood of reaching capacity limits before2014/15.Bord Gáis Networks & <strong>Gaslink</strong> continue torecommend reinforcing the 50km single sectionof pipeline in southwest Scotland as the mostappropriate and cost effective solution to provideadditional capacity. This is despite the currentposition of the CER being that this project shouldnot proceed at this time. Therefore, in the absenceof reinforcement <strong>Gaslink</strong> and Bord Gáis Networksstress the urgency of developing appropriatedemand side measures.Forecasted Peak Moffat flows are anticipatedto reach capacity limits again in 2018/19 and allsubsequent years, assuming no new supply sourcesmaterialise, supplies at the Inch Entry Point haveceased and supplies through the Corrib Entry Pointhave declined.• Work is ongoing with National Grid (UK) to clarifythe pressure service available from their system atMoffat (Scotland). The analysis for this statementwas on the basis that a minimum source pressureof 47 barg will be available from National Grid’sNational Transmission System (NTS) up to andincluding 2014/15, and 45 barg for all subsequentyears.• Bord Gáis Networks are finalising an operatingprocedure with Premier Transmission Ltd(PTL), which will clarify the necessary profilingarrangements at the Twynholm Exit Point insouthwest Scotland, where PTL’s system connectsto the Interconnector System. The capacity ofthe Interconnector System is influenced by thegas flow profiles at the Moffat Entry Point andExit Points on the southwest Scotland onshoresystem (SWSOS), including Twynholm. Theimplementation of this operating procedurewill enhance Bord Gáis Networks’s operationalconfidence in managing the SWSOS and providegreater certainty to NI regarding the pressure andcapacity available at Twynholm.• Regarding the ROI onshore transmission system,it has sufficient capacity to meet the gas flowrequirements on ‘Winter Peak Days’ and ‘SummerMinimum Days’ for the next six to seven years.The southern part of the ROI transmission system(Cork & Waterford) may require reinforcementin 2018/19, subject to supplies ceasing at the InchEntry Point.• <strong>Gaslink</strong> and Bord Gáis Networks have consideredstrategic network reinforcement as part of thelong term network development plan. The GoatIsland to Curraleigh West pipeline should be apriority strategic reinforcement, as the first stepin guaranteeing security of supply to all gasconsumers located in the south of the country(Cork & Waterford) and consumers on the nationalelectricity grid.3

2. Executive Summary2.2 Gas DemandIn contrast to the severe weather experienced in thewinters of 2009/10 and 2010/11, the recent 2011/12winter was a period of relatively mild weather. Thiswas reflected in the gas demand during the 6 monthperiod, October to March. The ROI gas demand for thecurrent gas year peaked on the 16th December, whichwas 13.9% less than the previous year’s peak day. Thetotal annual gas demand for the current gas year isanticipated to contract by 11.3% on the previous year(2010/11).The annual gas demand in 2010/11 was slightlydown on the previous year’s levels, primarily due tocontraction in the power generation sector. Fuel pricemovements resulted in coal fired plant becoming themost competitive thermal generator in the SingleElectricity Market (SEM) ‘Merit-Order’ all year round.This is still the case in 2011/12.Industrial & Commercial (I/C) gas demand grew in theprevious two gas years despite the significant economicslowdown. The I/C gas demand for the current yearis anticipated to be on par with the previous year’sdemand.ROI gas demand is anticipated to grow over the next10 years, despite increasing renewable generationcapacity, increasing gas prices, the economic slowdownand greater energy efficiency.Gas fired power plants will continue to play a verysignificant role in the Irish electricity market. Gasfired generation’s current level of participation in thethermal generation mix is anticipated to increase inthe medium to long term, in response to rising carbonprices. This will impact on the competitiveness of coal,peat and oil fired generation.Gas fired power plants are best placed to complementboth domestic and European energy policy goals.The baseload gas fired plants are the most efficientgenerators in the Irish thermal plant portfolio. Naturalgas is the cleanest fossil fuel and gas fired plants arebest able to provide the flexibility required to supportthe ever increasing renewable generation capacity onthe electricity grid.I/C gas demand is anticipated to experience furthergrowth as the economy recovers. Residential gasdemand is expected to contract slightly, in responseto increasing energy efficiency, for example theintroduction of more efficient domestic gas boilers.While this NDS has assumed no gas demand for thetransport sector, Natural Gas Vehicles (NGVs) couldpotentially be a new growth area for gas demandin future years. Future statements will monitor andconsider any developments in this sector.2.3 Gas SuppliesThe Moffat Entry Point and Interconnector Systemsupplied 93% of ROI gas demand in 2010/11, withsimilar levels of supply participation being observed inthe current gas year. The ROI will continue to dependon the Moffat Entry Point and Interconnector Systemto provide over 90% of its gas demand until Corribcommences production and is likely to revert to thislevel of dependency post Corrib. The Moffat EntryPoint and Interconnector system may be required tofully meet ROI gas demand post Corrib, should suppliescease at existing indigenous Entry Points and no otherfuture supply sources materialise.There is a some uncertainty surrounding the timing ofcertain proposed supply projects and the future of anexisting supply source on the Island. PSE Kinsale Energyhas indicated existing storage operations may ceaseafter 2013/14, followed by total cessation of Inch supplyafter 2016/17.The Corrib field operators, Shell E&P Ireland, haveindicated the commissioning of Corrib gas is anticipatedto commence in October 2014 for a period of 6 monthsfollowed by full commercial operation from April 2015.Shannon LNG have indicated their proposed LNGfacility maybe available from 2017. The developers ofthe two storage projects in the Larne area continue toprogress feasibility studies regarding their respectivesalt cavity storage projects.4

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>2.4 Network DevelopmentThe network analysis detailed in chapter 6 examinesthe capacity of the ROI onshore transmission systemand onshore Scotland system (including the subseaInterconnectors). Results indicated the ROI onshoretransmission system has sufficient capacity to meetthe gas flow requirements on ‘Winter Peak Days’ and‘Summer Minimum Days’ for the next six to seven years.Pressure violations were observed in the southern partof the transmission system (Cork and Waterford) forthe 1-in-50 peak days in the later years of the forecastperiod; the occurrence of such low pressures were asa result of the unavailability of supplies from the InchEntry Point. Future statements will continue to monitorthis potential issue, and recommend reinforcement ifand when required.Last year’s NDS (<strong>Gaslink</strong>), JGCS (CER & UREGNI) andWinter Outlook (<strong>Gaslink</strong>) noted the capacity limitsof the Moffat Entry Point (Interconnector System)will be approached over the coming winters and willbe reached in 2013/14, should the forecasted peakdemands occur. This year’s NDS indicates the sameconstraint will occur, albeit one year later in 2014/15,due to a change in date regarding the cessation ofexisting Celtic Sea storage operations. This constraint isanticipated to arise again in 2018/19 and all subsequentyears, assuming no new supply sources materialise andInch supplies have ceased. The ongoing presence ofnon-uniform flow profiles at the Moffat Entry Pointincreases the likelihood of reaching capacity limitsbefore 2014/15.<strong>Gaslink</strong> and Bord Gáis Networks, believe strategicnetwork reinforcement should be considered aspart of the long term network development plan. Arecent event in the southern section of the network,demonstrated that the loss of service through asection of the Ring-Main is a reality. The Goat Island toCurraleigh West pipeline should be a priority strategicreinforcement, as the first step in guaranteeing securityof supply to all gas consumers located in the southernhalf of the country and consumers on the nationalelectricity grid.It should be noted that any future (post 2011/12)network investment referenced in this document wouldbe subject to regulatory approval by the CER. Bord GáisNetworks currently await a final decision on the PriceReview 3 (PR3) approved spend.<strong>Gaslink</strong> note that the appropriate final decision onthe PR3 spend, should provide a sufficient allowancefor investment, to guarantee the supply capacity andsecurity to meet the ROI’s future demand requirements,while ensuring the continued safe, secure, reliable,efficient and economic operation of the gas network.Bord Gáis Networks and <strong>Gaslink</strong> continue torecommend, reinforcing the 50km single section ofpipeline in southwest Scotland as the most appropriateand cost effective solution to resolve the potentialconstraint. The current position of the CER is that thisproject should not proceed at this time and accordinglyBord Gáis Networks & <strong>Gaslink</strong> stress the urgency ofdeveloping appropriate demand side measures.5

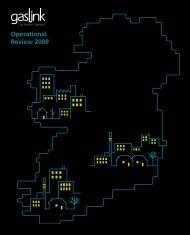

3. The BGÉROI Network3.1 Overview of the Existing BGÉ ROI Gas NetworkThe BGÉ ROI gas network consists of approximately13,224kms of high-pressure steel transmission pipelineand lower pressure polyethylene distribution pipelines,Above Ground Installations (AGIs), District RegulatingInstallations (DRIs) and compressor stations in theROI and Scotland. The integrated supply system issub-divided into 2,149kms of high pressure sub-sea &cross country transmission pipes and approximately11,076kms of lower pressure distribution pipes. Thedistribution network operates in two tiers; a mediumpressure and a low pressure network. The high-levelsystem statistics are summarised in Tables 3.1 and 3.2and illustrated in Figure 3.1Table 3.1: ROI Pipeline Summary StatisticsCurrentMaxMOP* Total Nominal PipePressure Length DiameterLocation (barg) (km) (mm)Onshore ROI 85.0 161 650Onshore ROI 1 75.0 60 450Onshore ROI 70.0 1,133 900Onshore ROI 40.0 92 500Onshore ROI 37.5 15 600Onshore ROI 19.0 153 600Onshore ROI 7.0/4.0 16 600Subtotal N/A 1,630 900Scotland 85.0 110 900Subsea 148.0 409 750Total Tx N/A 2,149 900Onshore Ireland Dx >100mBar 6,646 315Onshore Ireland Dx

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Figure 3.1: Overview of the ROI Transmission SystemCorribGas FieldCastlebarBallinaCrossmolinaDerry CityLough EgishCarrickmacrossBailieboroughColeraineBallymoneLimavadyBallymenaAntrimLurganCraigavonPortadownArmaghBanbridgeNewryWestportVirginiaBallinrobe ClaremorrisKells NavanAthloneAthenryAbbotstownLoughshinnyEnfield Kilcock DublinGalwayBallinasloe ProsperousTullamoreNaas5 Pwr StationsTynagh Portarlington Kildare BrownsbarnCraughwell Pwr StationBrayMonasterevinLoughreaGortPortlaoiseKilcullenWicklowEnnis SixmilebridgeAthyHeadfordMullingarTuamTrimDroghedaGormanstonBallina BallyraggetCarlowShannonArklowLimerickTarbertCashelAskeatonAughinishTipperary townKilkennyPwr StationCahirKinsaleLehenaghmorePwr StationCharlevilleCarrick-on-SuirMitchelstownWaterfordMallowArdfinnanGreat IslandFermoyTramoreMacroom Cork Midleton CompressorBandonBallineen2 Pwr StationsInch Entry PointKinsale Head Gas FieldSeven Heads Gas FieldDundalkKingscurtBelfastS.N.I.P.Interconnector 2Interconnector 1ScotlandMoffatEntry PointBeattock CompressorTwynholm AGIIsle of ManExisting PipelinesPlanned PipelinesProposed PipelinesBrighouseBayCompressorPwr StationPipelines operated by BGÉ NIPipelines Owned by OthersCityTownTown (proposed)Entry PointsCity Gate Entry PointsLandfall StationPower Station7

3. The BGÉ ROI NetworkDuring 2011 Kinsale, Tipperary, and Kells wereconnected to the natural gas network and phase1 of the network extension to Macroom was alsocompleted, allowing the connection of the Town’sanchor customer to the network.<strong>Gaslink</strong> will continue to review the feasibility ofconnecting new towns on an ongoing basis.In 2011 <strong>Gaslink</strong> and Endesa Ireland entered into a LargeNetwork Connection Agreement to commence theconstruction of a 46.5km high-pressure steel pipelineto fuel the ‘Combined Cycle Gas Turbine’ (CCGT) powerplant that is currently being developed at Great Island,Co. Wexford. Planning permission was granted by AnBord Pleanála to Bord Gáis Networks in May 2012 forconstruction of the cross country pipeline. Subjectto receiving all the remaining necessary statutoryapprovals, it is anticipated that construction on thepipeline will commence in Q3 2012. The pipeline hasalso been designed to cater for future gas demand inthe South East region which will bring many economicand environmental advantages to the area.3.3 System ReinforcementIt is necessary from time to time to reinforce theexisting gas transmission system to facilitate localdevelopment and other such works. Reinforcementprojects that were either completed during 2010/11 (orare in the final phases of commissioning) include:• Substantial completion of capacity upgrades toHollybrook AGI (Bray) and Loughshinny AGI (Rush),• Installation of volume control in Beattockcompressor station to increase the operatingenvelope of the turbo compressor units inanticipation of future requirements on thenetwork.• The twinning of the Curraleigh West to MidletonPipeline and the construction of the associatedLochcarrig Lodge to Midleton Pipeline hastransferred the Cork area transmission system tothe discharge side of Midleton compressor station.This has brought significant benefits in terms ofenhanced pressures to the customers connected tothe system.The old Aghada power station and the Whitegate andLong Point AGIs remain connected to the transmissionsystem between Midleton compressor station andthe Inch Entry Point. Any Inch gas in excess of thesedemands will be compressed at Midleton into the 70-barg system in the Cork area.Upgrades to Cadburys, Suir Road, Kilbarry, Blakestown,Raffeen AGIs are scheduled to be completed in 2012.Further capacity upgrades to Cork Gas, Fairview andSeapoint AGIs have been identified and are scheduledto commence detailed design in early 2013.17kms of reinforcement to the distribution networkwas carried out during 2012. One of the moresignificant projects completed last year was theClonshaugh to Stockhole reinforcement project whichconsisted of 4.2km of 250mm of polyethylene pipe.The pipeline was required to reinforce the networkon the north side of Dublin. Network reinforcementrequirements will continue to be monitored into PR3with necessary localised projects rolled into annualprogrammes of work.3.4 System RefurbishmentThere is a continuous programme to review andrefurbish the gas transmission system, to ensurethat it continues to comply with all of the relevantlegislation, technical standards and Codes of Practice.This refurbishment work is carried out in conjunctionwith reinforcement work (where possible), tominimise overall costs and to limit disturbance to localcommunities.Increases in population density in the vicinity oftransmission pipelines may require preventativemeasures to be taken such as the diversion ofpipelines, the provision of impact protection and theinstallation of “heavy-wall” pipe. The Dublin 4 pipelinereplacement project was completed in 2010.8

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>The following transmission system refurbishment anddiversion projects are planned for the 2011/12 gas year:• Detailed integrity and capacity assessments havebeen carried out on the Limerick 19 barg networkwhich has identified the need to refurbish andreinforce the network. Front-end engineeringwork is progressing with a view to constructioncommencing next in 2013.• Santry to Eastwall pipeline replacement project;Optimal solution for the refurbishment of the6.5km Santry to Eastwall pipeline is scheduled tocommence construction in Q3 2012.• Waterford pipeline replacement project; anoptimal solution for the refurbishment of the4.5km Waterford City pipeline is in progress.• Ballymun Interchange pipeline replacementproject; preliminary engineering work isprogressing with a view to constructioncommencing in 2013.Rolling programmes planned to commence in 2013(subject to CER PR3 approval) are as follows:• Heating system refurbishment at circa 25 AGIs(boilers and waterbaths) are scheduled tocommence in 2013; and• Refurbishment of c. 350 DRI and IC installations9

4. Demand4.1 Points of Interest4.1.1 2011 Mild Weather ConditionBased on a degree day comparison 2011 was 23% warmerthan 2010 and 7% warmer than the previous 69 yearaverage despite a colder than average January and Marchcombined with a colder summer period. The winter of2011/12 was 9% warmer than the 69 year average and23% warmer than the 2010/11 winter period. The coldestday in 2011/12 to date was 30% warmer than the 2010/11peak which was the coldest day on record.Mean wind speeds for the year were above average,measuring between 7 and 15 knots (13 and 27 km/h).Wind powered generation was 64% higher in 2011 than2010. While there was a growth in the installed windpowered generation capacity, the majority of the growthin wind powered generation can be attributed to theincreased wind experienced in 2011.4.1.2 Moyle Electrical Interconnector OutageAn outage on the 500MW Moyle electricalinterconnector lasting a little over 6 months had thepotential for higher gas demands in late 2011 due tothe inability to import electricity to the SEM.A fault was recorded on one of the two cables on the26th June 2011 with a separate fault recorded on thesecond cable on the 24th August. Repair works werecarried out over the following six months and it wasreturned to full operation in mid February 2012.Modelling indicates that the loss of the Moyle IC couldhave increased the ROI electricity generation sector’speak day gas demand by 13% on an average year peakday and by 8% on a 1 in 50 year peak day. Actual peakday gas demand in the electricity generation sectorfor 2011/12 was -14% lower than that estimated foran average year with the Moyle IC unavailable. Thereduction in demand is due to warmer than averagepeak day temperatures and higher than average windlevels resulting in lower electricity demands and higherwind powered generation.Mutual Energy Ltd (MEL), have recently announced thereoccurrence of a fault on the north cable of the MoyleInterconnector, resulting in an outage with transfercapacity reduced to 250 MW (half the full capacity of theMoyle Interconnector). MEL also acknowledge they arepreparing for the potential reality of recurring faults. It iscurrently unknown how long the existing outage will last.4.2 Historic Peak Day Demand – 2006/07 to 2011/124.2.1 Overall ROI demandTotal ROI peak day gas demand for 2011/12 was -14%lower than the 2010/11 peak day demand. The demanddecrease is driven primarily by reductions in the powergeneration and residential sector demands.The reduction in peak day gas demand was drivenprimarily by a drop in the electricity generation andresidential sector gas demands with a smaller reductionin the I/C sector in 2011/12 compared to 2010/11. Thepeak day gas demand has grown by 0.7% per annumon average since 2006/07. There has been significantgrowth and contraction in the peak day gas demandover this period.It is worth noting that, although the 2010/11 peak daygas demand was less than the 2009/10 peak, 2010/11witnessed a prolonged period of near peak daydemands. In 2009/10 6 days were within 90% of thepeak day demand and 3 days were within 95% of thepeak, including the peak day itself. 2010/11 howeversaw a prolonged demand period where 20 days wereTable 4.1: Historic ROI Peak day Gas Demand (Actual Demands) 12006/07 2007/08 2008/09 2009/10 2010/11 2011/12(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)Peak dayPower 2 111.2 119.7 126.4 134.3 132.2 116.3I/C 43.1 43.4 44.4 46.3 49.6 47.7RES 1 50.4 52.5 56.7 67.0 64.2 47.7Total 204.7 215.6 227.5 247.6 246.0 211.71Actual demands shown (no weather correction), with RES estimated as % of NDM demand2Power sector demand includes the gas demand for those I/C connections which generate electricity for their own use less process gas10

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Fig. 4.1: Historical Daily BGÉ System Gas Demand Load Duration Curve110%Annual Load Duration Curves100%90%80%70%60%50%1591317% of Peak Demand2125293337414549535761656973778185899397101Number of Days2009/10 2010/11 2011/12within 90% and 11 days were within 95% of the peakday demand. Of the 20 days within 90%, 19 of theseoccurred within 21 days of the peak. 2011/12 has seena continuation of this trend with 7 days within 90% ofthe peak day demand. This trend is shown in Figure 4.1.4.2.2 Power Generation SectorThe 2011/12 power generation sector peak day is-12.0% lower than 2010/11 figures. The reduction indemand is due to increasing gas prices, a reductionin total electricity demand and an increase in windgenerated electricity.The 2010/11 peak electricity demand increased by 2%from the 2009/10 peak demand while the 2011/12 peakcontracted by -8.8% on the 2011/12 peak. The 2010/11peak of 5,090MW occurred on the 21st December 2010and reflects the highest demand recorded on the systemto date. The 2011/12 peak of 4,640 MW represents thelowest annual peak demand since 2004/05.4.2.3 I/C SectorThe peak day demand fell by -3.8% but has increasedby 2.0% per annum since 2006/07. The reduction inthe peak day I/C gas demand is attributed primarilyto the contraction in the NDM IC sector which fell by-20% in 2011/12 compared to the previous year. Thetransmission connected I/C sector recorded a growth of3% from 2010/11 figures following very strong growthin 2010/11. The distribution connected daily meteredsector showed a slight decline of -3%.4.2.4 Residential SectorThe peak day demand contracted by -25.7% in 2011/12compared to 2010/11. The peak day residential gasdemand has grown by an annual average of 6.2%since 2006/07 to 2010/11. The significant reduction inthe peak day demand is due primarily to the milderweather conditions experienced to date in 2011/12.4.2.5 BGÉ System Demands2011/12 BGÉ system peak day was -11.6% lower than theprevious year peak. The system peak day gas demandhad grown by an average of 4.1% per year to 2010/11since 2006/07. The 2011/12 peak is the lowest systempeak since 2005/06. The reduction is due primarily tothe milder weather conditions and increased renewablegeneration.The fall in the system peak day gas demand was dueto a drop in both the ROI and NI figures as shown inTable 4.2. The reduction in the annual system demandTable 4.2: Historic BGÉ Peak day Gas Demand (Actual Demands)2006/07 2007/08 2008/09 2009/10 2010/11 2011/12(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)Peak day 1ROI 196.7 205.9 227.5 247.6 244.1 211.7NI + IOM 79.0 74.8 67.7 80.0 79.3 74.1Total 275.7 280.7 295.2 327.6 323.4 285.81Excludes shrinkage gas consumed on the peak day11

4. DemandFig. 4.2: Historical Daily Demand on the BGÉ Transmission System350Total BGÉ Demand30025020015010050001-Oct-0301-Apr-0401-Oct-0401-Apr-0501-Oct-0501-Apr-06Demand (GWh/d)01-Oct-0601-Apr-0701-Oct-0701-Apr-0801-Oct-0801-Apr-0901-Oct-0901-Apr-1001-Oct-1001-Apr-1101-Oct-1101-Apr-12ROINI+IOMhowever was solely a result of a reduction in ROIdemand offsetting an increase in NI annual gas demand.Figure 4.2 presents the historical peak day systemdemand. It is worth noting that while the 2010/11 peakday gas demand was less than the 2009/10 peak therewere a greater number of peak events seen within ashort period of time. In 2009/10 there were 3 eventswithin 95% of the peak day and 5 events which werewithin 90%. 2010/11 saw 7 events within 95% of thepeak and 15 events which were within 90%. 14 of the15 events within 90% occurred within a 16 day timerange of the peak day.These demands occurred despite unscheduled outagesat a number of gas fired power stations. Total daily gasdemands over the period would have been higher hadthese stations been available. Figure 4.2 also illustratesthe increasing range between peak and minimumdemand days, primarily due to the demand volatility inthe power generation sector, which is a consequenceof increasing wind generation, fuel price movementsand the construction of new gas fired plants. Thisincreasing variability is anticipated to continue infuture years, placing an even greater requirement onsystem flexibility, particularly the compressor stations inScotland, which are likely to approach their operatinglimits more frequently.4.3 Historic Annual Demand – 2006/07 to 2011/124.3.1 Overall ROI demandThe annual gas demand is presented up to andincluding 2011/12 gas year. The year to date datafor 2011/12 has been forecast forward to provide anapproximation for 2011/12 annual gas demand. The2010/11 annual gas demand fell by -4.3% comparedto 2009/10 and 2011/12 are forecast to be a further-11.3% below 2010/11 figures. The reduction canbe contributed largely to a reduction in the powergeneration sector gas demand with a smaller reductionevident in residential gas demand.4.3.2 Power Generation Sector2010/11 annual gas demands were -10% lowerrespectively compared to 2009/10 and the 2011/12forecast annual gas demand is anticipated to be -15.1%lower than 2010/11.Table 4.3: Historic ROI Annual Gas Demand (Actual Demands) 12006/07 2007/08 2008/09 2009/10 2010/11 2011/12 3(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)AnnualPower 2 34,688 37,758 36,007 39,338 35,432 30,085I/C 10,486 10,507 10,415 10,409 11,954 12,226RES 7,716 8,239 8,312 8,492 8,340 7,098Total 52,890 56,504 54,734 58,239 55,726 49,4091Actual demands shown (no weather correction), with RES estimated as % of NDM demand2Power sector gas demand is amended to account for those I/C connections which generate electricity for their own use less process gas3End of year totals forecast from year to date totals12

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Historical fuel prices are shown in Figure 4.3. Gas priceshave remained higher relative to coal prices since 2009.This coal to gas price ratio has enabled coal plants tomaintain a favourable position in the despatch order.The year to date demand for 2011/12 is -2.9% lowerthan the same period for 2010/11. 2010/11 annualelectricity demand fell by -1.2% compared to 2009/10demand. The annual demand has reduced by -1.1% perannum on average since 2006/07.The year to date wind powered generation is 43%higher than over the same period in 2010/11. Windpowered annual electricity generation increased by29.6% in 2010/11 compared to 2009/10. This increaseis due in part to new generation becoming availablebut is mainly due to a return to more favourable windspeeds following a lull in 2009/10.It is to be noted that a portion of the gas demandcurrently attributed by metering to the power sectoris in fact auto producers using gas for process use andnot for use in generating electricity. Auto producers arethose connections which use gas to generate electricityfor their own use. This portion of gas demandaccounted for approximately 1% of the annual powersector gas demand in 2010/11. There is no separatemetering system in place to accurately quantify theamount of gas which is currently used for non-powergeneration within these facilities. The approximateamount of production gas has been deducted fromthe 2010/11 power sector gas demand and has beenadded to the transmission connected I/C sector. Analysisis currently ongoing to identify the amount of futureprocess gas which is to be attributed to non-powergeneration sectorsFig. 4.3: Historical Fuel Prices4.3.3 I/C SectorThe 2010/11 annual I/C gas demands recorded a growthof 14.6% over the 2009/10 demands and has grownby 3.3% per annum since 2006/07. The 2011/12 annualdemands are forecast to increase by a further 2.3%over 2010/11 figures.The growth in annual I/C gas demand in 2010/11 wasdriven primarily by the growth in the transmissionconnected I/C sector. Gas demand for transmissionconnected sites grew by 32% in 2010/11 against theprevious year. Both the distribution connected dailymetered and non daily metered sites grew in 2010/11 by6% and 4% respectively. Figure 4.4 displays the growthtrend in both the transmission and distribution connectedI/C sites for a month on month comparison of the periodOctober 2009 to May 2011 against October 2010 to May2012. The transmission connected I/C demand growth isshown to be returning to a steadier growth rate followingthe high growth rates seen in early 2010/11. The negativedemand growth in the distribution connected I/C sectorfor January to May 2011 reflects a return to the demandlevels of 2009 following a growth in demand recorded forthe same period in 2010.The decision by auto producers to use gas for productionprocesses in addition to electricity production, as discussedin section 4.3.2, has increased the I/C gas demand. Thisactivity accounted for approximately 5% of the I/C gasdemand in 2010/11 and will contribute to approximately10% of IC demands in 2011/12.Fig.4.4: I/C Gas Demand Monthly Growthby Connection TypeFuel Prices (€/GJ)Historic Fuel Prices30.025.020.015.010.05.00.001-Dec-0301-Apr-0401-Aug-0401-Dec-0401-Apr-0501-Aug-0501-Dec-0501-Apr-0601-Aug-0601-Dec-0601-Apr-0701-Aug-0701-Dec-0701-Apr-0801-Aug-0801-Dec-0801-Apr-0901-Aug-0901-Dec-0901-Apr-1001-Aug-1001-Dec-1001-Apr-1101-Aug-1101-Dec-1101-Apr-12Gas Low Sulphur Fuel Oil (LSFO) CoalMonth on Month % Change50.0%40.0%30.0%20.0%10.0%0.0%-10.0%-20.0%-30.0%Month on Month % Change in I&C Gas Demand-Oct 10 to May 12 vs Oct 09 to May 11Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr MayTransmission I/CDistribution I/C13

4. DemandTable 4.4: Residential Gas Demand per Customer2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 3(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)No. of customersOn 1st October 538,822 571,485 595,740 609,034 614,973 620,292On 30th September 571,485 595,740 609,034 614,973 620,292 624,497Customer growth 32,663 24,255 13,294 5,939 5,319 4,205Average for Gas Yr 1 555,154 583,613 602,387 612,004 617,633 622,395RES DemandTotal RES demand 7,716.1 8,238.5 8,311.8 8,491.5 8,340.0 7,097.7Demand per customer 2 0.0139 0.0141 0.0138 0.0139 0.0135 0.01141Average for Gas Yr = Average number of residential customers connected to the distribution system over the course of the gas year(i.e. the average number of customers at the start and end of gas year)2Per customer = Average residential annual gas demand per customer (before weather adjustment)3End of year totals forecast from year to date totals4.3.4 Residential SectorThe 2010/11 residential annual gas demands decreased by-1.8% against 2009/10 figures and the 2011/12 residentialannual gas demand is forecast to fall a further -14.9%below 2010/11 figures. Annual residential gas demandhad increased on average by 2.0% per annum over theperiod 2006/07 to 2010/11.The demand figures shown in Table 4.4 reflect the impactof slowing connection numbers, a milder 2011/12 heatingseason and a reduction in average energy demand percustomer. Despite a prolonged period of cold weather inwinter 2010/11, the average annual weather conditionswere milder than those in 2009/10 due to a significantlymilder 2011. 2011/12 has been significantly milder thanthe long run average winter conditions.The average annual energy demand per customer is-2.7% lower in 2010/11 than in 2009/10 and has fallenby -0.7% on average each year since 2006/07. This trendis expected to continue in 2011/12 with a -15.5% fallin energy demand per customer. This trend reflects theongoing economic situation coupled with an impactfrom energy efficiency savings and warmer thanaverage weather conditions.The growth in residential connection numbers hasslowed significantly in recent years from over 32,000new connections in 2006/07 to a little over 5,000in 2010/11 and an estimated 4,000 in 2011/12. Thedecrease in new connections reflects the impact of thecurrent economic recession.4.3.5 BGÉ System DemandsTable 4.5 presents the annual BGÉ System gas demandssince 2006/07. 2010/11 BGÉ system annual gas demandcontracted -2.5% against 2009/10 figures with annualdemand increasing by 0.2% per annum since 2006/07.Forecast annual demands for 2011/12 are approximately-10% down on 2011/12 figures in both ROI and NI.4.3.6 ROI Annual Primary Energy DemandTotal primary energy requirement (TPER) grew marginallyin 2010 above 2009 figures increasing to 15,089 kTOE buthas contracted in 2011 to 14,174 kTOE. In 2011 coal andrenewable energy showed an increase on 2010 figureswhile peat, oil gas and electrical imports all fell. Figure 4.5indicates a continuing decline in the TPER following itsmaximum in 2008. Gas now accounts for 30% of ROI TPERas shown in Figure 4.6 with oil accounting for the majorityof energy demand at 50%.Table 4.5: Historic Annual Gas Demand (Actual Demands)2006/07 2007/08 2007/08 2009/10 2010/11 2011/12(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)AnnualROI 52,890 56,504 54,734 58,239 55,726 50,241NI+IOM 20,216 19,294 18,022 17,232 17,852 15,893Total 73,106 75,798 72,756 75,471 73,578 66,055The actual year to date 2011/12 gas demand has been forecast forward to provide an approximation for 2011/12 annual gas demand.14

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Fig.4.5: Analysis of Historical ROI TPERTPER by fuel (kTOE/year)18,00016,00014,00012,00010,0008,0006,0004,0002,000019801982198419861988Irish TPER by fuel19901992Total final energy consumption (TFC) fell by -7% in2011 from 2010 figures. This continues the reductionof -21% in 2010 consumption compared to 2009. Allsubsectors recorded a fall in 2011 consumption figurescompared to 2010.4.4 Forecast ROI Gas DemandThe NDS forecasts future gas demand by examiningthe possible individual power, I/C and residential sectorgas demands. A number of external data sources arereferenced in this process along with additional sectorspecific assumptions.1994E. Import REN Gas Oil Peat Coal199619982000Fig.4.6: Breakdown of ROI TPER for 2011ROI TPER analysis by fuel (2011)2002200450%5%9%0.4%6%30%2006Oil Peat Coal E. Impost REN Gas20082010Annual ROI gas demand is anticipated to increase by17% by 2020/21, at an average rate of 1.8% per annum.The 1 in 50 peak day demand is expected to grow by11% to 2020/21 with an annual growth rate of 1.2%.4.4.1 ROI Power Sector ForecastBoth peak day and annual power sector gas demandsare expected to increase over the period to 2020/21.This growth is supported by increasing electricitydemands, more favourable cost of gas fired generationand the introduction of the Large Combustion PlantDirective in 2016.4.4.1.1 Electricity DemandsThe NDS assumes future electricity demands as perEirGrid and SONI’s All Island Generation CapacityStatement 2012-2021. This report anticipates annual ROIelectricity demands will grow by 13% to 30,668 GWhby 2020 at a yearly average of 1.4%. Average year peakelectricity demands are also expected to grow by 11% to5,114 MW, with an annual average growth of 1.1%.4.4.1.2 Environmental PoliciesThe implementation of the Large Combustion PlantDirective in 2016 will impact on those generationstations with higher emissions. It is anticipated that coalfired generation and older less efficient generationstations will limit their annual running hours in orderto comply with the requirements of the regulations.This may initially lead to higher prices for electricityimports from the UK due to the high ratio of coal firedgeneration in the UK system and hence reduce importsto ROI. It is anticipated that gas fired generation willbenefit from higher efficiencies and lower carbon costs.4.4.1.3 Renewable GenerationThe expectations regarding the deployment of windpowered generation is also in line with EirGrid andSONI’s current assumptions. It is anticipated thatinstalled wind powered generation in ROI will increasefrom 1,629MW in 2011 to 3,918MW in 2020. Thisrepresents a 154% increase in total wind generationover the period. Such an increase would lead toa reduction in gas demand within the electricitygeneration sector. Any reduction may be offset by theneed to maintain a spinning reserve to compensate forunexpected shortfalls within wind powered generation.Such a need for spinning reserve would most likelycontinue to be provided by gas fired turbines due totheir flexibility and reliability.15

4. Demand4.4.1.4 Generation MixThe NDS assumptions regarding the future deliveryand retirement of electricity generation stations arepresented in Table 4.6. These assumptions are basedon the All Island Generation Capacity Statement. Somestations have been excluded due to the possibility thatnot all the projects identified in the statement wouldbe delivered.It is assumed that the period to 2021 will see a netincrease of 289MW of gas fired generation in operationon the island of Ireland. This additional generation mayresult in an increase in gas demand but the impact ofthis new generation capacity may simply push older lessefficient gas fired generation stations further alongthe merit order to a position where they would bedispatched less frequently.It is anticipated that annual gas demand will reduceslightly in 2012/13 due to the commissioning of theEast – West electricity interconnector. The East – Westelectricity interconnector will have 500MW capacityconnecting the transmission systems of Ireland andWales and is due for completion in late 2012.4.4.1.5 Generation Dispatch OrderThe order in which electricity generation stations arecalled upon to generate is dependant upon their shortrun marginal cost (SRMC). This cost is reflective of thecost to generate 1MW of electricity. Some generators,such as wind powered generation and those withpublic service obligation status, receive a prioritydispatch status and so are positioned highest on themerit order.The SRMC of a plant is a function of the cost of its fuel,generation efficiency and the cost of carbon. Presentlyfavourable coal prices relative to gas are expected tocontinue in the short term ensuring coal fired stationsremain high on the dispatch order. Increasing coalprices later in the forecast combined with an increasingcost of carbon is assumed to erode coal’s position onthe dispatch order, and gas fired generation will see anincrease in demand.4.4.1.6 Future Gas DemandsThe annual power sector gas demand is anticipatedto increase by 24% over the period to 2020/21 at anannual average growth rate of 2.4%. This growth rateis higher than the forecast electricity demand growthrate due to the increase in gas fired generation withinthe generation mix and the more favourable positionof gas fired generation in later years with increasingcarbon and coal prices. The commissioning of the GreatIsland combined cycle gas turbine in October 2013along with continued growth in electricity demands,the phasing out of the peat PSO levy and morefavourable gas price ratios, will all contribute to growthin annual gas demand from 2013/14.The peak day electricity demand is defined here as thelevel of demand which would occur once in every 50years. The forecast for this peak day electricity demandhas been estimated by applying EirGrid and SONI’speak annual electricity demand growth rate to theactual electricity demand of 5,090MW which occurredin December 2010 and which is assumed to reflect aone in 50 year peak day demand. The peak day powersector gas demand is forecast to rise by 18% over theTable 4.6: New and Retired Power Station AssumptionsName Type Export Start Location(MW)DateNewGreat Island CCGT 431 Oct 2013 Co. WexfordNore OCGT 98 Jan 2014 Co. KilkennyAthlone Cuilleen OCGT 98 Jan 2015 Co. WestmeathSuir OCGT 98 Jan 2016 Co. TipperaryTotal 725RetiringGreat Island LSFO 212 Sep 2013 Co. WexfordTarbert (1,2 &3) LSFO 349 Dec 2013 Co. KerryMarina OCGT 85 Sep 2014 Co. CorkTarbert (4) LSFO 241 Dec 2020 Co. KerryTotal 88716

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>period to 2020/21 at an annual average growth rate of1.8%. The peak day gas demand is anticipated to fallin 2012/13 due to the commissioning of the East – Westelectrical interconnector but will continue to showgrowth from 2013/14.Fig.4.7: Peak Day and Annual Gas Demand ForecastGDP forecasts are as per the ESRI Quarterly EconomicCommentary (QEC) Winter 2011/Spring 2012 Reportcombined with further long range GDP forecasts alsoprovided by the ESRI. It is anticipated that GDP willgrow by 0.9% in 2011/12 and the growth rate willcontinue to increase until 2015/16 when it will settle toan average growth of 3.3% per annum.Peak Demand (GWh/d)200.0180.0160.0140.0120.0100.080.060.040.020.00.0Peak Day and Annual Gas Demands Forecast2011/122012/132013/142014/152015/162016/172017/182018/192019/202020/21Peak Day Annual Demand45.0040.0035.0030.0025.0020.0015.0010.005.000.00Annual Demand (TWh/yr)Energy efficiency savings for all I/C sites are assumedas per the National Energy Efficiency Plan (NEEAP). Itis estimated that 50% of the savings will be achievedwhich results in 33 GWh/y up to 2015/16 and thenincrease to 133 GWh/y for each year onwards.The annual I/C gas demand is forecast to grow by17% by 2020/21 at an average growth rate of 1.7%.The majority of the growth is anticipated within thetransmission connected I/C sites. The distributionconnected sites are also expected to show moremoderate growth. The 1 in 50 year peak day I/C gasdemand is expected to grow at the same rate as theannual demand.4.4.2 Forecast I/C Gas DemandThe future Industrial and Commercial (I/C) gas demandforecast is generated by examining the previousyears gas demand for all transmission and distributedconnected sites which is then grown forward in linewith anticipated connection numbers and forecastGross Domestic Product (GDP) as appropriate.The transmission connected I/C demand growth isforecast for the first six years using anticipated newconnection numbers and associated gas demand. Itthen employs a rate equal to 80% GDP for the periodafter the initial six years. The distribution connected I/Cgas demand growth rate is linked to 80% GDP growthrate for all years.The forecast peak day and annual gas demands of theI/C sector are summarized in Appendix No.1, and theassumptions in relation to the I/C energy efficiencysavings are explained in more detail in Appendix No.3.4.4.3 Forecast Residential Gas DemandFuture residential sector gas demands are estimatedusing the most recent actual residential sector gas useand forecast connections, energy demand per unit,energy efficiency savings and disconnections over theperiod.The forecast of new residential customer numbersis shown in Table 4.7. It is assumed that connectionnumber growth will be relatively slow up until 2013/14after which connection numbers are expected to growsteadily to 2020/21. The total number of residentialcustomers is expected to grow from 620,292 at the startof 2011/12 to 693,223 at the end of 2020/21.Table 4.7: New Residential Connection Assumption by Gas Year2011 /12 2012 /13 2013 /14 2014 /15 2015 /16 2016 /17 2017 /18 2018 /19 2019 /20 2020 /21New 1,200 1,200 1,650 3,825 4,500 4,500 4,500 5,500 6,000 6,500One-off 4,750 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000Disconnections -1,120 -1,167 -1,247 -1,607 -1,719 -1,719 -1,719 -1,883 -1,965 -2,048Total 4,830 5,033 5,403 7,218 7,781 7,781 7,781 8,617 9,035 9,45217

4. DemandThe combination of improved building regulationsfor new housing, increased energy efficiency savingsfor existing housing and the continuing economicuncertainty are assumed to continue the decrease intotal gas demand per unit. It is assumed that the trendof dropping gas demand per customer over recent yearswill continue. 50% of the energy efficiency savingsidentified under the NEEAP document are assumed totake effect over the forecast period. These assumptionscombine to reduce the gas demand per unit from 13.3MWh/y in 2011/12 to 11.3 MWh/y in 2020/21.The annual residential sector gas demand is expected toreduce by -6% over the period to 2020/21 with an annualaverage of -0.7%. The peak day gas demand is assumed tocontract by the same amount. Despite the contraction inthe peak day demand, the residential sector gas demandwill continue to remain the second highest sectoraldemand on the peak day behind power generation.4.5 Sensitivity AnalysisA sensitivity analysis was used to further examine theimpact of the assumptions around forecast GDP andresidential connection numbers. This analysis reflectsthe effect of a variance in either of these assumptions.The analysis shows that varying the GDP assumptionsby +/- 100% along with a +/- 50% variation in newtransmission I/C connection assumptions has a relativelysmall impact on total ROI gas demand.Varying the assumptions regarding new residentialconnection numbers by +/- 100% also had an negligibleimpact on total ROI gas demand.4.5.1 GDP SensitivityGDP is used within the forecasting model to estimatethe future growth in the distribution connected I/Csector. The transmission connected I/C sector gasdemand is estimated through a combination of forecastnew connections for the first 6 years and is thenprojected forward using GDP for later years.A sensitivity analysis around GDP assumptionsexamined the impact of a high and low GDP growthrate combined with a high and low transmissionconnected I/C site growth rate. A high and low GDPgrowth rate was assumed as a 100% increase anddecrease from the base case GDP assumptions. The highand low transmission connections were assumed as plusone connection and minus one connection per yearfrom the assumptions of the base case scenario. Theassumptions and their impact are outlined in Table 4.8.Table 4.8: GDP Sensitivity2011 /12 2012 /13 2013 /14 2014 /15 2015 /16 2016 /17 2017 /18 2018 /19 2019 /20 2020 /21Base GDP 0.9 1.95 2.83 3 3.23 3.31 3.31 3.31 3.31 2.45High GDP 1.8 3.9 5.66 6 6.46 6.62 6.62 6.62 6.62 4.9Low GDP 0 0 0 0 0 0 0 0 0 0Base Connections 2 2 1 1 1 1High Connections 3 3 2 2 2 2Low Connections 1 1 0 0 0 0I/C Gas DemandBase I/C – GWh/y 12.93 13.27 13.52 13.79 13.98 14.18 14.42 14.67 14.92 15.08High I/C – GWh/y 13.11 13.68 14.24 14.83 15.36 15.92 16.63 17.38 18.17 18.75Low I/C – GWh/y 12.75 12.85 12.82 12.78 12.65 12.52 12.39 12.25 12.12 11.99% Change I/C SectorBase to High 1% 3% 5% 7% 10% 12% 15% 19% 22% 24%Base to Low -1% -3% -5% -7% -10% -12% -14% -16% -19% -21%% Change Total ROI Gas DemandTotal ROI to High 0.3% 0.8% 1.3% 1.8% 2.4% 2.9% 3.6% 4.3% 5.2% 5.7%Total ROI to Low -0.3% -0.8% -1.3% -1.7% -2.3% -2.8% -3.3% -3.8% -4.4% -4.8%18

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>The results of the analysis show that a significantvariation in the assumptions regarding GDP have areduced impact on I/C sector gas demand. The impacton I/C sector gas demand is seen to be relativelyinsignificant when viewed in the context of the totalROI gas demand.4.5.2 Residential Connection Numbers SensitivityThe residential gas demand is forecast by estimatingthe future rate of additional residential connectionsand associated gas demand per unit. This additionalload is added to the most recent actual annualresidential gas demand figures. An allowance is alsomade for future disconnections and energy efficiencysavings.A sensitivity analysis around the impact of alternativeresidential connection number forecasts was carriedout in order to examine the effect of alternativeassumptions. A high and a low annual connectionnumber was assumed. The high scenario assumeddouble the number of new connections identifiedin the base case while the low scenario assumed nonew connections. Both the high and low scenariosmaintained the same level of disconnections assumedin the base case scenario. The results of the analysis arepresented in Table 4.9.The results of the analysis indicate that even asignificant alteration in the assumptions regardingnew connection numbers has only a minor impact onresidential gas demand and has a negligible impact onthe overall gas demand forecast.4.5.3 Sensitivity Analysis for Power Generation SectorThe power generation gas demand forecastincorporates a significant range of input assumptions,e.g. electricity demand, forward fuel and carbon prices(see section 4.4.1). Applying a high/low variation toeach of these assumptions would result in a large ofresults, which would be very onerous to report on,compared to that of the I/C and Residential sectorsensitivities. Consequently, a simplified sensitivityanalysis for the power generation sector would not besufficiently robust to provide a conclusive indication ofthe impact of variations to the input assumptions.Table 4.9: Residential Connections Numbers Sensitivity2011 /12 2012 /13 2013 /14 2014 /15 2015 /16 2016 /17 2017 /18 2018 /19 2019 /20 2020 /21Base Numbers 4,830 5,033 5,403 7,218 7,781 7,781 7,781 8,617 9,035 9,452High Numbers 10,780 11,233 12,053 16,043 17,281 17,281 17,281 19,117 20,035 20,952Low Numbers -1,120 -1,167 -1,247 -1,607 -1,719 -1,719 -1,719 -1,883 -1,965 -2,048Residential Gas DemandBase Res – GWh/y 8.30 8.25 8.19 8.14 8.08 8.03 7.97 7.92 7.87 7.82High Res– GWh/y 8.31 8.29 8.26 8.22 8.20 8.17 8.14 8.11 8.08 8.06Low Res – GWh/y 8.29 8.21 8.13 8.05 7.97 7.89 7.81 7.73 7.65 7.58% Change Residential SectorBase to High 0.0% 0.0% 1.0% 1.0% 1.0% 2.0% 2.0% 2.0% 3.0% 3.0%Base to Low 0.0% 0.0% -1.0% -1.0% -1.0% -2.0% -2.0% -2.0% -3.0% -3.0%% Change Total ROI Gas DemandTotal ROI to High 0.0% 0.1% 0.1% 0.2% 0.2% 0.2% 0.3% 0.3% 0.3% 0.4%Total ROI to Low 0.0% -0.1% -0.1% -0.2% -0.2% -0.2% -0.3% -0.3% -0.3% -0.4%19

5. Gas SupplyOutlook5.1 Historical Gas SuppliesThe Moffat Entry Point continues to dominate both theannual and peak day gas supplies for the ROI and theBGÉ system as a whole.The Moffat Entry Point accounted for 93% of annualROI gas supplies in 2010/11 and 95% of BGÉ systemsupplies. Figure 5.1 reflects a growth in the 2010annual gas supply followed by a reduction in 2011. Theincrease in 2010 is due in part to a number of severeweather events occurring in January and December2010. Annual gas supply through the Moffat EntryPoint had grown by an annual average of 1.1% overthe period 2006/07 to 2010/11 but is estimated todecline in 2011/12 . Annual indigenous supply hasseen a -4.8% annual average fall since 2006/07. It isto be noted that indigenous production includes thewithdrawal of gas from storage facilities. It is estimatedthat almost 40% of gas labelled as indigenous supply in2010/11 was gas withdrawn from storage facilities.Moffat gas accounted for 89% of 2011/12 BGÉ systempeak day gas supplies and 85% of ROI peak daysupplies, as presented in Table 5.1. Peak day gas supplythrough the Moffat Entry Point has fallen by -15.9%on 2010/11 figures in line with a reduction in the peakday demand. Indigenous peak day production has alsofallen by -5.0% from 2010/11 and by -6.0% annuallyfrom 2006/07 levels. The 2011/12 BGÉ system peak daygas supply fell by -14.8% from 2010/11 figures.Fig.5.1: Historical Annual Indigenous Gas Production andGB ImportsSupplies (kTOE/year)5,0004,5004,0003,5003,0002,5002,0001,5001,0005000199019921994Sources of ROI gas supplies199619985.2 Future Gas Supply Outlook5.2.1 General OverviewIn the short-term the majority of the ROI gas demandwill continue to be met from GB imports through theMoffat Entry Point. It is likely to change significantlyfrom 2014/15 onwards, with a number of new gassupply projects at various stages of completion:• The Corrib gas field off the Mayo coast is expectedto commence commissioning in October 2014for a period of up to 6 months followed by fullcommercial operation;IND20002002GB2004200620082010Table 5.1: Historical Peak day and Annual Supplies through Moffat and Inch 12006/07 2007/08 2008/09 2009/10 2010/11 2011/12 3(GWh) (GWh) (GWh) (GWh) (GWh) (GWh)Peak dayMoffat 2 234.5 245.6 251.4 292.5 303.9 255.7Inch 43.6 40.0 35.6 34.8 33.7 32.0Total 278.1 285.6 287.0 327.3 337.6 287.7AnnualMoffat 2 69,236 72,645 70,446 73,843 72,320 63,827Inch 4,976 4,772 4,259 4,128 3,765 3,895Total 74,212 77,417 74,705 77,971 76,085 67,7221Daily supply data taken from Gas Transportation Management System (GTMS)2Table shows total Moffat supplies including supplies to ROI, NI and IOM3Annual figures are forecast based on year to date values20

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>• Shannon LNG has indicated 2017 as the earliestpotential date for commercial operation of theproposed LNG terminal on the river Shannon, nearBallylongford in Co. Kerry;• Islandmagee Storage and North East Storagecontinue to progress feasibility studies regardingthe two separate salt-cavity storage projects nearLarne in NI; and• PSE Kinsale Energy have presented two possiblefuture operational scenarios with activities eitherceasing in 2017 or continuing throughout the NDSforecast period.5.2.2 Low Flow Through MoffatIn order to investigate the impact of new indigenoussupply sources on minimum flows through the MoffatEntry Point, it is necessary to examine the flows on a‘Summer Minimum Day’. Two significant events willlead to a reduction in the gas supply through theMoffat Entry Point, namely the operation of KinsaleStorage 365 days a year during the blowdown period(should KEL proceed with decommissioning) and thecommissioning of the Corrib gas field. Please seesection 6.2.3.8 for further detail.5.2.3 Corrib GasThe Corrib gas field, located 83km off the coast ofMayo, is anticipated to be the main source of futureindigenously produced gas. The project’s final stageinvolves the construction of a 9km pipeline betweenland-fall at Glenagad and the gas processing terminalat Bellanaboy including the building of a 4.9km tunnelunder Sruwaddacon Bay in North Mayo.Table 5.2: Corrib Forecast Maximum Daily SupplyYear 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7mscm/dNDS 2012 8.9 8.1 7.0 7.0 6.7 5.9 5.0NDS 2011 10.0 10.0 10.0 8.1 6.8 5.3 4.4Fig.5.2: Glenagad (Landfall) to Bellanaboy Terminal Pipeline RouteSource: Shell E&P Ireland Ltd21

5. Gas Supply OutlookBased on the current construction and commissioningschedule, the Corrib field operators have indicatedthat commissioning of Corrib gas should take place inOctober 2014 for a period of approximately 6 monthsfollowed by full commercial operation.Corrib have recently revised their assumptions regardingpeak day flow capacity to slightly under 9 mscm/d forthe first year and slightly over 8 mscm/d for the secondyear. This change is based on recent well data and, aspresented in Table 5.2, is a revision from the previousfigure of 10 mscm/d for the first three years.For planning purposes, the NDS forecast assumes thatthe facility may not be operational during the peakwinter period of 2014/15 which may occur during thefacilities commissioning period and hence assumes firstcommercial production from October 2015. The impactof a 1 year sensitivity is also assessed where the facilityis assumed to commence full operation in October 2014or is delayed until October 2016.5.2.4 Shannon LNGShannon LNG have indicated the earliest potential startdate of 2017 for commercial operation. Shannon LNGhas received planning permission for both its proposedLNG terminal near Ballylongford in Co. Kerry, and for theassociated transmission pipeline that will deliver the gasinto the ROI transmission system. It is indicated that theterminal would be developed on a phased basis:• Phase I will involve the construction of LNGstorage tanks, and re-gasification facilities with amaximum export capacity of up to 127.0 GWh/d(11.3 mscm/d); and• The LNG terminal has been designed toaccommodate two additional expansion phases ata later date. The maximum send out for the twosubsequent phases are noted as 191.1 GWh/d (17.0mscm/d) and 314.7 GWh/d (28.3 mscm/d).Owing to the uncertainty regarding a possible start datethe facility has not been included in the base supplyscenario. The facility is examined in the NDS modellingnoting the future contribution of the facility to thesecurity of gas supply in Ireland.5.2.5 Larne StorageThere are currently two separate salt-cavity gas storageprojects being proposed for the Larne area in NI, byIslandmagee Storage and North East Storage respectively.Both projects are looking into the commercial feasibilityof developing gas storage in the salt-layers that rununderneath the Larne area:• Islandmagee Storage is a consortium of Infastrata plcand Mutual Energy Ltd, and is looking to developa 5,514 GWh (500 mscm) salt-cavity gas storagefacility underneath Larne Lough, with a maximumwithdrawal rate of 243 GWh/d (22.0 mscm/d) andinjection rate of 132 GWh/d (12.0 mscm/d); and• North East Storage Project, a consortium of BordGáis Energy and Storengy (a GDF-Suez company), islooking to develop a 3,308 GWh (300 mscm) storagefacility near Larne, with maximum withdrawal andinjection rates of 165-221 GWh/d (15-20 mscm/d)and 66-88 GWh/d (6-8 mscm/d) respectively.Fig 5.3: Bellanaboy Gas Terminal22

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Islandmagee submitted a full planning application tothe NI authorities in March 2010 and has since enteredinto agreements with BP Gas Marketing Limited(“BPGM”) regarding the appraisal of the facility.The agreement will fund the activities necessary tofurther develop the project, including the drilling ofa test borehole. The Islandmagee storage developershave indicated 2017/18 as a possible start date forcommercial operation.Fig 5.5: Kinsale Energy Gas RigNorth East Storage completed a exploratory boreholein early 2012. Although sizeable layers of salt were notencountered, samples of the geology were extractedduring drilling and will be analysed and correlated withthe seismic survey results taken in 2009. A decision onthe next steps for the project will be taken when theseresults are known later in 2012.5.2.6 Celtic Sea Gas StorageThe existing Kinsale storage facility is Ireland’s first andonly offshore gas storage facility, which was developedand is operated by PSE Kinsale Energy. It currently hasa working volume of c. 230 mscm, with a maximumwithdrawal and injection rate of 2.6 mscm/d and 1.7mscm/d respectively. This storage facility connects tothe BGÉ transmission system at Inch.PSE Kinsale Energy has expressed its intention toincrease its storage capacity of the South West Kinsalefacility through the installation of a new compressorwith an expected operational date of summer 2013.The new expanded storage facility would result in atotal working volume of 280 mscm, increasing from 230mscm presently, with a withdrawal rate of 2.6 mscm/dremaining unchanged and an injection rate increasingto 2.25 mscm/d, up from 1.7 mscm/d.PSE Kinsale Energy has identified two possible futureoperational scenarios. Kinsale Energy has indicated,as Celtic Sea gas production is gradually declining, theexisting storage operations will not be economic ona standalone basis and the lifetime of the facility isdependent on gas markets. The first scenario, takento be the base case scenario, in which the cessation ofstorage operations and blowdown of the cushion gasfrom the South West Kinsale facility commences in April2014, with total cessation around 2017. A second supplyscenario sees the existing storage operations continuingthroughout the NDS forecast period.Source: PSE Kinsale Energy5.2.7 Other Supply DevelopmentsProvidence resources are currently investigating thedevelopment of a gas storage facility, Ulysses, in the KishBank Basin offshore from Dublin in the Celtic Sea. Theyhave indicated that a number of scenarios have beendeveloped which have an associated range in capacity,off-take export rates and capital expenditure.Recently Providence Resources commenced flow testingon the Barryroe prospect, the results of which areexpected shortly. Future development in this area willcontinue to be assessed.San Leon Energy continue exploration operations offthe West coast of Ireland, located in the Porcupine,Rockall and Slyne basins on the Atlantic margin. Theyexpanded their operations into the Celtic Sea, throughthe acquisition of Island Oil and Gas during 2010.New production techniques mean that “unconventional”gas can now be produced from shale, coal-bed methaneand other “tight” formations, on a more commerciallyviable basis. Bord Gáis Networks and <strong>Gaslink</strong> welcome anynew sources of gas supplies which are produced safelyand in an environmentally friendly manner. Developmentsin this area continue to be reviewed for their potentialimpact on future gas supply scenarios.There is currently no firm data regarding the projectslisted above, therefore, they have been omitted in theNDS forecast. This situation will continue to be kept underreview for future NDS publications.23

6. Network Analysis6.1 Overview of Network AnalysisAs outlined in chapter 5, considerable uncertaintycontinues to surround the timing of certain proposedsupply projects and the future of an existing supplysource on the Island;• PSE KEL has indicated that the continuation ofcurrent Inch storage operations post 2013/14 issubject to ‘favourable’ market conditions, with thepotential for total cessation of Inch supplies after2016/17.Existing Inch storage operations may ceasein 2013/14, followed by a 3 year decommissioningphase when Inch supply is expected to comprise ofproduction and cushion gas and total cessation ofInch supply post 2016/17.• Shannon LNG has indicated the earliest potentialstart date for commercial operation at theirproposed LNG terminal is 2017.• Both Larne Storage developers continue to progressfeasibility studies regarding their respective saltcavity storage projects.Currently the Corrib field is the only prospectivenew supply source in the medium term, with firstcommercial gas supplies expected in 2015. Corrib isanticipated to meet approximately 33% of the ROI’speak day gas demand in its first year of production.However it declines relatively quickly, meetingapproximately 20% of the ROI’s peak day gas demandin 2020/21 (year 5 of production).The Moffat Entry Point (interconnector system) supplied93% of ROI gas demand in 2010/11, a contributionfour times that of Great Britain’s (GB) largest EntryPoint on the NG NTS, St. Fergus, which met 23% 1 ofGB supply in 2010/11. The ROI will continue to dependon the Moffat Entry Point and Interconnector Systemto provide over 90% of its gas demand until Corribcommences production and is likely to revert to this levelof dependency post Corrib. The Moffat Entry Point andInterconnector system may be required to meet 100% ofROI gas demand in the longer term, should Inch cease andno other future supply sources materialise.Last year’s NDS, JGCS and Winter Outlook noted thecapacity limits of the Moffat Entry Point (InterconnectorSystem) will be approached over the coming wintersand will be reached in 2013/14, should forecasted peakdemands occur. The demand and supply forecasts in thisyear’s NDS indicate the same capacity constraint willoccur, albeit one year later in 2014/15 2 . The ongoingpresence of non-uniform flow profiles at the MoffatEntry Point increases the likelihood of reaching capacitylimits before 2014/15.Similar to previous years, the network analysisundertaken for this year’s statement assessed theadequacy of the transmission network to transport arange of forecasted gas flows. However, this year’s NDSexamines Moffat Entry Point (Interconnector System) inmuch greater detail than previous statements and thefactors which impact on its capacity.A slightly different approach has been adoptedin presenting the modelling results andconclusions for this year’s NDS. This year’s statementpresents the network analysis for the onshore ROItransmission system and Interconnector system intwo separate sections. Section 6.2.2 and 6.2.3 arerepresentative of the central or base view. A 3rdsection, 6.2.4, discusses the results of the analysis forthe other potential supply sources (Shannon & Larne),should they proceed.This year’s statement also includes a section onstrategic network reinforcement, section 6.3. Thissection addresses why such reinforcement should beundertaken to mitigate the impact of losing a sectionof the onshore network for a sustained period of time.Appendix 4 provides an overview of the transmissionnetwork modelling and key modelling assumptionsincluded in the network analysis for the NDS.6.2 Network Analysis Results6.2.1 OverviewThe results and conclusions detailed in sections 6.2.2and 6.2.3 are subject to the base demand scenario andthe supply scenario summarised in the Table 6.1, whichindicates the availability of each source of supply over theforecast period. The analysis also considered the impactof Corrib supply commencing from winter 2014/15 andwinter 2016/17.It is important to note, the results and conclusions ofthe network analysis detailed in the following sectionsare subject to a set of assumed demand and supplyconditions. Any departure from these demandand/or supply conditions may lead to a change in pressureprofiles and possible violation of system pressure limits.241 Supply contribution by Entry Point provided by National Grid2 The change by 1 year can be primarily attributed to a change in assumption regarding the cessation of existing Inch storage operations. Last year’sstatements assumed 2012/13, whereas the current assumption is 2013/14.

<strong>NETWORK</strong> <strong>DEVELOPMENT</strong> <strong>STATEMENT</strong>Table 6.1: Summary of Base Scenario2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21Inch*CorribMoffat*Existing Inch storage operations cease in 2013/14, followed by 3 years of decommissioning and total cessation after 2016/17.6.2.2 ROI Onshore Transmission System6.2.2.1 Winter Peak DaysThe onshore ROI transmission system consists of theRing-Main linking Dublin, Galway and Limerick. Anumber of spur transmission pipelines run from theRing-Main to Cork, Limerick, Waterford, Dundalkand the Corrib Bellanaboy terminal in Mayo. The ROItransmission system also includes a compressor stationat Midleton.Network Analysis was undertaken to determine if theROI onshore transmission system has sufficient capacity tomeet forecasted 1-in-50 peak day demands for the next10 years. Corrib, Inch 3 and Moffat are the only sources ofsupply assumed in this analysis, due to the uncertaintyassociated with the other proposed supply sources. The1-in-50 peak day ROI demand forecasts, assumed suppliesand their associated supply capacities are illustrated inFigure 6.1.Network analysis indicates that the ROI onshore systemhas sufficient capacity to meet all gas flow requirementsup to and including 2017/18. Low pressures were observedin the Cork and Waterford areas of the network for allyears from 2017/18, with minimum system pressure limitsbreached from 2018/19.Figure 6.1: ROI Peak Day 1-in-50 Demands & Supply CapacityDemand/Supply (GWh/d)400.0350.0300.0250.0200.0150.0100.050.00.02012/13ROI Peak-day 1-in-50 Demand & Supply Capacity2013/142014/152015/162016/172017/182018/192019/20Moffat (ROI) Corrib Inch Peak Demand2020/21The absence of Inch supplies from 2017/18, results in allof the Cork and Waterford area demand being suppliedfrom Corrib and/or the ICs (Gormanston & Loughshinny).Corrib gas supplies travel south through the 30”Pipeline to the West (PTTW) to Goat Island (Co.Limerick), then through the 16” pipeline betweenGoatisland and Curraleigh West (GICWP) and finallythrough the twinned section of pipeline betweenCurraleigh West and Midleton.Whilst the PTTW (upstream of Goat Island) and theCurraleigh West to Midleton pipelines have sufficientcapacity to transport large volumes of gas, the 16”pipeline connecting Goatisland to Curraleigh Westdoes not. As illustrated in Figure 6.2, this 37km pipelineexperiences substantial pressure losses when subject tohigh flows.Figure 6.2: Pipeline Pressure Losses - Cappagh South to MidletonPressure (barg)70Cappagh South656055504540Cappagh South to Midleton Pressure Profile0 30 60 90 120 150 180 210Distance (km)PressureGoatislandCurraleighwestMidletonSimilarly, the 180km Cork to Dublin (CDP) 18” pipelinebetween Brownsbarn and Curraleigh West experiencessignificant pressure losses when transporting largevolumes of gas. Consequently the pressure losses whichoccur in the CDP and GICWP result in low pressuresdownstream in both Cork and Waterford, resulting inminimum pressure limits being violated from 2018/19.3 Inch supply is assumed to cease post 2016/1725

6. Network AnalysisFigure 6.3: Cork Area Demand & Local PressuresForecasted Cork Area Peak Day Demands & Pressures• The flow profile from the indigenous supplysources, Corrib and/or Inch; and• The within day demand diurnal.Cork Area Demand (GWh/d)Figure 6.3 illustrates Cork area demand (the columns),the associated supplies that meet this demand and thelocal pressures 4 .Considering the timeline associated with the occurrenceof such minimum pressure violations, i.e. approximatelysix to seven years away, and the future uncertaintyregarding Celtic Sea operations, future statements willcontinue to monitor this situation and recommendappropriate action if and when it is required. It shouldbe noted; the Goatisland to Curraleigh West pipelinereinforcement was identified in the Gas 2025 study,which was undertaken by the Department of PublicEnterprise and BGÉ in the late 1990’s.6.2.2.2 Summer Minimum DaysThe NDS demand and supply forecast indicates theremaybe a number of days during the summer period incertain years when indigenous ROI supply capacity will besufficient in meeting all of the ROI demand. Consequentlythere may be no gas supply required from the IC systemon such days (subject to contractual arrangementsbetween the Shippers and Suppliers/Producers).Currently pressures in the ROI onshore transmissionsystem remain relatively steady throughout the day, asthey are primarily regulated/controlled by GormanstonAGI, with the subsea IC system absorbing the withinday pressure swings that result from the within daydemand diurnal.However, if there was no gas supply required from theIC system (and through Gormanston), the pressure in theonshore ROI transmission system would be subject to;26807060504030201002016/17 2017/18 2018/19 2019/20 2020/215048464442403836343230Corrib & Moffat Inch Pressures @ Midleton Minimum Pressure Limit4 Pressure north of Midleton, Co. Cork5 Moffat will be required to meet 100% of the Island’s demand, if Inch supply is unavailablePressure (barg)The supply flow profile from Inch and Corrib is assumedto be flat. A flat flow supply profile combined with awithin day demand diurnal would result in the withinday pressure swings occurring in the onshore ROItransmission system.Network analysis indicates all pressure and flowrequirements may be met with supplies from Corriband Inch alone on a ‘Summer Minimum Day’, i.e. the‘Summer Minimum Day’ demand diurnal swing maybe accommodated within the Ring-Main, assumingappropriate supply pressures and flow profiles.6.2.2.3 Local ReinforcementNotwithstanding the results and conclusions detailedin the previous sections, local system reinforcementcould be required if large new connections (whichare not anticipated in the demand forecasts) were tomaterialise.6.2.2.4 ConclusionNetwork analysis indicates the ROI onshoretransmission system has sufficient capacity to meetthe gas flow requirements on winter peak days andsummer minimum days for the next six to seven years.Though pressure violations were observed in thesouthern part of the transmission system (Cork andWaterford) for the 1-in-50 peak days in the later yearsof the forecast period, the occurrence of such lowpressures were subject to the unavailability of Inchsupply. Future statements will continue to monitor thispotential issue, and recommend appropriate action ifand when required.6.2.3 Moffat Entry Point6.2.3.1 OverviewGB gas imports will continue to meet the significantmajority (or possibly all) 5 of the Island’s peak daygas demand until Corrib commences commercialproduction. However, there is a limitation to theamount of GB gas that can meet the Island’s demand,despite sufficient gas supplies being available in GB.This limitation is due to the technical capacity of theMoffat Entry Point on the BGÉ system.