2012 Copy of Budget - Upper Freehold Township

2012 Copy of Budget - Upper Freehold Township

2012 Copy of Budget - Upper Freehold Township

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

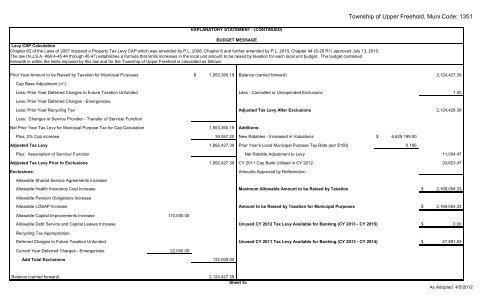

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENT - (CONTINUED)BUDGET MESSAGELevy CAP CalculationChapter 62 <strong>of</strong> the Laws <strong>of</strong> 2007 imposed a Property Tax Levy CAP which was amended by P.L. 2008, Chapter 6 and further amended by P.L. 2010, Chapter 44 (S-29 R1) approved July 13, 2010.The law (N.J.S.A. 40A:4-45.44 through 45.47) establishes a formula that limits increases in the local unit amount to be raised by taxation for each local unit budget. The budget containedherewith is within the limits imposed by this law and for the <strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> is calculated as follows:Prior Year Amount to be Raised by Taxation for Municipal Purposes $ 1,953,360.19 Balance (carried forward) 2,124,427.39Cap Base Adjustment (+/-)Less: Prior Year Deferred Charges to Future Taxation Unfunded Less - Cancelled or Unexpended Exclusions 1.00Less: Prior Year Deferred Charges - EmergenciesLess: Prior Year Recycling Tax Adjusted Tax Levy After Exclusions 2,124,426.39Less: Changes in Service Provider - Transfer <strong>of</strong> Service/ FunctionNet Prior Year Tax Levy for Municipal Purpose Tax for Cap Calculation 1,953,360.19 Additions:Plus: 2% Cap increase 39,067.20 New Ratables - Increased in Valuations $ 6,629,199.00Adjusted Tax Levy 1,992,427.39 Prior Year's Local Municipal Purpose Tax Rate (per $100) 0.166Plus: Assumption <strong>of</strong> Service/ Function Net Ratable Adjustment to Levy 11,004.47Adjusted Tax Levy Prior to Exclusions 1,992,427.39 CY 2011 Cap Bank Utilized in CY <strong>2012</strong> 33,623.47Exclusions:Amounts Approved by ReferendumAllowable Shared Service Agreements IncreaseAllowable Health Insurance Cost Increase Maximum Allowable Amount to be Raised by Taxation $ 2,169,054.33Allowable Pension Obligations IncreaseAllowable LOSAP Increase Amount to be Raised by Taxation for Municipal Purposes $ 2,169,054.33Allowable Capital Improvements Increase 110,000.00Allowable Debt Service and Capital Leases Increase Unused CY <strong>2012</strong> Tax Levy Available for Banking (CY 2013 - CY 2015) $0.00Recycling Tax AppropriationDeferred Charges to Future Taxation Unfunded Unused CY 2011 Tax Levy Available for Banking (CY 2013 - CY 2014) $ 47,891.53Current Year Deferred Charges - Emergencies 22,000.00Add Total Exclusions 132,000.00Balance (carried forward) 2,124,427.39Sheet 3cAs Adopted 4/5/<strong>2012</strong>