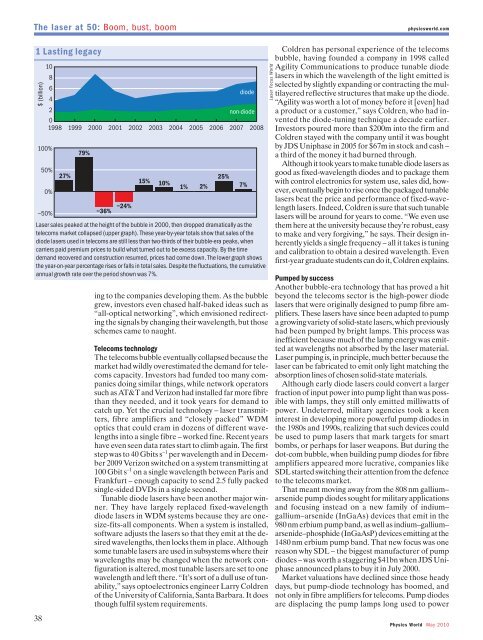

The laser at 50: Boom, bust, boomphysicsworld.com1 Lasting legacy1086diode42non-diode01998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008100%79%50%27%25%15% 10%1% 2% 7%0%–36% –24% –50%Laser sales peaked at the height of the bubble in 2000, then dropped dramatically as thetelecoms market collapsed (upper graph). These year-by-year totals show that sales of thediode lasers used in telecoms are still less than two-thirds of their bubble-era peaks, whencarriers paid premium prices to build what turned out to be excess capacity. By the timedemand recovered and construction resumed, prices had come down. The lower graph showsthe year-on-year percentage rises or falls in total sales. Despite the fluctuations, the cumulativeannual growth rate over the period shown was 7%.$ (billion)38ing to the companies developing them. As the bubblegrew, investors even chased half-baked ideas such as“all-optical networking”, which envisioned redirectingthe signals by changing their wavelength, but thoseschemes came to naught.Telecoms technologyThe telecoms bubble eventually collapsed because themarket had wildly overestimated the demand for telecomscapacity. Investors had funded too many companiesdoing similar things, while network operatorssuch as AT&T and Verizon had installed far more fibrethan they needed, and it took years for demand tocatch up. Yet the crucial technology – laser transmitters,fibre amplifiers and “closely packed” WDMoptics that could cram in dozens of different wavelengthsinto a single fibre – worked fine. Recent yearshave even seen data rates start to climb again. The firststep was to 40 Gbits s –1 per wavelength and in De cem -ber 2009 Verizon switched on a system transmitting at100 Gbit s –1 on a single wavelength between Paris andFrankfurt – enough capacity to send 2.5 fully packedsingle-sided DVDs in a single second.Tunable diode lasers have been another major winner.They have largely replaced fixed-wavelengthdiode lasers in WDM systems because they are onesize-fits-allcomponents. When a system is installed,software adjusts the lasers so that they emit at the de -sired wavelengths, then locks them in place. Althoughsome tunable lasers are used in subsystems where theirwavelengths may be changed when the network configurationis altered, most tunable lasers are set to onewavelength and left there. “It’s sort of a dull use of tunability,”says optoelectronics engin eer Larry Coldrenof the University of California, Santa Barbara. It doesthough fulfil system requirements.Laser Focus WorldColdren has personal experience of the telecomsbubble, having founded a company in 1998 calledAgility Com munications to produce tunable diodelasers in which the wavelength of the light emitted isselected by slightly expanding or contracting the multilayeredreflective structures that make up the diode.“Agility was worth a lot of money before it [even] hada product or a customer,” says Coldren, who had in -vented the diode-tuning technique a decade earlier.Investors poured more than $200m into the firm andColdren stayed with the company until it was boughtby JDS Uniphase in 2005 for $67m in stock and cash –a third of the money it had burned through.Although it took years to make tunable diode lasers asgood as fixed-wavelength diodes and to package themwith control electronics for system use, sales did, however,eventually begin to rise once the packaged tunablelasers beat the price and performance of fixed-wavelengthlasers. Indeed, Coldren is sure that such tu nablelasers will be around for years to come. “We even usethem here at the university because they’re robust, easyto make and very forgiving,” he says. Their design in -herently yields a single frequency – all it takes is tu ningand calibration to obtain a desired wavelength. Evenfirst-year graduate students can do it, Coldren explains.Pumped by successAnother bubble-era technology that has proved a hitbeyond the telecoms sector is the high-power diodelasers that were originally designed to pump fibre am -plifiers. These lasers have since been adapted to pumpa growing variety of solid-state lasers, which previouslyhad been pumped by bright lamps. This process wasinefficient because much of the lamp energy was emittedat wavelengths not ab sorbed by the laser material.Laser pumping is, in principle, much better because thelaser can be fabricated to emit only light matching theabsorption lines of chosen solid-state materials.Although early diode lasers could convert a largerfraction of input power into pump light than was poss -ible with lamps, they still only emitted milliwatts ofpower. Undeterred, military agencies took a keeninterest in developing more powerful pump diodes inthe 1980s and 1990s, realizing that such devices couldbe used to pump lasers that mark targets for smartbombs, or perhaps for laser weapons. But during thedot-com bubble, when building pump diodes for fibreamplifiers appeared more lucrative, companies likeSDL started switching their attention from the defenceto the telecoms market.That meant moving away from the 808 nm gallium–arsenide pump diodes sought for military applicationsand focusing instead on a new family of indium–gallium–arsenide (InGaAs) devices that emit in the980 nm erbium pump band, as well as indium– gallium–arsenide–phosphide (InGaAsP) devices emitting at the1480 nm erbium pump band. That new focus was onereason why SDL – the biggest manufacturer of pumpdiodes – was worth a staggering $41bn when JDS Uni -phase an nounced plans to buy it in July 2000.Market valuations have declined since those headydays, but pump-diode technology has boomed, andnot only in fibre amplifiers for telecoms. Pump diodesare displacing the pump lamps long used to powerPhysics World May 2010

physicsworld.comThe laser at 50: Boom, bust, boomneodymium-doped solid-state lasers, while today’sgreen laser pointers are miniaturized frequency-doubledneodymium lasers, pumped by battery-powereddiode lasers. (They are not strictly green lasers as theydo not generate green light; instead, they take infraredlight and double its frequency using nonlinear crystalsso that it emerges as green.) At the opposite end of thepower scale, the US defence firms Northrop Grummanand Textron Systems have each demonstrated 100 kWsolid-state laser weapons pumped by diode lasers.These much more powerful lasers – which could beused to track, illuminate and then ignite enemy rockets,artillery and mortars up to a couple of kilometresaway – are much smaller and easier to use than theywould be without pump diodes.Variations on a themeDiode pumping has also been the key to success for avariation on another bubble-era technology: a noveltype of semiconductor laser called the vertical-external-cavitysurface-emitting laser (VECSEL) that hadoriginally been developed by researchers at the Massa -chusetts Institute of Technology’s Lincoln La bor atory.The laser light in a VECSEL emerges from the top ofa wafer, not from the edge as in usual diode lasers, andthe device contains one external mirror and one at thebottom of the chip.During the bubble, Aram Mooradian – a Lincoln Labalumnus – landed over $100m in venture capital toset up a company called Novalux to build electricallypumped VECSELs for telecoms. That market nevergot off the ground, and, after burning through $193m inventure capital, the firm was finally sold in 2008 for amere $7m to Arasor International, an Australian startup.Its shares were last seen selling for 2 cents each.However, diode-pumped VECSELs – also knownas optically pumped semiconductor lasers – are doingmuch better, having become a hot new approach tomaking visible solid-state lasers (figure 2). The big ad -vantage of optically pumping a semiconductor laser inthis way is that the laser can generate wavelengths itcannot produce if it is pumped electrically. One leaderin the field is the US firm Coherent, which has used thisapproach to generate watt-range powers at, for ex -ample, an infra red wavelength of 1154 nm that can bedoubled in frequency in a nonlinear crystal to create ayellow 577 nm beam. This wavelength is important intreating diabetic retinopathy, a common cause of blindnessarising from the spread of abnormal blood vesselsacross the retina. When the laser illuminates the retina,oxygenated haemoglobin in the blood vessels absorbsits emission, heating and destroying the vessels.The power of fibreBut easily the most successful bubble-era spin-off arefibre lasers, which now deliver kilowatt-class powersfor industrial applications and ultrashort pulses forresearch. Like fibre amplifiers, fibre lasers use rareearth-dopedfibres pumped from their ends by diodelasers. The rare-earth metal is confined in a small innercore with high refractive index, which is surrounded byan outer core made of lower-index glass that confineslight from the pump diodes. The dual-core structurepasses the pump light repeatedly through the innerPhysics World May 20102 Spin-off successactive region Bragg mirrorsubstratequantum wellsoutputcouplerOne successful technology from the telecoms bubble of the early 2000s is a novel type ofoptically pumped semiconductor laser known as the vertical-external-cavity surface-emittinglaser (VECSEL). At the heart of these devices (left) is a series of sandwich-like layers ofsemiconducting material – known as quantum wells – sitting on top of an internal “Bragg”mirror that is deposited in turn on a substrate such as the “III–V” semiconductor galliumarsenide. As shown on the right, the light emerges from the top of the device, not from the edgeas in usual diode lasers. The VECSEL is pumped by light from a semiconductor diode laser,while a “heat sink” – a metal block or slab – conducts heat generated from the VECSEL awayand it is cooled either by flowing water or simply air convection. The “output coupler” is a mirrorthat transmits some light and reflects the rest back into the laser cavity to produce oscillation,while the “intercavity elements” are one or more optical devices that in this case double thefrequency of light generated in the VECSEL.core, so that most of the pump energy is converted intolaser output. With the best materials, the conversionefficiency can reach 80% in the lab – impressively highby laser standards. Another benefit of this fibre geometryis a large surface-area to volume ratio, easing theremoval of waste heat, which has been a problem withbulk rod or slab solid-state lasers.Bubble-era developers looked at many rare-earthdopants for optical fibres. Ytterbium is the most at -tract ive for high-power operation because it can bediode pumped using light at wavelengths only slightlyshorter than the output wavelength, which means thatthe emitted photons can contain more than 90% of thepump-photon energy. (The total pump efficiency is,however, limited to no more than 80% because not allof the excited atoms emit laser photons.) Ytterbiumemits light at wavelengths of about 1030 nm, close tothe 1064 nm emission of neodymium, which means thatytterbium-fibre lasers with higher power and efficiencycould replace widely used neodymium solid-state lasersfor many applications.Fibre lasers can reach impressive power levels. IPGPhotonics, for example, has built fibre oscillator amplifierswith single-mode powers of 10 kW and multimodepowers, with much lower beam quality, of 50 kW. Thoseare among the highest powers available from any commerciallaser. Although some of its lasers are so power -ful that military agencies have field-tested them for thedestruction of improvized explosive devices and un -exploded ordnance on the battlefield, IPG’s main businessis selling lasers that can be used in industry forapplications such as cutting metals (figure 3). Fibreslaser cavityintracavityelementssemiconductor-diodepump laserheatsinksemiconductordiskpump optics39John-Mark Hopkins, University of Strathclyde