Chapter 9: One-Tailed Tests, Two-Tailed Tests ... - Amherst College

Chapter 9: One-Tailed Tests, Two-Tailed Tests ... - Amherst College

Chapter 9: One-Tailed Tests, Two-Tailed Tests ... - Amherst College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

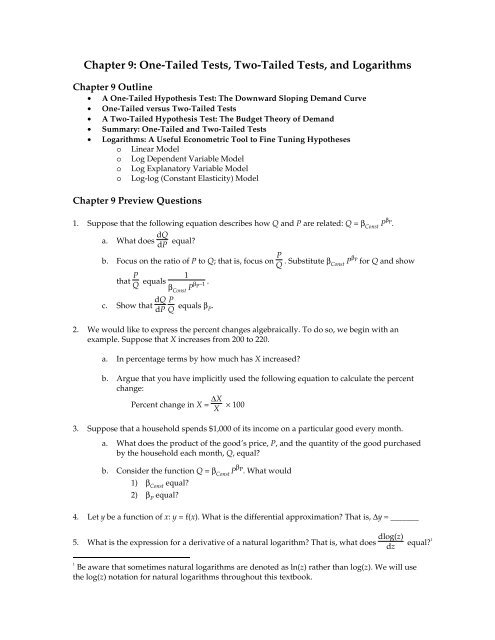

<strong>Chapter</strong> 9: <strong>One</strong>-<strong>Tailed</strong> <strong>Tests</strong>, <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>, and Logarithms<strong>Chapter</strong> 9 Outline• A <strong>One</strong>-<strong>Tailed</strong> Hypothesis Test: The Downward Sloping Demand Curve• <strong>One</strong>-<strong>Tailed</strong> versus <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>• A <strong>Two</strong>-<strong>Tailed</strong> Hypothesis Test: The Budget Theory of Demand• Summary: <strong>One</strong>-<strong>Tailed</strong> and <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>• Logarithms: A Useful Econometric Tool to Fine Tuning Hypotheseso Linear Modelo Log Dependent Variable Modelo Log Explanatory Variable Modelo Log-log (Constant Elasticity) Model<strong>Chapter</strong> 9 Preview Questions1. Suppose that the following equation describes how Q and P are related: Q = β ConstP β P.a. What does dQdP equal?b. Focus on the ratio of P to Q; that is, focus on P Q . Substitute β Const Pβ Pfor Q and showthat P Q equals 1β ConstP β P −1 .c. Show that dQ PdP Q equals β P .2. We would like to express the percent changes algebraically. To do so, we begin with anexample. Suppose that X increases from 200 to 220.a. In percentage terms by how much has X increased?b. Argue that you have implicitly used the following equation to calculate the percentchange:Percent change in X = ΔX X × 1003. Suppose that a household spends $1,000 of its income on a particular good every month.a. What does the product of the good’s price, P, and the quantity of the good purchasedby the household each month, Q, equal?b. Consider the function Q = β ConstP βP . What would1) β Constequal?2) β Pequal?4. Let y be a function of x: y = f(x). What is the differential approximation? That is, Δy ≈ _______5. What is the expression for a derivative of a natural logarithm? That is, what does dlog(z)dzequal? 11Be aware that sometimes natural logarithms are denoted as ln(z) rather than log(z). We will usethe log(z) notation for natural logarithms throughout this textbook.

2A <strong>One</strong>-<strong>Tailed</strong> Hypothesis Test: The Downward Sloping Demand CurveMicroeconomic theory tells us that the demand curve is typically downward sloping. Inintroductory economics and again in intermediate microeconomics we present sound logicalarguments justifying the shape of the demand curve. History has taught us many times, however,that just because a theory sounds sensible does not necessary mean that it is true in fact. We musttest this theory to determine if it is supported by real world evidence. We shall focus on gasolineconsumption in the United States during the 1990’s to test the downward sloping demand theory.Gasoline Consumption Data: Annual time series data U. S. gasoline consumption and pricesfrom 1990 to 1999.GasCons tU. S. gasoline consumption in year t (millions of gallons per day)PriceDollars tReal price of gasoline in year t (dollars per gallon – chained 2000 dollars)GasolineGasolineReal Price Consumption Real Price ConsumptionYear ($ per gallon) (Millions of gals) Year ($ per gallon) (Millions of gals)1990 1.43 303.9 1995 1.25 327.11991 1.35 301.9 1996 1.31 331.41992 1.31 305.3 1997 1.29 336.71993 1.25 314.0 1998 1.10 346.71994 1.23 319.2 1999 1.19 354.1Theory: A higher price decreases the quantity demanded; demand curve is downward sloping.Project: Assess the effect of gasoline prices on gasoline consumption.Step 0: Formulate a model reflecting the theory to be tested.Our model will be a simple linear equation:GasCons t= β Const+ β PPriceDollar s t+ e twhere GasCons = Quantity of Gasoline DemandedPriceDollars = Price (Chained 1990 Dollars)The theory suggests that β Pshould be negative. A higher price decreases the quantitydemanded; the demand curve is upward sloping.Step 1: Collect data, run the regression, and interpret the estimates.The gasoline consumption data can be accessed by clicking within the red box below:Click here to access data {EViewsLink}Dependent Variable: GasConsExplanatory Variable: PriceDollarsDependent Variable: GASCONSIncluded observations: 10Coefficient Std. Error t-Statistic Prob.PRICEDOLLARS -151.6556 47.57295 -3.187853 0.0128C 516.7801 60.60223 8.527410 0.0000Table 9.1: Gasoline Demand Regression PrintoutEstimated Equation: EstGasCons = 516.8 − 151.7PriceDollars

3Interpretation: We estimate that a $1 increase in the real price of gasoline decreases thequantity of gasoline demanded by 151.7 million gallons.Critical Result: The coefficient estimate equals −151.7. The negative sign of the coefficientestimate suggests that a higher price reduces the quantity demanded. This evidence supportsthe downward sloping demand theory.While the regression results indeed support the theory, remember that we can never expectan estimate to equal the actual value; sometimes the estimate will be greater than the actualvalue and sometimes less. The fact that the estimate of the price coefficient is negative,−151.7, is comforting, but it does not prove that the actual price coefficient, β x , is negative. Infact, we do not have and can never have indisputable evidence that the theory is correct.How do we proceed?Step 2: Play the cynic and challenge the results; construct the null and alternative hypotheses.Cynic’s view: The price actually has no effect on the quantity of gasoline demanded; thenegative coefficient estimate obtained from the data was just “the luck of the draw.” In fact,the actual coefficient, β P , equals 0.Now, we construct the null and alternative hypotheses:H 0: β P= 0H 1: β P< 0Cynic’s view is correct: Price has no effect on quantity demandedCynic’s view is incorrect: A higher price decreases quantity demandedThe null hypothesis, like the cynic, challenges the evidence. The alternative hypothesis isconsistent with the evidence.Step 3: Formulate the question to assess the cynic’s view and the null hypothesis.Question for the Cynic:• Generic Question: What is the probability that the results would be like those weactually obtained (or even stronger), if the cynic is correct and the price actually has noimpact?• Specific Question: The regression’s coefficient estimate was −151.7: What is theprobability that the coefficient estimate in one regression would be −151.7 or less, if H 0were actually true (if the actual coefficient, β P , equals 0)?Answer: Prob[Results IF Cynic Correct] or Prob[Results IF H 0True]The magnitude of this probability determines whether we reject the null hypothesis:Prob[Results IF H 0True] small↓Unlikely that H 0is trueProb[Results IF H 0True] large↓Likely that H 0is true↓↓Reject H 0Do not reject H 0

4Step 4: Use the general properties of the estimation procedure, the probability distribution of theestimate, to calculate Prob[Results IF H 0True].If the null hypothesis were true, theactual price coefficient would equal 0.Since ordinary least squares estimationprocedure for the coefficient value isunbiased, the mean of the probabilitydistribution for the coefficient estimateswould be 0. The regression printoutprovides us with the standard error ofthe coefficient estimate. The degrees offreedom equal the number ofobservations less 2, since we areestimating two parameters, the constantand the price coefficient..0128/2Student t-distributionMean = 0SE = 47.6DF = 8.0128/2−151.70Figure 9.1: Probability Distribution of Coefficient Estimatesb POLS estimation AssumeH 0Standard Number of Number ofprocedure unbiased is true Error observations parametersMean[b P] = β P= 0 SE[b P] = 47.6 DF = 10 − 2 = 8We now have the information needed to calculate Prob[Results IF H 0True], the probability ofobtaining a result like the one obtained (or even stronger) if the null hypothesis, H 0, were true.We could use the Econometrics Lab to compute this probability, but in fact the statisticalsoftware has already done this for us:Dependent Variable: GasConsExplanatory Variable: PriceDollarsDependent Variable: GASCONSIncluded observations: 10Coefficient Std. Error t-Statistic Prob.PRICEDOLLARS -151.6556 47.57295 -3.187853 0.0128C 516.7801 60.60223 8.527410 0.0000Table 9.2: Gasoline Demand Regression PrintoutRecall that the Prob. column reports the tails probability:Tails Probability: The probability that the coefficient estimate, b P, resulting from oneregression would lie at least 151.7 from 0, if the actual coefficient, β P , equals 0.The tails probability reports the probability of lying in either of the two tails. We are onlyinterested in the probability that the coefficient estimate will be −151.7 or less; that is, we areonly interested in the left tail. Since the Student t-distribution is symmetric, we divide thetails probability by 2 to calculated Prob[Results IF H 0True]:Prob[Results IF H 0True] = .01282= .0064

5Step 5: Decide on the standard of proof, a significance level.The significance level is the dividing line between the probability being small and theprobability being large.Prob[Results IF H 0True]Less Than Significance Level↓Prob[Results IF H 0True] small↓Unlikely that H 0is trueProb[Results IF H 0True]Greater Than Significance Level↓Prob[Results IF H 0True] large↓Likely that H 0is true↓↓Reject H 0Do not reject H 0The traditional significance levels in academia are 1, 5, and 10 percent. In this case, theProb[Results IF H 0True] equals .0064, less than .01. So, even with a 1 percent significancelevel, we would reject the null hypothesis that price has no impact on the quantity. Thisresult supports the theory that the demand curve is downward sloping.<strong>One</strong>-<strong>Tailed</strong> versus <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>Thus far, we have considered only one-tailed tests because thus far the theories we haveinvestigated suggest that the coefficient was greater than a specific value or less than a specificvalue:• Quiz Score Theory: The theory suggested that studying increases quiz scores, that thecoefficient of minutes studied was greater than 0.• Demand Curve Theory: The theory suggested that a higher price decreases the quantitysupplied, that the coefficient of price was less than 0.In these cases, we were only concerned with one side or one tail of the distribution, either theright tail or the left tail.Some theories, however, suggest that the coefficient equals a specific value. In these cases, bothsides (both tails) of the distribution are relevant and two-tailed tests are appropriate.We shall now investigate one such theory, the budget theory of demand.

6A <strong>Two</strong>-<strong>Tailed</strong> Hypothesis Test: The Budget Theory of DemandThe budget theory of demand postulates that households first decide on the total number ofdollars to spend on a good. Then, as the price of the good fluctuates, households adjust thequantity they purchase to stay within their budgets. We shall focus on gasoline consumption toassess this theory:Budget Theory of Demand: Expenditures for gasoline are constant. That is, when gasolineprices change, households adjust the quantity demanded so as to keep their gasolineexpenditures constant. Expressing this mathematically, the budget theory of demandpostulates that the price, P, times the quantity, Q, of the good demanded equals a constant:P×Q = BudAmtwhere BudAmt = Budget AmountProject: Assess the budget theory of demand.As we shall learn, the price elasticity of demand is critical in assessing the budget theory ofdemand. Consequently, we shall now review the verbal definition of the price elasticity ofdemand and show how we can make it mathematically rigorous.Verbal Definition: The price elasticity demand equals the percent change in the quantitydemanded resulting from a one percent change in price.To convert the verbal definition into a mathematical one we start with the verbal definition:Price elasticity of demand= The percent change in quantity demanded resulting from a 1 percent change in the priceConvert this verbal definition into a ratio.=Percent change in the QuantityPercent change in the PriceNext, let us express the percent changes algebraically. To do so, consideran example. Suppose that the variable X increases from 200 to 220; thisconstitutes a 10 percent increase. How did we calculate that?X: 200 → 220Percent change in X = 220−200200× 100 = 20200× 100 = .1× 100 = 10 percentWe can generalize this: Percent change in X = ΔX X × 100===ΔQQ × 100ΔPP × 100 Substituting for the percent changesΔQ PΔP QdQ PdP QSimplifyingTaking limits as ΔP approaches 0There always exists a potential confusion surrounding the numerical value for the price elasticityof demand. Since the demand curve is downward sloping, dQdPis negative. Consequently, theprice elasticity of demand will be negative. Some textbooks, in an effort to avoid negative

7numbers, refer to price elasticity of demand as an absolute value. This can lead to confusion,however. Accordingly, we shall adopt the more straightforward approach: our elasticity ofdemand will be defined so that it is negative.Now, we are prepared to embark on the hypothesis testing process.Step 0: Formulate a model reflecting the theory to be tested.The appropriate model is the constant price elasticity model:Q = β ConstP β P.Before doing anything else, however, let us now explain why this model indeed exhibitsconstant price elasticity. We start with the mathematical definition of the price elasticity ofdemand:Price elasticity of demand = dQ PdP QNow, compute the price elasticity of demand when Q = β ConstP β P:Price elasticity of demand = dQ PdP QRecalling the rules of differentiation:dQdP = β Const β P Pβ P −1= β Constβ P P β P −1 PQSubstituting β ConstP β Pfor Q.= β Constβ P P β P −1 Pβ ConstP β PSimplifying.= β PThe price elasticity of demand just equals the value of β P , the exponent of the price, P.A little algebra allows us to show that the budget theory of demand postulates that the priceelasticity of demand, β P, equals −1. First, start with the budget theory of demand:P×Q = BudAmtMultiplying through by P −1Q = BudAmt×P −1Compare this to the constant price elasticity demand model: Q = β ConstP β P. Clearly,β Const= BudAmt and β P= −1So, let us reframe the budget theory of demand in terms of the price elasticity of demand, β P:Budget Theory of Demand: β P= −1.0Natural logarithms allow us to convert the constant price elasticity model into its linear form:Q= β ConstP β Plog(Q) = log(β Const) + β Plog(P)Taking natural logarithms of both sides.LogQ = c + β PLogP where LogQ = log(Q), c = log(β Const), and LogP = log(P)

8Step 1: Collect data, run the regression, and interpret the estimates.Recall that we are using U.S. gasoline consumption data to assess the theory.Gasoline Consumption Data: Annual time series data U. S. gasoline consumption and pricesfrom 1990 to 1999.GasCons tU. S. gasoline consumption in year t (millions of gallons per day)PriceDollars tReal price of gasoline in year t (dollars per gallon – chained 2000 dollars)We must generate the two variables: the logarithm of quantity and the logarithm of price:• LogQ = log(GasCons)• LogP = log(Price)Click here to access data {EViewsLink}Getting Started in EViewsTo generate the new variables, open the workfile.• In the Workfile window: click Genr• In the Generate Series by Equation window: enter the formula for the new series:logq = log(GasCons)• Click OKRepeat the process to generate the logarithm of price.• In the Workfile window: click Genr• In the Generate Series by Equation window: enter the formula for the new series:logp = log(PriceDollars)• Click OKNow, we can use EViews to run a regression with logq, the logarithm of quantity, as thedependent variable and logp, the logarithm of price, as the explanatory variable.• In the Workfile window: Click on the dependent variable, logq, first; and then, clickon the explanatory variable, logp, while depressing the key.• In the Workfile window: Double click on a highlighted variable• In the Workfile window: Click Open Equation• In the Equation Specification window: Click OK• Do not forget to close the workfile.Dependent Variable: LogQExplanatory Variable: LogPDependent Variable: LOGQIncluded observations: 10Coefficient Std. Error t-Statistic Prob.LOGP -0.585623 0.183409 -3.192988 0.0127C 5.918487 0.045315 130.6065 0.0000Table 9.3: Budget Theory of Demand Regression Printout

9Estimated Equation: LogQ = 5.92 − .586LogPInterpretation: We estimate that a 1 percent increase in the price decreases the quantitydemand by .586 percent. That is, the estimate for the price elasticity of demand equals −.586.Critical Result: The coefficient estimate equals −.586. The coefficient estimate does not equal−1.0; the estimate is .414 from −1. This evidence suggests that the budget theory of demand isincorrect.NB: Since the budget theory of demand postulates that the price elasticity of demand equals −1.0,the critical result is not whether the estimate is above or below −1.0. Instead the critical result isthat the estimate does not equal −1.0; more specifically, the estimate is .414 from −1.0. Had theestimate been −1.414 rather than −.586, the results would have been just as troubling as far as thebudget theory of demand is concerned.TheoryEvidencePriceElasticity.414−1.0 −.5860Figure 9.2: Number Line Illustration of Critical ResultStep 2: Play the cynic and challenge the results; construct the null and alternative hypotheses.The cynic always challenges the evidence. The regression results suggest that the priceelasticity of demand does not equal −1.0 since the coefficient estimate equals −.586.Accordingly, the cynic challenges the evidence by asserting that it does equal −1.0.Cynic’s view: Sure the coefficient estimate from regression suggests that the price elasticityof demand does not equal −1.0, but this is just “the luck of the draw.” In fact, the actual priceelasticity of demand equals −1.0.Question: Can we dismiss the cynic’s view as absurd?Answer: No, as a consequence of random influences. Even if the actual price elasticity equals−1.0, we could never expect the estimate to equal precisely −1.0. The effect of randominfluences is captured formally by the “statistical significance question:”Statistical Significance Question: Is the estimate of −.586 statistically different from−1.0? More precisely, if the actual value equals −1.0, how likely would it be for randominfluences to cause the estimate to be .414 or more from −1.0?We shall now construct the null and alternative hypotheses to address this question:H 0: β P= −1.0H 1: β P≠ −1.0Cynic’s view is correct: Actual price elasticity of demand equals −1.0.Cynic’s view is incorrect: Actual price elasticity of demand does not equal −1.0.

10Step 3: Formulate the question to assess the cynic’s view and the null hypothesis.Question for the Cynic:• Generic Question: What is the probability that the results would be like those weactually obtained (or even stronger), if the cynic is correct and the actual priceelasticity of demand equals −1.0?• Specific Question: The regression’s coefficient estimate was −.586: What is theprobability that the coefficient estimate, b P , in one regression would be at least .414from −1.0, if H 0were actually true (if the actual coefficient, β P , equals −1.0)?Answer: Prob[Results IF Cynic Correct] or Prob[Results IF H 0True]The magnitude of this probability determines whether we reject the null hypothesis:Prob[Results IF H 0True] small↓Unlikely that H 0is trueProb[Results IF H 0True] large↓Likely that H 0is true↓↓Reject H 0Do not reject H 0Step 4: Use the general properties of the estimation procedure, the probability distribution of theestimate, to calculate Prob[Results IF H 0True].If the null hypothesis were true,the actual coefficient would equal−1.0. Since ordinary least squares(OLS) estimation procedure for thecoefficient value is unbiased, themean of the probabilitydistribution of coefficient estimateswould be −1.0. The regressionprintout provides us with thestandard error of the coefficientestimates. The degrees of freedomequal the number of observationsless 2, since we are estimating twoparameters, the constant and thecoefficient.Student t-distributionMean = −1.0SE = .183DF = 8.027.027b P.414.414−1.414−1.0−.586Figure 9.3: Probability Distribution of Coefficient EstimatesOLS estimation Assume H 0Standard Number of Number ofprocedure unbiased is true Error observations parametersMean[b P] = β P= −1.0 SE[b P] = .183 DF = 10 − 2 = 8Can we use can use the “tails probability” as reported in the regression printout to computeProb[Results IF H 0True]? Unfortunately, we cannot. The tails probability appearing in theProb. column of the regression printout is computed on the premise that the actual value ofthe coefficient equals 0. Our null hypothesis is based on the premise that the actual coefficientequals −1.0, not 0. Accordingly, the regression printout appearing in Table 9.3 does not reportthe probability we need. We can, however, use the Econometrics Lab to compute theprobability:

11Econometrics Lab 9.1: Using the Econometrics Lab to Calculate Prob[Results IF H 0True].We shall calculate this probability in two steps:• First, calculate the right tail probability. Calculate the probability that the estimatelies .414 or more above −1.0; that is, the probability that the estimate lies at or above−.586.{LabLink}The following information has been entered:Mean: −1.0 Value: −.586Standard Error: .183 Degrees of Freedom: 8Click Calculate. The right tail probability equals .027.• Second, calculate the left tail probability. Calculate the probability that the estimatelies .414 or more below −1.0; that is, the probability that the estimate lies at or below−1.414.{LabLink}The following information has been entered:Mean: −1.0 Value: −1.414Standard Error: .183 Degrees of Freedom: 8Click Calculate. The hand tail probability equals .027.The probability that the estimate lies at least .414 from −1.0 equals .054, the sum of the rightand left tail probabilities:Left RightTail Tail↓ ↓Prob[Results IF H 0True] ≈ .027 + .027 = .054.Recall why we could not use the tails probability appearing in the regression printout to calculatethe probability? The printout tail’s probability is based on the premise that the value of the actualcoefficient equals 0. Our null hypothesis, however, is based on the premise that the value of theactual coefficient equals −1.0. So, the regression printout is not calculating the probability weneed.Hypothesis Testing Using Clever Algebraic ManipulationsIt is very convenient to use a regression printout to calculate these probabilities, however. In fact,we can do so by being clever. Since the printout’s tails probability is based on the premise thatthe actual coefficient equals 0, we can cleverly define a new coefficient that equals 0 whenever thethe price elasticity of demand equals −1.0. The following definition accomplishes this:β Clever= β P+ 1.0The critical property of β Clever’s definition is that the price elasticity of demand, β P, equals −1.0 ifand only if β Cleverequals 0:β P= −1.0 if and only if β Clever= 0

12Now, recall the log form of the constant price elasticity model:LogQ = c + β PLogP where LogQ = log(GasCons)LogP = log(Price)Next, we shall perform a little algebra. Since β Clever= β P+ 1.0, β P= β Clever− 1.0. Let us substitutefor β P:LogQ = c + β PLogPLogQ = c + (β Clever− 1.0) LogPLogQ = c + β CleverLogP − LogPLogQ + LogP = c + β CleverLogPSubstituting for β PLogQPlusLogP = c + β CleverLogP where LogQPlusLogP = LogQ + LogPWe can now express the hypotheses in terms of β Clever. Recall that β P= −1.0 if and only if β Clever= 0:H 0: β P= −1.0 ⇒ H 0: β Clever= 0 Actual price elasticity of demand equals −1.0.H 1: β P≠ −1.0 ⇒ H 1: β Clever≠ 0 Actual price elasticity of demand does not equal −1.0.Click here to access data {EViewsLink}Getting Started in EViewsTo generate the new variables, open the workfile.• In the Workfile window: click Genr• In the Generate Series by Equation window: enter the formula for the new series; e.g.,logqpluslogp = logq + logp• Click OKNow, we can use EViews to run a regression with yclever as the dependent variable and logpas the explanatory variable.• In the Workfile window: Click on the dependent variable, logqpluslogp, first; andthen, click on the explanatory variable, logp, while depressing the key.• In the Workfile window: Double click on a highlighted variable• In the Workfile window: Click Open Equation• In the Equation Specification window: Click OK• Do not forget to close the workfile.Dependent Variable: LogQPlusLogPExplanatory Variable: LogPDependent Variable: LOGQPLUSLOGPIncluded observations: 10Coefficient Std. Error t-Statistic Prob.LOGP 0.414377 0.183409 2.259308 0.0538C 5.918487 0.045315 130.6065 0.0000Table 9.4: Budget theory of Demand Regression Printout with Clever AlgebraFirst, let us compare the estimates for β Pand β Clever:• Estimate for β P, b P, equals −.586;• Estimate for β Clever, b Clever, equals .414.

13This is consistent with the definition of β Clever. By definition β Cleverequals β Pplus 1.0:β Clever= β P+ 1.0The estimate of β Cleverequals the estimate of β Pplus 1:b Clever= b P+ 1.0= −.586 + 1.0= .414Next, calculate Prob[Results IF H 0True] focusing on β Clever:Question: What is theStudent t-distributionprobability of obtaining aMean = 0result like the one calculatedfrom the regression (acoefficient estimate, b Clever, of.414, .414 from 0), if thecynic’s view and the nullhypothesis were correct (thatis, if the actual coefficient,β Clever, equals 0)?.0538/2SE = .183DF = 8.0538/2Recall that β Cleverequaling 0.414.4140.414Figure 9.4: Probability Distribution of Coefficient Estimatesmeans that β Pequals −1.0.The tails probability appearing in the regression printout is based on the premise that theactual value of the coefficient equals 0. Consequently, the tails probability answers thequestion.Answer: Prob[Results IF H 0True] = .0538 ≈ .054.This is the same value for the probability that we computed when we used the Econometrics Lab.By a clever algebraic manipulation, we can get the statistical software to perform the probabilitycalculations.Step 5: Decide on the standard of proof, a significance level.The significance level is the dividing line between the probability being small and theprobability being large.Prob[Results IF H 0True]Less Than Significance Level↓Prob[Results IF H 0True] small↓Unlikely that H 0is trueProb[Results IF H 0True]Greater Than Significance Level↓Prob[Results IF H 0True] large↓Likely that H 0is true↓↓Reject H 0Do not reject H 0At a 1 or 5 percent significance level, we do not reject the null hypothesis that the elasticity ofdemand equals −1.0, thereby supporting the budget theory of demand. That is, at a 1 or 5 percentsignificance level, the estimate of −.586 is not statistically different from −1.0.b Clever

14Summary: <strong>One</strong>-<strong>Tailed</strong> and <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>The theory that we are testing determines whether we should use of a one-tailed or two-tailedtest. When the theory suggests that the actual value of a coefficient is greater than or less than aspecific constant, a one-tailed test is appropriate. Most economic theories fall into this category.Most economic theories suggest that the actual value of the coefficient is either greater than 0 orless than 0. For example, economic theory teaches that the price should have a negative influenceon the quantity demanded; similarly, theory teaches that the price should have a positiveinfluence on the quantity supplied. In most cases, economists use one-tailed tests. On the otherhand, some theories suggest that the coefficient equals a specific value; in these cases, a twotailedtest is required.Theory suggests thatthe coefficientis less than or greater thana specific value↓<strong>One</strong>-tailed test appropriateTheory suggests thatthe coefficientequalsa specific value↓<strong>Two</strong>-tailed test appropriateH 0 : β = cH 1 : β > cTheory: β > c or β < cProbability DistributionTheory: β = cProbability DistributionH 0 : β = cH 1 : β ≠ ccbcbProbability DistributionProb[Results IF H 0 True] =H 0 : β = cH 1: β < cProbability of obtaining results likethe ones obtained if H 0 is trueProb[Results IF H 0 True]SmallLargebReject Hc0 Do not reject H 0Figure 9.5: <strong>One</strong>-<strong>Tailed</strong> and <strong>Two</strong>-<strong>Tailed</strong> <strong>Tests</strong>

15Logarithms: A Useful Econometric Tool to Fine Tune HypothesesThe constant price elasticity model is just one example of how logarithms can be a usefuleconometric tool. More generally, logarithms provide a very convenient way to test hypothesesthat are expressed in terms of percentages rather than “natural” units. To see how, we shall firstreview three concepts:• the interpretation of the coefficient estimate;• the differential approximation;• the derivative of a logarithm.Interpretation of the coefficient estimate: Esty = b Const+ b xxLet x increase by Δx: x → x + ΔxConsequently, the estimated value of y will increase by Δy: Esty → Esty + ΔyEsty + Δy = b Const+ b x(x + Δx)Multiply through by b xEsty + Δy = b Const+ b xx + b xΔxEst = b Const+ b xx Original equationSubtractingΔy = b xΔxIn words, b xestimates the unit change in the dependent variable y resulting from a 1 unitchange in explanatory variable x.Differential Approximation: Δy ≈ dydx ΔxIn words, the derivative tells us by approximately how much y changes when x changesby a small amount; that is, the derivative equals the change in y caused by a one (small)unit change in x.Derivative of a Natural Logarithm: dlog(z)dz= 1 zThe derivative of the natural logarithm of z with respect to z equals 1 divided by z. 2We have already considered the case in which both the dependent variable and explanatoryvariable are logarithms. Now, we shall consider two cases in which only one of the two variablesis a logarithm:• Dependent variable is a logarithm.• Explanatory variable is a logarithm.2The log notation refers to the natural logarithm (logarithm base e), not the logarithm base 10.

16Dependent variable logarithm of z: y = log(z)Regression: Esty = b Const+ b xx where y = log(z)Interpreting b x↓Δy = b xΔxDifferential approximationΔy ≈ dlog(z)dzΔz↓ Derivative of logarithmΔy ≈ 1 ΔzzΔz =zSubstituting Δzzfor ΔyΔzz ≈ b x ΔxΔzz × 100 ≈ (b x×100) Δx Multiply both sides of the equation by 100Interpretation of Δzz× 100: Percent change in z.Percent change in z ≈ (b x×100) ΔxIn words: When the dependent variable is a logarithm, b x×100 estimates the percent changein the dependent variable resulting from a 1 unit change in the explanatory variable; that is,the percent change in y resulting from a 1 unit change in x.Explanatory variable logarithm of z: x = log(z)Regression: Esty = b Const+ b xx where x = log(z)Interpreting b x↓Δy = b xΔxDifferential approximationΔy ≈ b x ΔzzΔx ≈ dlog(z)dzΔz↓ Derivative of logarithmΔx ≈ 1 ΔzzΔz =zSubstituting Δzzfor ΔxΔy ≈ b x100 (Δz z×100) Multiply and divide the right side by 100Interpretation of Δzz× 100: Percent change in z.Δy ≈ b x100× Percent change in zIn words: When the explanatory variable is a logarithm, b x100estimates the unit change in thedependent variable resulting from a 1 percent change in the explanatory variable; that is, theunit change in y resulting from a 1 percent change in z.

17Using Logarithms – An Illustration: Wages and EducationTo illustrate the useful of logarithms, consider the effect of a worker’s high education on his/herwage. Economic theory (and common sense) suggests that a worker’s wage is influenced by thenumber of years of education he/she completes:Theory: Additional years of education increases a workers wage rate.Project: Assess the effect of experience on salary.To assess this theory we shall focus on the effect of high school education; we consider workerswho have completed the ninth, tenth, eleventh, or twelfth grades and have not continued on tocollege or junior college. We shall use data from the March 2007 Current Population Survey. Inthe process we can illustrate the usefulness of logarithms. Logarithms allow us to fine tune ourhypotheses by expressing them in terms of percentages.Wage and Education Data: Cross section data of wages and education for 212 workersincluded in the March 2007 Current Population Survey residing in the Northeast region ofthe United States who have completed the ninth, tenth, eleventh, or twelfth grades, but havenot continued on to college or junior college.Wage tWage rate earned by worker t (dollars per hour)HSEduc tHighest high school grade completed by worker t (9, 10, 11, or 12 years)We shall now consider four models that capture the theory in somewhat different ways:• Linear model• Log dependent variable model• Log explanatory variable model• Log-log (constant elasticity) modelLinear model: Wage t= β Const+ β EHSEduc t+ e tThis model includes no logarithms. Wage is expressed in dollars and education in years.Click here to access data {EViewsLink}Dependent Variable: WageExplanatory Variable: HSEducDependent Variable: WAGEIncluded observations: 212Coefficient Std. Error t-Statistic Prob.HSEDUC 1.645899 0.555890 2.960834 0.0034C -3.828617 6.511902 -0.587941 0.5572Table 9.7: Wage Regression Printout with Linear ModelEstimated Equation: Wage = −3.83 + 1.65HSEduc.Interpretation: We estimate that 1 additional year of high school education increases thewage by about $1.65 per hour.

18It is very common to express wage increases in this way. All the time we hear people say thatthey received a $1.00 per hour raise or a $2.00 per hour raise. It is also very common to hear raisesexpressed in percentage terms. When the results of labor new contracts are announced the wageincreases are typically expressed in percentage terms; management agreed to give workers a 2percent increase or a 3 percent increase or … This observation leads us to our next model: the logdependent variable model.Log dependent variable model: LogWage t= β Const+ βE HSEduc t + e tClick here to access data {EViewsLink}First, we must generate a new dependent variable, the log of wage:LogWage = log(Wage)The dependent variable (LogWage) is expressed in terms of the logarithm of dollars; theexplanatory variable (HSEduc) is expressed in years.Dependent Variable: LogWageExplanatory Variable: HSEducDependent Variable: LOGWAGEIncluded observations: 212Coefficient Std. Error t-Statistic Prob.HSEDUC 0.113824 0.033231 3.425227 0.0007C 1.329791 0.389280 3.416030 0.0008Table 9.8: Wage Regression Printout with Log Dependent Variable ModelEstimated Equation: LogWage = 1.33 + .114HSEduc.Interpretation of coefficient estimate: We estimate that 1 additional year of high schooleducation increases the wage by about 11.4 percent.Let us compare the estimates derived by our two models:• The linear model implicitly assumes that the impact of one additional year of high schooleducation is the same for each worker in terms of dollars. We estimate that a worker’swage increases by $1.65 per hour for each additional year of high school.• The log dependent variable model implicitly assumes that the impact of one additionalyear of high school education is the same for each worker in terms of percentages. Weestimate that a worker’s wage increases by 11.4 percent for each additional year of highschool.The estimates each model provides differ somewhat. For example, consider two workers, the firstearning $10.00 per hour and a second earning $20.00. The linear model estimates that anadditional year of high school would increase the wage of each worker by $1.65 per hour. On theother hand, the log dependent variable model estimates that an additional hear of high schoolwould increase the wage of the first worker by 11.4 percent of $10.00, $1.14 and the secondworker by 11 percent of $20.00, $2.28.

19As we shall see, the log explanatory variable and log-log models are not particularly natural inthis context of this example. We seldom express differentials in education as percentagedifferences. Nevertheless, the log explanatory variable and log-log models are appropriate inmany other contexts. Therefore, we will apply them to our wage and education data eventhought the interpretations will sound unusal.Log explanatory variable model: Wage t= β Const+ βE LogHSEduc t + e tClick here to access data {EViewsLink}Generate a new dependent variable, the log of experience:LogHSEduc = log(HSEduc)The dependent variable (Wage) is expressed in terms of dollars; the explanatory variable(LogHSEduc) is expressed in terms of the log of years.Dependent Variable: WageExplanatory Variable: LogHSEducDependent Variable: WAGEIncluded observations: 212Coefficient Std. Error t-Statistic Prob.LOGHSEDUC 17.30943 5.923282 2.922270 0.0039C -27.10445 14.55474 -1.862242 0.0640Table 9.9: Wage Regression Printout with Log Explanatory Variable ModelEstimated Equation: Wage = −27.1 + 17.31LogHSEduc.Interpretation of coefficient estimate: A 1 percent increase in high school educationincreases the wage by about $.17 per hour.Clearly, this model is not particularly appropriate for this example because we do not expresseducation changes in percentage terms. Nevertheless, the example does illustrate how weinterpret the coefficient in a log explanatory variable model.Log-log (constant elasticity) model: LogWage t= β Const+ βE LogHSEduc t + e tClick here to access data {EViewsLink}Both the dependent and explanatory variables are expressed in terms of logs. This is just theconstant elasticity model that we discussed earlier.Dependent Variable: LogWageExplanatory Variable: LogHSEducDependent Variable: LOGWAGEIncluded observations: 212Coefficient Std. Error t-Statistic Prob.LOGHSEDUC 1.195654 0.354177 3.375868 0.0009C -0.276444 0.870286 -0.317647 0.7511Table 9.10: Wage Regression Printout with Constant Elasticity ModelEstimated Equation: LogWage = −.28 + 1.20LogHSEduc.Interpretation of coefficient estimate: A 1 percent increase in high school educationincreases the wage by about 1.2 percent.

20While the log-log model is not particularly appropriate in this case, we have already seen that itcan be appropriate in other contexts. For example, this was the model we used to assess thebudget theory of demand earlier in this chapter.Summary: Logarithms and Interpreting Coefficient EstimatesDependent variable: y Explanatory variable: xCoefficient estimate: Estimates the unit change in y resulting from a one unit change in xDependent variable: log(y) Explanatory variable: xCoefficient estimate multiplied by 100: Estimates the percent change in y resulting from aone unit change in xDependent variable: y Explanatory variable: log(x)Coefficient estimate divided by 100: Estimates the unit change in y resulting from a onepercent change in xDependent variable: log(y) Explanatory variable: log(x)Coefficient estimate: Estimates the percent change in y resulting from a one percentchange in x<strong>Chapter</strong> 9 Review Questions1. In general, what is the general structure of the theory and the null and alternative hypotheseswhen aa. one-tailed hypothesis is appropriate?Theory: ___________________H 0: ___________H 1: ___________b. two-tailed hypothesis is appropriate?Theory: ___________________H 0: ___________H 1: ___________2. How should the coefficient estimate be interpreted when the dependent and explanatoryvariables are specified as:a. Dependent variable: y Explanatory variable: xb. Dependent variable: log(y) Explanatory variable: xc. Dependent variable: y Explanatory variable: log(x)d. Dependent variable: log(y) Explanatory variable: log(x)

21<strong>Chapter</strong> 9 ExercisesRevisit Nebraska petroleum consumption.Petroleum Consumption Data for Nebraska: Annual time series data of petroleumconsumption and prices for Nebraska from 1990 to 1999.PetroCons tConsumption of petroleum in year t (1,000’s of gallons)Cpi tMidwest Consumer Price Index in year t (1982-84 100)Pop tNebraska population in year tPriceNom tNominal price of petroleum in year t (dollars per gallon)Year tYear1. Generate two new variables from the Nebraska data:PetroConsPC tPriceReal tPer capita consumption of petroleum in year t (gallons)Real price of petroleum in year t (dollars per gallon)Click here to access data {EViewsLink}a. Petroleum consumption includes the consumption of all petroleum products:gasoline, fuel oil, etc. Consequently, would you expect petroleum to be a necessity ora luxury?b. In view of your answer to part a, would expect the per capita demand for petroleumto be inelastic? Explain.c. Consequently, why would the numerical value of the real price elasticity of demandbe greater than −1?d. Apply the hypothesis testing approach that we developed to assess the theory.Calculate Prob[Results IF H 0True] in two ways:1) Using the Econometrics Lab.{LabLink}2) Using the “clever definition” approach.e. What is your assessment of the theory? Explain.

222. Consider the budget theory of demand in the context of per capita petroleum consumption:PriceReal×PetroConsPC = RealBudAmtwhere RealBudAmt = Real budgeted amounta. Apply the hypothesis testing approach that we developed to assess budget theory ofdemand.Click here to access data {EViewsLink}Calculate Prob[Results IF H 0True] in two ways:1) Using the Econometrics Lab.{LabLink}2) Using the “clever definition” approach.bWhat is your assessment of the theory? Explain.3. Revisit the U.S. crude oil supply data.Crude Oil Production Data: Annual time series data of U. S. crude oil production and pricesfrom 1976 to 2004.OilProdBarrels tU. S. crude oil productions in year t (thousands of barrels per day)Price tReal well head price of crude oil in year t (1982-84 dollars per barrel)Consider the following rather bizarre theory of supply:Theory of Supply: The price elasticity of supply equals .10.a. Apply the hypothesis testing approach that we developed to assess the theory.Click here to access data {EViewsLink}Calculate Prob[Results IF H 0True] in two ways:1) Using the Econometrics Lab.{LabLink}2) Using the “clever definition” approach.b. What is your assessment of the theory? Explain.

234. Revisit the gasoline consumption data.Gasoline Consumption Data: Annual time series data U. S. gasoline consumption and pricesfrom 1990 to 1999.GasCons tPriceDollars tU. S. gasoline consumption in year t (millions of gallons per day)Real price of gasoline in year t (chained 2000 dollars per gallon)a. Would you theorize the price elasticity of demand for gasoline to be elastic orinelastic? Explain.b. Apply the hypothesis testing approach that we developed to assess the theory.Click here to access data {EViewsLink}c. What is your assessment of the theory? Explain.5. Revisit the cigarette consumption data.Cigarette Consumption Data: Cross section of per capita cigarette consumption and pricesin fiscal year 2008 for the 50 states and the District of Columbia.CigConsPC tCigarette consumption per capita in state t (packs)PriceConsumer tPrice of cigarettes in state t paid by consumers (dollars per pack)a. Would you theorize that the price elasticity of demand for cigarettes would be elasticor inelastic? Explain.b. Use the ordinary least squares (OLS) estimation procedure to estimate the priceelasticity of demand.Click here to access data {EViewsLink}c. Does your estimate for the price elasticity of demand support your theory? Explain.6. Reconsider the Current Population Survey wage data.Wage and Age Data: Cross section data of wages and ages for 190 union members includedin the March 2007 Current Population Survey who have earned high school degrees, but havenot had any additional education.Age tWage tAge of worker t (years)Wage rate of worker t (dollars per hour)and recall the seniority theory:Seniority Theory: Additional years of age increases wage rate.We often describe wage increases in terms of percent changes. Apply the hypothesis testingapproach that we developed to assess this “percent increase version” of the seniority theory.Click here to access data {EViewsLink}

247. Revisit the effect that the Current Population Survey labor supply data.Labor Supply Data: Cross section data of hours worked and wages for the 92 marriedworkers included in the March 2007 Current Population Survey residing in the Northeastregion of the United States who earned bachelor, but no advanced, degrees.HoursPerWeek tHours worked per week by worker tWage tWage earned by worker t (dollars per hour)Consider the theory that the supply elasticity is inelastic; that is, that the wage elasticity isless than 1.a. Apply the hypothesis testing approach that we developed to assess the inelastic laborsupply theory.Click here to access data {EViewsLink}b. What is your assessment of the theory? Explain.