Transfer of environmental liabilities in the oil and gas sector - WSP

Transfer of environmental liabilities in the oil and gas sector - WSP

Transfer of environmental liabilities in the oil and gas sector - WSP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

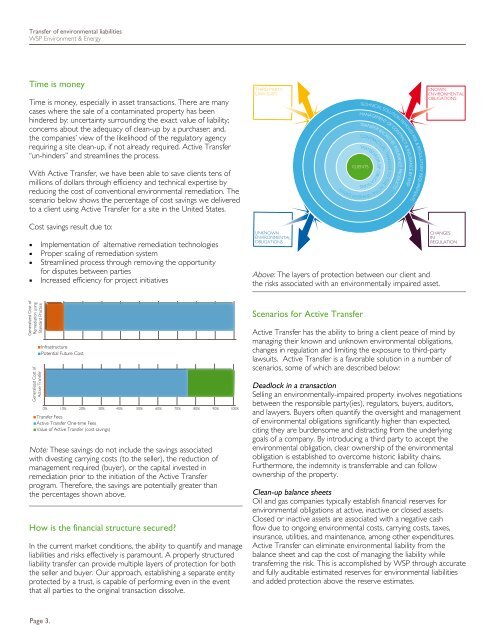

TRANSFEROR OF OBLIGATIONS<strong>Transfer</strong> <strong>of</strong> <strong>environmental</strong> <strong>liabilities</strong><strong>WSP</strong> Environment & EnergyTime is moneyTime is money, especially <strong>in</strong> asset transactions. There are manycases where <strong>the</strong> sale <strong>of</strong> a contam<strong>in</strong>ated property has beenh<strong>in</strong>dered by: uncerta<strong>in</strong>ty surround<strong>in</strong>g <strong>the</strong> exact value <strong>of</strong> liability;concerns about <strong>the</strong> adequacy <strong>of</strong> clean-up by a purchaser; <strong>and</strong>,<strong>the</strong> companies’ view <strong>of</strong> <strong>the</strong> likelihood <strong>of</strong> <strong>the</strong> regulatory agencyrequir<strong>in</strong>g a site clean-up, if not already required. Active <strong>Transfer</strong>“un-h<strong>in</strong>ders” <strong>and</strong> streaml<strong>in</strong>es <strong>the</strong> process.With Active <strong>Transfer</strong>, we have been able to save clients tens <strong>of</strong>millions <strong>of</strong> dollars through efficiency <strong>and</strong> technical expertise byreduc<strong>in</strong>g <strong>the</strong> cost <strong>of</strong> conventional <strong>environmental</strong> remediation. Thescenario below shows <strong>the</strong> percentage <strong>of</strong> cost sav<strong>in</strong>gs we deliveredto a client us<strong>in</strong>g Active <strong>Transfer</strong> for a site <strong>in</strong> <strong>the</strong> United States.THIRD-PARTYLAW-SUITSTECHNICAL SOLUTION REMOVES RISK & REGULATORY REQUIREMENTSMANAGEMENT OF CONTRACT & INSURANCE BY <strong>WSP</strong>TRANSFER BACKED BY INSURANCE PRODUCTSCONTRACTUAL TRANSFER TO THE ACTIVE TRANSFER ENTITYCLIENTSKNOWNENVIRONMENTALOBLIGATIONSCost sav<strong>in</strong>gs result due to:• Implementation <strong>of</strong> alternative remediation technologies• Proper scal<strong>in</strong>g <strong>of</strong> remediation system• Streaml<strong>in</strong>ed process through remov<strong>in</strong>g <strong>the</strong> opportunityfor disputes between parties• Increased efficiency for project <strong>in</strong>itiativesGeneralized Cost Cost <strong>of</strong> <strong>of</strong>Remediation us<strong>in</strong>g us<strong>in</strong>gSt<strong>and</strong>ard St<strong>and</strong>ard Practice PracticeGeneralized Cost Cost <strong>of</strong> <strong>of</strong>Active Active <strong>Transfer</strong> <strong>Transfer</strong>InfrastructurePotential Future CostInfrastructurePotential Future Cost0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<strong>Transfer</strong> FeesActive <strong>Transfer</strong> One-time FeesValue <strong>of</strong> Active <strong>Transfer</strong> (cost sav<strong>in</strong>gs)<strong>Transfer</strong> FeesNote: Active These <strong>Transfer</strong> sav<strong>in</strong>gs One-time Fees do not <strong>in</strong>clude <strong>the</strong> sav<strong>in</strong>gs associatedwith Value divest<strong>in</strong>g <strong>of</strong> Active <strong>Transfer</strong> carry<strong>in</strong>g (cost sav<strong>in</strong>gs) costs (to <strong>the</strong> seller), <strong>the</strong> reduction <strong>of</strong>management required (buyer), or <strong>the</strong> capital <strong>in</strong>vested <strong>in</strong>remediation prior to <strong>the</strong> <strong>in</strong>itiation <strong>of</strong> <strong>the</strong> Active <strong>Transfer</strong>program. Therefore, <strong>the</strong> sav<strong>in</strong>gs are potentially greater than<strong>the</strong> percentages shown above.How is <strong>the</strong> f<strong>in</strong>ancial structure secured?In <strong>the</strong> current market conditions, <strong>the</strong> ability to quantify <strong>and</strong> manage<strong>liabilities</strong> <strong>and</strong> risks effectively is paramount. A properly structuredliability transfer can provide multiple layers <strong>of</strong> protection for both<strong>the</strong> seller <strong>and</strong> buyer. Our approach, establish<strong>in</strong>g a separate entityprotected by a trust, is capable <strong>of</strong> perform<strong>in</strong>g even <strong>in</strong> <strong>the</strong> eventthat all parties to <strong>the</strong> orig<strong>in</strong>al transaction dissolve.UNKNOWNENVIRONMENTALOBLIGATIONSAbove: The layers <strong>of</strong> protection between our client <strong>and</strong><strong>the</strong> risks associated with an <strong>environmental</strong>ly impaired asset.InfrastructureInfrastructurePotential Future CostPotential Future CostScenarios for Active <strong>Transfer</strong>Active <strong>Transfer</strong> has <strong>the</strong> ability to br<strong>in</strong>g a client peace <strong>of</strong> m<strong>in</strong>d bymanag<strong>in</strong>g <strong>the</strong>ir known <strong>and</strong> unknown <strong>environmental</strong> obligations,changes <strong>in</strong> regulation <strong>and</strong> limit<strong>in</strong>g <strong>the</strong> exposure to third-partylawsuits. Active <strong>Transfer</strong> is a favorable solution <strong>in</strong> a number <strong>of</strong>scenarios, some <strong>of</strong> which are described below:<strong>Transfer</strong> Fees<strong>Transfer</strong> Active <strong>Transfer</strong> Fees One-time FeesCHANGESINREGULATIONDeadlock Active Value <strong>of</strong> <strong>Transfer</strong> <strong>in</strong> Active a transactionOne-time <strong>Transfer</strong> (cost Feessav<strong>in</strong>gs)Value <strong>of</strong> Active <strong>Transfer</strong> (cost sav<strong>in</strong>gs)Sell<strong>in</strong>g an <strong>environmental</strong>ly-impaired property <strong>in</strong>volves negotiationsbetween <strong>the</strong> responsible party(ies), regulators, buyers, auditors,<strong>and</strong> lawyers. Buyers <strong>of</strong>ten quantify <strong>the</strong> oversight <strong>and</strong> management<strong>of</strong> <strong>environmental</strong> obligations significantly higher than expected,cit<strong>in</strong>g <strong>the</strong>y are burdensome <strong>and</strong> distract<strong>in</strong>g from <strong>the</strong> underly<strong>in</strong>ggoals <strong>of</strong> a company. By <strong>in</strong>troduc<strong>in</strong>g a third party to accept <strong>the</strong><strong>environmental</strong> obligation, clear ownership <strong>of</strong> <strong>the</strong> <strong>environmental</strong>obligation is established to overcome historic liability cha<strong>in</strong>s.Fur<strong>the</strong>rmore, <strong>the</strong> <strong>in</strong>demnity is transferrable <strong>and</strong> can followownership <strong>of</strong> <strong>the</strong> property.Clean-up balance sheetsOil <strong>and</strong> <strong>gas</strong> companies typically establish f<strong>in</strong>ancial reserves for<strong>environmental</strong> obligations at active, <strong>in</strong>active or closed assets.Closed or <strong>in</strong>active assets are associated with a negative cashflow due to ongo<strong>in</strong>g <strong>environmental</strong> costs, carry<strong>in</strong>g costs, taxes,<strong>in</strong>surance, utilities, <strong>and</strong> ma<strong>in</strong>tenance, among o<strong>the</strong>r expenditures.Active <strong>Transfer</strong> can elim<strong>in</strong>ate <strong>environmental</strong> liability from <strong>the</strong>balance sheet <strong>and</strong> cap <strong>the</strong> cost <strong>of</strong> manag<strong>in</strong>g <strong>the</strong> liability whiletransferr<strong>in</strong>g <strong>the</strong> risk. This is accomplished by <strong>WSP</strong> through accurate<strong>and</strong> fully auditable estimated reserves for <strong>environmental</strong> <strong>liabilities</strong><strong>and</strong> added protection above <strong>the</strong> reserve estimates.Page 3.