Report of Independent Auditors Report of the Audit Committee - IUPAT

Report of Independent Auditors Report of the Audit Committee - IUPAT

Report of Independent Auditors Report of the Audit Committee - IUPAT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

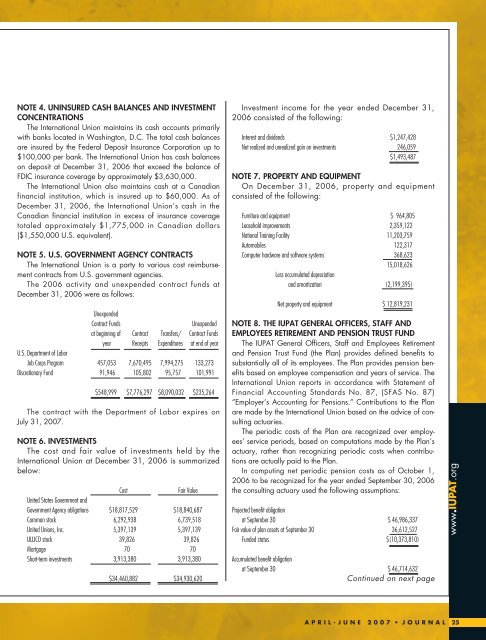

NOTE 4. UNINSURED CASH BALANCES AND INVESTMENTCONCENTRATIONSThe International Union maintains its cash accounts primarilywith banks located in Washington, D.C. The total cash balancesare insured by <strong>the</strong> Federal Deposit Insurance Corporation up to$100,000 per bank. The International Union has cash balanceson deposit at December 31, 2006 that exceed <strong>the</strong> balance <strong>of</strong>FDIC insurance coverage by approximately $3,630,000.The International Union also maintains cash at a Canadianfinancial institution, which is insured up to $60,000. As <strong>of</strong>December 31, 2006, <strong>the</strong> International Union’s cash in <strong>the</strong>Canadian financial institution in excess <strong>of</strong> insurance coveragetotaled approximately $1,775,000 in Canadian dollars($1,550,000 U.S. equivalent).NOTE 5. U.S. GOVERNMENT AGENCY CONTRACTSThe International Union is a party to various cost reimbursementcontracts from U.S. government agencies.The 2006 activity and unexpended contract funds atDecember 31, 2006 were as follows:UnexpendedContract FundsUnexpendedat beginning <strong>of</strong> Contract Transfers/ Contract Fundsyear Receipts Expenditures at end <strong>of</strong> yearU.S. Department <strong>of</strong> LaborJob Corps Program 457,053 7,670,495 7,994,275 133,273Discretionary Fund 91,946 105,802 95,757 101,991$548,999 $7,776,297 $8,090,032 $235,264The contract with <strong>the</strong> Department <strong>of</strong> Labor expires onJuly 31, 2007.NOTE 6. INVESTMENTSThe cost and fair value <strong>of</strong> investments held by <strong>the</strong>International Union at December 31, 2006 is summarizedbelow:CostFair ValueUnited States Government andGovernment Agency obligations $18,817,529 $18,840,687Common stock 6,292,938 6,739,518United Unions, Inc. 5,397,139 5,397,139ULLICO stock 39,826 39,826Mortgage 70 70Short-term investments 3,913,380 3,913,380$34,460,882 $34,930,620Investment income for <strong>the</strong> year ended December 31,2006 consisted <strong>of</strong> <strong>the</strong> following:Interest and dividends $1,247,428Net realized and unrealized gain on investments 246,059$1,493,487NOTE 7. PROPERTY AND EQUIPMENTOn December 31, 2006, property and equipmentconsisted <strong>of</strong> <strong>the</strong> following:Furniture and equipment $ 964,805Leasehold improvements 2,359,122National Training Facility 11,203,759Automobiles 122,317Computer hardware and s<strong>of</strong>tware systems 368,62315,018,626Less accumulated depreciationand amortization (2,199,395)Net property and equipment $ 12,819,231NOTE 8. THE <strong>IUPAT</strong> GENERAL OFFICERS, STAFF ANDEMPLOYEES RETIREMENT AND PENSION TRUST FUNDThe <strong>IUPAT</strong> General Officers, Staff and Employees Retirementand Pension Trust Fund (<strong>the</strong> Plan) provides defined benefits tosubstantially all <strong>of</strong> its employees. The Plan provides pension benefitsbased on employee compensation and years <strong>of</strong> service. TheInternational Union reports in accordance with Statement <strong>of</strong>Financial Accounting Standards No. 87, (SFAS No. 87)“Employer’s Accounting for Pensions.” Contributions to <strong>the</strong> Planare made by <strong>the</strong> International Union based on <strong>the</strong> advice <strong>of</strong> consultingactuaries.The periodic costs <strong>of</strong> <strong>the</strong> Plan are recognized over employees’service periods, based on computations made by <strong>the</strong> Plan’sactuary, ra<strong>the</strong>r than recognizing periodic costs when contributionsare actually paid to <strong>the</strong> Plan.In computing net periodic pension costs as <strong>of</strong> October 1,2006 to be recognized for <strong>the</strong> year ended September 30, 2006<strong>the</strong> consulting actuary used <strong>the</strong> following assumptions:Projected benefit obligationat September 30 $ 46,986,337Fair value <strong>of</strong> plan assets at September 30 36,612,527Funded status $(10,373,810)Accumulated benefit obligationat September 30 $ 46,714,632Continued on next pagewww.<strong>IUPAT</strong>.orgAPRIL-JUNE 2007 • JOURNAL25