SWIFTNet Advanced E&I Rulebook Framework

SWIFTNet Advanced E&I Rulebook Framework

SWIFTNet Advanced E&I Rulebook Framework

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

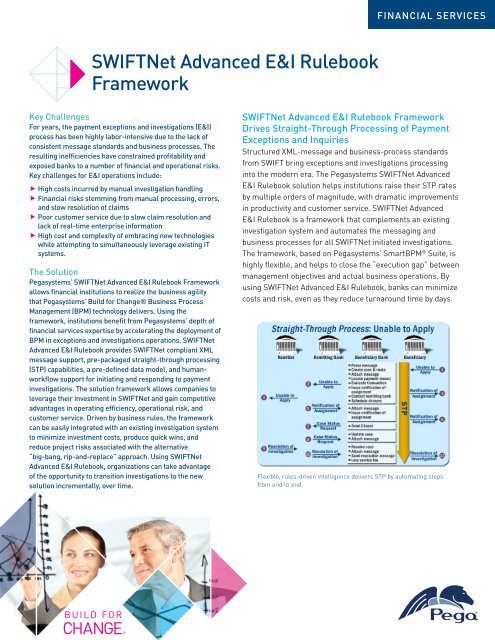

FINANCIAL SERVICES<strong>SWIFTNet</strong> <strong>Advanced</strong> E&I <strong>Rulebook</strong><strong>Framework</strong>Key ChallengesFor years, the payment exceptions and investigations (E&I)process has been highly labor-intensive due to the lack ofconsistent message standards and business processes. Theresulting inefficiencies have constrained profitability andexposed banks to a number of financial and operational risks.Key challenges for E&I operations include:ffHigh costs incurred by manual investigation handlingffFinancial risks stemming from manual processing, errors,and slow resolution of claimsffPoor customer service due to slow claim resolution andlack of real-time enterprise informationffHigh cost and complexity of embracing new technologieswhile attempting to simultaneously leverage existing ITsystems.The SolutionPegasystems’ <strong>SWIFTNet</strong> <strong>Advanced</strong> E&I <strong>Rulebook</strong> <strong>Framework</strong>allows financial institutions to realize the business agilitythat Pegasystems’ Build for Change® Business ProcessManagement (BPM) technology delivers. Using theframework, institutions benefit from Pegasystems’ depth offinancial services expertise by accelerating the deployment ofBPM in exceptions and investigations operations. <strong>SWIFTNet</strong><strong>Advanced</strong> E&I <strong>Rulebook</strong> provides <strong>SWIFTNet</strong> compliant XMLmessage support, pre-packaged straight-through processing(STP) capabilities, a pre-defined data model, and humanworkflowsupport for initiating and responding to paymentinvestigations. The solution framework allows companies toleverage their investment in <strong>SWIFTNet</strong> and gain competitiveadvantages in operating efficiency, operational risk, andcustomer service. Driven by business rules, the frameworkcan be easily integrated with an existing investigation systemto minimize investment costs, produce quick wins, andreduce project risks associated with the alternative“big-bang, rip-and-replace” approach. Using <strong>SWIFTNet</strong><strong>Advanced</strong> E&I <strong>Rulebook</strong>, organizations can take advantageof the opportunity to transition investigations to the newsolution incrementally, over time.<strong>SWIFTNet</strong> <strong>Advanced</strong> E&I <strong>Rulebook</strong> <strong>Framework</strong>Drives Straight-Through Processing of PaymentExceptions and InquiriesStructured XML-message and business-process standardsfrom SWIFT bring exceptions and investigations processinginto the modern era. The Pegasystems <strong>SWIFTNet</strong> <strong>Advanced</strong>E&I <strong>Rulebook</strong> solution helps institutions raise their STP ratesby multiple orders of magnitude, with dramatic improvementsin productivity and customer service. <strong>SWIFTNet</strong> <strong>Advanced</strong>E&I <strong>Rulebook</strong> is a framework that complements an existinginvestigation system and automates the messaging andbusiness processes for all <strong>SWIFTNet</strong> initiated investigations.The framework, based on Pegasystems’ SmartBPM ® Suite, ishighly flexible, and helps to close the “execution gap” betweenmanagement objectives and actual business operations. Byusing <strong>SWIFTNet</strong> <strong>Advanced</strong> E&I <strong>Rulebook</strong>, banks can minimizecosts and risk, even as they reduce turnaround time by days.Flexible, rules-driven intelligence delivers STP by automating stepsfrom end to end.