NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

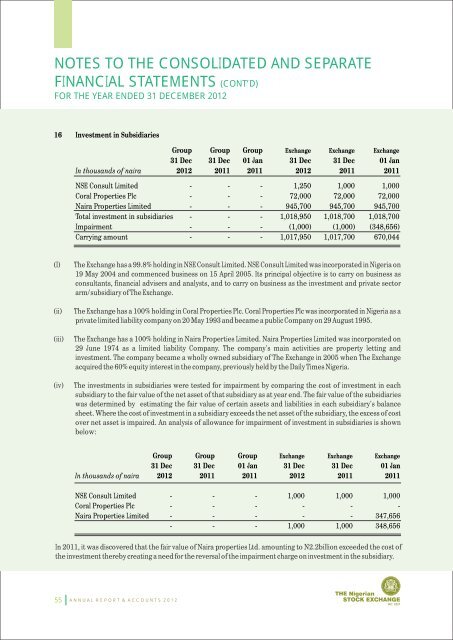

NOTES TO THE CONSOLIDATED AND SEPARATEFINANCIAL STATEMENTS (CONT’D)FOR THE YEAR ENDED 31 DECEMBER 201216Investment in SubsidiariesGroup Group Group <strong>Exchange</strong> <strong>Exchange</strong> <strong>Exchange</strong>31 Dec 31 Dec 01 Jan 31 Dec 31 Dec 01 JanIn thousands of naira 2012 2011 2011 2012 2011 2011<strong>NSE</strong> Consult Limited - - - 1,250 1,000 1,000Coral Properties Plc - - - 72,000 72,000 72,000Naira Properties Limited - - - 945,700 945,700 945,700Total investment in subsidiaries - - - 1,018,950 1,018,700 1,018,700Impairment - - - (1,000) (1,000) (348,656)Carrying amount - - - 1,017,950 1,017,700 670,044(I)(ii)(iii)(iv)<strong>The</strong> <strong>Exchange</strong> has a 99.8% holding in <strong>NSE</strong> Consult Limited. <strong>NSE</strong> Consult Limited was incorporated in Nigeria on19 May 2004 and commenced business on 15 April 2005. Its principal objective is to carry on business asconsultants, financial advisers and analysts, and to carry on business as the investment and private sectorarm/subsidiary of <strong>The</strong> <strong>Exchange</strong>.<strong>The</strong> <strong>Exchange</strong> has a 100% holding in Coral Properties Plc. Coral Properties Plc was incorporated in Nigeria as aprivate limited liability company on 20 May 1993 and became a public Company on 29 August 1995.<strong>The</strong> <strong>Exchange</strong> has a 100% holding in Naira Properties Limited. Naira Properties Limited was incorporated on29 June 1974 as a limited liability Company. <strong>The</strong> company's main activities are property letting andinvestment. <strong>The</strong> company became a wholly owned subsidiary of <strong>The</strong> <strong>Exchange</strong> in 2005 when <strong>The</strong> <strong>Exchange</strong>acquired the 60% equity interest in the company, previously held by the Daily Times Nigeria.<strong>The</strong> investments in subsidiaries were tested for impairment by comparing the cost of investment in eachsubsidiary to the fair value of the net asset of that subsidiary as at year end. <strong>The</strong> fair value of the subsidiarieswas determined by estimating the fair value of certain assets and liabilities in each subsidiary's balancesheet. Where the cost of investment in a subsidiary exceeds the net asset of the subsidiary, the excess of costover net asset is impaired. An analysis of allowance for impairment of investment in subsidiaries is shownbelow:Group Group Group <strong>Exchange</strong> <strong>Exchange</strong> <strong>Exchange</strong>31 Dec 31 Dec 01 Jan 31 Dec 31 Dec 01 JanIn thousands of naira 2012 2011 2011 2012 2011 2011<strong>NSE</strong> Consult Limited - - - 1,000 1,000 1,000Coral Properties Plc - - - - - -Naira Properties Limited - - - - - 347,656- - - 1,000 1,000 348,656In 2011, it was discovered that the fair value of Naira properties Ltd. amounting to N2.2billion exceeded the cost ofthe investment thereby creating a need for the reversal of the impairment charge on investment in the subsidiary.55A N N U A L R E P O R T & A C C O U N T S 2 0 1 2