NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

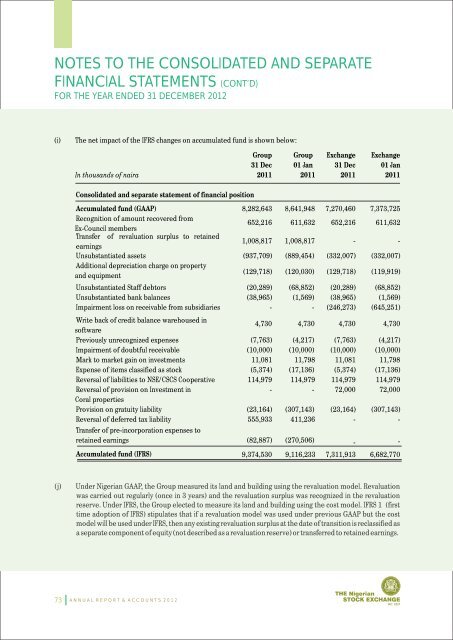

NOTES TO THE CONSOLIDATED AND SEPARATEFINANCIAL STATEMENTS (CONT’D)FOR THE YEAR ENDED 31 DECEMBER 2012(i)<strong>The</strong> net impact of the IFRS changes on accumulated fund is shown below:In thousands of nairaGroup31 Dec2011Group01 Jan2011<strong>Exchange</strong>31 Dec2011<strong>Exchange</strong>01 Jan2011Consolidated and separate statement of financial positionAccumulated fund (GAAP)Recognition of amount recovered fromEx-Council membersTransfer of revaluation surplus to retainedearningsUnsubstantiated assetsAdditional depreciation charge on propertyand equipmentUnsubstantiated Staff debtorsUnsubstantiated bank balancesImpairment loss on receivable from subsidiaries8,282,643652,2161,008,817(937,709)(129,718)(20,289)(38,965)-8,641,948611,6321,008,817(889,454)(120,030)(68,852)(1,569)-7,270,460652,216-(332,007)(129,718)(20,289)(38,965)(246,273)7,373,725611,632-(332,007)(119,919)(68,852)(1,569)(645,251)Write back of credit balance warehoused insoftwarePreviously unrecognized expensesImpairment of doubtful receivableMark to market gain on investmentsExpense of items classified as stockReversal of liabilities to <strong>NSE</strong>/CSCS CooperativeReversal of provision on Investment inCoral propertiesProvision on gratuity liabilityReversal of deferred tax liabilityTransfer of pre-incorporation expenses toretained earningsAccumulated fund (IFRS)4,730(7,763)(10,000)11,081(5,374)114,979-(23,164)555,933(82,887)9,374,5304,730(4,217)(10,000)11,798(17,136)114,979-(307,143)411,236(270,506)9,116,2334,730(7,763)(10,000)11,081(5,374)114,97972,000(23,164)--7,311,9134,730(4,217)(10,000)11,798(17,136)114,97972,000(307,143)--6,682,770(j)Under <strong>Nigerian</strong> GAAP, the Group measured its land and building using the revaluation model. Revaluationwas carried out regularly (once in 3 years) and the revaluation surplus was recognized in the revaluationreserve. Under IFRS, the Group elected to measure its land and building using the cost model. IFRS 1 (firsttime adoption of IFRS) stipulates that if a revaluation model was used under previous GAAP but the costmodel will be used under IFRS, then any existing revaluation surplus at the date of transition is reclassified asa separate component of equity (not described as a revaluation reserve) or transferred to retained earnings.73A N N U A L R E P O R T & A C C O U N T S 2 0 1 2