NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

NSE Annual Reports - The Nigerian Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

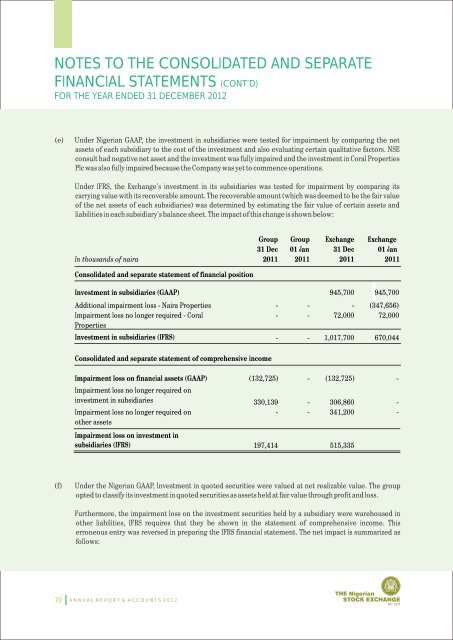

NOTES TO THE CONSOLIDATED AND SEPARATEFINANCIAL STATEMENTS (CONT’D)FOR THE YEAR ENDED 31 DECEMBER 2012(e)Under <strong>Nigerian</strong> GAAP, the investment in subsidiaries were tested for impairment by comparing the netassets of each subsidiary to the cost of the investment and also evaluating certain qualitative factors. <strong>NSE</strong>consult had negative net asset and the investment was fully impaired and the investment in Coral PropertiesPlc was also fully impaired because the Company was yet to commence operations.Under IFRS, the <strong>Exchange</strong>'s investment in its subsidiaries was tested for impairment by comparing itscarrying value with its recoverable amount. <strong>The</strong> recoverable amount (which was deemed to be the fair valueof the net assets of each subsidiaries) was determined by estimating the fair value of certain assets andliabilities in each subsidiary's balance sheet. <strong>The</strong> impact of this change is shown below:In thousands of nairaGroup31 Dec2011Group01 Jan2011<strong>Exchange</strong>31 Dec2011<strong>Exchange</strong>01 Jan2011Consolidated and separate statement of financial positionInvestment in subsidiaries (GAAP)945,700945,700Additional impairment loss - Naira PropertiesImpairment loss no longer required - CoralProperties-----72,000(347,656)72,000Investment in subsidiaries (IFRS)--1,017,700670,044Consolidated and separate statement of comprehensive incomeImpairment loss on financial assets (GAAP)Impairment loss no longer required oninvestment in subsidiariesImpairment loss no longer required onother assets(132,725)330,139----(132,725)306,860341,200---Impairment loss on investment insubsidiaries (IFRS)197,414515,335(f)Under the <strong>Nigerian</strong> GAAP, Investment in quoted securities were valued at net realizable value. <strong>The</strong> groupopted to classify its investment in quoted securities as assets held at fair value through profit and loss.Furthermore, the impairment loss on the investment securities held by a subsidiary were warehoused inother liabilities, IFRS requires that they be shown in the statement of comprehensive income. Thiserroneous entry was reversed in preparing the IFRS financial statement. <strong>The</strong> net impact is summarized asfollows:70A N N U A L R E P O R T & A C C O U N T S 2 0 1 2