Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

181 International Research Journal <strong>of</strong> Finance and Economics - Issue 29 (2009)<br />

apply to the new debt issues. Also when it is not sensible to issue any more debt, they would be obliged<br />

to realize new equity issues. This theory maintains that businesses adhere to a hierarchy <strong>of</strong> financing<br />

sources and prefer internal financing when available, and debt is preferred over equity if external<br />

financing is required. The theory suggests that the firms apply to external finance if and only if internal<br />

finance has not been sufficient. In case <strong>of</strong> using external financing, the firms issue the cheapest security<br />

first so they start with debt, then possibly applies to hybrid securities such as convertible bonds, and<br />

the issue equity only as a last resort. In contrast to the trade-<strong>of</strong>f theory, there is no well-defined target<br />

leverage ratio in the pecking order theory. Debt is considered the first source <strong>of</strong> external finance on the<br />

pecking order. Equity is issued only as a last resort, when the debt capacity is fully exhausted. Tax<br />

benefits <strong>of</strong> debt are assumed to have a second-order effect. The debt ratio varies when there is an<br />

imbalance between internal funds and real investment opportunities.<br />

The paper is organized as follows. The next section reports some stylized facts from the<br />

<strong>Turkish</strong> economy using the data taken from Istanbul Stock Exchange ISE-100 index. The third section<br />

aims to define some possible determinants <strong>of</strong> the capital structure <strong>of</strong> the firms. The fourth section<br />

briefly deals with the estimation methodology, whilst the ex-post findings are presented in section five.<br />

The last section summarizes the results to conclude the paper.<br />

2. Some Stylized Facts<br />

For an empirical research, we first try to figure out the leverage use <strong>of</strong> the firms. By this means, we use<br />

the financial reports <strong>of</strong> the firms traded at the ISE-100 index. However, we make some adjustments in<br />

the sense that since banks and insurance firms have been subject to specific rules, we exclude these<br />

institutions from our database. The financial reports used in the analysis cover the period <strong>of</strong> 2000-2007<br />

and the total number <strong>of</strong> observations amounts to the sum <strong>of</strong> 359.<br />

In order to examine the leverage position <strong>of</strong> the firms, we identify the measure <strong>of</strong> leverage, that<br />

is L, which denotes the ratio <strong>of</strong> debt use to finance total assets. The leverage parameters are computed<br />

within the years 2000-2007 through the financial reports <strong>of</strong> 42 firms traded in the Istanbul Stock<br />

Exchange ISE-100 index:<br />

Total liabilities<br />

L = (1)<br />

Total assets<br />

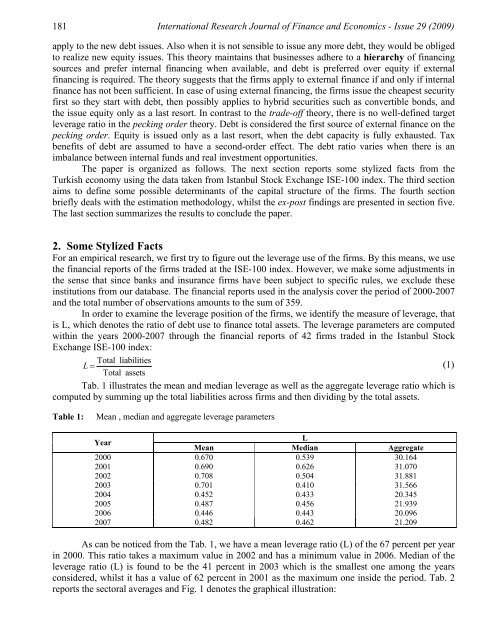

Tab. 1 illustrates the mean and median leverage as well as the aggregate leverage ratio which is<br />

computed by summing up the total liabilities across firms and then dividing by the total assets.<br />

Table 1: Mean , median and aggregate leverage parameters<br />

Year<br />

Mean<br />

L<br />

Median Aggregate<br />

2000 0.670 0.539 30.164<br />

2001 0.690 0.626 31.070<br />

2002 0.708 0.504 31.881<br />

2003 0.701 0.410 31.566<br />

2004 0.452 0.433 20.345<br />

2005 0.487 0.456 21.939<br />

2006 0.446 0.443 20.096<br />

2007 0.482 0.462 21.209<br />

As can be noticed from the Tab. 1, we have a mean leverage ratio (L) <strong>of</strong> the 67 percent per year<br />

in 2000. This ratio takes a maximum value in 2002 and has a minimum value in 2006. Median <strong>of</strong> the<br />

leverage ratio (L) is found to be the 41 percent in 2003 which is the smallest one among the years<br />

considered, whilst it has a value <strong>of</strong> 62 percent in 2001 as the maximum one inside the period. Tab. 2<br />

reports the sectoral averages and Fig. 1 denotes the graphical illustration: