Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Determinants of Capital Structure for Turkish Firms: A Panel Data ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

185 International Research Journal <strong>of</strong> Finance and Economics - Issue 29 (2009)<br />

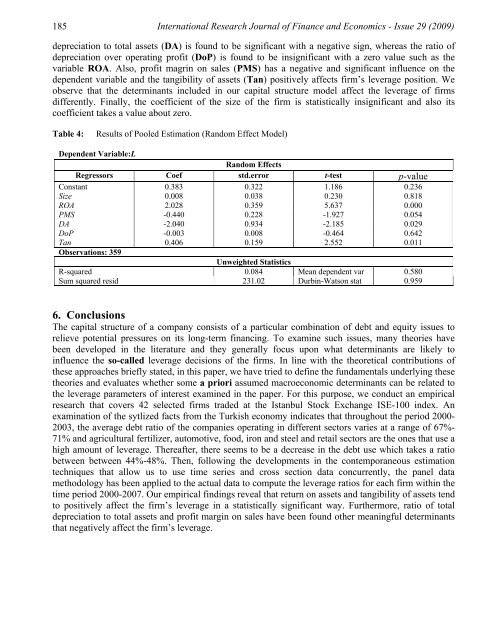

depreciation to total assets (DA) is found to be significant with a negative sign, whereas the ratio <strong>of</strong><br />

depreciation over operating pr<strong>of</strong>it (DoP) is found to be insignificant with a zero value such as the<br />

variable ROA. Also, pr<strong>of</strong>it magrin on sales (PMS) has a negative and significant influence on the<br />

dependent variable and the tangibility <strong>of</strong> assets (Tan) positively affects firm’s leverage position. We<br />

observe that the determinants included in our capital structure model affect the leverage <strong>of</strong> firms<br />

differently. Finally, the coefficient <strong>of</strong> the size <strong>of</strong> the firm is statistically insignificant and also its<br />

coefficient takes a value about zero.<br />

Table 4: Results <strong>of</strong> Pooled Estimation (Random Effect Model)<br />

Dependent Variable:L<br />

Regressors Coef<br />

Random Effects<br />

std.error t-test p-value<br />

Constant 0.383 0.322 1.186 0.236<br />

Size 0.008 0.038 0.230 0.818<br />

ROA 2.028 0.359 5.637 0.000<br />

PMS -0.440 0.228 -1.927 0.054<br />

DA -2.040 0.934 -2.185 0.029<br />

DoP -0.003 0.008 -0.464 0.642<br />

Tan<br />

Observations: 359<br />

0.406 0.159<br />

Unweighted Statistics<br />

2.552 0.011<br />

R-squared 0.084 Mean dependent var 0.580<br />

Sum squared resid 231.02 Durbin-Watson stat 0.959<br />

6. Conclusions<br />

The capital structure <strong>of</strong> a company consists <strong>of</strong> a particular combination <strong>of</strong> debt and equity issues to<br />

relieve potential pressures on its long-term financing. To examine such issues, many theories have<br />

been developed in the literature and they generally focus upon what determinants are likely to<br />

influence the so-called leverage decisions <strong>of</strong> the firms. In line with the theoretical contributions <strong>of</strong><br />

these approaches briefly stated, in this paper, we have tried to define the fundamentals underlying these<br />

theories and evaluates whether some a priori assumed macroeconomic determinants can be related to<br />

the leverage parameters <strong>of</strong> interest examined in the paper. For this purpose, we conduct an empirical<br />

research that covers 42 selected firms traded at the Istanbul Stock Exchange ISE-100 index. An<br />

examination <strong>of</strong> the sytlized facts from the <strong>Turkish</strong> economy indicates that throughout the period 2000-<br />

2003, the average debt ratio <strong>of</strong> the companies operating in different sectors varies at a range <strong>of</strong> 67%-<br />

71% and agricultural fertilizer, automotive, food, iron and steel and retail sectors are the ones that use a<br />

high amount <strong>of</strong> leverage. Thereafter, there seems to be a decrease in the debt use which takes a ratio<br />

between between 44%-48%. Then, following the developments in the contemporaneous estimation<br />

techniques that allow us to use time series and cross section data concurrently, the panel data<br />

methodology has been applied to the actual data to compute the leverage ratios <strong>for</strong> each firm within the<br />

time period 2000-2007. Our empirical findings reveal that return on assets and tangibility <strong>of</strong> assets tend<br />

to positively affect the firm’s leverage in a statistically significant way. Furthermore, ratio <strong>of</strong> total<br />

depreciation to total assets and pr<strong>of</strong>it margin on sales have been found other meaningful determinants<br />

that negatively affect the firm’s leverage.