Country report France - Construction Labour Research

Country report France - Construction Labour Research

Country report France - Construction Labour Research

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

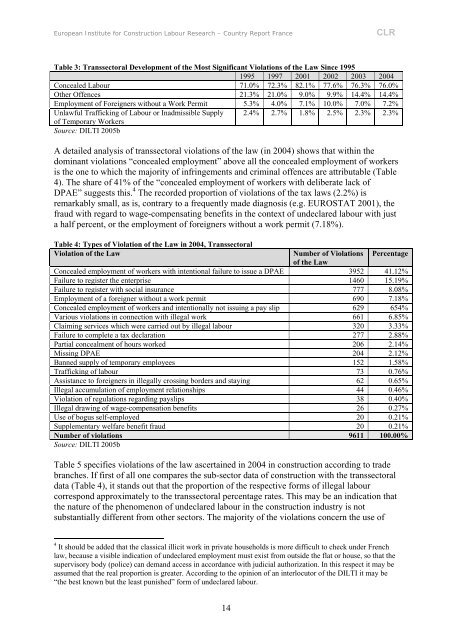

European Institute for <strong>Construction</strong> <strong>Labour</strong> <strong>Research</strong> – <strong>Country</strong> Report <strong>France</strong>CLRTable 3: Transsectoral Development of the Most Significant Violations of the Law Since 19951995 1997 2001 2002 2003 2004Concealed <strong>Labour</strong> 71.0% 72.3% 82.1% 77.6% 76.3% 76.0%Other Offences 21.3% 21.0% 9.0% 9.9% 14.4% 14.4%Employment of Foreigners without a Work Permit 5.3% 4.0% 7.1% 10.0% 7.0% 7.2%Unlawful Trafficking of <strong>Labour</strong> or Inadmissible Supply 2.4% 2.7% 1.8% 2.5% 2.3% 2.3%of Temporary WorkersSource: DILTI 2005bA detailed analysis of transsectoral violations of the law (in 2004) shows that within thedominant violations “concealed employment” above all the concealed employment of workersis the one to which the majority of infringements and criminal offences are attributable (Table4). The share of 41% of the “concealed employment of workers with deliberate lack ofDPAE” suggests this. 4 The recorded proportion of violations of the tax laws (2.2%) isremarkably small, as is, contrary to a frequently made diagnosis (e.g. EUROSTAT 2001), thefraud with regard to wage-compensating benefits in the context of undeclared labour with justa half percent, or the employment of foreigners without a work permit (7.18%).Table 4: Types of Violation of the Law in 2004, TranssectoralViolation of the LawNumber of Violations Percentageof the LawConcealed employment of workers with intentional failure to issue a DPAE 3952 41.12%Failure to register the enterprise 1460 15.19%Failure to register with social insurance 777 8.08%Employment of a foreigner without a work permit 690 7.18%Concealed employment of workers and intentionally not issuing a pay slip 629 654%Various violations in connection with illegal work 661 6.85%Claiming services which were carried out by illegal labour 320 3.33%Failure to complete a tax declaration 277 2.88%Partial concealment of hours worked 206 2.14%Missing DPAE 204 2.12%Banned supply of temporary employees 152 1.58%Trafficking of labour 73 0.76%Assistance to foreigners in illegally crossing borders and staying 62 0.65%Illegal accumulation of employment relationships 44 0.46%Violation of regulations regarding payslips 38 0.40%Illegal drawing of wage-compensation benefits 26 0.27%Use of bogus self-employed 20 0.21%Supplementary welfare benefit fraud 20 0.21%Number of violations 9611 100.00%Source: DILTI 2005bTable 5 specifies violations of the law ascertained in 2004 in construction according to tradebranches. If first of all one compares the sub-sector data of construction with the transsectoraldata (Table 4), it stands out that the proportion of the respective forms of illegal labourcorrespond approximately to the transsectoral percentage rates. This may be an indication thatthe nature of the phenomenon of undeclared labour in the construction industry is notsubstantially different from other sectors. The majority of the violations concern the use of4 It should be added that the classical illicit work in private households is more difficult to check under Frenchlaw, because a visible indication of undeclared employment must exist from outside the flat or house, so that thesupervisory body (police) can demand access in accordance with judicial authorization. In this respect it may beassumed that the real proportion is greater. According to the opinion of an interlocutor of the DILTI it may be“the best known but the least punished” form of undeclared labour.14