Sponsored by CUNA Strategic Services - Credit Union Magazine

Sponsored by CUNA Strategic Services - Credit Union Magazine

Sponsored by CUNA Strategic Services - Credit Union Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Sponsored</strong> <strong>by</strong> <strong>CUNA</strong> <strong>Strategic</strong> <strong>Services</strong>International <strong>Credit</strong> <strong>Union</strong> Day Special Edition

You will outsource yourOfficial Checks and SAVE $$$.$100 million30%4,000— helped our customers to preventin fraud losses over past 3 years— savings per item for somecustomers— financial institutions worldwidetrust MoneyGram

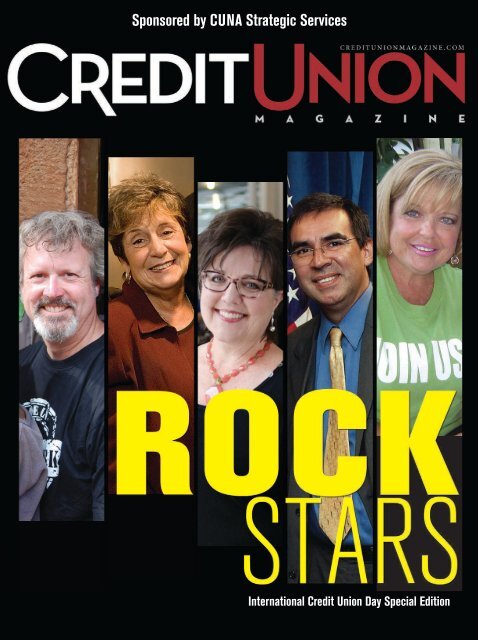

18ROCK STARS4827INTERNATIONAL CREDIT UNION DAY SPECIAL EDITIONVOLUME 79EDITOR’S LETTER7 THESE FOLKS ROCK!STEVE RODGERS, EDITOR-IN-CHIEF, CREDIT UNION MAGAZINEIf you boiled down the credit union movement to its essence, you’d wind up withthe familiar phrase “people helping people.” In honor of International <strong>Credit</strong> <strong>Union</strong>Day on Thursday, Oct. 17, <strong>Credit</strong> <strong>Union</strong> <strong>Magazine</strong> celebrates credit union rockstars—ordinary people who are doing the extraordinary—in this special bonus issuefor our subscribers. All of us have bright ideas from time to time, but few of ushave the passion, conviction, and drive to put those bright ideas into action.ROCK STARS8 PATRICK ADAMSCrossing the Lineto Fight the Good Fight9 LAURA AGUIRREA Lion for the Low Income10 ARLENE BERNARDFun With Numbers11 FRED BROWN‘CU Man’ Takes Fight toPredatory Lenders12 LESLEY CARRELL,LISA NICHOLAS,AND ANDY REEDSelling the CU Experience14 CARA CARLEVATTIYoung Professional Lives Out HerPassion for Lifelong Learning15 AMY DAVISFilling Canoes for the Community16 MATT DAVISMaking a DifferenceThrough Innovation17 BRENT DIXONIn Constant Pursuit of Good Design18 DICK ENSWEILEROnce a Coach, Always a Coach19 HELEN ESTESA Beloved Rule BenderNamed ‘Rokmom’20 PAM FINCHFrom Auditor to Advocate21 AMY GRAVITTEPassionate About CU Philosophy—and Leadership22 JEFF HARDINNew Conference KindlesCooperative Spirit23 SARAH DALE HARMONSocial Media ‘Spokester’Speaks From the Heart24 CHAD HELMINAK ANDCHRISTOPHER MORRISThey Sing the Songs ThatMake the CU World Sing26 CHERRY HEDGESEmphasis on Education Drives Growth27 JOHN HERRERAA Champion of Change28 MANUEL HOCHHEIMER,JANET McNEILLY,AND JEANETTE RADMERBringing New Business on Board32 HANK HUBBARDMaking an Impact in Motown34 ERIC JENKINSHe Means Business4 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

35 JEFF JOHNSONThe Right People, the Right Initiative,the Right Time36 JAMES ROBERT LAYEx-Punk Rocker JoinsDigital Revolution37 DAN McGOWANA ‘Come-From-Behind’ Story Line38 PATRICK LIVINGSTON ANDBRANDON McADAMSYoung Execs Build Bonds Between CUProfessionals and Their Communities40 HEATHER MOSHIERGetting Results and Enabling CUs41 DICK NESVOLDSteward of the Movement’s Principles42 JASON OSTERHAGEIntellectual Curiosity Trumps Insularity43 JENNI PARAMOREEnthusiasm + Education =Enduring Results44 JOHN PARKSHooked on CUs From Day One45 PAUL PHILLIPSA Heart for Service46 TERI ROBINSONHer Refusal to Quit Is an Inspiration47 JIM SCHRIMPFCalling the Central City Home ‘Bass’48 YVETTE SEGARRAMuch More Than a Paycheck49 EMMA SMALLEYThe Accidental Educator50 BOB STOWELLInner Fire Fuels Desire to Serve Others52 SANDRA SULLIVAN-WOODSEmpowering Employeesto Serve Members53 ROBBIE THOMPSONOn a Mission to Protect the System54 LISA TOTAROA Source of Innovation55 BILL VOGENEYDeveloping Tomorrow’s CU Leaders56 NANCY WHITTAKERWalking in Members’ Shoes57 CORLINDA WOODENThe Nerf of Some People!EXECUTIVE COMMITTEEPATRICIA WESENBERG • chair, Marshfield, Wis.DENNIS PIERCE • vice chair, Lenexa, Kan.SUSAN STREIFEL • secretary, Federal Way, Wash.ROD STAATZ • treasurer, Linthicum, Md.PAT JURY • member-at-large, Des Moines, IowaBILL CHENEY • ex-officio, Washington, D.C./Madison, Wis.MIKE MERCER • immediate past chair, Duluth, Ga.DIRECTORSSTEPHEN BEHLER Ohio; ROBERT CASHMAN Mass.PETE DZURIS Mich.; JOHN GRAHAM Ky.BRAD GREEN Ala.; ROGER HEACOCK S.D.PAUL HUGHES S.C.; MICHAEL L’ECUYER N.H.WENDELL LYONS Ky.; BRETT MARTINEZ Calif.WILLIAM MELLIN N.Y.; MAURICE SMITH N.C.TROY STANG Ore.; SCOTT SULLIVAN Neb.EDWIN WILLIAMS Pa.; JEFF YORK Calif.EXECUTIVE STAFFBILL CHENEY • president/CEOPAUL GENTILE • executive vice president ofstrategic communications and engagementJOHN MAGILL • executive vice president/special assistant to the presidentBRIAN NELSON • chief financial officerSUSAN NEWTON • executive vice presidentof system relationsERIC RICHARD • executive vice president/general counselJILL TOMALIN • executive vice president/chief operating officer, Madison, Wis.SENIOR VICE PRESIDENTSTERRY COSTIN • marketing & salesRYAN DONOVAN • legislative affairsMARY MITCHELL DUNN • regulatory advocacyRICHARD GOSE • political affairsBILL HAMPEL • research & policy analysisJOIN THE CONVERSATIONVisit our special rock star page,creditunionmagazine.com/rockstar, for these features:• PHOTOS, PHOTOS, PHOTOS. See ourcredit union rock stars in action.• ROCK STAR WRITE-UPS. Read all aboutthese remarkable people, who represent abroad cross-section of credit unions, leagues,and related organizations.• NOMINATE YOUR PEERS. Do you know someone who regularly channels his/herinner credit union rock star? Visit creditunionmagazine.com/nominate-rockstar andnominate your unsung colleagues.• TWEET AWAY. Follow the hashtag #CUrockstar and join the conversation.See you online!WES MILLAR • <strong>CUNA</strong> <strong>Strategic</strong> <strong>Services</strong>SUSAN PARISI • legal affairsHARLEY SKJERVEM • human resources & facilitiesPAT SOWICK • league relationsTODD SPICZENSKI • center for professional developmentKATHLEEN O. THOMPSON • regulatory affairsPOSTAL INFORMATION<strong>Credit</strong> <strong>Union</strong> <strong>Magazine</strong> (ISSN 0011-1066) is publishedmonthly, with an additional special issue to be published inOctober of 2013, for $69 per year <strong>by</strong> <strong>Credit</strong> <strong>Union</strong> NationalAssociation, 5710 Mineral Point Road, Madison, WI 53705.(Multiple-copy and multiyear discounts available.)Periodical postage paid at Madison, Wis., and additionalmailing office. Copyright 2013 <strong>by</strong> <strong>Credit</strong> <strong>Union</strong> NationalAssociation. Photocopying is illegal and unethical.POSTMASTER: Send address changes to <strong>Credit</strong> <strong>Union</strong><strong>Magazine</strong> subscription department, P.O. Box 461, AnnapolisJunction, MD 20701-0461. Single issues are available; call800-348-3646. A member of Cooperative CommunicatorsAssociation. Printed in USA <strong>by</strong> <strong>Union</strong> Labor.OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS5

Discover<strong>CUNA</strong>Councils.SYNERGYExperienced, connected and realworldfocused, <strong>CUNA</strong> Councils arethe only national organizations run<strong>by</strong> credit union professionals forcredit union professionals.2014 memberships available NOW —join today and enjoy the extendedvalue of the rest of 2013and all of 2014.Congratulationsto the 2013<strong>Credit</strong> <strong>Union</strong>Rock Stars!Join us at cunacouncils.orgDid youknow?15 of the <strong>Credit</strong><strong>Union</strong> Ui<strong>Magazine</strong>Rock Stars aremembers of the<strong>CUNA</strong> Councils.© <strong>Credit</strong> <strong>Union</strong> National Association 2013

MANAGEMENTPAUL GENTILEexecutive vice president ofstrategic communications and engagement202-508-6793 • pgentile@cuna.comDOUG BENZINEvice president of publishing608-231-4039 • dbenzine@cuna.comDOROTHY STEFFENSvice president of publishing operations608-231-5719 • dsteffens@cuna.comKRISTINA GREBENERdirector of editorial staff & strategic development608-231-4287 • kgrebener@cuna.comEDITOR’S LETTERThese Folks Rock!The credit union movement is all about people. If you boiled down thecredit union movement to its essence, you’d wind up with the familiarphrase “people helping people.”In honor of International <strong>Credit</strong> <strong>Union</strong> Day—Thursday, Oct. 17—<strong>Credit</strong><strong>Union</strong> <strong>Magazine</strong> is again publishing a special bonus edition as a gift to oursubscribers.This special issue is dedicated to credit union rock stars—ordinary peoplewho are doing the extraordinary. All of us have bright ideas from time totime, but few of us have the passion, conviction, and drive to put thosebright ideas into action.Some people do, however, and we call them “rock stars.”Without people who roll up their sleeves and actually make credit unionsfunction, the credit union vision would be just that—a vision. But thosewho work and volunteer for credit unions turn that vision into reality.We salute you.For the past several months, our subscribers have nominated their rockstarcolleagues on our website. If you missed this year’s nomination window, don’t worry. Just go to creditunionmagazine.com/nominate-rockstar tonominate one of your colleagues for next year’s edition.The end result of this year’s nomination process is what you see beforeyou—a showcase of 48 rock stars from a broad cross-section of credit unions,leagues, and related organizations. We didn’t have room for all of the photosand stories about our rock stars, so check out our website for more coverageof these remarkable people (creditunionmagazine.com/rockstar).As we move forward into 2014, you’ll notice more pages of our monthlymagazine dedicated to the credit union people who go the extra mile toserve their members and communities. In the meantime—Rock on!EDITORIAL STAFFJOHN WILEYpublisher310-490-3355 • jwiley@cuna.comSTEVE RODGERSeditor-in-chief608-231-4082 • srodgers@cuna.comSUE LANPHEARmanaging editor608-231-4086 • slanphear@cuna.comBILL MERRICKsenior managing editor608-231-4076 • bmerrick@cuna.comANN HAYES PETERSONdeputy editor608-231-4211 • apeterson@cuna.comADAM MERTZsenior editor608-231-4342 • amertz@cuna.comCRAIG SAUERassistant editor608-231-4918 • csauer@cuna.comCONTRIBUTORSPHIL BRITT, DIANNE MOLVIG,PATRICK TOTTYDESIGN & PRODUCTIONLINDA NAPIWOCKI • art directorDIANE LONG • graphic designerCHERYL GOKEY • graphic designerJOEY SABANI • graphic designerLARRY QUAM • ad productionADVERTISINGJOHN WILEY310-490-3355 • jwiley@cuna.comClassified adsLINDA CROCKER608-231-4122lcrocker@cuna.comfax 608-231-4370EDITORIAL ADVISORY BOARDSANDI CARANGI • Pennsylvania CU AssociationSUE DOUGLAS • State ECU, Raleigh, N.C.DALE FRANKHOUSE • Sun FCU, Maumee, OhioMICHELLE HUNTER • CU of Southern California, BreaWILLIAM KENNEDY • Interior FCU, Reston, Va.RICHARD S. MILLER • FeatherStone Planning and ConsultingROBERT REH • Nassau Financial FCU, Westbury, N.Y.CINDY SWIGERT • United FCU, St. Joseph, Mich.DARYL TANNER • Share One Inc.MAILING ADDRESSCREDIT UNION MAGAZINEP.O. Box 431Madison, WI 53701-0431SUBSCRIPTION SERVICESUBSCRIPTION DEPARTMENTP.O. Box 461,Annapolis Junction, MD20701-046800-348-3646Fax: 301-206-9789Steve RodgersEditor-in-chiefOCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS7

‘Our motto is:Passion over paycheck.’PATRICK ADAMSCrossing the Line to Fight the Good FightWhen you think of somebody willing tocross a line in the sand, Patrick Adamsshould come to mind.In 2012, the CEO of St. Louis Community <strong>Credit</strong><strong>Union</strong> defied a traditional boundary to begin a fouryearcollaboration with a bank.His reason? The need to bring all the power hecould muster to reach a dramatically underservedcommunity. “The problems in St. Louis are biggerthan any rivalry between banks and credit unions,”says Adams, noting the city has the nation’s third mostunderserved African-American population. Eightyfivepercent of the credit union’s members are lowto-moderateincome, and 80% are African-American.“We’re one of the largest CDFIs [community developmentfinancial institutions] in the city, and a bankcould use us to satisfy its community reinvestmentneeds,” he explains. “When I ran into an old friend andasked what he was up to, he said he was working forCarrollton Bank. I told him that if his bank needed touse CRA [Community Reinvestment Act] dollars, ourcredit union was the one to go through. Shortly afterthat, I got a phone call.”It took about a year to set up the collaboration.“There were no problems at the local level, but weguess it took a while to get the FDIC [Federal DepositInsurance Corp.] to fully understand—the approachwas so novel. A big help to getting this done was thecommitment of the bank’s president to serving themarket. He really understands the need.”Adams’ biggest target is payday lenders. “Missourihas the second-largest concentration of payday lendersin the U.S. They flock here and prey on the disadvantagedbecause there’s very little industry regulation.”The arrangement with Carrollton Bank involves$800,000 to help with operations, including financialeducation, marketing, and branch space. “We fundeda branch with them, and have 10 other offices as well.”In an in-your-face show of taking the fight to thefoe, Adams placed one of the branches in a strip malldirectly between two payday lenders.“We wanted to go after them. I’m a credit unionveteran who has taken the credit union movement’smission seriously for years. If credit unions drift awayfrom their original mission, it’s not good. So we decidedto find an economically disadvantaged communityand own it. We could have gone to the suburbs andbattled for deposits, and become a ‘me too’ institutionin the process, but that wasn’t for us.”Adams starts his work day early—usually arriving athis desk <strong>by</strong> 6:20 a.m. “I have a great staff. Our mottois ‘passion over paycheck,’ meaning we want peoplewho are in this for the good they can do, not just themoney they make.”8 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

A Lion for the Low I ncomeLaura Aguirre had a humble upbringinginvolving public assistance andthe fear of homelessness.As a result, she understands—perhaps morethan most—how encouragement and kindnesscan change lives.“Fortunately, one day I landed in the creditunion world” after a 15-year banking career,Aguirre says. “I absolutely fell in love with thecredit union philosophy of ‘people helpingpeople.’ Everywhere I looked I saw people whoreminded me of how I grew up.”As the president/CEO of Hawaii First Federal<strong>Credit</strong> <strong>Union</strong> in Kamuela, Aguirre was “determined”and “empowered” to help underserved,low-income, and native communities.Aguirre pushed her credit union to obtain alow-income designation and Native CommunityDevelopment Financial Institution certification.She also created a 501(c)(3) arm of the creditunion to serve the community with free accessto job-seeking assistance, credit and debt management,one-on-one financial counseling, andfinancial education workshops.Aguirre’s passion has rubbed off on her team.“She lives and breathes our mission of servingthe underserved and empowers our teamto ‘wow’ our members,” says Mary Ann Otake,Hawaii First Federal’s vice president of operationsand development.Aguirre believes in surrounding herself withlions, not deer—an illustration from one of herfavorite books, “You Don’t Need a Title to Be aLeader” <strong>by</strong> Mark Sanborn. In his book, Sanbornmakes the point that leaders embody the characteristicsof lions, whereas deer are more timid.Aguirre concedes that serving those who reallyneed it isn’t always easy. One of Aguirre’s firstinteractions with a member is a case in point.“The member wanted to apply for a car loan,and as I handed him an application he lookedlike he was in physical pain,” Aguirre recalls.She subsequently discovered the man couldn’tread or write—and she no longer assumes anymember interactions are routine.“Taking a few extra minutes could be the differencebetween someone receiving the help theyneed or walking out the door,” Aguirre says. “Ourstaff is expected to take these extra few minutes,and it shows. We have very loyal members.”The mountain of thank-you cards the creditunion receives is proof, she adds. “It doesn’t getany better than that.”LAURA AGUIRRELaura Aguirre poses withyoung member Ava-Amalia,who was designated a“Super Saver” <strong>by</strong> HawaiiFirst FCU during National CUYouth Week earlier this year.OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS9

‘She’s remarkably cool underpressure and handles themundane job of accountingwith grace and dignity.’Tom QuigleyARLENE BERNARDFun With NumbersFor management, numbers and accountingcan be a boring part of the job.Thanks to Arlene Bernard, that’s not the case atXCEL Federal <strong>Credit</strong> <strong>Union</strong> in Bloomfield, N.J.Bernard has served as the credit union’s chieffinancial officer only about a year and a half. But she’salready having a big impact and quickly earning therespect of senior leadership.“Normally, it’s a pretty boring department,” saysTom Quigley, XCEL Federal’s director of marketing.“She explains the financials with such passion that weall actually care about accounting.”So much so that Bernard would be an expert at theJeopardy category “Fun with Numbers,” Quigley says.“She loves accounting and all things numbers,” hesays.Previously, Bernard served for 16 years as CEO ofSaint Vincent’s Employees Federal <strong>Credit</strong> <strong>Union</strong> inNew York, which merged with another institution.Since coming to XCEL Federal, Bernard has had alot on her plate, including:• Dealing with the aftermath of an employee embezzlement;• Incorporating three new staff members in adepartment of four;• Handling some difficult NCUA guidelines; and• Working with many technology efforts.The credit union is ahead of most similar-sizedinstitutions technology-wise, says Quigley.XCEL Federal drives its own ATMs , offers a mobileapp loaded with extras, and is starting a wholly ownedcredit union service organization.“All this means a lot of work for her,” says Quigley.“But she’s remarkably cool under pressure and handlesthe mundane job of accounting with grace and dignity.“She could be the MVP here,” he continues. “She’sbeen our most valuable employee.”Bernard has accomplished a lot in a short time atXCEL Federal, Quigley says. She has improved andensured timely vendor payments, streamlined theentire accounting department, boosted morale, andskillfully managed the credit union’s relationship withregulators.“Oh, and she’s a pleasure to work with,” Quigleysays.She’s dedicated, motivated, and compassionate, headds, as well as down-to-earth—basically a great coworkerto have on your side.“She is smarter than me, but she doesn’t let on,”Quigley jokes.10 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

‘CU Man’ Takes Fight to Predatory LendersThere’s a superhero in our midst, born outof the frustration of big banking and sent toteach us better ways to handle our money.Immune to the gravitational pull of traditional banking,this consumer champion is strong enough to obliteratehigh fees, able to leap predatory interest rates in a singlebound—and lightning fast with loan approvals.Who is this subduer of subpar financial providers?It’s <strong>Credit</strong> <strong>Union</strong> Man, a.k.a. Fred Brown—mildmannereddirector of marketing/member developmentfor Northeast Family Federal <strong>Credit</strong> <strong>Union</strong>, Manchester,Conn., <strong>by</strong> day and credit union superhero some nightsand weekends during youth events, trade shows, andannual meetings.His initial mission was to entertain and teach kidsabout credit unions and smart money management. Butthe appeal of Brown’s message—and superhero threads—quickly spread to a wider audience. “When people seeme, they ask what I’m doing—and that gives me the perfectopening for a conversation about banks versus creditunions,” Brown says. “People let their guard down whenthey see me making a fool of myself.”They’re also receptive to <strong>Credit</strong> <strong>Union</strong> Man’s message,sometimes sharing impassioned stories of poor treatmentat the hands of banks. “When people know they canreceive the same services at a credit union, which caresabout them as much as the bottom line, most will movetheir accounts, or at least begin making the transition.”Brown feels fortunate his chosen method of spreadingthis message has been so successful. “I’m lucky to workin an industry that embraces that special kind of crazyall credit union marketers have within us.”The <strong>Credit</strong> <strong>Union</strong> Man persona is one way he maintainsa fresh marketing approach on a limited budget.“We can’t be everything to everyone. You need to identifyyour market and market to it. Use social media, guerillamarketing—dress up in a superhero costume if need be.”CU Man raised money for financial literacy efforts in Connecticut <strong>by</strong>posing for photographs and selling T-shirts during the 2013 <strong>CUNA</strong>Marketing & Business Development Conference.FRED BROWNOCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS11

Selling the CU Experience“Justify your existence” would bea fitting mantra for these marketingand business developmentrock stars, who sing the praises of• Lisa Nicholas, vice president of marketing for$627 million asset Amplify Federal <strong>Credit</strong> <strong>Union</strong>, Austin,Texas (Marketing Professional of the Year).These pros discuss keys to success in the marketing/businessdevelopment arena—and share somelittle-known tidbits about themselves.LESLEY CARRELLstrong analytics as way to provetheir endeavors are worth themoney budget crunchers sometimesbegrudgingly allot to them.The <strong>CUNA</strong> Marketing & Business DevelopmentCouncil named these Diamond Awardwinners as their top marketers for 2013:• Lesley Carrell, senior vice president ofmarketing for $750 million asset Fibre Federal<strong>Credit</strong> <strong>Union</strong>, Longview, Wash. (Hall ofFame);• Andy Reed, manager of business developmentfor $5.5 billion asset American AirlinesFederal <strong>Credit</strong> <strong>Union</strong>, Fort Worth, Texas, andthe council’s secretary/treasurer (BusinessDevelopment Professional of the Year); andCU Mag: What’s your guiding marketing/business development philosophy?Reed: “Leadership equals sales.” I heard this expressionfrom a credit union CEO whose career began asa marketer [Teresa Freeborn, CEO of Xceed FinancialFederal <strong>Credit</strong> <strong>Union</strong>, El Segundo, Calif.], andit quickly became my philosophy as well.<strong>Credit</strong> unions can’t take the marketplace <strong>by</strong> stormif they don’t understand the contribution they maketo people’s financial well-being. And the best wayto make that happen is to become a member andexperience the difference.We have to sell people on the credit union experience.Hopefully, we do that consultatively throughour commitment to improve people’s financial wellbeingand not to drive numbers or metrics.But number crunchers need numbers to crunch.If credit unions don’t embrace a sales culture, giveour profession a seat at the strategic table, and getserious about growth, our industry is at high risk ofextinction. Business development is about ensuringsurvival. Training is the backbone of the organizationand business development is the future.Nicholas: Marketing should be built on a strongfoundation that results in a positive outcome for themember and is fiscally responsible for the organization.We’ve had a lot of success getting team memberson board and genuinely believing in what creditunions do: helping people achieve financial success.So we do a lot of internal training for staff, andalso for members. I think that’s why they come backand refer us to their friends. Also, marketers have toknow where they’ve been so they know where to go.So I base a lot of our decisions on analytics.Carrell: Marketing is as important as finance,operations, information technology, or any otherdiscipline in helping credit unions succeed. A goodmarketer has to be proactive in leading efforts toupdate, launch, and improve products, procedures,and systems—and we must always think strategically.12 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

CU Mag: What are some keys to success?Carrell: Think strategically and understand that greatmarketing is an incredible investment. But you mustbe able to prove that. You must be able to lead and livethe credit union’s brand. And you’ve got to be willingto institute and campaign for needed changes—whetherit’s with the budget, the culture, orthe product. Marketers need to takethe lead on this.Nicholas: The key to success, atleast in my organization, is that I don’twork in a vacuum. My team workswith every department on promotions.We need things from differentareas, so working with everyoneis critical to our success and to theorganization’s success. Again, it’s important to analyzeeverything so we can prove what we do is successfuland that it’s worth the money we spend.Reed: It starts with the organization’s leadershiprealizing the value marketing and business developmentbring to the table and investing in both. Manyleaders undervalue our professions because they don’tunderstand them. We have to become adept at usingmetrics, which is their language to prove our value.Other keys to success include being a change agent,ANDY REEDthinking strategically, being a visionary, having endlessamounts of energy, being a great networker, and beingable to build relationships quickly.You also have to be good at motivating yourself andcelebrating your own successes.CU Mag: What’s one thing your colleaguesmight not know about you?Nicholas: I was a professional sled dog driver. Growingup, I had 40 to 80 dogs at any given time. Peopleknow the Iditarod, which is a distance race, but wewere sprint racers, going for speed.Reed: I’m kind of a cruise-aholic. I love to travel,and I’ve been to many incredible places. Cruises giveme the chance to get off the grid, disconnect, be withmy family, and recharge. Travel is relaxing, but it alsofulfills my need for adventure.Carrell: I’ve always wanted to write a book, and I’mretiring soon so I’m going to finally get the chance. Itcould be fiction or nonfiction; maybe both.I’ve got a lot of ideas germinating, but I haven’tmapped anything out yet.LISA NICHOLASOCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS13

Young Professional Lives OutHer Passion for Lifelong LearningCara Carlevatti says the rock star shewould most like to be is Gwen Stefaniof “No Doubt” because of the musician’sadvocacy for strong women.“There are a lot of women in leadership roles incredit unions in the state of New York,” says Carlevatti,member development coordinator for Great Erie Federal<strong>Credit</strong> <strong>Union</strong>, Orchard Park, N.Y. “Advancing inthe credit union is something that young professionalscan look forward to.”As a young professional herself, Carlevatti embracesthe credit union culture of community involvement.In two short years with Great Erie Federal, she hasrevamped the credit union’s youth savings programto include savings rewards such as savings depositsfor report card grades. She also started a credit unionlibrary with books, DVDs, and games for both youthand adult members. The financial literacy libraryallows members to borrow materials and then returnthem to the credit union at no cost. She has workedwith local Girl Scout troops, day camps, and otherlocal groups, bringing them to the credit union tolearn the basics of financial literacy.“Financial literacy is important at every age,” shesays. “From the time children receive their first paymentfrom the tooth fairy, proper money managementis a lifelong skill. If you get into‘From the timechildren receivetheir fi rst paymentfrom the toothfairy, proper moneymanagement is alifelong skill.’bad habits when you’re young,they’re harder to break whenyou’re older.”Another important elementof financial education isinforming consumers of theadvantages of credit unionmembership, adds Carlevatti,who was just recently electedvice chairman of the <strong>Credit</strong><strong>Union</strong> Association of NewYork’s Young ProfessionalsCommission.Her passion for educationextends to Carlevatti’s personallife as well. She is studying forher MBA at St. BonaventureUniversity. “You need to take advantage of everyopportunity that comes your way,” says Carlevatti,who advises young credit union professionals to dothe same. “<strong>Credit</strong> unions have such a rich history. It’simportant to stay true to credit union principles whileadapting for the future.”But current and future credit union leaders needto stay up-to-date on the evolving financial needs ofmembers and the techniques to best serve those needs,advises Carlevatti, who is also an active member of the“Don’t Tax My <strong>Credit</strong> <strong>Union</strong>” campaign.CARA CARLEVATTI14 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

‘We have canoes in city halls.We have canoes in local malls.We have them in the libraries….’AMY DAVISFilling Canoes for the CommunityFor Amy Davis, success equals red canoesfull of donated school supplies.Davis, vice president of marketing for Red Canoe<strong>Credit</strong> <strong>Union</strong> in Longview, Wash., has garnered anumber of marketing awards in her career. But she’smore likely to beam about results from her team’s“Fill the Canoe” school supply drives.“I am pretty proud of the work we’ve done in thecommunity,” Davis says. “We try to stand for what thecredit union difference is all about.”The annual canoe-filling event, which encouragesthe public to drop off school supplies in canoes displayedat branches, has been a huge success. Since itsinception, the credit union has collected and matchedmore than 47,000 pounds of donated school supplies.Plus, local business partners clamor to participate—65joined the effort this year.“W e have canoes in city halls. We have canoes inlocal malls. We have them in the libraries. A coupleof churches have come on board and brought in theirown canoes,” Davis says.The effort is a centerpiece for the credit union’soutreach efforts and builds on a brand pushed downstream<strong>by</strong> Davis and others in 2007. That’s when theinstitution changed its name from WeyerhaeuserEmployees’ <strong>Credit</strong> <strong>Union</strong>.“We definitely see return from Fill the Canoe eventhough that isn’t our intention. When you do rightthings, right things happen,” Davis says.The event, originally pulled together in a matter ofweeks, reinforces Davis’ ability to collaborate, not onlywith her team of “rock stars” but with the businesscommunity.“Amy is a talented marketer with a world-class marketingmind. She brings innovation and creativity toa higher level. You only need to look at the growthof her credit union to see this,” says Sean McDonald,director of business development for Mid-State Federal<strong>Credit</strong> <strong>Union</strong> in Carteret, N.J. “I’m always impressedwith Amy’s input and contributions.”McDonald and Davis both serve as members of the<strong>CUNA</strong> Marketing & Business Development Council’sexecutive committee. Participating on the council isone way she gives back to those who helped her earlyin her career.Back when she barely knew what a credit union was,Davis recalls receiving assistance from the council andan employee at another credit union that, technically,was a local competitor.“I just remember being so touched <strong>by</strong> that,” Davis says.The council is happy to have her intelligence andpassion on the team, says Michelle Hunter, chair ofthe executive committee.“She donates her time and talents graciously toadvance our profession nationally,” says Hunter, seniorvice president of marketing and development at <strong>Credit</strong><strong>Union</strong> of Southern California. “She is genuine, responsible,resourceful, and intellectually curious—characteristicsthat contribute to her being a ‘rock star’ inour profession.”OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS15

Making a Difference Through InnovationMatt Davis, director of innovation at theFilene Research Institute, is much morethan an idea man.He’s a doer. And his impact is rippling across thecredit union movement.“He’s got a combination of whip smart intellect andthe rare ability to do the things he talks about,” saysGeorge Hofheimer, Filene’s chief research and innovationofficer.Davis guides the prestigious i3 program that createsnew products, services, processes, and businessmodels for credit unions.He’s the author of several Filene publications, thecreator of The <strong>Credit</strong> <strong>Union</strong> Warrior blog, and theco-founder of cuwatercooler.com.Hofheimer is glad Davis is on Team <strong>Credit</strong> <strong>Union</strong>.“His values match up really well with the creditunion system,” Hofheimer says. “He is extremely helpfuland earnest. He really personifies that in his workand personal life. He is always willing to pitch in.”His list of innovations and accolades is too longto cover adequately in limited space. Basically, hetalks the talk and walks the walk.“He is extremely action-oriented. That was his hallmarkeven before coming to Filene,” Hofheimer says.Davis got his credit union start as director of publicrelations for Members <strong>Credit</strong> <strong>Union</strong> in Winston-Salem, N.C., where his “What Are You Saving For?”program was featured in Fast Company.So, where do all of Davis’s good ideas come from?“Empathy is the most reliable source of good ideas,”Davis says. “The willingness and ability to observehuman behavior and put yourself in the shoes of othershelps a creator understand problems that need tobe solved, when they are experienced, and how thoseproblems impact the people who experience them.“Innovation,” he adds, “is a problem-solving mechanismthat is fueled almost entirely <strong>by</strong> empathy.”Davis is glad to be working for a movement thathas a long history of improving people’s lives throughmutual self-help.“What fires me up about credit unions is the tremendouspotential we have to make a difference inthis world,” he says.MATT DAVIS‘Empathy is the most reliable source of good ideas.’16 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

‘It’s OK to positivelydisrupt the system.’BRENT DIXONIn Constant Pursuit of Good DesignOn his LinkedIn page, Brent Dixon sayshe’s “a designer, educator, and musician—in no particular order.” He’s not a sticklerabout such things.Dixon emphasizes the importance of design to creditunions “because it’s a way to show they care about people.I want to overcome the idea that design is solelyabout making something look aesthetically pleasingwhen it’s really about making things work beautifully.“It’s melding form and functioninto seamless interactions. At thecredit union level, it includes takingsomething logical—such as budgeting—andjoining it to somethingemotional—money. It’s about makingsomething that works well inaddressing both, whether it’s bankingproducts, a website, or branchdesign. Delight and happiness aretools used to design good creditunion experiences.”An example of good designresearch comes from The Cooperative Trust, a youngprofessionals group Dixon founded while working withthe Filene Research Institute. He oversaw a variety ofproject types, including one involving unbanked andunderbanked consumers.“Despite their fear of financial institutions, manyof the people we met with were more on top of theirfinances than banked people,” he says. “They can’tafford mistakes.”That research project led members of the CooperativeTrust to develop Tru Circle—a pilot programinspired <strong>by</strong> “village banking,” which is used in manydeveloping countries. “At no risk to the credit union, agroup of five friends or family members contributes aset monthly amount into a common account,” explainsDixon. “When a member requests a loan, the groupmust unanimously approve it. The transactions helpborrowers establish credit histories.”The Cooperative Trust enables young credit unionprofessionals to design and prototype products and servicesthat are relevant to young consumers. “It’s OK topositively disrupt the system,” says Dixon, who’s nowpursuing a master’s of fine arts degree.OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS17

Once a Coach, Always a CoachDick Ensweiler set off for college to become abasketball coach, but got sidetracked. After takinga summer job at State Central <strong>Credit</strong> <strong>Union</strong>in Milwaukee, he was hooked on credit unions.“The treasurer/manager and I hit it off well to the extent thathe promised me a position when I got out of college and themilitary,” Ensweiler recalls. “I took him up on it and he createda first-ever management training program. It paid off, and18 months later I became the treasurer/manager of the HarleyDavidson <strong>Credit</strong> <strong>Union</strong>.”It’s almost 50 years later and, in a way, the Cornerstone <strong>Credit</strong><strong>Union</strong> League CEO did become a coach—employing traits suchas consensus-building, perseverance, and adaptability in the faceof difficult circumstances. The most recent of the many creditunion milestones he’s experienced over the years is the merger ofthe Texas, Oklahoma, and Arkansas credit union leagues.“Leagues were facing shrinkingnumbers and finding it more difficultto provide full services,” Ensweiler says.“We saw value in a larger organizationwith broader reach. It took fouryears to get through all the questions,answers, and considerations, but onceinterested parties remained at the table,it took less than a year to come to an‘Make sure there’sa strong vision ofwhat could be.’agreement. The merger is everything we hoped it would be. We’remore relevant now than before. With 650 credit unions, we havea bigger voice with potential partners, vendors, regulators, andnational associations.”Ensweiler also came to credit unions’ aid in 1974 when disintermediationcaused savings rates to skyrocket from 6% to 22%.“<strong>Credit</strong> unions could not meet members’ withdrawal requestsand I was appointed to a task force of league presidents to find asolution,” he says. “We proposed to <strong>CUNA</strong> a new financial andsupport system—and created the corporate credit union network.”He also played a key role in forging a partnership with CajaPopular Mexicana (CPM) in Leon, Mexico. Today, CPM has morethan one million members, 330 branches, and $1 billion in assets.“The CPM partnership has been successful and mutually beneficial,”Ensweiler says. “We’ve learned a lot from each other.”DICK ENSWEILER18 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

HELEN ESTESA Beloved Rule Bender Named ‘Rokmom’If you know only two things about HelenEstes, they’ll tell you a lot.When we asked if she has any favorite rock stars,Estes, who will retire next year, immediately replied,“I’m a rocker at heart. My 36-year-old son was in aKISS tribute band and has played since he was 15.I’ve been a band mom since then, and knew all of thelocal groups. In fact, my email address is ‘rokmom.’ ”Her daughter also looks up to her mother, findinginspiration and guidance in her own credit unioncareer.Another thing about Estes, loan officer at Old DominionUniversity <strong>Credit</strong> <strong>Union</strong> in Norfolk, Va., is that shedetests credit scores. “I don’t believe in them. They don’ttell the story you need to hear. If you’re going to lendmoney to somebody questionable, why charge an outrageousrate just to foreclose on them a year earlier?”Her lending decisions run the gamut, from $100 consumerloans to $1 million mortgages. She recentlyhelped an overseas professor who had a $450,000down payment on a $1 million mortgage but couldn’tget a secondary market-approved loan because hedidn’t have a credit score.“I gave him the loan,” she says, adding that everyoneinvolved agreed the member was a good credit risk.As a one-woman loan department, Helen is in aunique position to bend the rules to everybody’s benefit.“Old Dominion accepts that I’ve occasionally madea wrong call, but they support my approach.”Her openness to borrowers’ stories doesn’t mean shenever says no. “The first time I had to say no I wasscared. It was difficult. I had to explain our policy andwhy this loan wouldn’t work. Many times when I sayno it’s from a gut feeling.”<strong>Credit</strong> scores‘don’t tell the storyyou need to hear.’She can be strict. “SometimesI’ll spend hours witha member, methodicallycontacting and paying offcreditors. When we’re finished,I say, ‘This is the onlytime I’ll do this for you. Ifyou go back to these lendersagain, where will you get the money to pay them off?’ ”Helen meets with almost all applicants face to face.“They have to sit down and talk to me. I know thepeople I lend to and I know their stories.”If her answer is “no,” she’ll work with the memberand explain the steps needed to make improvementsbefore the credit union can offer services. “Sometimesthey cry, and sometimes I cry right with them.”OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS19

SARAH DALE HARMONSocialMedia‘Spokester’ SpeaksFrom the HeartIn 2010, as Mississippi’s Youngand Free “spokester”—a job shecompeted for via social media—Sarah Dale Harmon drove upand down Mississippi in a brightpurple car visiting credit unions.Meeting people who operate serviceoriented,cooperative credit unions helpedher decide on her career path. After herstint with the Young and Free youth marketingcampaign, she attended the <strong>Credit</strong><strong>Union</strong> Development Education programin 2011, and later was hired as marketingspecialist at $132 million asset MagnoliaFederal <strong>Credit</strong> <strong>Union</strong> in Jackson, Miss.“<strong>Credit</strong> unions have products andservices created for the sole purpose ofhelping people,” notes Harmon. “That’ssomething I can feel good about. I don’thave to ‘sell’ anything to members—I justhave to be honest with them.”Since joining Magnolia Federal, Harmonhas overhauled its Facebook/Twitterpages and added other social medianetworks such as Vine, Pinterest, Blogger,and Instagram.“Social media is an inexpensive way topromote our products and services, communicatewith our members, and increaseour presence in the community,” she says.Harmon makes Magnolia Federal’sFacebook page attractive <strong>by</strong> updating itdaily, giving away prizes on Trivia Tuesday,and posting articles, tips, and picturesof staff out in the community.“Sarah Dale’s social media results areastounding,” says Lanet McCrary, vicepresident of marketing and businessdevelopment. “The ‘Likes’ on our Facebookpage increased from just over 200 inOctober 2012 to more than 3,600 today.”Magnolia Federal had reached approximately26,000 people through Facebook asof May 2013—a figure that grows monthly,with most of those contacts residingwithin its field of membership.Magnolia’s statistics are impressive. Inthe first half of this year, membershipincreased 7.6%, checking accounts andonline banking grew <strong>by</strong>‘I don’t have to“sell” anything tomembers—I justhave to be honestwith them.’approximately 10%, andmobile banking was upmore than 21%.In addition to handlingall digital marketing,Harmon also servesas Magnolia’s “Adopt-a-School” liaison, recentlyworking with a schoollocated in the communitysurrounding the creditunion’s newest branch.“Sarah Dale has amazing social mediaskills and the ability to reach our localyouth,” says McCrary.“We aren’t a huge credit union,” addsHarmon, “but with a little initiative andsmart use of our advertising dollars, we’vereally had some success.”OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS23

CHAD HELMINAKThey Sing the SongsThat Make the CUWorld SingBy day, they’re professional communicatorsfor the credit union movement.By night, they’re literally creditunion rock stars.In their spare time, Christopher Morris fromthe National <strong>Credit</strong> <strong>Union</strong> Foundation (NCUF)and Chad Helminak from the Wisconsin <strong>Credit</strong><strong>Union</strong> League travel the country singing themovement’s praises as musicians with a mission,known as The Disclosures.“People think we’re crazy sometimes becausewe finish our day jobs and then go work oncredit union music, but it’s something we loveand have a passion to do,” says Morris, NCUF’sdirector of communications. “It might seem alittle weird, but we have a niche and it’s great.”The duo embarked on the unique musicaljourney in 2009, releasing an album of creditunion-themed songs “(Hey, We’re) The Disclosures,”in 2011.A follow-up children’s album—aiming tomake the band “the School House Rock/Wigglesof financial education”—is slated for releaselater this year.“It’s our way of helping consumers understandcredit unions, but also letting credit unionpeople, especially young professionals, knowthey’re part of this amazing movement,” saysHelminak, the league’s vice president of development.The band was an outgrowth of NCUF’sDevelopment Education (DE) training program—whichhas been providing lessons incooperative principles, credit union philosophy,and member-centric business models for morethan 30 years. Both went through the training.Both were inspired.“Suddenly, it turns your credit union job intoa career you believe in, where you’re workingtoward a greater good,” Helminak says.The two struck up a friendship when Helminakwas going through training in 2009 andMorris was serving as a mentor, having gonethrough the program years earlier. They discoveredthey both played guitar, lived in Madison,Wis., and had an unbridled passion for creditunions.For fun, the pair started playing covers ofclassic rock tunes at local open mic shows. Butit wasn’t until their participation in an innocentcredit union-themed song contest that theyhoned their thrift rock sound.The band’s entry, “Movin’ on With My Mon-‘No one told us to start a CUband, but somewhere along theway people encouraged us to becreative and that happened.’24 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

‘People think we’re crazy sometimesbecause we fi nish our day jobs andthen go work on CU music.’ey,” was an immediate success. Shortly after itsrelease, it blew up on the Web in credit unioncircles and landed on The Huffington Post.“The response was great,” Morris says. “Musicand humor proved to be a unique and effectiveway of communicating messages.”Since then, the band has released tunes forInternational <strong>Credit</strong> <strong>Union</strong> Day, Bank TransferDay, National <strong>Credit</strong> <strong>Union</strong> Youth Week, aswell as a legislation-specific advocacy song. Ithas performed at staff training sessions, leaguemeetings, vendor meetings, and <strong>CUNA</strong> conferences,including one at the historic Estes Park.“I think what we’ve been able to prove is thatif you give young people a chance and someroom to think big—like Chris and I have in ourworkplaces—good things will come out of thatorganically,” Helminak says. “No one told us tostart a credit union band, but somewhere alongthe way people encouraged us to be creative andthat happened.”While their nights, weekends, and vacationday gigs have the cachet, Morris and Helminakhave been known to rock their day jobs, too.Helminak started in the league’s communicationsdepartment but advanced into developmentand outreach. He’s been influential inorganizing a strong network of about 300 youngcredit union professionals.“It’s really energizing to help other people getfired up about credit unions,” Helminak says.Morris got his credit union start as a temp atNCUF while he was trying to find a high-schoolteaching gig.“Then I went through DE and it changed mylife,” Morris says. “One thing DE does is that itties the movement together and helps you realizethe powerful, global impact of credit unions.”Ever since, Morris has been involved with theprogram in various capacities.Together, Morris and Helminak are a potentcombination of passion, creativity, and intelligence.And they complement each other well.Helminak says of Morris: “A lot of ideasfloat in the ether sometimes. He has this abilityto package it and put it into something that’sactionable. He has creativity, but also a groundednessabout him that allows that creativity tocome alive.”Meanwhile, Helminak, jumps where manyothers might not, Morris says of his bandmate.“Chad is one of those people who always hasthe spark to take it to the next step. He’s alwayswilling to go for it,” Morris says.Both are thrilled to share their passions witheach other and the world. It’s brought them toplaces and given them experiences they neverimagined.“We’re so lucky and honored to do this,” Morrissays.CHRISTOPHER MORRISOCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS25

CHERRY HEDGESEmphasis on Education Drives SuccessAt Virginia <strong>Credit</strong> <strong>Union</strong> in Richmond,commitment to financial educationcomes right from the top.A firm belief in the power of financial educationto help members succeed led President/CEO JaneWatkins to seek out a trained educator to serve asthe credit union’s first full-time director of financialeducation.The commitment became a reality when Virginia<strong>Credit</strong> <strong>Union</strong> hired former public school teacherCherry Hedges six years ago.“I was attracted to Virginia <strong>Credit</strong> <strong>Union</strong> becauseof the vision it has for helping its members,” saysHedges. “I loved the idea of using my teaching experienceto help people get ahead financially.”The credit union offers week-long money camps forteens, an introduction to personal finance for collegestudents, adult workshops in budgeting and reducingdebt, and seminars for first-time home buyers.Last year, Virginia <strong>Credit</strong> <strong>Union</strong> reached a newmilestone when more than 12,000 people participatedin its financial education programs. Young peopleaccounted for two-thirds of the participants.Effective financial education makes for smart,savvy consumers.After Hedges worked with a local communitycollege, an instructor recalled the way one of herstudents discussed home ownership in a final exampaper.“Integrating new thinking about their future is thegoal of this program,” the instructor wrote to Hedges.“I’m so pleased to see students asking questions andtrying to take ownership over their adult finances.Thank you again for bringing your knowledge andtools to our program.”Virginia <strong>Credit</strong> <strong>Union</strong> is the largest state-charteredcredit union in Virginia with 220,000 members,550 employees, and 16 branch offices. During thepast 10 years, assets have more than doubled from$1.1 billion to $2.5 billion.Education and empowerment for members andthe community have been a key to the credit union’ssuccess.“Our sole purpose as a cooperative is to help ourmembers be more successful,” says Watkins. “That’swhy we put such a priority on financial education.”“People are hungry for this,” says Watkins. “It tookthe recent recession for people to wake up and seehow important it is.”‘I loved the idea of using my teachingexperience to help people get ahead fi nancially.’26 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

Offi cial White House photo <strong>by</strong> Pete SouzaJOHN HERRERAA Champion of ChangeIf he could be a rock star, John Herrerawould be Elvis, “because he had goodlooks and good moves.”Herrera has made good moves since heco-founded Latino Community <strong>Credit</strong> <strong>Union</strong>,Durham, N.C., in 2000. The credit union hasgrown to a $100 million asset institution todaywith more than 55,000 members (a 30% increasein the past five years).A senior vice president at Self-Help <strong>Credit</strong><strong>Union</strong>, Durham, N.C., since 1999, he was recognizedearlier this year in the White House’s “Championsof Change” ceremony, which honored 11foreign-born entrepreneurs.North Carolina has several rural, underservedareas, where prospective members live on farmswith little access to the financial services foundin large cities, says Herrera. He sees a network oflocal farm bureaus, churches, mobile branches, andmobile communications providing financial productsand education to meet their needs.“Once folks know the benefits of the credit union,they’ll use it,” says Herrera, who has seen his creditunion help members buy their first homes and firstcars, open businesses, and send their children tocollege. Helping members in their financial questsis what Herrera finds most rewarding about his job.“Every day you’re changing people’s lives <strong>by</strong> helpingthem grow financially and realize their dreams.”“People helping people” is the primary theme of‘Every day you’rechanging people’s lives.’Latino Community and other credit unions, Herrerasays. “We work for our members. We want topromote the idea of volunteerism and the sharedbenefits of community development. We worktogether better than we do individually.”The White House announcement said Latino Community<strong>Credit</strong> <strong>Union</strong> “has become the fastest growingcommunity development credit union in the nationand a banking model for new immigrants.”“I remember when we started, people saw immigrantsas too expensive to serve,” Herrera recalls.“But we were created to serve the underserved.”The previously underserved individuals andbusinesses have rewardedLatino Community’sfaith in them <strong>by</strong> not onlykeeping the credit unionstrong, but also <strong>by</strong> helpingit grow during therecent financial crisis,adds Herrera, a naturalized American from CostaRica, who cites his faith and his family as the drivingforces in his life.Herrera sees Vietnamese communities in severalareas as needing the same financial servicesthat Latino communities need. And, he adds, theseservices are the same as what northern Europeanimmigrants needed only a few generations ago.“The sooner we embrace them, the sooner we’llhave stronger communities,” says Herrera.OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS27

MANUEL HOCHHEIMERBringing New Business on BoardNumerica <strong>Credit</strong> <strong>Union</strong>’s team of business developmentmanagers has been together just one year. But what a yearit’s been.Drawing from their separate areas of expertise, Manuel Hochheimer, JanetMcNeilly, and Jeanette Radmer teamed up to identify the Spokane Valley,Wash., credit union’s target demographics and introduced initiatives to broadenits market share within those segments.The trio’s Dealer Center Outbound Conversion Program dramaticallyimproved engagement among indirect auto loan recipients. Its University OutreachProgram deepened interactions between Numerica and more than ahalf-dozen colleges in its service area. And the credit union’s emphasis on thegrowing medical, dental, educational, and small-business communities in theregion meshes with its goal of attracting more 25- to 49-year-olds.Radmer sums up the team’s strategy:“Be strategic in your businessdevelopment efforts. Know the demographicyour credit union is targetingin its efforts to be successful andthrive in the future. Then, reach out tothat demographic, get to know them,and introduce them to the benefitsyour credit union has to offer.”The group’s successful onboardingprogram stands out as its chief accomplishment.In the past year, Numericaconnected with approximately 70% ofits indirect members, converting nearly20% of them into primary financialinstitution members—a rate about 10times the industry average.“Simply <strong>by</strong> reaching out to people,having a conversation, and listening totheir stories, we’ve become a partner intheir quest to find financial well-being,rather than the place where they havetheir car loan,” Hochheimer says.Numerica tailors financial educa-28 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

JEANETTE RADMER‘Know the demographicyour CU is targeting in itsefforts to be successful.’tion presentations for students and faculty at collegessuch as Gonzaga University, Whitworth University,and Eastern Washington University, and partners withthem on community involvement projects. The creditunion also offers a tour of its headquarters with anexecutive Q&A.Thanks to the region’s emphasis on becoming abusiness corridor, many of those rising stars remainin the area following graduation to start their careers.Numerica has positioned itself as their trusted financialadviser.“I get excited about learning what motivates membersand identifying their unique needs,” McNeillysays. “This process wouldn’t be as fulfilling if I didn’twork for a company that I believe in. I can honestlysay I enjoy going to work every day.”JANET McNEILLYOCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS29

<strong>CUNA</strong> <strong>Strategic</strong> <strong>Services</strong>RELATIONSHIPS THAT MATTERLast year$35CREDIT UNIONS SAVEDMILLIONthrough ouralliance relationships<strong>CUNA</strong> <strong>Strategic</strong> <strong>Services</strong>, along with our carefullychosen providers, saves you money and time <strong>by</strong>providing the products, services and technologiesyour credit union needs to be more competitivein the financial marketplace. We are:• Contributing to your bottom linewith expense reduction and revenuegeneration programs.• Adding to your peace of mindwith solutions that address security andcompliance needs.• Enhancing your relationshipswith products and services that strengthen theties between your credit union and its members.Find out how your credit union can benefit from our strategicrelationships. Visit cunastrategicservices.com.Strong Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships Systemnships System Relationships Strong Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationshipsipspg Relationships Secure Relationships System Relationships Strong Relationships Trusted Relationships Technology Technology Relationships psationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships System RelationsnStrong Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships Systemtem

STRATEGICALLIANCE PROVIDERSSecurity Solutions for Cash ProtectionPrivate Student Loan ProgramMobile Recovery <strong>Services</strong>General Purpose, Family, Gift, and Travel Prepaid Debit CardsCommunity-Based, Merchant-Funded Rewards ProgramMoney Orders, Money Transfers, and Official ChecksCloud ComputingSBA Loans, Health and Benefits Insurance, Payroll <strong>Services</strong>,Electronic Payment Processing, Website Development andHosting, Data StorageCalendar ProgramWORKPLACEOffice Products, Furniture and Workplace Planning,Technology Products, and Print and Document <strong>Services</strong><strong>Credit</strong> <strong>Union</strong> Member Discounts for General Motors, Sprint,TurboTax, Jackson Hewitt, DIRECTV, Allied Van Lines, andTruStage Auto & Home InsuranceDigital Identity and Security ApplicationATMs, Electronic Security, Fire Monitoring, Locksmith <strong>Services</strong>,Mobile Banking, Physical Security, ATM and Branch SuppliesOnline and Mobile Banking, Bill Payment, Personal FinancialManagement, and Growth and Retention <strong>Services</strong>Secondary Mortgage MarketBusiness Continuity Planning SolutionsCollaborative Portal Solutions for Vendor Management, Boards,and Business-to-Business CommunitiesSecondary Mortgage MarketInformation Security and Messaging ServiceMember Financial Counseling and EducationCloud-Based Risk Management and IT Security ComplianceStatements (Paper or Electronic), Marketing Solutions,Share Draft Printing, Business Checking,Integrated Client SolutionsCompetitive Rate and Fee Intelligence, Mystery Shopping <strong>Services</strong>for Sales/Service Evaluation and Compliance/Fair Treatment TestingLoan Portfolio Analysis for Risk, Loss Mitigation,Compliance, and GrowthBSA/Anti-Money Laundering and Fraud Detection SoftwareOverdraft Privilege, Contract Optimization, andEarnings Enhancement Programsng R Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships System Relatios SecurSSystem Relationships Strong Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Securelationships SmartSecure Relationships System Relationships Strong Relationships Relationships to Benef it America’s <strong>Credit</strong> <strong>Union</strong>s Trusted Relatioships StTrusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships System Relationships Strng R Relationships Trusted Relationships Technology Relationships Smart Relationships Lasting Relationships Secure Relationships System Relatio

HANK HUBBARD1Making an Impact in Motown“You’re Hank Hubbard, the presidentof Communicating Arts <strong>Credit</strong> <strong>Union</strong>,right?” the member asked with an angrylook on his face, interrupting Hubbard’sguided tour of the credit union’s branchin Highland Park, Mich.For the first few years of the branch’s existence,Hubbard couldn’t walk into the lob<strong>by</strong> without a memberthanking him. No financial institution had openeda location in that underserved community encircled<strong>by</strong> Detroit in 20 years, since before the Chrysler Corporationrelocated its headquarters to the suburbs.But this exchange started with a different tone.“And as a member, you work for me, right?” theman asked rhetorically. Hubbard nodded.The member complained that his calls to the creditunion continually funneled directly to voice mail.Hubbard responded that Communicating Arts hadjust opened a call center to address that problem, andasked if anything else was bothering him.Suddenly, the man’s mood changed, and he brokeinto a broad smile. “Would you like to hear the goodnews?” the member asked.Communicating Arts had twice renegotiated termsof Aaron McIver’s used vehicle loan for his beloved2005 GMC Yukon. The original $23,000 dealer loancarried an astounding 24.95% interest rate over sixyears. The credit union sliced that rate in half, andthen <strong>by</strong> half again after helping McIver improve hiscredit score, to 5% over five years.That memorable exchange, which inspired thecredit union’s Auto Bailout Loan program, explainsthe community development credit union’s positiveimpact through its progressive programs—and thereason Hubbard loves his job.“The truth is, you kind of get sucked into servingthe underserved—once you try it you just wantmore,” says Hubbard, a past winner of <strong>CUNA</strong>’s LouiseHerring Philosophy in Action and Dora MaxwellSocial Responsibility Community Service awards,and the Michigan <strong>Credit</strong> <strong>Union</strong> Foundation’s CommunityVolunteer recipient for 2011.Since Hubbard’s successful launch of the Auto32 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

‘The truth is, you kind of get suckedinto serving the underserved—onceyou try it you just want more.’Loan Bailout program, Communicating Arts has helpedmore than 250 members reduce their loan rate <strong>by</strong> an averageof nearly 7% and save about $100 on their monthly payment.The branch in gritty Highland Park—where parts of Eminem’s8 Mile and much of Clint Eastwood’s Gran Torino werefilmed—has opened about 3,200 accounts since coming tothe neighborhood in 2008. A branch in Detroit’s Eastsideneighborhood opened more than 1,300 accounts since 2011.Communicating Arts promotes community-focused projectsand partnerships, including annual charity drives, financialeducation seminars, and free tax assistance. Recently,Hubbard spearheaded a volunteer day with the Metro WestChapter of <strong>Credit</strong> <strong>Union</strong>s at a Detroit-based food rescuenonprofit. About 125 credit union staff and members participated,raising nearly $14,000 for Forgotten Harvest andpacking more than 11,000 pounds of reclaimed food.“Ever since I’ve known Mr. Hubbard, not a day goes <strong>by</strong>where he isn’t doing something for the community,” saysSharlena Clair, administrative assistant to the vice presidentof finance at Communicating Arts and one of 30 young professionalsand high school students Hubbard mentors.“Seeing how driven he is builds my appreciation for workingfor this company. He inspires not just his employees, butthe community, too,” says Clair.Of Detroit’s many rock stars. Marvin Gaye is Hubbard’sfavorite. Gaye’s social awareness also appealed to Hubbard,whose modern music idol is Bono—the philanthropic, socialactivist lead singer for U2. “He’s the poster boy for using hispowers for good,” Hubbard says.The building that housed the world’s first moving assembly line—1producing the Ford Motor Co.’s Model T—stands in disrepairacross the street from Hubbard’s Communicating Arts CU branch inHighland Park, Mich.Hubbard plays with children at an AIDS orphanage in Kenya,2where he’s traveled twice on behalf of the World Council of<strong>Credit</strong> <strong>Union</strong>s. The children love to play with his long, straight hairand beard, Hubbard says.3Communicating Arts CU employees work a craft tent at a holidayfair, helping children make ornaments.Hubbard and Shandel Small, a Communicating Arts CU branch4manager, volunteer at Forgotten Harvest, an organization thatrescues surplus food and repackages it for food pantries in Detroit.A Communicating Arts CU crew, led <strong>by</strong> Hubbard, boards up5abandoned homes around Detroit, where the home vacancyepidemic breeds crime and lowers the value of near<strong>by</strong> properties.23 4 5OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS33

He Means BusinessUnder Eric Jenkins’ leadership,CU Partner Link’s first big idea hasbecome the “Next Big Idea.”The company’s NOWaccount, which enables smallbusiness-to-business sellers to better manage cash flow,won a “Shark Tank”-like competition, claiming theNational Association of <strong>Credit</strong> <strong>Union</strong> Service Organizations’honor for the industry’s best new concept.NOWaccount provides simple, cost-effective accessto capital <strong>by</strong> turning accounts receivables into cash.The product also gives credit unions a “legitimatechance to offer something of significant value for smallbusinesses that banks can’t or won’t provide,” says AngiHarben, director of communications for the Georgia<strong>Credit</strong> <strong>Union</strong> Affiliates (GCUA).GCUA and the Cornerstone, Iowa, Ohio, and California/Nevada<strong>Credit</strong> <strong>Union</strong> Leagues own CU Partner Link.NOWaccount has “supercharged” business prospectsfor Logo Surfing Promotional Products, an onlineretailer based in Georgia that produces branded materials,says Logo Surfing CEO Matthew Watkins.“Before, I was literally afraid of getting too many bigPhoto: Stuler Photographyorders at once, which would put me in the positionof potentially having to walk away from an order forlack of funding,” says Watkins, who used to rely ontraditional lines of credit and home equity loans tobalance the books. “NOWaccount allows me to go afterlarger national accounts because we have the fundingto process just about any offer we close.”Logo Surfing added two service reps and increasedits average order total 35% to put the company on pacefor a record year. It counts among its clients both startupcompanies and giants such as The Coca-Cola Co.,The Dow Chemical Co., and OfficeMax.Jenkins envisioned making precisely that type ofimpact when he joined CU Partner Link as chiefoperating officer after more than 20 years representingcredit unions. That includes a stint as a senior vicepresident at GCUA and a 10-year run as president ofPalmetto Health <strong>Credit</strong> <strong>Union</strong> in Columbia, S.C., duringwhich time the institution grew from $5 million to$50 million in assets.To become the financial institution of choice formembers, credit unions “must be willing to evolvequickly and be open to creating value for consumersin new and innovative ways,” Jenkins says.CU Partner Link aims to drive revenue for creditunions <strong>by</strong> expanding membership, increasing loanoriginations, and creating additional fee income.“Small businesses can be very profitable membersif you have the right products and services to meettheir needs,” Jenkins says. “This is largely an untappedmarket for many credit unions.”ERIC JENKINS34 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

JEFF JOHNSONThe Right People, the RightInitiative, the Right TimeDeveloping the credit union movement’sfirst integration specifications has been asrewarding as the need is obvious, accordingto Jeff Johnson, who—as formervice chair of the <strong>CUNA</strong> TechnologyCouncil—spearheaded the project.But consider the scale of this undertaking: Countingconferences, committee meetings, and working groups,Johnson estimates participants have invested between10,000 and 15,000 volunteer hours getting <strong>Credit</strong><strong>Union</strong> Financial Exchange (CUFX) up and running.“A tremendous amount of effort has been put intoCUFX from credit unions, core processing providers,and third-party vendors,” says Johnson, senior vice presidentof information systems at Baxter <strong>Credit</strong> <strong>Union</strong> inVernon Hills, Ill. “More so than any time in the past,technology is a key driver of success, and it’s gratifyingto know that technology professionals are comingtogether to solve such a big industry challenge.”CUFX is an open, vendor-agnostic, broad integrationstandard designed <strong>by</strong> credit unions and vendors toreduce the time and costs of systems integration, whichhave increased as technology grows more complex.Johnson quips that the need for CUFX is as self-evidentas being nice to your mother on Mother’s Day. Heattributes the success of the effort to the right peoplediscussing the right initiative at the right time.He’s focused on delivering results, not getting credit.“Ultimately, the member wins, because we’ll be ableto get to market faster with more innovative products,”he notes. “The end goal isn’t technology, it’s to improveour competitiveness in the broader financial servicesmarketplace.”CUFX first tackled personal finance managementspecifications, which have been in production morethan a year, followed <strong>by</strong> membership application. Mostrecently, specs for online and mobile banking have beenapproved, with a request for proposal issued this fall.“Each iteration has built on the iteration before andwe improve each time,” Johnson says. “The project willnever be done because things always change and thespecs need to change as the world changes.”Early adoption of these standards <strong>by</strong> credit unionsand vendors willbe key to CUFX’ssuccess, accordingto Johnson, whowants to elevate‘The end goal is to improve ourcompetitiveness in the broaderfi nancial services marketplace.’credit unions’visibility in thefinancial world.“The creditunion movementis uniquely positioned for the benefit of its members,”Johnson says. “If credit unions, core processors, andthird-party vendors all focused on serving membersthrough integrated, robust, and secure offerings, wecould provide solutions unmatched <strong>by</strong> other financialinstitutions.”OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS35

JAMES ROBERT LAYEx-Punk Rocker Joins Digital RevolutionMost guys join rock bands to woowomen. James Robert Lay quit one towin his girl’s heart.While studying management information systemsduring his sophomore year at San JacintoCollege in his native Texas, Lay was living hisdream—playing in the emo punk band PerfectBalance, and waiting tables to pay the bills.Until one day...“I met this girl in the library who told me Iwould never make a career out of a punk band,”Lay recalls. “I liked her a lot and wanted toimpress her.”Lay had recently taken a course in Web designand the opportunities presented <strong>by</strong> the digital revolutionfascinated him. So he quit the band, soldhis guitar and other band equipment, and fundedhis new company with a couple hundred dollars.The leap of faith paid off. Not only did Lay getthe girl—Delena, now his wife—but the businesshe started in his parents’ basement in 2002 isgrowing and is stronger than ever.Lay has worked with more than 400 NorthAmerican credit unions, won more than 50 marketingawards, and shared throughout the industryhis belief in aligning people, product, andprocess around their purpose to deliver 1-on-1digital experiences.This month marks another bold step for Lay.He rebranded his company from PTP NewMedia to CU Grow, which will emphasize buildingdigital marketing and lead generation systemsfor select credit unions.“We were slowly but surely becoming allthings to all credit unions, which is something Ispeak about avoiding,” Lay says. “Focus is a mustfor continued success. And focus, according to[leadership guru] Jim Collins, is what takes anorganization from good to great.”CU Grow’s “destroying the box” mantraunderscores the company’s desire to revolutionizethe industry.Lay has long savored leveraging new mediaplatforms. With his brother and longtime colleague,Jonathan, the company produced astreaming video in 2003—two years before You-Tube came onto the scene.But Lay frets that many credit unions adoptdigital tools without any long-term plan to bringthem to market or maximize their potential.“Here’s a good analogy,” he says. “You go downto the hardware store to purchase a shovel, hammer,nails, wood, and concrete to build a fence.But if there’s no construction plan in place, aperson is left with an unfinished job and frustrationwhile the tools and most of the suppliescollect dust.”Lay believes this could be a golden age forcredit unions if they cease self-limiting practicesand embrace the brave new digital world in waysthey haven’t done before.“My vision and hope,” Lay says, “is that fiveyears from now, credit unions are celebrating a20% market share, and continuing to grow.”36 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013

DAN McGOWANA ‘Come-From-Behind’ Story LineStop if you’ve heard this before: Maninherits motley crew and transformsthem into an elite organization.Sounds like “The Bad News Bears,” “The Dirty Dozen,”or “Major League.” Now, it’s the script of PioneerWest Virginia Federal <strong>Credit</strong> <strong>Union</strong> in Charleston.The once struggling credit union just completedits third acquisition in as many years, and is now thelargest credit union in the southern half of the state.Along the way, it earned national awards and a cleanslate from regulators.The turnaround was a team effort, says DanMcGowan, the credit union’s executive vice president/chief financial officer (CFO). “Think of the emotionsyou feel when watching those ‘come-from-behindto-win’movies,” says McGowan. “That’s us—we werejudged losers but now we’re clearly winners. We arethe little credit union that could, and did, and continuesto do great things.”Three years ago, McGowan found himself in therole of outcast after he was ousted as CFO from aRock Star Dan McGowan (center) credits Pioneer West VirginiaFCU’s success to his “backup band,” PIMA (Pioneer’s IntrinsicallyMotivated Achievers).Florida credit union after losing his bid for CEO. Thatnight he saw a job opening at Pioneer West VirginiaFederal and applied in unorthodox fashion—mentioninghe’d just been let go, so the timing was good.That candor resonated with CEO C. Dana Rawlings,who was in his first year on the job. Rawlings calledMcGowan the followingnight and they hit it offimmediately.“For some reason,he seemed to think wewould make a great team,”McGowan says. “Turnsout he was right.”Among his manyachievements, McGowanengineered a tenfold‘We are the little CUthat could, and did,and continues to dogreat things.’increase in the credit union’s investment portfolioyield, developed a variable-rate certificate in whichmembers’ return can only increase over its four- orfive-year term, and conducted the first financial literacytraining program for the board of directors.“Dan has the ability to see things how they can be,not as they are,” Rawlings says. “He’s relentless in hispursuit of excellence.”OCTOBER 2013CREDIT UNION MAGAZINE ROCK STARS37

PATRICK LIVINGSTONPhotos <strong>by</strong> Paul StyronYoung Execs Build BondsCU Professionals and TheirIf they could be rock stars, BrandonMcAdams and Patrick Livingston seethemselves as long-lived stars that havespanned the ages with their work–MickJagger and Elton John, respectively,though McAdams is quick to add: “notin the leather pants.”McAdams and Livingston are employees withCoastal Federal <strong>Credit</strong> <strong>Union</strong> in Raleigh, N.C., andcreators of CUaware, which brings credit union professionalstogether to learn from each other and bridgethe knowledge gap between experienced veterans andthose who are new to the profession. It provides anopportunity to share ideas and contacts as well as successesand burdens, and take proactive steps to helpthe communities that credit unions serve.Part of helping those communities is to span generationsand to strive to engage Millenials, much asElton John does, according to Livingston, who is alsoCoastal Federal’s director of business transformation.He sees CUaware as a way to help credit unionemployees bridge the awareness gap with membersand prospective members. Unlike generations of thepast, Millenials typically aren’t brought up knowingthe services that financial institutions—particularlycredit unions—provide.It’s not only the typical checking, savings, and otheraccounts that credit unions bring to their communities,it’s the volunteerism in rescue missions, children’sgroups, and other similar community efforts,says Livingston. “A lot of the members don’t understandthe impact that credit unions are making intheir communities.”“If you’re not sacrificing for your community,you’re not doing your job as a credit union executive,”adds McAdams, Coastal Federal’s consumer lendingproduct development manager. “You have to care. Ifyou’re only in it for the paycheck, then you shouldget another job. You’re not going to get the happinessyou want if you’re not willing to sacrifice. Dedicationto the community adds a lot of value to what you do.”CUaware’s website (cuaware.org) offers informationabout local volunteerism and networking opportunitiesfor credit union participants to interact with38 CREDIT UNION MAGAZINE ROCK STARS OCTOBER 2013