to read the full edition - Credit Union Magazine

to read the full edition - Credit Union Magazine

to read the full edition - Credit Union Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

YOUR OWNINSURANCEAISLEIN AS LITTLE AS90 DAYSYOUR AGENCY. YOUR BRAND. OUR EXPERTISE.You al<strong>read</strong>y offer your members an aisle for checking, savings,loans and investments. Now you can open an insurance aislein a way that’s working for credit unions nationwide, with a<strong>full</strong> service insurance agency under your brand.Call 860.653.1134 for a free strategic assessment,or go online at rethinkinsurance.com <strong>to</strong>day.rethinkinsurance.com

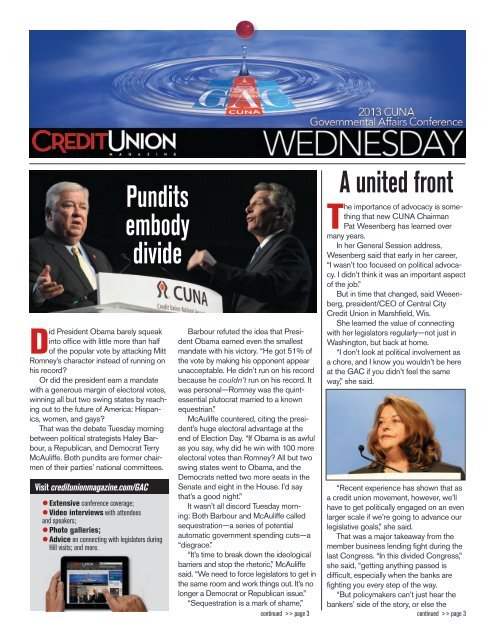

Barbour/McAuliffe >> continued from page 1Barbour added, blaming <strong>the</strong> Democrat-ledSenate for not passing a budget in threeyears. “Twice last year, <strong>the</strong> RepublicanHouse passed measures <strong>to</strong> end sequestration.This is a fundamental differencebetween Democrats and Republicans.” Innovate andstay aheadConnect with <strong>the</strong> exclusiveindustry articles andthought-provoking insightyou rely on most.Subscribe for <strong>full</strong> access!Stay on <strong>to</strong>p of news and trends thatimpact your credit union and <strong>the</strong>entire movement.creditunionmagazine.comWesenberg >> continued from page 1bankers will end up defining us. We’vegot <strong>to</strong> unite, work <strong>to</strong>ge<strong>the</strong>r, and tell ourown s<strong>to</strong>ry,” she said. “When we do, weget results.”The opportunities for credit unionshave never been greater, Wesenberg said.And politically, <strong>the</strong> stronger and moreunited our front is, <strong>the</strong> more likely <strong>the</strong>banks will be <strong>to</strong> find common ground onlegislation ra<strong>the</strong>r than work against us,she added. Boehnercalls forcommongroundAmerica is on <strong>the</strong> verge of a renaissance,Speaker of <strong>the</strong> House JohnBoehner <strong>to</strong>ld credit unions duringyesterday’s special General Session.“We’re moving quickly <strong>to</strong>ward energyindependence,” he said. “The innovationand technology in <strong>the</strong> past severaldecades have allowed American oil andgas producers <strong>to</strong> go in<strong>to</strong> old oil fieldsand find gas still locked in <strong>the</strong> ground.”This will give American manufacturersa competitive edge internationally, hesaid. But first three things must happen:1. Fix our tax code. “I hope we’re on<strong>the</strong> verge of moving a tax reform bill thatwill lower rates for all and clean out someof <strong>the</strong> loopholes.”2. Do something about <strong>the</strong> $16 trilliondebt. Americans have <strong>to</strong> grapple withthis issue. With millions of baby boomersretiring each year and <strong>the</strong> current stateof entitlement programs, <strong>the</strong> “whipsaw”effect on our budget is tremendous.3. Ensure more American childrenreceive a decent education.These efforts will ensure economicgrowth for generations and allow <strong>the</strong>energy renaissance <strong>to</strong> continue.“A lot of people believe <strong>the</strong> Americandream is in peril. But it doesn’t have <strong>to</strong>be that way,” Boehner said. “Leadersin this <strong>to</strong>wn can put <strong>the</strong>ir politicaldifferences aside and find commonground <strong>to</strong> address <strong>the</strong> needs of ourcountry.“It’s going <strong>to</strong> take all of us.” “Pat, I now turn over <strong>the</strong> gavel <strong>to</strong> you, and <strong>the</strong> honor,<strong>the</strong> responsibility, and <strong>the</strong> obligations of serving aschairman of <strong>the</strong> <strong>Credit</strong> <strong>Union</strong> National Association,” outgoingCUNA Chairman Mike Mercer said <strong>to</strong> Wesenbergas she now begins her term.Summarizing <strong>the</strong> four turbulent years that have passed since he addressed <strong>the</strong> GAC at <strong>the</strong> height of <strong>the</strong> recession,Michael Fryzel, NCUA Board member and former chairman, <strong>to</strong>ld attendees that <strong>the</strong> CU system not only survived buthas become <strong>the</strong> nation’s premier financial services industry. He credits <strong>the</strong> fortitude of its leaders and a shared vision.“We have wea<strong>the</strong>red a great s<strong>to</strong>rm. We are stronger for it. And <strong>the</strong> future is bright,” he said. To <strong>read</strong> Fryzel’s entirespeech, visit http://ow.ly/i4utE.WEDNESDAY DAILY NEWS | 3

LEGISLATORSRep. Denny Heck, D-Wash.Rep. Spencer Bachus, R-Ala.“All I ever really needed <strong>to</strong> know I learned while workingat <strong>the</strong> teller window at Columbia <strong>Credit</strong> <strong>Union</strong>,” saidHeck, who once served as marketing direc<strong>to</strong>r at <strong>the</strong> Vancouver,Wash.-based credit union. “Every day I wanted<strong>to</strong> get up and go <strong>to</strong> work and help people live <strong>the</strong> Americandream. That’s what credit unions are all about.“I know credit unions weren’t <strong>to</strong> blame for <strong>the</strong> shenanigansthat drove our economy south. And you can coun<strong>to</strong>n me <strong>to</strong> make that clear <strong>to</strong> all <strong>the</strong> rest of <strong>the</strong> membersof <strong>the</strong> House Financial Services Committee.” Rep. Jeb Hensarling, R-Texas“First, I’ll start with some good news,” said Bachus, chairmanemeritus of <strong>the</strong> House Financial Services Committee.“We’ve made great progress in <strong>the</strong> past year-and-a-halfon spending cuts.“The March 1 ‘sequestration’ [or au<strong>to</strong>matic spending cut]deadline is looming, however. No one thought we’d be here.But Congress and <strong>the</strong> White House usually act in crisis.“I believe we’ll see more bipartisan efforts, and wemight revisit <strong>the</strong> Dodd-Frank Act, taking apart whatdoesn’t apply <strong>to</strong> credit unions.” “We’re not suffering from a lack of capital, but a lack ofconfidence,” said Hensarling. “In my role as chairman of<strong>the</strong> House Financial Services Committee, my job is <strong>to</strong>promote economic growth. To do that, we need <strong>to</strong> reduce<strong>the</strong> weight of <strong>the</strong> red-tape burden on community financialinstitutions.“The Dodd-Frank Act created 400 new regulationsthat fit in<strong>to</strong> two categories: those that create uncertaintyand those that create harm. And I won’t rest until I see<strong>the</strong> repeal of <strong>the</strong> Durbin Amendment.” 4 | CREDITUNIONMAGAZINE.COM/GAC

Rep. Steny Hoyer, D-Md.Rep. Kevin McCarthy, R-Calif.“We meet <strong>to</strong>day on <strong>the</strong> threshhold of what could be adangerous period for our economy and our markets as<strong>the</strong> result of irrational and arbitrary budget cuts, known as<strong>the</strong> ‘sequester,’” said Hoyer.“We need you <strong>to</strong> add your voices <strong>to</strong> <strong>the</strong> chorus ofAmerican businesses and families who are urgingCongress <strong>to</strong> act.“I hope you will deliver that message loudly and clearly<strong>to</strong> members of <strong>the</strong> House and Senate this week when yousee us.” Rep. Blaine Luetkemeyer, R-Mo.McCarthy didn’t take <strong>the</strong> traditional path <strong>to</strong> become alegisla<strong>to</strong>r. The only Republican from a family of Democrats,McCarthy refurbished and sold cars <strong>to</strong> pay forjunior college, eventually quitting school—after winning$5,000 in <strong>the</strong> California lottery—<strong>to</strong> open a deli with helpfrom a credit union business loan. He applied for—butdidn’t get—an internship with a California congressman.“Now I have his seat,” said McCarthy, House majoritywhip. He believes both parties must work <strong>to</strong>ge<strong>the</strong>r <strong>to</strong>solve <strong>the</strong> nation’s financial problems. Rep. Gregory Meeks, D-N.Y.“Passing bills takes a lot of work, even on <strong>the</strong> simplestissues,” said Luetkemeyer, who serves on <strong>the</strong> HouseFinancial Services Committee.“But we live in a partisan environment in D.C. That’swhy we need <strong>to</strong> work on pushing through smallerissues first. We have <strong>to</strong> find common ground here.“I know you feel you’ve been inundated with rulesand regulations. We still have opportunities <strong>to</strong> makea difference in your lives and your members’ lives. It’swhy we’re here.” “As a ranking member of <strong>the</strong> House Financial InstitutionsSubcommittee, I will fight <strong>to</strong> ensure that credit unionsremain a corners<strong>to</strong>ne of Main Street America,” Meekssaid in his first GAC appearance.“One way <strong>to</strong> do this is <strong>to</strong> boost member businesslending, which I have once again co-sponsored in abipartisan way with [Rep.] Ed Royce in this Congress.“It is time <strong>to</strong> remove <strong>the</strong> handcuffs and allow you<strong>to</strong> continue <strong>to</strong> serve as <strong>the</strong> backbone of your localcommunities.” WEDNESDAY DAILY NEWS | 5

LEGISLATORSRep. Debbie Wasserman Schultz, D-Fla.Rep. Ed Royce, R-Calif.“<strong>Credit</strong> unions have been doing a tremendous jobof lending <strong>to</strong> small businesses and creating newjobs nationally and in my home state of Florida,” saidWasserman Schultz. “Nationally, you created 157,000new jobs in January alone and 7,000 in Florida.“The 120 regula<strong>to</strong>ry changes that <strong>to</strong>ok placebetween 2008 and 2012 have created unsustainablecomplexity. But we can change that through grassrootsactivities, and credit unions know how <strong>to</strong> mobilizeat <strong>the</strong> grassroots level better than anyone.” “We want <strong>to</strong> redefine [<strong>the</strong> member business lending]bill a little bit <strong>to</strong> get that critical momentum, that criticalmass, that we need <strong>to</strong> get this signed in<strong>to</strong> law,”said Royce. “We need <strong>to</strong> get it in<strong>to</strong> an issue where itis simply about small business and creating access <strong>to</strong>capital.“Now is not <strong>the</strong> time <strong>to</strong> maintain artificial caps onsafe and sound lending. Businesses are asking for it.The economy and <strong>the</strong> job market are in dire need of it.You have <strong>the</strong> expertise <strong>to</strong> provide it and so we havegot <strong>to</strong> get this done.” Create a connection in CongressConducting business with a personal<strong>to</strong>uch is an ethos that has servedcredit unions well. Taking <strong>the</strong> sameapproach during GAC Hill visits canmake a big impact on legisla<strong>to</strong>rs. Hereare seven strategies <strong>to</strong> help make <strong>the</strong>m asuccess:Be prepared.1 Focus on no more than two issues.Do your homework on all sides of <strong>the</strong>argument, as well as <strong>the</strong> legisla<strong>to</strong>r’srecord. Bring concise, engaging handouts.Strategize as a group.2 Decide a plan of attack and <strong>the</strong>desired outcomes. Appoint a manager<strong>to</strong> keep your meeting on <strong>to</strong>pic, and asecretary <strong>to</strong> take notes.Arrive cool, calm, and in control.3 Show up early <strong>to</strong> acclimate <strong>to</strong> <strong>the</strong>surroundings. Introduce yourself <strong>to</strong> yourrepresentative and aides wi<strong>the</strong>nthusiasm, intent on forming a personalconnection.Put on your game face.4 Be professional and objective. Do notrant and rave. Let <strong>the</strong> facts speakfor <strong>the</strong>mselves.Make specific requests.5 Form your “money” question in yesor-nofashion <strong>to</strong> elicit a clear response.Clarify <strong>the</strong> next steps, and set a timetablefor action.Be greedy.6 Ask a supportive legisla<strong>to</strong>r <strong>to</strong> rallyo<strong>the</strong>r members within a committee orstate delegation—and <strong>to</strong> write an op-edfor a newspaper.Keep <strong>the</strong> ball rolling.7 Publicize your visit on social mediaand in your publications. Send a thankyounote. Keep tabs on <strong>the</strong> issue and followthrough on your pledge <strong>to</strong> follow up. Send us yourHill visit pho<strong>to</strong>s!Help us promote your visits <strong>to</strong>Capi<strong>to</strong>l Hill using <strong>the</strong> #CUNAGAChashtag on <strong>the</strong> images you post<strong>to</strong> Twitter or by emailing <strong>the</strong>m <strong>to</strong>CUmagadmin@cuna.com.#CUNAGACCUmagadmin@cuna.comPho<strong>to</strong>disc/Thinks<strong>to</strong>ck6 | CREDITUNIONMAGAZINE.COM/GAC

Slow growth, but uncertainty still prevailsEconomists expect continued slowimprovement in U.S. economic performanceand credit union operationsin 2013.In a Tuesday breakout session, CUNAeconomists Mike Schenk and Steve Rick,joined by NCUA Chief Economist JohnWorth, scrutinized that forecast and examinedcurrent economic trends.The biggest drag on <strong>the</strong> U.S. economyis likely <strong>to</strong> be <strong>the</strong> combination of uncertaintysurrounding government financeand <strong>the</strong> threat of austerity.Despite <strong>the</strong>se risks, CUNA economistsexpect economic growth <strong>to</strong> rise modestly<strong>to</strong> 2.5%. Consumer prices should holdsteady, with increases in <strong>the</strong> consumerprice index remaining below <strong>the</strong> Fed’snewly articulated inflation threshold of2.5%.The unemployment rate should finish<strong>the</strong> year not much lower than 7.5%, wellabove <strong>the</strong> Fed’s 6.5% target. Discouragedworkers re-entering <strong>the</strong> market will keep<strong>the</strong> rate high.Short-term market interest rates willstay near zero all year,and longer-term interestrates will rise, but onlyslowly.The recent fiscal cliffagreement will have anet positive effect. Thepermanent extensionof tax cuts for 99% ofAmericans will reducetax uncertainty, boosthousehold and businessconfidence, and spuradditional consumptionand investment spending.The increase in <strong>the</strong> payroll tax rate <strong>to</strong>6.2% from 4.2% will tend <strong>to</strong> counteract<strong>the</strong>se positive effects, but <strong>the</strong> increaseand subsequent drop in disposableincome likely will lead <strong>to</strong> a lower savingsrate ra<strong>the</strong>r than a decline in spending,CUNA economists say.“We expect slightly faster loan growthin 2013, with increases in <strong>the</strong> 4.5% <strong>to</strong>5.5% range,” said Schenk. “Savingsgrowth rates will recede modestly <strong>to</strong>wardMike Schenk Steve Rick John Worth<strong>the</strong> rates anticipated in loan balances,causing loan-<strong>to</strong>-savings ratios <strong>to</strong> firm up.”<strong>Credit</strong> union asset quality will continue<strong>to</strong> improve. Loan loss provisions willremain low, helping <strong>to</strong> boost earnings.Declines in gains on sales may offset thisas mortgage refinancing activity wanes.Corporate stabilization expenses will beessentially unchanged. On balance, thissuggests credit union net income will beabout 80 basis points of assets. CU IN THE FUTUREIt’s rising brighter than ever.We’ll CU along <strong>the</strong> way.5877.570.2824cu24.comWEDNESDAY DAILY NEWS | 7

CU House: Yourpermanent presenceon <strong>the</strong> HillMember-ownership is a unique trai<strong>to</strong>f your credit union and of your<strong>Credit</strong> <strong>Union</strong> House. Owned byevery state credit union league and <strong>the</strong>American Association of <strong>Credit</strong> <strong>Union</strong>Leagues, <strong>Credit</strong> <strong>Union</strong> House givescredit unions a permanent presence andincreased visibility on Capi<strong>to</strong>l Hill.Last year, more than 2,600 visi<strong>to</strong>rsarrived at <strong>Credit</strong> <strong>Union</strong> House. TheyThe 2013 Hall of Leaders inducteesThe <strong>Credit</strong> <strong>Union</strong> House congratulates<strong>the</strong> 2013 Hall of Leaders inductees.Their dedication has made a significantimpact on <strong>the</strong> credit union movement at<strong>the</strong> local, state, and national levels:* John Annaloro (Wash.)* Frank Berrish (N.Y.)* Marshall Boutwell (Ga.)* Ken Bradshaw (Neb.)* Susan J. Brayman (Colo.)* Loretta Burd (Ind.)* Mary Ann Clancy (Mass.)* Gary R. Clark (Mont.)* Ron Collier (Ind.)* Michael Connery (N.Y.)* Donald Edwards (Ill.)* Clarence Hall (Miss.)* Gail Krall (Minn.)* James “Jimmy” G. Lankford (Ala.)* Robin Lentz (Calif.)* John McKenzie (Ind.)* Robert D. Ramirez (Ariz.)* Randy Smith (Texas)* Marsha S. Tynsky (Wyo.)* Bill Winter (Minn.)* Al Vukasin (Mont.)* Michael A. Williams (Colo.)The Hall of Leaders provides recognitionat <strong>the</strong> Capi<strong>to</strong>l Hill facility for adistinguished group of individuals whoseleadership serves as a model for creditunion leaders throughout <strong>the</strong> U.S.Their names remind all <strong>Credit</strong> <strong>Union</strong>House visi<strong>to</strong>rs—including prominentmembers of Congress—of <strong>the</strong> individualsdedicated <strong>to</strong> <strong>the</strong> founding mission,values, and philosophy of <strong>the</strong> creditunion movement.included political figures, business leaders,government officials, and credit unionpeople from across <strong>the</strong> U.S. <strong>Credit</strong> <strong>Union</strong>House-hosted events raise <strong>the</strong> nationalpresence of <strong>the</strong> credit union movement,emphasizing credit unions’ mission andcreating partnership opportunities forleagues, credit unions, and CUNA withour nation’s leaders.This year, <strong>Credit</strong> <strong>Union</strong> House will onceagain recognize a distinguished group ofindividuals who demonstrate outstandingleadership, a strong commitment <strong>to</strong> creditunion values, and a vision for continuedsuccess. The <strong>Credit</strong> <strong>Union</strong> House Hall ofLeaders has grown <strong>to</strong> honor 70 leadersfrom 30 states, and <strong>the</strong> newest inducteeswill be honored during <strong>the</strong> GAC (“The2013 Hall of Leaders Inductees”).Visit <strong>Credit</strong> <strong>Union</strong> House during itsannual Open House on Thursday, Feb.28 from 9 a.m.-5 p.m. S<strong>to</strong>p by <strong>to</strong> rest inbetween Hill meetings, take a <strong>to</strong>ur, andhonor <strong>the</strong> newest inductees <strong>to</strong> <strong>the</strong> Hall ofLeaders.<strong>Credit</strong> <strong>Union</strong> House is located at 403C St., NE, just a few blocks from <strong>the</strong> U.S.Capi<strong>to</strong>l building. 8 | CREDITUNIONMAGAZINE.COM/GAC

Scenes from <strong>the</strong> 2013 GAC1 2345 6At left: MWCUA President/CEO Scott Earl and1his wife, Bonnie; CUNA COO John Franklin andhis wife, Hazel; and Pat Sowick, CUNA SVP league andstate affairs and her husband, Chris, at World Council ofCUs’ Worldwide Foundation for CUs Supporters Receptionon Sunday.CUNA President/CEO Bill Cheney honors2league representatives for Children’s MiracleNetwork hospital projects, creating playgrounds in NationalConvention host cities. From left: Cheney; SteveFowler, president, South Carolina CU League; JohnRadebaugh, president, North Carolina CU League; andPatrick La Pine, president, League of Sou<strong>the</strong>astern CUs.The Concert: A Tribute <strong>to</strong> ABBA rocked <strong>the</strong>3 house as original and new band membersperformed several <strong>to</strong>p hits in true ABBA-esque fashion:“Dancing Queen,” “S.O.S.,” and “Take a Chance on Me.”CUNA Councils presented <strong>the</strong> event.Thousands of attendees <strong>to</strong>ured <strong>the</strong> largest4exhibit hall in <strong>the</strong> financial services industryat this year’s GAC. Attendees had <strong>the</strong>ir choice of morethan 300 booths and more than 200 companies.“In my 10 years of serving as your GAC emcee,5this is <strong>the</strong> best lineup of speakers I’ve everseen,” said Paul Berry as he welcomed GAC attendeesMonday morning.John Mason, board vice chairman, Ambridge6Area FCU, and his wife, Ellen, team up with aCanadian Mountie in anticipation of <strong>the</strong> World Council’s2013 World CU Conference in Ottawa, July 14-17.WEDNESDAY DAILY NEWS | 9

Vice president of publishing: Doug BenzineVice president of publishing operations: Dorothy SteffensEdi<strong>to</strong>r-in-chief: Steve RodgersManaging edi<strong>to</strong>r: Sue LanphearSenior edi<strong>to</strong>rs: Bill Merrick, Adam Mertz, Ann Peterson, Craig SauerContributing edi<strong>to</strong>r: Jeremiah CahillDesign & production: Cheryl Gokey, Joey SabaniVice president of vendor sales: Joe DayAd representatives:Chris Kennedy—East/Central: 847-656-0322, ext. 3008Cathy Woods—West/Southwest/Sou<strong>the</strong>ast: 602-863-2212Printing: Staples Digital Copy Services, Columbia, Md.Cheney receives NLCUP awardCUNA President/CEO Bill Cheneyreceived <strong>the</strong> Leadership & VisionAward Tuesday from <strong>the</strong> Networkfor Latino <strong>Credit</strong> <strong>Union</strong> Professionals(NLCUP).Hispanics are essential <strong>to</strong> <strong>the</strong> futuregrowth of <strong>the</strong> nation’s credit unions, saidCheney, who spoke at NLCUP’s annualnetworking reception. He noted that <strong>the</strong>importance of ethnic diversity has beenapparent during his entire career in <strong>the</strong>credit union movement, beginning in hishome<strong>to</strong>wn of San An<strong>to</strong>nio and continuingduring his days as a credit union CEO and<strong>the</strong>n CEO of <strong>the</strong> California and Nevada<strong>Credit</strong> <strong>Union</strong> Leagues.“Last fall’s presidential election was aclear indication of how strong a presenceHispanics now have,” said Cheney. “Andyou can see <strong>the</strong> future by simply lookingat <strong>the</strong> diversity of school children acrossAmerica.”Joining Cheney as an award recipientwas Iowa League COO Murray Williamswho received NLCUP’s Leadership & SupportAward. SUBSCRIBE TODAYTwo easy ways <strong>to</strong> order your subscription <strong>to</strong><strong>Credit</strong> <strong>Union</strong> <strong>Magazine</strong>:Call: 800-348-3646Visit: creditunionmagazine.comCheney accepts <strong>the</strong> Leadership & Vision Award from members of <strong>the</strong> NLCUP board.See you in New York City for <strong>the</strong> 2013 ACUCDon’t miss <strong>the</strong> most energizing,forward-thinking conference in <strong>the</strong>credit union movement.America’s <strong>Credit</strong> <strong>Union</strong> Conference(ACUC) takes place June 30-July 3 in NewYork City.Featuring a high-impact lineup of keynotespeakers, thought-leader sessions,and networking opportunities, you’ll returnhome with a new-found enthusiasm andvision for your credit union’s future.Keynote speakers include: Lt. Col. Robert Darling (Ret.). During<strong>the</strong> attack of Sept. 11, 2001, Darling supported<strong>the</strong> president, vice president, andnational security adviser in <strong>the</strong> undergroundPresident’s Emergency Operations Center(PEOC) and witnessed unprecedentedevents and decision making. Malcolm Gladwell. Gladwell is a staffwriter at The New Yorker and author offour New York Times bestsellers, including“Blink: The Power ofThinking Without Thinking”and “Outliers: TheS<strong>to</strong>ry of Success.” Hiswriting often deals withapplications of researchand new ideas in <strong>the</strong>social sciences, makingfrequent use of academicwork in <strong>the</strong> areas of sociology,psychology, andsocial psychology. Lyn Heward. Hewardis <strong>the</strong> current direc<strong>to</strong>r ofcreation for Montreal’sCirque du Soleil and <strong>the</strong>former president and chief operating officerof <strong>the</strong> creative content division. She’s <strong>the</strong>author of <strong>the</strong> critically acclaimed book, “TheSpark: Igniting <strong>the</strong> Creative Fire that LivesWithin Us All.” Her renowned keynote of<strong>the</strong> same title takes <strong>the</strong> audience behind<strong>the</strong> scenes of Cirque du Soleil <strong>to</strong> explore<strong>the</strong> nature and origins of creativity.CUNA and CUNA Mutual Group willteam up <strong>to</strong> bring Discovery Sessions <strong>to</strong> thisyear’s conference. These sessions providecredit union leaders practical information <strong>to</strong>solve problems, capture opportunities, andaddress current market challenges.The Hil<strong>to</strong>n New York hosts ACUC, juststeps away from <strong>the</strong> city’s premier attractions.Conveniently situated in Mid<strong>to</strong>wnManhattan, you’ll enjoy one of New York’smost sophisticated hotels.You’ll be within walking distance ofTimes Square, Radio City Music Hall, FifthAvenue shopping, <strong>the</strong> Broadway Theatredistrict, Central Park, The Museum of ModernArt, and many more iconic New Yorklandmarks.For more information and <strong>to</strong> register,visit acuc.cuna.org. 10 | CREDITUNIONMAGAZINE.COM/GAC

What’s <strong>the</strong> best part of <strong>the</strong> GAC?Michael ToblerPresident/league direc<strong>to</strong>r, Albany Firemen’s FCUAlbany, N.Y.I think <strong>the</strong> best part is just bringing everybody<strong>to</strong>ge<strong>the</strong>r and getting <strong>the</strong> point of view ofwhat’s happening, not only with credit unionsyour size, but also what’s going on nationally.CUNA always brings in <strong>to</strong>p speakers—<strong>the</strong>y’reon <strong>the</strong> forefront of everything that’s going on,and it’s nice <strong>to</strong> get <strong>the</strong> feedback on what’scurrent. The biggest thing is you walk awayfeeling that <strong>the</strong>re’s a lot you can change.Joe QuihuisDirec<strong>to</strong>r of finance, Bashas Associates FCUTempe, Ariz.I’m really looking forward <strong>to</strong> <strong>the</strong> speakers—especially Tom Brokaw and Bill Cheney. I’dalso like <strong>to</strong> get regulation insight; that’s reallyhot right now. I always get something out of<strong>the</strong>se conferences from networking—gettingsome fresh ideas <strong>to</strong> energize our staff onselling products <strong>to</strong> members. I’m also reallylooking forward <strong>to</strong> <strong>the</strong> Capi<strong>to</strong>l visit becauseI’m a first timer <strong>to</strong> D.C.Marsha CoarseyDirec<strong>to</strong>r, Community First CUJacksonville, Fla.I really enjoy hearing <strong>the</strong> politicians give <strong>the</strong>irviewpoints on what’s happening in Washing<strong>to</strong>n—howit will affect <strong>the</strong> economy andspecifically how it will affect credit unionsacross <strong>the</strong> nation. I’ve enjoyed hearing DebbieWasserman Schultz; she’s very energeticand interesting. And I always enjoy going <strong>to</strong>CUNA’s breakout session on <strong>the</strong> economy—Bill Hampel and that group.WEDNESDAY DAILY NEWS | 11