(IFRS) for Small and Medium-sized Entities (SMEs)

(IFRS) for Small and Medium-sized Entities (SMEs)

(IFRS) for Small and Medium-sized Entities (SMEs)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

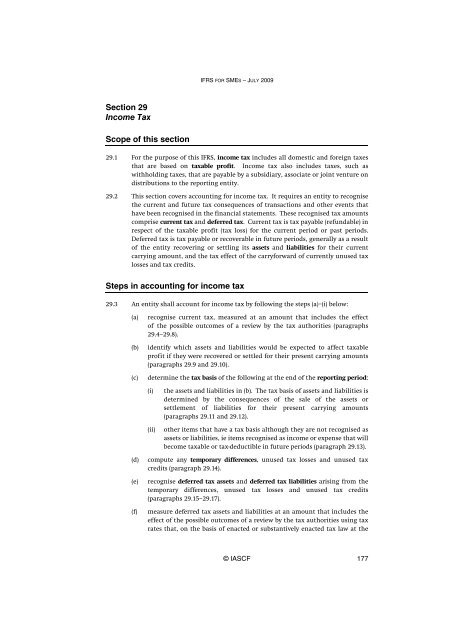

<strong>IFRS</strong> FOR SMES – JULY 2009Section 29Income TaxScope of this section29.1 For the purpose of this <strong>IFRS</strong>, income tax includes all domestic <strong>and</strong> <strong>for</strong>eign taxesthat are based on taxable profit. Income tax also includes taxes, such aswithholding taxes, that are payable by a subsidiary, associate or joint venture ondistributions to the reporting entity.29.2 This section covers accounting <strong>for</strong> income tax. It requires an entity to recognisethe current <strong>and</strong> future tax consequences of transactions <strong>and</strong> other events thathave been recognised in the financial statements. These recognised tax amountscomprise current tax <strong>and</strong> deferred tax. Current tax is tax payable (refundable) inrespect of the taxable profit (tax loss) <strong>for</strong> the current period or past periods.Deferred tax is tax payable or recoverable in future periods, generally as a resultof the entity recovering or settling its assets <strong>and</strong> liabilities <strong>for</strong> their currentcarrying amount, <strong>and</strong> the tax effect of the carry<strong>for</strong>ward of currently unused taxlosses <strong>and</strong> tax credits.Steps in accounting <strong>for</strong> income tax29.3 An entity shall account <strong>for</strong> income tax by following the steps (a)–(i) below:(a)(b)(c)recognise current tax, measured at an amount that includes the effectof the possible outcomes of a review by the tax authorities (paragraphs29.4–29.8).identify which assets <strong>and</strong> liabilities would be expected to affect taxableprofit if they were recovered or settled <strong>for</strong> their present carrying amounts(paragraphs 29.9 <strong>and</strong> 29.10).determine the tax basis of the following at the end of the reporting period:(i)(ii)the assets <strong>and</strong> liabilities in (b). The tax basis of assets <strong>and</strong> liabilities isdetermined by the consequences of the sale of the assets orsettlement of liabilities <strong>for</strong> their present carrying amounts(paragraphs 29.11 <strong>and</strong> 29.12).other items that have a tax basis although they are not recognised asassets or liabilities, ie items recognised as income or expense that willbecome taxable or tax-deductible in future periods (paragraph 29.13).(d)(e)(f)compute any temporary differences, unused tax losses <strong>and</strong> unused taxcredits (paragraph 29.14).recognise deferred tax assets <strong>and</strong> deferred tax liabilities arising from thetemporary differences, unused tax losses <strong>and</strong> unused tax credits(paragraphs 29.15–29.17).measure deferred tax assets <strong>and</strong> liabilities at an amount that includes theeffect of the possible outcomes of a review by the tax authorities using taxrates that, on the basis of enacted or substantively enacted tax law at the© IASCF 177