(IFRS) for Small and Medium-sized Entities (SMEs)

(IFRS) for Small and Medium-sized Entities (SMEs)

(IFRS) for Small and Medium-sized Entities (SMEs)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

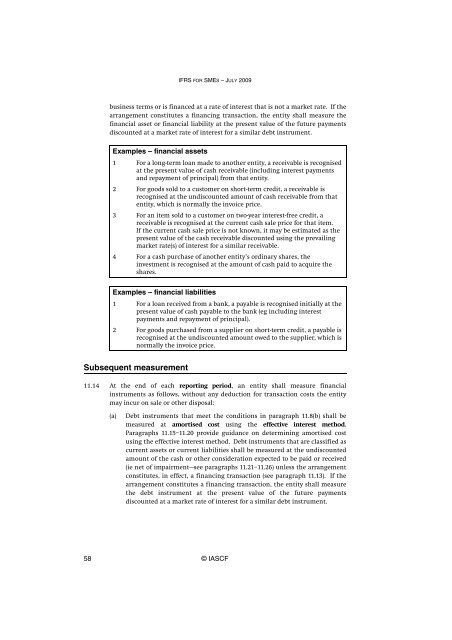

<strong>IFRS</strong> FOR SMES – JULY 2009business terms or is financed at a rate of interest that is not a market rate. If thearrangement constitutes a financing transaction, the entity shall measure thefinancial asset or financial liability at the present value of the future paymentsdiscounted at a market rate of interest <strong>for</strong> a similar debt instrument.Examples – financial assets1 For a long-term loan made to another entity, a receivable is recognisedat the present value of cash receivable (including interest payments<strong>and</strong> repayment of principal) from that entity.2 For goods sold to a customer on short-term credit, a receivable isrecognised at the undiscounted amount of cash receivable from thatentity, which is normally the invoice price.3 For an item sold to a customer on two-year interest-free credit, areceivable is recognised at the current cash sale price <strong>for</strong> that item.If the current cash sale price is not known, it may be estimated as thepresent value of the cash receivable discounted using the prevailingmarket rate(s) of interest <strong>for</strong> a similar receivable.4 For a cash purchase of another entity’s ordinary shares, theinvestment is recognised at the amount of cash paid to acquire theshares.Examples – financial liabilities1 For a loan received from a bank, a payable is recognised initially at thepresent value of cash payable to the bank (eg including interestpayments <strong>and</strong> repayment of principal).2 For goods purchased from a supplier on short-term credit, a payable isrecognised at the undiscounted amount owed to the supplier, which isnormally the invoice price.Subsequent measurement11.14 At the end of each reporting period, an entity shall measure financialinstruments as follows, without any deduction <strong>for</strong> transaction costs the entitymay incur on sale or other disposal:(a)Debt instruments that meet the conditions in paragraph 11.8(b) shall bemeasured at amortised cost using the effective interest method.Paragraphs 11.15–11.20 provide guidance on determining amortised costusing the effective interest method. Debt instruments that are classified ascurrent assets or current liabilities shall be measured at the undiscountedamount of the cash or other consideration expected to be paid or received(ie net of impairment—see paragraphs 11.21–11.26) unless the arrangementconstitutes, in effect, a financing transaction (see paragraph 11.13). If thearrangement constitutes a financing transaction, the entity shall measurethe debt instrument at the present value of the future paymentsdiscounted at a market rate of interest <strong>for</strong> a similar debt instrument.58 © IASCF