Compare and contrast the Australian and US sheep industries ...

Compare and contrast the Australian and US sheep industries ...

Compare and contrast the Australian and US sheep industries ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Compare</strong> <strong>and</strong> <strong>contrast</strong> <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>US</strong> <strong>sheep</strong> <strong>industries</strong>,providing opportunities for market growth for <strong>the</strong> <strong>Australian</strong>industry?Isaac Allen, Charles Sturt University Wagga WaggaIntroductionSheepmeat is a staple source of protein around <strong>the</strong> world, with <strong>sheep</strong>meat accounting for4.6% of <strong>the</strong> worlds meat consumption (Barnard, 2006). The <strong>Australian</strong> <strong>and</strong> United States ofAmerica’s <strong>sheep</strong>meat <strong>industries</strong> are different in terms of size, breed dominance, productionsystems, processing methods <strong>and</strong> target markets. Australia is one of <strong>the</strong> worlds leadingproducers of both lamb <strong>and</strong> mutton, <strong>the</strong> largest exporter of mutton <strong>and</strong> live <strong>sheep</strong> <strong>and</strong> <strong>the</strong>second largest exporter of lamb (MLA/ABS/ABARE, 2012). In comparison, <strong>the</strong> United Statesis a net importer of <strong>sheep</strong>meat, in particular a major consumer of <strong>Australian</strong> <strong>sheep</strong>meat.Interestingly, more than 40% of <strong>the</strong> lamb <strong>and</strong> mutton consumed in <strong>the</strong> United States ofAmerica is imported, supplied by ei<strong>the</strong>r Australia or New Zeal<strong>and</strong> (Geisler, 2011).This paper explores <strong>the</strong> differences between <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>the</strong> United States ofAmerica’s <strong>sheep</strong>meat industry, describes <strong>the</strong> current situation in both <strong>industries</strong> <strong>and</strong>discusses possible future opportunities for <strong>Australian</strong> <strong>sheep</strong>meat into <strong>the</strong> United States ofAmerica.Historical Comparison of <strong>the</strong> two IndustriesHave you ever heard of <strong>the</strong> phase ‘Australia, riding on <strong>the</strong> <strong>sheep</strong>’s back’? For most of acentury <strong>the</strong> <strong>Australian</strong> Sheep Industry gave <strong>the</strong> nation one of <strong>the</strong> highest living st<strong>and</strong>ardsinternationally. From <strong>the</strong> humble beginnings of Sir John Macarthur <strong>and</strong> Reverend SamuelMarsden <strong>and</strong> <strong>the</strong> importation of Spanish Merinos in 1797, <strong>the</strong> industry has experiencedtriumphs <strong>and</strong> accolades as well as hardships.From a national flock of 2 million head in 1830 to a record high set in 1970 with 180 millionhead of <strong>sheep</strong>, <strong>the</strong> <strong>sheep</strong> largely shaped Australia’s future. The success of early Australiacan be largely attributed to <strong>the</strong> wool industry, however due to a combination of factorsincluding <strong>the</strong> demise of <strong>the</strong> wool industry due to <strong>the</strong> Reserve Price Scheme <strong>and</strong> <strong>the</strong>availability of syn<strong>the</strong>tic fibres. Currently <strong>the</strong> <strong>Australian</strong> <strong>sheep</strong> industry has diversified intodual purpose <strong>sheep</strong> breeds <strong>and</strong> as such, <strong>Australian</strong> <strong>sheep</strong>meat exports nowadays contributesignificantly to our national economy with lambs <strong>and</strong> <strong>sheep</strong> contributing to 6% of <strong>the</strong> totalfarm value of $48.7 billion in 2011-12 (Live Export Care, 2009; MLA, 2012).In Australia, <strong>the</strong> main <strong>sheep</strong> breeds include <strong>the</strong> Merino, Dorset, Suffolk, Border Leicester<strong>and</strong> Romney. As dual-purpose breeds continue to increase in popularity so to does <strong>the</strong>development of new breeds such as <strong>the</strong> South African Meat Merino (SAMM) <strong>and</strong> <strong>the</strong>Dohnes. These breeds are continuing to play an important role in shaping <strong>the</strong> futuredirection of <strong>the</strong> <strong>sheep</strong> industry within Australia <strong>and</strong> offer producers versatility aroundcommodity marketing.More specifically, <strong>the</strong> <strong>Australian</strong> prime lamb market is shaped upon an animal that isextremely productive, high yielding whilst having quality carcase attributes. This ‘lamb’ isobtained using a unique breeding system whereby Merino ewes are joined to maternal siresgenerally from a British breed decent, predominately Border Leicester to produce a Border<strong>Compare</strong> <strong>and</strong> <strong>contrast</strong> <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>US</strong> <strong>sheep</strong> <strong>industries</strong>, providing opportunities for market growth for <strong>the</strong><strong>Australian</strong> industry? Isaac Allen, Charles Sturt University Wagga Wagga1

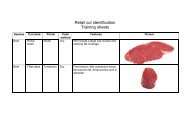

Leicester/Merino or first cross ewe. These ewes are <strong>the</strong>n joined to terminal meat sire breedssuch as <strong>the</strong> Poll Dorset or White Suffolk, to yield a second cross lamb. This second crossprogeny is <strong>the</strong> iconic ‘<strong>Australian</strong> prime lamb’.The United States is home to more than 47 breeds of <strong>sheep</strong>, with several having originatedin <strong>the</strong> country. These breeds can be categorised under six types; meat breeds, fine woolbreeds, long wool breeds, dual purpose breeds, hair <strong>and</strong> double coat breeds <strong>and</strong> minorbreeds. American <strong>sheep</strong> breeds have a diverse range of performance attributes rangingfrom growth, carcass attributes reproduction, <strong>and</strong> milk <strong>and</strong> wool characteristics. The main<strong>sheep</strong>meat breeds in America include: <strong>the</strong> Cheviot, Dorset, Hampshire, Southdown, Suffolk<strong>and</strong> Texel (ASI, 2013).The Current SituationPer capita, <strong>the</strong> <strong>Australian</strong> population are among <strong>the</strong> world’s largest consumers of lamb.Consuming 9.0 kg of lamb <strong>and</strong> 0.5kg of mutton in 2010-11 (MLA/ABS/ABARE, 2012). Instark <strong>contrast</strong>, Americans consume only approximately 0.74 pounds or 0.34 kilograms oflamb per person per annum. (Geisler, 2011). The disparity of lamb consumption between<strong>the</strong>se two nations is reflective of <strong>the</strong> size of <strong>the</strong> <strong>sheep</strong>meat industry in each countryrespectively.After travelling around America, I was interested to hear <strong>the</strong> views of American producers<strong>and</strong> processors, as too why lamb consumption in America was so low. They believe thatsome consumers are unaware that lamb offers an alternative red meat protein source apartfrom beef. The harder issue to overcome is that of eating experience. Some believe thatconsumers have previously had a negative eating experience from lamb, whe<strong>the</strong>r that isei<strong>the</strong>r because <strong>the</strong>y purchased a product that was subst<strong>and</strong>ard or poor choice of cookingmethod. Some consumers believe that American lamb has a distinct taste <strong>and</strong> this againcontributes to a negative eating experience. All of <strong>the</strong>se factors much be considered whenattempting to increase lamb consumption in <strong>the</strong> United States.Producing approximately 7% of <strong>the</strong> worlds lamb <strong>and</strong> mutton supply Australia has a nationalflock currently at 73.1 million head, significantly lower than <strong>the</strong> record highs of 180 millionhead in <strong>the</strong> 1970’s (Live Export Care, 2009). However our current flock is considerablylarger <strong>the</strong>n that of <strong>the</strong> United States, which is currently at 5.35 million as of January 2012,America’s lowest recorded number in over a century. (<strong>US</strong>DA Sheep <strong>and</strong> Goats, 2012). InAustralia, <strong>the</strong>re are 43 828 properties producing <strong>sheep</strong>, where 41.8 million breeding ewesone year <strong>and</strong> older nation wide (MLA, 2011). In comparison, <strong>the</strong> United States has 82 000<strong>sheep</strong> producers (ASI, 2011). From this we can deduce that America has many more <strong>sheep</strong>producers, while <strong>the</strong> average producer or ranching family has a much smaller flock size.Sheep production in Australia can be divided into two production systems, prime lambproduction which is generally concentrated around <strong>the</strong> wheat- <strong>sheep</strong> zone including highrainfall areas such as <strong>the</strong> Riverina <strong>and</strong> Central West zones of New South Wales as well asVictoria <strong>and</strong> parts of South Australia. Dheep producing areas are generally found in lowerrainfall areas such as Western Australia, South West Victoria <strong>and</strong> Western New SouthWales (MLA, 2012).Sheep production in <strong>the</strong> United States occurs in all 50 states, however <strong>the</strong> larger <strong>sheep</strong>ranches are concentrated west of <strong>the</strong> Mississippi River, while <strong>the</strong> eastern states support agreater number of smaller, pastured based production systems. The American <strong>sheep</strong>meatindustry heavily relies on intensively grain feeding in a feedlot environment to finish lambs.This has historically differed from <strong>the</strong> <strong>Australian</strong> industry, as extensive pasture basedfeeding systems are <strong>the</strong> dominant production system. However, due to changing consumer<strong>Compare</strong> <strong>and</strong> <strong>contrast</strong> <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>US</strong> <strong>sheep</strong> <strong>industries</strong>, providing opportunities for market growth for <strong>the</strong><strong>Australian</strong> industry? Isaac Allen, Charles Sturt University Wagga Wagga2

dem<strong>and</strong>s, market specifications <strong>and</strong> seasonal conditions, intensively finishing lambs inAustralia has increased in popularity over recent years. Most of <strong>the</strong> lamb consumed in <strong>the</strong>United States is consumed on <strong>the</strong> East <strong>and</strong> West coasts where <strong>the</strong>re is a distinct increase inper capita income as well as higher end or ‘white tablecloth’ restaurants. O<strong>the</strong>r key marketsfor American lamb include those of Greek, Hispanic or Middle Eastern cultural descentwhere lamb proves a key animal protein source (Geisler, 2011).Seasonal conditions are important factors in any primary industry <strong>and</strong> <strong>the</strong> <strong>sheep</strong> industry iscertainly no exception. Presently <strong>the</strong>re is a severe drought occurring throughout <strong>the</strong> UnitedStates, which is heavily impacting upon <strong>sheep</strong>meat production. Specifically, due to <strong>the</strong>reliance on grain finishing <strong>and</strong> <strong>the</strong> currently lack of surplus grain in order to finish lambs,producers are faced with finding alternative feed sources. These have been in <strong>the</strong> form ofdistillers’ grain that is a by-product of <strong>the</strong> fermentation process used in ethanol plants. Thisfeed base alternative is also being used in <strong>the</strong> beef <strong>and</strong> swine production <strong>industries</strong>.The <strong>Australian</strong> Sheepmeat Council of Australia (SCA) regulates our national Sheepmeatindustry. This is <strong>the</strong> nations peak body representing <strong>the</strong> national <strong>and</strong> international interestsof lamb <strong>and</strong> <strong>sheep</strong>meat producers around Australia, providing policy advice both at <strong>the</strong> farmgate <strong>and</strong> industry level. The goal of <strong>the</strong> SCA, funded by membership from State FarmerOrganisations is to enhance <strong>the</strong> integrity, profitability <strong>and</strong> sustainability of our nationsSheepmeat industry (SCA, 2013).In <strong>the</strong> United States, <strong>the</strong> equivalent body is <strong>the</strong> American Sheep Industry Association (ASI);representing <strong>the</strong> interests of <strong>sheep</strong> producers throughout America. The ASI includes 45state <strong>sheep</strong> associations in combination with individual members <strong>and</strong> its chief goals include:creating strong national <strong>and</strong> international markets for wool through advertising, promotion<strong>and</strong> marketing, The ASI has roots dating back to 1865, with <strong>the</strong> formation of <strong>the</strong> NationalWool Growers Association, which was <strong>the</strong> first national livestock association within <strong>the</strong>United States (ASI, 2013). From this it is clear to see that similar to Australia, <strong>the</strong> UnitedStates of America has a rich history embedded around with <strong>sheep</strong> production.There is a shared concern across both American Sheepmeat producers <strong>and</strong> processorsabout <strong>the</strong> future of <strong>the</strong> industry. The lowest national <strong>sheep</strong> flock in over a century <strong>and</strong>combined with <strong>the</strong> widespread drought, producers are finding it difficult to increase <strong>the</strong>breeding stock numbers. The current drought has also in turn lead to high gain prices, whichare forcing producers to look to alternatives fro protein sources such as distillers grain.However this proves difficult fro <strong>the</strong> American industry as <strong>the</strong> industry is heavily reliant upongrain finishing in comparison to <strong>the</strong> <strong>Australian</strong> industry in which a pasture feed basesignificantly contributes to production.Recently in 2011, two announcements were made which are encouraging signs for <strong>the</strong>American Sheepmeat industry. Kroger, one of America’s largest supermarket chainslaunched an American br<strong>and</strong>ed lamb campaign; <strong>and</strong> Walmart made a formal commitment toexclusively stock American lamb. This has secured a small place for American lamb uponsupermarket shelves <strong>and</strong> coupled with heightened consumer awareness, ensures lamb hasa place upon shelves <strong>and</strong> in consumer trolleys (ASI, 2013).In Australia, <strong>the</strong> SCA has released <strong>the</strong> Sheepmeat Industry Strategic Plan (SISP) outlining<strong>the</strong> council’s goals of driving <strong>the</strong> industry forward into 2015. Moving forward, <strong>the</strong> SISP ornational blueprint provides a link between <strong>the</strong> <strong>Australian</strong> red meat industry <strong>and</strong> <strong>the</strong>producers, agencies <strong>and</strong> corporates servicing <strong>and</strong> contributing to <strong>the</strong> <strong>Australian</strong> SheepmeatIndustry. Importantly, <strong>the</strong> SISP will be regularly evaluated against key performance indictors(KPI’s) identified by <strong>the</strong> SCA (SCA, 2013).<strong>Compare</strong> <strong>and</strong> <strong>contrast</strong> <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>US</strong> <strong>sheep</strong> <strong>industries</strong>, providing opportunities for market growth for <strong>the</strong><strong>Australian</strong> industry? Isaac Allen, Charles Sturt University Wagga Wagga3

likely to increase in market share <strong>and</strong> as consumers watch spending ‘value for money cuts’such as <strong>the</strong> short loin, will certainly increase in popularity (MLA, 2012).As previously mentioned lamb consumption is a niche market. Substantial growth can occurif markets are exp<strong>and</strong>ed; how exactly this will be achieved is uncertain. Many producers <strong>and</strong>processors in America have tried to increase consumption through raising consumerawareness. From talking first h<strong>and</strong> to both producers <strong>and</strong> processors, it is clear that <strong>the</strong>re isno one definitive solution. Instead market accessibility proves to be an important factorlimiting lamb consumption, as two is <strong>the</strong> supply of a consistent <strong>and</strong> reliable product, whichensures consumers are getting a good eating experience ‘every time’. It is <strong>the</strong>n no surprisethat this continual battle is reflected in pricing at <strong>the</strong> market place, with lamb retail pricesexpected to be lower in 2013, interestingly this is <strong>the</strong> only meat protein source forecast tohave a negative trend (ASI, 2013).Overall, while <strong>the</strong> United States is expected to remain <strong>the</strong> largest export market for<strong>Australian</strong> lamb in 2013, growth of this market is likely to be limited due to watchfulconsumer spending <strong>and</strong> lower lamb prices within <strong>the</strong> United States, in combination with anincrease in dem<strong>and</strong> for <strong>Australian</strong> lamb in China <strong>and</strong> <strong>the</strong> Middle East. These two alternativemarkets will continue to play a key role in <strong>the</strong> future of <strong>Australian</strong> <strong>sheep</strong>meat exports.ConclusionThere are distinct differences between <strong>the</strong> <strong>sheep</strong>meat <strong>industries</strong> of Australia <strong>and</strong> <strong>the</strong> UnitedStates of America. This paper has explored <strong>the</strong>se differences <strong>and</strong> highlighted <strong>the</strong> possiblefuture opportunities <strong>the</strong> <strong>Australian</strong> <strong>sheep</strong>meat industry may be able to capitalise on. As welook to <strong>the</strong> future, Australia is in <strong>the</strong> box seat. We have a great ability for our Agricultural<strong>industries</strong> to provide food <strong>and</strong> fibre for both our nations needs <strong>and</strong> also <strong>the</strong> worlds. Thisposition, if managed efficiently <strong>and</strong> sustainably, will ensure <strong>the</strong> future of <strong>Australian</strong>Agriculture is bright through calculated marketing <strong>and</strong> exportation strategies. One suchstrategy is to find appropriate avenues in order to increase <strong>the</strong> market share of <strong>Australian</strong>lamb within <strong>the</strong> United States.<strong>Compare</strong> <strong>and</strong> <strong>contrast</strong> <strong>the</strong> <strong>Australian</strong> <strong>and</strong> <strong>US</strong> <strong>sheep</strong> <strong>industries</strong>, providing opportunities for market growth for <strong>the</strong><strong>Australian</strong> industry? Isaac Allen, Charles Sturt University Wagga Wagga5