Quality - UAC Berhad

Quality - UAC Berhad

Quality - UAC Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ContentsNotice of Annual General Meeting 2Corporate Data 5Financial Calendar 5Five Years Summary of Group Results 6Year in Brief 6Five Years Financial Highlights 7Directors’ Responsibility Statement 8Profile of Directors 10Chairman’s Statement 16Penyata Pengerusi 22Corporate Governance Statement 27Report of The Audit Committee 32Statement of Internal Control 36Financial Statements 41Statement of Shareholdings 81List of Properties 83Proxy FormCover Rationale<strong>UAC</strong> is not just about products. It is aboutpeople, be they staff, customers or end users.For our staff, we seek to create an environmentthat develops their potential to the full. For ourcustomers, we strive to combine top quality,competitive cost, timely delivery andoutstanding service. For the end users weprovide an environment that is not only safeand functional but aesthetically appealing.It is a total commitment to people thatdetermines the way we run our business.

Notice of Annual General MeetingNOTICE IS HEREBY GIVEN that the Forty Second Annual General Meeting of the Company will be held at 4th Floor,Menara Boustead, 69 Jalan Raja Chulan, 50200 Kuala Lumpur on Wednesday, 29 March 2006 at 11.30 a.m. for thefollowing purposes:ORDINARY BUSINESSTo receive the audited financial statements for the year ended 31 December 2005 and the Reports of the Directors andAuditors thereon. | Resolution 1To approve a final dividend of 12 sen per share less tax and 6 sen per share tax exempt. | Resolution 2To elect the following Directors:Tan Sri Dato' Lodin bin Wok Kamaruddin | Resolution 3Tan Sri Dato' Haji Hanafiah bin Haji Ahmad | Resolution 4Tan Leh Kiah | Resolution 5To consider and, if thought fit, pass the following resolutions:“THAT pursuant to Section 129(6) of the Companies Act, 1965, Jen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat,who is over seventy years of age, be re-appointed a Director of the Company to hold office until the next AnnualGeneral Meeting.” | Resolution 6To approve Directors' fees. | Resolution 7To re-appoint Auditors and to authorise the Directors to fix the Auditors' remuneration. | Resolution 8SPECIAL BUSINESSAuthority for Allotment of SharesTo consider and, if thought fit, pass the following Ordinary Resolution:“THAT pursuant to Section 132D of the Companies Act, 1965, full authority be and is hereby given to the Directors toissue shares in the capital of the Company from time to time, at such price upon such terms and conditions for suchpurposes and to such person or persons whomsoever as the Directors may in their absolute discretion deem fit,provided that the aggregate number of shares to be issued pursuant to this Resolution does not exceed 10% of theissued share capital of the Company for the time being, subject to the Companies Act, 1965, the Articles ofAssociation of the Company and approval from Bursa Malaysia Securities <strong>Berhad</strong> and other relevant bodies wheresuch approval is necessary AND THAT such authority shall continue in force until the conclusion of the next AnnualGeneral Meeting of the Company.” | Resolution 92

Notice of Annual General MeetingProposed Renewal of Shareholders' Mandate for Recurrent Related Party TransactionsTo consider and, if thought fit, pass the following Ordinary Resolution:“THAT, subject always to the Listing Requirements of Bursa Malaysia Securities <strong>Berhad</strong>, the Company and its subsidiariesshall be mandated to enter into the category of recurrent transactions of a revenue or trading nature with the relatedparties as specified in Section 2.4 of the Circular to Shareholders dated 6 March 2006 subject further to the following:iiithe transactions are in the ordinary course of business and are on terms not more favourable than those generallyavailable to the public and not to the detriment of the minority shareholders;disclosure will be made of a breakdown of the aggregate value of transactions conducted pursuant to the Mandateduring the financial year based on the following information in the Company's Annual Report and in the AnnualReports for subsequent financial years that the Mandate continues in force:abthe type of the recurrent related party transactions made; andthe names of the related parties involved in each type of the recurrent related party transactions made and theirrelationship with the Company; andiiithat such approval shall continue to be in force until:abcthe conclusion of the next Annual General Meeting (“AGM”) of the Company at which time it will lapse, unlessby a resolution passed at the meeting, the authority is renewed;the expiration of the period within which the next AGM after this date is required to be held pursuant toSection 143(1) of the Companies Act, 1965 (but shall not extend to such extension as may be allowed pursuantto Section 143(2) of the Companies Act, 1965); orrevoked or varied by resolution passed by the shareholders in general meeting,whichever is the earlier.” | Resolution 10By Order of The BoardOoi Lee ChooSecretaryKuala Lumpur6 March 20063

Notice of Annual General MeetingNOTE:A member entitled to attend and vote at the Meeting may appoint a proxy or proxies (not more than two) to attend and vote instead of him. A proxy neednot be a member of the Company.The instrument appointing a proxy must be deposited at the Registered Office of the Company, not less than forty eight hours before the time of the Meeting.EXPLANATORY NOTESOrdinary Resolution No. 9The Company continues to consider opportunities to broaden its earnings potential. If any of the expansion/diversification proposals involves the issue ofnew shares, the Directors, under certain circumstances, would have to convene a general meeting to approve the issue of new shares even though the numberinvolved may be less than 10% of the issued capital.In order to avoid any delay and costs involved in convening a general meeting to approve such issue of shares, it is thus considered appropriate that theDirectors be empowered to issue shares in the Company, up to any amount not exceeding in total 10% of the issued share capital of the Company for the timebeing, for such purposes. This authority, unless revoked or varied at a general meeting, will expire at the next Annual General Meeting of the Company.Ordinary Resolution No. 10Ordinary Resolution No. 10, if passed, will authorise the Company and each of its subsidiaries to enter into recurrent related party transactions of a revenueor trading nature in the ordinary course of business.This authority, unless revoked or varied by the Company at general meeting, will expire at the conclusion of the next Annual General Meeting of the Company.STATEMENT ACCOMPANYING NOTICE OF ANNUAL GENERAL MEETINGA total of five Board Meetings were held during the financial year ended 31 December 2005; details of which are as follows:Date & TimeVenue17 February 2005 – 3.55 p.m. 3rd Floor, Menara Boustead, Kuala Lumpur.24 March 2005 – 10.30 a.m. 3rd Floor, Menara Boustead, Kuala Lumpur.30 May 2005 – 9.10 a.m. 36, Jalan Portland, Tasek Industrial Estate, Ipoh.17 August 2005 – 10.30 a.m. 3rd Floor, Menara Boustead, Kuala Lumpur.30 November 2005 – 4.30 p.m. 3rd Floor, Menara Boustead, Kuala Lumpur.The attendance of the Directors standing for election, or re-appointment at the Annual General Meeting at theabovementioned Board Meetings are as follows:Directors standing for election:i Tan Sri Dato' Lodin bin Wok Kamaruddin – attended all of the 5 Board Meetings.ii Tan Sri Dato' Haji Hanafiah bin Haji Ahmad – attended all of the 5 Board Meetings.iii Tan Leh Kiah (Appointed on 14/11/2005) – attended all of the Board Meetings since his appointment.Directors standing for re-appointment under Section 129(6) of the Companies Act, 1965:iJen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat – attended all of the 5 Board Meetings.Profiles of the Directors standing for election and re-appointment are on pages 10 to 14.4

Corporate DataDIRECTORSJen (B) Tan Sri Dato’ Mohd Ghazali bin Haji Che MatChairmanKoo Hock FeeChief Executive Officer/Managing DirectorDatuk Alladin HashimTan Sri Dato’ Haji Hanafiah bin Haji AhmadTan Sri Dato’ Lodin bin Wok KamaruddinDato’ (Dr.) Megat Abdul Rahman bin Megat AhmadTan Leh KiahCHIEF FINANCIAL OFFICER/SECRETARYOoi Lee ChooREGISTERED OFFICE3rd Floor, Menara Boustead69 Jalan Raja Chulan50200 Kuala LumpurTel : 03–21412266Fax: 03–21415160REGISTRARSBoustead Management Services Sdn Bhd13th Floor, Menara Boustead69 Jalan Raja Chulan50200 Kuala LumpurTel : 03–21419044Fax: 03–21443016AUDITORSPricewaterhouseCoopersSTOCK EXCHANGE LISTINGBursa Malaysia Securities <strong>Berhad</strong>Financial CalendarFINANCIAL YEAR 1 January 2005 to 31 December 2005RESULTSANNOUNCEDFirst quarter 30 May 2005Second quarter 17 August 2005Third quarter 30 November 2005Final quarter 15 February 2006ANNUAL GENERAL MEETING 29 March 2006DIVIDENDS BOOKS CLOSURE DATE PAYMENT DATEInterim 15 October 2005 to 16 October 2005 7 November 2005Proposed Final 15 April 2006 to 16 April 2006 28 April 20065

Five Years Summary of Group Results2005 2004 2003 2002 2001RM’000 RM’000 RM’000 RM’000 RM’000PROFITS AND DIVIDENDSProfit before taxation 40,406 48,934 44,628 44,389 42,468Taxation (12,216) (13,562) (11,400) (12,025) (10,394)Profit after taxation 28,190 35,372 33,228 32,364 32,074Gross Dividend per share (sen) 24.0 * 29.0 24.0 24.0 24.0Tax Exempt Dividend per share (sen) 6.0 * 6.0 6.0 5.0 6.0Basic earnings per share (sen) 38.5 48.5 46.5 45.6 46.1 **FINANCED BYPaid up capital 73,881 73,238 72,455 70,786 55,100Reserves and retained earnings 211,981 199,101 181,353 159,867 143,478Shareholders’ equity 285,862 272,339 253,808 230,653 198,578* Include final dividend which is subject to the approval of shareholders at the forthcoming Annual General Meeting.** Restated for bonus issue.Year in BriefYear Yearended ended31 Dec 2005 31 Dec 2004RM’000 RM’000Revenue 180,075 189,760Profit before tax 40,406 48,934Profit attributable to shareholders 28,259 35,402Shareholders’ equity 285,862 272,339Total assets 324,552 312,0136

Profile of DirectorsJen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che MatAge 75, Malaysian | Non-Independent, Non-Executive DirectorJen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat was appointed to the Boardon 1 July 1992 as Chairman. He is a member of the Nomination Committee.He is also the Chairman of Lembaga Tabung Angkatan Tentera (LTAT), andBoustead Holdings <strong>Berhad</strong> (BHB). The latter, listed on Bursa MalaysiaSecurities <strong>Berhad</strong> (“Bursa Malaysia”), is the largest shareholder of <strong>UAC</strong> <strong>Berhad</strong>.He graduated from the Royal Military Academy Sandhurst, UK and theCommand and Staff College, Quetta, Pakistan and served in the MalaysianArmed Forces in various capacities for 34 years, culminating in hisappointment as Chief of the Armed Forces from 1985 to 1987.He sits on the Boards of the following companies which are also listed onBursa Malaysia, The New Straits Times Press (M) <strong>Berhad</strong> and BousteadProperties <strong>Berhad</strong>. He is also on the Boards of several private limitedcompanies in which LTAT/BHB have investments.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company, except that he is also the Chairman ofBHB, the largest shareholder of the Company.Koo Hock FeeAge 55, Malaysian | Non-Independent, Executive DirectorKoo Hock Fee was appointed to the Board on 5 January 2004 and became theChief Executive Officer/Managing Director on 1 July 2005. He is a member ofthe Strategic Planning, Option and Share Portfolio Committees.He is also a senior manager of Boustead Holdings <strong>Berhad</strong> (BHB).He is a Member of the Malaysian Institute of Accountants and a FellowMember of the Institute of Chartered Accountants in England and Wales. Hesits on the Boards of several companies in which BHB has investments,amongst them Royal & Sun Alliance Insurance (M) <strong>Berhad</strong>, Kao Malaysia SdnBhd and Cadbury Confectionery Malaysia.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company, except that he is also a senior officer ofBHB, the largest shareholder of the Company.10

Profile of DirectorsTan Sri Dato' Lodin bin Wok KamaruddinAge 56, Malaysian | Non-Independent, Non-Executive DirectorTan Sri Dato' Lodin bin Wok Kamaruddin was appointed to the Boardon 1 August 1991. He is a member of the Audit, Strategic Planning,Remuneration and Share Portfolio Committees.He is currently the Chief Executive of Lembaga Tabung Angkatan Tentera(LTAT) and Group Managing Director of Boustead Holdings <strong>Berhad</strong> (BHB),a company listed on Bursa Malaysia. BHB is the largest shareholder of<strong>UAC</strong> <strong>Berhad</strong>.Tan Sri Dato' Lodin graduated from the College of BusinessAdministration, The University of Toledo, Toledo, Ohio, United States ofAmerica with a Bachelor of Business Administration and Master ofBusiness Administration. Prior to joining LTAT he was the GeneralManager of Perbadanan Kemajuan Bukit Fraser from 1973 to 1983. Hehas extensive experience in general management.Tan Sri Dato' Lodin also sits on the Boards of Affin Holdings <strong>Berhad</strong>,Affin Bank <strong>Berhad</strong>, Affin Capital Holdings Sdn Bhd, Affin MerchantBank <strong>Berhad</strong>, Boustead Properties <strong>Berhad</strong>, Johan Ceramics <strong>Berhad</strong>,Power Cables (Malaysia) Sdn <strong>Berhad</strong>, BP Malaysia Sdn Bhd, Ramatex<strong>Berhad</strong> and several other companies in which LTAT has investments.He is also a member of the Minority Shareholder Watchdog Group.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company, except that he is also the GroupManaging Director of BHB, the largest shareholder of the Company.11

Profile of DirectorsDatuk Alladin HashimAge 67, Malaysian | Independent, Non-Executive DirectorDatuk Alladin Hashim was appointed to the Board on 1 June 1989. He is theChairman of the Audit Committee and the Option Committee as well as amember of the Strategic Planning and Nomination Committees.Datuk Alladin holds a Bachelor of Agricultural Science from UniversitiMalaya and a Master of Science in Agricultural Economics from theUniversity of Massachusetts, U.S.A. He attended the executive developmentprogram of the Harvard Business School. He is also a Fellow of the Academyof Science Malaysia.He served the Federal Land Development Authority (Felda) from 1966 invarious capacities, and was the Director General from 1979 to 1989. He wasalso the Chairman of the Malaysian Rubber Board from 1998 to 2001.He sits on the Boards of the following companies which are also listed onBursa Malaysia, Timberwell <strong>Berhad</strong>, PK Resources <strong>Berhad</strong>, Guthrie Ropel<strong>Berhad</strong> and Kumpulan Guthrie <strong>Berhad</strong>.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company except as disclosed in the Directors' Report.Tan Sri Dato' Haji Hanafiah bin Haji AhmadAge 68, Malaysian | Independent, Non-Executive DirectorTan Sri Dato' Haji Hanafiah bin Haji Ahmad was appointed to the Board on1 January 1991. He is a member of the Nomination, Remuneration, Optionand Audit Committees.Tan Sri Dato’ Haji Hanafiah holds a Bachelor of Arts from Universiti Malaya andhas attended the Advanced Management Program at Harvard Business School.As an officer of the Malaysian Administrative and Diplomatic Service since1962, he served in various capacities in Malaysia and overseas. In 1974, hewas seconded to Lembaga Tabung Haji where he was the Director Generalfrom 1978 to 1989, before becoming the Chairman until retirement in 1992.He sits on the Boards of several companies, including Unilever (Malaysia) SdnBhd and RHB Unit Trust Management <strong>Berhad</strong>.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company.12

Profile of DirectorsDato' (Dr.) Megat Abdul Rahman bin Megat AhmadAge 66, Malaysian | Non-Independent, Non-Executive DirectorDato' (Dr.) Megat Abdul Rahman bin Megat Ahmad, was appointed tothe Board on 1 March 2002. He is a member of the Audit andStrategic Planning Committees, as well as Advisor to the RiskManagement Committee.He also sits on the Board of Boustead Holdings <strong>Berhad</strong> (BHB), a companylisted on Bursa Malaysia. BHB is the largest shareholder of <strong>UAC</strong> <strong>Berhad</strong>.Dato' (Dr.) Megat Abdul Rahman holds a Bachelor of Commerce degreefrom University of Melbourne, Australia. He is a member of theMalaysian Institute of Certified Public Accountants, a member of theMalaysian Institute of Accountants and a Fellow Member of theInstitute of Chartered Accountants in Australia. He was awarded anHonorary Doctorate in Business Administration [DBA (Hons.)] byUniversiti Kebangsaan Malaysia.He was a partner in KPMG, Managing Partner of KPMG Desa, Megat &Co. for over 10 years and an Executive Director in Kumpulan Guthrie<strong>Berhad</strong> for 11 years. He sits on the Boards of Press Metal <strong>Berhad</strong>,Integrated Rubber Corporation Bhd, Tronoh Consolidated Malaysia<strong>Berhad</strong>, Royal & Sun Alliance Insurance (M) <strong>Berhad</strong> and IJMCorporation <strong>Berhad</strong>. He also sits on the Boards of UniversitiKebangsaan Malaysia and Hospital Universiti Kebangsaan Malaysia.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/ormajor shareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in anybusiness arrangement involving the Company, except that he also sitson the Board of BHB, the largest shareholder of the Company.13

Profile of DirectorsTan Leh KiahAge 54, Malaysian | Independent, Non-Executive DirectorTan Leh Kiah was appointed to the Board on 14 November 2005. He is amember of the Audit and Remuneration Committees.Mr Tan is an Advocate and Solicitor of the High Court Malaya and is theManaging Partner of Azman Davidson & Co., Advocates & Solicitors, since1986. Prior to joining the legal profession, he was Company Secretary of theInchcape Group from 1977 to 1985. He has also served as an AssistantRegistrar of Companies. He holds the LL.B degree from the University ofLondon. He is on the rolls of Advocates & Solicitors of Brunei Darussalamand has also been admitted as a Solicitor of the Supreme Court of Englandand Wales. Besides being a member of the Malaya Bar, he is an associate ofthe Institute of Chartered Secretaries and Administrators U.K. and theMalaysian Institute of Taxation.He is currently a member of the Securities Commission. He was firstappointed in May 1998.He has no conviction for any offence within the past 10 years.He does not have any family relationship with any director and/or majorshareholder of <strong>UAC</strong> <strong>Berhad</strong>, nor any personal interest in any businessarrangement involving the Company.14

Tang Ling Hsueh | HousewifeSafety & AestheticsBeing happy at home is what matters most to me. Thatmeans that my family’s environment must not only be safeand weather-tight but beautiful and stylish. I love where welive. And <strong>UAC</strong> has contributed to that. How? Through quality“materials,”attractive designs and sheer good looks.UCO Supertex PlankBungalow, Johore Bahru

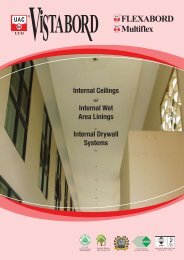

Chairman’s StatementTHE BUSINESS ENVIRONMENTFollowing a contraction of 1.5% in 2004, the construction sector of the Malaysian economy continued to registernegative growth ranging from 1.4% to 2.4% in the first three quarters of 2005. This contraction of the sector was feltvery much by the industry with declining demands for building products in the domestic market for the greater partof 2005. In addition to soft market demands in the domestic market, the industry also had to contend with thechallenges of uncertain and at times escalating crude oil prices and higher cost of production. Housing projects in thedomestic market continued to be limited during the year but the silver lining in the midst of a generally depresseddomestic market is the encouraging growth of overseas markets during the year.FINANCIAL PERFORMANCEDespite the many challenges faced, the Group was able to achieve revenue of RM180.10 million. This was down onprevious year by 5.1% with the bulk of the decline coming from Subsidiaries.Group profit before tax of RM40.41 million was down on the previous year by 17.4%. The weaker performance of theGroup's subsidiaries namely <strong>UAC</strong> Steel Systems Sdn Bhd and <strong>UAC</strong> Pipes Sdn Bhd was the main set back on the overallperformance of the Group.Net profit after tax and minority interests of RM28.26 million for the year still managed to generate earnings pershare for the year of 38.5 sen (2004: 48.5 sen). This was a satisfactory performance given the challenging businessenvironment of the Group was in.Despite the weaker profit performance this year, the balance sheet of the Group remained healthy with an additionalRM37.38 million cash generated from operating activities (2004: RM29.11 million). Cash and cash equivalents at theend of the financial year increased further to RM168.64 million, up from RM153.95 million a year ago.UCO VistabordYTL Lake Edge, PuchongUCO Supertex PlankKorea16

Chairman’s StatementCOMPANYAt Company level, revenue declined only marginally by 1.0% to RM167.53 million. Demand for building products inthe domestic market was soft but this was partially offset by an encouraging increase in export sales as a result ofintensified efforts to seek higher penetration into overseas markets. Despite a marginal decline in revenue, net profitbefore tax at RM41.88 million (2004: RM50.13 million) was down 16.4% from the preceding year. Selective increasesin selling prices during the year was not sufficient to offset increased costs of production like the cost of importedpulp and medium fuel oil. 2005 did not have the benefit of a boost from a one time write back in 2004 amounting toRM2.40 million in respect of allowance for diminution in the value of investment and the full recovery of a loanacquired previously at a discount.After some delay in the approval process, the Company has started construction of its corporate office building on thecorporate lot at the very successful entertainment, commercial and lifestyle retail hub in Mutiara Damansara. Whencompleted in the 4th quarter of 2007, this office building, to be named Menara <strong>UAC</strong>, will house the Company'scorporate, marketing and sales operations with the balance of space rented to third party tenants. Depending ontenancy take up rate, this office building could start generating profit and cash flow from the later part of 2008.SUBSIDIARIESS.B. Industries (Sdn) Bhd continued to earn rental income on itspremises in Shah Alam, Selangor Darul Ehsan.<strong>UAC</strong> Pipes Sdn Bhd registered lower revenue from the sale of polyethylenepipes due mainly to softer demand. It also faced keen price competition inthe face of rising price of polyethylene resins, a by-product of thepetroleum industry. This Subsidiary incurred a loss.UCO Supertex PlankKuala Lumpur Performing Arts Centre, SentulUCO SuperflexAman Sari, Bukit Kuchai17

Chairman’s StatementIn line with the slowdown in the construction industry, demand for steel roof trusses slowed down during the year.Tighter credit control and more selective choice of jobs resulted in <strong>UAC</strong> Steel Systems Sdn Bhd recording lowerrevenue compared to the previous year. As a result of lower revenue the Subsidiary ended the year with a loss.<strong>UAC</strong> Reflange Sdn Bhd ceased operations during the year following several years of losses. This Subsidiary has sincechanged its name to <strong>UAC</strong> Masterflange Sdn Bhd arising from an agreement to purchase the remaining shares of <strong>UAC</strong>Reflange Sdn Bhd from minority shareholders. The Company is now a wholly owned subsidiary.ISSUE OF SHARESIn the financial year 2005, 643,000 new shares were issued to eligible employees who exercised their options pursuantto the Employees' Share Option Scheme implemented in April 2002.DIVIDENDSAn interim dividend of 12 sen per share less tax at 28% on paid-up share capital of 73,587,000 ordinary shares ofRM1 each, amounting to RM6.36 million was paid on 7 November 2005.A final dividend of 12 sen per share less tax and a 6 sen tax exempt dividend has been proposed and will be paid outon 28 April 2006, subject to the approval of shareholders at the forthcoming Annual General Meeting.CORPORATE GOVERNANCEThe Group continues to be committed to good corporate governance in all areas of its operations. Our CorporateGovernance Statement on pages 27 to 31 outlines the application and compliance with the principles and bestpractices set out in the Malaysian Code of Corporate Governance.A Statement on Internal Control is alsoset out on pages 36 to 39.UCO SuperspanUCO SupersealNottingham University of Malaysia, SemenyihUCO VistabordNofa Farm Villas, Riyadh, Saudi Arabia18

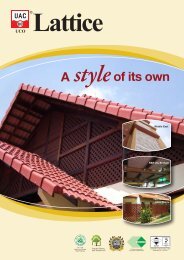

Chairman’s StatementRELATED PARTY TRANSACTIONSSignificant related party transactions of the Group during the year are disclosed in Note 27 of the financialstatements. This Note also sets out the aggregate value of recurrent related party transactions of revenue or tradingnature, conducted in accordance with the mandate obtained from shareholders at the Annual General Meeting of24 March 2005. Renewal of this mandate will be sought at the forthcoming Annual General Meeting.PROSPECTSThe Malaysian economic outlook for 2006 is encouraging, as it has been forecasted to expand by 5.5%. In particularthe construction sector is expected to reverse the downturn experienced over the past two years to expand by 3%. Allthese augur well for the Group as its operation from production to sales and marketing and the network ofdistributors and dealers in the country are primed to spring ahead to ride the wave of an industry upturn.The year 2006 is likely to be challenging as there are several significant potential challenges looming in the horizon,some of which are beyond the control of the Group. However the Group's intensified efforts in developing new overseasmarkets would enable the Group to overcome these challenges and sustain its profitability in the coming year.BOARD OF DIRECTORSThe year 2005 saw several changes to the composition of the Board.Mr Li Heng Tiong, the Managing Director, retired on 30 June 2005 afterhaving served the Company for many years with distinction. During histenure as the Managing Director for over 15 years, the Companyachieved significant growth in revenue and profits and in the processalso laid the foundation for the future well being of the Company.UCO Lattice (Square)Houses, Johore BahruUCO Lattice (Diamond)Houses, Johore Bahru19

Chairman’s StatementY. Bhg. Dato' Siew Nim Chee retired from the Board on 2 August 2005 after having been a Board Member sinceDecember 1971. Y. Bhg. Dato' Siew had contributed much to the Company during his tenure on the Board.On behalf of the Board, I extend my deepest appreciation to Mr Li Heng Tiong and Y. Bhg. Dato' Siew Nim Chee fortheir invaluable contribution over the years and also wish them good health and happy retirement.Mr Koo Hock Fee was appointed the Chief Executive Officer/Managing Director of the Company on 1 July 2005. Prior tothis appointment he was a Non-Independent, Non-Executive Director. I also extend a warm welcome to Mr Tan Leh Kiahon his appointment as Independent, Non-executive Director on 14 November 2005.APPRECIATIONOn behalf of the Board, I wish to extend my appreciation to management and staff for their invaluable contribution ina very challenging and competitive year.Appreciation also goes to our shareholders, distributors and dealers in Malaysia and overseas and other businesspartners for their continued support and confidence in the Group.My role has been made easier by the wise counsel and strong support of my fellow Board Members whom I thankvery much.Jen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat | ChairmanDate : 15 February 2006UCO Supertex PlankBungalow, Teluk IntanUCO Supertex Woodgrain PlankSemi-D, Chemor20

Mohd Yusouf b Abdul Latif | R&D Engineer<strong>Quality</strong> & InnovationIn my job, quality and innovation are paramount. We haveintroduced a good range of quality products, such as fibrecement corrugated roofing sheets, patterned and flatboards, eave linings, woodgrained plank, perforated boards“and flush-jointable flat boards.”Research Facility at <strong>UAC</strong> Factory, Tasek, Ipoh

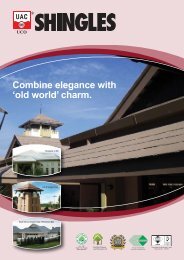

Penyata PengerusiPERSEKITARAN PERNIAGAANSektor pembinaan ekonomi Malaysia terus mencatatkan pertumbuhan negatif di sekitar 1.4% hingga 2.4% untuksembilan bulan pertama 2005 berikutan penguncupan sebanyak 1.5% dalam tahun 2004. Penguncupan ini amatdirasai dalam industri dengan permintaan untuk bahan-bahan binaan bagi pasaran tempatan merosot bagisebahagian besar 2005. Di samping permintaan menurun dalam pasaran tempatan, industri juga terpaksa berhadapandengan cabaran-cabaran ketidaktentuan dan kadang kala kenaikan harga minyak mentah dan kos pengeluaran yangtinggi. Projek-projek perumahan dalam pasaran tempatan terus terhad sepanjang tahun namun ketika pasarantempatan mengalami kelembapan pada keseluruhannya, pertumbuhan pasaran luar negara pula adalahmemberangsangkan.PRESTASI KEWANGANMeskipun berhadapan dengan pelbagai cabaran, Kumpulan berjaya mencapai hasil pendapatan sebanyak RM180.10juta. Ini adalah lebih rendah daripada tahun sebelumnya sebanyak 5.1% dengan sebahagian besar penurunanberpunca daripada anak-anak syarikat.Keuntungan sebelum cukai Kumpulan sebanyak RM40.41 juta adalah lebih rendah daripada tahun sebelumnyasebanyak 17.4%. Pencapaian yang lemah daripada anak-anak syarikat iaitu <strong>UAC</strong> Steel Systems Sdn Bhd dan <strong>UAC</strong>Pipes Sdn Bhd merupakan penyumbang utama kepada keputusan keseluruhan Kumpulan yang lebih rendah ini.Keuntungan bersih selepas cukai dan kepentingan minoriti sebanyak RM28.26 juta bagi tahun ini masih berupayamenjana perolehan sesaham sebanyak 38.5 sen (2004: 48.5 sen). Pencapaian ini adalah memuaskan di sebalikpersekitaran perniagaan yang amat mencabar yang dialami Kumpulan.Meskipun pencapaian keuntungan merosot tahun ini, kunci kira-kira Kumpulan terus kukuh dengan pertambahantunai berjumlah RM37.38 juta yang dijana daripada aktiviti-aktiviti operasi (2004: RM29.11 juta). Tunai dan setaratunai pada akhir tahun kewangan meningkat kepada RM168.64 juta, naik daripada RM153.95 tahun sebelumnya.UCO ShinglesZoo Negara, Kuala LumpurUCO Supertex PlankBanglo, Kuala Lumpur22

Penyata PengerusiSYARIKATDi peringkat Syarikat, hasil pendapatan merosot sedikit sebanyak 1.0% kepada RM167.53 juta. Permintaan bagibahan-bahan binaan dalam pasaran tempatan adalah lemah tetapi sebahagiannya berjaya diatasi melalui peningkatanjualan ekspot yang menggalakkan hasil daripada usaha gigih yang diambil bagi menembusi pasaran luar negara.Meskipun hasil pendapatan menurun sedikit, keuntungan bersih sebelum cukai pada RM41.88 juta (2004: RM50.13juta) adalah 16.4% lebih rendah daripada tahun sebelumnya. Kenaikan terpilih pada harga-harga jualan sepanjangtahun tidak mencukupi untuk menampung kenaikan kos pengeluaran seperti kos palpa impot dan minyak bahanbakar sederhana. Tahun 2005 tidak mendapat manfaat daripada suntikan pengiraan semula berjumlah RM2.40 jutadalam 2004 berkaitan elaun untuk pengurangan nilai pelaburan dan pemungutan semula sepenuhnya pinjaman yangdiambil alih sebelum ini pada kadar diskaun.Setelah mengalami beberapa kelewatan dalam proses kelulusan, Syarikat telah memulakan pembinaan bangunanpejabat korporatnya di satu kawasan bersebelahan sebuah pusat hiburan, komersil dan gaya hidup yang amat berjayadi Mutiara Damansara. Apabila siap pada suku keempat 2007, bangunan pejabat yang akan diberi nama Menara <strong>UAC</strong>,akan menempatkan operasi-operasi korporat, pemasaran dan jualan manakala lebihan ruang akan disewa kepadapihak ketiga. Bergantung kepada kadar penyewaan bangunan pejabat ini boleh mula menjana keuntungan dan alirantunai pada akhir tahun 2008.ANAK-ANAK SYARIKATS.B. Industries (Sdn) Bhd terus menerima pendapatan sewa daripadapremis-premisnya di Shah Alam, Selangor Darul Ehsan.<strong>UAC</strong> Pipes Sdn Bhd mencatatkan hasil pendapatan jualan paippolietilina yang lebih rendah disebabkan terutamanya olehpermintaan yang menurun. Ia juga berhadapan dengan persainganharga yang sengit berikutan kenaikan harga resin polietilina yangtinggi, satu produk sampingan industri petroleum. Anak syarikat initerus mengalami kerugian bagi tahun 2005.UCO Supertex Woodgrain PlankBanglo, Johor BahruUCO CeilMasjid, Shah Alam23

Penyata PengerusiSelaras dengan kelembapan industri pembinaan, permintaan bagi rangka atap keluli menurun sepanjang tahun.Kawalan kredit yang ketat di samping pemilihan selektif urusniaga mengakibatkan <strong>UAC</strong> Steel Systems Sdn Bhdmencatatkan hasil pendapatan yang lebih rendah berbanding tahun sebelumnya. Akibat daripada hasil pendapatanyang lebih rendah anak syarikat ini mengakhiri tahun dengan kerugian.<strong>UAC</strong> Reflange Sdn Bhd menamatkan operasinya dalam tahun setelah mengalami kerugian untuk beberapa tahundahulu. Anak syarikat ini telah menukar namanya kepada <strong>UAC</strong> Masterflange Sdn Bhd ekoran daripada keputusanuntuk membeli baki saham <strong>UAC</strong> Reflange Sdn Bhd daripada pemegang-pemegang saham minoriti. Syarikat ini kiniadalah anak syarikat milikan sepenuhnya.TERBITAN SAHAMDalam tahun kewangan 2005, 643,000 saham baru telah diterbitkan kepada pekerja-pekerja yang layak yang telahmelaksanakan opsyen mereka mengikut Skim Opsyen Saham-Saham Pekerja yang dilaksanakan dalam April 2002.DIVIDENDividen awal sebanyak 12 sen sesaham tolak cukai 28% atas modal berbayar berjumlah 73,587,000 saham biasabernilai RM1 setiap satu, berjumlah RM6.36 juta telah dibayar pada 7 November 2005.Dividen akhir sebanyak 12 sen sesaham tolak cukai dan 6 sen dikecualikan cukai telahpun dicadangkan dan akandibayar pada 28 April 2006, tertakluk kepada kelulusan pemegang-pemegang saham di Mesyuarat Agong Tahunanyang akan datang.TADBIR URUS KORPORATKumpulan terus komited kepada tadbir urus korporat yang baik disemua bahagian operasinya. Penyata Tadbir Urus Korporat kamidalam muka surat 27 hingga 31 menggariskan penerimaan pakai danpematuhan dengan prinsip-prinsip dan amalan-amalan terbaikmengikut “Malaysian Code of Corporate Governance”.Penyata mengenai Kawalan Dalaman juga dinyatakan dalam mukasurat 36 hingga 39.UCO VistabordPejabat-pejabat Kerajaan, PutrajayaUCO SuperflexMutiara Puchong24

Penyata PengerusiTRANSAKSI PIHAK BERKAITANUrusniaga pihak berkaitan Kumpulan yang ketara sepanjang tahun ada dinyatakan pada nota 27 dalam penyatakewangan. Nota ini juga mengemukakan nilai keseluruhan urusniaga pihak berkaitan yang berterusan bagi hasilpendapatan atau perniagaan, yang dikendalikan mengikut mandat umum yang diperolehi daripada pemegangpemegangsaham di Mesyuarat Agong Tahunan pada 24 Mac 2005. Pembaruan mandat ini akan diperolehi padaMesyuarat Agong Tahunan yang akan datang.PROSPEKProspek ekonomi Malaysia bagi 2006 adalah menggalakkan, kerana ia diramalkan akan berkembang sebanyak 5.5%.Sektor pembinaan terutamanya dijangka akan pulih daripada penurunan yang dialami lebih dua tahun lepas danberkembang sebanyak 3%. Semua ini adalah petanda baik bagi Kumpulan oleh kerana operasinya daripadapengeluaran ke jualan dan pemasaran dan rangkaian pengedar dan penjual dalam negara berkedudukan terbaik untukmelangkah ke hadapan dan mengharungi gelombang peningkatan industri.Tahun 2006 dijangka lebih mencabar kerana terdapat pelbagai potensi cabaran ketara yang akan timbul di masahadapan yang sebahagiannya adalah di luar kawalan Kumpulan. Namun usaha-usaha gigih Kumpulan dalammengembangkan pasaran luar negara yang baru akan membolehkan Kumpulan mengatasi cabaran-cabaran ini danmengekalkan keuntungannya pada tahun akan datang.LEMBAGA PENGARAHTahun 2005 menyaksikan beberapa pertukaran dalam komposisiLembaga Pengarah. Encik Li Heng Tiong, Pengarah Urusan, bersarapada 30 Jun 2005 setelah berkhidmat dengan Syarikat selama 15 tahundengan cemerlang. Sepanjang tempoh perkhidmatannya sebagaiPengarah Urusan, Syarikat mencapai pertumbuhan ketara bagi hasilpendapatan dan keuntungan dan dalam proses ini turut meletakkanasas masa hadapan Syarikat.UCO VistabordPutrajayaUCO Supertex PlankKaryaneka25

Penyata PengerusiY. Bhg. Dato' Siew Nim Chee bersara daripada Lembaga Pengarah pada 2 Ogos 2005 setelah menjadi Ahli Lembagasejak Disember 1971. Y. Bhg. Dato' Siew telah banyak menyumbang kepada Syarikat sepanjang perkhidmatannyadengan Lembaga.Bagi pihak Lembaga Pengarah, saya mengucapkan setinggi-tinggi penghargaan kepada Encik Li Heng Tiong dan Y. Bhg.Dato' Siew Nim Chee di atas sumbangan mereka yang tidak ternilai sepanjang perkhidmatan mereka danmengharapkan mereka dikurniakan kesihatan yang baik dan selamat bersara.Encik Koo Hock Fee dilantik sebagai Ketua Pegawai Eksekutif/Pengarah Urusan Syarikat pada 1 Julai 2005. Sebelumperlantikan ini, beliau ialah Pengarah Bukan Bebas, Bukan Eksekutif. Saya juga ingin mengucapkan selamat datangkepada Encik Tan Leh Kiah di atas perlantikan beliau sebagai Pengarah Bebas, Bukan Eksekutif pada 14 November 2005.PENGHARGAANBagi pihak Lembaga Pengarah saya ingin mengucapkan setinggi-tinggi penghargaan kepada pengurusan dankakitangan atas sumbangan mereka yang tidak ternilai di dalam tahun yang sungguh mencabar dan kompetitif.Penghargaan saya juga ditujukan kepada Pemegang-Pemegang Saham, Pengedar dan Penjual di Malaysia dan luarnegara dan Rakan-Rakan Niaga di atas sokongan dan keyakinan mereka yang berterusan kepada Kumpulan.Tugas saya dipermudahkan dengan nasihat yang baik dan sokongan berterusan daripada semua Ahli LembagaPengarah dan saya mengucapkan berbanyak-banyak terima kasih.Jen (B) Tan Sri Dato' Mohd Ghazali Hj Che Mat | PengerusiTarikh : 15 Februari 2006UCO VistabordPangsapuri AscottUCO Supertex Woodgrain PlankKelab Golf Kinrara, Kinrara26

Corporate Governance StatementThe Board of <strong>UAC</strong> BERHAD is pleased to report to shareholders on the manner the Group has applied the principles,and the extent of compliance with the best practices of corporate governance, as set out in Part 1 and Part 2respectively of the Malaysian Code on Corporate Governance (“the Code”), pursuant to Paragraph 15.26 of the ListingRequirements of Bursa Malaysia Securities <strong>Berhad</strong>.THE BOARD OF DIRECTORSThe Board has the overall responsibility for corporate governance, strategic direction, formulation of policies andoverseeing the investment and business of the Group. The various policies, procedures and guidelines present in theGroup clearly set out the roles, responsibilities and authorities of staff of the Group, and ensure that the direction andcontrol of the Group rests firmly with the Board. The Board has established a formal schedule of matters reserved toitself for decision; this includes the approval of corporate plans and budget, acquisition and divestment policy, majorcapital expenditure and significant financial matters.The Board has in place clear terms of reference for the Board, the Chairman and the Executive Director, spelling outtheir duties and responsibilities.The Board met five (5) times during the year ended 31 December 2005. Details of attendance by Directors are as follows:AttendanceJen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat 5/5Tan Sri Dato' Lodin bin Wok Kamaruddin 5/5Datuk Alladin Hashim 5/5Tan Sri Dato' Haji Hanafiah bin Haji Ahmad 5/5Dato' (Dr.) Megat Abdul Rahman bin Megat Ahmad 5/5Koo Hock Fee 5/5Tan Leh Kiah (Appointed on 14 November 2005) 1/1Li Heng Tiong @ Lee Heng Tiong (Resigned on 30 June 2005) 3/3Dato' Siew Nim Chee (Resigned on 2 August 2005) 2/3BOARD BALANCEThere were some changes to the composition of the Board since the end of the previous financial year. However, thecomposition of the Board was always maintained so that not less than one-third of the Board members wereIndependent Directors in compliance with Paragraph 15.02 of Bursa Malaysia Listing Requirements.At the present moment, the Board has seven members, comprising six non-executive Directors (including theChairman) and one executive Director, with three of the Directors being Independent Directors. Collectively, theDirectors have a wide range of business, financial and technical experience. This mix of skills and experience is vitalfor the successful direction of the Group. A brief profile of each Director is presented on pages 10 to 14.The role of the Chairman and the Chief Executive Officer/Managing Director are separate and clearly defined, so as toensure that there is a balance of power and authority.27

Corporate Governance StatementThe Chairman is responsible for ensuring Board effectiveness and conduct, whilst the Chief ExecutiveOfficer/Managing Director has overall responsibility for the operating units, organizational effectiveness andimplementation of Board policies and decisions. The presence of three independent, non-executive Directors fulfill apivotal role in corporate accountability. Although all the Directors have an equal responsibility for the Group'soperations, the role of these independent, non-executive Directors is particularly important as they provide unbiasedand independent views, advice and judgment. The Board is of the view that it is not necessary to identify a seniorindependent, non-executive Director to whom other directors may bring their concerns to, as all Directors believe thatthey can freely express their views at Board meetings.SUPPLY OF INFORMATIONAll Directors are provided with a monthly report on the performance of the Group. An agenda and a set of Boardpapers are distributed in sufficient time prior to Board meetings to enable the Directors to consider and obtain furtherexplanation/clarification, where necessary, and be properly prepared for discussion and informed decision making.The Board papers include reports on financial, operational, corporate, regulatory, business development matters andminutes of meetings of all Board Committees. Directors may obtain independent professional advice in the furtheranceof their duties. All Directors also have access to the advice and services of the Company Secretary.BOARD COMMITTEESA number of Board Committees are in place to facilitate the smooth transaction of business within the Company. Theterms of reference of each Committee were approved by the Board and where applicable, comply with therecommendations of the Code.NOMINATION COMMITTEEThe Nomination Committee comprises one non-independent, non-executive Director and two independent, nonexecutiveDirectors, as follows:Jen (B) Tan Sri Dato' Mohd Ghazali bin Haji Che Mat (non-independent, non-executive)Datuk Alladin Hashim (independent, non-executive)Tan Sri Dato' Haji Hanafiah bin Haji Ahmad (independent, non-executive)This Committee is responsible for proposing new nominees to the Board and Board Committees, for assessing on anon-going basis, the contribution of each individual Director and the overall effectiveness of the Board. The finaldecision as to who shall be appointed a Director remains the responsibility of the full Board, after considering therecommendations of the Committee.28

Corporate Governance StatementMr. Tan Leh Kiah, a new appointee to the Board had attended the Mandatory Accreditation Training Programme(MAP) prescribed by Bursa Malaysia Securities <strong>Berhad</strong>. Tan Sri Dato' Haji Hanafiah bin Haji Ahmad attended coursesconducted by Rating Agency Malaysia <strong>Berhad</strong> on Strategic and Operational Risk Management, PNB InvestmentInstitute on Modern Internal Auditing for Directors, Marcus Evans on Directors Duties 2005 and Strategies forSuccessful Investor Relations and Internal Auditing. Mr Koo Hock Fee attended the briefing by the SecuritiesCommission on updates on new Financial Reporting Standards, Crisis & Media Communications Workshop by WeberShandwick Worldwide (CMGRP (Malaysia) Sdn Bhd), FRS 2 on Share Based Payments conducted byPricewaterhouseCoopers and Public Rulings of the Inland Revenue Board by the Malaysian Institute of Accountants.The rest of the Directors kept themselves informed on latest developments on new Financial Reporting Standards andGoods and Services Tax by attending briefings and courses conducted by Ernst & Young.The Company Secretary ensures that all necessary information is obtained from the Directors and that appointmentsto the Board are properly made in accordance with the regulatory requirements.In accordance with the Company's Articles of Association, all Directors who are appointed by the Board are subject tore-election by shareholders at the next Annual General Meeting immediately after their appointment. Directors overseventy (70) years of age submit themselves for re-appointment annually, in accordance with Section 129(6) of theCompanies Act, 1965. In accordance with the Company's Articles of Association, one-third of the remaining Directors,including the Managing Director, submit themselves for re-election by rotation at each Annual General Meeting.REMUNERATION COMMITTEEThe Remuneration Committee comprises one non-independent, non-executive Director and two independent, nonexecutiveDirectors, as follows:Tan Sri Dato' Lodin bin Wok Kamaruddin non-independent, non-executiveTan Sri Dato' Haji Hanafiah bin Haji Ahmad independent, non-executiveTan Leh Kiah independent, non-executive (Appointed on 15 February 2006)Dato' Siew Nim Chee independent, non-executive (Resigned on 2 August 2005)The Remuneration Committee is responsible for making recommendations on the remuneration of executive Directors.The determination of remuneration packages of non-executive Directors is the responsibility of the Board as a whole.The remuneration package of the executive Director comprises a fixed salary and allowances, and a bonus approvedby the Board, which is linked to Group performance. Non-executive Directors are paid Directors' fees and anattendance allowance for each Board or Committee Meeting they attend. The individuals concerned abstained fromdiscussion of their own remuneration.29

Corporate Governance StatementThe aggregate Directors' remuneration paid or payable or otherwise made to all Directors of the Company who servedduring the financial year are as follows:BenefitsFees Salaries Allowances Bonus in-kind TotalRM RM RM RM RM RMExecutive Directors – 489,776 24,140 57,500 42,544 613,960Non-Executive Directors 180,696 – 36,100 – – 216,796None of the non-executive Directors received directors' remuneration of more than RM50,000 each. The aggregatetotal of Directors' fees are subject to shareholders' approval at the Annual General Meeting. The Board is of theopinion that the non-disclosure of the individual remuneration of each Director will not significantly affect theunderstanding and evaluation of the Group's governance.AUDIT COMMITTEEThe Audit Committee reviews issues of accounting policies, presentation for external financial reporting and the auditfindings of both the external and internal auditors arising from the Company's financial statements, and any otherissues raised by the auditors.The report of the Audit Committee for the year ended 31 December 2005 is set out on pages 32 to 35.SHARE PORTFOLIO COMMITTEEThe Share Portfolio Committee oversees the Company's investment in securities listed on Bursa Malaysia Securities<strong>Berhad</strong>. The members of the committee are as follows:Tan Sri Dato' Lodin bin Wok KamaruddinKoo Hock Fee (Appointed on 1 July 2005)Li Heng Tiong @ Lee Heng Tiong (Resigned on 30 June 2005)Yu Choong Cheong (Advisor)OPTION COMMITTEEThe Option Committee oversees the Employees' Share Option Scheme of the Company. The members of the committeeare as follows:Datuk Alladin HashimKoo Hock Fee (appointed on 1 July 2005)Tan Sri Dato' Haji Hanafiah bin Haji Ahmad (Appointed on 17 August 2005)Li Heng Tiong @ Lee Heng Tiong (Resigned on 30 June 2005)Dato' Siew Nim Chee (Resigned on 2 August 2005)30

Corporate Governance StatementSTRATEGIC PLANNING COMMITTEEThe Strategic Planning Committee advises the Board on the strategic direction of the various businesses within theGroup. The members of the committee are as follows:Dato' (Dr.) Megat Abdul Rahman bin Megat AhmadTan Sri Dato' Lodin bin Wok KamaruddinDatuk Alladin HashimKoo Hock Fee (Appointed on 1 July 2005)Li Heng Tiong @ Lee Heng Tiong (Resigned on 30 June 2005)DIALOGUE BETWEEN COMPANIES AND INVESTORSThe Board acknowledges the need for shareholders to be informed of all material business matters affecting theCompany. Announcements and release of financial results on a quarterly basis provide the shareholders and theinvesting public with an overview of the Group's performance and operations. Summaries of the Group's financialresults are advertised in a major newspaper and copies of the full announcement are supplied on request.THE ANNUAL GENERAL MEETINGThe Annual General Meeting provides a means of communication with shareholders. At each Annual GeneralMeeting, the Board presents the progress and performance of the business, and encourages shareholders to participatein the question and answer session.The Board has identified Datuk Alladin Hashim, a senior independent Director to whom any queries or concernsregarding <strong>UAC</strong> BERHAD group may be conveyed.FINANCIAL REPORTINGIn presenting the annual financial statements and quarterly announcement of results to shareholders, the Directorsaim to present a balanced and understandable assessment of the Group's position and prospects.INTERNAL CONTROLThe Directors acknowledge the responsibility of maintaining a good system of internal control, including riskassessments, and the need to review its effectiveness regularly in order to safeguard the Group's assets and thereforeshareholders' investments in the Group. This system, by its nature, can only provide reasonable but not absoluteassurance against misstatement or loss. A Risk Management Committee is in place to assist the Board in identifyingand assessing risks and the control measures within the Group. The Group's Statement on Internal Control for the yearended 31 December 2005 is set out on pages 36 to 39 of this annual report.RELATIONSHIP WITH THE AUDITORSThe role of the Audit Committee in relation to the auditors is described on pages 32 to 35.This statement is made in accordance with a resolution by the Board dated 15 February 2006.31

Report of The Audit CommitteeThe Board of Directors has pleasure in submitting the report of the Audit Committee of the Board for the year ended31 December 2005.TERMS OF REFERENCE OF THE AUDIT COMMITTEE1 CompositionThe Audit Committee shall consist of at least three Directors, a majority of whom are independent. The Chairmanof the Audit Committee shall be an independent, non-executive Director.2 AuthorityThe Audit Committee shall have explicit authority to investigate any matter within its terms of reference, theresources which it needs to do so, and full access to information. The Committee should be able to obtain externalprofessional advice and to invite outsiders with relevant experience to attend its meetings, if necessary.3 ResponsibilityThe Audit Committee shall be the focal point for communication between external auditors, internal auditors,Directors and the management on matters in connection with financial accounting, reporting and controls. It shallalso ensure that accounting policies and practices are adhered to by the Company and its subsidiaries.4 FunctionsThe duties of the Audit Committee shall include the following:iiiTo consider the appointment of the external auditor, the audit fees and any questions of their resignation or dismissal;To discuss with the external auditor before the audit commences, the nature and scope of the audit;iii To review the quarterly and year-end financial statements of the Company and the Group, focusing particularly on:• Any changes in major accounting policies and practices;• Significant adjustments arising from the audit;• Significant and unusual events;• The going concern assumption; and• Compliance with accounting standards and other legal requirements;iv To discuss problems and reservations arising from the interim and final audits, and any matter the auditor maywish to discuss;vTo review the external auditor's audit report, management letter and management's response;vi To review the assistance given by the employees of the Company and its subsidiaries to the external auditor;vii To consider the appointment of the internal auditor, the audit fees and any questions of their resignation or dismissal;32

Report of The Audit Committeeviii To review the internal audit functions namely:• The adequacy of the scope, functions and resources of the internal audit function, and that it has thenecessary authority to carry out its work;• The internal audit programme and results of the internal audit process and where necessary, ensure thatappropriate action is taken on the recommendations of the internal auditor; and• The performance of the internal auditor, whose role includes the examination and evaluation of theGroup's operations and their compliance with the relevant policies, codes and legislations;ix To consider any related party transactions and conflict of interest situations that may arise within theCompany or Group;xxixiiTo consider the major findings of internal investigations and management's response;To review and monitor the effectiveness of the Group's system of internal control; andTo consider other matters as defined by the Board.5 Meetings and minutesiiiiiiThe Audit Committee shall meet regularly, with due notice of issues to be discussed and should record itsconclusions in discharging its duties and responsibilities.The quorum for any meeting shall be at least two, the majority of whom must be independent Directors.The Secretary of the Committee shall be the internal auditor. Minutes of each meeting are to be prepared andsent to the Committee members, the Company's Directors who are not members of the Committee and theCompany Secretary.MEMBERSThe Audit Committee comprises three independent, non-executive Directors and two non-independent, non-executiveDirectors, as follows:Independent, non-executiveDatuk Alladin Hashim (Chairman of the Audit Committee)Tan Sri Dato' Haji Hanafiah bin Haji AhmadTan Leh Kiah (Appointed on 14 November 2005)Dato' Siew Nim Chee (Resigned on 2 August 2005)Non-Independent, non-executiveTan Sri Dato' Lodin bin Wok KamaruddinDato' (Dr.) Megat Abdul Rahman bin Megat Ahmad33

Report of The Audit CommitteeMEETINGSThe Audit Committee held a total of four (4) meetings during the year ended 31 December 2005. Details of attendanceby Directors are as follows:AttendanceDatuk Alladin Hashim 4/4Tan Sri Dato' Haji Hanafiah bin Haji Ahmad 4/4Tan Sri Dato' Lodin bin Wok Kamaruddin 4/4Dato' (Dr.) Megat Abdul Rahman bin Megat Ahmad 4/4Tan Leh Kiah (Appointed on 14/11/2005) 1/1Dato' Siew Nim Chee (Resigned on 2 August 2005) 3/3The Chief Executive Officer/Managing Director and the Chief Financial Officer were invited and attended all themeetings. The Group's external auditors attended two (2) of the meetings during this period. The Audit Committee hadthe opportunity to meet up with the external auditors without the presence of management.INTERNAL AUDIT FUNCTIONThe Audit Committee is assisted by the Internal Audit team from Boustead Holdings <strong>Berhad</strong> (a significant shareholderof <strong>UAC</strong> BERHAD) in maintaining a sound system of internal control. This team is staffed by competent personnel withwide knowledge of the industry.The Internal Audit team undertakes internal audit functions based on the audit plan that is reviewed by the AuditCommittee and approved by the Board. The audit plan covered a review of operational controls, the effectiveness ofmanagement in identifying and managing principal risks, compliance with law and regulations, quality of assets andmanagement efficiencies, amongst others.The internal audit reports are deliberated by the Audit Committee and recommendations are duly acted upon bymanagement.ACTIVITIESDuring the year, the Audit Committee carried out its duties as set out in its terms of reference. The main activitiesundertaken by the Audit Committee during the year under review were as follows:abreviewed the quarterly financial statements and Annual Report of the Group prior to presentation for the Board's approval;reviewed the related party transactions that had arisen within the Company or the Group;c reviewed the audit fees payable to external and internal auditors;dreviewed with the external auditors their audit plan prior to commencement of audit;34

Report of The Audit Committeeefghijdiscussed and reviewed the Group's financial year end statements with the external auditors including issues andfindings noted in the course of the audit of the Group Financial Statements;reviewed the enterprise risk management framework and the effectiveness of the system of internal control of the Group;reviewed and discussed with the internal auditors their evaluation of the system of internal control of the Group;reviewed and appraised the audit reports submitted by the internal auditors. The audit reports covered all businesssectors of the Group incorporating audit findings and recommendations on system and control weaknesses notedduring the course of the audit;reviewed the credit policy of the Group; andreviewed and verified that the allocation of share options was in accordance with the criteria as set out in the <strong>UAC</strong><strong>Berhad</strong> Employees' Share Option Scheme.The Committee also appraised the adequacy of actions and remedial measures taken by the management in resolvingthe audit issues reported.35

Statement on Internal ControlINTRODUCTIONThis Statement on Internal Control is made in accordance with Paragraph 15.27(b) of the Listing Requirements ofBursa Malaysia Securities <strong>Berhad</strong>, which requires Malaysian public listed companies to make a statement about theirstate of internal control, as a Group, in their Annual Report.RESPONSIBILITYThe Board of Directors recognises that it is responsible for the Group's system of internal control and for reviewing itsadequacy and integrity. The Group's internal control system is designed to manage rather than eliminate the risk offailure to achieve business objectives. Notwithstanding, due to the limitations that are inherent in any system of internalcontrol, the system can only provide reasonable and not absolute assurance against material misstatement or loss.THE GROUP'S SYSTEM OF INTERNAL CONTROLKey Features of the System of Internal ControlThe Board entrusts the daily running of the business to the Chief Executive Officer/Managing Director (‘CEO/MD') andhis management team. The Board members receive timely information pertaining to performance and profitability ofthe Group through monthly management reports and quarterly Board papers, both of which include quantitative andqualitative trends and analyses. At quarterly Board meetings, the Directors manage the principal risks affecting theGroup through discussion and deliberation of the strategic issues facing the businesses, and resolve on actions tomitigate such risks.The CEO/MD plays a pivotal role in communicating the Board's expectations of the system of internal control tomanagement. This is achieved, on a day-to-day basis, through his active participation in the operations of thebusiness as well as attendance at various scheduled management and operational level committee meetings whereoperational and financial risks are discussed and dealt with. The CEO/MD will update the Board of any significantmatters that require the latter's immediate attention.The Board believes that the existing oversight structure of the Group has an appropriate balance of both the Board'sand Management's involvement in managing the Company. This is illustrated in the diagram on the following page.36

Statement on Internal Control<strong>UAC</strong> BERHAD OVERSIGHT STRUCTURE<strong>UAC</strong> BERHADBoard of DirectorsExternal Audit Nomination Remuneration Chief Strategic Share OptionAudit Committee Committee Committee Executive Planning Portfolio CommitteeOfficer/ Committee CommitteeInternalManagingAuditDirectorOperationsRisk Budget and Subsidiary Establishment <strong>Quality</strong> Credit Work Safety TechnologyManagement Operations Management Committee Management Committee Committee ReviewCommittee Review Committees Committee CommitteeCommitteeThe functions of the Board committees above are described in the Corporate Governance Statement on pages 27 to 31.The key roles of the abovementioned management committees are depicted below:Management CommitteeRisk Management CommitteeBudget and OperationsReview CommitteeSubsidiary Management CommitteesEstablishment Committee<strong>Quality</strong> Management CommitteeCredit CommitteeWork Safety CommitteeTechnology Review CommitteeFunctionsResponsible for monitoring the risk management activities of the Group.Additional details are given in the following page on Enterprise RiskManagement Framework.Responsible for monitoring both the financial and non-financialperformance of the Company as well as evaluation of other factorsaffecting operations.Responsible for the monitoring both the operational and financialperformance of subsidiary companies as well as evaluation of otherfactors affecting their operations.Responsible for focusing on policy setting in relation to employeerelated issues.Responsible for all MS ISO 9001:2000 related matters includingmonitoring compliance and resolution of audit findings.Responsible for reviewing credit policies and monitoring the creditposition of customers.Responsible for monitoring occupational health and safety practices.Responsible for setting the direction and monitoring of research anddevelopment activities37

Statement on Internal ControlENTERPRISE RISK MANAGEMENT FRAMEWORKThe Group has established an Enterprise Risk Management (‘ERM') framework to formalise the identification ofprincipal risks affecting the achievement of the Group's business objectives. The Board believes that such a frameworkprovides a structured and focused approach in managing the Group's significant business risks and enables the Groupto effectively adopt a risk-based internal control system that is embedded within the Group.The ERM framework encompasses the following key elements:• Adoption of a Risk Management Policy (‘RMP'), endorsed by the Board. The RMP incorporates, amongst others, astructured process for identifying, evaluating and prioritising risks as well as clearly defining the riskresponsibilities and the escalation process.• Maintenance of a consolidated risk profile populated into the specialist risk management software. Changes in therisk profile and the corresponding action plans are reported to the Board.• A Risk Management Committee (‘RMC'), chaired by the CEO/MD, with an oversight function to ensure thecontinued efficiency and effectiveness of the ERM framework. A non-executive member of the Board undertakesthe role of advisor, ensuring that the views of the entire Board are also represented on the RMC.• Services of a dedicated Risk Coordinator, tasked with ensuring the smooth operation of the ERM framework.• Periodic audit of the ERM framework by the internal auditor.ASSURANCE MECHANISMThe Audit Committee (‘AC') is tasked by the Board with the duty of reviewing and monitoring the effectiveness of theGroup's system of internal control. The AC periodically receives reports from the independent assurance functions ofthe Group. The Internal Audit function provides the AC with an assessment on the adequacy and integrity of theGroup's system of internal control via reports from visits conducted at various operating units. The external auditorsconduct an annual statutory audit on the financial statements. Areas for improvement, if any, identified during thecourse of the statutory audit by the external auditors are brought to the attention of the AC through managementletters, or at AC meetings.The Board reviews the minutes of the AC's meetings. The Report of the AC is set out on pages 32 to 35 of the Annual Report.Additionally, as part of the requirements of the MS ISO 9001:2000 certification, scheduled audits are conductedinternally as well as by SIRIM QAS auditors. Results of audits are reported to the <strong>Quality</strong> Management Committeewhich is chaired by the CEO/MD. Any pertinent or unresolved issues arising out of these audits are escalated to theBoard for its attention.The Board of <strong>UAC</strong> remains committed towards keeping abreast with the ever-changing business environment in orderto support the Group's businesses and size of operations. Cognisant of this fact, the Board of <strong>UAC</strong> in striving forcontinuous improvement will put in place appropriate measures, when necessary, to further enhance the Group'ssystem of internal control.This statement is made in accordance with a resolution by the Board dated 15 February 2006.38

Statement on Internal ControlFEATURES OF <strong>UAC</strong>'S INTERNAL CONTROL SYSTEM• Formal Enterprise Risk Management Framework• Mission Statement and <strong>Quality</strong> Policy clearly outlining the Group's direction• Clear organisation structure with delineated reporting lines• Defined levels of authority• Scheduled operations and management meetings• Board approved annual financial budgets• MS ISO 9001:2000 certification• Monthly management reports to the Board• Board papers which include both financial and non-financial information• Position descriptions for non-unionised employees• Staff handbooks for both unionised and non-unionised employees• Formal employee appraisal system• Structured training for employees based on an annual training plan• Frequent dialogues with union representatives• Quarterly newsletters i.e. Berita <strong>UAC</strong>• Annual statutory audit• Annual field visits by the Board to the plant in Ipoh, Perak• Regular internal audit visits39

Financial StatementsDirectors’ Report 42Statement by Directors 46Statutory Declaration 46Report of The Auditors 47Income Statements 48Balance Sheets 49Consolidated Statement of Changes in Equity 50Company Statement of Changes in Equity 51Consolidated Cash Flow Statement 52Company Cash Flow Statement 53Notes to The Financial Statements 54

Directors’ ReportFor The Financial Year Ended 31 December 2005The directors have pleasure in submitting their report to the members together with the audited financial statementsof the Group and the Company for the financial year ended 31 December 2005.PRINCIPAL ACTIVITIESThe principal activities of the Company are the manufacture and distribution of fibre cement building products. Theprincipal activities of the subsidiary companies during the financial year are set out in Note 13 to the financialstatements. There were no significant changes in the nature of these activities during the financial year.FINANCIAL RESULTSGroupRM'000CompanyRM'000Profit after taxation 28,190 31,594Minority interests 69 0Net profit for the financial year 28,259 31,594DIVIDENDSDividends declared and paid and payable since 31 December 2004 are as follows:RM'000In respect of the financial year ended 31 December 2004,as shown in the Directors' report of that year:- a final dividend of 12 sen per share less tax at 28% and6 sen per share tax exempt was paid on 29 April 2005 10,749In respect of the financial year ended 31 December 2005:- an interim dividend of 12 sen per share less tax at 28% was paid on 7 November 2005 6,358The Directors now recommend the payment of a final dividend of 12 sen per share less tax at 28% and 6 sen per sharetax exempt in respect of the financial year ended 31 December 2005 which, subject to the approval of members at theforthcoming Annual General Meeting of the Company, will be paid on 28 April 2006 to the shareholders registered onthe Company's Register of Members at the close of business on 14 April 2006.RESERVES AND PROVISIONSAll material transfers to or from reserves or provisions during the financial year are disclosed in the financial statements.ISSUES OF SHARESDuring the financial year, the Company increased its issued and fully paid up share capital from RM73,238,000 toRM73,881,000 as a result of the issuance and allotment of 444,000, 77,000, 81,000 and 41,000 new ordinary shares ofRM1.00 each at an option price of RM3.48, RM3.77, RM4.40 and RM4.37 per share respectively, to eligible employeeswho had exercised their options pursuant to the Employees' Share Option Scheme (“ESOS”).The newly issued shares rank pari passu in all respects with the existing ordinary shares of the Company.42 <strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia)

Directors’ ReportFor The Financial Year Ended 31 December 2005EMPLOYEES' SHARE OPTION SCHEMEThe Company implemented an Employees' Share Option Scheme (“ESOS”) on 29 April 2002 for a period of 5 years.The ESOS is governed by the by-laws which were approved by the shareholders at the Extraordinary General Meetingof the Company held on 18 February 2002.Details of the ESOS are set out in Note 23 to the financial statements.The Company has been granted exemption by the Companies Commission of Malaysia from having to disclose thenames of employees who have been granted option to subscribe for less than 100,000 shares of RM1.00 each. Duringthe financial year, no option to subscribe for 100,000 or more shares of RM1.00 each was granted to any employee.DIRECTORSThe directors in office since the date of the last report are:Jen (B) Tan Sri Dato' Mohd. Ghazali bin Haji Che Mat ChairmanTan Sri Dato' Lodin bin Wok KamaruddinDatuk Alladin HashimTan Sri Dato' Haji Hanafiah bin Haji AhmadDato' (Dr.) Megat Abdul Rahman bin Megat AhmadKoo Hock Fee Managing Director/CEO (appointed 1 July 2005)Tan Leh Kiah (appointed 14 November 2005)Li Heng Tiong @ Lee Heng Tiong Managing Director (resigned 30 June 2005)Dato' Siew Nim Chee (resigned 2 August 2005)DIRECTORS' INTERESTS IN SHARESAccording to the Register of Directors' Shareholdings, particulars of interests of those directors holding office at theend of the financial year in shares in the Company are as follows:Number of ordinary shares of RM1 eachBalanceBalanceatat1.1.2005 Bought Sold 31.12.2005Shares in the CompanyDirectDatuk Alladin Hashim 1 0 0 1Other than as stated above, the directors have no interests in shares in the Company or its related corporations duringthe financial year.<strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia) 43

Directors’ ReportFor The Financial Year Ended 31 December 2005DIRECTORS' BENEFITSDuring and at the end of the financial year, no arrangements subsisted to which the Company is a party, beingarrangements with the object or objects of enabling directors of the Company to acquire benefits by means of theacquisition of shares in, or debentures of, the Company or any other body corporate.Since the end of the previous financial year, no director has received or become entitled to receive a benefit otherthan the fees, emoluments and money value of benefits disclosed in Note 7 to the financial statements by reason of acontract made by the Company or a related corporation with the director or with a firm of which he is a member, orwith a company in which he has a substantial financial interest.DIRECTORS' ROTATIONIn accordance with Article 105 of the Company's Articles of Association, Tan Sri Dato' Lodin bin Wok Kamaruddinand Tan Sri Dato' Haji Hanafiah bin Haji Ahmad retire by rotation from the Board at the forthcoming Annual GeneralMeeting and being eligible, offer themselves for re-election.DIRECTORS' RETIREMENTIn accordance with Article 112 of the Company's Articles of Association, Tan Leh Kiah who was appointed on14 November 2005 retires from the Board at the forthcoming Annual General Meeting and being eligible, offershimself for re-election.In accordance with Section 129 (2) of the Companies Act, 1965, Jen (B) Tan Sri Dato' Mohd. Ghazali bin Haji Che Matwho is over seventy years of age, retires from the Board at the forthcoming Annual General Meeting and the directorsrecommend his reappointment under Section 129 (6) of the said Act.STATUTORY INFORMATION ON THE FINANCIAL STATEMENTSBefore the income statements and balance sheets of the Group and the Company were made out, the directors tookreasonable steps:abto ascertain that proper action had been taken in relation to the writing off of bad debts and the making ofallowance for doubtful debts and have satisfied themselves that all known bad debts had been written off and thatadequate allowance had been made for doubtful debts; andto ensure that any current assets, other than debts, which were unlikely to realise in the ordinary course ofbusiness, their values as shown in the accounting records of the Group and the Company had been written downto an amount which they might be expected so to realise.At the date of this report, the directors are not aware of any circumstances:abwhich would render the amounts written off for bad debts or the amount of the allowance for doubtful debts inthe financial statements of the Group and the Company inadequate to any substantial extent; orwhich would render the values attributed to current assets in the financial statements of the Group and theCompany misleading; or44 <strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia)

Directors’ ReportFor The Financial Year Ended 31 December 2005cwhich have arisen which render adherence to the existing method of valuation of assets or liabilities of the Groupand the Company misleading or inappropriate.No contingent or other liability has become enforceable or is likely to become enforceable within the period of twelvemonths after the end of the financial year which, in the opinion of the directors, will or may affect the ability of theGroup and the Company to meet their obligations when they fall due.At the date of this report, there does not exist:abany charge on the assets of the Group and the Company which has arisen since the end of the financial year whichsecures the liabilities of any other person; orany contingent liability of the Group or the Company which has arisen since the end of the financial year.At the date of this report, the directors are not aware of any circumstances not otherwise dealt with in this report orthe financial statements which would render any amount stated in the financial statements misleading.In the opinion of the directors:abthe results of the Group's and the Company's operations during the financial year were not substantially affectedby any item, transaction or event of a material and unusual nature; andthere has not arisen in the interval between the end of the financial year and the date of this report any item,transaction or event of a material and unusual nature likely to affect substantially the results of the operations ofthe Group or the Company for the financial year in which this report is made.AUDITORSThe auditors, PricewaterhouseCoopers, have expressed their willingness to continue in office.Signed on behalf of the Board of Directors in accordance with a resolution dated 15 February 2006.Jen (B) Tan Sri Dato' Mohd.Ghazali bin Haji Che MatChairmanKoo Hock FeeManaging Director<strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia) 45

Statement by DirectorsPursuant to Section 169(15) of the Companies Act, 1965We, Jen (B) Tan Sri Dato' Mohd. Ghazali bin Haji Che Mat and Koo Hock Fee, being two of the directors of <strong>UAC</strong><strong>Berhad</strong> state that, in the opinion of the directors, the financial statements set out on pages 48 to 80 are drawn up soas to give a true and fair view of the state of affairs of the Group and the Company as at 31 December 2005 and ofthe results and cash flows of the Group and the Company for the financial year ended on that date in accordance withthe provisions of the Companies Act, 1965 and the MASB approved accounting standards in Malaysia.Signed on behalf of the Board of Directors in accordance with a resolution dated 15 February 2006.Jen (B) Tan Sri Dato' Mohd.Ghazali bin Haji Che MatChairmanKoo Hock FeeManaging DirectorStatutory DeclarationPursuant to Section 169(16) of the Companies Act, 1965I, Ooi Lee Choo, being the officer primarily responsible for the financial management of <strong>UAC</strong> <strong>Berhad</strong>, do solemnly andsincerely declare that to the best of my knowledge and belief the financial statements set out on pages 48 to 80 are, inmy opinion, correct, and I make this solemn declaration conscientiously believing the same to be true and by virtue ofthe provisions of the Statutory Declarations Act, 1960.Subscribed and solemnly declared by the abovenamed Ooi Lee Choo at Kuala Lumpur on 15 February 2006.Before me,Lam Theng Sum(No. W244)Commissioner for OathsSuite 6.02, Tingkat 6Wisma Lim Foo Yong86, Jalan Raja Chulan50200 Kuala Lumpur46 <strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia)