Quality - UAC Berhad

Quality - UAC Berhad

Quality - UAC Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

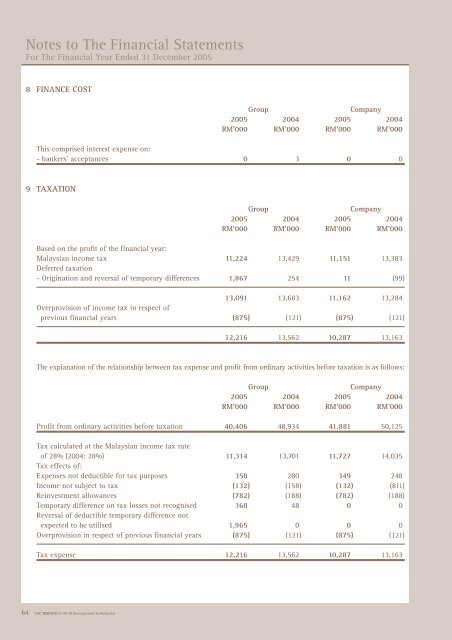

Notes to The Financial StatementsFor The Financial Year Ended 31 December 20058 FINANCE COSTGroupCompany2005 2004 2005 2004RM'000 RM'000 RM'000 RM'000This comprised interest expense on:- bankers' acceptances 0 3 0 09 TAXATIONGroupCompany2005 2004 2005 2004RM'000 RM'000 RM'000 RM'000Based on the profit of the financial year:Malaysian income tax 11,224 13,429 11,151 13,383Deferred taxation- Origination and reversal of temporary differences 1,867 254 11 (99)13,091 13,683 11,162 13,284Overprovision of income tax in respect ofprevious financial years (875) (121) (875) (121)12,216 13,562 10,287 13,163The explanation of the relationship between tax expense and profit from ordinary activities before taxation is as follows:GroupCompany2005 2004 2005 2004RM'000 RM'000 RM'000 RM'000Profit from ordinary activities before taxation 40,406 48,934 41,881 50,125Tax calculated at the Malaysian income tax rateof 28% (2004: 28%) 11,314 13,701 11,727 14,035Tax effects of:Expenses not deductible for tax purposes 358 280 349 248Income not subject to tax (132) (158) (132) (811)Reinvestment allowances (782) (188) (782) (188)Temporary difference on tax losses not recognised 368 48 0 0Reversal of deductible temporary difference notexpected to be utilised 1,965 0 0 0Overprovision in respect of previous financial years (875) (121) (875) (121)Tax expense 12,216 13,562 10,287 13,16364 <strong>UAC</strong> BERHAD (5149-H) (Incorporated in Malaysia)