2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

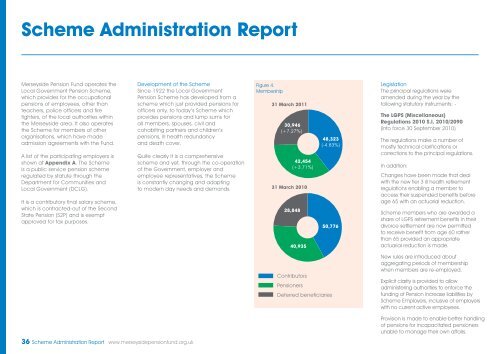

Scheme Administration ReportMerseyside Pension Fund operates theLocal Government Pension Scheme,which provides for the occupationalpensions of employees, other thanteachers, police officers and firefighters, of the local authorities withinthe Merseyside area. It also operatesthe Scheme for members of otherorganisations, which have madeadmission agreements with the Fund.A list of the participating employers isshown at Appendix A. The Schemeis a public service pension schemeregulated by statute through theDepartment for Communities andLocal Government (DCLG).It is a contributory final salary scheme,which is contracted-out of the SecondState Pension (S2P) and is exemptapproved for tax purposes.Development of the SchemeSince 1922 the Local GovernmentPension Scheme has developed from ascheme which just provided pensions forofficers only, to today’s Scheme whichprovides pensions and lump sums forall members, spouses, civil andcohabiting partners and children’spensions, ill health redundancyand death cover.Quite clearly it is a comprehensivescheme and yet, through the co-operationof the Government, employer andemployee representatives, the Schemeis constantly changing and adaptingto modern day needs and demands.Figure 4.Membership31 March 20<strong>11</strong>30,946(+7.27%)42,454(+3.71%)31 March <strong>2010</strong>28,8<strong>48</strong>40,935<strong>48</strong>,323(-4.83%)50,776LegislationThe principal regulations wereamended during the year by thefollowing statutory instruments: -The LGPS (Miscellaneous)Regulations <strong>2010</strong> S.I. <strong>2010</strong>/2090(into force 30 September <strong>2010</strong>)The regulations make a number ofmostly technical clarifications orcorrections to the principal regulations.In addition:Changes have been made that dealwith the new tier 3 ill health retirementregulations enabling a member toaccess their suspended benefits beforeage 65 with an actuarial reduction.Scheme members who are awarded ashare of LGPS retirement benefits in theirdivorce settlement are now permittedto receive benefit from age 60 ratherthan 65 provided an appropriateactuarial reduction is made.ContributorsPensionersDeferred beneficiariesNew rules are introduced aboutaggregating periods of membershipwhen members are re-employed.Explicit clarity is provided to allowadministering authorities to enforce thefunding of Pension Increase liabilities byScheme Employers, inclusive of employerswith no current active employees.Provision is made to enable better handlingof pensions for incapacitated pensionersunable to manage their own affairs.36 Scheme Administration Report www.merseysidepensionfund.org.uk