2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

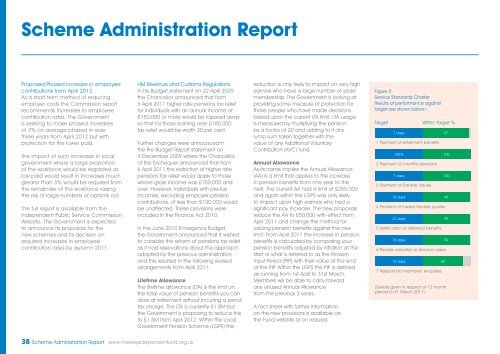

Scheme Administration ReportProposed Phased Increase in employeecontributions from April 2012As a short term method of reducingemployer costs the Commission reportrecommends increases to employeecontribution rates. The Governmentis seeking to make phased increasesof 3% on average phased in overthree years from April 2012 but withprotection for the lower paid.The impact of such increases in localgovernment where a large proportionof the workforce would be regarded aslow paid would result in increases muchgreater than 3% would be required fromthe remainder of the workforce raisingthe risk of large numbers of optants out.The full report is available from theIndependent Public Service CommissionWebsite. The Government is expectedto announce its proposals for thenew schemes and its decision onrequired increases in employeecontribution rates by autumn 20<strong>11</strong>.HM Revenue and Customs RegulationsIn his Budget statement on 22 April 2009the Chancellor announced that from6 April 20<strong>11</strong> higher rate pensions tax relieffor individuals with an annual income of£150,000 or more would be tapered awayso that for those earning over £180,000tax relief would be worth 20 per cent.Further changes were announced inthe Pre-Budget Report statement on9 December 2009 where the Chancellorof the Exchequer announced that from6 April 20<strong>11</strong> the restriction of higher ratepensions tax relief would apply to thosewhose gross income was £150,000 andover. However, individuals with pre-taxincomes, excluding employer pensioncontributions, of less than £130,000 wouldbe unaffected. These provisions wereincluded in the Finance Act <strong>2010</strong>.In the June <strong>2010</strong> Emergency Budget,the Government announced that it wishedto consider the reform of pensions tax reliefas it had reservations about the approachadopted by the previous administrationand this resulted in the following revisedarrangements from April 20<strong>11</strong>:Lifetime AllowanceThe lifetime allowance (LTA) is the limit onthe total value of pension benefits you candraw at retirement without incurring a penaltax charge. The LTA is currently £1.8M butthe Government is proposing to reduce thisto £1.5M from April 2012. Within the LocalGovernment Pension Scheme (LGPS) thisreduction is only likely to impact on very highearners who have a large number of years’membership. The Government is looking atproviding some measure of protection forthose people who have made decisionsbased upon the current LTA limit. LTA usageis measured by multiplying the pensionby a factor of 20 and adding to it anylump sum taken together with thevalue of any Additional VoluntaryContribution (AVC) fund.Annual AllowanceAs its name implies the Annual Allowance(AA) is a limit that applies to the increasein pension benefits from one year to thenext. The current AA had a limit of £255,000and again within the LGPS was only likelyto impact upon high earners who had asignificant pay increase. The new proposalsreduce the AA to £50,000 with effect fromApril 20<strong>11</strong> and change the method forvaluing pension benefits against the newlimit. From April 20<strong>11</strong> the increase in pensionbenefits is calculated by comparing yourpension benefits adjusted by inflation at thestart of what is referred to as the PensionInput Period (PIP) with their value at the endof the PIP. Within the LGPS the PIP is definedas running from 1st April to 31st March.Members will be able to carry forwardany unused Annual Allowancefrom the previous 3 years.A fact sheet with further informationon the new provisions is available onthe Fund website or on request.Figure 5.Service Standards CharterResults of performance againsttarget are shown below:-TargetWithin target %Within target 7 days%971 Payment of retirement benefits100% 1002 Payment of monthly pensions7 days 1003 Payment of Transfer Values10 days 984 Provision of inward transfer quotes22 days5 Notification of deferred benefits10 days 996 Provide valuation in divorce cases10 days 807 Respond to members’ enquiries(Details given in respect of 12 monthperiod to 31 March 20<strong>11</strong>)9938 Scheme Administration Report www.merseysidepensionfund.org.uk