2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

2010/11 (PDF, 48 Pages, 1013KB) - THE LOCAL GOVERNMENT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

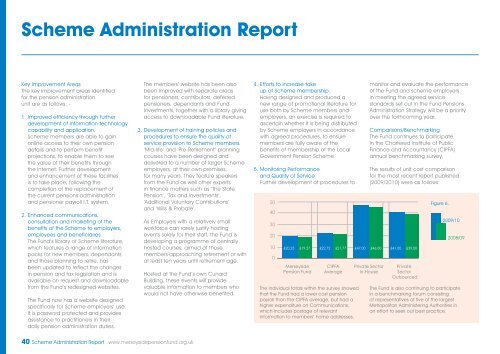

Scheme Administration ReportKey Improvement AreasThe key improvement areas identifiedfor the pension administrationunit are as follows: -1. Improved efficiency through furtherdevelopment of information technologycapability and application.Scheme members are able to gainonline access to their own pensiondetails and to perform benefitprojections, to enable them to seethe value of their benefits throughthe internet. Further developmentand enhancement of these facilitiesis to take place, following thecompletion of the replacement ofthe current pensions administrationand pensioner payroll I.T. system.2. Enhanced communications,consultation and marketing of thebenefits of the Scheme to employers,employees and beneficiaries.The Fund’s library of Scheme literature,which features a range of informationpacks for new members, dependantsand those planning to retire, hasbeen updated to reflect the changesin pension and tax legislation and isavailable on request and downloadablefrom the Fund’s redesigned websites.The Fund now has a website designedspecifically for Scheme employers’ use.It is password protected and providesassistance to practitioners in theirdaily pension administration duties.The members’ website has been alsobeen improved with separate areasfor pensioners, contributors, deferredpensioners, dependants and FundInvestments, together with a library givingaccess to downloadable Fund literature.3. Development of training policies andprocedures to ensure the quality ofservice provision to Scheme members.’Mid-life’ and ‘Pre-Retirement’ planningcourses have been designed anddelivered to a number of larger Schemeemployers, at their own premises,for many years. They feature speakersfrom the Fund as well other expertsin finance matters such as ‘The StatePension’, ‘Tax and Investments’,‘Additional Voluntary Contributions’and ‘Wills & Probate’.As Employers with a relatively smallworkforce can rarely justify hostingevents solely for their staff, the Fund isdeveloping a programme of centrallyhosted courses, aimed at thosemembers approaching retirement or withat least ten years until retirement age.Hosted at the Fund’s own CunardBuilding, these events will providevaluable information to members whowould not have otherwise benefited.4. Efforts to increase takeup of Scheme membership.Having designed and produced anew range of promotional literature foruse both by Scheme members andemployers, an exercise is required toascertain whether it is being distributedby Scheme employers in accordancewith agreed procedures, to ensuremembers are fully aware of thebenefits of membership of the LocalGovernment Pension Scheme.5. Monitoring Performanceand Quality of ServiceFurther development of procedures to504030<strong>2010</strong>0monitor and evaluate the performanceof the Fund and scheme employersin meeting the agreed servicestandards set out in the Fund PensionsAdministration Strategy will be a priorityover the forthcoming year.Comparisons/BenchmarkingThe Fund continues to participatein the Chartered Institute of PublicFinance and Accountancy (CIPFA)annual benchmarking survey.The results of unit cost comparisonfor the most recent report published(2009/<strong>2010</strong>) were as follows:£20.25 £19.27 £22.72 £21.77 £47.00 £46.00 £41.00 £39.00MerseysidePension FundCIPFAAverageThe individual totals within the survey showedthat the Fund had a lower cost pensionpayroll than the CIPFA average, but had ahigher expenditure on Communications,which includes postage of relevantinformation to members’ home addresses.Private Sectorin-HousePrivateSectorOutsourcedFigure 6.2009/102008/09The Fund is also continuing to participatein a benchmarking forum consistingof representatives of five of the largestMetropolitan Administering Authorities inan effort to seek out best practice.40 Scheme Administration Report www.merseysidepensionfund.org.uk