Department of Transport Annual Report 2010 - 2011

Department of Transport Annual Report 2010 - 2011

Department of Transport Annual Report 2010 - 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

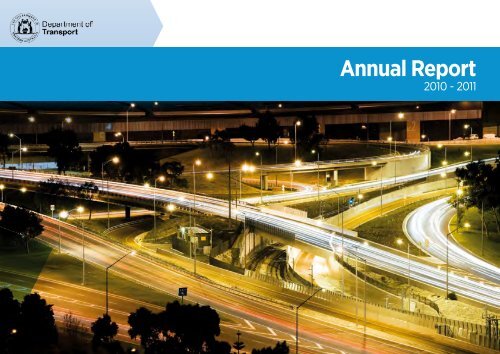

<strong>Annual</strong> <strong>Report</strong><br />

<strong>2010</strong> - <strong>2011</strong>

<strong>Department</strong> <strong>of</strong> <strong>Transport</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2010</strong>-11<br />

version 2<br />

Our purpose<br />

To provide safe, accessible, sustainable and efficient transport services and systems<br />

which promote economic prosperity and enhance the lifestyles <strong>of</strong> all Western<br />

Australians.<br />

Our vision<br />

To be recognised for excellence in customer service in providing world class<br />

transport services and solutions.<br />

Our services<br />

The <strong>Department</strong> benefits the community in many ways through planning, development<br />

and regulation <strong>of</strong> transport operations and systems; licensing services; strategic<br />

transport policy and integrated transport planning.<br />

Our goals<br />

To provide effective and efficient transport systems and services to the economy <strong>of</strong><br />

Western Australia, and assist the well-being <strong>of</strong> all Western Australians.<br />

We will do this by:<br />

• Focussing on strategic transport policy and planning, regulation and operational<br />

transport functions across the range <strong>of</strong> public and commercial transport systems<br />

that service Western Australia;<br />

• Connecting people with goods and services through an intricate system <strong>of</strong><br />

roads, railways, airports, ports and waterways and educating and regulating to<br />

keep them safe within those networks; and<br />

• Planning, co-ordinating and prioritising the transport related infrastructure that<br />

allows our economy to grow.<br />

Our outcomes<br />

• <strong>Transport</strong> system and services development, planning, operation and regulation.<br />

• Motor vehicle and driver licensing services.<br />

• Strategic transport policy.<br />

• Integrated transport planning.<br />

Our values<br />

Teamwork<br />

We work together in the spirit <strong>of</strong> cooperation.<br />

Respect<br />

We welcome and accept differences and commonalities.<br />

Passion<br />

We embrace work with enthusiasm and energy.<br />

Learning and innovation<br />

We grow and seek better solutions.<br />

Commitment and pride<br />

We strive for excellence and do our best.<br />

Honesty and integrity<br />

We act ethically and fairly.<br />

Leadership<br />

We inspire and guide others.<br />

Understanding<br />

We listen and respond appropriately.

Contents<br />

Overview <strong>of</strong> agency ii<br />

Statement <strong>of</strong> compliance with the Financial Management Act 2006 ii<br />

Director General’s foreword 1<br />

Executive summary 2<br />

Financial summary 4<br />

Organisational structure 6<br />

Legislation priorities 8<br />

Outcome based management framework 10<br />

Goal 1: Outcome based service delivery 10<br />

Goal 2: State building – Major projects 12<br />

Agency performance 14<br />

Significant issues impacting the agency 30<br />

Financial targets 31<br />

Government policy requirements 32<br />

Policy statement 32<br />

Occupational health safety and wellbeing key performance indicators 32<br />

Disability access and inclusion plan outcomes 34<br />

Workers compensation and rehabilitation 35<br />

Substantive equality 36<br />

Peer support program 36<br />

Employee assistance 36<br />

Employment and industrial relations 37<br />

Internal audit reviews 37<br />

Audit and risk management committee (ARMC) 38<br />

Risk management 38<br />

Freedom <strong>of</strong> information 39<br />

Other legal requirements 40<br />

Advertising 40<br />

Better recordkeeping 40<br />

Governance disclosure 41<br />

Ministerial directives 41<br />

Financial disclosures 41<br />

Major capital projects 41<br />

Financial statements 42<br />

Auditor General independent audit opinion 42<br />

Certification <strong>of</strong> financial statements 44<br />

Financial statements 45<br />

Key performance indicators 94<br />

Certification <strong>of</strong> key performance indicators 94<br />

Key performance indicators 94<br />

Office locations 110<br />

i

Overview <strong>of</strong> agency<br />

ii<br />

Statement <strong>of</strong> compliance with the Financial<br />

Management Act 2006<br />

For the year ended 30 June <strong>2011</strong><br />

To the Minister<br />

Hon Troy Buswell BEc MLA<br />

Minister for <strong>Transport</strong><br />

In accordance with Section 61 <strong>of</strong> the Financial Management<br />

Act 2006, I hereby submit for your information and<br />

presentation to Parliament the <strong>Department</strong> <strong>of</strong> <strong>Transport</strong>’s<br />

annual report for the financial year ended 30 June <strong>2011</strong>.<br />

The report has been prepared in accordance with the<br />

provisions <strong>of</strong> the Financial Management Act 2006 and fulfils<br />

the <strong>Department</strong> <strong>of</strong> <strong>Transport</strong>’s reporting obligations under<br />

the Public Sector Management Act 1994, the Disability<br />

Services Act 1993 and the Electoral Act 1907.<br />

Reece Waldock<br />

Director General - <strong>Transport</strong><br />

Hon Troy Buswell BEc MLA<br />

Minister for <strong>Transport</strong>

Director General’s foreword<br />

The <strong>Department</strong> <strong>of</strong> <strong>Transport</strong> (DoT) has made great strides towards becoming the<br />

leader in transport in Western Australia over the past two years.<br />

DoT’s Policy, Planning and Investment division has been extremely active and some<br />

<strong>of</strong> the projects it has been engaged in include the High Street upgrade in Fremantle,<br />

the Public <strong>Transport</strong> Network Plan, upgrades to the State’s grain freight network and<br />

securing the future <strong>of</strong> Fremantle Ports’ inner harbour.<br />

Similarly DoT’s operations division, <strong>Transport</strong> Services, also delivered some good<br />

outcomes in the past year.<br />

The division oversaw construction <strong>of</strong> a multi-million dollar public boat-launching<br />

facility at Port Kennedy, commencement <strong>of</strong> works at the Milligan Street Secure Taxi<br />

Rank and the $1.9 million demolition and reconstruction <strong>of</strong> D Jetty at Hillarys Boat<br />

Harbour.<br />

Aside from those things DoT also:<br />

• Successfully introduced a new demerit point system for novice (L and P plate)<br />

drivers.<br />

• Secured $7.74 million for the replacement <strong>of</strong> taxi camera units to make taxi travel<br />

safer.<br />

• Facilitated a record $8.4 million in regional airports funding.<br />

The <strong>Transport</strong> portfolio reached a significant milestone on 3 May <strong>2011</strong>, marking 12<br />

months since I took responsibility for the State’s three transport agencies – DoT,<br />

Public <strong>Transport</strong> Authority (PTA) and Main Roads WA (MRWA).<br />

In the past year I have taken a holistic view <strong>of</strong> the key role that transport plays in<br />

our State’s continued economic growth, and especially <strong>of</strong> the considerable benefits<br />

<strong>of</strong>fered by a cohesive, integrated approach to the planning, investment and operation<br />

<strong>of</strong> WA’s transport system.<br />

Together with the Minister for <strong>Transport</strong>, we are setting clear priorities and investing in<br />

our transport system, while planning for the next generation <strong>of</strong> transport users.<br />

In a year <strong>of</strong> changing priorities, the <strong>Transport</strong> portfolio has overcome challenges and<br />

accomplished significant goals, while demonstrating an integrated model that acts as<br />

a benchmark for other Government agencies.<br />

The formal appointment <strong>of</strong> Mark Burgess as Managing Director PTA and Menno<br />

Henneveld as Managing Director MRWA further strengthens the position <strong>of</strong> those<br />

two agencies as leaders in public transport and roads delivery and management.<br />

As Director General <strong>of</strong> the <strong>Transport</strong> portfolio, it is a<br />

privilege to lead such a strong team and I commend the<br />

many teams and individuals in DoT, PTA and MRWA for<br />

their efforts during <strong>2010</strong>-11.<br />

Reece Waldock<br />

Director General - <strong>Transport</strong><br />

Reece Waldock<br />

Director General, <strong>Transport</strong><br />

1

Executive summary<br />

The <strong>Department</strong> <strong>of</strong> <strong>Transport</strong> (DoT) made major progress last year towards its vision <strong>of</strong><br />

being a leader in providing world-class transport services and solutions.<br />

This executive summary outlines some <strong>of</strong> the major achievements and milestones met<br />

by DoT during the <strong>2010</strong>-11 financial year.<br />

Driver and Vehicles Services (DVS, formerly known as Licensing) has continued to adapt<br />

and improve its business through use <strong>of</strong> new technologies.<br />

A major upgrade to the customer contact centre’s telecommunications systems and<br />

various other reform projects were completed in <strong>2010</strong>-11.<br />

The telecommunications system improvements provide customers with greater flexibility<br />

to make enquiries and payments using voice recognition, and in March <strong>2011</strong> the call<br />

centre achieved its highest service level in more than seven years.<br />

BPOINT, an internet and telephone credit card payment system, was introduced in<br />

December <strong>2010</strong> for the payment <strong>of</strong> traffic infringements, and provides customers with<br />

the ability to pay by credit card at any time.<br />

2<br />

Self-service web kiosks were installed in all nine metropolitan DVS centres to reduce the<br />

number <strong>of</strong> people waiting to be served by customer service <strong>of</strong>ficers.<br />

A new graduated demerit point system for novice drivers was introduced in <strong>2010</strong>-11. This<br />

initiative, which reduced the number <strong>of</strong> demerit points available to learner and P-plate<br />

drivers, was the result <strong>of</strong> recommendations from the Road Safety Council regarding the<br />

high number <strong>of</strong> novice drivers involved in road crashes.<br />

The DoT website was enhanced in <strong>2010</strong>-11, bolstering self-service initiatives such as<br />

demerit points enquiries, the optional plates enquiry tool, driver licence status, vehicle<br />

licence enquiry, account details enquiry and the introduction <strong>of</strong> smart forms.<br />

In the regions, a landmark agreement was forged between DoT and the Meekatharra<br />

Community Resource Centre to provide driver and vehicle licensing services to people<br />

in the Meekatharra area. This marked the first time a not-for-pr<strong>of</strong>it organisation was<br />

engaged to provide online licensing services.<br />

DVS business once again grew in <strong>2010</strong>-11, and approximately $1.6 billion was collected<br />

through fees and charges and 6.2 million transactions were processed.<br />

Driver and Vehicle Services: Customer receiving new plates

In the Passenger Services Business Unit (PSBU), DoT developed a new Taxi Camera<br />

Surveillance Unit (TCSU) standard and secured $7.7 million to fund camera upgrades in<br />

all metropolitan taxis.<br />

During the <strong>2010</strong>-11 financial year DoT approved 130 peak period, 58 restricted area and<br />

30 conventional taxi lease plates for release to meet increasing demand.<br />

DoT also started work on the Taxi Action Plan (TAP), which aims to achieve the State<br />

Government’s objective to improve metropolitan taxi services, specifically in the areas<br />

<strong>of</strong> availability, safety and standards.<br />

As part <strong>of</strong> the TAP, DoT has recruited additional staff and purchased new vehicles to<br />

improve taxi compliance.<br />

Coastal areas were again a focus for DoT. The construction <strong>of</strong> a land-backed wharf at<br />

the Kalbarri Maritime Facility was completed to meet the growing demands <strong>of</strong> the local<br />

fishing and charter boat industries.<br />

At Woodman Point, DoT upgraded the parking facilities to a total <strong>of</strong> 300 car and boat<br />

trailer bays, costing $1.25 million.<br />

In April <strong>2011</strong> work was completed on the latest stage <strong>of</strong> a major program to replace<br />

jetties at Hillarys Boat Harbour. The $1.9 million demolition and reconstruction <strong>of</strong> D<br />

Jetty delivered a modern floating pen system with increased capacity and improved<br />

safety.<br />

A $10 million upgrade at the Port <strong>of</strong> Wyndham started in <strong>2010</strong>-11 and is scheduled for<br />

completion at the end <strong>of</strong> <strong>2011</strong>. The works will allow larger vessels to access the port,<br />

providing a strategic transport link for the east Kimberley region, which services the<br />

mining, cattle and tourism industries.<br />

DoT also continued its work in the promotion <strong>of</strong> safe boating throughout WA.<br />

The Marine Education Boatshed was a finalist in the <strong>2011</strong> WA Outdoor Recreation<br />

Industry Awards for its successful Seatrek Program, which provides teenagers with<br />

the skills to undertake week long sailing or powerboat voyages. The program is just<br />

one <strong>of</strong> the many exciting marine education experiences boatshed staff delivered to<br />

9,235 primary and high school students in <strong>2010</strong>-11.<br />

The number <strong>of</strong> Recreational Skipper’s Tickets issued to boaters also grew in <strong>2010</strong>-11<br />

with 15,967 people joining the 141,000 already qualified, strongly reinforcing the success<br />

<strong>of</strong> the marine safety initiative.<br />

Marine Officer verifying current Recreational Skipper’s Ticket<br />

3

Financial summary<br />

In <strong>2010</strong>-11, the DoT recorded a net cost <strong>of</strong> services <strong>of</strong> $125.09 million. Expenditure<br />

on ordinary activities totalled $308.14 million.<br />

The DoT provided a highly diverse range <strong>of</strong> products and services to its numerous<br />

stakeholders, clients and customers, through:<br />

• <strong>Transport</strong> system planning and regulation;<br />

• Motor vehicle registration and driver licensing services;<br />

• Strategic transport policy; and<br />

• Integrated transport planning.<br />

4<br />

Expenditure by key activities<br />

$308.14 million<br />

151,063<br />

10,621<br />

13,316<br />

133,138<br />

<strong>Transport</strong> system planning<br />

and regulation<br />

Motor vehicle registration and<br />

driver licensing services<br />

Strategic <strong>Transport</strong> Policy<br />

Integrated <strong>Transport</strong> Planning<br />

Operating expenses by category<br />

$308.14 million<br />

8,605<br />

11,120<br />

73,534<br />

96,976<br />

47<br />

8,179<br />

As the graph illustrates, the major expense categories were<br />

• Employee expenses (35.6%)<br />

• Supplies and services (31.5%)<br />

• Grants and subsidies (23.9%)<br />

109,676<br />

Employee expenses<br />

Supplies and services<br />

Depreciation and amortisation<br />

expense<br />

Accommodation expenses<br />

Grants and subsidies<br />

Loss on Disposal <strong>of</strong> Non-Current<br />

Assets<br />

Other expenses from ordinary<br />

activites

1,815<br />

23,241<br />

Income by category<br />

$183.04 million<br />

38,278<br />

231<br />

Operating revenues <strong>of</strong> $183.04 million were raised in <strong>2010</strong>-11. The revenue was<br />

derived from a range <strong>of</strong> services including:<br />

• Boat registrations;<br />

• Small boat harbour fees;<br />

• Motor vehicle and driver licences; and<br />

• Perth parking fees.<br />

The accompanying chart shows the distribution by the main revenue categories.<br />

Administered revenues<br />

$1.57 billion<br />

532,754<br />

343,017<br />

7,667 40,424<br />

73,262<br />

119,479<br />

522,304<br />

6,856<br />

44,985<br />

User charges and fees<br />

Sales<br />

Grants and subsidies<br />

Interest Revenues<br />

Other revenues<br />

Motor drivers’ licences<br />

Motor vehicle registrations<br />

Plate and transfer infringements<br />

Recording fees<br />

Speed and red light infringement<br />

fines<br />

Stamp duty<br />

Third party motor vehicle<br />

insurance premiums<br />

Other<br />

The DoT also administered functions on behalf <strong>of</strong> the <strong>Department</strong> <strong>of</strong> Treasury and<br />

Finance and other Government agencies. The administered revenue from these<br />

functions totalled $1.57 billion in <strong>2010</strong>-11.<br />

Assets under management<br />

$329.73 million<br />

15,721<br />

119,227<br />

41,849<br />

152,937<br />

The DoT managed a diverse asset base totalling $329.73 million in the provision <strong>of</strong><br />

services.<br />

The accompanying chart shows the distribution by asset class.<br />

Property, plant, equipment<br />

and vessels<br />

Infrastructure<br />

Intangible Assets<br />

Construction in Progress<br />

The DoT’s equity at 30 June <strong>2011</strong> was $503.70 million, which comprises contributed<br />

equity ($431.48 million), reserves ($16.31 million) and accumulated surplus<br />

($55.91 million).<br />

Funding for the operations <strong>of</strong> the DoT was sourced from revenue from Government<br />

<strong>of</strong> $149.14 million (primarily appropriations $143.51 million) and retained revenues <strong>of</strong><br />

$183.04 million (as shown above under income by category).<br />

5

Organisational structure<br />

<strong>Transport</strong> Portfolio<br />

6<br />

Deputy Director General<br />

Policy Planning and Investment<br />

Sue McCarrey<br />

<strong>Department</strong> <strong>of</strong> <strong>Transport</strong><br />

Managing Director<br />

<strong>Transport</strong> Services<br />

Nina Lyhne<br />

Director – O�ce <strong>of</strong><br />

Director General<br />

Richard Barrett<br />

Managing Director - MRWA<br />

Menno Henneveld<br />

Main Roads WA<br />

Minister<br />

for <strong>Transport</strong><br />

Director General -<br />

<strong>Transport</strong><br />

Reece Waldock<br />

Managing Director - PTA<br />

Mark Burgess<br />

Public <strong>Transport</strong> Authority<br />

Port Authority<br />

Boards<br />

Broome<br />

Port Authority<br />

Port Hedland<br />

Port Authority<br />

Dampier<br />

Port Authority<br />

Geraldton<br />

Port Authority<br />

Fremantle<br />

Port Authority<br />

Bunbury<br />

Port Authority<br />

Albany<br />

Port Authority<br />

Esperance<br />

Port Authority<br />

Port Authorities

<strong>Department</strong> <strong>of</strong> <strong>Transport</strong><br />

Executive Director<br />

- <strong>Transport</strong> Policy<br />

& Systems<br />

Ben Harvey (A)<br />

• Strategic<br />

<strong>Transport</strong> Policy<br />

• Freight Policy<br />

• Maritime &<br />

Aviation Policy<br />

• Sustainable &<br />

Active <strong>Transport</strong><br />

Policy<br />

• Freight &<br />

Logistics Council<br />

Deputy Director General -<br />

Policy, Planning & Investment<br />

Sue McCarrey<br />

Executive Director<br />

- Integrated<br />

<strong>Transport</strong> Planning<br />

Steve Beyer (A)<br />

• Strategic Network<br />

Development<br />

• People Mobility<br />

Network<br />

Development<br />

• Travel Demand<br />

Management<br />

Executive Director<br />

- Major <strong>Transport</strong><br />

Projects<br />

Gary Player (A)<br />

• Major <strong>Transport</strong><br />

Project<br />

Development<br />

• Lead Agency<br />

Framework<br />

• Oakajee<br />

Infrastructure<br />

Project<br />

• Grain Network<br />

Project<br />

• Esperance Clean<br />

Up<br />

Executive Director<br />

- Investment &<br />

Finance Coordination<br />

Peter King (A)<br />

• Chief Financial<br />

O�cer<br />

• Portfolio<br />

Strategic<br />

Investment<br />

Coordination<br />

• Financial Services<br />

• Budget Planning<br />

• Review & Audit<br />

Director, O�ce <strong>of</strong> the<br />

Director General<br />

Richard Barrett<br />

• Portfolio<br />

Coordination<br />

• Communications<br />

• Ministerial and<br />

Government<br />

Business<br />

• Governance and<br />

Strategic Planning<br />

Executive Director<br />

– People and<br />

Organisational<br />

Development<br />

Fiona Knobel<br />

• Human Resources<br />

• Organisational<br />

Development<br />

• Occupational<br />

Health & Safety<br />

<strong>Department</strong>al Services<br />

Minister<br />

for <strong>Transport</strong><br />

Director General - <strong>Transport</strong><br />

Reece Waldock<br />

Executive Director<br />

– Corporate Support<br />

Bill Ielati (A)<br />

• Legal & Legislative<br />

Services<br />

• Accommodation<br />

Services<br />

• Procurement<br />

Services<br />

• Information<br />

Management<br />

• Strategic<br />

Information<br />

Technology<br />

Planning<br />

• Information<br />

Technology<br />

Support<br />

General Manager –<br />

Driver and Vehicle<br />

Services<br />

Michael D’souza<br />

• Licensing Services<br />

General Manager<br />

- Regional Services<br />

Peter Ollerenshaw<br />

• Regional Services<br />

Managing Director<br />

<strong>Transport</strong> Services<br />

Nina Lyhne<br />

General Manager<br />

- Coastal<br />

Infrastructure<br />

Steve Jenkins (A)<br />

• Coastal<br />

Infrastructure<br />

General Manager<br />

- Marine Safety<br />

David Harrod<br />

• Marine Safety<br />

General Manager<br />

- O�ce <strong>of</strong> Rail Safety<br />

Rob Burrows<br />

• Rail Safety<br />

July <strong>2011</strong><br />

(A) Denotes: Acting<br />

General Manager<br />

- Passenger Services<br />

Peter Ryan<br />

• Passenger<br />

Services<br />

7

Legislation priorities<br />

On behalf <strong>of</strong> the Minister for <strong>Transport</strong> during <strong>2010</strong>-11 the <strong>Department</strong> <strong>of</strong><br />

<strong>Transport</strong> administered the following Acts:<br />

• Harbours and Jetties Act 1928<br />

• Jetties Act 1926<br />

• Lights (Navigation Protection) Act 1938<br />

• Marine and Harbours Act 1981<br />

• Marine Navigational Aids Act 1973<br />

• Maritime Fees and Charges (Taxing) Act 1999<br />

• Motor Vehicle Drivers Instructors Act 1963<br />

• Owner-Drivers (Contracts and Disputes) Act 2007<br />

• Perth Parking Management Act 1999<br />

• Perth Parking Management (Consequential Provisions) Act 1999<br />

• Perth Parking Management (Taxing) Act 1999<br />

• Pilots’ Limitation <strong>of</strong> Liability Act 1962<br />

• Pollution <strong>of</strong> Waters By Oil and Noxious Substances Act 1987<br />

• Port Authorities Act 1999<br />

• Rail Safety Act <strong>2010</strong><br />

• Railway Discontinuance Act 2006<br />

• Railway Discontinuance Act (No 2) 2006<br />

8<br />

• Railway (Butler to Brighton) Act <strong>2010</strong><br />

• Railway (Tilley to Karara) Act <strong>2010</strong><br />

• Road Traffic Act 1974<br />

• Road Traffic (Administration) Act 2008<br />

• Road Traffic Amendment (Dangerous Driving) Act 2004<br />

• Road Traffic (Authorisation to Drive) Act 2008<br />

• Road Traffic (Vehicle Licensing) (Taxing) Act 2001<br />

• Road Traffic (Vehicles) (Taxing) Act 2008<br />

• Sea Carriage <strong>of</strong> Goods Act 1909<br />

• Shipping and Pilotage Act 1967<br />

• Taxi Act 1994<br />

• Trans-Continental Railway Act 1911<br />

• <strong>Transport</strong> Co-ordination Act 1966<br />

• Western Australian Marine Act 1982<br />

• Western Australian Marine (Sea Dumping) Act 1981<br />

• Wire and Wire Netting Act 1926<br />

Source: Western Australian Government Gazette No 1, 4 January <strong>2011</strong>

Other legislation and regulations affecting the functions and operation <strong>of</strong> the<br />

<strong>Department</strong> <strong>of</strong> <strong>Transport</strong> include:<br />

• State Records Act 2000<br />

• State Records (Consequential Provisions) Act 2000<br />

• State Trading Concerns Act 1916<br />

• Criminal Code 1913<br />

• Electronic Transactions Act 2003<br />

• Evidence Act 1906<br />

• Financial Management Act 2006<br />

• Freedom <strong>of</strong> Information Act 1992<br />

• Limitation Act 2005<br />

• Public Sector Management Act 1994<br />

• Disability Services Act 1993<br />

• Equal Opportunity Act 1984<br />

• Industrial Relations Act 1979<br />

• Interpretation Act 1984<br />

• Library Board <strong>of</strong> Western Australia Act 1951<br />

• Minimum Conditions <strong>of</strong> Employment Act 1993<br />

• Native Title Act (Commonwealth) 1993<br />

• Occupational Safety and Health Act 1984<br />

• Royal Commission (Custody <strong>of</strong> Records) Act 1992<br />

• State Supply Commission Act 1991<br />

9

Outcome based management framework<br />

Government goals<br />

1. Outcome based service<br />

delivery<br />

Greater focus on achieving<br />

results in key service delivery<br />

areas for the benefit <strong>of</strong> all<br />

Western Australians.<br />

2. State building - Major<br />

projects<br />

Building strategic infrastructure<br />

that will create jobs and<br />

underpin Western Australia’s<br />

long-term economic<br />

development.<br />

10<br />

<strong>Department</strong>al desired<br />

outcomes<br />

1. An accessible and safe<br />

transport system.<br />

2. Vehicles and road users<br />

that meet established<br />

vehicle standards and driver<br />

competencies.<br />

3. Integrated transport<br />

systems that facilitate<br />

economic development.<br />

<strong>Department</strong>al services<br />

1. <strong>Transport</strong> system and<br />

services development,<br />

planning, operation and<br />

regulation.<br />

2. Motor vehicle and driver<br />

licensing services.<br />

3. Strategic transport policy.<br />

4. Integrated transport<br />

planning.<br />

Goal 1 - Outcome based service delivery<br />

Greater focus on achieving results in key service delivery areas for the benefit <strong>of</strong> all<br />

Western Australians.<br />

Outcomes and key effectiveness indicators for Goal 1<br />

Outcome 1: An accessible and safe transport system<br />

Key effectiveness<br />

<strong>2010</strong>-11 <strong>2010</strong>-11<br />

Reasons for significant variance<br />

indicators<br />

target actual<br />

Percentage <strong>of</strong> standard<br />

metropolitan (non multipurpose)<br />

taxi jobs not covered.<br />

Percentage by which the<br />

waiting time standard for<br />

metropolitan area taxis is met.<br />

Percentage <strong>of</strong> time maritime<br />

infrastructure is fit for purpose<br />

when required.<br />

Percentage <strong>of</strong> regional airports<br />

receiving regular public<br />

transport air services.<br />

Rate <strong>of</strong> reported incidents<br />

(accidents) on the water<br />

per 100 commercial vessels<br />

surveyed under the Western<br />

Australian Marine Act 1982.<br />

Rate <strong>of</strong> reported incidents<br />

(accidents) on the water per<br />

10,000 registered recreational<br />

vessels.<br />

Rate <strong>of</strong> serious rail accidents<br />

per million train kilometres.<br />

1.00% 1.60%<br />

90.00% 91.90%<br />

99.65% 99.73%<br />

100% 96%<br />

4.00 5.95<br />

9.00 12.52<br />

3.30 2.38<br />

During the <strong>2010</strong>-11 year, the demand for<br />

metropolitan taxis increased by 9.4 per cent<br />

(peak and <strong>of</strong>f-peak period demand combined).<br />

As a consequence <strong>of</strong> this increase in demand,<br />

the percentage <strong>of</strong> jobs not covered also<br />

increased.<br />

The introduction <strong>of</strong> a penalty provision for nonreporting<br />

<strong>of</strong> incidents appears to have had an<br />

impact on incident numbers known to DoT. In<br />

turn, there has been a shift <strong>of</strong> fishing vessels<br />

now surveyed to operate as trading vessels in<br />

the North-West servicing the resource industry.<br />

Recreational vessel registrations increased by<br />

4.7 per cent and incident numbers increased<br />

by 38 per cent. It appears the introduction <strong>of</strong> a<br />

penalty provision for non-reporting <strong>of</strong> incidents<br />

has had a negative effect on this indicator.<br />

The reporting definition for Category A<br />

occurrences changed with the introduction <strong>of</strong><br />

the Rail Safety Act <strong>2010</strong> on 1 February <strong>2011</strong>.<br />

This resulted in 24 occurrences previously<br />

categorised as Category A to become Category<br />

B. Had all occurrences been classified<br />

according to the Rail Safety Act 1998 then the<br />

actual rate <strong>of</strong> serious accidents would be 2.998.

Outcome 2: Vehicles and road users that meet established vehicle<br />

standards and driver competencies<br />

Key effectiveness<br />

indicators<br />

Percentage <strong>of</strong> vehicle<br />

examinations completed in<br />

accordance with the Australian<br />

Design Rules assessed by<br />

independent audit.<br />

Percentage <strong>of</strong> driver licences<br />

issued that comply with the<br />

Graduated Driver Training and<br />

Licensing System assessed by<br />

independent audit.<br />

<strong>2010</strong>-11<br />

target<br />

<strong>2010</strong>-11<br />

actual<br />

100% 99.80%<br />

100% 84.50%<br />

Reasons for significant variance<br />

Records management practices associated<br />

with pro<strong>of</strong> <strong>of</strong> identity documentation and log<br />

books not meeting the mandatory 25 hours <strong>of</strong><br />

supervised driving are key contributors to the<br />

variance.<br />

Services and key efficiency indicators for Goal 1<br />

Service 1: <strong>Transport</strong> system and services development, planning, operation<br />

and regulation<br />

Key efficiency<br />

indicators<br />

Cost <strong>of</strong> regulation<br />

per taxi plate<br />

administered.<br />

Average cost per<br />

day per maritime<br />

infrastructure<br />

asset managed.<br />

Average survey<br />

cost per<br />

commercial vessel.<br />

Average cost per<br />

private recreational<br />

vessel registration.<br />

Cost to maintain<br />

marine pollution<br />

response<br />

preparedness per<br />

registered vessel.<br />

Average cost<br />

per household<br />

contacted under<br />

the ‘TravelSmart’<br />

scheme.<br />

<strong>2010</strong>-11<br />

target<br />

<strong>2010</strong>-11<br />

actual<br />

$4,135 $2,959<br />

$63.07 $58.28<br />

$3,210 $2,429<br />

$104.01 $113.26<br />

$29.08 $24.48<br />

$335.51 $182.42<br />

Reasons for significant variance<br />

This is the first year <strong>of</strong> reporting this key performance<br />

indicator (KPI) and further consideration has been<br />

given as to what costs constitute the regulation <strong>of</strong> the<br />

taxi industry. For example, costs more aligned with a<br />

customer service <strong>of</strong>ficer provision have been removed,<br />

as well as Taxi Industry Board expenditure (apart from<br />

board sitting fees). The changes have resulted in a<br />

decrease in the estimated cost <strong>of</strong> regulation per taxi<br />

plate administered.<br />

The variation between the <strong>2010</strong>-11 budget target<br />

and the <strong>2010</strong>-11 actual was due to lower staffing<br />

costs attributable to a lower than expected number<br />

<strong>of</strong> surveyed vessels and improved data collection for<br />

Regional Services and Corporate Support overhead<br />

costs resulting in a more accurate allocation <strong>of</strong> costs.<br />

The <strong>2010</strong>-11 actual is lower than the <strong>2010</strong>-11 budget<br />

due to the original estimate including additional<br />

costs <strong>of</strong> $250,000 for Oil Spill Mapping which did not<br />

eventuate.<br />

The method <strong>of</strong> calculation <strong>of</strong> the KPI has been<br />

changed to include only the nett cost to the State<br />

Government, excluding grants received during <strong>2010</strong>-11.<br />

The <strong>2010</strong>-11 actual is below the <strong>2010</strong>-11 budget target<br />

because the grant was secured after the KPI target<br />

was established and the program scale was doubled<br />

(from 5,000 to 10,000 households) at no extra cost.<br />

The cost effectiveness improved as a result <strong>of</strong> the<br />

grant income.<br />

11

Service 2: Motor vehicle and driver licensing services<br />

Key efficiency indicators<br />

Average cost per vehicle and<br />

driver transaction.<br />

Average cost per vehicle<br />

inspection.<br />

Average cost per driver<br />

assessment.<br />

Percentage <strong>of</strong> driver licence<br />

cards issued within 21 days<br />

<strong>of</strong> completed application.<br />

12<br />

<strong>2010</strong>-11<br />

target<br />

<strong>2010</strong>-11<br />

actual<br />

$17.57 $17.19<br />

$78.22 $81.22<br />

$66.25 $77.94<br />

99.00% 99.90%<br />

Reasons for significant variance<br />

Revised models have more accurately<br />

identified driver assessment costs<br />

associated with the regions that align directly<br />

to this measure.<br />

This along with a minor increase in the<br />

number <strong>of</strong> assessments undertaken for that<br />

period has resulted in a $11.69 increase per<br />

driver assessment compared to target.<br />

Goal 2 - State building – Major projects<br />

Building strategic infrastructure that will create jobs and underpin Western Australia’s<br />

long-term economic developement.<br />

Outcomes and key effectiveness indicators for Goal 2<br />

Outcome 3: Integrated transport systems that facilitate economic development<br />

Key effectiveness<br />

<strong>2010</strong>-11 <strong>2010</strong>-11<br />

Reasons for significant variance<br />

indicators<br />

target actual<br />

Percentage <strong>of</strong> containerised<br />

freight transported via rail in<br />

relation to total metropolitan<br />

container movements to and<br />

from Fremantle port.<br />

16.00% 11.50%<br />

The global economic downturn in trade has<br />

impacted significantly on rail volumes both<br />

through loss <strong>of</strong> certain trades and the intense<br />

competition from the road sector.

Services and key effectiveness indicators for Goal 2<br />

Service 3: Strategic transport policy<br />

Key efficiency indicators<br />

Average cost per policy hour<br />

for strategic transport policy<br />

development.<br />

<strong>2010</strong>-11<br />

target<br />

<strong>2010</strong>-11<br />

actual<br />

$118.25 $109.78<br />

Driver and Vehicle Services Centre<br />

Reasons for significant variance<br />

Service 4: Integrated transport planning<br />

Key efficiency indicators<br />

Average cost per planning<br />

hour for integrated transport<br />

planning development.<br />

<strong>2010</strong>-11<br />

target<br />

<strong>2010</strong>-11<br />

actual<br />

$121.05 $149.73<br />

Reasons for significant variance<br />

The variance reflects cost structures for multimodal<br />

planning activity and management <strong>of</strong><br />

the Perth Parking Fund (totalling $3.66 million)<br />

that were transferred to DoT during <strong>2010</strong>-11<br />

and not included in the budget target.<br />

Due to the split <strong>of</strong> DPI and the introduction<br />

<strong>of</strong> OSS, the <strong>2010</strong>-11 KPIs were remapped to<br />

include not only human resource costs (as<br />

was done in 2009-<strong>2010</strong>), but items such as<br />

consultancy fees and pr<strong>of</strong>essional services<br />

that are attributable to Integrated <strong>Transport</strong><br />

planning functions.<br />

13

Agency performance<br />

Government goals <strong>Department</strong>al desired<br />

outcomes<br />

1. Outcome based<br />

service delivery<br />

Greater focus on achieving<br />

results in key service delivery<br />

areas for the benefit <strong>of</strong> all<br />

Western Australians.<br />

2. State building –<br />

Major projects<br />

Building strategic<br />

infrastructure that will create<br />

jobs and underpin Western<br />

Australia’s long-term<br />

economic development.<br />

14<br />

1. An accessible and safe<br />

transport system.<br />

2. Vehicles and road users<br />

that meet established<br />

vehicle standards and driver<br />

competencies.<br />

3. Integrated transport systems<br />

that facilitate economic<br />

development.<br />

Passenger Services Compliance Officer with a taxi driver<br />

<strong>Department</strong>al services<br />

1. <strong>Transport</strong> system and<br />

services development,<br />

planning, operation and<br />

regulation.<br />

2. Motor vehicle and driver<br />

licensing services.<br />

3. Strategic transport policy<br />

4. Integrated transport planning<br />

<strong>Transport</strong> services<br />

Rail safety accreditations<br />

Twenty-nine rail transport operators are currently regulated by the Office <strong>of</strong> Rail<br />

Safety. An important addition was the accreditation <strong>of</strong> BHPB Iron Ore PL, which had<br />

previously been exempted from the Rail Safety Act <strong>2010</strong> and was being regulated<br />

under the Mines Safety and Inspection Act 1994.<br />

Taxi Action Plan<br />

The Taxi Action Plan (TAP) aims to achieve the State Government’s objective to<br />

improve metropolitan taxi services, specifically in the areas <strong>of</strong> availability, safety and<br />

standards.<br />

The TAP specifically targets strategies to improve taxi reliability through:<br />

• the release <strong>of</strong> additional taxi plates;<br />

• enhancements to taxi driver entry and training standards;<br />

• the introduction <strong>of</strong> mechanisms to manage non-compliant driver behaviour<br />

following entry to the industry;<br />

• initiatives to improve taxi driver and taxi vehicle identification;<br />

• an increased ‘on-road’ compliance presence; and<br />

• actions to address a number <strong>of</strong> other issues <strong>of</strong> importance to the taxi industry.

Milligan Street Secure Taxi Rank upgrade<br />

The Milligan Street Secure Taxi Rank upgrade is a joint initiative with the City <strong>of</strong><br />

Perth, designed to deliver safe and reliable transport and a safer Northbridge.<br />

The capital works, managed by the City <strong>of</strong> Perth, commenced in January <strong>2011</strong> and<br />

include changes to the road layout and the installation <strong>of</strong> lighting, CCTV and shelters<br />

to deliver a safer and more efficient taxi hub at Milligan Street. The upgrade will help<br />

minimise customer waiting times and reduce incidences <strong>of</strong> anti-social behaviour.<br />

The $1.87 million project is predominantly funded by Taxi Industry Development<br />

Account (TIDA), along with a contribution <strong>of</strong> $500,000 from the City <strong>of</strong> Perth.<br />

Taxi cameras<br />

The new Taxi Camera Surveillance Unit (TCSU) standard was approved on<br />

16 November <strong>2010</strong>. The new standard requires TCSUs to have an increased frame<br />

rate, with continuous recording and storage capacity <strong>of</strong> 288 hours. External cameras<br />

are also required to capture incidents that occur immediately outside the taxi. The<br />

Minister for <strong>Transport</strong> announced on 5 January <strong>2011</strong> that the State Government<br />

would undertake a TCSU replacement program over 30 months from 1 July <strong>2011</strong> to<br />

31 December 2013. A subsidy <strong>of</strong> up to 80 per cent <strong>of</strong> the cost <strong>of</strong> a new TCSU will be<br />

made available with funding from TIDA.<br />

Extensive preparatory work has been undertaken with new regulations gazetted,<br />

two new TCSU models approved and a third under consideration. From 1 July <strong>2011</strong><br />

all new taxis must comply with the requirement to have an approved TCSU installed<br />

and to prevent unauthorised tampering and downloading <strong>of</strong> the recorded material.<br />

Additional taxi plates<br />

During <strong>2010</strong>-11 DoT approved 130 peak period, 58 restricted area and 30 conventional<br />

taxi lease plates for release. Recent performance data had indicated that the taxi<br />

industry could not meet increasing demand and DoT is in the process <strong>of</strong> releasing<br />

the additional plates.<br />

Payment options<br />

For many years the Passenger Services Business Unit (PSBU) could only <strong>of</strong>fer the<br />

traditional payment options <strong>of</strong> cash or cheque to their clients. Following discussions<br />

with industry, PSBU worked with Driver and Vehicle Services (DVS) to provide new<br />

payment options.<br />

The new options were introduced in <strong>2010</strong>-11 and included the traditional options<br />

<strong>of</strong> cash and cheque, as well as the more favoured choices <strong>of</strong> EFTPOS and credit<br />

card, which could be taken at the PSBU counter or over the telephone. These new<br />

arrangements have been met with satisfaction from industry.<br />

Construction <strong>of</strong> a land-backed wharf at Kalbarri<br />

The construction <strong>of</strong> the land-backed wharf at the Kalbarri Maritime Facility has been<br />

completed. The new facility will meet the growing demands <strong>of</strong> the local fishing and<br />

charter boat industries.<br />

The wharf is located between the existing service jetty and boat pens, which will<br />

allow the local fishing fleet operators to directly load and unload consumables and<br />

catch, avoiding double handling and greatly improving efficiency and safety.<br />

Project planning and consultation occurred in conjunction with the Kalbarri<br />

Fishermen’s Association, Mid-West Development Commission, Shire <strong>of</strong> Northampton<br />

and the traditional land owners. Onsite construction <strong>of</strong> the facility was completed in<br />

June <strong>2011</strong> at a cost <strong>of</strong> $1.9 million.<br />

Kalbarri Maritime Facility<br />

15

Woodman Point Recreational Boating Precinct<br />

The Perth Recreational Boating Facility Study identified the Woodman Point<br />

Recreational Boating Precinct as a highly important site within the south metropolitan<br />

area to support the growth and future demand for boat launching, storage and a<br />

range <strong>of</strong> supplementary maritime service businesses.<br />

Four new public boat ramps built in 2008 brought the total to eight public and five<br />

private ramps, making Woodman Point the largest recreational boat launching facility<br />

in Western Australia. To cater for the increased patronage resulting from the new<br />

ramps, in May <strong>2010</strong> DoT opened upgraded parking facilities with a total <strong>of</strong> 300 car<br />

and boat trailer bays. The total cost <strong>of</strong> this project was $1.25 million.<br />

Funding has now been approved to upgrade the existing access road into the boat<br />

launching facility. This will include all existing and future services requirements along<br />

this section <strong>of</strong> road. Construction is planned to begin in 2012.<br />

Future planned improvements at Woodman Point include replacing the original four<br />

ramps with new structures, sealing the eastern parking area, constructing a new<br />

ablution block, building a new access way into the facility from Cockburn Road and<br />

lighting, landscaping and security improvements.<br />

Earthworks associated with the parking area construction also provided fill material<br />

for the adjacent land, bringing it to a level where it can be developed in the future as<br />

serviced lots that can be leased for marine related purposes.<br />

16<br />

Woodman Point Recreational Boating Precinct<br />

Recreational Boating Facilities Grant Scheme<br />

In June <strong>2011</strong> the Minister for <strong>Transport</strong> and the Minister for Regional Development<br />

and Lands announced that unprecedented funding <strong>of</strong> more than $8.93 million had<br />

been allocated in grants to successful applicants in Round 16 <strong>of</strong> the Recreational<br />

Boating Facilities Scheme (RBFS).<br />

The RBFS is directly funded from recreational boat registration fees and Royalties for<br />

Regions, and helps to improve recreational boating infrastructure by providing grants to<br />

eligible authorities throughout Western Australia.<br />

Each year the scheme <strong>of</strong>fers grants to assist planning and construction <strong>of</strong> public<br />

facilities for recreational boaters. Eligible projects include boat ramps, jetties,<br />

signage, moorings, lighting, trailer parking, toilets, universal access paths, design<br />

drawings, planning studies and fish cleaning facilities.<br />

Since its inception in 1998, the RBFS has allocated $20.1 million to 282 projects<br />

across Western Australia.<br />

Hillarys Boat Harbour development<br />

In April <strong>2011</strong> work was completed on the latest stage <strong>of</strong> a major program to replace<br />

jetties at Hillarys Boat Harbour. The $1.9 million demolition and reconstruction <strong>of</strong><br />

D Jetty delivered a new modern floating pen system with increased capacity and<br />

improved safety.<br />

As part <strong>of</strong> the ongoing pen replacement, contractors replaced the original 22 year old<br />

concrete and wood structure. The new system provided space for an additional four<br />

pens, catering for 20 metre vessels, bringing the number <strong>of</strong> vessels accommodated<br />

to 53.<br />

The work on D Jetty followed the construction <strong>of</strong> W-Z jetties to provide additional<br />

pens to meet growing demand in the metropolitan area.<br />

The $3.6 million construction project saw a total <strong>of</strong> 44 pens built <strong>of</strong> which 20 have<br />

been licensed and 24 made available for casual users and to accommodate the<br />

temporary relocation <strong>of</strong> vessels to allow future upgrades <strong>of</strong> pen facilities at Hillarys.<br />

Five <strong>of</strong> the pens constructed cater for the top end <strong>of</strong> the recreational market providing<br />

two 30 metre and three 35 metre pens. Pens <strong>of</strong> this size have not previously been<br />

available at Hillarys and there has been significant interest in these large pens, which<br />

provide boaters the opportunity to up-size their vessels.

New managing contractor agreement - relationship-based contracting<br />

DoT’s Coastal Infrastructure and Marine Safety business units are responsible for<br />

planning, designing, constructing and maintaining DoT’s maritime infrastructure,<br />

including navigational aids.<br />

Following a public tender process, DoT successfully awarded a new managing<br />

contractor agreement in November <strong>2010</strong>.<br />

This new long-term performance based agreement covers the delivery <strong>of</strong> asset<br />

management, maintenance and project delivery services with an estimated contract<br />

value <strong>of</strong> $88 million over the initial six year period.<br />

The new agreement will more effectively deliver services required for whole-<strong>of</strong>-life<br />

asset management and the delivery <strong>of</strong> maritime assets.<br />

Port <strong>of</strong> Wyndham upgrade<br />

Funding <strong>of</strong> $10 million to upgrade the Port <strong>of</strong> Wyndham has been made available<br />

through the Commonwealth Government under the East Kimberley Development<br />

Package.<br />

The port is a strategic transport link for the East Kimberley region servicing the<br />

mining, cattle and tourism industries, and will service future agricultural trade from<br />

the Ord Expansion Project.<br />

A strategic development plan is being produced in conjunction with industry, local<br />

government and State Government agencies. The plan will guide future development<br />

<strong>of</strong> the port including key infrastructure required to cater for future trade and port<br />

operations.<br />

Refurbishment <strong>of</strong> protective coatings to jetty piles is complete. Projects in progress<br />

include replacement <strong>of</strong> the jetty amenities building, construction <strong>of</strong> a new port<br />

amenities building, fendering to the jetty berth face, installation <strong>of</strong> a new cathodic<br />

protection system and reconstruction <strong>of</strong> the container hardstand pavement.<br />

Hydrographic surveying program<br />

DoT’s hydrographic survey crew carry out work across the State in support <strong>of</strong> its<br />

coastal management, dredging and facility management programs. Work is also<br />

performed for port authorities, other government agencies and local government.<br />

In <strong>2010</strong>-11 significant support was provided to the Fremantle Port Authority with<br />

its deepening and dredging program. This involved many surveys over dredged<br />

areas to ensure that project depths were achieved. A major survey was performed<br />

at Geraldton in collaboration with the Geraldton Port Authority and the University <strong>of</strong><br />

Western Australia’s centre for water research. Bathymetric and seismic data was<br />

collected as part <strong>of</strong> an extensive research project. Surveys were also carried out for<br />

the Bunbury and Broome port authorities.<br />

Another major achievement was the completion <strong>of</strong> a hydrographic survey in the<br />

northern reaches <strong>of</strong> Cambridge Gulf. This survey entailed significant logistic<br />

problems due to the remoteness <strong>of</strong> the area and technical difficulties due to huge<br />

tidal movements and lack <strong>of</strong> ground control. All issues were overcome, however,<br />

and the area was successfully surveyed. Two temporary tide gauges were installed<br />

and will remain in place for 12 months to collect a more complete record <strong>of</strong> the tidal<br />

constituents in the area.<br />

A new hydrographic survey vessel was delivered in November <strong>2010</strong>. The custom<br />

designed and built nine metre vessel provides excellent facilities for equipment and<br />

staff. The vessel itself delivers a more stable platform, which allows surveying to<br />

continue in previously unsuitable conditions.<br />

Geraldton Batavia Coast Marina<br />

Construction is complete on the refurbishment and expansion <strong>of</strong> boat trailer parking<br />

facilities at Geraldton Batavia Coast Marina in Geraldton. DoT has also awarded a<br />

$1.7 million contract to Engineered Water Systems to construct 42 new floating pens<br />

at the marina. This project is due for completion in July <strong>2011</strong>.<br />

17

New boat ramp at Carnarvon<br />

Work has commenced on a new boat ramp adjacent to the yacht club on Harbour<br />

Road in Carnarvon. The boat ramp consists <strong>of</strong> a two lane ramp complete with two<br />

holding jetties and parking for about 80 car and trailer units. These new additions<br />

will assist in the efficient use <strong>of</strong> the facility at peak times. The project has an<br />

estimated total cost <strong>of</strong> $3 million and will be carried out in three stages.<br />

The first stage marine works contract including ramp and jetties was completed<br />

in June <strong>2011</strong>. MRWA has been engaged to undertake the stage two car park<br />

construction works. The final stage <strong>of</strong> the project involves paving, installation<br />

<strong>of</strong> signage, construction <strong>of</strong> a toilet block and fish cleaning facility, which will be<br />

completed following completion <strong>of</strong> stage two. The project is funded from the<br />

Royalties for Regions program.<br />

Telecommunications technology<br />

The customer contact centres telecommunications systems upgrade project was<br />

completed in <strong>2010</strong>-11. The upgrades are providing customers with greater flexibility<br />

to make enquiries and payments to DVS. Upgrades include substantially increased<br />

capacity and a new interactive voice response system allowing for enquires utilising<br />

voice recognition. The current options also include demerit point information and<br />

associated <strong>of</strong>fences details, payment details and processing payments, all available<br />

at any time, without needing to speak to operators.<br />

Payment security<br />

BPOINT, an Internet and telephone credit card payment system, was introduced for<br />

the payment <strong>of</strong> traffic infringements. BPOINT provides customers with the ability to<br />

pay traffic infringements via credit card at any time and, in the first three months <strong>of</strong><br />

operation, more than $6 million was collected through 50,000 transactions using this<br />

payment channel.<br />

18<br />

Customer service<br />

DVS’s commitment to improve and refine customer service levels through enhanced<br />

frontline and online customer contact is illustrated by the following achievements.<br />

Improved workforce management in the DVS call centre as well as other initiatives to<br />

streamline services has produced the highest service level in more than seven years.<br />

This was achieved in the March <strong>2011</strong> quarter by meeting its target <strong>of</strong> 80 per cent <strong>of</strong><br />

calls answered by a consultant within 60 seconds. A marked improvement on the<br />

same period in the previous year when the average customer waited nearly seven<br />

minutes and only 13.1 per cent <strong>of</strong> calls were answered within 60 seconds.<br />

A new licensing service for Meekatharra residents was opened in March. DoT signed<br />

an agreement with the Meekatharra Community Resource Centre to become the<br />

new DoT agent to provide driver and vehicle licensing services for Meekatharra and<br />

surrounding areas. This landmark agreement not only provides a more convenient<br />

solution for everyone in the community but also allows for a not-for-pr<strong>of</strong>it organisation<br />

to provide online licensing services on behalf <strong>of</strong> DoT.<br />

A new enhanced website was rolled out in <strong>2010</strong>-11, with further improvements made<br />

throughout the year including self-service initiatives such as the online demerit<br />

points enquiry, designer plates enquiry tool, driver licence status, vehicle registration<br />

enquiry, account details enquiry and the introduction <strong>of</strong> smart forms. Further online<br />

initiatives giving customers greater choice will continue to be rolled out in <strong>2011</strong>-12.<br />

Self-service web kiosks were installed in all nine metropolitan DVS centres, with the<br />

aim to help reduce the number <strong>of</strong> people waiting to be served by a customer service<br />

<strong>of</strong>ficer. The kiosks encourage the use <strong>of</strong> online services by providing customers with<br />

the option <strong>of</strong> paying their account by credit card or making online enquiries such as<br />

checking vehicle or driver’s licence status without waiting to be served.<br />

A total <strong>of</strong> 16, 916 new Country Age Pensioner Fuel Cards (CAPFC) were issued<br />

in <strong>2010</strong>-11 as part <strong>of</strong> the expanded CAPFC scheme. The total number <strong>of</strong> cards<br />

currently issued is 43,187. Existing cards will expire 30 June <strong>2011</strong>, and on 1 July<br />

those existing cardholders who remain eligible will have their fuel card renewed for<br />

<strong>2011</strong>-12. Preparation for the renewal process has been completed and the cards will<br />

again carry a value <strong>of</strong> $500.

Driver safety<br />

The new novice driver graduated demerit point system was introduced in <strong>2010</strong>-11<br />

with a reduced number <strong>of</strong> demerit points available to learner and P-plate drivers. This<br />

initiative was a result <strong>of</strong> recommendations from the Road Safety Council and concerns<br />

about the high number <strong>of</strong> novice drivers involved in road crashes. Improving road user<br />

behaviour is critical in saving lives and preventing injuries. The reduction in the number<br />

<strong>of</strong> available demerit points is designed to encourage novice drivers to think about their<br />

driving habits and change their driving behaviour.<br />

A safe driving course has been developed by DoT to be delivered by WA Police<br />

or other suitably qualified facilitators. It is based on the defensive driving course<br />

used in the Ngaanyatjarra Lands pilot program. It <strong>of</strong>fers eligible customers aged 25<br />

and over, living in specified remote communities, an alternative to completing the 25<br />

hour supervised driving requirement <strong>of</strong> the Graduated Driver Training and Licensing<br />

System.<br />

Vehicle safety<br />

Commencing <strong>2010</strong>-11, certain vehicles are eligible for an exemption from an annual<br />

inspection for up to 39 months. Eligible vehicles are low risk factory-new rental<br />

industry vehicles. These vehicles are generally under a manufacturer’s warranty and<br />

are regularly maintained to comply with this warranty. In addition, these vehicles<br />

generally do not exceed 60,000 km over a three year period and most are situated<br />

at mine sites operating under stringent mine site regulations. This initiative involved<br />

close consultation with the Motor Trade Association, representing the rental vehicle<br />

industry, as well as drafting legislative changes to allow for the exemptions.<br />

Business efficiencies<br />

In <strong>2010</strong>-11 DVS formed a unique temporary partnership with the Motor Trade Association<br />

and RACWA that allowed authorised repairers belonging to either organisation to check<br />

hail damaged vehicles. The arrangement helped deliver more choice to consumers and<br />

allowed for the expedient processing <strong>of</strong> thousands <strong>of</strong> vehicles damaged by the March<br />

<strong>2010</strong> hail storm. It also assisted in mitigating the impact <strong>of</strong> the enormous demand<br />

placed on DVS vehicle examination centres.<br />

New training facilities have been built to increase capacity; integrating new technologies<br />

that help deliver improved training to new and existing DVS staff and agents.<br />

Legislation<br />

The Road Traffic Legislation Amendment (Information) Bill <strong>2010</strong> was passed by<br />

Parliament and the Governor has assented to the Bill. The amendments are currently<br />

awaiting proclamation allowing supporting regulatory changes to be completed.<br />

These amendments to the Road Traffic Act 1974 deal specifically with access to<br />

driver and vehicle licence information, the disclosure <strong>of</strong> driver’s licence photographs<br />

and the requirement for learner’s permit photographs.<br />

Implementation <strong>of</strong> Trade Plates (replacing Dealer Plates) occurred in late <strong>2010</strong>. This<br />

is part <strong>of</strong> the move to align Western Australia with other jurisdictions and provide<br />

a title more reflective <strong>of</strong> their wider usage. The transition to Trade Plates is marked<br />

by a new number plate design and amendments to the Road Traffic (Licensing)<br />

Regulations 1975 and Road Traffic (Charges & Fees) Regulations 2006.<br />

Navigational safety at the North West Shelf development<br />

DoT, in conjunction with the Commonwealth Government, has progressed the<br />

development <strong>of</strong> an integrated navigational management system for shipping in the<br />

North West.<br />

Due to the increase <strong>of</strong> mineral and petroleum developments and associated shipping,<br />

the North West was identified as an area that required management plans to mitigate<br />

risks that might impact on the economy and the environment. DoT and the Australian<br />

Maritime Safety Authority undertook a joint initiative to identify particular areas and<br />

locations that require risk mitigating plans to be developed.<br />

With all consultative processes with State, Commonwealth and industry stakeholders<br />

now complete, a set <strong>of</strong> recommendations, joint policies and project plans to risk<br />

manage the North West waterway have been agreed upon. It is anticipated that<br />

implementation will begin in November <strong>2011</strong><br />

19

State mooring control project<br />

The growing demand for moorings in the metropolitan area and coastal regions has<br />

been the catalyst for a review <strong>of</strong> the management <strong>of</strong> moorings throughout Western<br />

Australia and the initiation <strong>of</strong> a management strategy by DoT. The Swan and Canning<br />

rivers have reached capacity for mooring placements and there has been a proliferation<br />

<strong>of</strong> unauthorised moorings across the State, particularly in the Rockingham, Peel and<br />

South West regions. The rapid growth and high income <strong>of</strong> regional mining communities<br />

has also seen significant expansion in recreational boating activity. This, combined with<br />

ad hoc placement <strong>of</strong> moorings, has exacerbated the need for a State-wide moorings<br />

management plan supported by strengthened legislation.<br />

DoT has embarked on a project to enhance the management <strong>of</strong> moorings in<br />

its jurisdictional navigable waters in order to address the issue <strong>of</strong> unauthorised<br />

moorings, and minimise the adverse impact those moorings are having on public<br />

safety and the environment. Equity <strong>of</strong> access by boat users in locations suitable for<br />

vessel moorings is the desired outcome <strong>of</strong> this new regime.<br />

The formal application <strong>of</strong> the Shipping and Pilotage (Mooring Control Areas)<br />

Regulations 1983 in the Rockingham Mangles Bay Mooring Control Area commenced<br />

on 1 October <strong>2010</strong> bringing approximately 650 unauthorised moorings under a<br />

formal management regime. Certificates <strong>of</strong> Registration will be issued to successful<br />

applicants in Mangles Bay when the current processing is complete. Supplementary<br />

to the user pays moorings, DoT has also installed five courtesy moorings at Mangles<br />

Bay for casual use <strong>of</strong> up to 72 hours, and funds allocated from the RBFS will provide<br />

for another five to be installed.<br />

Progress is also continuing on proclaiming additional mooring control areas around<br />

the State. DoT has recently tagged a total <strong>of</strong> 72 moorings in the Carnarvon Fascine<br />

as a preliminary step towards proclaiming a mooring control area and ultimately<br />

alleviating the current demand for moorings.<br />

20<br />

Recreational boating community engagement education program:<br />

promotion <strong>of</strong> Junior Crew Certificate<br />

Supplementary to the Recreational Skipper’s Ticket, DoT has the Junior Crew Pack,<br />

an educational initiative that promotes marine safety and a safer boating community<br />

through a program focused at primary school students.<br />

The Junior Crew Pack, designed by DoT in partnership with the Western Australian<br />

Curriculum Council and the <strong>Department</strong> <strong>of</strong> Education, provides a marine safety<br />

educational package for Western Australian primary schools students in Years 3, 4 and 5.<br />

The program consists <strong>of</strong> five marine safety topics and a final task that uses these topics<br />

as a foundation to support the marine safety message. The program introduces students<br />

to marine safety, specifically the safe use <strong>of</strong> boats and how to ensure their own safety<br />

and that <strong>of</strong> others while boating. At the successful completion <strong>of</strong> the program, students<br />

are awarded a Junior Crew Certificate.<br />

The program was launched by the Minister for <strong>Transport</strong> on 10 February <strong>2010</strong> and<br />

received overwhelming and immediate success. To date 132 schools throughout<br />

the State have taken up the course and it is planned that DoT’s Regional <strong>Transport</strong><br />

Officers will attend schools to further enhance the delivery <strong>of</strong> the program and<br />

stimulate further interest. The enthusiastic take-up <strong>of</strong> the Junior Crew program by<br />

primary schools is beyond the anticipated outcomes <strong>of</strong> the initiative.<br />

In June <strong>2011</strong> a Junior Crew Program Education Officer was appointed to provide for<br />

further growth <strong>of</strong> the program. Concurrent to the promotion <strong>of</strong> the pack, the <strong>of</strong>ficer<br />

will conduct a review <strong>of</strong> the program’s effects and outcomes, and this information<br />

will be used in continual improvement <strong>of</strong> the pack.<br />

Swan River Mooring

Aquatic use review<br />

DoT, in partnership with the Swan River Trust, has commenced a comprehensive<br />

aquatic use review <strong>of</strong> the entire Swan Canning Riverpark. The aim <strong>of</strong> the review is to<br />

formulate and implement a new aquatic use plan to promote the safe, equitable and<br />

sustainable use <strong>of</strong> waterways within the riverpark.<br />

The review involved extensive consultation with key stakeholders and the community,<br />

and is anticipated to be completed for implementation in time for the commencement<br />

<strong>of</strong> the <strong>2011</strong>-12 summer.<br />

The outcomes <strong>of</strong> the first round <strong>of</strong> consultations (held in February <strong>2011</strong>) are currently<br />

being considered by the project team and the stakeholder engagement summary<br />

report will be released shortly. Once these deliberations have been concluded, a<br />

draft aquatic use plan will be released for an open comment period ahead <strong>of</strong> the<br />

final draft being presented jointly to the Minister for Environment and the Minister for<br />

<strong>Transport</strong> for approval.<br />

Opening <strong>of</strong> new Exmouth <strong>of</strong>fice<br />

DoT’s new centrally-located Exmouth <strong>of</strong>fice opened on 30 May <strong>2011</strong>.<br />

The <strong>of</strong>fice is co-located with the Gascoyne Development Commission, which will<br />

ensure a close working relationship between the Development Commission and DoT.<br />

Geraldton Port<br />

Policy, Planning and Investment<br />

Oakajee port and rail infrastructure<br />

The development <strong>of</strong> a deep water port, associated rail infrastructure and a purpose<br />

built industrial estate at Oakajee is one <strong>of</strong> Western Australia’s most important<br />

economic projects. When constructed, Oakajee will open up the Mid West as a<br />

major mineral resources region.<br />

While the <strong>Department</strong> <strong>of</strong> State Development is the lead agency for the Oakajee Port<br />

and Rail project, DoT has responsibility for setting the port specifications, approving<br />

the design, ensuring the technical proposals are sound and that the Government<br />

gets value for the $678 million set aside for the development <strong>of</strong> common use port<br />

infrastructure. In the past year, the port design has been refined, further technical<br />

studies carried out and due diligence conducted by DoT in conjunction with the<br />

Geraldton Port Authority.<br />

An Oakajee Port Master Plan has been developed by the Geraldton Port Authority<br />

with DoT’s assistance. The plan will allow staged development <strong>of</strong> the port and<br />

preserve the opportunity for Oakajee to eventually become a multi-user, multiproduct<br />

port. Particular attention has been given to land requirements and ensuring<br />

there are service corridors and appropriate access between the port and the Oakajee<br />

industrial estate.<br />

DoT has also been assisting the <strong>Department</strong> <strong>of</strong> State Development in developing<br />

elements <strong>of</strong> the Oakajee Implementation Agreement, and working with PTA in<br />

relation to the Oakajee Rail Corridor.<br />

21

Esperance Clean up and Recovery Project<br />

The town <strong>of</strong> Esperance was contaminated with lead dust during the handling and<br />

loading <strong>of</strong> lead carbonate from Magellan Metals at the Esperance port between April<br />

2005 and March 2007.<br />

Concerns were first raised in December 2006 when birds that had died in Esperance<br />

were found to have high lead levels. A Parliamentary inquiry tabled in September<br />

2007 showed that, as a result <strong>of</strong> lead emissions from the Esperance port, residential<br />

and commercial premises in the town <strong>of</strong> Esperance, as well as the environment,<br />

had been contaminated by lead dust with consequential impacts on the community<br />

including elevated blood lead levels in children.<br />

Following a Cabinet decision, the Esperance Clean up and Recovery Project (ECRP)<br />

was established in December 2008 with DoT as the responsible agency.<br />

The ECRP is proceeding systematically and has made good progress to date with<br />

the strong support <strong>of</strong> the local community. There is a high level <strong>of</strong> confidence from<br />

all stakeholders that this project will be completed successfully.<br />

During <strong>2010</strong>-11 $4 million was spent on the ECRP. Clean-up guidelines, sampling<br />

methodologies and cleaning procedures have been developed to ensure an effective<br />

clean up.<br />

The area <strong>of</strong> contamination has been identified, approximately 2,000 premises are<br />

affected and more than 88,000 samples have been collected and sent for testing and<br />

analysis. The ECRP has completed detailed sampling <strong>of</strong> approximately 1,950 premises<br />

for Magellan lead contamination and about 1,750 require some form <strong>of</strong> cleaning.<br />

Cleaning commenced in July <strong>2010</strong> under three major cleaning contracts and 820<br />

premises have been cleaned to date. Cleaning has included ro<strong>of</strong> surfaces, gutters,<br />