nonprofit financial management self assessment tool - COCo

nonprofit financial management self assessment tool - COCo

nonprofit financial management self assessment tool - COCo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

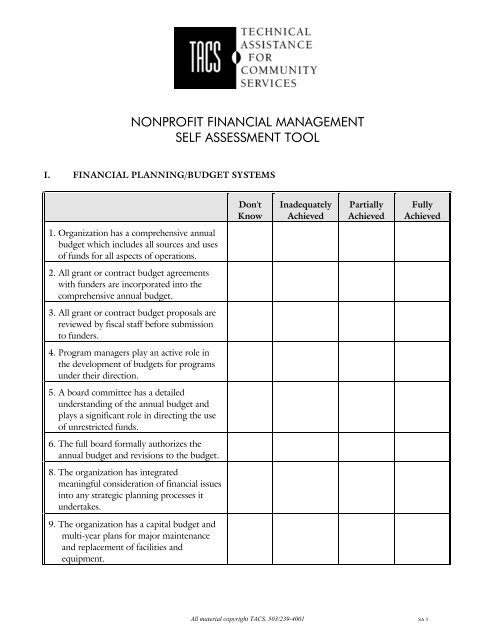

NONPROFIT FINANCIAL MANAGEMENTSELF ASSESSMENT TOOLI. FINANCIAL PLANNING/BUDGET SYSTEMSDon'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved1. Organization has a comprehensive annualbudget which includes all sources and usesof funds for all aspects of operations.2. All grant or contract budget agreementswith funders are incorporated into thecomprehensive annual budget.3. All grant or contract budget proposals arereviewed by fiscal staff before submissionto funders.4. Program managers play an active role inthe development of budgets for programsunder their direction.5. A board committee has a detailedunderstanding of the annual budget andplays a significant role in directing the useof unrestricted funds.6. The full board formally authorizes theannual budget and revisions to the budget.8. The organization has integratedmeaningful consideration of <strong>financial</strong> issuesinto any strategic planning processes itundertakes.9. The organization has a capital budget andmulti-year plans for major maintenanceand replacement of facilities andequipment.All material copyright TACS. 503/239-4001 SA 3

Don'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved6. Written purchasing policies clearly identifythe purchasing authority of each staffposition, and establish appropriate dollarlimits for purchasing authority at eachlevel.7. There are clear procedures for review ofand authorization to pay all vendorinvoices.8. Written policies and procedures forcharging and collecting fees are followedconsistently and reviewed regularly.9. Cash handling policies and procedures arewell-documented and are testedperiodically.a. All checks are restrictively endorsedupon receipt.b. Receipts are given for all cashtransactions and donors/clients areinformed that they should receive areceipt for all cash payments. Prenumbered,multi-copy, customizedreceipts are used.c. A receipts log is maintained by theperson responsible for opening themail.d. Cash reconciliation sheets aremaintained by all individualsresponsible for accepting cash. Allcash counts are initialled by theindividual preparing the initial countand the individual receiving the cashfor further processing.e. Post dated checks are not generallyaccepted, and if accepted, are securedcarefully.f. All disbursements are made by checkexcept for small purchases madethrough a Petty Cash fund.All material copyright TACS. 503/239-4001 SA 3

Don'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved8. Back-ups of accounting data are stored offsiteat least monthly.9. Detailed records of client fees and/orgrants and contracts receivable aremaintained and reconciled to the generalledger receivables balances.10. All contributions are recorded in theaccounting records. If more detailedrecords are maintained by staff responsiblefor fund development, the funddevelopment and accounting records ofcontributions are reconciled monthly.11. All general ledger balance sheet accountsare reconciled at least quarterly. All cash,payroll liabilities, and accounts receivablecontrol accounts are reconciled monthly.IV.REPORTINGDon'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved1. Monthly <strong>financial</strong> statements are availableno later than the end of the followingmonth (i.e. April 30th statements areavailable no later than May 31st).2. Monthly <strong>financial</strong> statements include aBalance Sheet as well as a Statement ofActivities and Changes in Net Assets.3. In organizations with multiple programs,statements of the expenses of each distinctprogram are prepared monthly.4. In organizations which receive restrictedfunds, separate statements of revenue andexpenses are prepared for each fundingsource.All material copyright TACS. 503/239-4001 SA 3

Don'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved5. All revenue and expense statements (for thewhole organization, for specific programs,and for specific funding sources) includethe current month's activity, the fiscal yearto date activity, and a comparison to theyear to date or annual budget by line item.6. The excess (deficit) of support and revenueover expenses (net income) is reconciled tothe change in fund balance between thebeginning and ending of the accountingperiod.V. MONITORINGDon'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved1. The executive director and the programmanagers review the monthly <strong>financial</strong>statements carefully.2. The fiscal manager highlights unusualitems and identifies potential problems innotes to the <strong>financial</strong> statements sharedwith the executive director and boardcommittee or full board.3. A board committee or the full boardreviews the monthly <strong>financial</strong> statementscarefully.4. The board or a board committee selects anindependent CPA to conduct an annualaudit or review. The board determineswhether the organization should have anaudit or a review, and whether or not theaudit must conducted within the guidelinesof OMB A-133, as required fororganizations receiving over $300,000 infederal funds or recommended fororganizations receiving more than$100,000 each from more than one federalsource.All material copyright TACS. 503/239-4001 SA 3

Don'tKnowInadequatelyAchievedPartiallyAchievedFullyAchieved5. The board or a board committee reviewsthe auditor's report, including any<strong>management</strong> letters, and reports oninternal controls and compliance withgovernmental law and regulation.7. The board and executive directorcontinually review the organization's<strong>financial</strong> statements to determine whether:a. The use of the organization's resourcesis consistent with the organization'smission and priorities.b. The organization is solvent, i.e. hasassets in excess of its liabilities.c. The organization has adequate cashand other liquid assets to meet itscurrent obligations and assure itscontinuing ability to pay itsemployees, taxing authorities, andvendors on time.d. The organization is observing anddocumenting its observance of allrestrictions imposed by funders anddonors.8. The board and executive director are awareof the IRS requirements for maintainingtax exempt status and continually evaluatethe organization's activities, use of funds,record keeping, and reporting to the IRSto assure compliance with all requirements.All material copyright TACS. 503/239-4001 SA 3