Fuel Price Adjustment - Islamabad High Court

Fuel Price Adjustment - Islamabad High Court

Fuel Price Adjustment - Islamabad High Court

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

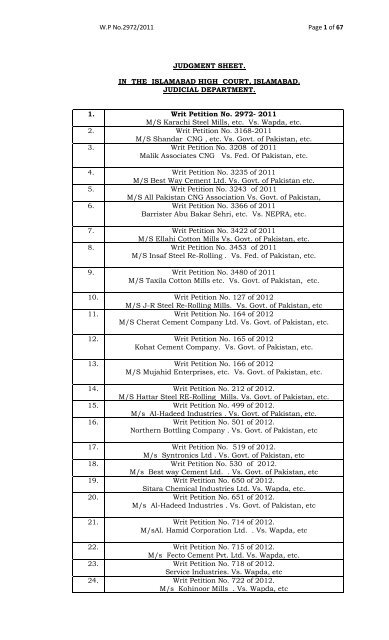

W.P No.2972/2011 Page 10 of 67Neeli Bar Textile Mills Vs. FOP, etc279. Writ Petition No. 1994 of 2012.Hussain Mills Ltd Vs. FOP, etc280. Writ Petition No. 1995 of 2012.Fawad Textile Mills Ltd Vs. Wapda, etc281. Writ Petition No. 1996 of 2012.Sitara Chemical Industry Vs. Wapda, etc282. Writ Petition No. 1997 of 2012.Zia ul Qamar Spinning Mills etc Vs. FOP, etc283. Writ Petition No. 2002 of 2012.New Shalimar Steel etc Vs. FOP, etc284. Writ Petition No. 2003 of 2012.Shah Jewana Textile Mills Vs. FOP, etc285. Writ Petition No. 2004 of 2012.Sunday Textile Mills etc Vs. FOP, etc286. Writ Petition No. 2007 of 2012.Bilal Weaving Factory Vs. Wapda, etc287. Writ Petition No. 2008 of 2012.S.M Qadri Sugar Mills Vs. Wapda, etc288. Writ Petition No. 2011 of 2012.Pakistan CNG Station Vs. FOP, etc289. Writ Petition No. 2015 of 2012.M/s Pioneer Cement Pvt. Ltd Vs. Wapda, etc290. Writ Petition No. 2017 of 2012.Fatima Enterprises Vs. Wapda, etc291. Writ Petition No. 2018 of 2012.Al-Qamar Flour Mills Vs. FOP, etc292. Writ Petition No. 2019 of 2012.M/s Campellpur Flour Mills Vs. FOP, etc293. Writ Petition No. 2021 of 2012.Colony Mills Ltd Vs. FOP, etc294. Writ Petition No. 2022 of 2012.Sapphire Textile Mills Vs. FOP, etc295. Writ Petition No. 2023 of 2012.Reliance Weaving Mills Vs. FOP, etc296. Writ Petition No. 2032 of 2012.Areeha Pvt. Ltd Vs. FOP, etc297. Writ Petition No. 2036 of 2012.M/s Al-Rehman Processing etc Vs. Wapda, etc298. Writ Petition No. 2037 of 2012.M/s Flying Cement Company Ltd Vs. Wapda, etc299. Writ Petition No. 2039 of 2012.M/s Bhimra Textile Mills Ltd Vs. FOP, etc300. Writ Petition No. 2040 of 2012.Muhammad Saeed etc Vs. Wapda etc301. Writ Petition No. 2041 of 2012.M/s Waheed Shahzad Plastic Works Vs. Wapda, etc302. Writ Petition No. 2045 of 2012.M/s <strong>Islamabad</strong> Steel Mills Vs. GOP, etc303. Writ Petition No. 2046 of 2012.Fatima Flour Mills Vs. FOP, etc304. Writ Petition No. 2047 of 2012.Nasir Flour Mills etc Vs. FOP, etc305. Writ Petition No. 2084 of 2012.M/s Best Chip Board Vs. Wapda, etc306. Writ Petition No. 2100 of 2012.M/s Nabeel Papers & Board Mills Vs. FOP, etc307. Writ Petition No. 2159 of 2012.M/s Maqbool & Sons Vs. FOP, etc308. Writ Petition No. 2230 of 2012.M/s Ali Riasat Steel Vs. FOP, etc309. Writ Petition No. 2276 of 2012.Fine Gas Co. Vs. FOP, etc

W.P No.2972/2011 Page 11 of 67310. Writ Petition No. 2281 of 2012.M/s City Textile etc Vs. FOP, etc311. Writ Petition No. 2285 of 2012.M/s Noor Hussain &Sons etc Vs. FOP, etc312. Writ Petition No. 2289 of 2012.M/s Kohinoor Textile Mills Ltd etc Vs. FOP, etc313. Writ Petition No. 2290 of 2012.M/s Faisal Spinning Mills Ltd etc Vs. FOP, etc314. Writ Petition No. 2301 of 2012.Ch. Muhammad Shafique etc Vs. Wapda, etc315. Writ Petition No. 2306 of 2012.M/s MLW Vs. Wapda, etc316. Writ Petition No. 2307 of 2012.M/s Malik Board & Papers Vs. Wapda, etc317. Writ Petition No. 2308 of 2012.Waheed Shahzad Plastic Works Vs. Wapda, etc318. Writ Petition No. 2309 of 2012.M/s Sajid Paper Mills Pvt. Vs. Wapda, etc319. Writ Petition No. 2310 of 2012.M/s Umer Tissue Mills Vs Wapda, etc320. Writ Petition No. 2311 of 2012.Pak Mughal Enterprises Vs Wapda, etc321. Writ Petition No. 2312 of 2012.M/s Kamal Steel Mills Vs Wapda, etc322. Writ Petition No. 2313 of 2012.Anmol Textile Mills Vs Wapda, etc323. Writ Petition No. 2314 of 2012.M/s Pak Steel etc Vs Wapda, etc324. Writ Petition No. 2316 of 2012.Ghouri Tyre & Tube Pvt Vs FOP etc325. Writ Petition No. 2317 of 2012.M/s MHA Weaving Mills Vs FOP etc326. Writ Petition No. 2318 of 2012.M/s Fiber Dyeing Vs FOP etc327. Writ Petition No. 2324 of 2012.M/s Riaz Bottlers Vs Wapda, etc328. Writ Petition No. 2325 of 2012.HA Fiber Pvt. Ltd Vs FOP etc329. Writ Petition No. 2327 of 2012.Zia ur Rehman Vs FOP etc330. Writ Petition No. 2331 of 2012.Qasur Textile Mills Vs FOP etc331. Writ Petition No. 2332 of 2012.Al-Fateh Industries Vs FOP etc332. Writ Petition No. 2335 of 2012.M/s Umair Steel Industry Vs Wapda, etc333. Writ Petition No. 2336 of 2012.M/s Happy Manufacturing Co. Vs Wapda, etc334. Writ Petition No. 2337 of 2012.M/s Qadria Board Mills Vs Wapda, etc335. Writ Petition No. 2343 of 2012.M/s Al-Karam Papers Mills Pvt Vs FOP etc336. Writ Petition No. 2344 of 2012.Muhammad Yousaf Munir Vs FOP etc337. Writ Petition No. 2345 of 2012.Makkah Steel Mills Vs FOP etc338. Writ Petition No. 2346 of 2012.M/s Black Diamond Steel Re-Rolling Mills Vs FOP etc339. Writ Petition No. 2347 of 2012.Combine Spinning Pvt. Ltd Vs FOP etc340. Writ Petition No. 2348 of 2012.Nafeesa Textile Ltd. Etc Vs FOP etc341. Writ Petition No. 2349 of 2012.Farooq Khalid Pipe Mills Pvt. Ltd etc Vs Wapda etc

W.P No.2972/2011 Page 12 of 67342. Writ Petition No. 2352 of 2012.Muhammad Rab Nawaz Vs FOP etc343. Writ Petition No. 2353 of 2012.Royal Steel Mills etc Vs FOP etc344. Writ Petition No. 2358 of 2012.Shams Textile Mills Ltd Vs FOP etc345. Writ Petition No. 2366 of 2012.M/s Anmol Paper Mills Vs FOP etc346. Writ Petition No. 2367 of 2012.ACRO Spinning & Weaving Mills etc Vs FOP etc347. Writ Petition No. 2371 of 2012.Maahar Fashion Apparels Pvt Vs FOP etc348. Writ Petition No. 2379 of 2012.SINCO Steel Re-Rolling Vs Wapda etc349. Writ Petition No. 2416 of 2012.Fuji Cement Co. Ltd Vs Wapda etc350. Writ Petition No. 2417 of 2012.Standard Textile Mills etc Vs Wapda etc351. Writ Petition No. 2418 of 2012.M/s Faisal Asad Textile Mills Vs Wapda etc352. Writ Petition No. 2419 of 2012.M/s Ch. Steel Casting Vs Wapda etc353. Writ Petition No. 2421 of 2012.M/s Hiadri Beverages Vs Wapda etc354. Writ Petition No. 2428 of 2012.Gharibwal Cement Vs Wapda etc355. Writ Petition No. 2430 of 2012.Haleeb Foods Ltd Vs Wapda etc356. Writ Petition No. 2431 of 2012.Haleeb Foods Ltd Vs Wapda etc357. Writ Petition No. 2439 of 2012.ACRO Textile Mills Ltd Vs FOP etc358. Writ Petition No. 2440 of 2012.Nisar Ahmed etc Vs FOP etc359. Writ Petition No. 2445 of 2012.Al-Khair CNG Vs Wapda etc360. Writ Petition No. 2446 of 2012.Bismallah Cold Storage Vs FOP etc361. Writ Petition No. 2447 of 2012.Campbellpur Flour Mills Vs FOP etc362. Writ Petition No. 2455 of 2012.M/s Mark Industries Pak. Vs GOP etc363. Writ Petition No. 2465 of 2012.M/s White Pearl Rice Mills Vs FOP etc364. Writ Petition No. 2468 of 2012.M/s Best chip Board Industries Vs FOP etc365. Writ Petition No. 2470 of 2012.Aftab Textile Processing etc Vs Wapda etc366. Writ Petition No. 2482 of 2012.M/s Ever Green Rice Mills & 2 others Vs Chairman NEPRA etc367. Writ Petition No. 2495 of 2012.M/s General Industrial Gases Vs FOP etc368. Writ Petition No. 2505 of 2012.M/s Sangha CNG Vs Chairman NEPRA etc369. Writ Petition No. 2506 of 2012.Bismallah Ice Factory Vs Chairman NEPRA etc370. Writ Petition No. 2507 of 2012.Pir Kabeer Flour Mills Vs Chairman NEPRA etc371. Writ Petition No. 2508 of 2012.Ch. Muhammad Sidduqe Flour Mills Vs Chairman NEPRA etc372. Writ Petition No. 2513 of 2012.Fatima Enterprises Vs Wapda etc373. Writ Petition No. 2539 of 2012.M/s Ahmed Rice etc Vs Chairman NEPRA etc

W.P No.2972/2011 Page 13 of 67374. Writ Petition No. 2540 of 2012.M/s Rehman Rice Mills etc Vs Chairman NEPRA etc375. Writ Petition No. 2636 of 2012.Matloob Hussain etc Vs FOP etc376. Writ Petition No. 2637 of 2012.M/s Textile Mills Ltd Vs Wapda etc377. Writ Petition No. 2647 of 2012.Asian Food Industries etc Vs FOP etc378. Writ Petition No. 2648 of 2012.Kohinoor Textile Mills etc Vs FOP etc379. Writ Petition No. 2649 of 2012.Fawad Textile Mills Vs FOP etc380. Writ Petition No. 2650 of 2012.Naseem Enterprises etc Vs FOP etc381. Writ Petition No. 2651 of 2012.Maple Leaf Cement Vs FOP etc382. Writ Petition No. 2652 of 2012.M/s Qad Cast Pvt. Ltd Vs FOP etc383. Writ Petition No. 2655 of 2012.M/s Paramount Engineering Works etc Vs FOP etc384. Writ Petition No. 2662 of 2012.M/s Capital Flour Mills etc Vs NEPRA through its Chairman etc385. Writ Petition No. 2664 of 2012.AA Cotton Mills etc Vs FOP etc386. Writ Petition No. 2674 of 2012.M/s M.H.A Weaving Mills Pvt. Ltd Vs FOP etc387. Writ Petition No. 2675 of 2012.M/s Malik Steel Re-Rolling etc Vs FOP etc388. Writ Petition No. 2676 of 2012.Shams Textile Mills Vs FOP etc389. Writ Petition No. 2682 of 2012.M/s Ali Riasat Steel Industry Vs FOP etc390. Writ Petition No. 2683 of 2012.M/s Faisal Spinning Mills Ltd Vs FOP etc391. Writ Petition No. 2691 of 2012.M/s KSF Plastic Industries Vs FOP etc392. Writ Petition No. 2696 of 2012.M/s Famous Plastic Industries Vs FOP etc393. Writ Petition No. 2697 of 2012.M/s Neelum Soap Industries Vs FOP etc394. Writ Petition No. 2698 of 2012.M/s Mujahid Soap & Chemical Vs FOP etc395. Writ Petition No. 2701 of 2012.Eastern Steel etc Vs FOP etc396. Writ Petition No. 2706 of 2012.Golden Textile Mills Vs FOP etc397. Writ Petition No. 2709 of 2012.M/s Nishat Product Textile Vs FOP etc398. Writ Petition No. 2715 of 2012.M/s Naeem Industry Vs FOP etc399. Writ Petition No. 2721 of 2012.M/s Sayid Paper Mills Vs FOP etc400. Writ Petition No. 2722of 2012.M/s Paradise Spinning Mills Vs FOP etc401. Writ Petition No. 2728 of 2012.M/s Umer Tissue Mills Vs FOP etc402. Writ Petition No. 2729 of 2012.M/s MLW Industries Pvt. Ltd Vs FOP etc403. Writ Petition No. 2730 of 2012.M/s Malik Board & Papers Mills Vs FOP etc404. Writ Petition No. 2731 of 2012.M/s Qadria Board Mills Vs FOP etc405. Writ Petition No. 2732 of 2012.

W.P No.2972/2011 Page 14 of 67New Horizan Spinning Mills Vs FOP etc406. Writ Petition No. 2733 of 2012.Hamza Enterprises etc Vs FOP etc407. Writ Petition No. 2738 of 2012.Fuji Cement Co. Vs FOP etc408. Writ Petition No. 2743 of 2012.Sinco Steel Re-Rolling Mills Vs FOP etc409. Writ Petition No. 2745 of 2012.M/s M. Asif Steel Industries Vs FOP etc410. Writ Petition No. 2746 of 2012.M/s Tariq Steel Mills etc Vs FOP etc411. Writ Petition No. 2747 of 2012.Terry World Textile Vs FOP etc412. Writ Petition No. 2748 of 2012.Lahore Polypropylene Industries Vs FOP etc413. Writ Petition No. 2751 of 2012.Al-Qamar Flour Mills Vs FOP etc414. Writ Petition No. 2753 of 2012.M/s Muhammadi Papers & Board Industry Pvt. Ltd Vs FOP etc415. Writ Petition No. 2757 of 2012.Shamim Akhtar etc Vs FOP etc416. Writ Petition No. 2762 of 2012.M/s Shaheen Paper Vs FOP etc417. Writ Petition No. 2765 of 2012.M/s Islam Steel Mills etc Vs FOP etc418. Writ Petition No. 2770 of 2012.M/s TSJ International etc Daska Vs Wapda etc419. Writ Petition No. 2772 of 2012.M/s Syed Papers Mills Vs Wapda etc420. Writ Petition No. 2773 of 2012.M/s Umer Tissue Papers Mills Vs Wapda etc421. Writ Petition No. 2774 of 2012.M/s Malik Board & Papers Industries Vs Wapda etc422. Writ Petition No. 2775 of 2012.M/s Qadri Baord Mills Vs Wapda etc423. Writ Petition No. 2777 of 2012.M/s Abdul Ghani Rice Mills Vs FOP etc424. Writ Petition No. 2778 of 2012.M/s Farooq Ayub Steel Re-Rolling Mills etc Vs Wapda etc425. Writ Petition No. 2781 of 2012.M/s Haleeb Foods Ltd Vs Wapda etc426. Writ Petition No. 2784 of 2012.M/s Nasir Solvent Plant Vs Wapda etc427. Writ Petition No. 2785 of 2012.M/s Bismallah Cold Storage Vs FOP etc428. Writ Petition No. 2786 of 2012.M/s Campbellpur Flour Mills Vs FOP etc429. Writ Petition No. 2787 of 2012.M/s Garnada Textile Mills Vs FOP etc430. Writ Petition No. 2788 of 2012.M/s Bilal Fiber Ltd Vs FOP etc431. Writ Petition No. 2789 of 2012.M/s REDCO Textile Ltd Vs FOP etc432. Writ Petition No. 2791 of 2012.Kunjah Textile Mills Vs FOP etc433. Writ Petition No. 2795 of 2012.M/s HAR Textile Mills etc Vs FOP etc434. Writ Petition No. 2797 of 2012.Gharibwal Cement Ltd Vs Wapda etc435. Writ Petition No. 2803 of 2012.M/s Al-Madina Packages Vs Govt. of Pak. Through M/o Wapda436. Writ Petition No. 2804 of 2012.M/s Koni Pex etc Vs Govt. of Pak. Through M/o Wapda

W.P No.2972/2011 Page 15 of 67437. Writ Petition No. 2805 of 2012M/s Fazal ur Rehman etc Vs Govt of Pak. Through M/o Wapda438. Writ Petition No. 2806 of 2012M/s Ittehad Pvt. Ltd Vs FOP etc439. Writ Petition No. 2807 of 2012M/s Ruby Textile Mills Vs FOP etc440. Writ Petition No. 2808 of 2012M/s Ahmed Textile Processing Pvt. Ltd etc Vs Wapda etc441. Writ Petition No. 2814 of 2012Usman Goraya Spinning Mills Vs FOP etc442. Writ Petition No. 2816 of 2012Mehboob Alam Vs Wapda etc443. Writ Petition No. 2821 of 2012Iftikhar Ahmed Vs FOP etc444. Writ Petition No. 2822 of 2012M/s Fatima Enterprises Ltd Vs FOP etc445. Writ Petition No. 2830 of 2012M/s Agha Ghee Printers, Isb. Vs Chairman NEPRA etc446. Writ Petition No. 2832 of 2012M/s National Filling Station Vs GOP etc447. Writ Petition No. 2833 of 2012M/s Haideri Beverages Pvt. Ltd Vs FOP etc448. Writ Petition No. 2845 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc449. Writ Petition No. 2846 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc450. Writ Petition No. 2847 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc451. Writ Petition No. 2848 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc452. Writ Petition No. 2849 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc453. Writ Petition No. 2850 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc454. Writ Petition No. 2851 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc455. Writ Petition No. 2852 of 2012M/s Steel Complex Pvt. Ltd Vs FOP etc456. Writ Petition No. 2921 of 2012Ahmed Glass Industies . Vs Wapda, etc.457. Writ Petition No. 2944 of 2012Faisal Spinning Mills etc. Vs FOP etc458. Writ Petition No. 2960 of 2012Asia Food Industry Vs FOP etc459. Writ Petition No. 2962 of 2012Prosperity Weaving Mills Vs FOP etc460. Writ Petition No. 2965 of 2012Naveena Industry Ltd Vs FOP etc461. Writ Petition No. 2969 of 2012Lyallpur Textile Vs FOP etc462. Writ Petition No. 2974 of 2012M/s Malik Steel Re Rolling Mills Vs FOP etc463. Writ Petition No. 2986 of 2012Shams Textile Mills, etc. Vs FOP etc464. Writ Petition No. 2988 of 2012M/s Riasat Ali Mills, etc . Ltd Vs FOP etc465. Writ Petition No. 2989 of 2012M/s Fast Steel Casting, etc. Vs FOP etc466. Writ Petition No. 2992 of 2012M/s Standard Spinning Mills etc. Vs FOP etc467. Writ Petition No. 2993 of 2012Sardarpur Textile Mills etc. Vs FOP etc468. Writ Petition No. 2994 of 2012M/s Sayid Paper Mills Pvt. Ltd Vs Wapda, etc

W.P No.2972/2011 Page 16 of 67469. Writ Petition No. 2995 of 2012M/s MLW Industries Pvt. Ltd. Vs Wapda, etc.470. Writ Petition No. 2996 of 2012M/s Umer Tissue Mills Ltd Vs Wapda, etc.471. Writ Petition No. 2997 of 2012M/S Qadria Board Mills Pvt. Ltd Vs. Wapda, etc.472. Writ Petition No. 2999 of 2012Haleeb Food Mills Vs. Wapda, etc.473. Writ Petition No. 3001 of 2012Haleeb Foods Mills . Ltd Vs. Wapda, etc.474. Writ Petition No. 3004 of 2012Rehmat Steel Vs Wapda, etc.475. Writ Petition No. 3011 of 2012Fauji Cement Co. Ltd. Vs. Wapda, etc476. Writ Petition No. 3013 of 2012M/S Siddique Leather Pvt. Ltd. etc. Vs. Wapda, etc.477. Writ Petition No. 3014 of 2012Abdul Jabbar, etc. Vs. Wapda, etc.478. Writ Petition No. 3016 of 2012M/S City Steel UAE Mills etc. Vs. Wapda, etc.479. Writ Petition No. 3020 of 2012M/S Hafsa Foundary Vs. FOP etc480. Writ Petition No. 3024 of 2012Muhammad Younas, etc. Vs FOP etc481. Writ Petition No. 3028 of 2012Tata Textile Mills Ltd. etc. Vs FOP etc482. Writ Petition No. 3030 of 2012AZGARD NINE Ltd. Vs FOP etc483. Writ Petition No. 3037 of 2012M/S MHA Weaving Mills Vs. FOP etc484. Writ Petition No. 3038 of 2012Muhammad Siddique Mughal Vs FOP etc485. Writ Petition No. 3052 of 2012Abdullah Textile Mills Vs Wapda, etc486. Writ Petition No. 3067 of 2012M/S Baba Fareed Steel Vs FOP etc487. Writ Petition No. 3077 of 2012Poly Pack Pvt. Ltd. Vs FOP etc488. Writ Petition No. 3097 of 2012M/S SH Steel Re-Rolling Mills Vs GOP etc489. Writ Petition No. 3099 of 2012Faisal Spinning Mills Vs FOP etc490. Writ Petition No. 3124 of 2012M/S Disposable Utensics Industries Vs Chairman NEPRA, etc.491. Writ Petition No. 3139 of 2012Al-Qammar Flour Mills Vs FOP etc492. Writ Petition No. 3140 of 2012Bismillah Cold Storage Vs FOP etc493. Writ Petition No. 3141 of 2012M/S Cambellpur Flour Mills Vs FOP etc494. Writ Petition No. 3143 of 2012

W.P No.2972/2011 Page 17 of 67Masood Textile Mills Ltd. Vs. Wapda, etc495. Writ Petition No. 3150 of 2012M/S Zahara Textile Mills etc. Vs FOP etc496. Writ Petition No. 3151 of 2012Gharibwal cement Ltd. Vs FOP etc497. Writ Petition No. 3152 of 2012Fiber Tex Industry Vs FOP etc498. Writ Petition No. 3153 of 2012Super Asia Muhammad Din Sons Vs FOP etc499. Writ Petition No. 3161 of 2012C.M Food Vs FOP etc500. Writ Petition No. 3162 of 2012Shamim Feed Industries Vs FOP etc501. Writ Petition No. 3163 of 2012Saweera Flour & General Mills Vs NEPRA, etc502. Writ Petition No. 3164 of 2012Shamim Ghee Vs FOP etc503. Writ Petition No. 3165 of 2012Shamim Oil Mills Vs FOP etc504. Writ Petition No. 3192 of 2012Al-Hamra Fabrics etc. Vs Wapda, etc505. Writ Petition No. 3195 of 2012Qaiser Altaf Peracha, etc. Vs FOP etc506. Writ Petition No. 3196 of 2012M/s Haidri Beverages Vs. FOP etc507. Writ Petition No. 3198 of 2012Blue Star Spinning Mills. Vs. FOP etc508. Writ Petition No. 3200 of 2012Ittehad Pvt. Ltd. Vs. FOP etc509. Writ Petition No. 3210 of 2012Lahore Spinning Vs. FOP etc510. Writ Petition No. 3245 of 2012M/S Z.N Fabrics Pvt. Ltd. Vs. FOP etc511. Writ Petition No. 3272 of 2012Excel Engineering Pvt. Ltd. Vs. FOP etc512. Writ Petition No. 3273 of 2012Excel Cards Pvt. Ltd. Vs. FOP etc513. Writ Petition No. 3274 of 2012Daud Ahmed Vs. FOP etc514. Writ Petition No. 3275 of 2012Computer Valley Vs. FOP etc515. Writ Petition No. 3301 of 2012M/S Lafarge Pakistan Cement Co. Vs. FOP etc516. Writ Petition No. 3337 of 2012M/S Dewan Farooq Spinning Vs. FOP etc

W.P No.2972/2011 Page 18 of 67517. Writ Petition No. 3406 of 2012Ayesha Spinning Mills Ltd. Vs. FOP etc518. Writ Petition No. 3410 of 2012M/S ATS Synthetic Pvt. Ltd. Vs. Wapda, etc519. Writ Petition No. 3418 of 2012Khokhar Textile Mills. Vs. FOP etc520. Writ Petition No. 3453 of 2012Fauji Cement Company Vs. Wapda, etc521. Writ Petition No. 3469 of 2012Abdullah Textile Mills Vs. Wapda, etc522. Writ Petition No. 3478 of 2012M/S Umer Tissue Mills Vs. Wapda, etc523. Writ Petition No. 3479 of 2012M/S MLW Industries Vs. Wapda, etc524. Writ Petition No. 3480 of 2012M/S Sayid Paper Mills Vs. Wapda, etc525. Writ Petition No. 3481 of 2012Diamond Tyres Ltd. etc. Vs. FOP, etc526. Writ Petition No. 3482 of 2012Mian Muhammad Hamza Nizami Vs. FOP, etc527. Writ Petition No. 3485 of 2012M/S Lucky Steel Foundry Vs. FOP, etc.528. Writ Petition No. 3502 of 2012M/S Barkat Steel Mills. Vs. FOP, etc529. Writ Petition No. 3506 of 2012Suraj Textile Mills Vs. Wapda, etc530. Writ Petition No. 3507 of 2012Shams Textile Mills Vs. FOP, etc531. Writ Petition No. 3515 of 2012Tanvir Spinning Mills Vs. Wapda, etc532. Writ Petition No. 3516 of 2012Unze Trading Pvt. Ltd. Vs. FOP, etc533. Writ Petition No. 3526 of 2012Haleeb Foods Ltd. Vs. Wapda, etc534. Writ Petition No. 3542 of 2012Shaheen Cotton Mills. Ltd. Vs. FOP, etc535. Writ Petition No. 3545 of 2012Shehzad Textile Mills Ltd. Vs. FOP, etc536. Writ Petition No. 3423 of 2012Unipet Industries Pvt. Ltd. etc. vs. Wapda, etc.537. Writ Petition No. 3558 of 2012King Flour Mills Vs. NEPRA, etc.538. Writ Petition No. 3575 of 2012M/S Excel Engineering Pvt. Ltd. Vs. FOP, etc539. Writ Petition No. 3576 of 2012

W.P No.2972/2011 Page 19 of 67M/S Excel cards Pvt. Ltd. Vs. FOP, etc540. Writ Petition No. 3577 of 2012Famous Textile Mills Ltd. etc. Vs. FOP, etc.541. Writ Petition No. 3585 of 2012Service Industries Ltd. Vs. FOP, etc542. Writ Petition No. 3590 of 2012Muhammad Sharif, etc. Vs. FOP, etc543. Writ Petition No. 3591 of 2012M/S Asmat Textile Mills Vs. FOP, etc544. Writ Petition No. 3597 of 2012M/S Gunj Bux Gases Co. etc. Vs. FOP, etc.545. Writ Petition No. 3600 of 2012Mubeen Maqbool, etc. Vs. Wapda, etc546. Writ Petition No. 3602 of 2012Al-Qamar Flour Mills Vs. FOP, etc547. Writ Petition No. 3606 of 2012M. Asif Steel Industries Vs. FOP, etc548. Writ Petition No. 3607 of 2012M/S BM Steel Mills. Vs. FOP, etc.549. Writ Petition No. 3608 of 2012Champbellpur Flour Mills Vs. FOP, etc550. Writ Petition No. 3609 of 2012Bismillah Cold Storage Vs. FOP, etcPetitioners by:Malik Qamar Afzal, Mian Mehmood Rashid, Mr. Babar IlyasChatha, Mr. Nabeel Rehman, Syed Ishfaq Hussain Naqvi,Ms. Zainab Effendi, Ms. Rehana Zaman, Rao HamidRehman, Mr. Niazullah Khan Niazi, Ms. Mehraj Tareen, Kh.Manzoor Ahmed, Mr. Shahzad Rabbani, Barrister MominAli Khan, Mr. Bilal Akbar Tarrar, Mr. Faqir HussainMajrooh, Mr. Muhammad Akram Naveed, Mr. A. SalamQureshi, Mr. Tariq Mehmood, Mr. Muhammad SiddiqueMughal, Mr. M. Anum Salim, Ms. Mehnaz Shiraz, Ch. M.Tahir Mehmood, Ch. Muhammad Abdul Latif Gujar, Mr.Arif Mehmood, Mr. Jawad Mehmood Pasha, Mr. M. RehanSameer, Mr. M. Waseem Chaudhry, Rana Ali Akbar Khan,Mr. Muhammad Nawaz, Mr. Ghulam Farid Chaudhry, Mr.Mushtaq Ahmed Kamboh, Mr. Muhammad Rehan Sarwar,Malik Mumtaz Hussain Khokhar, Mr. Muhammad SiddiqueQazi, Mr. Muhammad Waqas Malik, Mian MuhammadHussain Chotiya, Mr. Zulqarnain Hamid, Ch. Mumtaz-ul-Hassan, Advocates for petitioners in their respectivepetitions.Respondents by:-Kh. Ahmed Tariq Rahim and Sh. Muhammad Ali, Advocatesfor M/O Water & Power, <strong>Islamabad</strong>.Mr. Shamshad Ullah Cheema along with Mr. MuhammadShafique, Legal Advisor for NEPRA.

W.P No.2972/2011 Page 20 of 67Mr. Munawar-us-Salam and Muhammad Usman Sahi,Advocate for LESCO.Syed Kazim Hussain Kazmi along with Muhammad SiddiqueMalik, Director Legal (GEPCO) for GEPCO & IESCO.Mr. Fazal-ur-Rehman, Mr. Muhammad Shakeel Abbasi, Mr.Muhammad Asif Khan and Mr. Saeed Raza, Advocates forIESCO.Rana Asif Saeed, Advocate on behalf of MEPCO, GEPCO,NTDC & FESCO.Mr. Asad Jan, Advocate along with Mr. Shakeel, AD Legalfor PESCO.Mr. Noman Munir Peracha, Advocate for HESCO.Mr. Muhammad Khalid Zaman, Advocate and Mr. KamranAmjad Advocate for FESCO.Syed Murtaza Ali Zaidi, Advocate for MEPCO.Dates of hearing: 08-10-2012, 15-10-2012 & 22-10-2012.SHAUKAT AZIZ SIDDIQUI; J: The bulk of writ petitions,consisting of 550 in total, challenging the levy anddemand of “<strong>Fuel</strong> <strong>Adjustment</strong> Charges”, were allowed bythis court by means of a short order dated 24.10.2012,which is reproduced herein below for ready reference:-“For the reasons, to be recorded later on, all abovecaptioned writ petitions are allowed through instantsingle order, to the following effect:(i)It is declared that Regulatory Authority isunder statutory obligation to protect theinterest of consumer as well, instead ofallowing the distributors to raise demandof FAC in a mechanical fashion. TheConstitution of the Islamic Republic ofPakistan does not permit exploitation ofany kind or form, therefore, it casts dutyupon the <strong>High</strong> <strong>Court</strong> to protect any

W.P No.2972/2011 Page 21 of 67person from being exploited and to provideshield to the Socio Economic fiber of thecountry, from being disrupted at the handsof executive functionaries. Theconsumer/citizens cannot be left at themercy of bodies at advantageous position,as arbitrary exercise of authority, malafideactions and illegal demands have alwaysbeen checked by the superior <strong>Court</strong>s.(ii) Levy and demand of <strong>Fuel</strong> <strong>Adjustment</strong>Charges as arrears with retrospective effectis declared as unconstitutional, besides the lawapplicable, principles of natural justice anddictums laid down by the superior courts of thecountry.(iii) The scope of levy/demand of <strong>Fuel</strong><strong>Adjustment</strong> Charges cannot be expanded andhas to remain within the variations in the pricesof fuel.(iv) The distributors of electricity are directedto issue amended bills and in case consumershad already paid the bills, excessive amountreceived be adjusted accordingly, which has tobe reflected in the bills of coming month. Allpersons/consumers whether before this <strong>Court</strong>,or not, must be treated equally.”2. The reasons for the above reproduced shortorder are as follows.3. In all the writ petitions captioned above, thepetitioners, who are consumers of electricity in thecountry, have attacked the legality of the levy anddemand of <strong>Fuel</strong> <strong>Adjustment</strong> Surcharge from them

W.P No.2972/2011 Page 22 of 67by the distribution companies allowed by theNational Electric Power Regulatory Authority, hereinafter referred to as NEPRA.4. Learned Counsel appearing on behalf of thepetitioners argued the case at great length. The cruxof their arguments is given in the followingpassages.5. Malik Qamar Afzal, Advocate Supreme <strong>Court</strong>made a comprehensive reference to the NEPRA’spowers, structure and historical back ground. Hisarguments are:• Executive order/notification which isdetrimental or prejudicial to the interest of aperson cannot operate retrospective. Howevera beneficial executive order/notification can begiven retrospective effect. He has placedreliance upon 2005 SCMR 492, PLD 1997 SC1027.• Fiscal liability is to be construed strictly andno fiscal liability can be imposed on past andclosed transaction, PLD 2011 Karachi 437,2011 PTD 1460, 2009 PTD 722.• Every fiscal statute contains three distinctcategories i.e., charging, collection andassessment provisions. Charging provisionshave to be construed strictly and any benefitfound therein has to be given to the tax payer.(2010 PTD 635, 2009 PTD 1473)• There exists a glaring gap between the monthfor which FPA is determined and demand of

W.P No.2972/2011 Page 23 of 67same through bills. The submissions made inthis regard may be illustrated in the form ofchart as follows:SRO No &Determinationdate202(1)/2012dated28.02.2012374(1)/2012dated17.04.2012447(1)/2012dated02.05.2012448(1)/2012dated02.05.2012449(1)/2012dated02.05.2012450(1)/2012dated02.05.2012523(1)/2012dated18.05.2012524(1)/2012dated18.05.2012Date of Billing Month Corresponding DifferenceNotification implementingthe Notificationmonth29.02.2012 March, 2012 August, 2011 7 Months17.04.2012 May, 2012 Sept. 2011 7 Months03.05.2012 June, 2012 Oct. 2011 8 Months03.05.2012 July, 2012 November,201103.05.2012 July, 2012 December,20118 Months7 Months03.05.2012 August, 2012 January, 2012 7 Months22.05.2012 September,2012 February, 2012 6 Months22.05.2012 October, 2012 March, 2012 6 Months• In order to explain the proposition involved inthe instant case the learned counsel has givena brief comparison of NEPRA with RegulatoryCommission of Alaska, USA. In this account hehas placed on record a judgment rendered bySupreme <strong>Court</strong> of Alaska in case of“Matanuska Electric Association Inc. Vs.Chugach Electric Association Inc.”, wherein ithas been held that Retroactive Rate making isprohibited in Alaska as it is in the majority ofjurisdiction in US. The Supreme <strong>Court</strong>reversed the Commission’s order whileconcluding that commission’s orderconstituted retroactive rate making.• Fundamental rule of rate making is that ratesare exclusively prospective in nature.

W.P No.2972/2011 Page 24 of 676. Muhammad Anum Saleem Advocate, whileputting appearance on behalf of the petitioners,argued at length about the fundamental rights atstake in the matter; the power, scope andjurisdiction of the superior courts to review theexecutive/administrative actions; and issuespertaining to rule of law, democratic norms, goodgovernance and equal treatment in context of the lisin hand. He made the following submissions:• While referring to a number of celebratedjudgments of the court of apex as well as fromIndian Jurisdiction, the learned counselmaintained that Article 9 of the Constitutionhas been interpreted and its scope has beenenlarged to each and every aspect of humanlife. Therefore, whenever a policy is framed,with reference to uplifting the socio-economicconditions of the citizens, object should be toensure enforcement of their fundamentalrights. Relied upon 2012 SCMR 773; PLD 2010SC 1109; PLD 2010 SC 759; PLD 2011 SC619; PLD 1994 SC 693• Right to live guaranteed in any civilized societyimplies the right to shelter and whilediscussing the right to shelter the superiorcourts have held that the same includes theelectricity being an essential service to theshelter for the human beings. He has referredto AIR 1996 SC 90; 1995 INDLAW SC 1358;2007 INDLAW CAL 133; PLD 2009 SC 644• Every executive or administrative action of thestate or other statutory or public body is open

W.P No.2972/2011 Page 25 of 67to judicial scrutiny and <strong>High</strong> <strong>Court</strong>s andSupreme <strong>Court</strong>, in exercise of the power ofjudicial review under the Constitution, canquash the executive action or decision which isviolative of fundamental rights guaranteedunder the Constitution.• Judicial review is designed to prevent thecases of abuse of power and neglect of duty bypublic authority, and the superior courts ofthe country under the constitutionaljurisdiction are conferred with wide powers toreach injustice where ever it is found. Inthis regard he has made reference to PLD 2012SC 292; PLD 2011 SC 963; PLD 2011 SC 997;2012 SCMR 06; PLD 2011 SC 407; PLD 1967SC 569; 2010 INDLAW DEL 928.• Public functions need not be the exclusivedomain of the State and several corporationsand companies have also been formed toperform public functions and to achieve somecollective benefit for the public or a section ofpublic, then a writ of mandamus lie in suchmatters against such corporations andcompanies.• The superior court’s power of judicial review ofadministrative and executive decisions issquarely, adequately and widely available onthe grounds of illegality, irrationality andprocedural impropriety.• While referring to Arts.18, 15, 24 of theconstitution submit that in fact the impugnedproviso and consequent levy of surcharge

W.P No.2972/2011 Page 26 of 67tantamount to prohibit and prevent thebusiness and trade in the country. Reasonablerestriction does not, at all mean deprivation ofcitizens from fundamental rights.• Impugned proviso as well as levy and demandof <strong>Fuel</strong> <strong>Adjustment</strong> Surcharge do not stand thetest of due process as well as fundamentalrights as envisaged under Arts. 4, 9, 14 and25.• The respondent’s acts are also against the veryconcepts of good governance, rule of law,which are recipe for corruption,mismanagement, nepotism, jobbery besidesbeing illegal, ultra-vires to the constitutionalcommands and discriminatory as well.• NEPRA order(s) does not contain within itselfthe essential requirement of rule of law. It isclear besides the mandate of expressprovisions of section 31(2) of the Act. It alsoamounts to arbitrary, unreasonable andconfiscatory exercise of power.• Fundamental rights in the constitution are tobe read and interpreted by the superior courtsin expansive, dynamic and flexible manner.Articles of Universal Declaration of HumanRights have also been taken in considerationby the superior courts of the country whileinterpreting the fundamental rights asguaranteed in our own Constitution. PLD 2011SC 407; 2012 SCMR 06, PLD 2012 SC 292;PLD 1993 SC 341; PLD 2011 LAHORE 120;1999 SCMR 1379

W.P No.2972/2011 Page 27 of 677. Mian Mehmood Rashid, Advocate Supreme<strong>Court</strong>, while putting his appearance submitted asfollows:• The proviso to section 31(4) of the NEPRA Act,1997, amended on 29.09.2011, is ultra viresthe constitution and the vires of NEPRA Act,1997. The learned counsel emphasized thatthe proviso was ultra vires to the constitutionand law even before the amendment, what totalk of its absurdity after the amendment.• While dilating upon the issue of retrospectivecharge the learned counsel stated that almostall the determinations and notifications aredelayed for about five to seven months at least.The difference pointed out by the learnedcounsel is as follows:DeterminationdateDate ofNotificationBillingMonthimplementtingtheNotificationsCorrespondingmonthDifference15.06.2011 23.08.2011 April, 2011 September, 5 Months201119.07.2011 23.08.2011 May, 2011 September, 4 Months201112.08.2011 29.09.2011 June, 2011 October, 2011 5 Months03.10.2011 01.11.2011 July, 2011 November,20115 Months• In this back drop, the learned counselemphasized that the <strong>Fuel</strong> <strong>Adjustment</strong>Surcharge for the month of April was madeafter a lapse of 170 days, and for the month ofMay, June and July, 2011 was made after slapse of 140 days each.

W.P No.2972/2011 Page 28 of 67• The recovery of <strong>Fuel</strong> <strong>Adjustment</strong> Charges isobviously back dated; retrospective in nature,levied in a situation when the crucial monthshad already been closed and paid for, thusbecame a past and closed transaction.• All the electricity companies, acting under theblessings of the government, operate in amonopolistic manner, whereas the petitionersare the commercial entrepreneurs who areacting in competitive commercial markets. Themanner, the authority is being exercised, theelectricity companies have been ensured thatthey are not only made entitled to recover theirentire input costs, but also the profit in everysituation, while on the other hand, theconsumers must have to suffer the loss ineach and every circumstance, that too, byretrospective imposition of FAS.• The impugned law is causing perpetual loss tothe consumers by imposing fuel adjustmentsurcharge in a retrospective manner, which isin violation to their fundamental rights.• The concept of predictability of the tariff whichis a universally accepted and required criterionfor the determination of tariff, has beenblatantly violated, ignored and destroyed.• While narrating the history tariffdetermination, the learned counsel maintainedthat earlier on the tariff was determined andnotified on the yearly basis, which took care ofthe preceding year’s differentia in a prospectivemanner, thereafter, in the year 2006-07, bi-

W.P No.2972/2011 Page 29 of 67annual fuel adjustment method was devised bythe NEPRA, which was also prospective innature. Then, the exercise was made onquarterly basis but always in a prospectivemanner. The learned counsel stressed that thisprocess gave a fair opportunity to theelectricity distributing companies to recovertheir cost at one hand while on the other handgave an equal margin to the commercialconsumers to pass on the costs in theirproduction, manufacturing and sale of goods,but through the introduction of impugnedproviso the whole scheme has been changedand consumers’ rights have been usurped.• The proviso is punitive, arbitrary,expropriatory, confiscatory, vague, overboard,unreasonable and violative of the fundamentalrights to carry on business or to holdproperties.• It invites uncertainty and takes away theconcept of predictability of tariff, which iscardinal principle of NEPRA Act. In this regardthe learned counsel referred Guidelines underRule-16 of the tariff standards and ProcedureRules, 1998.• A colorable piece of legislation, which not onlyinvites discrimination between the licenseesand consumers in general but also a directand personal burden on the industrialconsumers of electricity, which burden theycan neither pass on to their customers norinclude into the cost of production.

W.P No.2972/2011 Page 30 of 67• Determinations and notifications are illegaldue to the reason that NEPRA before passingthe notification was required to follow theguidelines/directions issued in judgmentsrendered by the honorable <strong>High</strong> <strong>Court</strong> in caseof ICC Textiles Limited Vs. WAPDA etc,reported as 2009 CLC 1343 and by the courtof apex in Watan Party’s case reported as PLD2011 SC 997. He maintained that NEPRA alsoignored the Hagler & Bailley Audit Report, andinstead of taking remedial measures at its ownend, it threw the entire burden on consumersby levying exaggerated, unjustified and illegalcost.• Lastly, even otherwise, notifications for themonths of June and July, 2011 being issuedby the Federal Government are without lawfulauthority, as by then the power to issuenotification was lied with NEPRA and not withthe Federal Government.• In support of his arguments he has referred to2012 SCMR 06; 2001 CLC 848; AIR 1967 MP268; AIR 1961 SC 552; PLD 1993 SC 176;2004 PTD 2267; PLD 2005 SC 193; PLD 1957SC 09; PLD 2005 SC 873; PLD 2011 LAH 120;2009 SCMR 187; PLD 2011 SC 44; 2011 PLC(C.S) 7; 1991 CLC 13; 2002 SCMR 312; I998SCMR 2268; 2007 SCMR 1835; PLD 1966 SC628; 1997 SCMR 503; 1988 SCMR 715; 1993SCMR 1905; PLD 2011 SC 997; 2009 CLC1343.

W.P No.2972/2011 Page 31 of 678. Muhammad Siddique Mughal, AdvocateSupreme <strong>Court</strong>, while appearing in 13 writpetitions, by referring a plethora of case law fromnumerous jurisdictions raised the following points:• The principle against the retrospectiveoperation of the statutes is applicable withmore force in the case of fiscal statutes. Fiscallegislation imposing liability is generallysubject to normal presumption that it is notretrospective, reliance has been place uponAIR 1954 SC 158.• If monetary benefits accrued on account of theretrospective operation has to be denied to thebeneficiaries, by the same token, monetarybenefits also enjoyed by the person adverselyaffected by such retrospective operation shouldnot be taken away.• It is well settled principle of law that thedoctrine of promissory estoppel applies to theState. It is also not in dispute that alladministrative orders ordinarily are to beconsidered prospective in nature. The effect ofwithdrawal of the relief with retrospectiveoperation will be to impose on the assessee ahuge accumulated financial burden for notfault of the assessee and this is bound tocreate serious financial problems for theassessee. The respondent could not haverevised its price from a back date andrecovered it from innumerable customers towhom its finished products were supplied at afixed price. The Government is competent toresile from a promise even if no one is put in

W.P No.2972/2011 Page 32 of 67any adverse situation which cannot berectified. The law does not authorize the Stateto issue a direction with retrospective effect.The authority therefore could only giveprospective effect to such directions.• Even otherwise, it is consistently followed lawthat what is directly forbidden cannot beachieved indirectly and also that when a thingis to be done in a particular manner it must bedone in that way and not otherwise, but theimpugned determinations and notificationswith regard to imposition of <strong>Fuel</strong> <strong>Adjustment</strong>Surcharge are violative of these goldenprinciples of law. The learned counsel reliedupon 2010 SCMR 1437, PLD 1971 SC 61,2005 PLC 634, AIR 1975 SC 2299.• The consumers were not served with anynotice; however, the same could have easilybeen served through monthly electricity bill.Moreover, no written objections or commentswere ever called upon from the consumersregarding the proposed adjustments, which isviolative of the principles of natural justice.9. On the other hand, while vehemently refutingthe arguments advanced from petitioners’ side,learned counsels for respondents Kh. Ahmed TariqRahim and Sh. Muhammad Ali, Advocates for M/OWater & Power, <strong>Islamabad</strong>.Mr. Shamshad UllahCheema along with Mr. Muhammad Shafique, LegalAdvisor for NEPRA.Mr. Munawar-us-Salam andMuhammad Usman Sahi, Advocate for LESCO.

W.P No.2972/2011 Page 33 of 67Syed Kazim Hussain Kazmi along with MuhammadSiddique Malik, Director Legal (GEPCO) for GEPCO& IESCO. Mr. Fazal-ur-Rehman, Mr. MuhammadShakeel Abbasi, Mr. Muhammad Asif Khan and Mr.Saeed Raza, Advocates for IESCO. Rana Asif Saeed,Advocate on behalf of MEPCO, GEPCO, NTDC &FESCO. Mr. Asad Jan, Advocate along with Mr.Shakeel, AD Legal for PESCO. Mr. Noman MunirPeracha, Advocate for HESCO. Mr.MuhammadKhalid Zaman, Advocate for FESCO contested thepetition and took the stance of non-maintainabilityof writ petition by raising preliminary objections,which are as follows:• No Board Resolutions conferring authorityupon the petitioners have been attached withthe petitions.• Alternate remedies were available to Petitionerunder the 1998 Rules.- Rule 3: File a petition foradjustment/revision of Tariff.- Rule 16(6): File a review petition beforeNEPRA.- In the presence of alternate remedies,constitutional petitions are not maintainable.Petitioners did not seek the remedy available tothem, hence cannot assail the same underconstitutional jurisdiction. Reliance is placedon PLD 1997 Lah 546, 2008 SCMR 308 and2007 CLD 530.

W.P No.2972/2011 Page 34 of 67• The earlier mechanism for fuel priceadjustment was challenged, on the samegrounds and principles, before this <strong>Court</strong>, andthe same has been adjudicated upon. Thejudgment is cited as 2010 YLR 2872.• The determinations of NEPRA, and the modusoperandi of fuel price adjustment, were upheldby this <strong>Court</strong> in 2010 YLR 2872; therefore,instant petitions are hit by the principle of resjudicataas well.• The monthly price adjustment mechanism hasbeen in field since 2008. The same have beenpaid by consumers. Furthermore, mechanismfor 2010-2011 was finalized as far back as 09-12-2010. No objections were raised. Publicnotice was given before finalizing tariff, as wellas before finalizing adjustment for specificmonths; therefore, Petitioners are nowestopped from impugning the mechanismwhich was finalized as far back as 09-12-2010.Reliance was placed upon PLD 2004 Lahore404.• The questions in the petitions involvedetermination of facts and call for detailedfactual inquiry relating to tariff determinationwhich is beyond the scope of the constitutionaljurisdiction of this <strong>Court</strong>.• On merits they asserted that the bills did notbecome a past and closed transaction.Financial liability does not become past andclosed transaction. While referring to 1988

W.P No.2972/2011 Page 35 of 67SCMR 715, PLD 1970 SC 514, 2003 CLD1299, PLD 2003 Kar. 174, PLD 2004 SC 25hemaintained that the concept of ‘past andclosed transaction’ is based on theinterpretation that the transactionscontemplated had attained finality. Finalitywas not attained in the present case.Mechanism for adjustment was finalized as farback as 09-12-2010. It involved adjustment offuel price variation on a monthly basis, whichis also warranted under the NEPRA Act.Finality is only attained once the adjustmentshave been made.• The notifications were issued in consequenceof the Tariff Determination of NEPRA. Thesame was never objected to. Such anotification cannot be retrospective, as the fuelprice variation can only be concluded after themonth has passed. Reliance is placed on 2010YLR 2872.• No vested right accrued in favor of thepetitioners. The Petitioners were aware, orshould have been aware, of the fuel priceadjustment mechanism. The mechanism hasbeen used for previous years as well, from2008 onwards. Reliance is placed on 1992SCMR 2430 page 2433, 2010 YLR 2872, 2010SCMR 517.• All actions are transparent, and open to thepublic. The determinations are made in light ofthe facts and figures provided by the relevantbodies. Hence, there is no discrimination.

W.P No.2972/2011 Page 36 of 67• Due process of law has been followed. Section31(4) gives NEPRA the power to determinetariffs. Under this power, NEPRA gave its TariffDetermination dated 09-12-2010. The fuelprice adjustment mechanism was containedtherein. As per the proviso to section 31(4),NEPRA had to revise tariff on account of fuelprice variation. This is what was done afterproper public notice and dueprocess.Furthermore, there was no delay.Notices for hearing were published on amonthly basis, and tariff was revised afterdeliberations on the content placed beforeNEPRA. Even otherwise, no penalconsequences provided hence the provision notmandatory, but directory. Reliance was placedupon PLD 1974 SC 13, 2000 SCMR 1305.• Electricity falls under the Federal LegislativeList, and the Federal Government has thepower to pass legislation for matters related toelectricity. Therefore, the NEPRA Act and thepowers granted thereunder are valid law.• The contention of the Petitioner thatamendment to section 31(4) and its proviso toprovide for monthly revision goes against theprinciple of NEPRA Act to protect consumersfrom monopolistic and oligopolistic prices, andis ultra vires Article 18, it is contended thatthere is no promotion of monopolisticpractices. In fact, revision of prices ensuresuniformity and accountability of pricingstructures. On the basis of the above

W.P No.2972/2011 Page 37 of 67mentioned arguments learned counsel prayedfor the dismissal of the writ petitions.10. I have heard the learned counsel for theparties and through their able assistance gonethrough the statutory and precedent law.For betterunderstanding of the controversy raised in thesepetitions, it would be quite relevant andadvantageous to give a brief history and hierarchy ofNEPRA. In 1992, the Government approvedWAPDAs Strategic Plan for Privatization of thePakistan Power Sector. A critical element ofstrategic plan was the creation and establishment ofa regulatory authority to oversee the restructuringprocess and to regulate monopolistic services. OnDecember 16, 1997, issue of the gazette of Pakistanproclaimed the enactment of the Regulation ofGeneration, Transmission and Distribution ofElectric Power Act, 1997, which had becomeeffective on 13 December 1997, National ElectricPower Regulatory Authority (NEPRA) has beencreated to introduce transparent and judiciouseconomic regulation, based on sound commercialprinciples, to the electric power sector of Pakistan.NEPRA’s main responsibilities are to:• Issue Licenses for generation, transmissionand distribution of electric power;

W.P No.2972/2011 Page 38 of 67• Establish and enforce standards to ensurequality and safety of operations and supply ofelectric power to consumers;• Determine tariffs for generation, transmissionand distribution of electric powerNEPRA is responsible for issuing licenses fordistribution of electric power under section 21 of theRegulations of Generation, Transmission andDistribution of Electric Power Act, 1997. There arefive broad categories that consist of numerouslicensees. A brief illustration is envisaged here inbelow:-i) EX-WAPDA Distribution Companies(DISCOs)- includes <strong>Islamabad</strong> Electric SupplyCompany (IESCO), Peshawar Electric SupplyCompany (PESCO), Lahore Electric SupplyCompany (LESCO), etc.ii)Karachi Electric Supply Company (KESCO)iii)GENCOs-Thermal- Jamshoro Power CompanyLimited (JPCL), GENCO-I, Central PowerGeneration Company (CPGCL), GENCO-II,Northern Power Generation Company Limited(NPGCL), GENCO-IIIiv) Independent Power Procedures (IPPs)-NishatPower Limited, DHA Cogen Limited,Attock Gen Limited, Sapphire ElectricCompany Limited, etc.v) Small Power Procedures (SPPs)- ICI PakistanPower Gen Ltd, Crescent Power Tech Ltd,Kohinoor Power Company Ltd, Ibrahim Fibers

W.P No.2972/2011 Page 39 of 67Ltd, Sitara Energy Ltd, Mehmood Textiles MillsLtd, etc.The following chart describes the hierarchy ofNational Electric Power Regulatory Authority:-Federal GovernmentNational Electric Power Regulatory Authority (NEPRA)Karachi Electric GENCO- IPPs SPPsSupply Company Thermal (Independent (Small Powerissues licensesPower Producers)Producers) WAPDAto Ex-WAPDADistributionCompaniesQESCOPESCO IESCO LESCO(Quetta)(Peshawar) (<strong>Islamabad</strong>) (Lahore)Industrial and Residential Consumers11. Before dilating upon the other issues, I deem itappropriate to take up the issue of the maintainability ofthe writ petitions under Article 199 of the Constitution.In this regard the judgment of the honorable Supreme<strong>Court</strong> of Pakistan passed in the case of MuhammadYasin versus Federation of Pakistan, reported as PLD2012 SC 132, wherein appointment of Mr. Touqeer Sadiq

W.P No.2972/2011 Page 40 of 67as Chairman of the regulatory authority i.e OGRA was setaside, has served as a lightship for me. The honorableSupreme <strong>Court</strong> has elaborately set forth certainguidelines for the high courts in terms of Article-189 ofthe Constitution which are fully attracted in the instantcase. The honorable Supreme <strong>Court</strong> held as follows:“At the end of this part of our opinion, we can nowsummarize our three-step rationale for maintaining thepresent petition. Firstly, when understood correctly, anumber of Articles of the Constitution make it clear that itis not silent about the economic life of the nation and theconcomitant fundamental rights of its citizens; secondly,we are clear that there is an ever-greater nexus betweenthe proper and independent functioning of the regulatorybodies and economic life of the nation and its citizens andthat this nexus is fully recognized by the Legislature in itsuse of language employed by the Ordinance in theprovisions referred to above; and finally, there can be nodoubt that regulatory bodies can function competently andindependently only once their autonomy is ensuredthrough enforcement of the legal checks uponappointments to important positions therein. When thesethree points are fully appreciated, it becomes clear thatthe validity of the process of appointment of theChairman, OGRA is indeed a matter of public importancewhich has a direct linkage with the fundamental rights ofthe people of Pakistan, and thus warrants the exercise ofjurisdiction by this <strong>Court</strong> under Article 184 (3) supra. It ispossible, however, that if similar cases arise in future, the<strong>High</strong> <strong>Court</strong>s may be in a position to decide the same byapplying the principles of law enunciated in this judgment,in terms of Article 189 of the Constitution.”In paras-13 & 14 of the verdict (supra) the honorableSupreme <strong>Court</strong> while elaborating the fundamental rightsof the citizens in connection with the functions andpowers of the regulatory authorities, has held:“When we see the Constitution in this manner, we arebrought to the unavoidable conclusion that it is a part of

W.P No.2972/2011 Page 41 of 67the fundamental rights of the people of Pakistan that theybe governed by a State which provides effectivesafeguards for their economic well-being; a State whichprotects inter alia, the belongings and assets of the Stateand its citizens from waste and malversation. Contrary towhat some commentators seem to believe, ourConstitution is not silent on issues, which affect theeconomic life of the nation and its citizens. It contains awhole range of Articles which have a direct nexus withgood economic governance and fundamental rights. Atthe very beginning in Article 3 there is, for instance, anoft-forgotten but eloquently stated directive “The Stateshall ensure that elimination of all forms of exploitationand the gradual fulfillment of the fundamental principle,from each according to his ability to each according to hiswork”. Then there is Article 4, which guarantees theprotection of law, not just for life and liberty, but also forthe body and property of citizens. Furthermore, there is awhole range of fundamental rights, such as the right to life(Article 9), the universal and non-derogable right to a lifeof dignity (Article-14), the right to engage in business(Article 25) which has clear economic ramifications. Whenthese articles are read together, we cannot escape theconclusion that the Constitution envisages a politicaldispensation where good economic governance is a rightof the people of Pakistan which they cannot be deprivedof. Articles, Justice Fazal Karim a former Judge of this<strong>Court</strong> and the nation’s leading legal academic and author,concludes with a telling comment from which we seekguidance: “In short, Article 18 and the rights guaranteedby it are concerned with the economic life of the nationand its citizens.” (emphasis supplied) p. 718. The directnexus between the appointment of Chairman, OGRA andthe other fundamental rights enumerated above can nowbe elaborated as the Second step of our reasoning.14. It needs to be understood that in our presentcontext, the economic life of the nation and its citizens, isinextricably linked with the proper functioning ofregulatory bodies such as OGRA. To fully appreciate this,we may take stock of some recent developments, whichhave deepened the connection between the proper‘effective and efficient’ functioning of regulatory bodiesand the fundamental rights of citizens. In the past,particularly during the 1970’s, direct State ownership andmanagement of business enterprises was a policyobjective of the Government. More recently, however,such State involvement has receded through privatization

W.P No.2972/2011 Page 42 of 67of many State owned enterprises and throughentrustment of activities (which hitherto were undertakenby the State) to companies initially owned by the State butslated for disinvestment through privatization. The mostrelevant example of this, in the context of the presentcase is the creation of the Oil and Gas DevelopmentCompany Ltd. It has been incorporated under theCompanies ordinance, 1984 pursuant to the Oil and GasDevelopment Corporation (Re-organization) Ordinance2001. In view of this increasing trend towardsprivatization, regulation has emerged as perhaps thesingle most important function of the State in the sphereof macro-economics.I find it appropriate to borrow the words of wisdom fromHonorable Supreme <strong>Court</strong>, on the powers of superiorcourts on the judicial review.A Larger Bench of thehonorable Supreme <strong>Court</strong> in 2011 PLC (CS) 1076 (HajjCorruption case) held that:“20. The judiciary including the <strong>High</strong> <strong>Court</strong>s and theSupreme <strong>Court</strong> is bound to protect and preserve theConstitution as well as to enforce fundamental rightsconferred by the Constitution either individually orcollectively, in exercise of the jurisdiction conferred upon iteither under Article 199 or 184(3) of the Constitution. We arefully cognizant of our jurisdiction; it is one of the functions ofthe judicial functionaries to decide the matters strictly inaccordance with the Constitution and law. We are consciousof our jurisdiction, and exercise the same with judicialrestraint. But such restraint cannot be exercised at the costof rights of the citizens to deny justice to them.The scheme of the constitution makes it obligatory on thepart of superior <strong>Court</strong>s to interpret constitution, law andenforce fundamental rights. There is no cavil with theproposition that ultimate arbiter is the <strong>Court</strong> which is thecustodian of the Constitution, as it has been noted hereinbefore and without repeating the same, this <strong>Court</strong> hadinitiated proceedings in the instant case as is evident fromthe detailed facts and circumstances noted hereinabove toensure that corruption and corrupt practices by which theHujjaj were looted and robed has brought bad name to thecountry.23. This <strong>Court</strong> is of the considered view that a democraticsystem must prevail in the Country which aspect has beenhighlighted in the case of Sindh <strong>High</strong> <strong>Court</strong> BarAssociation’s Case (PLD 2009 SC 879) wherein all theactions of the military dictator were declaredunconstitutional besides the elections held in February,2008 was also under threat of being declared illegal werevalidated to promote will of the electorate. Justice AbdulHameed Dogar, who was not recognized as lawful Chief

W.P No.2972/2011 Page 43 of 67Justice but the oath he administered to the President ofPakistan was declared valid by this <strong>Court</strong> in order to savethe system by holding inter alia as under: -191. This <strong>Court</strong> hopes that all institutions, on the wellknown principles of good governance, and withouttransgressing their constitutional bounds, willendeavor to eradicate corruption and self enrichment,and will devote themselves to the service of the people.Needless to add that the <strong>Court</strong>s will, at all times,remain vigilant in this behalf and will always come tothe rescue of any beleaguered citizen or class ofcitizens whenever and wherever an occasion ‘arises’.”As this proposition has been exhaustively discussed,comprehensively elaborated and thoroughly settled in avariety of cases. It would be advantageous to reproducefollowing passages from a recent judgment of thehonorable Supreme <strong>Court</strong> i.e. Watan Party V. Federationof Pakistan, PLD 2012 SC 292 [Memogate case]:Indisputably, if the action or decision is perverse or issuch that no reasonable body of persons, properlyinformed; could come to or has been arrived at by theauthority misdirecting itself by adopting a wrongapproach or has been influenced by irrelevant orextraneous matters the <strong>Court</strong> would be justified ininterfering with the same. [Commissioner of Income Tax v.Mahindra (AIR 1984 SC 1182)]. The exercise ofconstitutional powers by the <strong>High</strong> <strong>Court</strong> and the Supreme<strong>Court</strong> is categorized as power of judicial review. Everyexecutive or administrative action of the State or otherstatutory or public bodies is open to judicial scrutiny andthe <strong>High</strong> <strong>Court</strong> or the Supreme <strong>Court</strong> can, in exercise ofthe power of judicial review under the Constitution,quash the executive action or decision which is contraryto law or is violative of Fundamental Rights guaranteedby the Constitution. With the expanding horizon ofArticles dealing with Fundamental Rights, everyexecutive action of the Government or other public bodies,if arbitrary, unreasonable or contrary to law, is nowamenable to the writ jurisdiction of the Superior <strong>Court</strong>sand can be validly scrutinized on the touchstone of theConstitutional mandates. [Common Cause, A Regd.Society v. Union of India (AIR 1999 SC 2979)]. In the caseof Union Carbide Corporation v. Union of India [AIR 1992SC 248 = 1991 SCR (1) Supl. 251], the <strong>Court</strong> while takingup the issues of healthcare and compensation to thevictims, supervised the distribution of the money amongthe victims of Bhopal gas tragedy and monitored thehospitals set up to treat the victims.

W.P No.2972/2011 Page 45 of 67the opinion of Ch. Ijaz Ahmad, J. in the case of the ChiefJustice of Pakistan, supra at pages 232 to 238. The analysisin the case of the Civil Service Union supra is equallyapplicable to the circumstances of these petitions. LordDiplock stated three grounds for exercise of the <strong>Court</strong>’s powerof judicial review. These are ‘illegality’, ‘irrationality’ and‘procedural impropriety.’ Council of Civil Service Union v.Minister ([1984] 3 All ER 935, 950-952).What is important fordeciding the present petitions is the scope and nature of‘illegality’, which, in the language of the aforesaid case, ismeasured on the consideration “… that the decision-makermust understand correctly the law that regulates his decisionmakingpower and must give effect to it. Whether he has ornot is par-excellence a justiciable question to be decided, inthe event of dispute, by those persons - the Judges by whomjudicial power of the State is exercisable” (ibid). Thus anydecision based on an incorrect understanding of the law thatregulates the decision-maker’s decision-making power, wouldbe an illegal decision, and it could be corrected throughjudicial review. What must be emphasized here is that indisputed cases, it is for the <strong>Court</strong>s to definitively interpret thelaw and thereafter to test the administrative decision on thetouchstone of the law so interpreted.In the case of Watan Party and another Vs. Federation ofPakistan (Law and Order in Karachi) PLD 2011 SC 997, ithas been held:“2. This aspect of the Islamic teachings, as well finds itsreflection in the Constitution of the Islamic Republic ofPakistan 1973. The Constitution, in its very Preamble,postulates that the principles of democracy, freedom, equality,tolerance and social justice, as enunciated by Islam, shall befully observed and the fundamental rights, including equalityof status, of opportunity and before the law, social, economicand political justice, and freedom of thought, expression,belief, faith, worship and association, subject to law andpublic morality; shall be fully guaranteed. These veryprinciples have been made a substantive part of theConstitution under Article 2A. Thus, it is the duty of the Stateto protect and safeguard all these Fundamental Rightsincluding the right to life and liberty as envisaged by Article 9of the Constitution, which has been interpreted by this <strong>Court</strong>in Shehla Zia’s case (PLD 1994 SC 693) as under: -“Article 9 of the Constitution provides that no personshall be deprived of life or liberty save in accordancewith law. The word "life" is very significant as it covers

W.P No.2972/2011 Page 46 of 67all facts of human existence. The word "life" has notbeen defined in the Constitution but it does not meannor can it be restricted only to the vegetative or animallife or mere existence from conception to death. Lifeincludes all such amenities and facilities which aperson born in a free country is entitled to enjoy withdignity, legally and constitutionally.The instances are not few when the Honorable Supreme<strong>Court</strong> of Pakistan has held that the right to life includesthe right to live with human dignity and termed it afundamental right as mandated under the Constitution ofthe Islamic Republic of Pakistan, more particularlyArticles 9 and 10 thereof. In a recent case of AllegedCorruption in Rental Power Plants etc., reported as 2012SCMR 773, the honorable Supreme <strong>Court</strong> of Pakistanhas held:“The Constitution of the Islamic Republic ofPakistan mandates that State shall exercise itspowers and authority through chosenrepresentatives of the people. A democratic orderin place, through the representatives of people,being the members of Parliament, obligates theelected representatives to fulfill theircommitments bestowed upon them under theConstitution, and in their representative capacity,they are bound to perform their functionshonestly, to the best of their ability, faithfully, inaccordance with the Constitution and the law aswell as the Rules of the Assembly, and always inthe interest of sovereignty, integrity, solidarity,well being and prosperity of Pakistan. Such abinding force of the Constitution commands themto ensure well being and prosperity of Pakistan,so whenever they feel threat to the well being of

W.P No.2972/2011 Page 47 of 67the people of Pakistan for any reason, they arebound to preserve the same.”“It is to be clarified that the Government of theday under Article 29 read with Article 2A of theConstitution is bound to formulate policies for thepromotion of social and economic well being of thepeople, which includes provision of facilities to thecitizens for work and adequate livelihood with areasonable rest and leisure, etc.Energy/electricity is essentially one of thesignificant facilities required by the citizens formanifold purposes, namely, uplifting of theirsocial and economic status. Non-supply ofelectricity to the citizen regularly, is tantamount todepriving them of one of the essentials of the lifeincluding the security of economic activities,which are relatable to their fundamental rightsprotected under Articles 9 and 14 of theConstitution. In the cases of the Bank of Punjab v.Haris Steel Industries (PLD 2010 SC 1109),Liaqat Hussain v. The Federation of Pakistan(Constitution Petition No.50/2011), In Re: HumanRights Case regarding fast food chain in F-9 Park(PLD 2010 SC 759), In Re: SMC No.13/2009(Case regarding Multi-Professional HousingSchemes) (PLD 2011 SC 619) and Shehla Zia v.WAPDA (PLD 1994 SC 693), Article 9 has beeninterpreted and its scope has been enlarged toeach and every aspect of human life. Therefore,whenever a policy is framed with reference touplifting the socio-economic conditions of thecitizens, object should be to ensure enforcementof their fundamental rights.”12. Seeking guidance from the above referreddictums of the honorable Supreme <strong>Court</strong>, I am ofthe considered opinion that the petitions aremaintainable and this court has ample powers

W.P No.2972/2011 Page 48 of 67under the constitution to exercise the power ofjudicial review in the matter as the matter relates tothe fixation of (FPA) tariff and prices for consumersand is a part of regulatory function of the NEPRAand has a direct connection with the economic wellbeingof the people of Pakistan.13. Before proceeding further, I find itappropriate to mention relevant provisions ofNEPRA, 1997. Section 31 deals with tariffs, andSub-section (4) lay down the procedure of issuanceof notifications by the federal government regardingthe tariff determined in accordance with the saidprovision. Section 32 (1)mandates that the Authorityshall, within 18 months from the commencement ofthis Act prescribe procedures and standards for theAuthority’s prior approval of transmissioncompanies and distribution companies investmentand power acquisition programs. Section 46stipulates Rules and Sub-section (2)(d) deals withdetermination of rates, fees, charges and othersterm and condition of licenses; and (f) procedure forresolving disputes amongst the licensees andconsumers.National Electric Power Regulatory Authority(Tariff Standards and Procedure) Rules, 1998commenced by virtue of section 46 of the 1997 Act.o Rule 2(m)- defines tariff

W.P No.2972/2011 Page 49 of 67o Rule 3- filing of petitions and communication;o Rule 4(1)- Admission of petitiono Rule 4(7)- Authority may, while admitting the petitionallow immediate application of proposed tariff Subject toan order for refund for protection of consumerso Rule 12- Rulings of the presiding officer. Rule 12(1) to (4)o Rule 14- Tentative opinionso Rule 16- Decision by the Authority. Rule 16(2), (6), (11)o Rule 18- Filing of tariffo Rule 21 (d)- Notice of general rate changes to thecustomers of licenseesFor the purposes of the instant petitions, section 31,more particularly, section 31(4) is most important. Followingamendments were made in section 31 of NEPRA Act 1997 tillto date:Section 31 Of Act –dated 16-12-1997Tariff. (1)- As soon as maybeen, but not later thansix months from thecommencement of this Act, the Authority shall thedetermine and prescribeprocedures and standardsfor determination,modification or revision ofrates, charges and termsand conditions for thegeneration of electricpower , transmission,interconnection,distribution services andpower sales to consumersby licensees and untilsuch procedures andstandards are prescribe,the Authority shalldetermine, modify orrevise such rates, chargesand terms and conditionsin accordance with thedirections issued by thefederal government.(2)- The Authority whiledetermining the standardsreferred to in sub-section(1) shall –a) Protect consumersagainstmonopolistic andoligopolistic prices;b) Keep in view theresearch,Section 31 Of Act – newamendment dated : 31-07-2009 (throughOrdinance which stoodlapse)Section 31 Of Act –further amendmentdated: 29-09-2011

W.P No.2972/2011 Page 50 of 67development andcapital investmentprograms costs oflicensees;c) Encourageefficiency inlicensees operationsand quality ofservice;d) Encourageeconomic efficiencyin the electric powerindustry;e) Keep in view theeconomic and socialpolicy objective ofthefederalgovernment; andf) Determine tariff soas to eliminateexploitation andminimize economicdistortion(3)- The proceduresestablished under subsection(1) shall includea)Time frame fordecisions by theauthority on tariffapplications;b) Opportunity forcustomers andother interestedpartiestoparticipatemeaningfully in thetariff approvalprocess; andc) Protection forrefund, if any. Tocustomers whiletariff decision ispending(4)- Notification of theAuthority’s approved tariff,rates, charges and otherterm and conditions forthe supply of electricpower services bygeneration, transmissionanddistributioncompanies shall be made,in the official gazette bythe federal governmentupon the intimation by theAuthority; Provided thatthe federal governmentmay, as soon as may be,but not later than 15 daysof receipt of Authority’sintimation, require theAuthority to consider itsdetermination of suchtariff, rates, charges andother terms and conditionwhereupon the AuthorityIn sub-section (4), -i. For the word“Authority:”, at theend, the words,brackets, figureand letter “Authority withinperiod of 15 days ofsuch intimationexcept where thefederal governmentrefers the matter tothe Authority forreconsiderationunder sub-section(4A)” shall besubstituted ; andii. “ Provided furtherthat the Authorityshall, on a monthlybasis, review andrevise the approvedtariff on account ofIn the said Act, insection 31 , in subsection(4) for the secondproviso the followingshall be substituted,namely“Provided further that theAuthority may, on amonthly basis and do notlater than a period of 7days make adjustment inthe approved tariff onaccount of, any variationin the fuel charges and,policy guideline as thefederal government mayissue and , notify thetariff so adjusted in theofficial Gazette.

W.P No.2972/2011 Page 51 of 67shall, within 15 days,determine these anewafter reconsideration andintimate the same to thefederal government;any variation in thefuel charges andpolicy guidelines tobe issued by thefederal; governmentin this behalf andrecommend ther=tariff so revised tothe federalgovernment for thenotification in theofficialgazette.”;andiii. After sub-section(4) amended asaforesaid, thefollowing new subsectionsshall beinserted, namely:-“(4A) The federalgovernment may, as soonas possible but not laterthan 15 days of receipt ofthe Authority’s intimationrequire the Authority’s toreconsideritsdetermination of tariff,rates, charges and otherterms and conditionsmade under sub-section(1) and the Authority shallreconsider and determinethe same anew within aperiod of 15 days from thedate of reference by thefederal government”(4B) within 3 days of theexpiry of the periodavailable to the Authorityunder sub-section(4A), thefederal government shallnotify in the officialGazette,a) The tariffreconsidered anddetermined by theAuthority undersub-section (4A) ifavailable; orb) Where theAuthority has notconcluded thereconsideration,thetariffdetermined by theAuthority undersub-section(1)“(4C) not withstandinganything contained in this

W.P No.2972/2011 Page 52 of 67section, the Authorityshall continue to concludeits reconsideration undersection(4A) and the effectof such reconsiderationshall be adjusted by theAuthority in the tariff,rates, charges or otherterms and conditionsdetermined by it undersub-section (1) for thesubsequent period”It is evident from section 31(4) of the Act 1997, the federalgovernment has a margin of 15 days to approve thedetermination/assessment and notify the official gazette for anycharges to be imposed in the billing demand of next month.Law was amended on 29-09-2011. The power to notify in theofficial gazette is now vested with the Authority.14. In my view following are the justifiable issues whichrequire determination:i) Whether proviso to section 31 (4) of the NEPRA Act,1997 is ultra vires to the constitution?ii)Whether <strong>Fuel</strong> <strong>Adjustment</strong> Surcharge can be leviedand demanded with retrospective effect?iii) Whether on expiry of stipulated period of 15 days,provided under section 31 (4) of the NEPRA Act,Authority vests with power to levy and demand <strong>Fuel</strong><strong>Adjustment</strong> Surcharge as part of tarrif?iv) Whether scope of <strong>Fuel</strong> <strong>Adjustment</strong> Surcharge canbe expanded/ enhanced to provide cover to theelements/factors of mismanagement, badgovernance, inefficiency theft, inability to recoveracross the board?v) Whether already determined Tariff can be varied inthe name of fuel adjustment?

W.P No.2972/2011 Page 53 of 6715. I may deal to first point, as to whether proviso tosection 31 (4) of NEPRA Act is ultra vires to theconstitution or not?For convenience Section 31 with insertedproviso is being reproduced here in below:“Tariff: (1)- As soon as may been, but not later than sixmonths from the commencement of this Act, the Authorityshall determine and prescribe procedures and standards fordetermination, modification or revision of rates, chargesand terms and conditions for the generation of electricpower , transmission, interconnection, distribution servicesand power sales to consumers by licensees and until suchprocedures and standards are prescribe, the Authority shalldetermine, modify or revise such rates, charges and termsand conditions in accordance with the directions issued bythe federal government.(2)- The Authority while determining the standards referredto in sub-section (1) shalla) Protect consumers against monopolistic andoligopolistic prices;b) Keep in view the research, development and capitalinvestment programs costs of licensees;c) Encourage efficiency in licensees operations andquality of service;d) Encourage economic efficiency in the electric powerindustry;e) Keep in view the economic and social policy objectiveof the federal government; andf) Determine tariff so as to eliminate exploitation andminimize economic distortion.(3)- The procedures established under sub-section (1) shallinclude-a) Time frame for decisions by the authority on tariffapplications;b) Opportunity for customers and other interested partiesto participate meaningfully in the tariff approvalprocess; andc) Protection for refund, if any. To customers while tariffdecision is pending(4)- Notification of the Authority’s approved tariff, rates,charges and other term and conditions for the supply ofelectric power services by generation, transmission anddistribution companies shall be made, in the official gazette

W.P No.2972/2011 Page 54 of 67by the federal government upon the intimation by theAuthority;Provided that the federal government may, as soon as maybe, but not later than 15 days of receipt of Authority’sintimation, require the Authority to consider itsdetermination of such tariff, rates, charges and other termsand condition whereupon the Authority shall, within 15days, determine these anew after reconsideration andintimate the same to the federal government;Provided further that the Authority may, on a monthly basisand not later than a period of 7 days, make adjustments inthe approved tariff on account of, any variation in the fuelcharges and, policy guidelines as the federal governmentmay issue and, notify the tariff so adjusted in the officialGazette.(5)- Each distribution company shall pay to the FederalGovernment such surcharge as the Federal government,from time to time, notify in respect of each unit of electricpower sold to the consumers and any amount paid underthis sub-section shall be considered as a cost incurred bythe distribution company to be included in the tariffdetermined by the authority.”There is no cavil to the proposition that legislator inits wisdom can bring certain amendments in the Statuteand these amendment are fully protected unless found tobe offensive to the fundamental rights guaranteed by theconstitution. Arbitrary exercise of authority and perverseorders passed by the Authority, competent to pass order

W.P No.2972/2011 Page 55 of 67does not render the provision ultra vires to theConstitution. Man made laws are recurring ones, therefore,in order to bring the law inconformity with the new orchanged situation is the right of legislator in which nointerference can be made except on the touchstone ofArticle 8 of the constitution, therefore, plea of petitioner todeclare the inserted provision to section 31 (4) cannot beacceded to as nothing unconstitutional for issuance ofdeclaration of ultra vires has been pointed.16. Now, I would like to compass may view on thesecond point i.e. as to whether <strong>Fuel</strong> <strong>Adjustment</strong> Surchargecan be levied and demanded with retrospective effect ornot? My observations are as under:-“There is no doubt that Government has theauthority to levy tax and can demand surcharge butquestion arises is that, whether any tax payer can be takenby surprise and require to adjust cost of any product,which had already been reached to consumer? Answer tothis question is a big NO, as it looks not only ridiculous butunjust as well. The constitution of the Islamic Republic ofPakistan does not allow any sort of exploitation and permiteconomic and social wrongs. It is provided in the law thatAuthority empowered to make adjustment, due to variancein the fuel prices and period for this purpose has beenprescribed as 15 days. Under the Rules, Authority isempowered to allow interim levy subject to final

Groundwater flow at the site is reported in the Army EE/CA as consistently to the southeast toward astream tributary east of the site. Recorded depths to groundwater ranged from 0.2 to 30.8 feet bgs inMarch 2000. Water level measurements were performed in accordance with the Installation- WideSampling and Analysis Plan (IT, 2000c). Groundwater in well LF1-G02 was not observed under artesianconditions in March 2000. During RI activities in 1994 and 1995, SAIC (2000) reported that thegroundwater conditions in this well were periodically artesian. The groundwater elevation measured atLandfill No. 1, Parcel 78(6), wells in March 2000 ranged between 765.2 and 737.4 feet above msl. Thecalculated average hydraulic gradient, based on the March 2000 data is 0.04 feet per foot (ft/ft).Hydraulic conductivity measurements were obtained by the Army in LFl-G02 (3.27x10 cm/sec) and LFl-G03 (4.08x10-5 cm/sec) (SAIC, 2000). Groundwater data collected by the JPA indicate groundwaterflow at Landfill 1 is toward the southeast consistent with the Army data (Figure 4-3).4.1.5 Surrounding Land Use and PopulationsA residential housing area is located adjacent to Landfill No. 1, Parcel 78(6). Homes in this area werebuilt circa 1958 according to Asbestos Containing Building Materials Survey Miscellaneous HousingUnits (Reisz Engineering, 1998) and were used as residences for Fort McClellan staff and their familiesfrom 1958 to approximately September 1999. The current reuse plan for the area around Landfill 1 isresidential. Reuse scenarios that will be evaluated for Landfill No. 1 include residential and recreational.None of Landfill No. 1 is compatible with building homes due to waste debris and potential subsidenceissues. The land use for Landfill 1 is open space because the structural integrity of the fill materialprecludes placement of structures.Former housing units 3335, 3337, and 3339, which were a part of the residential housing area, weredemolished in 2005 due to concern over the proximity of these units to waste and/or fill materials.Specifically, unit 3335 appeared to be located over actual fill material, and unit 3337 was located within30 feet of the limits of waste fill.4.1.6 Sensitive EcosystemsThe ecological setting of Landfill No. 1, Parcel 78(6), is greatly defined by its proximity to a residentialarea and the fact that it is surrounded by relatively heavily traveled roads. The original ecological settinghas been altered through historical anthropogenic activities. The terrestrial habitat at Landfill No. 1 iscomprised of two types; maintained lawns and mixed coniferous and deciduous forest. There are nopermanent aquatic features or aquatic habitat at Landfill No. 1. A more complete discussion of theenvironmental setting at Landfill No. 1 is presented in Section 4.3.1.4-6