ITA. 152-2000 - Islamabad High Court

ITA. 152-2000 - Islamabad High Court

ITA. 152-2000 - Islamabad High Court

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

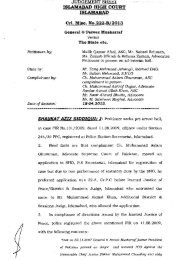

ORDER SHEETIN THE ISLAMABAD HIGH COURT, ISLAMABADCASE NO.:TAX APPEAL NO.<strong>152</strong>/<strong>2000</strong>.THE COMMISSIONER OF INCOME TAX/WEALTH TAXAPPELLANTPETITIONERVERSUSM/S SARHAD WOOLEN MILLS (PVT.) LTDRESPONDENTDEFENDANTAppeal/revision against the decree or order (as the case may be) of ______________SERIAL NO. OFORDER OFPROCEEDINGSDATE OR ORDEROF PROCEEDINGSOrder with signatures of judge, and thatof parties or counsel, where necessary.1 2 312.12.2011 Hafiz Munawar Iqbal, Advocate for theappellant.NOOR-UL-HAQ N. QURESHI J.-Theappellant/Commissioner of Income Tax/WealthTax, Companies Zone, <strong>Islamabad</strong> has filed theinstant appeal under Section 136 of the IncomeTax Ordinance, 1979, against the order dated21.5.1998 and has requested to decide thefollowing question of law:-1) Whether the facts and in thecircumstances of the case, thelearned <strong>ITA</strong>T was justified inholding that the provisions ofsection 5(1)(c) of the Income TaxOrdinance, 1979 do not empowerthe Commissioner to assign thejurisdiction to Tax RecoveryOfficer for receiving the statementunder Section 139 to 143 and toact as DCIT in terms of section2(17A) of the Ordinance for thepurposes of levying penalty u/s108 of the aforesaid ordinance?”2. Arguments heard and record perused.

TA No.<strong>152</strong> of <strong>2000</strong>- 5 –Tribunal on making an option under Section 136(1) ofthe ordinance XXXI of 1979 or re-promulgatedordinance XXI of <strong>2000</strong> (Finance Ordinance, <strong>2000</strong>) asthe case may, the dates and periods of promulgation ofsuch enactment are submitted herein below:-(A) Income Tax Ordinance, 1979 cameinto force on 1 st July 1979.(b) Finance Act XXII of 1997 waspromulgated on 1 st July 1997(c) The Finance Ordinance XXI of<strong>2000</strong> promulgated on 1 st July,<strong>2000</strong>.9. Therefore, any transmute by overlapping theperiod in preferring reference or appeal whateverthe case may be, invalidates it beyond the law.And any such institution under no circumstancescan be considered as legal practice, as such, sameis incurable under the scheme of law.10. In the instant appeal, in Para-3, it is ratheradmitted by the appellant himself that he thoughreceived the order on 14.12.1999, but instead ofpreferring an appeal within a period stipulated bylaw, they with slackness only shifted the burdenfrom their shoulders and lethargically filed theappeal even not confronted the relevant provisionsof law, which provides the specific period forpreferring the appeal.

TA No.<strong>152</strong> of <strong>2000</strong>- 6 –11. Therefore, under the circumstances, whenthe party i.e. the appellant themselves sit overtheir own rights with such slackness on their part,as such, they are not entitled for the reliefclaimed, for which the procedural law does notprovide any favour. The appellant failed to followthe spirit of law for seeking relief claimed in theinstant appeal.12. From the perusal of the appeal it is evidentthat the present appellant had filed the instantappeal on 12.02.<strong>2000</strong> against the order of IncomeTax Appellate Tribunal dated 21.5.1998 i.e. afterabout one year and nine months of the passing ofperiod of limitation, as the appellant in Para-3 ofthe appeal, himself has mentioned that limitationunder Section 136 of the Income Tax Ordinance,1979 expires on 12.2.<strong>2000</strong> and that too, withoutany application for condonation of delay. It hasbeen the constant view of the superior <strong>Court</strong>s thatfor administration of justice, principle has to befollowed “law would support vigilant and notindolent”. Therefore, any delay in filing appeal insuch a situation is occurred on account ofindolence on the part of any party, then no law oflimitation will support in any manner. Such delayis to be considered negligence on the part of that

TA No.<strong>152</strong> of <strong>2000</strong>- 7 –party, thus the other party should not bepenalized for such negligence. Therefore, whilefortifying the judgments reported in “2004 SCMR145, (Nazakat Ali Vs. WAPDA through Managerand others)”, “2011 SCMR 1341”, (AmanullahSoomro Vs. P.I.A through managingDirector/Chairman and another)”, and “PLD2001 SC 228” (Bashir Ahmad Vs. MuhammadSharif and 4 others)”, as such, the instantappeal is badly time barred. Resultantly, the sameis hereby dismissed in limine.(CHIEF JUSTICE)(NOOR-UL-HAQ N. QURESHI)JUDGE*AR.ANSARI/APPROVED FOR REPORTING.

- 8 –TA No.<strong>152</strong> of <strong>2000</strong>