Annual Report 2008 - Axiata Group Berhad - Investor Relations

Annual Report 2008 - Axiata Group Berhad - Investor Relations

Annual Report 2008 - Axiata Group Berhad - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

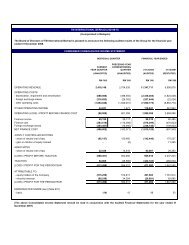

Chairman’s Statement (cont’d.)The completion of the demerger and the listing arehistoric milestones in the evolution of <strong>Axiata</strong>, and thedrive to create national and regional champions fromamong the Malaysian Government-Linked Companies(GLCs). The demerger has unleashed <strong>Axiata</strong> into itsown distinct growth path with a clear mandate tounlock and realise the value of its OpCos. With the solidbacking of Khazanah Nasional <strong>Berhad</strong> (Khazanah) as themajor shareholder, <strong>Axiata</strong> with its unique Asian footprinthas all the ingredients to become the regional championthat we aspire to be.However, profitability was affected from increasingcompetition, rising inflation and slowing economies. Inthe fourth quarter, this was further exacerbated fromthe global financial crisis and its impact on credit andequity markets as well as foreign exchange.The <strong>Group</strong> reported revenue of RM11.3 billion, up 14%year on year (YoY) due to continued momentum atCelcom and strong yearly performance at XL. EBITDAalso increased by 5% in the same period to RM4.4billion.What a year <strong>2008</strong> has been - much work has beendone and we have hit the ground running. As anorganisation, <strong>Axiata</strong> is focusing on a transformationfrom an investment holding to a multinational companywith world class people, processes and best practices.We have completed an impressive line-up ofmanagement and key positions, and put in place manyinitiatives targeted towards harnessing performanceand synergies across our OpCos.<strong>Axiata</strong> also saw an expansion into India via the mergerof Idea under the Aditya Birla <strong>Group</strong> and Spice. Themerger created a new number five player in India andadded a staggering 34.2 million subscribers to our totalcustomer base. This was a major landmark for <strong>Axiata</strong>on the road to being a leading regional player in amarket critical to that success. We also saw the entryof DoCoMo into TMIB. These were certainly significantevents in themselves.<strong>2008</strong> was also a year of unprecedented challenges.<strong>Axiata</strong> saw steady and improving operationalperformance throughout the most part of <strong>2008</strong> withstrong growth in revenue and a healthy EarningsBefore Interest Tax Depreciation and Amortisation(EBITDA).The weakening currencies, particularly against RM andUSD, affected contributions from regional OpCos whichdid have a material effect on the <strong>Group</strong>. Actual Profitafter Taxation and Minority Interests (PATAMI) wasRM498 million down 72% YoY, largely due to forexlosses and higher interest charges. Adjusted PATAMIwas RM1.1 billion down 27% 2 .Notwithstanding challenges arising from the globalfinancial crisis, the <strong>Group</strong> has delivered strong revenuegrowth for the year. As with most regional companies,<strong>2008</strong> results have been impacted by foreign exchangemovements. Solid operational performance remains asource of strength for the <strong>Group</strong> and the proactiveoperational and financial steps taken by managementwill go a long way towards strengthening its competitiveposition moving forward.In order to reduce overall debt levels and achieve anoptimal capital structure, <strong>Axiata</strong> has also embarkedon a renounceable rights issue to raise gross proceedsof approximately RM5.2 billion. This exercise is aproactive and prudent step by management, allayinginvestor concerns on gearing, setting a more solidfoundation for future growth and towards increasingshareholder value.2 One-offs in 2007 included the disposal of Dialog shares, Spice IPO and tower sale. One-offs in <strong>2008</strong> included interest costs on TM’sbridging loans, financing cost on Idea/Spice acquisition, and foreign exchange loss. Detailed explanations can be found in the <strong>Group</strong>Financial Review on pages 42 – 45.26<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)