Annual Report 2008 - Axiata Group Berhad - Investor Relations

Annual Report 2008 - Axiata Group Berhad - Investor Relations

Annual Report 2008 - Axiata Group Berhad - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2008</strong>A X I ATA G R O U P B E R H A D A N N U A L R E P O R T (242188-H) 2 A X I ATA G R O U P B E R H A D A N N U A L R E P O R T (242188-H) 2 0 0 8A X I ATA G R O U P B E R H A D A N N U A L R E P O R T (242188-H) 2 0 0 8<strong>Axiata</strong> <strong>Group</strong> <strong>Group</strong> <strong>Berhad</strong> (242188-H) (242188-H)(formerly (formerly known known as known TM as TM as TM International <strong>Berhad</strong>) <strong>Berhad</strong>) <strong>Berhad</strong>)Level Level 42, Level 42, North 42, North North Wing Wing WingMenara Menara TM TM TMJalan Jalan Pantai Jalan Pantai Pantai Baharu Baharu50672 50672 50672 Kuala Kuala Lumpur Kuala LumpurMalaysia MalaysiaWebsite: www.axiata.com

PRESENTING<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> (242188-H)(Formerly known as TM International <strong>Berhad</strong>)

The Tangram ConnectionThe TANGRAM is an ancient Chinese moving piece puzzle, consisting ofgeometric shapes. Various tangram patterns may be formed from the geometricpieces of the tangram puzzle. It is highly creative and flexible in its application.<strong>Axiata</strong>, like the TANGRAM has its origins in Asia and is piecing together:connectivity, technology and talent to catalyse progress in Asia.<strong>Axiata</strong>, like the TANGRAM offers a variety of innovative solutions for ourover 89 million customers, connecting them to the world, expanding the horizonsof an upwardly mobile Asia.<strong>Axiata</strong>’s values and beliefs are reflected on the TANGRAM pieces, wherethey come together as one – binding our values and beliefs as guiding pillars ofour operations, laying the path to our future success.2<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

OPTIMISTICThe bird in full flight symbolises our aspirations for <strong>Axiata</strong>, a dynamic organisationthat is set to soar and make its presence felt in the industry. <strong>Axiata</strong> is AdvancingAsia through mobile communications by piecing together technology, connectivityand talent.COLLABORATIVEThe bridge is reflective of <strong>Axiata</strong>, bridging relationships through affordable connectivity.<strong>Axiata</strong> is firmly grounded in each national economy, leveraging on world-classprocesses, economies of scale and regional synergies.EXCELLENCEThe arrow embodies <strong>Axiata</strong>’s quest to excel, delivering sustainable growth andperformance excellence across all of its operations, guided by a policy of strictfinancial discipline to enhance value to shareholders. <strong>Axiata</strong> continuously evaluatesnew emerging technologies to deliver cost effective, innovative and differentiatedservices to over 89 million customers across Asia.PRINCIPLEDThe boat is representative of the firm and sound leadership of <strong>Axiata</strong>, navigating theorganisation towards its ambition to become the regional champion by 2015.LOCAL RELEVANCEThe key represents <strong>Axiata</strong>’s ability to unlock the potential of its Operating Companies.<strong>Axiata</strong> understands Asia better than anyone else – we are a unique organisationcombining the local expertise of national operating companies with the strongsupport of a regional corporation.INNOVATIONThe rocket signifies <strong>Axiata</strong>’s commitment to accelerate progress through innovativetechnology and alliances – <strong>Axiata</strong> brings new technologies and services such as 3G,HSPA and mobile broadband to expand the horizons of an upwardly mobile Asia.UNCOMPROMISINGThe house demonstrates <strong>Axiata</strong>’s commitment as an organisation to advancingcommunities for sustainable development through its technology and people.3

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>4<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

ContentsI OPTImistic9 The Brand10 Who We Are and WhatWe Do11 Our Beliefs and Values12 Financial Calendar12 Corporate InformationII COLLABORATIVE16 <strong>Axiata</strong> Profile18 Regional Presence20 <strong>Group</strong> Corporate StructureIII EXCELLENCE24 Chairman’s Statement28 President and <strong>Group</strong> ChiefExecutive Officer’s BusinessReview37 <strong>Group</strong> Financial Overview38 Two-Year <strong>Group</strong> FinancialSummary39 Two-Year <strong>Group</strong> FinancialHighlights40 Simplified <strong>Group</strong> BalanceSheet41 <strong>Report</strong>ing by GeographicalLocation42 <strong>Group</strong> Financial Review46 Acquisition of Idea:Expansion into India48 Major Milestones51 Awards and AccoladesIV PRINCIPLED54 Board of Directors56 Profile of Directors62 Profile of Management Team67 Profile of OperatingCompanies’ ManagementTeam72 Statement on CorporateGovernance79 Directors’ Statement onInternal Control86 Board Audit Committee<strong>Report</strong>V LOCAL RELEVANCE98 Malaysia104 Indonesia108 Sri Lanka114 Bangladesh118 Cambodia120 India122 Singapore124 Iran126 Pakistan128 ThailandVI INNOVATION136 Products and ServicesCatalogue140 Products and Services ReviewVII UNCOMPROMISING146 Corporate Responsibility– Marketplace Perspective– People Perspective– Community Perspective– Environmental PerspectiveFINANCIAL STATEMENTS156 Directors’ Statement ofResponsibility157 Audited Financial Statementsfor the financial year ended31 December <strong>2008</strong>305 <strong>Group</strong> Financial AnalysisOTHER INFORMATION309 Shareholding Statistics312 Additional ComplianceInformation315 Net Book Value of Land andBuildings316 List of Top Ten Properties317 <strong>Group</strong> Directory318 Glossary322 Notice of <strong>Annual</strong> GeneralMeeting325 Statement AccompanyingNotice of <strong>Annual</strong> GeneralMeeting326 Administrative Details for the17th <strong>Annual</strong> General Meeting• Proxy Form5

OPTIMISTICThe bird in full flight symbolises our aspirations for <strong>Axiata</strong>, a dynamicorganisation that is set to soar and make its presence felt in the industry.<strong>Axiata</strong> is Advancing Asia through mobile communications by piecing togethertechnology, connectivity and talent.I

10countries25,000employees89million customers8<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

The name <strong>Axiata</strong> embodies who we are. A company that’s vital to people allacross Asia. Our logo, the <strong>Axiata</strong> prism is multifaceted and multidimensionalreflecting our rich heritage, diversity and vibrancy. It is as colourful as thedifferent countries we serve.It shows the world that we view situations from every perspective, taking allviewpoints into account.It also reflects our vision of providing multiple services – from basic voice to richdata, from basic data to broadband, from SMS to 3G, from simple data to richcontent.It unites all our partners and connects us to our customers.Multidimensional.That’s <strong>Axiata</strong>.9

Who We Are and What We DoWe understand Asia’s communication needs better than others. Together we area family, with operations in 10 countries, 25,000 employees and over 89 millioncustomers. We are uniquely Asian. Our purpose is to advance Asia towards abetter, brighter future.<strong>Axiata</strong> is Advancing Asia by:• bridging relationships through affordable connectivity. We strive to bringaffordable and innovative mobile communication services and coverage toover 1.5 billion people throughout Asia, so they can be connected to eachother and to a wealth of information, entertainment and more. From remotevillages, to large cities, we are connecting people from all walks of life.• accelerating progress through technology. We are investing in cutting edgetechnologies that include 3G, HSPA, Next Generation Networks and Wimax,so customers can experience Internet on the move and connect with anyone,anytime, anywhere, any way they want. Technologies that are innovative,relevant and affordable.• developing talent throughout Asia. We bring employment and careeropportunities to 25,000 people throughout Asia. We leverage on thisdiversity to develop human capital for national and regional growth. We aregrooming the talent of Asia, by providing regional career experience andworld class people development programmes, so they can realise their fullpotential.10<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Our Beliefs and Values<strong>Axiata</strong> is the emerging leader in Asian telecommunications with a vision ofbecoming a regional champion. <strong>Axiata</strong> is Advancing Asia by bringing affordableconnectivity, innovative technology and world class talent to the entire region.We are an organisation that pursues excellence and innovation across ourentire operations, bringing the most advanced and world-class communicationservices to the region.We are an organisation of global stature with sensitivity to the local marketsthat we operate in. We take a collaborative approach in all our partnerships,ensuring that we address the specific needs of our stakeholders, offeringproducts, services and solutions that are of local relevance.We are principled and uncompromising, holding ourselves to the higheststandards of conduct. We are a company with a purpose and we play a corerole in nation development in the markets that we serve.We are adaptive and optimistic, an organisation with continued energy andconfidence, that is ready to meet global challenges.<strong>Axiata</strong> is Advancing Asia towards a better, brighter future.11

Financial CalendarFinancial Year <strong>2008</strong>Corporate InformationAnnouncement of Results22 May <strong>2008</strong> – ThursdayAnnouncement of the unaudited consolidatedresults for the first quarter ended 31 March <strong>2008</strong>26 August <strong>2008</strong> – TuesdayAnnouncement of the unaudited consolidatedresults for the second quarter ended 30 June<strong>2008</strong>26 November <strong>2008</strong> – WednesdayAnnouncement of the unaudited consolidatedresults for the third quarter ended 30 September<strong>2008</strong>26 February 2009 – ThursdayAnnouncement of the unaudited consolidatedresults for the fourth quarter ended 31 December<strong>2008</strong>BOARD OF DIRECTORSTAN SRI DATO’ AZMAN HJ. MOKHTARChairmanNon-Independent Non-Executive DirectorDATO’ SRI JAMALUDIN IBRAHIMManaging Director/President and<strong>Group</strong> Chief Executive OfficerDATO’ YUSOF ANNUAR YAACOBExecutive Director/<strong>Group</strong> Chief Financial OfficerTAN SRI GHAZZALI SHEIKH ABDUL KHALIDIndependent Non-Executive Director<strong>Annual</strong> <strong>Report</strong> and<strong>Annual</strong> General Meeting29 April 2009 – WednesdayDate of notice of 17th <strong>Annual</strong> General Meetingand date of issuance of the <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>20 May 2009 – WednesdayDate of 17th <strong>Annual</strong> General MeetingDATUK AZZAT KAMALUDINSenior Independent Non-Executive DirectorJUAN VILLALONGA NAVARROIndependent Non-Executive DirectorDAVID LAU NAI PEKIndependent Non-Executive DirectorGITA IRAWAN WIRJAWANIndependent Non-Executive DirectorISMAEL FARIZ ALINon-Independent Non-Executive DirectorDR. FARID MOHAMED SANINon-Independent Non-Executive DirectorAlternate Director to Ismael Fariz Ali12<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

group COMPANY SECRETARYSuryani Hussein (LS0009277)REGISTERED OFFICELevel 42, North WingMenara TMJalan Pantai Baharu50672 Kuala LumpurMalaysiaTel : 603 2240 3000Fax : 603 2241 3005Website : www.axiata.comSHARE REGISTRARTenaga Koperat Sdn Bhd(Company No. 118401-V)Level 17, The Gardens North TowerMid Valley CityLingkaran Syed Putra59200 Kuala LumpurMalaysiaTel : 603 2264 3883Fax : 603 2282 1886AUDITORSPricewaterhouseCoopers(AF: 1146)Level 10, 1 SentralJalan TraversKuala Lumpur Sentral50706 Kuala LumpurMalaysiaTel : 603 2173 1188Fax : 603 2173 1288STOCK EXCHANGE LISTINGListed on Main Board ofBursa Malaysia Securities <strong>Berhad</strong>Listed Date : 28 April <strong>2008</strong>Stock Code : 6888Stock Name : <strong>Axiata</strong>This <strong>Annual</strong> <strong>Report</strong> is available on our website at www.axiata.com13

COLLABORATIVEThe bridge is reflective of <strong>Axiata</strong>, bridging relationships through affordableconnectivity. <strong>Axiata</strong> is firmly grounded in each national economy, leveragingon world-class processes, economies of scale and regional synergies.II

<strong>Axiata</strong> ProfileAbout <strong>Axiata</strong><strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> (<strong>Axiata</strong>) is the emerging leader inAsian mobile telecommunications. The <strong>Group</strong>, one ofthe largest telecommunication companies in the region,has extensive operations and businesses in 10 countriesin Asia, providing a comprehensive range of mobilecommunication services to a combined base of over89 million subscribers.The <strong>Group</strong> currently has controlling interests in itsmobile communication operations in Malaysia, Indonesia,Sri Lanka, Bangladesh and Cambodia as well as strategicstakes in India, Singapore, Iran, Pakistan and Thailandthrough its various subsidiaries and affiliates. Its mobilesubsidiaries and affiliates operate under the brandnames ‘Celcom’ in Malaysia, ‘XL’ in Indonesia, ‘Dialog’ inSri Lanka, ‘AKTEL’ in Bangladesh, ‘hello’ in Cambodia,‘Idea’ and ‘Spice’ in India, ‘M1’ in Singapore and ‘MTCE’in Iran.<strong>Axiata</strong>’s Journey to DateThe <strong>Axiata</strong> story has been a remarkable one –incorporated in Malaysia on 12 June 1992 as a privatelimited company under the name Telekom MalaysiaInternational Sdn. Bhd., it commenced business in 1994as a division within Telekom Malaysia <strong>Berhad</strong> (TM),focusing on expanding the <strong>Group</strong>’s footprint primarilythrough mergers and acquisitions (M&A). On 16 October2001, the Company changed its name to TMInternational Sdn. Bhd., and over the next seven yearscontinued to expand its presence in the region, buildinga portfolio which balances interest in emerging marketswith low mobile penetration rates and Best-in-Classand innovation driven subsidiaries in mature markets.On 12 December 2007, the Company was convertedinto a public company bearing the name TM International<strong>Berhad</strong> (TMI).16<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

The <strong>Group</strong> completed its strategicdemerger exercise that saw theseparation of the mobile businessfrom TM. The demerger resulted inTMI emerging as an independententity in the regional mobilet e l e c o m m u n i c a t i o n s m a r k e t ,enabling it to focus on its own corebusiness and accelerate operationali m p r o v e m e n t s a n d g r o w t hinitiatives. TMI was listed on BursaMalaysia Securities <strong>Berhad</strong> (BursaSecurities) on 28 April <strong>2008</strong>,marking a new chapter in itstransformation towards becominga regional giant in the mobilecommunications market.Since then, the <strong>Group</strong> has continuedto build on its strengths andsynergies. As part of its move toconsolidate and strengthen itsregional footprint, the <strong>Group</strong>entered into an arrangement withIdea Cellular Limited (Idea), whichwill see the merger of Idea andSpice Communications Limited(Spice) in India. The enlarged Ideais the fifth largest mobile player inIndia’s high growth market. Inaddition, the <strong>Group</strong> expanded itsregional partnerships with the entryof Japan’s largest cellular operatorNTT DoCoMo, Inc. (DOCOMO) intoTM International (Bangladesh)Limited (TMIB) in June <strong>2008</strong>.Marking a new Era:<strong>Axiata</strong>The Company has, with effect from31 March 2009, changed its nameto <strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> andlaunched its new identity on 2 Aprilthis year, as part of a rebrandingexercise aimed at enhancing itsposition as a leading regional mobileoperator. The move was a requisitestep to reinforce the <strong>Group</strong>’s newbusiness philosophy and itscommitment to Advancing Asia bya d d r e s s i n g t h e u n f u l f i l l e dcommunication needs of localpopulations with affordable andinnovative products and services.As an emerging leader, <strong>Axiata</strong> willcontinuously invest in innovativeproducts and services that areuniquely catered for customers inAsia. It is committed to bringingfirst-class resources, technologyand expertise to its unique portfolioof growth assets. In all spheres ofits operations, <strong>Axiata</strong>’s OperatingCompanies (OpCos) play a leadingrole in developing and enhancingthe local telecommunicationsindustry.As a <strong>Group</strong>, <strong>Axiata</strong> is a uniqueorganisation, combining the localexpertise of national operatingcompanies with the strong supportof a regional corporation. Throughaffordable connectivity, <strong>Axiata</strong>bridges relationships between 1.5billion people across Asia to theworld.Today, the <strong>Group</strong> providesemployment to over 25,000 peopleacross Asia, bringing greateropportunities and developing worldclass talent across the region. Itsregional platform enables thedynamic exchange of knowledgeamong employees and contributesto the human capital developmentof the OpCos.<strong>Axiata</strong>, as a major regional entity inmobile telecommunications iscommitted to using its technologicaland human capabilities to drivesocial, economic and environmentalchange in the nations it serves andplans to introduce and implementits <strong>Group</strong> Corporate Responsibility(CR) Policy and programmeinitiatives in 2009. In line with theUN Millennium Development Goals(MDGs), the <strong>Group</strong>’s CR initiativeswill be focused on Information andCommunication Technologies (ICT)for development, education andthe environment.Because it understands Asia, <strong>Axiata</strong>is piecing together the bestt h r o u g h o u t t h e r e g i o n i nconnectivity, technology andpeople, uniting them towards asingle goal: Advancing Asia.17

Regional Presence18<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

SUBSIDIARIESASSOCIATES / AffiliatesMALAYSIAINDONESIAcelcom (malaysia) <strong>Berhad</strong>Year of Investment/Shareholding : <strong>2008</strong> / 100%Nature of Business : TelecommunicationsSubscribers : 8.8 MillionTechnology Deployed : GSM, GPRS, EDGE, 3G,HSDPANo of BTS : 9,202Network Coverage (By populated area) : 98.7%pt excelcomindo pratama tbkYear of Investment/Shareholding : 2005 / 83.8%Nature of Business : CellularSubscribers : 26.0 MillionTechnology Deployed : GSM & WCDMANo of BTS : 16,729Network Coverage (By populated area) : 90.0%INDIASINGAPOREIDEA CELLULAR LIMITEDYear of Investment/Shareholding : <strong>2008</strong> / 15.0%Nature of Business : CellularSubscribers : 34.2 Millionspice communications limitedYear of Investment/Shareholding : 2006 / 49.0%Nature of Business : CellularSubscribers : 3.8 MillionMobileone LTDYear of Investment/Shareholding : 2005 / 29.7%Nature of Business : Cellular and BroadbandSubscribers : 1.6 MillionSRILANKADIALOG TELEKOM PLCYear of Investment/Shareholding : 1996 / 85.0%Nature of Business : Mobile, Internet services andinternational data and backbone, fixed wirelessand transmission infrastructure and media relatedservicesSubscribers : 5.5 MillionTechnology Deployed : GSM, GPRS, EDGE, 3G,HSDPA, WiFi, WiMax, CDMA, DVB-SNo of BTS : 1,360Network Coverage (By populated area) : 90.0%BANGLADESHtm international (bangladesh)limitedYear of Investment/Shareholding : 1995 / 70.0%Nature of Business : CellularSubscribers : 8.7 MillionTechnology Deployed : GSM, GPRS, EDGENo of BTS : 4,875Network Coverage (By populated area) : 84.0%CAMBODIATelekom Malaysia International(Cambodia) Company LimitedYear of Investment/Shareholding : 1998 / 100%Nature of Business : CellularSubscribers : 591,515Technology Deployed : GSM, GPRS, EDGENo of BTS : 392Network Coverage (By populated area) : 86.0%IRANTHAILANDTHAILANDmobile telecommunicationscompany of esfahanYear of Investment/Shareholding : 2005 / 49.0%Nature of Business : Cellular (Province of Esfahan)Subscribers : 13,696samart corporationpublic company limitedYear of Investment/Shareholding : 1997 / 19.0%Nature of Business : Mobile Multimedia, ICTSolutions and Services and Technology-relatedbusinessessamart i-mobilepublic company limitedYear of Investment/Shareholding : 2006 / 24.4%Nature of Business : Mobile, multimedia andinternational businessPAKISTANMultinet pakistan (private)limitedYear of Investment/Shareholding : 2005 / 89.0%Nature of Business : Broadband & Long Distanceand International Services19

<strong>Group</strong> Corporate StructureAs at 31 March 2009*<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong>Celcom (Malaysia) <strong>Berhad</strong>(Malaysia)SunShare Investments Ltd(Labuan)TMI Mauritius Ltd(Mauritius)24.4%Samart I-Mobile PublicCompany Limited(Thailand) ‡Technology ResourcesIndustries <strong>Berhad</strong>29.7%MobileOne Ltd(Singapore) ‡TMI India Ltd(Mauritius)Celcom Transmission (M) Sdn Bhd49.0%Spice Communications Limited(India) ‡Celcom Technology (M) Sdn Bhd80.0%Celcom Timur (Sabah) Sdn Bhd15.0%Idea Cellular Limited(India) ‡Celcom Multimedia (Malaysia) Sdn BhdCT Paging Sdn BhdC-Mobile Sdn BhdCelcom Mobile Sdn BhdAlpha Canggih Sdn BhdLegend :* = Depicting active subsidiaries,associates and affiliates= Key Operating Companies20.0%Sacofa Sdn Bhd38.2%Tune Talk Sdn Bhd= Wholly-owned subsidiaries= Non wholly-owned subsidiaries= Associates / Affiliates‡ = Listed Companies20<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

19.0%Samart Corporation PublicCompany Limited(Thailand) ‡TM International (L) Limited(Labuan)Indocel Holding Sdn Bhd(Malaysia)Telekom Malaysia International (Cambodia)Company Limited(Cambodia)83.8%PT Excelcomindo Pratama Tbk(Indonesia) ‡49.0%Mobile Telecommunications Company of Esfahan(Iran)70.0%TM International (Bangladesh) Limited(Bangladesh)89.0%Multinet Pakistan (Private) Limited(Pakistan)85.0%Dialog Telekom PLC(Sri Lanka) ‡Dialog Television (Private) Limited(Sri Lanka)CBN Sat (Private) Limited(Sri Lanka)Communiq Broadband Network (Private) Limited(Sri Lanka)Dialog Broadband Networks (Private) Limited(Sri Lanka)21

EXCELLENCEThe arrow embodies <strong>Axiata</strong>’s quest to excel, delivering sustainable growth andperformance excellence across all of its operations, guided by a policy of strictfinancial discipline to enhance value to shareholders. <strong>Axiata</strong> continuouslyevaluates new emerging technologies to deliver cost effective, innovative anddifferentiated services to over 89 million customers across Asia.Iii

Chairman’s StatementTan Sri Dato’ Azman Hj. MokhtarChairman, Non-Independent Non-Executive Director24<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Dear Shareholders,I am pleased to present <strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong>’s inaugural <strong>Annual</strong><strong>Report</strong> for <strong>2008</strong> which marks a year since this company,formerly known as TMI, demerged from TM on 25 April <strong>2008</strong>,and made its debut on Bursa Securities on 28 April <strong>2008</strong>.It has indeed been an eventful journey for <strong>Axiata</strong>. From its origins as aninternational ventures division to a wholly-owned subsidiary of TM and a listedentity, <strong>Axiata</strong> (then TMI) has transformed itself to a formidable company withpresence in fast-growing South and Southeast Asian markets, complemented bymobile operations in Malaysia generating strong cash flows. From its pioneerinvestment back in 1994 in Sri Lanka and over a span of 14 years, <strong>Axiata</strong> hasbuilt a strong portfolio of OpCos with a workforce of over 25,000 in 10countries namely Malaysia, Indonesia, Sri Lanka, Bangladesh, Cambodia, India,Singapore, Pakistan, Iran and Thailand with a mobile customer base of over 89million; making us one of the largest players in the region.The name change and our new brand identity are of particular significance. Notonly do they mark this momentous year of change and transformation, they area symbol of a new beginning, uniting the group of companies with a visual andtangible sense of shared purpose and belonging; aligned with our new corporatepositioning and business strategy.<strong>Axiata</strong> believes in the Asian potential. With over 4 billion mobile connections inthe world today, close to 45% are in the Asia-Pacific region 1 . The global marketis set to grow to over 6 billion by 2013, with Asia expected to continue to leadthe rest of the world.1 GSMA website: Wireless Intelligence 11 February 200925

Chairman’s Statement (cont’d.)The completion of the demerger and the listing arehistoric milestones in the evolution of <strong>Axiata</strong>, and thedrive to create national and regional champions fromamong the Malaysian Government-Linked Companies(GLCs). The demerger has unleashed <strong>Axiata</strong> into itsown distinct growth path with a clear mandate tounlock and realise the value of its OpCos. With the solidbacking of Khazanah Nasional <strong>Berhad</strong> (Khazanah) as themajor shareholder, <strong>Axiata</strong> with its unique Asian footprinthas all the ingredients to become the regional championthat we aspire to be.However, profitability was affected from increasingcompetition, rising inflation and slowing economies. Inthe fourth quarter, this was further exacerbated fromthe global financial crisis and its impact on credit andequity markets as well as foreign exchange.The <strong>Group</strong> reported revenue of RM11.3 billion, up 14%year on year (YoY) due to continued momentum atCelcom and strong yearly performance at XL. EBITDAalso increased by 5% in the same period to RM4.4billion.What a year <strong>2008</strong> has been - much work has beendone and we have hit the ground running. As anorganisation, <strong>Axiata</strong> is focusing on a transformationfrom an investment holding to a multinational companywith world class people, processes and best practices.We have completed an impressive line-up ofmanagement and key positions, and put in place manyinitiatives targeted towards harnessing performanceand synergies across our OpCos.<strong>Axiata</strong> also saw an expansion into India via the mergerof Idea under the Aditya Birla <strong>Group</strong> and Spice. Themerger created a new number five player in India andadded a staggering 34.2 million subscribers to our totalcustomer base. This was a major landmark for <strong>Axiata</strong>on the road to being a leading regional player in amarket critical to that success. We also saw the entryof DoCoMo into TMIB. These were certainly significantevents in themselves.<strong>2008</strong> was also a year of unprecedented challenges.<strong>Axiata</strong> saw steady and improving operationalperformance throughout the most part of <strong>2008</strong> withstrong growth in revenue and a healthy EarningsBefore Interest Tax Depreciation and Amortisation(EBITDA).The weakening currencies, particularly against RM andUSD, affected contributions from regional OpCos whichdid have a material effect on the <strong>Group</strong>. Actual Profitafter Taxation and Minority Interests (PATAMI) wasRM498 million down 72% YoY, largely due to forexlosses and higher interest charges. Adjusted PATAMIwas RM1.1 billion down 27% 2 .Notwithstanding challenges arising from the globalfinancial crisis, the <strong>Group</strong> has delivered strong revenuegrowth for the year. As with most regional companies,<strong>2008</strong> results have been impacted by foreign exchangemovements. Solid operational performance remains asource of strength for the <strong>Group</strong> and the proactiveoperational and financial steps taken by managementwill go a long way towards strengthening its competitiveposition moving forward.In order to reduce overall debt levels and achieve anoptimal capital structure, <strong>Axiata</strong> has also embarkedon a renounceable rights issue to raise gross proceedsof approximately RM5.2 billion. This exercise is aproactive and prudent step by management, allayinginvestor concerns on gearing, setting a more solidfoundation for future growth and towards increasingshareholder value.2 One-offs in 2007 included the disposal of Dialog shares, Spice IPO and tower sale. One-offs in <strong>2008</strong> included interest costs on TM’sbridging loans, financing cost on Idea/Spice acquisition, and foreign exchange loss. Detailed explanations can be found in the <strong>Group</strong>Financial Review on pages 42 – 45.26<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Our tagline of “Advancing Asia” is at the very core ofour strategies moving forward: <strong>Axiata</strong> aims to bringaffordable connectivity; both in voice and broadbandservices, as well as the best in technology and talentto the people of Asia. We will continuously engagewith governments and regulators to ensure a stableindustry operating environment.Still, we need to be vigilant. The global economy willnot be out of the woods for some foreseeable timeand is even expected to contract for the first time in60 years in 2009, by as much as 1% 3 . In fact, mostnational economies have yet to feel the full brunt ofthe downturn. Although emerging economies showgreater resilience from sustained productivity andstronger policy frameworks; they will not be sparedshould recovery be further delayed. A slight recoveryis however forecasted for 2010, with global growthexpected at 1.5% to 2.5%.Amidst this economic uncertainty, the fact remains thattelecommunications is a strategic enabler for socioeconomicadvancement and ultimately economicgrowth. This is reflected in its growing share of worldoutput and household spending. The World Bankestimates global telecommunications spending as ashare of global GDP to have been 2.5% in 1990. INSIGHTResearch estimates that in 2006 it had grown to 4.8%and is forecasted to grow to 5.9% by 2013 – even inthe face of the current credit crisis. Developing andemerging markets, particularly in South and SoutheastAsia, contribute to half of the world’s output. Thisreinforces our belief that <strong>Axiata</strong> is in the right businessand in the right markets for long term investment andsustainable growth, and that our contributions canmake a real difference to people’s lives in helping totransform the countries in which we operate.When I came on board as Chairman of TMI, and now<strong>Axiata</strong>, I joined an experienced team, ready to takethis Company to the next level. I would like to expressmy sincere thanks to the Board of <strong>Axiata</strong> for theirguidance and support, and to the Management andemployees for their dedication and achievements thispast year. I would also like to take this opportunity tothank our customers, business partners, the media andespecially our shareholders for their continuing supportduring these challenging times. A special thanks to theGovernments and regulators in the countries of ourOpCos, your co-operation is most appreciated.Together, we are confident that <strong>Axiata</strong> is on the rightpath towards advancing Asia and a better, brighterfuture.TAN SRI DATO’ AZMAN HJ. MOKHTARCHAIRMAN3 IMF March 19 2009 analysis G20 meeting.27

President and <strong>Group</strong> Chief Executive Officer’sBusiness ReviewDato’ Sri Jamaludin IbrahimManaging Director/President and <strong>Group</strong> Chief Executive Officer28<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Dear Shareholders,This being our inaugural <strong>Annual</strong> <strong>Report</strong>, I have taken the liberty to fullyshare our vision and the journey that is needed to take us there, as wellas highlighting the business review and outlook.<strong>2008</strong> proved to be both a challenging andrewarding year. On one hand, the economicand competitive environment, as well as thecurrency volatility, did put a significant strainon our fourth quarter profit performance. Onthe other hand, we did deliver on ourcommitment for growth, whilst putting thefoundations in place for our long term future.Amidst these challenges, we saw a healthygrowth in revenue and EBITDA, and evenmore so based on constant currency terms,strongly reaffirming our growth story. <strong>2008</strong>was also a defining year for us, where wetook stock of our historical journey thus farand charted new directions for the future.Only eight months after the demerger, wehave made good progress in building thefoundation for our future growth.In April <strong>2008</strong> <strong>Axiata</strong>, then known as TMI,became an independent entity after thedemerger from TM. The pre demerger TMI,with its international operations in ninecountries, had been merged with TM’s whollyowned subsidiary, Celcom (Malaysia) <strong>Berhad</strong>(Celcom).Thus the new TMI came into being alreadyarmed with the right ingredients – a uniqueregional footprint with its predominantlymobile operations and enormous growthpotential – ready to pursue its own aspirationsand strategies, distinct from TM, which is setto become Malaysia’s leading next-generationcommunications provider focusing on nationalfixed line and broadband services.I came into office towards the end of thedemerger process in March <strong>2008</strong>, with amandate to realise a bolder vision to redefinethe future of TMI. A brand new chapter forthe company that was about to unfold.I would like to acknowledge and thank theprevious Board and management of TMI forthe important formative years of the <strong>Group</strong>and for handing over the baton for the nextphase of our evolution and growth. Togetherwith the new Board of <strong>Axiata</strong>, we haverapidly defined the targets and parametersof our vision to be ‘a Regional Champion’.We aspire to become the mobile leader inthis region by 2015, in terms of both valueand size.29

President and <strong>Group</strong> Chief Executive Officer’s Business Review(cont’d.)Towards this vision, we have charted a completelynew set of strategic directions.In the past our strategy had been primarily predicatedon inorganic growth through acquisitions, which wasnecessary to build a strong footprint. We now need toshift our focus significantly, more towards organicgrowth by nurturing and developing our existingoperations.Alongside this, we need to transform the group into aworld class multinational company (MNC) in terms ofthe quality and standard of our people, processes andproducts and services, as well as our governance.To achieve the above, we need to restructure andstrengthen our group and subsidiaries managementteams. We also need to review the processes forperformance management, human capital, financial,strategy and planning, governance and risk management,to take them to the next level of discipline of MNCstandards. We also have to revise the strategies of oursubsidiaries and our M&A approach. Last but not least,a new engagement model with our OpCos, driven by avalue-adding corporate centre, needs to be developed.These are the ‘fundamentals’ that have to be put inplace to pave the way for our future.30<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

GROUP PERFORMANCEREVIEWFor most of <strong>2008</strong>, one of the biggestexternal challenges was the high inflationrates in all the countries we operate in.For Sri Lanka, the inflation was moreprolonged and the impact more severe.Regulatory environment and stiffcompetition were equally challengingbut for the most part expected.Towards the end of the year, whilstinflation subsided slightly, the globalfinancial crisis hit and caused a majorswing in currency volatility especiallyfor the Indonesian Rupiah (IDR).Despite that, in <strong>2008</strong> the <strong>Group</strong> recorded a revenue ofRM11.3 billion or a strong YoY growth of 14%. Inconstant currency terms, it would have seen a strongerdouble digit growth of 20%. This was driven primarilyby our Malaysian and Indonesian operations, which areour top two subsidiaries in terms of contributions tothe <strong>Group</strong>. At the end of <strong>2008</strong>, our total mobilesubscriber base reached over 89 million customers,making us already, one of the largest players in theregion. EBITDA was RM4.4 billion a 5% YoY growth. Inconstant currency terms, it actually grew 12%. EBITDAmargin however, dipped slightly to 38.4% from 41.4%,due to higher operating costs in all the countries,mostly due to inflation and price competition.Contributions from regional operating companies wereaffected by weakening currencies, high inflation andincreased competition, which did have a significanteffect on the <strong>Group</strong>. PATAMI was RM498 million, down72% from 2007.Comparing the underlying performances for the twoperiods, by adjusting 2007 for one-off extraordinarygains and adjusting <strong>2008</strong> for the foreign exchange(forex) loses as well as the interest charges due to theTM loan and Idea acquisitions, PATAMI would havebeen 27% lower at RM1.1 billion in <strong>2008</strong>. 1<strong>2008</strong> saw <strong>Axiata</strong>’s significant expansion in India beyondSpice. This strategic move has significantly upgradedour position to a stronger growth platform that instantlyprovides exposure across the whole of India, capturingthe window of growth opportunity early in one of thefastest growing markets in the region. Idea is an idealmatch in so many ways; meeting our financial criteriawhilst providing a proven financial performance andoperational capability, nationwide licences and withoutany overlapping operational circles with Spice.1 One-offs in 2007 included the disposal of Dialog shares, Spice IPO and tower sale. One-offs in <strong>2008</strong> included interest costs on TM’sbridging loans, financing cost of Idea/Spice acquisition, and foreign exchange loss. Detailed explanations can be found in the <strong>Group</strong>Financial Review on pages 42 – 45.31

President and <strong>Group</strong> Chief Executive Officer’s Business Review(cont’d.)This was the best option to give us an immediate nearpan-Indian presence with further growth potentialwhere post merger we will have a population coverageof 80% in India. Furthermore, we could grow with lowerexecution risks given the relatively less rollout requiredand the combined strengths of the merged entities.The <strong>Group</strong> invested over RM5.5 billion in capitalexpenditure (capex) in <strong>2008</strong>, mostly in Indonesia, toaggressively capture the high growth market there,and in Malaysia to expand 3G and HSPA for data andmobile broadband services.Given the volatility of the current economic conditions<strong>Axiata</strong> took a pro-active and prudent step to deliver itsbalance sheet through the proceeds of a rights issue ofapproximately RM5.2 billion. We strongly believe thatthis strategic move will make <strong>Axiata</strong> more flexible andfinancially agile to weather any uncertainties movingforward.major OPERATING COMPANIES REVIEWStrong Operational Growth by CelcomCelcom continued its stellar performance, delivering itsbest quarterly growth in the fourth quarter of the yeardespite the intensifying competition, challenges ofMobile Number Portability (MNP) and operating in ahighly penetrated market. Recording an unprecedented11th consecutive quarter of growth, Celcom saw solidrevenue of RM5.6 billion, a rise of 10% 2 YoY.Its segment-focus strategy yielded encouraging resultswhereby total subscribers grew to 8.8 million driven by1.6 million net additions, leading the industry growth inboth postpaid and prepaid.Celcom maintained its leadership in mobile broadbandwith a unique subscribers YoY growth of four times toover 228,000.Continued efforts in cost management saw EBITDAmargins improving from 44.6% to 45.2% amidst costescalations from MNP and weakened macro-economicconditions. Network cost saving initiatives in particularwas reduced from 13.0% to 12.3% (adjusted for oneoffs)as a percentage of revenue. PATAMI in <strong>2008</strong> wasRM1.3 billion, a spectacular rise of 23% YoY.<strong>2008</strong> saw continued focus on operational efficienciesin an effort to further enhance customer delivery.Celcom has also strengthened its management teamwith key appointments, enhancing its momentum goingforward.Continued Challenges in <strong>Group</strong>’s Emerging Markets’OperationsIn 2007, XL decided to embark on a clear and simplestrategy, ie: offering better value through comparablequality and aggressive pricing. This strategy was furtherenhanced in <strong>2008</strong> and formalised by regionally tailoredpricing, service quality with improved networkprovisioning and controlled cost management.2 Fibrecomm has been excluded for growth comparison purposes as it has ceased to be a subsidiary of the <strong>Group</strong> post demerger.32<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

This hugely successful strategy, which provided scalebenefits and higher margins, led to XL outperformingthe industry in terms of revenue and EBITDA with astrong growth of 45.3% and 46.2% respectively. Totalrevenue reached IDR12,156.0 billion, mainly driven bythe increase in total outgoing minutes which rose byseven times and a larger customer base which saw anincrease of 68% YoY to 26 million. EBITDA marginsremained stable at 42.2% due to strong focus on costcontrols despite the lower average tariffs per minute.However, lower elasticity, intensifying competition andweaker consumer spending affected XL’s performancein the fourth quarter which saw negative revenuegrowth. Profitability was also impacted as a result fromhigher forex losses due to a significant weakening ofIDR towards the end of the year; higher interestexpenses from increased borrowings and incidentalcharges for the accelerated depreciation of theremaining legacy switches, as well as some provisions.During <strong>2008</strong>, XL had invested in capital expenditurefocusing on capacity provisioning and qualityimprovements amounting to USD 1.2 billion. This sawXL adding over 5,500 new BTS in <strong>2008</strong>, bringing thetotal to over 16,000 BTS.Dialog <strong>Group</strong> recorded revenue of SLR36.2 billion forthe year, a growth of 6% YoY. Operating costshowever, which includes expansion costs related to thecompany’s network infrastructure and energy costs,jumped 41% YoY resulting in EBITDA falling by 44%.The lowering of consumer charges in combination withthe impact of general inflation, increased networkcosts and network related energy costs resulted inprofitability being impacted. Furthermore, Dialog tooka conscious decision in <strong>2008</strong> to make way fortechnology modernisation by way of amortisation andimpairment provisions.In Bangladesh, TMIB had a very challenging year.However, its turnaround plan yielded positive results,with improvements in revenue and EBITDA margin inthe fourth quarter, of 15% and 18%, respectively.<strong>2008</strong> also saw DOCOMO replacing the local shareholder’s30.0% stake. Equity infusion from the shareholders inthe fourth quarter further strengthened its financialposition and put TMIB on a better footing movingforward.Dialog continued its leadership in the mobile industry,recording the highest-ever net additions, with a 29%increase in subscribers to 5.5 million.Amidst growing competition, the fixed line andBroadband services saw an increase in customer baseof over 175,000 connections in less than 2 years ofoperation whilst Pay TV made remarkable inroads,reaching a customer base of over 122,000, a growthof 121% YoY.33

President and <strong>Group</strong> Chief Executive Officer’s Business Review(cont’d.)THE TRANSFORMATION OF AXIATAMany focused initiatives were planned and implementedin <strong>2008</strong>, driven by the new transformation agenda ofthe company.In <strong>2008</strong>, significant organisational changes were madeto reflect our new strategies. The Board of <strong>Axiata</strong> wasrefreshed with a good mix of highly experienced localand international board members. Subsequently, manychanges were also made at the OpCo Boards. The<strong>Group</strong> strengthened its top management line up, hiringthe best from local and international talents. Reflectingour regional aspirations, almost all of the Boardmembers and senior management team have workedfor established MNCs, with extensive internationalresponsibilities, in and out of Malaysia.With this, we at <strong>Axiata</strong> are set for change.We have reengineered the role of the corporate centre,with the primary mandate to deliver value to theOpCos and help them to achieve their targets. We doso by facilitation, consultation, giving direction andsupport and by sharing best practices and benchmarking,with strong governance in place. This was key toredefining the engagement model with our OpCos.Initial work on a talent development process and afirst-class Leadership Development Programme werecompleted, and subsequently launched in February2009. We have also introduced a unique and highlyperformance-based Long Term Incentive (LTI) plan toalign the long term interests of the employees withthat of the shareholders.A few but impactful list of synergies were identifiedthrough OpCo feedback and prioritisation. In marketingand products and services, we launched key InternationalDirect Dialing (IDD) and roaming initiatives. Inprocurement, we identified initial ‘low hanging fruits’bringing more than RM100 million savings over thenext two years. Procurement processes were introducedto ensure a more coordinated approach and bettergroup-wide leverage without sacrificing speed or localpriorities. Other synergy initiatives, which include anew pricing process, were developed and will becompleted in early 2009.In <strong>2008</strong>, we also improved the business planningprocess towards building robust strategy and budgetingprocesses.A strong focus on performance saw a new performancemanagement and reporting system put in place toraise the bar for results.Beyond organisational changes, Phase one of humancapital management was also completed. A revisedcompensation and benefits scheme, especially for keypositions, was made to retain and attract the besttalent. A new set of Balanced Scorecards (BSC) forcorporate centre management and staff was introducedwith improvements in the measurement process towardsadding value to our OpCos.We also reviewed thestrategies of our OpCos.Some were significantlychanged, some refocused andsome refined. The existing M&Alist was also narrowed downc o n s i d e r a b l y . S o m e t a r g e toperators, areas or countries wereeliminated, either because they wereoutside our focus region, non-core,sub-optimal or highly risky.34<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Strengthening governance included a revised set ofterms of reference for Board committees, and improvedfinancial, procurement and human resource policies forempowerment within the corporate centre andvis-à-vis the subsidiaries. All board sub-committees atthe <strong>Group</strong> level and at the subsidiaries were alsoreviewed and changes made where appropriate.As part of the new vision and direction for the <strong>Group</strong>,a new brand was also contemplated. After sevenmonths of hard work in defining the strategic rationale,evaluating several brand architectures and more than700 names, as well as getting feedback from 20 focusgroups in all key markets – the <strong>Axiata</strong> brand identity,name and logo were developed. <strong>Axiata</strong> was launchedofficially on 2 April 2009. 3LOOKING TO THE FUTURE2009 will be another challenging year. The impact ofthe global economic crisis, the increased competitionin some markets and the volatility in currencies remainuncertain.Despite this there are significant opportunities. Whilstoverall growth will be somewhat dampened by theglobal crisis, we do expect growth to remain generallyrobust in all the markets we are in, either in basicvoice, data, broadband, or in all areas. With ourstrengthened balance sheet, a new <strong>Group</strong> managementteam, improvements in key processes and disciplines–in performance management, human capital, synergy,best practices, business planning, financial managementand governance - as well as tractions in many of theOpCos, I believe we are in a stronger position toperform and compete.I am confident that we will reap the rewards of ourefforts and be on track to meet our long-term targetof being “A Leading Regional Champion”, whilstdelivering short term financial results.We will continue to focus on our sustainable long-termstrategies by further strengthening our grouporganisation, and accelerate more improvements inkey processes and disciplines. In particular this year,we want to step up our focus where it really matters,that is at Opco level. We will work with OpCos tofortify their management teams and improve in-countryperformance through better processes, and to linkperformance with better rewards and incentives. Fewbut key synergies and best practice areas will beimplemented including pricing, procurement, networkplanning and management.Given the economic environment, in addition to existingcost initiatives at OpCo level, <strong>Group</strong>-wide initiativeswill be implemented, overseen by the <strong>Group</strong> OpCocommittee, assisted by the newly formed ProcessExcellence <strong>Group</strong> (PEG).3 Refer to Chapter I: Optimistic and pages 9 – 11 for a more detailed discussion of the brand.35

President and <strong>Group</strong> Chief Executive Officer’s Business Review(cont’d.)At the same time, the original capex budget has beenreduced by at least RM1 billion. Care has been takennot to do so at the expense of our future competitiveposition. Strong emphasis will be made on improvingcapacity utilisation and efficiency, as well asprocurement savings. Non-critical capex will be deferredor not pursued.Our OpCo CEOs-led talent management process hasbegun but will be populated with talents from allOpcos and the corporate centre by the second quarterof 2009. The initial phase of the Leadership DevelopmentProgramme and for identified managers will becompleted this year.Finally, for 2009, our M&A plans have also been furtherrevised. We have taken a more conservative stance.There will be less focus on M&A except where it isvery compelling. Emphasis will be on in-countryconsolidation, where the opportunity presents itself.We have instituted stricter financial disciplines with anincreased hurdle rate for new investments with arigorous business case.In summary, while it will be a challenging year, we aregeared up to face 2009. We have revised many of ourtactical plans to be more cautious yet agile to act onnew opportunities. Overall, we will remain steadfast onour long term strategies and direction.In light of the prevailing challenges in our operatingenvironment, we are also assisting the OpCos in theprocess of revising their respective strategies andbusiness plans.Celcom will continue with its segmented strategy andwill accelerate its mobile broadband initiatives, whilsttransforming two critical elements of the companynamely, its human capital development and customertouch points.XL will improve its capex utilisation and refocus ongeographic areas that they are already strong in.Improved loyalty and retention programmes will alsobe introduced.ACKNOWLEDGEMENTSThroughout <strong>2008</strong>, we have been working hard layingthe foundations for our continuous growth.I would like to extend my thanks to the Board of<strong>Axiata</strong> for their guidance and support in this first yearof our new journey. On behalf of the management, Iwish to pay tribute to our 25,000 dedicated employeesand our 89 million customers. I would also like toexpress my appreciation to the governments andregulators in the countries that we serve, and to all ourstakeholders, namely shareholders, business partners,the media and others for their support. Thank you.Dialog’s main focus will be on cost management, whichrequires a structural change. Many initiatives will bere-prioritised for better focus and effectiveness.Aktel will continue with its turnaround strategies ondistribution improvements and aggressive marketingand packaging, but with a focus on its existing customerbase, given the high SIM tax in the country.Dato’ Sri Jamaludin IbrahimManaging Director / Presidentand <strong>Group</strong> Chief Executive Officer36<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

+13.5%<strong>Group</strong> Financial OverviewOperating Revenue2007<strong>2008</strong>50.5% 48.5%Celcom30.1% 32.6%XL10.6% 10.3%Dialog7.2% 6.7%TMIB1.4% 1.7%TMIC0.2% 0.2%+5.3%OthersEBITDA2007 <strong>2008</strong>54.4% 56.5%Celcom31.3% 33.6%XL10.2% 5.1%4.2%1.5%DialogTMIB5.0%1.1%-1.6%TMIC-1.3%OthersNote: Comparative percentage composition is based on translated results in RM at <strong>Group</strong> level37

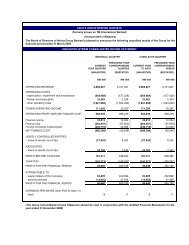

Two-Year <strong>Group</strong> Financial Summaryoperational highlightsAll in RM Million unless stated otherwise <strong>2008</strong> 20071. Operating revenue 11,347.7 9,996.92. Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) 4,356.0 4,135.93. Earnings from Associates & Jointly Controlled entities (59.4) 276.14. Profit Before Tax (PBT) 905.8 2,337.25. Profit After Tax (PAT) 471.1 1,847.66. Profit After Tax and Minority Interests (PATAMI) 498.0 1,781.97. Normalised PATAMI 1,138.2 1,561.18. Total shareholders’ equity 11,216.7 9,703.69. Total assets 37,352.4 24,489.510. Total borrowings (Note 1) 19,984.4 9,094.611. Subscribers (million) (Note 2) 89.3 39.8GROWTH RATES YoY(Note 3)1. Operating revenue 13.5% 16.6%2. EBITDA 5.3% 10.1%3. Total shareholders’ equity 15.6% 19.5%4. Total assets 52.5% 15.2%5. Total borrowings 119.7% 11.2%SHARE INFORMATION1. Per shareEarnings (basic) – sen 13.5 49.8Net assets – RM 3.0 2.72. Share price information – RMHigh 7.85 N/ALow 3.12 N/AFINANCIAL RATIOS1. Return on shareholders’ equity (Note 4) 4.8% 20.0%2. Return on total assets (Note 5) 1.3% 7.5%3. Debt equity ratio (Note 6) 1.8 0.9Notes:1 Interest bearing debts to third parties and amounts due to TM2 Total subscribers of all subsidiaries, associates and affiliates3 2007 YoY growth using 2006 unaudited Proforma numbers4 PATAMI over average shareholders’ equity5 PAT over total assets6 Total borrowings over total shareholders’ equity38<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Two-Year <strong>Group</strong> Financial HighlightsOperating Revenue(RM Million)EBITDA(RM Million)9,996.911,347.72007<strong>2008</strong>2007<strong>2008</strong>Subscribers(Million)39.889.34,135.94,356.0PATAMI(RM Million)Normalised PATAMI(RM Million)1,781.92007498.0<strong>2008</strong>1,561.11,138.22007 Note 1 <strong>2008</strong> Note 2Return on Shareholders’ Equity(%)4.820.02007<strong>2008</strong>2007<strong>2008</strong>Note 1 – Normalised PATAMI excludes one-off gains on disposal of Dialog shares (RM234.8 million) and Spice IPO and tower sale (RM200.1 million)Note 2 – Normalised PATAMI excludes interest costs on TM’s bridging loans (RM168.5 million), financing cost for Idea acquisition and one-off Spicecosts (RM187.0 million) and foreign exchange loss (RM284.7 million).39

Simplified <strong>Group</strong> Balance Sheet2007Jointly controlledentitiesAssociatesTrade and otherreceivablesCash and bankbalancesJointly controlledentitiesAssociatesInvestmentsProperty,plant andequipmentIntangibleassetsOther assets<strong>2008</strong>Trade and otherreceivablesCash and bankbalancesProperty,plant andequipmentIntangibleassetsOther assetsTrade andotherpayablesAmounts dueto formerholdingcompanyOtherliabilities2007Share capitalBorrowingsShare premiumOther reservesMinority interestsTrade andotherpayablesAmountsdue toformerholdingcompanyOtherliabilities<strong>2008</strong>Share capitalShare premiumOtherreservesMinorityinterestsBorrowings40<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

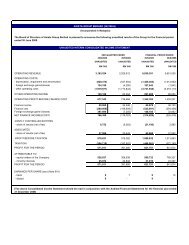

<strong>Report</strong>ing by Geographical Location5.25.2 5.25.65.6 5.62.32007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>2007 Revenue<strong>2008</strong> 2007 EBITDA<strong>2008</strong>2007 PATAMI <strong>2008</strong>2007 RM <strong>2008</strong> 2007 (Billion)RM <strong>2008</strong>2007Revenue(Billion)RM PATAMI<strong>2008</strong>EBITDA(Billion)RevenueEBITDAPATAMIRM (Billion)RM (Billion)RM (Billion)RM (Billion)RM (Billion)RM (Billion)8,364.78,364.712,156.012,156.03,509.03,509.02007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>2007 Revenue<strong>2008</strong> 2007 EBITDA<strong>2008</strong>2007 PATAMI <strong>2008</strong>2007 IDR Revenue(Billion) <strong>2008</strong> 2007 IDR EBITDA(Billion) <strong>2008</strong>2007 IDR PATAMI(Billion) <strong>2008</strong>RevenueEBITDAPATAMIIDR (Billion)IDR (Billion)IDR (Billion)IDR (Billion)IDR (Billion)IDR (Billion)34.134.136.236.213.913.92007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>2007 Revenue<strong>2008</strong> 2007 EBITDA<strong>2008</strong>2007 PATAMI <strong>2008</strong>2007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>SLR Revenue(Billion)SLR EBITDA(Billion)SLR PATAMI(Billion)RevenueEBITDAPATAMISLR (Billion)SLR (Billion)SLR (Billion)SLR (Billion)SLR (Billion)SLR (Billion)14.414.414.614.62.3 2.32.52.5 2.55,131.55,131.57.87.8 7.81.11.1 1.1250.8250.88.98.9 8.91.31.3 1.3(15.1)(15.1)(2.9)(2.9)4.32007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>2007 Revenue<strong>2008</strong> 2007 EBITDA<strong>2008</strong>2007 PATAMI <strong>2008</strong>2007 BDT <strong>2008</strong> 2007 (Billion)BDT <strong>2008</strong>2007Revenue(Billion)BDT PATAMI<strong>2008</strong>EBITDA(Billion)RevenueEBITDAPATAMIBDT (Billion)BDT (Billion)BDT (Billion)BDT (Billion)BDT (Billion)BDT (Billion)41.141.154.154.14.3 4.317.617.62007 <strong>2008</strong> 2007 <strong>2008</strong>2007 <strong>2008</strong>2007 Revenue<strong>2008</strong> 2007 EBITDA<strong>2008</strong>2007 PATAMI <strong>2008</strong>2007 USD <strong>2008</strong> 2007 (Million)USD <strong>2008</strong>2007Revenue(Million)USD PATAMI<strong>2008</strong>EBITDA(Million)RevenueEBITDAPATAMIUSD (Million)USD (Million)USD (Million)USD (Million)USD (Million)USD (Million)* All financial figures are according to Celcom audited financial statements4.24.2 4.214.014.00.10.1 0.19.89.8 9.8(1.2)(1.2)1.41.4 1.441

<strong>Group</strong> Financial ReviewThe regional telecommunications industry recordedslower growth over the past year in an environment ofuncertainty with currency fluctuations and challengingeconomic conditions. Although the general businessenvironment remained challenging, the <strong>Group</strong> hascontinued to maintain its position in terms of revenueand subscriber market share in most markets ascompared to the previous year.For the year ended 31 December <strong>2008</strong>, the <strong>Group</strong>’soperating revenue grew by 13.5% to RM11.3 billioncompared to RM10.0 billion the previous year, largelydriven by strong revenue growth in Celcom and XL.Celcom showed a strong performance contributing48.5% to total operating revenue of the <strong>Group</strong>. Revenuefrom Celcom was 10.1%* higher as compared to revenuerecorded in the preceding year. The positiveperformance was brought about by strong growth inthe prepaid segment as a result of aggressive marketingcampaigns throughout the year. The overall growthwas also driven from improvement in postpaid revenue,due to the 1+5 Plan, Celcom Executive Plan andBroadband packages. Celcom added 1.6 million newcustomers in <strong>2008</strong>, bringing the total customers to 8.8million, a growth of 21.6% from 7.2 million as at end of2007.Total revenue contribution from other markets namelyBangladesh, Cambodia and Pakistan reduced slightlyby 0.2% to 8.6% of <strong>Group</strong> revenue but collectivelygrew 10.9% YoY.The fluctuation of the RM against local currencies in allmarkets had unfavourably affected the <strong>Group</strong>’stranslated revenue for the year. At constant currency,the <strong>Group</strong> revenue for the year grew by 20.3% fromthe previous year.For the year ended 31 December <strong>2008</strong>, the <strong>Group</strong>’soperating costs rose by 19.3% to RM7.0 billion ascompared to RM5.9 billion recorded in 2007 mainlydue to inflationary effects and cost escalation in linewith revenue growth in all markets. With rising costpressures and greater competition, the <strong>Group</strong> EBITDAmargin declined to 38.4% from 41.4% the previousyear.Depreciation, impairment and amortisation charges ofproperty, plant and equipment (PPE) and intangibleassets increased 28.2% to RM2.3 billion as comparedto RM1.8 billion recorded in 2007. In <strong>2008</strong>, <strong>Group</strong> BTShad increased to more than 30,000 in line with revenuegrowth, which is the key driver for the increase indepreciation costs.Our international operations continued to provide the<strong>Group</strong> with an outstanding growth of 18.1% wherebyXL, in terms of RM, grew by 22.9%. As a result, overseascontribution grew to 51.5% from 49.5% in the previousyear with XL making up 63.3% of the total overseasoperating company revenue. Revenue from XLaccounted for 32.6% of the <strong>Group</strong>’s revenue, anincrease from 30.1% in the preceding year. Revenuecontribution from our OpCo in Sri Lanka, Dialog <strong>Group</strong>,declined to 10.3% as compared to 10.6% in 2007.Depreciation of RM and local currency in all marketsagainst the USD has resulted in net loss on foreignexchange in <strong>2008</strong>, predominantly arising fromtranslation of USD denominated debt as well aspayables in other foreign currencies.The weakening of the IDR against USD has resulted inforeign exchange loss of RM354.4 million from XL in<strong>2008</strong>, as compared to RM124.4 million in the previousyear, mainly from debt and payables in USD and otherforeign currencies. Higher foreign exchange loss in <strong>2008</strong>was also the result of the translation loss of RM84.3million from USD borrowings for the investment in Idea.42<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

Dialog and TMIB had registered RM25.8 million andRM5.3 million foreign exchange loss in <strong>2008</strong> respectively,due to the weakening of SLR and BDT against USD.As a result, a net loss on foreign exchange of RM445.8million was recorded in the current year as comparedto a net loss of RM131.6 million recorded in thepreceding year.Share of profit from SunShare in <strong>2008</strong> was attributedto its contribution as a jointly controlled entity up to25 April <strong>2008</strong>. SunShare had effectively become the<strong>Group</strong>’s subsidiary following the completion of thedemerger exercise and acquisition of the remaining49.0% stake from Khazanah. Negative contributionfrom the jointly controlled entity was mainly attributedto share of loss from Spice as opposed to profit in thepreceding year.Higher interest charges at <strong>Group</strong> level, largely relatedto the investment in India, has further impacted PAT.Year on year finance costs increased by RM397.5million, mainly driven by interest on TM’s bridging loanand financing cost for the Idea acquisition totalingRM275.3 million.The challenging market environment caused XL, Dialog<strong>Group</strong>, TMIB and TMIC to record declines in profit forthe year. PAT attributable to shareholders declined by72.1% to RM498.0 million from RM1.8 billion the previousyear mainly due to the foreign exchange loss andlower contribution from subsidiary companies.financial aNALYSIS of KEY OPERATINGCOMPANIESCelcomIn the Malaysian market, the postpaid segment showedstronger growth than the prepaid segment asbroadband/3G customers grew 218.2% in <strong>2008</strong>. Celcomrecorded its highest annual revenue in <strong>2008</strong>, closingthe year with a total revenue of RM5.6 billion which isa 10.1%* increase from the previous year. For the past11 quarters, Celcom has registered quarter on quartergrowth.Celcom managed to achieve this whilst concurrentlyimproving its profit level. Various cost saving measuresin <strong>2008</strong> has helped in Celcom posting a growth of10.5% in EBITDA to RM2.5 billion compared to RM2.3billion in the previous year, improving EBITDA marginfrom 44.6% to 45.2%.Amidst intense competition and an uncertain economicoutlook, Celcom recorded a double digit growth in itspre-tax profit, growing by 24.4% in <strong>2008</strong>, to close atRM1.8 billion. For the same period, it recorded a netprofit of RM1.3 billion which is an increase from RM1.1billion in 2007.Earnings per share fell to 13.5 sen, while Return onEquity declined to 4.8% from 20.0% the previousyear.* Fibrecomm has been excluded for growth comparison purposes as it has ceased to be a subsidiary of the <strong>Group</strong> post demerger.43

<strong>Group</strong> Financial Review (cont’d.)XLIn <strong>2008</strong>, XL outperformed the industry in terms ofrevenue and EBITDA growth and increased its marketshare. XL grew its top line revenue by 45.3% YoYwhile EBITDA margin increased 0.2% to 42.2%, despiteintensified competition and the global economic crisisin the second half of the year.Total revenue reached IDR12,156.0 billion, an increasefrom IDR8,364.7 billion in 2007, mainly driven byexponential growth in total minutes and a largercustomer base. All segments experienced positivegrowth with additional revenue from the tower businessin <strong>2008</strong>. Prepaid subscribers accounts for 98.4% of itstotal subscriber base. Prepaid revenue was 58.0%higher YoY at IDR8,849.4 billion and contributed 72.8%to the total revenue. In <strong>2008</strong>, XL had a new revenuestream from the leasing out of tower space, amountingto IDR276.7 billion, which made up 2.3% of the totalrevenue.Total operating expenses increased 54.7% YoY toIDR6,929.7 billion, mainly due to increase ininterconnection and telecommunication service chargesand network infrastructure expenses.Dialog <strong>Group</strong>Revenue growth was mitigated by successivereductions in mobile telephony charges during thecourse of <strong>2008</strong>, in line with the company’s consciousdecision to lower tariff charges to subscribers in thewake of economic pressures. Results of this strategyare evidenced by the company’s continued success incapturing a major share of mobile subscriber additionsacross Sri Lanka, notwithstanding aggressivecompetition from other operators in the country.For the year ended 31 December <strong>2008</strong>, the Dialog<strong>Group</strong> recorded consolidated revenue of SLR36.2billion, a growth of 6.0% compared to the previousyear which was SLR34.1 billion.Dialog <strong>Group</strong> costs grew by 40.5% YoY resulting in adecline in EBITDA at SLR7.8 billion against SLR13.9billion in 2007. Inflationary effects in the first half ofthe year of above 20% and the economic downturn inthe second half of the year, impacted the EBITDA andPAT of the <strong>Group</strong>. The <strong>Group</strong> recorded a loss ofSLR2.9 billion for <strong>2008</strong>, representing negative growthin group earnings of 132.3% YoY.EBITDA increased 46.3% YoY to IDR5,131.5 billion andmargin increased to 42.2% as a result of strong costmanagement, despite lower average tariffs perminute.Normalised net income declined 51.8% YoY due tohigher interest expenses from higher interest bearingdebts, higher depreciation, driven by accelerateddepreciation on XL core equipment amounting toIDR451.0 billion, and foreign exchange loss of IDR332.2billion.44<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

TMIBFor the year ended 31 December <strong>2008</strong>, TMIB recordeda growth of 1.6% in its revenue to close at BDT14.6billion from BDT14.4 billion recorded in 2007. This wasachieved despite higher acquisition costs offered byother operators, declining ARPU and tariff arising fromintense competition across the industry.The increase in revenue is mainly attributed to increasein minutes of use (MoU) and increased revenuegenerating base (RGB) through effective reactivationand quality acquisition. TMIB added 1.5 million newcustomers in <strong>2008</strong> bringing the total customers to 8.7million, a growth of 21.4% from 7.2 million as at end of2007.TMICTMIC achieved a 31.6% growth in revenue, fromUSD41.1 million recorded in financial year 2007 toUSD54.1 million in <strong>2008</strong>. Whilst subscriber growth wasstrong at 90.0%, blended ARPU reduced by 19.1%compared to the previous year.EBITDA margin stood at 25.9% while PAT wasUSD1.4 million with normalised figures for EBITDA andPAT margins was at 33.0% and 19.0% respectively.Lower EBITDA and PAT during the year were causedby one-off spectrum fees and impairment costs oftelecommunications equipment arising from the networkupgrading exercise.The EBITDA for the year was at BDT4.2 billion, amarginal drop from BDT4.3 billion achieved in thepreceding year. EBITDA margin recorded at 28.8%, amarginal decrease from 29.9% in 2007. Negative PATduring the year was due to higher borrowing costs anddepreciation costs during the year.The overall achievements during the year, especially inthe fourth quarter of <strong>2008</strong>, have been attributed tothe improved marketing and communication strategiessupported by growth in network capacity and improveddistribution channels.45

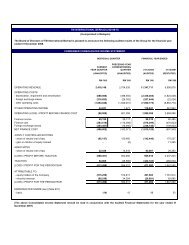

Acquisition of Idea: Expansion into India<strong>Axiata</strong>, on 25 June <strong>2008</strong> entered into an agreementwith Idea, Aditya Birla <strong>Group</strong> and Spice, which saw<strong>Axiata</strong> expanding its presence significantly in India froma two circle operator in Spice to a 13 circle operator inone of the fastest growing mobile markets in theworld.Post merger with Spice, Idea will be the fifth largestmobile player in India with an aspiration to emerge asa pan-Indian mobile operator with presence in all 22circles in India.Through Idea, <strong>Axiata</strong> has access to over 38 millionsubscribers representing an 11.0% (pan-India) marketshare with a presence in the 15 operating circles inIndia as at end <strong>2008</strong>.The strategic expansion in India was the best option for<strong>Axiata</strong> for a faster, most economical and least riskinvestment for an India-wide presence to capture thewindow of growth opportunity and position ourselvesagainst bigger players and new entrants.Amongst the key rationales of our expansion in Indiaare as follows:Significant Growth PotentialThe Indian market is in a rapid growth phase withapproximately 10 million net additions per month and49.0% YoY growth recorded in <strong>2008</strong>. With the currentlow penetration level of 20.0% - 30.0% range (one ofthe lowest in the region) and improving economics,future growth is expected to be strong withapproximately 200 - 300 million net additionalsubscribers expected over the next three years*.Accelerate Participation ThroughConsolidationAs a regional telecommunication investor, it is essentialfor <strong>Axiata</strong> to capitalise on the current high growthphase, especially as the headroom for growth is in thenext three to five years. By 2012, it is expected thatpenetration will reach the 50.0% - 60.0% level andbeyond 2012 the country is expected to record slowergrowth*. As such, the ‘India opportunity’ prevails verymuch now and any delay would reduce the ability tocapitalise on the rapid growth.Idea and Spice – The Ideal CombinationThe combination of Spice and Idea has no operationaloverlaps in its circles. Furthermore, the combinedentity will become the fifth largest operator in Indiaagainst Idea’s standalone fifth position and Spice’sstandalone eighth position. Idea has also securedlicences for all the remaining circles and national rolloutis in the pipeline. The investment also brings a verystrong partnership to the <strong>Axiata</strong> <strong>Group</strong> with Idea‘sexcellent financial performance, and the addedadvantage of enabling collaboration with the Birla<strong>Group</strong>.Idea has been performing extremely well, recording 61.6%YoY growth in subscribers together with revenue of49.5% up to quarter ended 31 December <strong>2008</strong>.Benefits to Both PartiesThe investment leverages <strong>Axiata</strong>’s regional experienceespecially in the more mature markets includingexpertise in 3G businesses and rollout experiences asIndia moves into the next technology wave.For <strong>Axiata</strong>, the transaction will provide additionalexposure to new emerging business models vis-a-vispay-as-you-grow, managed services, active/passiveinfrastructure sharing, hosted Value Added Services(VAS), etc. Together, <strong>Axiata</strong> and Idea will form abusiness co-operation forum to help facilitate synergiesand share knowledge as well as best practices betweenthe two groups of companies.46<strong>Axiata</strong> <strong>Group</strong> <strong>Berhad</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>(formerly known as TM International <strong>Berhad</strong>)

PRE MERGERPOST SPICE MERGER13 No. of Operational Service Areas 159.9% National Market Share 11.0%68% Subscriber Coverage 78%7 No. of Service Areas in 900 Mhz 939% % of Subscribers Pan India, Covered by 900 Mhz 49%Source: IdeaThe investment in Idea saw <strong>Axiata</strong> subscribing for14.99% equity interest in Idea, for a cash considerationof approximately USD1.8 billion which was financed bydebt. Subsequently, <strong>Axiata</strong>’s shareholdings in Idea willincrease to 19.0% pursuant to the merger of Spice andIdea in which <strong>Axiata</strong> will then equity account itsinvestment in Idea. The merger process is expected tobe completed in the first half of 2009.The combined entity of Spice and Idea has the potentialto become one of the largest players in the wirelesstelecommunication market in India.* Source:Association of Unified Telecom Service Providers of IndiaCellular Operators Association of India (COAI)Department of Telecommunications, IndiaTelecom Regulatory Authority of IndiaOVUM47