- Page 1: ANNUAL REPORT 2008A X I ATA G R O U

- Page 4 and 5: The Tangram ConnectionThe TANGRAM i

- Page 6 and 7: Annual Report 20084Axiata Group Ber

- Page 9 and 10: OPTIMISTICThe bird in full flight s

- Page 11 and 12: The name Axiata embodies who we are

- Page 13 and 14: Our Beliefs and ValuesAxiata is the

- Page 15: group COMPANY SECRETARYSuryani Huss

- Page 18 and 19: Axiata ProfileAbout AxiataAxiata Gr

- Page 20 and 21: Regional Presence18Axiata Group Ber

- Page 22 and 23: Group Corporate StructureAs at 31 M

- Page 25 and 26: EXCELLENCEThe arrow embodies Axiata

- Page 27 and 28: Dear Shareholders,I am pleased to p

- Page 29 and 30: Our tagline of “Advancing Asia”

- Page 31 and 32: Dear Shareholders,This being our in

- Page 33 and 34: GROUP PERFORMANCEREVIEWFor most of

- Page 35 and 36: This hugely successful strategy, wh

- Page 37 and 38: Strengthening governance included a

- Page 39 and 40: +13.5%Group Financial OverviewOpera

- Page 41 and 42: Two-Year Group Financial Highlights

- Page 43 and 44: Reporting by Geographical Location5

- Page 45: Dialog and TMIB had registered RM25

- Page 49 and 50: PRE MERGERPOST SPICE MERGER13 No. o

- Page 51 and 52: September 2006Dialog acquired 90.0%

- Page 53: Awards and AccoladesCelcom (Malaysi

- Page 56 and 57: Board of DirectorsFrom left to righ

- Page 58 and 59: Profile of DirectorsTan Sri Dato’

- Page 60 and 61: Profile of Directors (cont’d.)Dat

- Page 62 and 63: Profile of Directors (cont’d.)Dav

- Page 64 and 65: Profile of Management TeamDato’ S

- Page 66 and 67: Profile of Management Team (cont’

- Page 68 and 69: Profile of Management Team (cont’

- Page 70 and 71: Profile of Operating Companies’ M

- Page 72 and 73: Profile Of operating Companies’ M

- Page 74 and 75: Statement on Corporate GovernanceAx

- Page 76 and 77: Statement on Corporate Governance (

- Page 78 and 79: Statement on Corporate Governance (

- Page 80 and 81: Statement on Corporate Governance (

- Page 82 and 83: Directors’ Statement on Internal

- Page 84 and 85: Directors’ Statement on Internal

- Page 86 and 87: Directors’ Statement on Internal

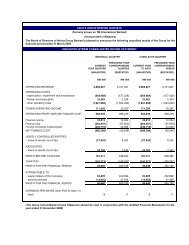

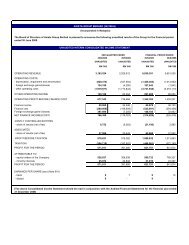

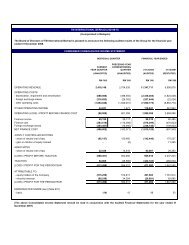

- Page 88 and 89: Board Audit Committee ReportThe Boa

- Page 90 and 91: Board Audit Committee Report (cont

- Page 92 and 93: Board Audit Committee Report (cont

- Page 94 and 95: Board Audit Committee Report (cont

- Page 96 and 97:

Board Audit Committee Report (cont

- Page 99 and 100:

LOCAL RELEVANCEThe key represents A

- Page 101 and 102:

BUSINESS HIGHLIGHTS 2008Through the

- Page 103 and 104:

Xpax also offers the budget-conscio

- Page 105 and 106:

Business SolutionsWith its widest n

- Page 107 and 108:

Business Highlights 2008XL expanded

- Page 109 and 110:

Regulatory OverviewThe Indonesian r

- Page 111 and 112:

Business Highlights 2008Dialog cons

- Page 113 and 114:

FINANCIAL PERFORMANCEDialog Telekom

- Page 115 and 116:

Mobile IndustryThe mobile telecommu

- Page 117 and 118:

With its strengths and competencies

- Page 119 and 120:

OUTLOOK FOR 2009Despite the absence

- Page 121 and 122:

EBITDA margin stood at 25.9% whilst

- Page 123 and 124:

Axiata’s investment into Idea was

- Page 125 and 126:

BUSINESS HIGHLIGHTS 2008As at 31 De

- Page 127 and 128:

OUTLOOK FOR 2009The telecommunicati

- Page 129 and 130:

REGULATORY OVERVIEWPakistan is gene

- Page 131 and 132:

The technology-related business uni

- Page 133 and 134:

Given the higher inflation and over

- Page 135:

AWARDS• Prime Minister Award 2008

- Page 138 and 139:

Products and Services CatalogueMala

- Page 140 and 141:

Products and Services Catalogue (co

- Page 142 and 143:

Products and Services ReviewAxiata

- Page 144 and 145:

Products and Services Review (cont

- Page 147 and 148:

UNCOMPROMISINGThe house demonstrate

- Page 149 and 150:

Key Investor Relations initiatives

- Page 151 and 152:

In line with this people strategy,

- Page 153 and 154:

XL’s initiatives are focused on e

- Page 155 and 156:

The Dialog - University of Moratuwa

- Page 157 and 158:

Financial Statements156 Directors

- Page 159 and 160:

directors’ reportThe Directors ha

- Page 161 and 162:

DIRECTORSThe Directors who have hel

- Page 163 and 164:

STATUTORY INFORMATION ON THE FINANC

- Page 165 and 166:

BALANCE SHEETSAS AT 31 DECEMBER 200

- Page 167 and 168:

CONSOLIDATED STATEMENT OF CHANGES I

- Page 169 and 170:

COMPANY STATEMENT OF CHANGES IN EQU

- Page 171 and 172:

NOTES TO THE FINANCIAL STATEMENTSFO

- Page 173 and 174:

2 BASIS OF PREPARATION OF THE FINAN

- Page 175 and 176:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 177 and 178:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 179 and 180:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 181 and 182:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 183 and 184:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 185 and 186:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 187 and 188:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 189 and 190:

3 SIGNIFICANT ACCOUNTING POLICIES (

- Page 191 and 192:

4 CRITICAL ACCOUNTING ESTIMATES AND

- Page 193 and 194:

5 SIGNIFICANT GROUP RESTRUCTURING,

- Page 195 and 196:

5 SIGNIFICANT GROUP RESTRUCTURING,

- Page 197 and 198:

5 SIGNIFICANT GROUP RESTRUCTURING,

- Page 199 and 200:

7(b) OTHER OPERATING COSTS (continu

- Page 201 and 202:

10 TAXATIONThe taxation expense for

- Page 203 and 204:

12 SHARE CAPITALGroupCompany2008 20

- Page 205 and 206:

13 EMPLOYEES’ SHARE OPTION SCHEME

- Page 207 and 208:

13 EMPLOYEES’ SHARE OPTION SCHEME

- Page 209 and 210:

13 EMPLOYEES’ SHARE OPTION SCHEME

- Page 211 and 212:

13 EMPLOYEES’ SHARE OPTION SCHEME

- Page 213 and 214:

13 EMPLOYEES’ SHARE OPTION SCHEME

- Page 215 and 216:

14 OTHER RESERVESGroupCompany2008 2

- Page 217 and 218:

15 BORROWINGS (continued)2008Weight

- Page 219 and 220:

15 BORROWINGS (continued)(d)Consist

- Page 221 and 222:

15 BORROWINGS (continued)(f)Borrowi

- Page 223 and 224:

15 BORROWINGS (continued)(f)Borrowi

- Page 225 and 226:

16 AMOUNTS DUE TO FORMER HOLDING CO

- Page 227 and 228:

18 DEFERRED TAX (continued)The tax

- Page 229 and 230:

20 INTANGIBLE ASSETS (continued)Goo

- Page 231 and 232:

20 INTANGIBLE ASSETS (continued)(b)

- Page 233 and 234:

21 PROPERTY, PLANT AND EQUIPMENT (c

- Page 235 and 236:

21 PROPERTY, PLANT AND EQUIPMENT (c

- Page 237 and 238:

22 INVESTMENT PROPERTIES (continued

- Page 239 and 240:

25 JOINTLY CONTROLLED ENTITIES (con

- Page 241 and 242:

26 ASSOCIATES2008 2007RestatedMalay

- Page 243 and 244:

26 ASSOCIATES (continued)(a)Key ass

- Page 245 and 246:

27 INVESTMENTS (continued)(ii)The f

- Page 247 and 248:

30 TRADE AND OTHER RECEIVABLES (con

- Page 249 and 250:

31 CASH AND BANK BALANCES (continue

- Page 251 and 252:

33 CASH FLOWS FROM/(USED IN) OPERAT

- Page 253 and 254:

34 CONTINGENCIES AND COMMITMENTS (c

- Page 255 and 256:

34 CONTINGENCIES AND COMMITMENTS (c

- Page 257 and 258:

34 CONTINGENCIES AND COMMITMENTS (c

- Page 259 and 260:

34 CONTINGENCIES AND COMMITMENTS (c

- Page 261 and 262:

34 CONTINGENCIES AND COMMITMENTS (c

- Page 263 and 264:

35 HEDGING TRANSACTIONS (continued)

- Page 265 and 266:

35 HEDGING TRANSACTIONS (continued)

- Page 267 and 268:

35 HEDGING TRANSACTIONS (continued)

- Page 269 and 270:

36 SIGNIFICANT EVENTS DURING THE FI

- Page 271 and 272:

36 SIGNIFICANT EVENTS DURING THE FI

- Page 273 and 274:

37 SUBSEQUENT EVENTS (continued)(b)

- Page 275 and 276:

39 SEGMENTAL REPORTING (continued)S

- Page 277 and 278:

39 SEGMENTAL REPORTING (continued)M

- Page 279 and 280:

40 FINANCIAL RISK MANAGEMENT OBJECT

- Page 281 and 282:

41 INTEREST RATE RISK (continued)Ma

- Page 283 and 284:

41 INTEREST RATE RISK (continued)Ma

- Page 285 and 286:

42 CREDIT RISKFor on-balance sheet

- Page 287 and 288:

44 LIST OF SUBSIDIARIES (continued)

- Page 289 and 290:

44 LIST OF SUBSIDIARIES (continued)

- Page 291 and 292:

46 LIST OF ASSOCIATES (continued)%

- Page 293 and 294:

48 CHANGES IN COMPARATIVES (continu

- Page 295 and 296:

48 CHANGES IN COMPARATIVES (continu

- Page 297 and 298:

48 CHANGES IN COMPARATIVES (continu

- Page 299 and 300:

49 RELATED PARTY TRANSACTIONSAll re

- Page 301 and 302:

49 RELATED PARTY TRANSACTIONS (cont

- Page 303 and 304:

49 RELATED PARTY TRANSACTIONS (cont

- Page 305 and 306:

INDEPENDENT AUDITORS’ REPORTTO TH

- Page 307 and 308:

Group Financial AnalysisOperating R

- Page 309 and 310:

The weakening of the IDR against US

- Page 311 and 312:

Shareholding Statisticsas at 31 Mar

- Page 313 and 314:

List of Top 30 Largest Shareholders

- Page 315 and 316:

No.6.Compliance Issuevariation in r

- Page 317 and 318:

Net Book Value of Land and Building

- Page 319 and 320:

Group DirectoryAxiata Group BerhadL

- Page 321 and 322:

EDGEEnhanced Data rates for GSM Evo

- Page 323 and 324:

SLTSenior Leadership TeamSMESmall M

- Page 325 and 326:

AS SPECIAL BUSINESS:To consider and

- Page 327 and 328:

EXPLANATORY NOTES ON SPECIAL BUSINE

- Page 329 and 330:

PROXY14. A member entitled to atten

- Page 331 and 332:

Proxy Form(Before completing the fo