Incorporated in Malaysia - Axiata Group Berhad - Investor Relations

Incorporated in Malaysia - Axiata Group Berhad - Investor Relations

Incorporated in Malaysia - Axiata Group Berhad - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

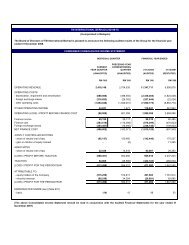

AXIATA GROUP BERHAD (242188-H)(formerly known as TM International <strong>Berhad</strong>)(<strong>Incorporated</strong> <strong>in</strong> <strong>Malaysia</strong>)PART B : EXPLANATORY NOTES PURSUANT TO APPENDIX 9B OF THE LISTINGREQUIREMENTS OF BURSA MALAYSIA SECURITIES BERHAD1. Review of Performance (cont<strong>in</strong>ued)(b) Year-on-YearFor the first half of the f<strong>in</strong>ancial year (“1H 2009”), the <strong>Group</strong>’s revenue improvedby 6.7%, from RM5,651.5 million recorded <strong>in</strong> first half of 2008 (“1H 2008”) toRM6,030.4 million. This was primarily attributed to the higher achievement <strong>in</strong>Celcom and AxB. Celcom and XL rema<strong>in</strong>ed as the major contributors towards the<strong>Group</strong>’s revenue while AxB’s contribution had improved from 6.1% <strong>in</strong> the 1H 2008to 7.8% <strong>in</strong> 1H 2009.The <strong>Group</strong> recorded a 229.2% <strong>in</strong>crease <strong>in</strong> other operat<strong>in</strong>g <strong>in</strong>come for 1H 2009 fromRM88.6 million to RM291.7 million. The <strong>in</strong>crease was ma<strong>in</strong>ly driven by XL’s oneoffga<strong>in</strong> of RM150.8 million aris<strong>in</strong>g from derecognition of its dark fibre optic l<strong>in</strong>esas a result of a f<strong>in</strong>ance lease arrangement.The <strong>Group</strong>’s other operat<strong>in</strong>g cost <strong>in</strong>creased by 12.8% from RM3,318.1 million <strong>in</strong>1H 2008 to RM3,741.9 million <strong>in</strong> 1H 2009 ma<strong>in</strong>ly from Celcom , XL, Dialog andAxB. The <strong>in</strong>crease <strong>in</strong> Celcom was ma<strong>in</strong>ly due to higher outgo<strong>in</strong>g traffic and 3Gnetwork expansion. In XL, operat<strong>in</strong>g costs was driven by higher manpower cost andma<strong>in</strong>tenance expenses from the <strong>in</strong>crease <strong>in</strong> BTS.The <strong>Group</strong>’s PAT was RM621.8 million, a 26.1% lower aga<strong>in</strong>st PAT of RM841.7million reported <strong>in</strong> 1H 2008. Apart from the higher other operat<strong>in</strong>g cost which<strong>in</strong>creased by RM423.8 million from the previous correspond<strong>in</strong>g period, the lowerPAT achievement was resulted from higher depreciation, impairment andamortisation which was driven by Dialog’s accelerated depreciation charge ofRM187.5 million aris<strong>in</strong>g from network modernisation plan. The <strong>Group</strong> recordedhigher net f<strong>in</strong>ance cost of RM203.9 million, to RM462.2 million <strong>in</strong> 1H 2009.Higher f<strong>in</strong>ance cost was predom<strong>in</strong>antly driven by the f<strong>in</strong>anc<strong>in</strong>g of <strong>in</strong>vestment <strong>in</strong>Idea.The <strong>Group</strong>’s PAT was positively impacted by pre-tax higher foreign exchange ga<strong>in</strong>of RM315.8 million recorded <strong>in</strong> 1H 2009 as compared to pre-tax foreign exchangega<strong>in</strong> of RM30.9 million <strong>in</strong> 1H 2008. The higher pre-tax foreign exchange ga<strong>in</strong> <strong>in</strong>1H 2009 was due to the weaken<strong>in</strong>g of USD aga<strong>in</strong>st IDR, RM and other localcurrencies.11