<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>g) Reserves policyThe <strong>RNLI</strong>’s reserves fall into the following categories:Endowment reserves are capital sums, which are donated underthe restrictions that they are invested and that only the incomearising is available for expenditure in accordance with thedonors’ directions.Restricted reserves are reserves that are only available forexpenditure in accordance with the donors’ directions. Wherethose reserves have been expended on fixed assets, the reservesfinancing the book value of those assets will continue to beaccounted as restricted reserves, reflecting the source of fundsand the <strong>RNLI</strong>’s continued obligations in respect of the use ofthose assets. Other than fixed assets there are over 700 of thesereserves, all represented by investments, which are restricted toexpenditure on particular items of equipment and on particulartypes of service such as crew training or at particular stations.Accrued legacy reserves represent the restricted legacy valueaccrued on an estimated basis, in accordance with the policy onincoming resources detailed in this note.Designated reserves are set aside at the discretion of theTrustees and comprise:Fixed Assets, which finances the fixed assets of the <strong>RNLI</strong> fundedother than by restricted donations.Planned Capital Expenditure, which sets aside funds to assuresuppliers that the <strong>RNLI</strong> can meet its planned capital expenditure.This is expenditure to which the <strong>RNLI</strong> is committed over the next3 years in order to maintain the operation of the lifeboat andlifeguard service, principally new lifeboats and lifeboat stations.The total amount set aside excludes projects to be funded byrestricted reserves.All the above reserves are Committed reserves.Free reserves are retained to enable the Trustees to provideassurance to those at sea, the public and the governments of theUK and RoI, that the <strong>RNLI</strong> will be able to sustain its commitmentto provide the lifeboat and lifeguard service. The reserves areset at a level to withstand any short-term setback, whetheroperational, in the investment markets or in key sources ofincome, such as legacies. If free reserves fall outside the rangeof 6–18 months’ charitable expenditure cover, the Trustees willreview the Strategic Plan and make changes, as they considerappropriate. For the purposes of this calculation, free reserves arecalculated excluding FRS17 pension reserves.Accrued legacy reserves represent the legacy value accruedon an estimated basis once probate has been granted andnotification has been received, where the amount can bequantified with reasonable accuracy. The amount excludesrestricted legacies.FRS17 pension reserves represent the FRS17 accountingdeficit for the defined benefit pension scheme and dependants’pensions as at the year end. The FRS17 basis is a prescribedaccounting basis that requires the discount rate to be the returnon AA-rated (or equivalent) corporate bonds. Each year, theScheme Actuary assesses the financial position of the scheme,allowing for the returns expected to be generated by the assetsplanned to be held by the scheme in the future. These assetswould not typically consist of 100% in corporate bonds. Furtherdetails are shown in note 14.Transfers between reserves represent the application ofrestricted and designated funds to capital projects and transfersto maintain the committed value of restricted funds. In <strong>2011</strong>,there has been a review of restricted assets and a transferbetween designated and restricted funds to reflect this.h) Operating leasesRentals applicable to operating leases are charged to the SoFAover the period in which the cost is incurred.i) InvestmentsListed investments are stated at market value. Realised gains andlosses on sales of investments are calculated as the differencebetween the sale proceeds and original costs. Unrealised gainsand losses represent the movement in market values.j) StocksStocks are valued at cost or written-down value. Stocks arereviewed on a line-item basis at least annually and provisionis made against cost to reduce carrying value to estimatedrealisable value.k) Exchange gains and lossesTransactions in foreign currencies are recorded using the rate ofexchange ruling at the date of the transaction. Monetary assetsare translated at the rate of exchange ruling at the balance sheetdate. Gains and losses on exchange are included in the SoFAunder investment income.2 Subsidiary companiesThe <strong>RNLI</strong> has four directly, wholly owned subsidiaries, <strong>RNLI</strong>(Trading) Limited, <strong>RNLI</strong> (Enterprises) Limited, <strong>RNLI</strong> (Sales) Limitedand <strong>RNLI</strong> College Limited, all of which are registered in Englandand Wales. <strong>RNLI</strong> (Trading) Limited has a wholly owned subsidiary,SAR Composites Limited, that carries out hull construction. <strong>RNLI</strong>College Limited was incorporated on 14 July <strong>2011</strong> and exists toprovide training to the <strong>RNLI</strong> and approved third parties, primarilyin the emergency launching and operational use of lifeboats.The activities of <strong>RNLI</strong> (Trading) Limited and <strong>RNLI</strong> CollegeLimited relate directly to the charitable activities of the <strong>RNLI</strong>,although both companies have some external sales of sparecapacity if available. The other companies are used for noncharitableactivities to raise funds for the charity. <strong>RNLI</strong> (Enterprises)Limited raises funds through lotteries and other trading activities.<strong>RNLI</strong> (Sales) Limited sells gifts and souvenirs through the <strong>RNLI</strong>’snetwork of station branches, fundraising branches and guilds andoperates a mail-order and web-based catalogue.22

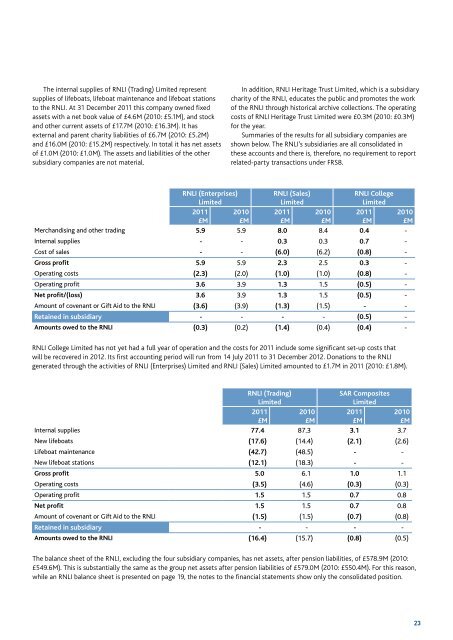

The internal supplies of <strong>RNLI</strong> (Trading) Limited representsupplies of lifeboats, lifeboat maintenance and lifeboat stationsto the <strong>RNLI</strong>. At 31 December <strong>2011</strong> this company owned fixedassets with a net book value of £4.6M (2010: £5.1M), and stockand other current assets of £17.7M (2010: £16.3M). It hasexternal and parent charity liabilities of £6.7M (2010: £5.2M)and £16.0M (2010: £15.2M) respectively. In total it has net assetsof £1.0M (2010: £1.0M). The assets and liabilities of the othersubsidiary companies are not material.In addition, <strong>RNLI</strong> Heritage Trust Limited, which is a subsidiarycharity of the <strong>RNLI</strong>, educates the public and promotes the workof the <strong>RNLI</strong> through historical archive collections. The operatingcosts of <strong>RNLI</strong> Heritage Trust Limited were £0.3M (2010: £0.3M)for the year.Summaries of the results for all subsidiary companies areshown below. The <strong>RNLI</strong>’s subsidiaries are all consolidated inthese accounts and there is, therefore, no requirement to reportrelated-party transactions under FRS8.<strong>RNLI</strong> (Enterprises)Limited<strong>RNLI</strong> (Sales)Limited<strong>RNLI</strong> CollegeLimited<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£MMerchandising and other trading 5.9 5.9 8.0 8.4 0.4 -Internal supplies - - 0.3 0.3 0.7 -Cost of sales - - (6.0) (6.2) (0.8) -Gross profit 5.9 5.9 2.3 2.5 0.3 -Operating costs (2.3) (2.0) (1.0) (1.0) (0.8) -Operating profit 3.6 3.9 1.3 1.5 (0.5) -Net profit/(loss) 3.6 3.9 1.3 1.5 (0.5) -Amount of covenant or Gift Aid to the <strong>RNLI</strong> (3.6) (3.9) (1.3) (1.5) - -Retained in subsidiary - - - - (0.5) -Amounts owed to the <strong>RNLI</strong> (0.3) (0.2) (1.4) (0.4) (0.4) -<strong>RNLI</strong> College Limited has not yet had a full year of operation and the costs for <strong>2011</strong> include some significant set-up costs thatwill be recovered in 2012. Its first accounting period will run from 14 July <strong>2011</strong> to 31 December 2012. Donations to the <strong>RNLI</strong>generated through the activities of <strong>RNLI</strong> (Enterprises) Limited and <strong>RNLI</strong> (Sales) Limited amounted to £1.7M in <strong>2011</strong> (2010: £1.8M).<strong>RNLI</strong> (Trading)LimitedSAR CompositesLimited<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£MInternal supplies 77.4 87.3 3.1 3.7New lifeboats (17.6) (14.4) (2.1) (2.6)Lifeboat maintenance (42.7) (48.5) - -New lifeboat stations (12.1) (18.3) - -Gross profit 5.0 6.1 1.0 1.1Operating costs (3.5) (4.6) (0.3) (0.3)Operating profit 1.5 1.5 0.7 0.8Net profit 1.5 1.5 0.7 0.8Amount of covenant or Gift Aid to the <strong>RNLI</strong> (1.5) (1.5) (0.7) (0.8)Retained in subsidiary - - - -Amounts owed to the <strong>RNLI</strong> (16.4) (15.7) (0.8) (0.5)The balance sheet of the <strong>RNLI</strong>, excluding the four subsidiary companies, has net assets, after pension liabilities, of £578.9M (2010:£549.6M). This is substantially the same as the group net assets after pension liabilities of £579.0M (2010: £550.4M). For this reason,while an <strong>RNLI</strong> balance sheet is presented on page 19, the notes to the financial statements show only the consolidated position.23