RNLI ANNUAL REPORT AND ACCOUNTS 2011

RNLI ANNUAL REPORT AND ACCOUNTS 2011

RNLI ANNUAL REPORT AND ACCOUNTS 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

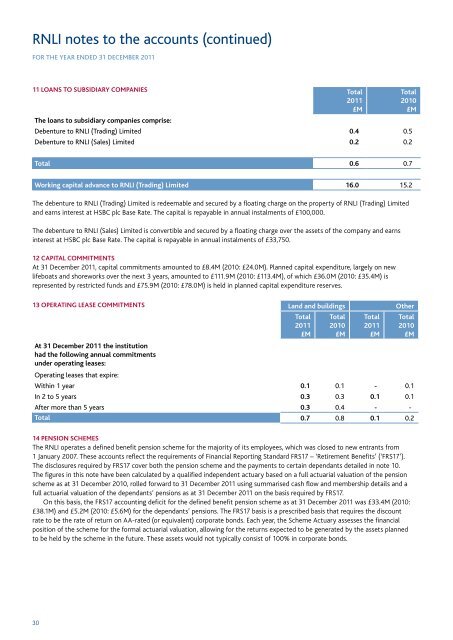

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>11 Loans to subsidiary companies Total<strong>2011</strong>£MThe loans to subsidiary companies comprise:Debenture to <strong>RNLI</strong> (Trading) Limited 0.4 0.5Debenture to <strong>RNLI</strong> (Sales) Limited 0.2 0.2Total2010£MTotal 0.6 0.7Working capital advance to <strong>RNLI</strong> (Trading) Limited 16.0 15.2The debenture to <strong>RNLI</strong> (Trading) Limited is redeemable and secured by a floating charge on the property of <strong>RNLI</strong> (Trading) Limitedand earns interest at HSBC plc Base Rate. The capital is repayable in annual instalments of £100,000.The debenture to <strong>RNLI</strong> (Sales) Limited is convertible and secured by a floating charge over the assets of the company and earnsinterest at HSBC plc Base Rate. The capital is repayable in annual instalments of £33,750.12 Capital commitmentsAt 31 December <strong>2011</strong>, capital commitments amounted to £8.4M (2010: £24.0M). Planned capital expenditure, largely on newlifeboats and shoreworks over the next 3 years, amounted to £111.9M (2010: £113.4M), of which £36.0M (2010: £35.4M) isrepresented by restricted funds and £75.9M (2010: £78.0M) is held in planned capital expenditure reserves.13 Operating lease commitments Land and buildings OtherAt 31 December <strong>2011</strong> the institutionhad the following annual commitmentsunder operating leases:Operating leases that expire:Within 1 year 0.1 0.1 - 0.1In 2 to 5 years 0.3 0.3 0.1 0.1After more than 5 years 0.3 0.4 - -Total 0.7 0.8 0.1 0.2Total<strong>2011</strong>£MTotal2010£MTotal<strong>2011</strong>£MTotal2010£M14 PENSION SCHEMESThe <strong>RNLI</strong> operates a defined benefit pension scheme for the majority of its employees, which was closed to new entrants from1 January 2007. These accounts reflect the requirements of Financial Reporting Standard FRS17 – ‘Retirement Benefits’ (‘FRS17’).The disclosures required by FRS17 cover both the pension scheme and the payments to certain dependants detailed in note 10.The figures in this note have been calculated by a qualified independent actuary based on a full actuarial valuation of the pensionscheme as at 31 December 2010, rolled forward to 31 December <strong>2011</strong> using summarised cash flow and membership details and afull actuarial valuation of the dependants’ pensions as at 31 December <strong>2011</strong> on the basis required by FRS17.On this basis, the FRS17 accounting deficit for the defined benefit pension scheme as at 31 December <strong>2011</strong> was £33.4M (2010:£38.1M) and £5.2M (2010: £5.6M) for the dependants’ pensions. The FRS17 basis is a prescribed basis that requires the discountrate to be the rate of return on AA-rated (or equivalent) corporate bonds. Each year, the Scheme Actuary assesses the financialposition of the scheme for the formal actuarial valuation, allowing for the returns expected to be generated by the assets plannedto be held by the scheme in the future. These assets would not typically consist of 100% in corporate bonds.30