price stabilization measures and its effects on - Philippine Institute ...

price stabilization measures and its effects on - Philippine Institute ...

price stabilization measures and its effects on - Philippine Institute ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

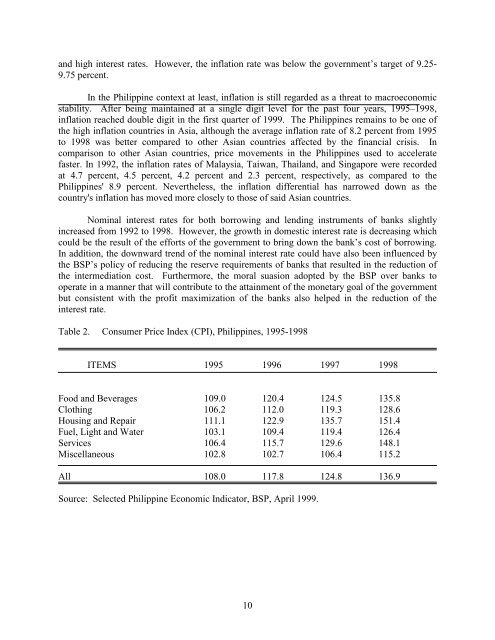

<str<strong>on</strong>g>and</str<strong>on</strong>g> high interest rates. However, the inflati<strong>on</strong> rate was below the government’s target of 9.25-9.75 percent.In the <strong>Philippine</strong> c<strong>on</strong>text at least, inflati<strong>on</strong> is still regarded as a threat to macroec<strong>on</strong>omicstability. After being maintained at a single digit level for the past four years, 1995–1998,inflati<strong>on</strong> reached double digit in the first quarter of 1999. The <strong>Philippine</strong>s remains to be <strong>on</strong>e ofthe high inflati<strong>on</strong> countries in Asia, although the average inflati<strong>on</strong> rate of 8.2 percent from 1995to 1998 was better compared to other Asian countries affected by the financial crisis. Incomparis<strong>on</strong> to other Asian countries, <str<strong>on</strong>g>price</str<strong>on</strong>g> movements in the <strong>Philippine</strong>s used to acceleratefaster. In 1992, the inflati<strong>on</strong> rates of Malaysia, Taiwan, Thail<str<strong>on</strong>g>and</str<strong>on</strong>g>, <str<strong>on</strong>g>and</str<strong>on</strong>g> Singapore were recordedat 4.7 percent, 4.5 percent, 4.2 percent <str<strong>on</strong>g>and</str<strong>on</strong>g> 2.3 percent, respectively, as compared to the<strong>Philippine</strong>s' 8.9 percent. Nevertheless, the inflati<strong>on</strong> differential has narrowed down as thecountry's inflati<strong>on</strong> has moved more closely to those of said Asian countries.Nominal interest rates for both borrowing <str<strong>on</strong>g>and</str<strong>on</strong>g> lending instruments of banks slightlyincreased from 1992 to 1998. However, the growth in domestic interest rate is decreasing whichcould be the result of the efforts of the government to bring down the bank’s cost of borrowing.In additi<strong>on</strong>, the downward trend of the nominal interest rate could have also been influenced bythe BSP’s policy of reducing the reserve requirements of banks that resulted in the reducti<strong>on</strong> ofthe intermediati<strong>on</strong> cost. Furthermore, the moral suasi<strong>on</strong> adopted by the BSP over banks tooperate in a manner that will c<strong>on</strong>tribute to the attainment of the m<strong>on</strong>etary goal of the governmentbut c<strong>on</strong>sistent with the profit maximizati<strong>on</strong> of the banks also helped in the reducti<strong>on</strong> of theinterest rate.Table 2. C<strong>on</strong>sumer Price Index (CPI), <strong>Philippine</strong>s, 1995-1998ITEMS 1995 1996 1997 1998Food <str<strong>on</strong>g>and</str<strong>on</strong>g> Beverages 109.0 120.4 124.5 135.8Clothing 106.2 112.0 119.3 128.6Housing <str<strong>on</strong>g>and</str<strong>on</strong>g> Repair 111.1 122.9 135.7 151.4Fuel, Light <str<strong>on</strong>g>and</str<strong>on</strong>g> Water 103.1 109.4 119.4 126.4Services 106.4 115.7 129.6 148.1Miscellaneous 102.8 102.7 106.4 115.2All 108.0 117.8 124.8 136.9Source: Selected <strong>Philippine</strong> Ec<strong>on</strong>omic Indicator, BSP, April 1999.10