2002 Report And Accounts - Guinness Peat Group plc

2002 Report And Accounts - Guinness Peat Group plc

2002 Report And Accounts - Guinness Peat Group plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

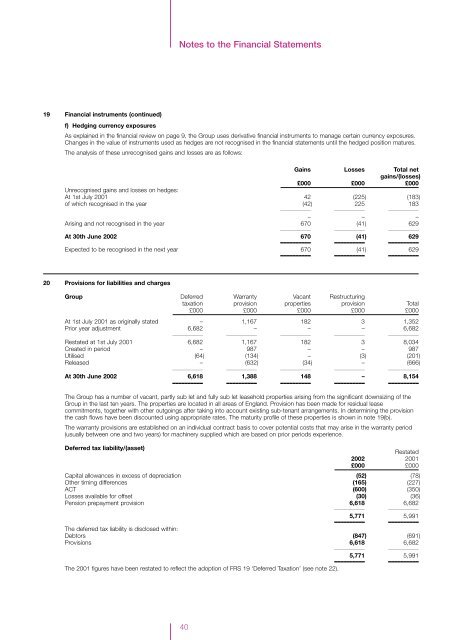

Notes to the Financial Statements19 Financial instruments (continued)f) Hedging currency exposuresAs explained in the financial review on page 9, the <strong>Group</strong> uses derivative financial instruments to manage certain currency exposures.Changes in the value of instruments used as hedges are not recognised in the financial statements until the hedged position matures.The analysis of these unrecognised gains and losses are as follows:Gains Losses Total netgains/(losses)£000 £000 £000Unrecognised gains and losses on hedges:At 1st July 2001 42 (225) (183)of which recognised in the year (42) 225 183–––––––––– –––––––––– ––––––––––– – –Arising and not recognised in the year 670 (41) 629–––––––––– –––––––––– ––––––––––At 30th June <strong>2002</strong> 670 (41) 629–––––––––– –––––––––– ––––––––––Expected to be recognised in the next year 670 (41) 629–––––––––– –––––––––– ––––––––––20 Provisions for liabilities and charges<strong>Group</strong> Deferred Warranty Vacant Restructuringtaxation provision properties provision Total£000 £000 £000 £000 £000At 1st July 2001 as originally stated – 1,167 182 3 1,352Prior year adjustment 6,682 – – – 6,682–––––––––– –––––––––– –––––––––– –––––––––– ––––––––––Restated at 1st July 2001 6,682 1,167 182 3 8,034Created in period – 987 – – 987Utilised (64) (134) – (3) (201)Released – (632) (34) – (666)–––––––––– –––––––––– –––––––––– –––––––––– ––––––––––At 30th June <strong>2002</strong> 6,618 1,388 148 – 8,154–––––––––– –––––––––– –––––––––– –––––––––– ––––––––––The <strong>Group</strong> has a number of vacant, partly sub let and fully sub let leasehold properties arising from the significant downsizing of the<strong>Group</strong> in the last ten years. The properties are located in all areas of England. Provision has been made for residual leasecommitments, together with other outgoings after taking into account existing sub-tenant arrangements. In determining the provisionthe cash flows have been discounted using appropriate rates. The maturity profile of these properties is shown in note 19(b).The warranty provisions are established on an individual contract basis to cover potential costs that may arise in the warranty period(usually between one and two years) for machinery supplied which are based on prior periods experience.Deferred tax liability/(asset)Restated<strong>2002</strong> 2001£000 £000Capital allowances in excess of depreciation (52) (78)Other timing differences (165) (227)ACT (600) (350)Losses available for offset (30) (36)Pension prepayment provision 6,618 6,682–––––––––– ––––––––––5,771 5,991–––––––––– ––––––––––The deferred tax liability is disclosed within:Debtors (847) (691)Provisions 6,618 6,682–––––––––– ––––––––––5,771 5,991–––––––––– ––––––––––The 2001 figures have been restated to reflect the adoption of FRS 19 ‘Deferred Taxation’ (see note 22).40