APPLICANT'S UNDERTAKING SHRIRAM TRANSPORT FINANCE COMPANY LIMITED

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

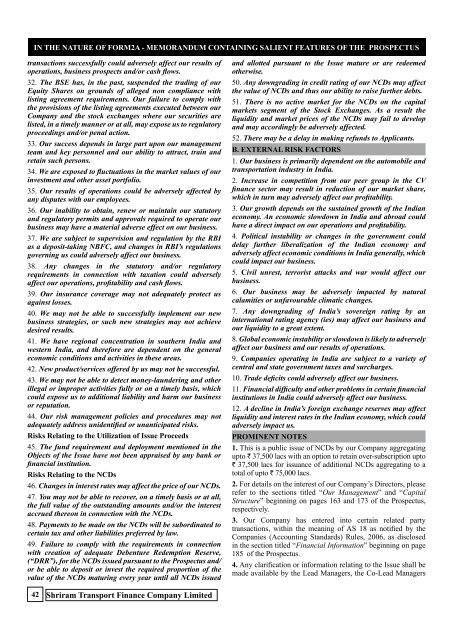

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUStransactions successfully could adversely affect our results ofoperations, business prospects and/or cash flows.32. The BSE has, in the past, suspended the trading of ourEquity Shares on grounds of alleged non compliance withlisting agreement requirements. Our failure to comply withthe provisions of the listing agreements executed between ourCompany and the stock exchanges where our securities arelisted, in a timely manner or at all, may expose us to regulatoryproceedings and/or penal action.33. Our success depends in large part upon our managementteam and key personnel and our ability to attract, train andretain such persons.34. We are exposed to fluctuations in the market values of ourinvestment and other asset portfolio.35. Our results of operations could be adversely affected byany disputes with our employees.36. Our inability to obtain, renew or maintain our statutoryand regulatory permits and approvals required to operate ourbusiness may have a material adverse effect on our business.37. We are subject to supervision and regulation by the RBIas a deposit-taking NBFC, and changes in RBI’s regulationsgoverning us could adversely affect our business.38. Any changes in the statutory and/or regulatoryrequirements in connection with taxation could adverselyaffect our operations, profitability and cash flows.39. Our insurance coverage may not adequately protect usagainst losses.40. We may not be able to successfully implement our newbusiness strategies, or such new strategies may not achievedesired results.41. We have regional concentration in southern India andwestern India, and therefore are dependent on the generaleconomic conditions and activities in these areas.42. New product/services offered by us may not be successful.43. We may not be able to detect money-laundering and otherillegal or improper activities fully or on a timely basis, whichcould expose us to additional liability and harm our businessor reputation.44. Our risk management policies and procedures may notadequately address unidentified or unanticipated risks.Risks Relating to the Utilization of Issue Proceeds45. The fund requirement and deployment mentioned in theObjects of the Issue have not been appraised by any bank orfinancial institution.Risks Relating to the NCDs46. Changes in interest rates may affect the price of our NCDs.47. You may not be able to recover, on a timely basis or at all,the full value of the outstanding amounts and/or the interestaccrued thereon in connection with the NCDs.48. Payments to be made on the NCDs will be subordinated tocertain tax and other liabilities preferred by law.49. Failure to comply with the requirements in connectionwith creation of adequate Debenture Redemption Reserve,(“DRR”), for the NCDs issued pursuant to the Prospectus and/or be able to deposit or invest the required proportion of thevalue of the NCDs maturing every year until all NCDs issuedand allotted pursuant to the Issue mature or are redeemedotherwise.50. Any downgrading in credit rating of our NCDs may affectthe value of NCDs and thus our ability to raise further debts.51. There is no active market for the NCDs on the capitalmarkets segment of the Stock Exchanges. As a result theliquidity and market prices of the NCDs may fail to developand may accordingly be adversely affected.52. There may be a delay in making refunds to Applicants.B. EXTERNAL RISK FACTORS1. Our business is primarily dependent on the automobile andtransportation industry in India.2. Increase in competition from our peer group in the CVfinance sector may result in reduction of our market share,which in turn may adversely affect our profitability.3. Our growth depends on the sustained growth of the Indianeconomy. An economic slowdown in India and abroad couldhave a direct impact on our operations and profitability.4. Political instability or changes in the government coulddelay further liberalization of the Indian economy andadversely affect economic conditions in India generally, whichcould impact our business.5. Civil unrest, terrorist attacks and war would affect ourbusiness.6. Our business may be adversely impacted by naturalcalamities or unfavourable climatic changes.7. Any downgrading of India’s sovereign rating by aninternational rating agency (ies) may affect our business andour liquidity to a great extent.8. Global economic instability or slowdown is likely to adverselyaffect our business and our results of operations.9. Companies operating in India are subject to a variety ofcentral and state government taxes and surcharges.10. Trade deficits could adversely affect our business.11. Financial difficulty and other problems in certain financialinstitutions in India could adversely affect our business.12. A decline in India’s foreign exchange reserves may affectliquidity and interest rates in the Indian economy, which couldadversely impact us.PROMINENT NOTES1. This is a public issue of NCDs by our Company aggregatingupto ` 37,500 lacs with an option to retain over-subscription upto` 37,500 lacs for issuance of additional NCDs aggregating to atotal of upto ` 75,000 lacs.2. For details on the interest of our Company’s Directors, pleaserefer to the sections titled “Our Management” and “CapitalStructure” beginning on pages 163 and 173 of the Prospectus,respectively.3. Our Company has entered into certain related partytransactions, within the meaning of AS 18 as notified by theCompanies (Accounting Standards) Rules, 2006, as disclosedin the section titled “Financial Information” beginning on page185 of the Prospectus.4. Any clarification or information relating to the Issue shall bemade available by the Lead Managers, the Co-Lead Managers42 Shriram Transport Finance Company Limited