New Markets Investor

Published by The Media Corporation

Published by The Media Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

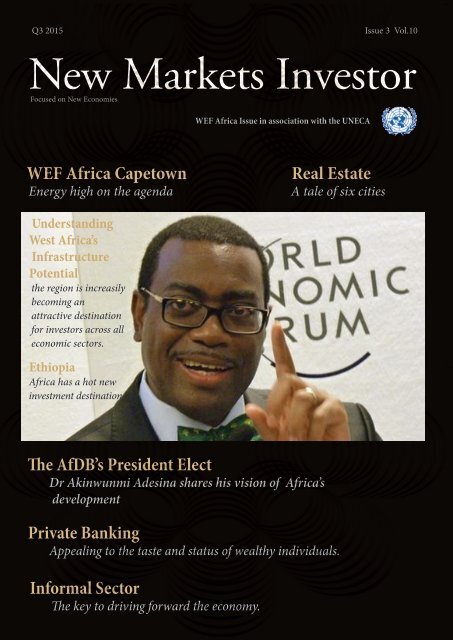

Q3 2015Q3 2015Issue 3 Vol.10<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>Focused on <strong>New</strong> EconomiesWEF Africa Issue in association with the UNECAWEF Africa CapetownEnergy high on the agendaReal EstateA tale of six citiesUnderstandingWest Africa’sInfrastructurePotentialthe region is increasilybecoming anattractive destinationfor investors across alleconomic sectors.EthiopiaAfrica has a hot newinvestment destinationThe AfDB’s President ElectDr Akinwunmi Adesina shares his vision of Africa’sdevelopmentPrivate BankingAppealing to the taste and status of wealthy individuals.Informal SectorThe key to driving forward the economy.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>1

Q3 2015<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>2

Q3 2015

Q3 2015ContentsInfrastructure34 The AIIBWith just two African member countries,does the newly formed AIIB,mean that Africa’s infrastructure needswill be overlooked?.14 Indigenous triumvirate leadingthe continents infrastructuredriveInitiatives being led by the AfricanUnion Commission (AUC), NEPADSecretariat and the African DevelopmentBank.30 Private InfrastructureDevelopment GroupAn innovative, multi-donor organizationthat encourages private infrastructure indeveloping countries with 37 projects inAfricaFinance & Investment18 EthiopiaAfrica’s hot new investment desination10 Côte d’IvoireThe country entered the internationaldebt markets as the first sub-SaharanAfrican sovereign issuer in 2015, a dealthat indicates an appetite for investmentin the region.62 Rwanda an investmentdestinationRwanda’s economy is on a solid inclinewith its gross domestic product (GDP)growing to 7.6 per cent in the first quarterof the year.64 Rwanda’ Stock ExchangeThe beginning46 Private BankingThe outlook of private banking looksgreat and reassuring, nevertheless thereare myriad of challenges confronting thisbanking model32 Consumer GoodsWith the rise of shopping malls theFMCG sector in Africa has significantscope to expand88 Sub-Saharan AfricaSet to be second fastest-growing regionin the world in 201590 Private EquityThe great “African growth story”27 The African Competitiveness Report, releasedat the WEF Africa Cape Town54 Construction Opportunities specialreport by KPMGGroup Managing EditorCharles FaulknerAssociate EditorJames AndersonHead of ProductionJeremy St.ClairHead AdministratorKeisha AbatemiHead of Business DevelopmentAndrew JohnstoneSales DirectorAlex ShawBusiness DevelopmentHayley Winstone, Charlotte LupinTom Heathfield. Robert Grobo,Raul Hernandez.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>4The information contained within thispublication has been obtained from sourceswhich the publishers believe to be correct.Legal liability will not be accepted for anyerrors or omissions. The contents can onlybe copied with prior permission fromThe Media Corporation ©2015

Q3 2015Energy20 Renewable energyAfrica’s light at the end of the tunnel?Rolake Akinkugbe, head of energy andnatural resources at FBN CapitalTourism78 The hotel growth story of the21st century76 The tourism industry couldpotentially add 3.8 million jobsover the next 10 years in SSAComment22 AfDB chief forsees Africa asthe worlds manufacturing center26 Ghana’s Vice-President,Kwesi Amissah-Arthur at theWEF claims informal sectors arethe drivers of many of the continentseconomies.66 Science, Technology andInnovation in AfricaNot yet cutting edge, but it will soon getsharper69 Management Education with aPractical EdgeThe Lagos Business School74 The Continents’ newest realestateA tale of six cities82 The boomingentertainment sectorThe continents film andentertainment sector employsmillions with potential for millions more24 SeacomA privately owned African carrierbringing connectivity to the continentCover Story86 African Development Bankappoints new LeaderAt the Bank Group’s 50th Annual Meetingsin Abidjan, Côte d’Ivoire, the 8thPresident was elected.50 BrandingOne size fits all’ marketingconcept of global corporations fails to ‘fit’ Africa74 Real EstateInstitutional investors, both local and international, arepumping millions of dollars into retail propertyIn partnership withContributorsThe AfDBThe WEFThe African Union CommissionThe Media Corporation23-26 Tabernacle StreetLondon EC2A 4AAinfo@newmarketsinvestor.comPrinted in ChinaShanghai DP Printing Co., Ltd.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>5

Q3 2015Klaus SchwabForwardAfrica has negotiated the journeyto another level of economicdevelopment. With six of the tenfastest growing economies in theworld, a growing middle class,expanding sectors like manufacturingand retail, and the fastest-growingtelecommunicationsmarkets in the world. Therefore,the choices Africa makes in theshort term will greatly affect itsdevelopment trajectory far intothe long-term.Good governance, education andentrepreneurship will be crucialin the region’s development story;according to Klaus Schwab, theFounder and Executive Chairmanof the World Economic Forum(WEF).stated at WEF Africain Cape Town. “Governmentsshould create space for youngpeople to exercise their talents;education will be the key to theirfuture,” adding that Africa had anadvantage of a democratic dividendas 75 per cent of the continent’spopulation were under theage of 35.“I am a big believer of Africa fortwo reasons; Africa has a youngpopulation while other countrieslike China are faced with an ageingpopulation. Africa has alsoyoung people with entrepreneurialabilities,” he added.Schwab concluded that Africacould be influential in thiscentury just as Asia was in thelast century but this depended onhow Africa goes forward.“In past decades, people cameto look for opportunities butnow they come to look for jointsolutions with government as it isclear governments alone cannotsolve problems by themselves,” hesaid.“I am very much positive aboutthe potential of Africa, I think wewill always be two steps forwardthan one step backwards.Economically there are manychallenges, but in Africa, wheregrowth is needed most, economiesare booming. More thanhalf the world’s fastest growingeconomies are now in Africa.The challenge remains that thetrickle down of this growth is stillslow, with per capita growth ratesmuch lower due to rapid populationgrowth. Africa has greatcapabilities and possibilities”.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>6

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>7Q3 2015

Q3 2015IntroductionAfDB PresidentDonald KaberuksThe title of this publication says it all; <strong>New</strong><strong>Markets</strong> <strong>Investor</strong>. There are many new marketsin Africa and the African DevelopmentBank invested in them to the tune of over$7.3 billion last year. Africa does so; therest of the world does so. People invest forgood reason - not just to see others prosper,but to prosper themselves. Africa is not theworld’s next investment frontier; it is itscurrent investment magnet.In investing in Africa, we are investing ina growing concern. Africa grew at 3.9 percent in 2014, stronger than the global averageof 3.3 per cent.Of course growth performance variedwidely across the continent’s countries andregions. Growth is expected to accelerate to4.5 per cent in 2015 and increase further tofive per cent in 2016. This year it will surpassAsia’s growth rates, to reach the levelswhich it achieved prior to the global financialcrisis in 2008/09.Total external flows of investment intoAfrica continue to rise, and are projected toreach $193 billion in 2015, almost doublethe figure for 2005. Foreign direct investmentflows and remittances have becomeAfrica’s most important external financialsources. FDI will reach $55 billion in 2015(a threefold increase in a decade), alongsidecontinuous growth in the emerging Africanmiddle class. That section of society has alsoincreased threefold, over three decades. Itwill reach 1.1billion (or just over 40 per centof the population) in 2060.In response to growing urbanization inAfrica, foreign direct investments areincreasingly shifting from extractive industriestowards the retail sector, and especiallyconsumer goods and services. Meanwhile,Africa continues to attract investors fromemerging countries and from within thecontinent. African cities represent a growingand untapped consumer market, andare increasingly targeted by investors.Disposable income in Africa’s major citiesis expected to grow at an average of 5.6 percent each year up to 2030, while aggregatespending power is set to more than doubleto $1trillion,from now to 2030.Johannesburg,Cape Town, Nairobi, Lagos, Casablanca,Cairo and Tunis are all considered to betop investment destinations.Africa’s middle-income countries aretapping the international capital markets,mainly to secure funding for infrastructuredevelopmentAs official aid receipts decline, increasingdomestic revenues and attracting privateexternal flows will be vital in financing theUnited Nations’ Post-2015 DevelopmentAgenda.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>8

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>9Q3 2015

Q3 2015Nialé Kaba, the Minister of Financeand the economy for Côte d’IvoireWith Strong growth levelsIvory Coast returns to theCapital <strong>Markets</strong> with thelaunch of Africa’s firstEurobond of 2015Africa’s fortunes have changed dramaticallyin recent times. Even as the BRICgrowth story began to lose its lustre,Africa emerges as a continent that is finallybeginning to fulfill its potential. Thestarting point was low, but growth ratesare often stellar, luring investors in fromfar and wide.In 2014, however, some cracks began toshow, as tumbling oil prices, weaknessacross commodity markets and politicalvolatility took their toll. Such a backdropis less than ideal for bond issuance,particularly as the capital markets remainvirgin territory for most African countries.Côte d’Ivoire seems slightly different,however. The country experienced a periodof intense political unrest in 2011 butsince then economic growth has been robust.Since civil war in 2010 and a defaulton the country’s first Eurobond in 2011,there has been a strong turnaround in theeconomy. Repayments on the defaultedEurobond resumed in 2012 amid strongeconomic growth: 8.7% in 2013 and 9.1%in 2014. Growth of 8.5% is expected in2015, according to the World Bank“Côte d’Ivoire benefits from key growthdrivers, such as high public and privateinvestment, strong export capacity andfavourable demographics. The countryalso benefits from factors supportingfiscal, macroeconomic and monetarystability, such as moderate levels of publicdebt, sound external accounts and astructural trade surplus, as well as the securityof the CFA Franc peg to the euro,”says Nialé Kaba, the minister of financeand the economy for Côte d’Ivoire.In 2014, Côte d’Ivoire launched a highlysuccessful $750m, 10-year bond. Thisyear, Ms. Kaba decided to return to thecapital markets with a more adventuroustransaction – a $1bn benchmark Eurobondwith a maturity schedule dividedinto three equal payments due in 2026,2027 and 2028. It was four times oversubscribed,with a “negligible” new-issuepremium, a testament to Côte d’Ivoire’sstrong fundamentals, say bankers. BNPParibas, Citi and Deutsche Bank werejoint book runners on the deal.“The structure was intended to smooth<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>10Côte d’Ivoire’s debt maturity profile,avoid a concentration of maturities andestablish a long-term pricing referencefor the country,” says Ms. Kaba. “Theorder book was strong, made up mainlyof high-quality fund and asset managerspredominantly from the US, “said MaryamKhosrowshahi, head of CEEMEAsovereign DCM at Deutsche Bank, whoworked with the Ivorian government onthe deal, adding “Between now and lastJuly, market conditions have changedbut, despite this, there was a window ofopportunity for Côte d’Ivoire to be thefirst African sovereign to issue this yearwhile the pipeline was quiet,”Côte d’Ivoire began thinking about the2015 bond late last year, discussing thetransaction with the International MonetaryFund as part of its 2015 budget.“Concerning timing, two market factorswere key; first the increase in sovereignspreads since autumn 2014, linked tohigher volatility on commodity marketsand emerging market-specific factors,and second, the expected increase in theUS Federal Reserve’s interest rate this

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>11Q3 2015

Q3 2015year. In our view, these developments increasedthe likelihood of a tighter marketwindow for African sovereigns later thisyear,” says Ms. Kaba. “Issuing early in2015 had strategic benefits as well. First,it allowed us to open the market andanchor investor perceptions about ourrelative and fundamental strengths as aregional issuer. Second, it allowed us tobenefit from continuing strong appetitefor Côte d’Ivoire’s credit,” she adds.The country chose BNP Paribas, Citi andDeutsche as book runners for the issue,after in-depth analysis conducted by theDirection des Marchés Publics (DMP).“Each proposal was rigorously analysedby our DMP, based on a combinationof technical and financial criteria. Thebanks that received the highest scoreswere appointed as book runners. Thebanks we chose also led our 2014 Eurobondand handled it in a very satisfactoryway,” says Ms. Kaba.Having appointed the three book runners,Ms. Kaba and her team embarkedon an international roadshow, spanningLondon, <strong>New</strong> York and Boston.“Although we conducted the roadshow inspecific cities, we spoke to a wide rangeof investors across the US and Europe.For timing considerations, we made astrategic choice about the cities we visitedto maximise the number of investors wecould meet and target those most likelyto take part in the transaction,” says Ms.Kaba. “We achieved an exceptionallyhigh, 97% conversion rate of investormeetings to orders, which proved ourchoice was right.”Unsurprisingly, investors had a widerange of questions but focused particularlyon the use of the bond money, Côted’Ivoire’s growth prospects and politicalstability. “Côte d’Ivoire’s economicoutlook is widely perceived to be stronglypositive. The key challenge was to explainthe positive differentiation factors fromour peers, in the context of oil and USdollar volatility,” says Ms. Kaba.Ultimately, investors were satisfied andthe book grew to about $4bn with morethan 240 orders. As a result, pricing wastightened by 25 basis points from initialprice talks and the coupon was fixed at6.625%.“The book was built with an overwhelmingmajority of fund managers whom weknow, and who have demonstrated theirwillingness to invest in Côte d’Ivoire forthe long term,” says Ms. Kaba.The country is coming to the end of itsthree-year National Development Plan,which was started in 2012 and designedto boost economic growth and employmentby increasing public investmentand encouraging the development ofthe private sector. Proceeds from thebond will be used to implement strategicinvestments under the NationalDevelopment Plan, with a specific focuson infrastructure, education, health andagricultural sectors.Happy with the results of the $1bnbenchmark, Côte d’Ivoire has no plansto return to the markets but Ms. Kaba iskeeping her options open. “We do not<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>12expect to return to the international marketsin the near future but we will considerany opportunity which may arise,” shesays. Côte d’Ivoire is now sub-SaharanAfrica’s second-largest issuer, with totalstock amounting to $4.25 billion, arounda third of what has been issued by theregion’s foremost issuer, South Africa.The debt to GDP level in Côte d’Ivoire isaround 35%. The latest transaction maytake the percentage up slightly, but thisis still sustainable, especially with thestrong growth levels coming out of thecountry. Côte d’Ivoire’s economy is welldiversified. It is the leading producerof cocoa, accounting for 40% of globalproduction, the second-largest globalproducer and leading global exporter ofcashew nuts, the leading African producerof rubber, bananas and tuna, andthe second-largest African producer ofpalm oil. The Eurobond issue comes ata challenging time for frontier markets,with deteriorating commodity prices,a stronger dollar and expectations of aUS rate increase that have threatenedinvestor flows into sub-Saharan Africa.But despite the broader macro challenges,Côte d’Ivoire continues to pull ininvestors.

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>13Q3 2015

Q3 2015Indigenous triumvirateleading the continentsinfrastructure drivePromoting socio-economic developmentand poverty reduction in Africathrough improved access to integratedregional and continental infrastructurenetworks and services, the PIDA initiativeis being led by the African UnionCommission (AUC), NEPAD Secretariatand the African Development Bank.The Programme for InfrastructureDevelopment in Africa {PIDA), coversprojects in transport, energy, waterand telecommunications. In April, theAfrican Development Bank (AfDB) andthe Infrastructure Consortium for Africaparticipated in the Validation Meetingfor the PIDA Acceleration Strategy ActionPlan (PAS).The PAS aims to fast-track the implementationof a number of priority PlDAprojects, including the Serenje-Nakonderoad in Zambia, which is part of theNorth-South Corridor, and the Dar esSalaam Port expansion project in EastAfrica. A Pan-African InfrastructureDevelopment Fund {PAIDF) has alsobeen launched by the Public InvestmentCorporation of South Africa to financehigh-priority, cross-border infrastructureprojects.The scale of the infrastructure challengefacing Africa was set out in a PIDA studyentitled ‘Interconnecting, Integratingand Transforming a Continent’. It pointsout that the road access rate acrossAfrica is 34 per cent, compared with 50per cent in other parts of the developingworld. Furthermore, transport costs aretwice as high in Africa as other developingcountries. “Deficits Iike these have aclear impact on African competitiveness:African countries, particularly thosesouth of the Sahara, are among the leastcompetitive in the world, and infrastructureappears to be one of the mostimportant factors holding them back,”says the report. “Ensuring that growingdemand for regional infrastructure ismet...will require a determinedly coordinatedregional approach.”East AfricaCountries in East Africa, particularly<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>14Kenya, currently lead the way in largescaleregional transport projects on thecontinent, the most ambitious of whichis a new standard-gauge railway Iinethat is to run from Mombasa to Nairobi,eventually extending to Uganda, Rwanda,Burundi and South Sudan.Last year, regional leaders and ChinesePremier Li Keqiang signed officialagreements for the project, under whichChina’s Export-Import bank will finance90 per cent of the first phase of the line,which is estimated to cost $3.8 billion,with Kenya funding the remaining 10per cent. According to Kenyan PresidentUhuru Kenyatta, the costs of movingpeople and goods across borders willfall sharply as a result of the new railwayline.One big winner from the rail project willbe Uganda, a landlocked country thathas struggled to export its goods by roadto Mombasa and Dar es Salaam, Tanzania.Uganda is about to begin producingoil, and has already commissioned a60,000 barrel-per-day refinery from

Q3 2015: “Once we have the infrastructurein Africa, it should not beblocked by borders.Regional and transcontinentalintegration, enabled by bettertransport links, will be key toAfrica’s continued growth andfuture success”.South African President Jacob Zuma remarked this year at the WorldEconomic Forum in Cape Towna Russian-led consortium, which willbecome operational in 2017-18.Comparable in scale and ambition is theLamu Port and South Sudan-EthiopianTransport Corridor Project (LAPSS ET),which the Kenyan Government describedas “the largest game changer infrastructureproject the government has initiatedand prepared under [the] Vision 2030Strategy Framework, without externalassistance”. The $24.5 billion project encompassesseven components, includinga standard-gauge railway line, a crude oilpipeline, the 32-berth Lamu Portman oilrefinery, resort cities and airports servingKenya. Once completed, the project willgreatly enhance transport links betweenKenya, Ethiopia and South Sudan, andthereby foster socio-economic developmentin the region. The Kenyan Governmentestimates that the project will addbetween two to three per cent of GDPinto the economy, based on conservativefeasibility statistics.In the Horn of Africa, Ethiopia is planningto open a new railway line linkingthe capital Addis Ababa with the Red Seastate of Djibouti in early 2016.The 700kmline, being built by two Chinese companies,is expected to cost $4 billion. Thenew railway line will cut the journey timefrom days to about eight hours. GetachewBetru, Chief Executive of the EthiopianRailways Corporation, described theproject as a “game changer”.Southern AfricaAnother focal point of regional infrastructuredevelopment is southern Africa.The North-South Corridor Programme,part of the World Trade Organization-ledAid for Trade initiative, links the port ofDurban in South Africa to Copperbeltin the Democratic Republic of Congo(DRCJ and Zambia. It also includes spurslinking the port of Dar es Salaam and theCopperbelt, and Durban to Malawi. Theprogramme, covering eight countries intotal (Botswana, DRC, Malawi, Mozambique,South Africa, Tanzania, Zambiaand Zimbabwe). will involve the buildingand maintenance of 8,599km of roadsat a cost of $9.lbillion;the upgrading of600km of rail at $800 million; priorityport development at $800 million; as wellas a number of power generation andtransmission projects. Once complete,it will give regional trade and economicdevelopment a powerful boost.Yet another completed major project inthe region is the rehabilitation of the,344km Benguela Railway linking theport of Lobito in Angola and the DRC.The original railway, built by the Portuguesein the early 20th century, fell intodisrepair in the 1970s amid the chaosof Angola’s civil war. China RailwayConstruction Corporation won the bid torepair the line in 2007. In February thisyear, the presidents of Angola, DRC andZambia inaugurated the completed railway.Furthermore, bilateral agreementswere signed by ministers from Angolaand Zambia, under which Zambia is tobuild a 590km line linking Chingola to<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>15

Q3 2015left; Kenya’s Standard Gauge Railway Line initially linking Mombasa& NairobiBelow; The Kankan-Koouremale-Bamako transnational intercityhighway linking Guinea & MaliJimbe on the Angolan border, with a connectionto the Benguela line, which willmake Zambia a transit country betweenthe west and east coasts of Africa.These new links will help provide a vitalpiece that has always been missing fromAfrica’s economies: regional integration.West AfricaIn West Africa, the AfDB has supporteda number of major road infrastructureprojects. The Kankan-Kouremale-Bamakotransnational intercity highway, onesuch example, is the single point of entryand exit between Conkary in Guineaand Bamako in Mali. The CFA9 billion(approximately $ 15 million) project,which has been financed by AfDB, wascompleted in December 2013, benefitingthe daily lives of thousands of people.According to AfDB, the project resultedin manifold benefits, including “feweraccidents for road users and residents,better traffic flow, more businesses andbooming economic activity, new buildingdevelopments, better sanitation andcleanliness”.Similarly, the Enugu-Bamenda Highwayconnecting Nigeria and Cameroon, alsobacked by the AfDB, has delivered considerablesocio-economic benefits for theregion since its completion in 2013.North and Central AfricaThe construction of a 9,022km Trans-SaharaHighway (TSH) linking severalcountries in North, Central and WestAfrica further underlines the continent’scommitment to regional integration.TSH aims to facilitate overland trade betweenthe Arab Maghreb Union (AMUJand Economic Community of CentralAfrican States (ECCAS) in general, andAlgeria, Niger and Chad in particular. Asone of PlDA’s priority projects to connectcapitals and major cities, TSH has alreadyreceived funding from AfDB. Targetbeneficiaries of the project include usersof the TSH and residents of the impactarea, which spans 4.4 million square kilometres,with a population of 60 millionacross Algeria, Tunisia, Mali, Niger, Chadand Nigeria. The project will be implementedover a period of 60 months at acost of $585.5 million.Smaller projects in the region include theCongo-Gabon road and transport facilitationproject, which has been adoptedby ECCAS, and is part of the PIDA’s PAS.It involves the construction and rehabilitationof the 276km Ndende-Doussala-Dolisiesection of the internationalroad linking Libreville and Brazzaville.As South African President Jacob Zumaremarked this year at the World EconomicForum: “Once we have the infrastructurein Africa, it should not be blockedby borders. Regional and transcontinentalintegration, enabled by better transportlinks, will be key to Africa’s continuedgrowth and future success”.With a slew of regional transport projectscurrently underway, Africa can lookforward to a more integrated, prosperousfuture. •<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>16

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>17Q3 2015

Q3 2015Africa has a hotnew investmentdestination andit’s not Nigeria.Africa has a hot new investment destinationand it’s not Nigeria.The buzz at the World Economic Forumon Africa, an annual summit of thecontinent’s rich and powerful, is all aboutEthiopia, where the economy is flourishingand the government is embracingselect foreign capital. Executives fromGeneral Electric Co., Dow Chemical Co.,Standard Bank Group Ltd. and Master-Card Inc. attending the June 3-5 gatheringin Cape Town all singled out the EastAfrican nation as a market with strongpotential.Ethiopia was Africa’s eighth-largest recipientof foreign direct investment last year,up from 14th position in 2013, a reportreleased by accounting firm EY on June 2showed. The number of projects in Ethiopiasurged 88 percent, the most of allcountries ranked, while those in Nigeriaslumped 17 percent.“It’s got a government that is managingeconomic development in a very deliberate,cautious manner,” according to RossMcLean, Dow’s president for sub-SaharanAfrica, “It’s the second-most populouscountry in Africa. It hasn’t urbanized likeother African countries, but it’s going to.It’s a very exciting place.”Ethiopia’s economy is expected to expand8.6 percent this year and 8.5 percent in2016, compared with 10.3 percent growthlast year, the International MonetaryFund said in its World Economic Outlookreleased in April.Nigeria, which has Africa’s largest economyand is grappling with energy shortagesand the fallout of an oil price slump, isforecast to grow 4.8 percent this year and5 percent next year.Ethiopia’s (B1 Stable) government bondrating is supported by its strong growthprospects, prudent fiscal managementand large and stable donor inflows, Yieldson the nation’s debut $1 billion Eurobondhave climbed to 6.77 percent from 6.625percent when they were sold last December.Moody’s <strong>Investor</strong>s Service says in itslatest credit analysis of the country “Weexpect public sector investment to continueto drive economic expansion in thenear-term, with growth averaging around10% in real terms over the next twoyears,” said Rita Babihuga, Assistant VicePresident — Analyst and co-author of thereport. “Risks to this outlook stem fromexternal shocks, such as an economicslowdown in major export partners,constraints to the financing of Ethiopia’s<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>18

Q3 2015investment projects, or a protractedslump in commodity export prices.”Prudent government spending controlsand efforts to mobilise domestic revenueshave led to low and stable deficits. Afive-year plan has focused on rebalancingthe economy and improving agriculture,rural development and infrastructure.About 60% of government spending isdirected towards public investment projectsin sectors such as health, education,agriculture and transport.Construction BoomEthiopia’s capital, Addis Ababa, showsall the signs of a construction boom.Private developers are erecting scores ofoffice blocks and luxury housing estates,while the government is clearing slums toConstruction of Ethiopia-Kenya road in progressWhen completes in 2017, the road, which is funded by the Ethiopian government and theAfrican Development Bank, is expected to enhance trade relations between Ethiopia andKenya.build low-cost apartments. RadissonHotels International Inc. and MarriottInternational Inc. are among globalchains that have opened hotels to caterfor an influx of business travelers.A Chinese-built railway line that snakesalongside the capital’s main roads is partof a nationwide infrastructure developmentprogram that’s helping enticeinvestors. In April, Chinese companyHuajian Group began work on a $400million shoe-manufacturing park onAddis Ababa’s southwestern outskirts,while companies including Taiwan’sGeorge Shoe Corp. have opened plantsin an industrial zone in the Bole Lemidistrict.Dangote Group, the Nigerian companycontrolled by Aliko Dangote, Africa’srichest man, have plans to spend $500million expanding its cement plant inEthiopia, adding to $600 million alreadyinvested. “We will leave no stone unturnedto make this country a suitabledestination for foreign investment,”Prime Minister Hailemariam Desalegnsaid at the opening of the plant atMugher, about 80 kilometers (50 miles)west of Addis Ababa.Business Obstacles“We’ve done quite a lot of Ethiopianbusiness,” said David Munro, head ofcorporate and investment banking inStandard Bank, which has applied for alicense for a representative office. “Wesee it as a prospective place to grow ourbusiness. There’s the possibility of significantresources and it’s within an economicallysignificant zone, the eastAfrican trade area.”Obstacles to doing business in Ethiopiaremain. The Ethiopian Peoples’ RevolutionaryDemocratic Front has ruledthe country for the past two decadesand the state continues to dominatethe financial services, telecommunicationsand transport industries. Foreignexchange is in short supply, becausethe government uses inflows to financeits infrastructure program and exportsremain meager.Poverty DataOnly 18 percent of Ethiopia’s 94.1million people are urbanized and theeconomy is worth just $48.9 billion,according to the Abidjan, Ivory CoastbasedAfrican Development Bank.About 30 percent of the population livesin poverty, according to 2010 data fromthe World Bank, down from 46 percentin 1995.Pan-African lender Ecobank TransnationalInc. has a representative office inEthiopia. Equity Group Holdings Ltd.,owner of Kenya’s second-biggest bank,will prioritize its Ethiopian business aspart of an expansion into nine other Africannations; Dow doubled its sales inEthiopia last year and sees more growthto come.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>19

Q3 2015Renewable energy:Africa’s light at theend of the tunnel?Rolake Akinkugbe, head of energy and natural resourcesat FBN CapitalThe sheer scale of energy demand inAfrica rather than the environmental impactof fossil fuels should be the crucialdriver of energy policies on the continentEnergy deficient Africa’s energy landscapeis pretty perplexing. The continent’soil producers are also amongst the largestpetroleum product importers in theworld. On average up to 70% of Africa’senergy consumption is imported, mostlyin the form of refined products. Despiteaccounting for around 9% of global oilproduction, energy access in Africa islimited to less than 20% of the continent’sentire population. The average access toenergy for developing countries is 72%.From an economic perspective, poweroutages also cost the continent a greatdeal in terms of GDP and economic efficiency.At least 30 countries on the continentexperience daily outages, whichcan account for up to 3% of GDP in someof the worst-affected economies.An African renewable-energy revolutionis brewing.Now trending in African governmentpolicy circles is the theme of renewableand sustainable energy. Effectively, Africais looking for a new ‘leapfrog’ sector.Pretty much like its telecoms revolution,there appears to be a renewable-energyrevolution brewing on the continent. Butthere are two key questions that needsto be asked: with the fossil fuel discoveriesthat Africa continues to make, isthe pursuit of green energy a short-termrealistic proposition; and would governments’limited financial resources notbe better focused on making the most ofexisting sources of conventional energy,before pursuing a green energy switch?In Africa, renewable energy accounts foraround 20% of installed capacity acrossthe continent. Not bad, considering theposition it started from, but still smallrelative to the abundant wind, hydro andsolar energy resources the continent has.If the truth be told, renewable-energysources will not materialize quick enoughto cope with Africa’s rising energydemand, estimated at least 3% annuallyover the next decade. The short-termneed for power in Africa is around74,000MW, and around $39 billion willbe required annually in new investmentto plug the energy gap. Current investmentin the sector is less than $5 billionannually. Countries, from Kenya toRwanda, Ghana to South Africa, haveall embarked on green energy plans, andhave introduced new regulation includingthe much liked feed-in tariffs (FITs)that help to incentivize private-sector<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>20investment in off-grid and sustainablesolutions. But for rural communities,energy education will be crucial if householdusers of fossil-fuel energy sourcesare to be made to switch to solar powersources for heat and lighting.Subsidies for fossil fuels distort thepicture. A short-term and rapid switch tolow carbon energy is also undermined tosome extent by the existing subsidies thatcontinue to distort fossil-fuel consumptionin some African economies. Thus, asfar as many household users of energy inrural Africa are concerned, the perceptionis that kerosene would be muchcheaper than alternative energy sources.With much of Africa’s power infrastructurebeing historically part of nationalgrids, there is likely to be an argument torehabilitate existing infrastructure, andeliminate transmission and distributionlosses before focusing resources on greenenergy. Notwithstanding, we continue tosee the gradual introduction and uptakeof solar technologies; certain governments,such as Kenya and South Africa,have introduced regulation that will, overtime, help to bring down the investmentcosts and, consequently, retail costs ofthese energy sources. Kenya has FITs thatinclude 20-year contracts that should

Q3 2015provide a semblance of investment stabilityfor investors. These renewable-energypolicies are still being pursued alongsidethe extraction and development ofhydrocarbons, though there is clearly anincreasing emphasis on sustainability asfar as the latter is concerned. Support forprojects that plug the energy access gap.A big challenge is access to finance for offgridsolutions.Equity investors and special funds, ringfencedfor this sub-sector, are likely to bethe most ideal. Banks in many Africancountries, primarily due to lack of technicalexpertise, may be reluctant to lendinto the sector. Meanwhile, some off gridsolutions still do not qualify for state rebates,and can be up to 30% more expensivethan grid tie-back systems. However,Africa is clearly awash with green-energyentrepreneurs who are hardly short oftailor-made energy solutions for ruraland urban communities. The key wouldbe to identify the projects that are likelyto help plug the energy-access gap andbuild the capacity of these SMEs andentrepreneurs to operate profitably andsustainably – and to create the rightinvestment conditions that will attractfunding domestically, or globally, forthese projects. Ultimately, governmentsneed to create the right policy framework. It sounds like a cliché, but it can’tbe overemphasized.South Africa has become one of theleading destinations for renewable energyinvestment with an estimated R193billion already committed.But there arequestion marks over how successful theprogramme has been in balancing thedemands of financial and commercialsoundness, and requirements of economicdevelopment and community co-ownership.The investment is the result of arenewable energy programme introducedby the government four years ago. Tariffsoffered by the most recent renewableenergy projects are now well below thosethat will come from the state energy utilityEskom’s future coal plants.The programme has been applaudedinternationally for its strong regulatoryframework, tough qualification criteriaand strong economic development andcommunity ownership requirements.Since its launch in 2011, the programmehas brought a diversity of new playersand sources of investment to South Africa.Consolidation is now taking place,with international firms playing a leadingrole in project development.Fewer companieshave won more megawatts (MW)with each bidding round. Two examplesare consortia led by Italy’s Enel Green<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>21Power and Ireland’s Mainstream RenewablePower.This consolidation has seensmaller South African developers beingpriced out of the market by foreign companies.Some have sold their equity shareat financial close to a larger company.Finance is Africa’s biggest challengeThe Sustainable Energy Fund for Africais a bilateral trust fund, administered bythe African Development Bank, whichstarted with a total capital of around $57million provided by the Danish government.It’s a good model that should bebuilt upon across the board. Finance willbe Africa’s biggest challenge, but withrapid urbanization and an explodingpopulation, energy demand will likelydouble on the continent in the next decade,so the financing requirements willaccelerate even faster. One idea is to ringfencepools of funds specifically targetinggreen-energy development, though thesewould need to align with national developmentpriorities which may not alwaysprioritize the green agenda. Indeed, thedebate also needs to be led in the west,since Africa’s contribution to global emissionsis less than 3% of the global total. Infact, lobbyists for a switch to low carbonenergy in Africa should be aware it is thesheer scale of energy demand in Africaitself, rather than the environmentalimpact or emissions debate, that shouldbe a crucial driver of national policies onthe continent.For now, there has to be a short-term,long-term trade-off. The hydrocarbonsthat Africa has should be used in a muchmore sustainable manner, in relation tothe environment or in relation to theextent of local value and jobs createdfrom resource extraction. Revenues andthe ripple effect of sustainable resourceuse can then provide a future platformfor Africa’s transition to a green economy.However, there’s a need to broaden thedefinition of ‘green’ in ‘green economy’.It should really be as much as about inclusivenessand development, rather thanjust the end goal of achieving low carbongrowth.There are at least 600 million Africanswho need affordable, cheap and reliablepower. Low carbon energy alone won’t bethe panacea for the energy-access problem,but it will be one of the best futureoptions Africa has.

Q3 2015Industrial Cooperation withChina is key for Africabecoming a manufacturinghub says AfDB Chief Donald KaberukaDonald Kaberuka the President of theAfrican Development Bank (AfDB) saysthe time has come for Africa to becomethe world’s manufacturing hub and thiscan be done through industrial cooperationwith China as the Asian giant phasesout labour-intensive industries.“The global manufacturing cycle startedfrom Europe then to America, beforemoving to South East Asia and China. Itis now coming to Africa,” Kaberuka commentedon the side-lines of the AfricanUnion (AU) summit held in Johannesburg,South Africa. Kaberuka, who is toretire from the helm of the AfDB thisAugust after serving two consecutive fiveyearterms, quoted a Chinese metaphor“building the nest to attract birds” to urgeAfrican countries to put in place properinfrastructure and enabling policies tofacilitate the transfer of manufacturingindustries from China.He said low labour costs and an integrated,larger market through the creationof the Tripartite Free Trade Area (TFTA)would help Africa attract foreign investmentto the manufacturing sector.However, the regional bank chiefstressed the need for the continent toput in place an enabling environment forinvestors to come in, such as adequatepower and transport infrastructure. Hesaid Africa needed to address factorsundermining its foreign investment attractioncapacity such as the high cost ofdoing business mainly due to insufficientenergy supplies and a weak regulatoryenvironment.China built up its export-oriented economybased on the proliferation of low-cost,labour intensive factories over the pastthree decades. But this edge of low-cost isbeing eroded by the gradual rise of workers’income and benefits as the economycontinues to develop. Overcapacity athome in sectors like steel, cement, textile,and solar panel manufacture pushed Chinesecompanies to seek better businessopportunities abroad. The governmenthas also identified industrial cooperationas the top priority for its engagementwith Africa this year. Chinese investmentto the continent reached USD 21.2bn in2012, a figure aimed to be raised to USD100bn by 2020.Turning to the recently launched TFTAby Africa’s three regional economic blocs,Kaberuka said the TFTA was a “majorturning point” in Africa’s quest to boostintra-Africa trade. “This region comingtogether has already made huge progresson the issue of tariff reduction and tariffharmonisation,” he said.The TFTA encompassing 26 countriesof the Common Market for East andSouthern Africa (COMESA), East AfricanCommunity (EAC) and the SouthernAfrican Development Community(SADC) was launched on 10 June withthe aim of boosting intra-Africa trade.The 26 countries, with a combined populationof 625 million people, and GDPof USD 1.3tn, present close to 60% of theAU’s GDP and population. Kaberuka saidwhile intra-Africa trade was generally putat 12% and true for the whole of Africa,the actual levels of intra-trade within theTFTA was about 20%.But for the TFTA to become successful,Kaberuka said all non- tariff barriersmust be removed while free movement ofbusiness people and bona fide travellersmust be ensured. “So for the free tradezone to become free, tariff agreement isimportant,” he said. The AfDB presidentsaid the TFTA presented an immenseinvestment opportunity for China toboost industrial cooperation with Africa.“For Chinese companies coming to thisregion, they have access to a whole biggermarket from Cape Town to Alexanderand that’s a huge advantage it offers toChinese manufactures,” he said.Kaberuka also hailed cooperation in thefinancial sector where he noted that theAfDB and the Chinese were cooperatingin co- financing of infrastructure developmentprojects on the continent. Onesuch project that had been co-financedby the USD 2bn Africa Growing TogetherChinese Fund being managed by AfDBwas the Sharm-el-Sheik InternationalAirport in Egypt, he said.Chinese investment in Africa could seea considerable increase with the boostin intra–Africa trade over the long term.The transfer of manufacturing capacityfrom China could help African industryleap frog and become more competitivewith the rest of the world. In orderto reach that level of competitivenesssome aspects of African trade need tobe looked at e.g. the high cost of doingbusiness and the free movement of goodsand people.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>22

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>23Q3 2015

Q3 2015A privately ownedAfrican carrierbringing connectivityto the continentA group of private investors establishedSEACOM in 2007 with a clear purposeand vision: They wanted to make broadbandconnectivity cheaper and moreaccessible to people throughout Africa.When they launched the SEACOMundersea cable in 2009, its impact on telecomsacross the east coast and southernparts of Africa was immediateFrom South Africa to Kenya to Ethiopia,telecom prices tumbled while the qualityof connectivity improved in leaps andbounds. That, in turn, has helped to spureconomic growth, create new ways ofproviding for the enablement of educationand healthcare services to Africa’speople, and enrich people’s lives withaccess to entertainment and information.“Before SEACOM launched, operatorsin southern and eastern Africa, as well asEthiopia, were heavily reliant on slow, expensivesatellite bandwidth, while bandwidthin countries such as South Africawas controlled by incumbent operatorsmonopolising the sector. The result wasthat prices were high. connectivity qualitywas poor, and the growth of the internetwas hampered.SEACOM saw an opportunity to changethat picture and started to raise fundsto build a new undersea telecoms cablealong the east coast of Africa with connectivityto Europe, says Seacom’s CEOByron Clatterbuck.When SEACOM went live, it gave Africannetwork operators and service providersaccess to plentiful and affordable Internationalbandwidth for the first time.This helped to set off a telecoms revolutionacross the continent. Since 2009,wholesale international bandwidth priceshave tumbled.There has been a huge increase in availabilityof broadband services for end-usersin a region where internet access for anordinary private citizen was prohibitivelyexpensive just four years ago.With SEACOM, several other underseacables have also arrived off the westand east coasts of Africa. We have seendemand for international capacity significantlygrow in the past three years asoperators roll out a range of compellingand affordable data services. Furthermore,the arrival of international cableshas also spurred movement in othercomponents of the telecoms infrastructureincluding national terrestrial fibrenetworks. All of this new infrastructuremovement is also helping to improve theend -user’s internet experience and todrive connectivity costs down:There is a flurry of innovation underwayin Africa’s telecoms market, thanks tonew national and international cables.Mobile networks have turned themselvesinto major data players, innovating withservices such as voice-over-IP, videomessaging, and video calling. The impacton African consumers and businesseshas been remarkable. SMEs are tradingon the web, relying on instant messaging,and even using multimedia webapplications for the first time. For consumers,social medla, mobile banking,and other applications are now a partof their everyday lives. E-government,e-health and e-learning applications arealso becoming a reality.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>24

Q3 2015SEACO M is not, however, resting on itslaurels - the company is rapidly evolvingg from a simple cable operator intoAfrica’s foremost data network serviceprovider offering a range of private dataand IP solutions to its service providerand operator customers.“From SEACOM’s perspective, thefuture will be all about building a continent-wideecosystem rather than simplyfocusing on international connectivity.”SEACOM have continuously made keyinvestments to expand and enhance itsinfrastructure with the goal of buildinga faster, more reliable, and affordable internetservice for African telecom users.The company’s upgrade of its global IPand MPLS network has been recentlycompleted. This project consolidates itsposition as the continent’s leading data<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>25network service provider.. “The company continues to take advantageof the trends reshaping the telecomlandscape,” says Clatterbuck “FromSEACOM’s perspective, the future willbe all about building a continent-wideecosystem rather than simply focusingon international connectivity.” •

Q3 2015WEF Africa 2015Calls for recognition ofthe informal sectoras a major drivingforce towardseconomic growthThe African continent’s informal sector isgaining legitimacy as “the new normal”in driving forward the economy.Ghana’s Vice-President, Kwesi Amissah-Arthurat the World Economic Forumon Africa in a televised BBC debatesaid that informal producers and tradersare, in fact, the mainstream of manyeconomies throughout the continent, andgovernments must respond with policiesthat recognize that fact.Amissah-Arthur drove this statementhome when he cited an example fromhis home country, “In Ghana, farmersin rural areas are, in effect, an informaleconomy, yet they are large contributorsto the country’s foreign earnings.”While informal economies in Africaexist, they should never be seen asillegitimate or marginalized as the futureof Africa lies in self-employment andcreativity.“What is required is a policy crossover.We cannot assume such activities areillegitimate when making policy. Weneed to make legitimate activities in theinformal sector quantifiable so that wecan respond adequately,” he explained.Mandla Sibeko, Chairman of MineonlineAfrica in South Africa, said that theinformal sector is increasingly a youthdemographic due to the very limitedemployment opportunities being createdin the formal sector.Sibeko added that, in order to meet thenumber of young people reaching thework age, South Africa needs to create 80million jobs. “The young are forced to bein the informal sector, so their future hasto be self-creation,” said.Sibeko believes there are huge opportunitiesfor such ‘self-actualization’. “Morethan 80 per cent of what we consumein South Africa, for example, comesfrom outside the continent. So there areobvious opportunities there for people tomake many products,” he said.John Veihmeyer, Global Chairman ofKPMG International USA, said, “There isa tremendous amount of interaction betweenthe formal and informal sectors inAfrica – making it difficult to distinguishbetween the two.”He added that policy initiatives that aimto build economies should not seek todifferentiate between these two elements.It is not an either-or situation. “Growthshould be about lifting all boats in thesea.”Winnie Byanyima, who is theExecutive Director for Oxfam Internationalraised her voice for poor communitiesoutside the formal sector to begiven more access to the supply chain.She asked for governments to ensurethat, with such access, fair prices are paid,there is protection against low wages,there is risk insurance against changingweather and a system of credit access isintroduced.“With the ultimate aim to bring the informalsector into the formal sector andinto the tax base”, said Amissah-Arthur,“the Ghanaian government has set up apension system for rural farmers”.“They are small steps, but they are progresstowards bringing the informal sectorcloser to the formal,” he concluded.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>26

Q3 2015WEF Africa 2015Africa CompetitivenessReportAfrican economies’ prospects for longterm,sustainable growth are under threatfrom weakness in the core conditionsnecessary for competitive and productiveeconomies, despite outwardlyhealthy-looking growth rates in manyparts of the region, according to the AfricanCompetitiveness Report, released atthe WEF Africa in Cape Town.The biennial report, themed “TransformingAfrica’s Economies”, is jointly producedby the African Development Bank,the Organisation for Economic Cooperationand Development, the World Bankand the World Economic Forum, andcontains the detailed competitivenessprofiles of 40 African economies, andcomprehensive summaries of the driversof competitiveness in each. These profilesare used by policy-makers, business strategistsand other key stakeholders with aninterest in the region.This year’s report combines detailed datafrom the Forum’s Global CompetitivenessIndex (GCI) with studies on three keyareas of economic activity; agriculturalproductivity, services sector growth andglobal and regional value chains.The data points to low and stagnatingproductivity across all sectors: agriculture,manufacturing and services, partlyas a result of ongoing weakness in thebasic drivers of competitiveness, such asinstitutions, infrastructure, health andeducation. This shortfall masks a betterperformance in other areas of the economy;specifically, better functioning oflabour and goods markets.In view of Africa’s young and growingpopulation, labour-intensive sectorsmust play a larger role in the continent’stransformation: the growth in services –both in terms of GDP and employment– cannot propel Africa’s growth alone andeven here development remains uneven,with too many people employed in lowproductivity services.“In recent years we have seen some ofAfrica’s leading economies make verypromising progress in terms of drivinggrowth through the enabling of markets.However, sustainable growth mustbe built on a solid foundation, and thismeans strong institutions, good infrastructureand targeted investments inhealth, education and skills,” said CarolineGalvan, Economist, World EconomicForum, and co-author of the report.Key findings from the report’s analysisinclude:• Improving agricultural productivity:Agriculture provides an importantsource of income for the majority of Africancitizens, but productivity remains toolow and based on small-scale subsistenceproduction. Improvements such as betterleveraging of technology (both informationand communications technologies,as well as development of high-yieldcrops and better irrigation), more clearlydefined land property rights and promotionof rights and opportunities forwomen, who represent a significant shareof the agricultural workforce on thecontinent, are all needed to address this.Moreover, enabling greater market accessfor small-scale farmers would help ensureinclusiveness, while the development ofregional value chains would serve as auseful stepping stone, enabling them to<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>27

Q3 2015Textile production in EgyptUS$1.5 billion investment in new port in GhanaAfrican leaders sign 26 nation Tripartite Free TradeArea TFTA agreementimprove production and marketing processes,and ultimately to meet the qualitystandards of world markets.• Leveraging services:Services exports are typicallyviewed as an area of comparative advantagefor more advanced economies, buta deeper examination of trade statisticssuggests that they are much more significantfor Africa than previously thought,especially as inputs into exports fromother sectors. Further development oflow-cost, high-quality services will helpcountries participate in local, regionaland global value chains. It will alsoencourage policy-makers to promoteservices development as part of a widergrowth agenda.• Tapping global value chains (GVCs):Greater participation in globaland regional value chains can accelerateAfrican economic transformationthrough the gains associated withenhanced productivity and the developmentof new activities. However, gainsfrom GVC participation are not automaticand require a broad set of policies,with a particular focus on trade facilitation,investment, transport infrastructureand access to finance. Many of thesepolicy areas have economy-wide benefitsbeyond GVC integration.“Business cannot continue as usual inAfrica’s agriculture sector. It is imperativethat productivity be significantlyboosted through tailored agricultureresearch, harnessing ICT and strengtheninglinkages between small-scalefarmers and commercial producers,integrating them into regional and globalvalue chains” said Steve Kayizzi-Mugerwa,Chief Economist and Vice-President,African Development Bank.“The service sector is rapidly becomingmuch more prominent on the developmentagenda across Africa and for theWorld Bank. In many countries acrossthe region, services are the most rapidlygrowing sector, creating new jobs andeconomic activities, and providing criticalinputs to boost production in othersectors. Yet productivity of the servicesector remains low.To be more competitive, governmentsmust lower trade barriers as well as enactcomplementary regulatory reforms.These reforms are also necessary for Africato deepen its integration into globalvalue chains,” said Anabel González,Senior Trade and Competitiveness Director,World Bank, Washington, DC.“To consolidate the progress achievedand make new gains that will allowSub-Saharan Africa to fulfill its fullpotential, we need to promote furtherinvestment in infrastructure, adopt swiftertrade procedures, increase regionalintegration and build more effectiveinstitutions. Faster structural transformationis also needed to boost productivity,enhance job creation and improvesocial cohesion,” said Angel Gurría,Secretary-General, Organisation for EconomicCo-operation and Development(OECD), Paris.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>28

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>29Q3 2015

Q3 2015The Private InfrastructureDevelopment GroupAn innovative, multi-donor organization thatencourages private infrastructure in developingcountries with 37 projects in AfricaInfrastructure is the vital foundationupon which people start businesses,transport goods to new markets, createemployment, boost tax revenues, andgrow economies. The effective developmentof infrastructure transformed thefortunes of Europe and America in the19th and 20th centuries and has been vitalto Asia’s recent economic ascendancy.With a population of over 1 billion,a growing middle class, and naturalresources surpassing every other continent,Africa has enormous potentialfor economic growth. The past 20 yearshave seen improvements in governance,transformative mobile technologies, andglobal demand for natural resourceswhich has powered African economicgrowth. However, sustaining or acceleratingthis growth is only possible withsignificant investment in infrastructure.In particular, Africa needs to invest inenergy and transport to fuel growth andbetter integrate with the global economy.The African Development Bank hasestimated that addressing Africa’s infrastructuredeficit requires investment ofalmost US$ 100 billion every year for thenext decade and that the current annualshortfall in funds is more than half thatamount. While greater efficiency in theuse of public funds could help to addressthe financing gap, it will not sufficientlymeet all of Africa’s future infrastructurefunding needs. Private financing needsto be mobilized if Africa is to achieve itsvast economic potential.Bridging the gap is a core commitment ofthe Private Infrastructure DevelopmentGroup (PIDG). For more than a decadeit has built on the insight and belief thattackling poverty sustainably requireslong-term investment in infrastructurein order to allow economies to grow andprosper. Its founders (a group of publicdevelopment agencies) understood, andyear after year have sought to demonstratethat economic growth is criticalto lifting individuals and nations out ofpoverty.PIDG comprises of eight national developmentagencies and the IFC, one of theWorld Bank Group’s private sector arms.Together they commit funds, which areinvested through a portfolio of eightFacilities run by private sector managers.Each of these Facilities has a distinctremit but with shared aim to mobilizeand increase flows of local, regional, andinternational investor capital; to lend; andto bring expertise and resources neededfor infrastructure investment.The Group actively encourages innovation,creativity, and entrepreneurialspirit to respond to prevailing marketconditions. With its focus solely on infrastructuredevelopment (concentratingon low-income and fragile countries), ithas established a strong track record indeveloping and funding projects infrontier markets. It has consistentlyrisen to the challenge of attractinginvestment to countries with thegreatest need for infrastructure butwhere perception of risk has frequentlydeterred private sector investors.In these under developedmarkets, its members invest publicfunds to leverage domestic andcross-border private sector financein infrastructure projects whichare expected to stimulate pro-pooreconomic growth and improve theaccess to services of those living insome of the poorest countries.While PDIG seeks to tackle majorinstitutional market obstacles hinderingprivate sector participation,its projects demonstrate to theprivate sector that investment inlow- and middle-income countriesis commercially viable and able todeliver real benefits to those livingwithout access to basic infrastructureservices like power, transport,water, sanitation, and communications.To date, group members havecommitted public funds in excessof US$ 1 billion and PIDG Facilitiesleveraged that to mobilize US$27 billion from other DevelopmentFinance Institutions (DFI) and theprivate sector. More than 100 pro<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>30

Q3 2015Bumbuna Hydroelectric Project Sierra Leonejects have reached financialclose and 46 are now deliveringa range of new and improvedservices in power, transport,agri-infrastructure, and manufacturingto local people andbusinesses. 37 PIDG projectsin Africa are now operationaland providing services on theground. These projects are providingnew or improved accessto infrastructure for over 106million Africans, while 4,966and 24,514 are benefiting fromshort and long term employmentrespectively as a direct resultof the PIDG intervention.These projects are also boostingeconomic developmentthrough the provision of vitalinfrastructure services, anddemonstrate to more conservativeinvestors that such projectsare commercially viable..The environment PIDG operatesin inevitably continues tobe shaped by the after-effects ofthe global financial crisis andunderscores the importanceof the work PIDG undertakes.The impact of the financial crisiswas felt globally. In Africa,it has confirmed the urgency ofmassive and sustained effort toimprove infrastructure developmentacross the region.While there are deficits in spendingacross the full range of African infrastructurerequirements, by far the largestinvestment and need is in the energy sector.According to the World Bank Group,sub-Saharan Africa’s 48 countries (witha combined population of 800 million)generate the same amount of power asSpain (45 million). Power cuts are a regularfeature of daily life in many Africancountries; rural communities in particularare without access to power or enduresporadic, unpredictable supplies.Reliable and cost-effective supplies of energywill be essential for countries acrossAfrica to participate and benefit fromincreased trade and economic growth. Itis especially, a vital necessity for SMEs.Recognizing the need for investment inenergy, Green Africa Power (GAP) is thelatest PIDG Facility to be established.Open for business in November 2014,it is a mezzanine-financing fund. It isdesigned to address key market failuresin the power sector to stimulate privatesector investment in renewable energyby reducing the overall cost of capital forenergy generation projects, maintainingcommercial returns.GAP has an ambitious target to finance240MW of renewable energy generationcapacity, saving 9 million tonnes of carbonemissions and improving the supplyof clean energy to millions in sub-Saha-<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>31

Q3 2015ran Africa. Through selected investments,GAP will demonstrate the economicviability and technical feasibility of newtechnologies and encourage investmentby private investors in sustainable businessmodels and economies of Africa.The need for targeted funds has increasedin recent years. International FinancingInstitutions (IFI) face capital constraintsand commercial banks are below pre-crisislevels as they deal with weak balancesheets and regulator pressure to avoid orlimit long-term structured finance.Traditional donor governments are alsoexperiencing constrained fiscal environmentsand greater scrutiny of aid spending.Consequently, there is a growinginterest in contributions private sectorenterprise can make to poverty alleviationand an understanding that there isa need to further leverage the existingsources of finance (official or commercial)with alternative sources of debt andequity.PIDG is uniquely placed to build on itssuccessful track record, engaging theprivate sector, mobilizing and deliveringsustainable commercial returns oninvestments in some of the poorest countriesin the world, securing measurablepoverty reduction, and economic growth.The continued need for significantinfrastructure provision investmentrequires the pursuit of alternative sourcesof capital including private equity funds,sovereign wealth funds, social impact,and local investors. Currently, new playersare looking to enter the market butnot necessarily at the frontier.PIDG can take the lead, demonstratingthat investment in infrastructure in lowerincome countries can be viable and therisk profile may not always be as highas perceived. It often can be managedthrough risk mitigating measures.PIDG and its funding members remaincommitted to tackling poverty bymobilizing private investments for vitalinfrastructure. Securing that infrastructureremains key to sustainable prosperityand economic progress for Africa. ■Case StudyGigawatt Solar Power Plant, RwandaThe Gigawatt project is the first utilityscale private solar PV power projectin East Africa and demonstrates thepotential of solar power for the region.Furthermore, the project has led to aninnovative developmental model where ajoint-venture is created between a commerciallyviable power project and a socialenterprise - in this case allowing theAgahozo-Shalom Youth Village to securea source of long term income via the landlease agreement, while also creating localemployment related to the maintenanceof the solar field.The plant is connected to the nationalgrid and sells the produced powerunder a 25 year power purchase agreementto the Rwanda Energy Group(“REG”), the national power utility. Theproject is also governed by a 25 year concessionagreement with the Governmentof Rwanda.THE DEALTotal investment US$23.7m.The senior debt financing (totalling 75%of the total project cost) was financed byFMO and EAIF.Norfund provided a mezzanine loan.Norfund also provided equity to theproject on its own and jointly with theNorwegian Pension Fund KLP.In addition, significant equity wasinvested by the constructor and operatorScatec Solar. Grants were received fromEEP and from OPIC.The Project was developed by GigawattGlobal Cooperatief, who also retain anequity stake.PIDG SUPPORTEAIF and FMO were able to leverage thecompany up to 75% with a 17 year loan,which is higher and respectively longerthan many benchmark IPP projects in theregion. Both international and commercialbanks are not able to provide suchloan tenors. In addition, due to thespeedy turnaround by EAIF and the otherDFIs involved, this transaction reachedfinancial close within 3 months, whichis faster than most IPP transactions insub-Saharan Africa which typically takebetween8-12 months to complete.This is the first utility-scale solar powerproject in the region. Skill transferand training and development of localemployees was and will be undertakenduring the construction and operation<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>32phases of the project. Several local engineerswere provided with the opportunityto attend solar energy training at SMA inGermany in order to further build theirtechnical capacityAdditional Benefits60 944 People expected to benefit fromnew/better infrastructure23 826 Women expected to benefit fromnew/better infrastructureFirst solar IPP in East Africa. In the regionthere are various government driveninitiatives to boost investments in solartechnology. This project potentially hasa demonstration effect and will lead tomore investors exploring solar opportunities.

<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>33Q3 2015

Q3 2015The AIIBWith just two African member countries, doesthe newly formed AIIB, mean that Africa’sinfrastructure needs will be overlooked?.Wirth just two African member countries,does the newly formed AIIB,mean that Africa’s infrastructure needswill be overlooked.The AIIB was conceived by China in2013. India and 48 other countriesoriginally joined China as co-founder ofthe bank and documents detailing eachmember’s share in its initial capital weresigned in Beijing in June this year. Fromdeveloped economies such as the UK, toformer Soviet states such as Kazakhstanand Kyrgyzstan, the Asian InfrastructureInvestment Bank (AIIB) has attracteddiverse members. But among the 57founding members announced in April,only two are from Africa. With just SouthAfrica and Egypt being named as membersof what’s been touted as China’s rivalto the World Bank, there are fears thatAfrica could be overlooked in China’slatest push for multilateral influence.The AIIB will have initial capital of $50bnand authorised capital of $100bn. TheAsian Development Bank estimated in2009 that the region needs to plug an $8trillion infrastructure gap from 2010 to2020. It was a de facto plea for greaterfunding because the huge amount farexceeded what ADB or the World Bankcould gather. Today, the ADB has anestimated $78 billion in capital, includingretained earnings and borrowings.It is dominated by Japan and the U.S.which have larger shareholding thanChina. ADB has begun to restructure itsoperations, while seeking greater fundsfrom the West. But even a highly efficientand recapitalized ADB could offer only afraction of the real needs in Asia.Meanwhile, the World Bank estimatesthat Africa has similarly towering needsof $93 billion annually until 2020. Chinaitself is a testament to the extent to whichinfrastructure investment can contributeto development. Formerly remote areasof the country are now prosperous as aresult of the connectivity – and thus thefreer flow of people, goods, and ideas –that such investments have delivered.<strong>New</strong> attempts to multilateralise flows ofassistance (including the Brics countries’launch of the <strong>New</strong> Development Bank aresimilarly likely to contribute significantlyto global development. Some years ago,the Asian Development Bank defendedthe virtues of competitive pluralism. TheAIIB offers a chance to test that idea indevelopment finance itself. It would bringsimilar benefits to other parts of Asia,which deepens the irony of US opposition.President Barack Obama’s administrationis championing the virtues oftrade; but, in developing countries, lackof infrastructure is a far more seriousbarrier to trade than tariffs.With such fierce competition for funds,a solely Asia-focused bank might beexpected to divert attention away fromAfrica’s infrastructure concerns and theexisting institutions that serve them.However, it is most likely that followingan initial focus on Asia, China is likelyto expand the bank’s remit – a move thatcould benefit Africa.President of the African DevelopmentBank Group (AfDB), Donald Kaberuka,has welcomed the creation of the Banknoting that it would be an importantpartner in closing infrastructure gaps inAsia and Africa.Speaking during a visit to Beijing,Kaberuka said the new instrument isa welcome complement to the work ofother multilateral development financeinstitutions. “Once the new bank has putin place its new business plans, we will bein a better position to determine specificareas of cooperation, he said.”<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>34Kaberuka met with Mr. Jin Liqun, headof the AIIB, as well as the newly electedpresident of the <strong>New</strong> Development Bankof BRICS countries, Kundapur VamanKamathAs well as altering China’s relationshipwith the existing Western-backed developmentinstitutions, it remains to be seenhow the AIIB will work alongside Chinese-backedinstitutions such as the <strong>New</strong>Development Bank – commonly knownas the BRICS Bank – an institution whichfeatures a prominent role for South Africa.As well as matching the initial $10bninvestment of the other four members,South Africa will host the <strong>New</strong> DevelopmentBank’s African regional centre.Given its role in both institutions and theabsence of fellow sub-Saharan African

Q3 2015nations, South Africa may be expectedby some to assume the mantle of ‘voice ofthe continent’.Mamphela Ramphele, a former managingdirector of the World Bank, thinks thatthe country would be better off re-evaluatingits own motivations for joining, andsays that African countries need to rethinktheir role in international forums –whether Western-backed or Chinese.“South Africa has done the right thing Iguess by joining, but did they ask themselveswhat is it we want to get out ofthis programme? Because it seems to mewell, China is setting up this, we want tobe friends with China therefore we join.If that’s the reason then we’re in trouble.But if they’ve gotten into the AIIB with astrategic approach to development thatthis bank will add to, then we have adifferent ball game”.For Ramphele, regardless of China’s intentions,Africa will need to engage withthe AIIB with far more strategic purposethan it has with development institutionsto date – starting with sending the mostcompetent people as the continent’s representatives.“We need to sit down anddecide for ourselves what it is we’d like toaccomplish by being part of internationaldevelopment aid finance or the IMFor whatever entity – right now we areonly there because those institutions arethere,” she says.It is a widely held belief throughout theAfrican continent that only when muchneeded infrastructure is complete, canthe economic and social developmentprograms progress.Chinese President Xi Jinping (Center R) meets withdelegates attending the signing ceremony for theArticles of Agreement of the Asian Infrastructure InvestmentBank (AIIB) at the Great Hall of the Peoplein Beijing on June 29, 2015.<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>35

Q3 2015<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>36

Q3 2015The development of Africanmalls, and consumer spending, isattracting international brands tolocal shoresToday there are 292 malls and 31 have been opened since Jan 2014, with West Africa showing thelargest growth in terms of new mall openingsThe number of malls in West Africa has increased by 19% in the past 18 months, the remainingregions have increased by 9% on average. International European and North American brands suchas Bata, Adidas, Mango, Celio, Swatch, Carrefour, Etam, Aldo, KFC, Nike and Levis are increasingtheir number of stores in the continent.By 2018, 223 new shopping centres are expected to be opened, including 40 in Egypt, 25 in Nigeria,20 in Kenya, 15 in Ghana, 14 in Angola and 13 in Morocco.The total surface area by 2018 will reach 10 million m².<strong>New</strong> <strong>Markets</strong> <strong>Investor</strong>37