Average land values - Strutt & Parker

Average land values - Strutt & Parker

Average land values - Strutt & Parker

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

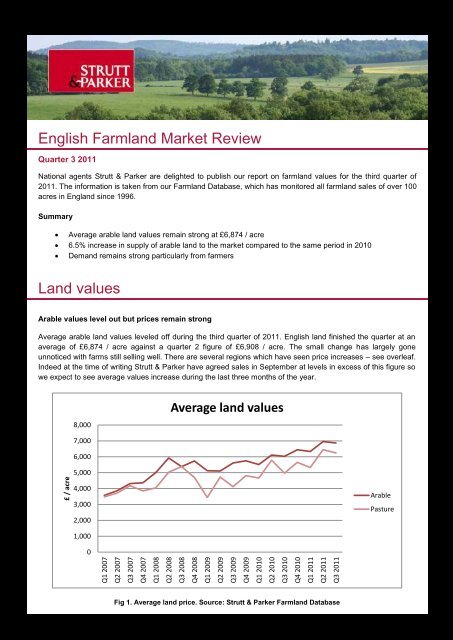

English Farm<strong>land</strong> Market ReviewQuarter 3 2011National agents <strong>Strutt</strong> & <strong>Parker</strong> are delighted to publish our report on farm<strong>land</strong> <strong>values</strong> for the third quarter of2011. The information is taken from our Farm<strong>land</strong> Database, which has monitored all farm<strong>land</strong> sales of over 100acres in Eng<strong>land</strong> since 1996.Summary <strong>Average</strong> arable <strong>land</strong> <strong>values</strong> remain strong at £6,874 / acre 6.5% increase in supply of arable <strong>land</strong> to the market compared to the same period in 2010 Demand remains strong particularly from farmersLand <strong>values</strong>Arable <strong>values</strong> level out but prices remain strong<strong>Average</strong> arable <strong>land</strong> <strong>values</strong> leveled off during the third quarter of 2011. English <strong>land</strong> finished the quarter at anaverage of £6,874 / acre against a quarter 2 figure of £6,908 / acre. The small change has largely goneunnoticed with farms still selling well. There are several regions which have seen price increases – see overleaf.Indeed at the time of writing <strong>Strutt</strong> & <strong>Parker</strong> have agreed sales in September at levels in excess of this figure sowe expect to see average <strong>values</strong> increase during the last three months of the year.8,000<strong>Average</strong> <strong>land</strong> <strong>values</strong>7,0006,000£ / acre5,0004,0003,0002,000ArablePasture1,0000Q1 2007Q2 2007Q3 2007Q4 2007Q1 2008Q2 2008Q3 2008Q4 2008Q1 2009Q2 2009Q3 2009Q4 2009Q1 2010Q2 2010Q3 2010Q4 2010Q1 2011Q2 2011Q3 2011Fig 1. <strong>Average</strong> <strong>land</strong> price. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database

Strong prices continue to be driven by purchasers who are buying <strong>land</strong> close to their existing holdings and areprepared to pay extra for what they consider a once in a generation opportunity to expand their farm. There isalso strong demand from buyers who have sold an asset and are seeking to roll over capital gains made.Buying <strong>land</strong> provides them with roll-over relief from capital gains tax which defers payment of CGT so thesebuyers are often prepared to pay a premium for <strong>land</strong> in order to delay paying tax.Pasture <strong>land</strong> however dropped back marginally at an average figure of £6,242 / acre although this is still 11%higher than 12 months ago.Fig 2. <strong>Average</strong> arable <strong>values</strong> by region. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> DatabaseFig 1 shows quarterly average arable <strong>values</strong> in Eng<strong>land</strong>. As ever this average figure hides regional differencesand there is evidence of a north / south divide. Land <strong>values</strong> in the south and east have actually increased in thelast quarter and average over £7,000 / acre whereas <strong>values</strong> in central and northern areas are lower. A sign thatbetter quality <strong>land</strong> (most commonly found in the east) is achieving higher prices than poorer <strong>land</strong> (mostcommonly found in the north and west). Fig 2 shows the average arable <strong>land</strong> value by region.

Land entering the marketIncrease in supply of <strong>land</strong> helps prevent market from overheatingBuyers have welcomed the increase in supply of <strong>land</strong> to the market which has ended the run of 3 years ofrestricted supply. Like for like there has been a 6.5% increase in the number of acres entering the market with98,216 acres in the first three quarters of 2011 compared with 92,008 acres over the same period of 2010.One of the reasons for the increase is that <strong>land</strong>owners have seen <strong>land</strong> <strong>values</strong> rise rapidly in the first half of theyear and there has been a temptation to “profit take” from an asset which has performed so strongly in a shortperiod of time.Fig 3. Land entering the market. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database.Fig 3 shows the amount of <strong>land</strong> entering the market in 2010 and 2011. 2011 started slowly with less <strong>land</strong>entering the market than the previous year. This prompted a sharp increase in <strong>land</strong> <strong>values</strong> in Q2 of this year.Subsequently there was a rush of <strong>land</strong> to the market in the second quarter with over 10,000 more acresavailable in Q2 2011 compared to Q2 2010. Inevitably this is part of the reason for the price of <strong>land</strong> beginning toplateau.Greatest demand from buyers remains for commercial arable farms. 2011 has seen more arable farms comeforward for sale with the percentage of all farms entering the market increasing by 1% to 51% as shown by Fig4. Interestingly there was a big increase in the number of residential farms coming to the market. This could be asign of pressure growing on lifestyle buyers suffering from the continued economic troubles.

Type of farm entering themarket2010Type of farm entering themarket20118%12%18%24%50%ArablePastureResidential24%13%51%ArablePastureResidentialOtherOtherFig 4. Type of farm entering the market. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database.<strong>Average</strong> farm size has also increased by 53 acres to 330 acres. This is likely to be as a result of the increase incommercial arable farms which tend to be larger in size than other types of farm, see Fig 5.Fig 5. <strong>Average</strong> size of farm entering the market. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database.

Buyer profileFarmers continue to dominate market but investors on the riseFarmers continued to be the major force in the market buying 62% of farms available in 2011. Continuedoptimism in the farming economy (particularly arable farmers) and better than expected yields of crops in someparts of the country have helped farmers to continue to plan to expand.Interestingly there was an increase in both private and institutional investors buying <strong>land</strong>. Many buy <strong>land</strong> forinheritance tax reasons but there are investors who are buying in <strong>land</strong> as it is perceived to be a relatively safeasset, particularly when compared to the recent huge fluctuations in the stock marketFig 6. Buyer type. Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database

Case studies1) Commercial farms – Location and soil quality are keyThe Kelsale Hall Farms, Suffolk2,373 acres – FOR SALEThe real strength in the farm<strong>land</strong> market has been for commercial arable farms. <strong>Strutt</strong> & <strong>Parker</strong> have beeninstructed to sell the largest commercial arable farm of the year. The Kelsale Hall Farms in Suffolk boast highquality soil ideal for growing cereals and oil seed rape.The farm has a guide price of £19,000,000 and includes 7 houses, 3 farm yards with 6,000 tonnes of grainstorage, 1,870 acres of cereal <strong>land</strong> and 430 acres of lighter irrigated <strong>land</strong> which grows potatoes. The sale iscreating a great deal of interest in the market from local farmers and larger investors alike.

2) Residential Estates – Best in class are still sellingBrightwell Park, Watlington Guide price £5,000,000 – SOLD FOR IN EXCESS OF GUIDEBrightwell Park will be one of the sales of the year. The beautiful small residential estate of 135 acres nearWatlington in Oxfordshire attracted 7 bidders and sold for a figure well in excess of the guide price of£5,000,000. Proof that for a high quality property in a prime location, the market is still strong.Looking forwardAnalysis of these statistics shows a small drop in average <strong>land</strong> <strong>values</strong>. This came as a surprise to many of usinvolved with the market day to day as the feeling is that there are still good buyers out there who want to buy<strong>land</strong> – particularly arable <strong>land</strong>. Based on negotiations on the farms currently on the market in September, weare expecting to see average prices increase in Q4. All of the commercial arable farms we are currentlynegotiating on are in excess of £7,500 per acre. That having been said we expect the increased amount of <strong>land</strong>that 2011 has produced will begin to soak up some of the demand and <strong>land</strong> <strong>values</strong> to rise more slowly over thewinter. Looking forward, provided commodity prices remain strong we expect <strong>land</strong> prices to rise further nextyear.For more information, please contactCharlie Evans MRICSPartnerPress OfficeEstate and Farm Agency<strong>Strutt</strong> & <strong>Parker</strong>Telephone: 020 7318 5172 Telephone: 020 7318 5194charlie.evans@struttandparker.comcharlotte.hessey@struttandparker.com<strong>Strutt</strong> & <strong>Parker</strong> is one of the largest and most successful independent property partnerships in the UK with a network of offices throughout Eng<strong>land</strong>and Scot<strong>land</strong>. Established in 1885, the business provides professional support on all matters relating to <strong>land</strong> and property - whether offices or farms,country houses or business parks, leisure centres or shooting rights, new home construction or international real estate. With a dedicated, forwardthinkingteam offering expert knowledge and sound, professional advice, <strong>Strutt</strong> & <strong>Parker</strong> can ensure that businesses, farmers, <strong>land</strong>owners, housebuyersand international investors can make their assets perform to their best ability. To see what else the business has to offer, visit our website atwww.struttandparker.com

<strong>Strutt</strong> & <strong>Parker</strong>’s key statistics for Q3 2011Q3 2010 Q3 2011English average arable <strong>land</strong> prices £6,081/ acre £6,874/ acre<strong>Average</strong> arable <strong>values</strong> in:Northern Eng<strong>land</strong> £5,121 / acre £5,625/ acreCentral Eng<strong>land</strong> £6,553/ acre £6,467/ acreSouth East Eng<strong>land</strong> £6,210/ acre £7,375/ acreSouth West Eng<strong>land</strong> £5,211/ acre £7,079/ acreEastern Eng<strong>land</strong> £5,737/ acre £7,224/ acreSouthern Eng<strong>land</strong> £6,519/ acre £7,625/ acreLand entering market 38,882 acres 38,246 acresBuyer TypeFarmer 63% 62%Lifestyle 18% 16%Equestrian 1% 2%Private Investor 11% 12%Institutional Investors 2% 3%Overseas 1% 2%Other 4% 3%Source: <strong>Strutt</strong> & <strong>Parker</strong> Farm<strong>land</strong> Database. Analysis of English farms over 100 acres in size.