Capital Structure in the REIT Sector - Green Street Advisors

Capital Structure in the REIT Sector - Green Street Advisors

Capital Structure in the REIT Sector - Green Street Advisors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

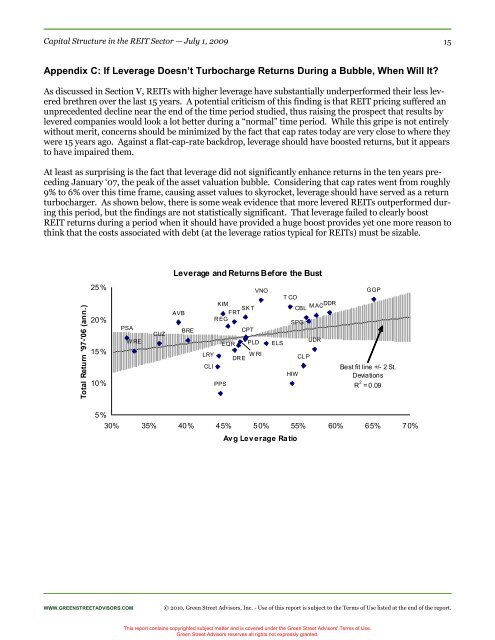

<strong>Capital</strong> <strong>Structure</strong> <strong>in</strong> <strong>the</strong> <strong>REIT</strong> <strong>Sector</strong> — July 1, 200915Appendix C: If Leverage Doesn’t Turbocharge Returns Dur<strong>in</strong>g a Bubble, When Will It?As discussed <strong>in</strong> Section V, <strong>REIT</strong>s with higher leverage have substantially underperformed <strong>the</strong>ir less leveredbrethren over <strong>the</strong> last 15 years. A potential criticism of this f<strong>in</strong>d<strong>in</strong>g is that <strong>REIT</strong> pric<strong>in</strong>g suffered anunprecedented decl<strong>in</strong>e near <strong>the</strong> end of <strong>the</strong> time period studied, thus rais<strong>in</strong>g <strong>the</strong> prospect that results bylevered companies would look a lot better dur<strong>in</strong>g a “normal” time period. While this gripe is not entirelywithout merit, concerns should be m<strong>in</strong>imized by <strong>the</strong> fact that cap rates today are very close to where <strong>the</strong>ywere 15 years ago. Aga<strong>in</strong>st a flat-cap-rate backdrop, leverage should have boosted returns, but it appearsto have impaired <strong>the</strong>m.At least as surpris<strong>in</strong>g is <strong>the</strong> fact that leverage did not significantly enhance returns <strong>in</strong> <strong>the</strong> ten years preced<strong>in</strong>gJanuary ‘07, <strong>the</strong> peak of <strong>the</strong> asset valuation bubble. Consider<strong>in</strong>g that cap rates went from roughly9% to 6% over this time frame, caus<strong>in</strong>g asset values to skyrocket, leverage should have served as a returnturbocharger. As shown below, <strong>the</strong>re is some weak evidence that more levered <strong>REIT</strong>s outperformed dur<strong>in</strong>gthis period, but <strong>the</strong> f<strong>in</strong>d<strong>in</strong>gs are not statistically significant. That leverage failed to clearly boost<strong>REIT</strong> returns dur<strong>in</strong>g a period when it should have provided a huge boost provides yet one more reason toth<strong>in</strong>k that <strong>the</strong> costs associated with debt (at <strong>the</strong> leverage ratios typical for <strong>REIT</strong>s) must be sizable.Leverage and Returns Before <strong>the</strong> BustTotal Return '97-'06 (ann.)25%20%15%10%PSAW RECUZAVBBREVNOKIMSK TFRTR EGCPTEQR PLDLRYDR EW RICLIPPST CODDRCBLM ACSPGUDRELSCL PHIWGGPBest fit l<strong>in</strong>e +/- 2 St.DeviationsR 2 = 0.095%30% 35% 40% 45% 50% 55% 60% 65% 70%Avg Leverage RatioWWW.GREENSTREETADVISORS.COM© 2010, <strong>Green</strong> <strong>Street</strong> <strong>Advisors</strong>, Inc. - Use of this report is subject to <strong>the</strong> Terms of Use listed at <strong>the</strong> end of <strong>the</strong> report.This report conta<strong>in</strong>s copyrighted subject matter and is covered under <strong>the</strong> <strong>Green</strong> <strong>Street</strong> <strong>Advisors</strong>' Terms of Use.<strong>Green</strong> <strong>Street</strong> <strong>Advisors</strong> reserves all rights not expressly granted.