EDITOR’S

LM64-15

LM64-15

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 Editor’s Note<br />

ISSUE 64-15<br />

Welcome to the latest edition of Lawyer<br />

Monthly. As usual we have plenty of<br />

news and features to bring you this<br />

month, keeping you updated with all the legal<br />

and corporate news stories from across the globe.<br />

PUBLISHER<br />

<strong>EDITOR’S</strong> NOTE<br />

You cannot look at the news these days without reading something about<br />

the ongoing migrant crisis that is affecting both Calais and Greece. As<br />

well as being awful for the migrants themselves, forced to endure such<br />

horrendous and dangerous journeys in an attempt to find a better life,<br />

this crisis is having a disastrous effect on the tourism market. The popular<br />

holiday destination, Kos, is experiencing an influx of refugees from troubled<br />

and war torn countries such as Syria, Afghanistan and Iraq, and streets that<br />

were once filled with honeymooning couples and holidaying families now<br />

resemble refugee camps, lined with makeshift tents, rubbish and people.<br />

It is clear to me that something needs to be done to resolve this situation<br />

soon, whether that be amendments to immigration law or asylum laws,<br />

before many more migrants die needlessly and these countries’ economies<br />

are damaged beyond repair.<br />

This month it was announced that the UK inflation rate has risen to 0.1%.<br />

According to the Office for National Statistics, The Consumer Prices Index<br />

(CPI) grew by 0.1% in the year to July 2015, up from 0.0% in the year to June<br />

2015. It seems that a smaller fall in clothing prices on the month compared<br />

with a year ago was the main contributor to the rise in inflation and falling<br />

prices for food and non-alcoholic beverages partially offset the rise.<br />

In-keeping with this positivity, it was also reported this month that within the<br />

UK conveyancing markets, Q2 transactions have broken the post-recession<br />

record as the top five conveyancers pull ahead of the competition.<br />

According to the Conveyancing Market Tracker from Search Acumen,<br />

the average conveyancing firm enjoyed an 8% year-on-year increase in<br />

business during Q2. Volumes among the top five firms growing quickest of<br />

all (10%), meaning conveyancers in this part of the market handled 220<br />

more transactions on average than in Q2 2014. Total transactions reached<br />

230,430 between April and June this year, up from 219,613 during Q2 2014<br />

when the Mortgage Market Review (MMR) changes contributed to a<br />

temporary slowdown of activity.<br />

As usual, this month I am happy to be able to bring you several exclusive<br />

interviews and features. We speak to international law firm WilmerHale<br />

about the issues surrounding corporate crime and what course of action<br />

businesses can take if they suspect corporate crime within their company.<br />

We also speak exclusively to leading Italian law firm, Bonelli Erede, about<br />

the impact of changing EU law on shareholder voting rights and the brand<br />

new President of the American Bar Association, Paulette Brown, as she<br />

begins her one year term.<br />

I hope you enjoy this edition of Lawyer Monthly and I look forward to<br />

bringing you more news and insight next month when we will be looking<br />

at the options for US employers that wish to have foreign trainees, Funds,<br />

Construction Disputes and our Europe Special Report.<br />

Claire Middleton<br />

Editor<br />

108,229 net digital distribution<br />

figure Audit undertaken May<br />

2013<br />

SUBSCRIPTION DETAILS:<br />

Lawyer Monthly is published 12 times per year.<br />

Annual print subscription rates:<br />

£475.00 GBP<br />

$650.00 USD<br />

€735.00 EU<br />

Digital Edition Subscription - Free<br />

Available from: www.lawyer-monthly.com/subscriptions<br />

LAWYER MONTHLY ©2015<br />

Parity Media Limited<br />

Lawyer Monthly is published by Parity Media Limited and<br />

is available on general subscription. Readership and<br />

circulation information can be found at:<br />

www.lawyer-monthly.com<br />

The views expressed in the articles within Lawyer Monthly<br />

are the contributors’ own. All rights reserved. Material<br />

contained within this publication is not to be reproduced<br />

in whole or in part without prior permission. Permission may<br />

only be given in written form by the management board<br />

of Parity Media Limited.<br />

Parity Media Europe:<br />

No. 2 Parkside Court, Greenhough Road, Lichfield,<br />

Staffordshire, WS13 8FE<br />

Tel: 0044 (0) 1543 415422<br />

Follow us on twitter -<br />

@LawyerMonthly<br />

LinkedIn -http://www.linkedin.com/<br />

company/lawyer-monthly<br />

Key Contacts:<br />

Claire Middleton<br />

Editor<br />

editor@lawyer-monthly.com<br />

Mark Palmer<br />

Editorial Director (Parity Media Publications)<br />

mp@parity-media.com<br />

Andrew Gold<br />

Commercial Director<br />

andrew.gold@lawyer-monthly.com<br />

Emma Tansey<br />

Production Manager<br />

production@lawyer-monthly.com<br />

Leona Sheasby<br />

Sales Manager<br />

leona.sheasby@lawyer-monthly.com<br />

Stephanie Barratt<br />

Features Manager<br />

stephanie.barratt@parity-media.com<br />

www.lawyer-monthly.com

ISSUE 64-15<br />

Contents & Welcome<br />

5<br />

CONTENTS<br />

10 WORLD REPORT<br />

10. International News<br />

16. Lawyer Moves<br />

21 MY LEGAL LIFE<br />

30<br />

22. Hoda Barakat from Hoda Barakat Legal Consultancy<br />

24. Maximilien Jazani, Managing Partner at Manswell Advocates<br />

30 LEAD ARTICLES<br />

30. Corporate Crime – How to identify it and what to do when you do<br />

Christopher David Counsel at WilmerHale<br />

32. Italian Increased Voting Rights Mechanism<br />

Gianfranco Veneziano, Partner at BonelliErede<br />

34. New ABA President to Focus on Diversity, Inclusion in justice System<br />

Paulette Brown, American Bar Association<br />

38<br />

37 INTERNATIONAL LEGAL ROUNDTABLE<br />

38. Construction and Infrastructure<br />

43<br />

EXPERT INSIGHT INTO…<br />

44. Bankruptcy & Insolvency<br />

45. Commercial Litigation<br />

46. Patents<br />

48. Intellectual Property<br />

51<br />

SPECIALIST ADVOCATE<br />

52. Construction Disputes<br />

54. Media, Entertainment and Sports Law<br />

54<br />

57<br />

LEGAL FOCUS<br />

59. Introduction<br />

60. Agriculture<br />

62. Commercial Law<br />

63. Electronic Discovery<br />

71. Notary Services<br />

72. Product Liability<br />

74. Professional Negligence<br />

79<br />

TRANSACTIONS<br />

79. What’s happening in the world of M&As & IPOs?<br />

60<br />

91<br />

LAWYER LIFE<br />

92. Sofitel Paris Le Faubourg<br />

www.lawyer-monthly.com

12 World Report - UK & Ireland<br />

ISSUE 64-15<br />

Vincents joins national Legal Aid protest<br />

Lancashire’s Vincents Solicitors<br />

is to boycott Crown Court Legal<br />

Aid work as part of a national<br />

protest against government<br />

cuts. The firm which has one of<br />

the county’s largest criminal<br />

practices, is backing the stance<br />

of other firms across the UK in<br />

aiming to highlight the chaos<br />

further cutbacks could cause.<br />

Government investment in Legal<br />

Aid provision has seen the<br />

funding, which is provided to<br />

people who cannot afford their<br />

own solicitor, cut twice in the last<br />

15 months. The latest 8.75 per<br />

cent cut on July 1 takes reductions<br />

over the last 20 years to 27<br />

per cent.<br />

There are fears that people accused<br />

of a crime could be left<br />

without adequate representation,<br />

as smaller firms would<br />

no longer be able to afford to<br />

undertake Legal Aid work and<br />

larger firms may struggle to attract<br />

new entrants into criminal<br />

law. A shortage of Legal<br />

Aid lawyers could lead to the<br />

accused having to consider<br />

whether fighting a case was financially<br />

viable, rather than on<br />

the basis of whether they were<br />

innocent or had a winnable<br />

case.<br />

Trevor Colebourne, Vincents’<br />

head of criminal law, said the<br />

Q2 transactions break post-recession<br />

record as top five conveyancers pull<br />

ahead of the competition<br />

Conveyancing activity broke<br />

records between April and<br />

June 2015, as total transactions<br />

reached their highest point<br />

for any second quarter of the<br />

post-recession era, according<br />

to the Conveyancing Market<br />

Tracker from Search Acumen,<br />

the search provider.<br />

The Tracker – which uses Land<br />

Registry data to assess competitive<br />

pressures in the conveyancing<br />

market – also reveals the<br />

average conveyancing firm<br />

enjoyed an 8% year-on-year<br />

increase in business during Q2.<br />

Volumes among the top five<br />

firms growing quickest of all<br />

(10%), meaning conveyancers<br />

in this part of the market handled<br />

220 more transactions on<br />

average than in Q2 2014.<br />

Total transactions reached<br />

230,430 between April and June<br />

this year, up from 219,613 during<br />

Q2 2014 when the Mortgage<br />

Market Review (MMR) changes<br />

contributed to a temporary<br />

slowdown of activity.<br />

The relatively strong performance<br />

of Q2 2015 has helped<br />

system is already on the verge<br />

of collapse and further cuts<br />

could take it over the edge. He<br />

said: “Everyone is entitled to legal<br />

representation, regardless<br />

of their ability to pay. This is a<br />

fundamental principle of British<br />

justice. And that representation<br />

should be provided by a qualified,<br />

experienced lawyer who<br />

has the skills and expertise to<br />

understand and work within the<br />

UK’s complex legal system.<br />

“That ideal is sadly under threat<br />

as the Government makes and<br />

proposes further cuts to its Legal<br />

Aid funding, in fact the service<br />

is dangerously close to breaking<br />

down. Law firms who undertake<br />

Legal Aid work have to provide<br />

a 24/7 service yet the money to<br />

pay for that service continues<br />

to be reduced. The risk is that<br />

it becomes unviable for some<br />

firms to continue to take on such<br />

cases or they face going under.<br />

“There’s also the impact upon<br />

recruitment, no one would be<br />

surprised if many junior lawyers<br />

chose to go into other more lucrative<br />

areas of practice. As the<br />

older lawyers retire and younger<br />

ones select other options, the<br />

pool of talent is diminished.<br />

The remaining practitioners are<br />

overworked and underpaid,<br />

and less skilled juniors will be<br />

drafted in to fill the gaps. And<br />

the market recover from a slow<br />

start to this year. Having been<br />

down 5% year-on-year at the<br />

end of Q1, total transactions<br />

were down just 0.3% year-onyear<br />

by the end of H1.<br />

Search Acumen’s analysis suggests<br />

the combination of softening<br />

house prices and record low<br />

mortgage rates has helped to<br />

continue the long-term recovery<br />

in transaction volumes. Fouryear<br />

comparisons show activity<br />

in Q2 2015 was up by 73% compared<br />

with Q2 2011: the year<br />

when the market was at its low<br />

point following the recession.<br />

Q2 2015 also saw the first rise<br />

in the number of active conveyancing<br />

firms since Q3 2014,<br />

as 20 more firms on average<br />

registered transactions each<br />

month compared with Q1. But<br />

with fewer businesses competing<br />

for work than was the case<br />

four years ago, the average firm<br />

has seen an even bigger rise in<br />

transactions – 95% – over this<br />

period.<br />

The top five firms have seen the<br />

greatest growth in the last year,<br />

who wants the overworked, underpaid,<br />

less experienced lawyer<br />

representing their interests<br />

when their very liberty may be<br />

at stake?”<br />

Law firms across the UK are taking<br />

action in a bid to encourage<br />

a rethink by the Ministry of Justice,<br />

which is set to impose another<br />

cut in January 2016, and<br />

prevent the creation of a “twotier”<br />

system of justice where only<br />

those able to afford a lawyer<br />

can defend themselves.<br />

Firms taking action will not represent<br />

clients in Legal Aid cases<br />

at Crown Court for the duration<br />

of the protest. Mr Colebourne<br />

added: “Vincents has decided<br />

to support this protest because<br />

everyone - especially the innocent,<br />

children and the vulnerable<br />

- is entitled to a fair trial<br />

and this usually means representation<br />

from a skilled lawyer. The<br />

criminal justice system must be<br />

organised and funded to make<br />

sure this happens.<br />

“We hope that our clients will<br />

understand why we are making<br />

this protest. This issue is so important<br />

for the future, for everyone<br />

who wants to live in a country<br />

where the rights of the individual<br />

to fair justice are treated with<br />

respect.”<br />

but those firms ranking 51st –<br />

100th have recorded the most<br />

significant uplift since 2011, with<br />

Q2 transaction volumes up by<br />

114% in this part of the market.<br />

The Tracker indicates that dealing<br />

applications – including the<br />

transfer of titles, charges and<br />

notices – continued to make<br />

up the bulk of Q2 activity, totalling<br />

201,522: 4% more than in Q2<br />

2014. There was also a 46% yearon-year<br />

growth in Dispositionary<br />

First Leases to 308 and an 18%<br />

growth of Transfers in Part to<br />

23,409.<br />

Collectively, the top 1,000 firms<br />

maintained a 72% market share<br />

for the second quarter in succession:<br />

down slightly from 73%<br />

in Q4 2014 but up from 71% a<br />

year ago. This is also significantly<br />

more than the 66% market share<br />

the top 1,000 had four years ago<br />

in Q2 2011.<br />

Having hit 8% in Q4 2014, the<br />

market share for the top ten<br />

firms dipped slightly from 6% in<br />

Q1 2015 to 5% in Q2: the same<br />

level recorded in Q2 2014.<br />

DLA Piper and Pegasystems<br />

Collaborate to Automate<br />

the Management of<br />

Regulatory Rule<br />

Maintenance for<br />

Financial Institutions<br />

Pegasystems Inc. the software<br />

company empowering the<br />

world’s leading enterprises with<br />

strategic business applications,<br />

and DLA Piper, a leading global<br />

law firm and regulatory advisor,<br />

have collaborated to assist<br />

Pega in offering new software<br />

capabilities enabling financial<br />

institutions to reduce the time<br />

and costs associated with managing<br />

rapidly evolving laws and<br />

regulations. Banks can now<br />

readily integrate ongoing updates<br />

to their customer due diligence<br />

regulatory rules through<br />

Pega’s industry-leading Know<br />

Your Customer (KYC) application,<br />

helping ensure they are up<br />

to date with major regulatory<br />

rule changes affecting client<br />

onboarding.<br />

According to a recent Forrester<br />

Research report, complying<br />

with KYC regulations ranks as<br />

the biggest pain point for global<br />

corporate banking executives.<br />

(1) The rapid pace of regulatory<br />

change makes it even more difficult<br />

to onboard clients, which<br />

can affect client lifetime value,<br />

client satisfaction, and even the<br />

ability to win new business. This<br />

unique collaboration between<br />

Pegasystems and DLA Piper<br />

gives retail to corporate and<br />

investment banks a faster, more<br />

efficient and cost-effective way<br />

to manage and integrate these<br />

increasingly complex regulatory<br />

rule changes.<br />

DLA Piper’s experienced global<br />

team of regulatory, legal, audit,<br />

and enforcement practitioners<br />

work on behalf of clients<br />

with all major regulators in all<br />

major financial centers to monitor<br />

regulatory changes and<br />

provide legal interpretation for<br />

any relevant updates. These<br />

include key regulations in the<br />

US, UK, EMEA, and Asia Pacific,<br />

such as complex rules related to<br />

Dodd Frank, EMIR, and MiFID, as<br />

well as Anti-Money Laundering<br />

(AML), the US Foreign Account<br />

Tax Compliance Act (FATCA),<br />

and Common Reporting Standard<br />

(CRS) rules.<br />

Financial institutions can rapidly<br />

update and integrate these<br />

regulatory changes directly into<br />

Pega’s flexible, rules-driven KYC<br />

software through an easy-to-use<br />

import wizard that eliminates<br />

the need for manual hard coded<br />

methods. Pega clients can<br />

complement these DLA recommendations<br />

to accommodate<br />

special circumstances or their<br />

own interpretations of the rules<br />

by geography, booking entity,<br />

line of business, and product.<br />

“In this era of unprecedented<br />

regulatory scrutiny, global financial<br />

institutions still struggle<br />

to keep pace with regulatory<br />

changes while minimising the<br />

impact on onboarding times<br />

and customer experience,” said<br />

Reetu Khosla, Senior Director<br />

of Risk, Compliance and Onboarding<br />

for Financial Services,<br />

Pegasystems. “By teaming with<br />

DLA Piper, Pega uniquely taps<br />

into a wealth of regulatory enforcement<br />

expertise to give<br />

clients peace of mind that they<br />

can rapidly update their systems<br />

and efficiently mitigate risk.”<br />

“Financial institutions around the<br />

world are facing unprecedented<br />

regulatory requirements.<br />

Fortunately, a wide range of<br />

innovative technologies are<br />

helping them comply in a more<br />

efficient and effective manner<br />

than ever before,” said Bart Chilton,<br />

former commissioner of the<br />

US Commodity Futures Trading<br />

Commission and a Senior Policy<br />

Advisor at DLA Piper.<br />

“Monitoring rule changes and<br />

updating compliance programs<br />

in this ever-changing regulatory<br />

environment is expensive, timeconsuming<br />

and risky – particularly<br />

in countries where institutions<br />

have less robust business<br />

and support staff,” said Gerald<br />

Francese, Partner, DLA Piper.<br />

“Combining our global regulatory<br />

team with Pegasystems’<br />

market-leading KYC software<br />

gives financial organisations a<br />

cost-effective and collaborative<br />

set of end-to-end services<br />

and software to support them<br />

at every stage of the regulatory<br />

change process and mitigate<br />

any unique localised regulatory<br />

risks."<br />

www.lawyer-monthly.com

ISSUE 64-15<br />

World Report - Asia & Australasia<br />

13<br />

Baker & McKenzie Named the<br />

Strongest Law Firm Brand in<br />

Asia Pacific for Second Year<br />

Running<br />

Baker & McKenzie has again<br />

been named the strongest<br />

law firm brand in the Acritas'<br />

2015 Asia Pacific Law<br />

Firm Brand Index, and has<br />

developed a lead at the top<br />

over its nearest competitor<br />

of 18 Index points.<br />

The Firm's "strategic foresight<br />

to build footprint in the<br />

region" combined with its<br />

global network has made the<br />

Firm "an obvious first choice<br />

for many clients" according<br />

to Acritas. The Firm leads<br />

other organizations as the<br />

most used firm for inbound<br />

work, as well as most<br />

considered firm for multijurisdictional<br />

deals and for<br />

multi-jurisdictional litigation.<br />

The ranking was based on<br />

interviews with 363 senior<br />

general counsel in Asia<br />

Pacific organizations with<br />

revenues over USD50 million,<br />

who were asked about<br />

their awareness of and<br />

favourability towards law<br />

firms; their consideration of<br />

firms for top-level litigation<br />

and major M&A; as well<br />

as their use of firms for high<br />

value work. A further 315<br />

senior in-house counsel<br />

across leading multinationals<br />

based outside the region<br />

with revenues in excess of<br />

USD1 billion were asked<br />

which firms they used for<br />

their legal needs in Asia<br />

Pacific. The Firm has topped<br />

the Asia Pacific Index since it<br />

was first released in 2014.<br />

Bruce Hambrett, Baker &<br />

McKenzie's Asia Pacific<br />

Regional Chairman, said:<br />

"We are extremely honoured<br />

to be cited again by Acritas<br />

as the region's strongest law<br />

firm brand, particularly at<br />

a time when the market for<br />

legal services is becoming<br />

increasingly competitive.<br />

We have been in Asia<br />

Pacific for more than 50<br />

years, and continued<br />

to grow our practice by<br />

aligning ourselves to those<br />

markets where our clients<br />

are investing. We strive to<br />

stay ahead of the curve<br />

by anticipating our clients’<br />

needs and developing<br />

new practice areas. This<br />

recognition validates our<br />

global strategy and clientdriven<br />

approach to our work<br />

and service delivery.”<br />

Lisa Hart-Shepherd, CEO of<br />

Acritas, commented: “Our<br />

data shows an increasing<br />

need for firms that offer<br />

international workflows, both<br />

between the different Asia<br />

Pacific markets and outside<br />

of the region. This means<br />

that firms who can offer<br />

local market knowledge,<br />

and depth and breadth<br />

of expertise in multiple<br />

territories are going to offer<br />

comfort and value to clients,<br />

particularly those who are<br />

often unfamiliar with the<br />

markets themselves. I predict<br />

that we will continue to see<br />

firms who can be a true<br />

global partner to clients<br />

rise up the ranks, seize<br />

competitive advantage and<br />

ultimately win market share.”<br />

White & Case opens<br />

office in Korea<br />

White & Case LLP has<br />

announced the opening<br />

of an office in Seoul, South<br />

Korea to strengthen and<br />

expand its Korea practice.<br />

Since establishing its Korea<br />

practice more than 20<br />

years ago, White & Case<br />

has supported the needs<br />

of clients investing in the<br />

country as well as Korean<br />

clients expanding globally.<br />

The office enables the<br />

Firm to better support<br />

long-standing<br />

project<br />

finance clients, as well as<br />

broadening its role advising<br />

on mergers & acquisitions,<br />

private equity, commercial<br />

litigation and international<br />

arbitration matters.<br />

"Asia is a strategically<br />

important region for the<br />

Firm," said Hugh Verrier,<br />

White & Case Chairman.<br />

"We've had an active Korea<br />

practice for many years,<br />

and now the office in Seoul<br />

will allow us to provide onthe-ground<br />

support for our<br />

clients in their complex,<br />

cross-border work."<br />

The office will be headed<br />

by James K. Lee, who leads<br />

the Korea practice group<br />

and will relocate to Seoul<br />

from Los Angeles. James<br />

specializes in complex<br />

cross-border<br />

commercial<br />

litigation and has been<br />

working with Korean<br />

clients for more than 15<br />

years. He will be joined<br />

initially by Mark Goodrich,<br />

a construction practice<br />

group partner in London<br />

who will be transferring<br />

to Seoul, and Kyungseok<br />

Kim, who recently joined<br />

the Firm as a partner in<br />

the Global Mergers &<br />

Acquisitions Practice.<br />

"We are thrilled to announce<br />

the opening of our new<br />

office in Seoul," said Eric<br />

Berg, Head of Asia for White<br />

& Case. "This allows us to<br />

provide local support with<br />

UK and US law capability<br />

for our Korean clients,<br />

which include a broad<br />

spectrum of organizations<br />

and government agencies.<br />

It is a natural next step for<br />

the Firm."<br />

The establishment of the<br />

Firm's onshore presence in<br />

Korea marks the seventh<br />

location in Asia and the<br />

39th globally.<br />

Clayton Utz covers Victoria PLC acquisition of Quest<br />

Carpet businesses in Australia<br />

Leading Australian law<br />

firm Clayton Utz has acted<br />

as legal adviser to UKbased<br />

international carpet<br />

business Victoria PLC on<br />

its strategic acquisition of<br />

the Quest Carpet (Quest)<br />

businesses in Australia.<br />

The transaction was<br />

announced to the market<br />

on 7 August 2015. The deal<br />

value is approximately<br />

A$35 million.<br />

Clayton Utz Melbourne<br />

corporate partner Michael<br />

Linehan led the firm's<br />

transaction team, which<br />

included senior associate<br />

Quentin Reidy and lawyer<br />

Kate Allison.<br />

Michael said Clayton<br />

Utz was pleased to have<br />

worked with an established<br />

and successful international<br />

business in expanding its<br />

operations in Australia.<br />

He said it was particularly<br />

exciting for the Clayton Utz<br />

team to be able to advise<br />

on part of the recent and<br />

impressive growth strategy<br />

of Victoria PLC.<br />

Victoria PLC manufactures,<br />

supplies and distributes<br />

design-led carpets and<br />

floor coverings. With a<br />

history dating back to 1895,<br />

it has extensive operations<br />

across the UK and in<br />

Australia.<br />

Based in the Melbourne<br />

suburb of Dandenong,<br />

Quest designs, sells and<br />

distributes premium quality<br />

carpets across Australia<br />

and New Zealand.<br />

Under the transaction<br />

terms, Victoria PLC will<br />

acquire all of the issued<br />

share capital in Quest<br />

Carpet Manufacturers Pty<br />

Limited and all of the issued<br />

units in the Quest Carpet<br />

Manufacturers Unit Trust.<br />

www.lawyer-monthly.com

14 World Report - Latin America<br />

ISSUE 64-15<br />

IBAHRI greatly concerned as Venezuela continues to<br />

target lawyers and human rights defenders<br />

The International Bar Association’s<br />

Human Rights<br />

Institute (IBAHRI) is gravely<br />

concerned at the ongoing<br />

targeting of lawyers and<br />

human rights defenders in<br />

Venezuela. The public call<br />

made by the President of<br />

the National Assembly, Diosdado<br />

Cabello, for the imprisonment<br />

of Judge María<br />

Lourdes Afiuni’s defence<br />

lawyers exemplifies a worrying<br />

trend.<br />

Mr Cabello, who is also the<br />

Vice-President of the United<br />

Socialist Party of Venezuela,<br />

made the remark on 22<br />

July 2015 on the television<br />

programme Con el Mazo<br />

Dando, which he hosts. During<br />

the broadcast he called<br />

for the imprisonment of Juan<br />

Garantón, Thelma Fernández<br />

and José Amalio Graterol<br />

on the grounds of alleged<br />

contempt of court.<br />

A group of United Nand Inter-American<br />

Commission on<br />

Human Rights experts have<br />

previously expressed serious<br />

concern at the use of Con el<br />

Mazo Dando, transmitted by<br />

the state network, to target<br />

human rights defenders and<br />

have called on the Venezuelan<br />

authorities ‘to immediately<br />

cease the targeting of<br />

rights activists’.<br />

IBAHRI Co-Chair Hans Corell<br />

commented: ‘The IBAHRI<br />

would like to remind the<br />

Venezuelan authorities of<br />

their responsibilities under<br />

international law, including<br />

Inter-American human rights<br />

instruments, to protect and<br />

uphold human rights and the<br />

independence of the legal<br />

profession. This includes the<br />

fundamental principle that<br />

lawyers should not be associated<br />

with the causes of their<br />

Energy M&A to have a weaker 2015<br />

but to pick up in following years<br />

The energy sectors will<br />

continue to see significant<br />

merger and acquisition activity<br />

over the next five years<br />

reveals a unique new forecast<br />

by Baker & McKenzie<br />

published in association with<br />

Oxford Economics.<br />

The report predicts an estimated<br />

$136 billion in completed<br />

energy deals in 2015,<br />

down from $371 billion in<br />

2014. However, the forecast<br />

assumes that number<br />

will pick up to $251 billion in<br />

2016, $326 billion in 2017 before<br />

peaking in 2018 at over<br />

$350 billion.<br />

Jim O'Brien, Global Energy<br />

leader at Baker & McKenzie<br />

explains, "Although the<br />

drop in oil prices has helped<br />

fuel the global economic<br />

recovery, there have been<br />

negative implications for energy<br />

producers, prompting<br />

a wave of consolidation in<br />

the energy sector. Transactions<br />

should unfold over the<br />

next three years as high-cost<br />

oil producers, especially USbased<br />

hydraulic frackers<br />

that face illiquidity in rolling<br />

over their high-yield debt,<br />

are ripe for takeover.<br />

"Globally, we expect less<br />

efficient and high-cost oil<br />

producers to become vulnerable<br />

to acquisition as<br />

they strive to compete in an<br />

industry in which innovation<br />

is keeping oil prices low. The<br />

quest for geographic expansion<br />

and the need for new<br />

technologies and services<br />

will also drive M&A activity."<br />

Markets that are predicted<br />

to grow the fastest in terms<br />

of overall M&A in the next<br />

5 years across all sectors<br />

are China, The Netherlands,<br />

Mexico, India, UK, Germany,<br />

Indonesia, Saudi Arabia and<br />

the UAE.<br />

"Many US and European<br />

companies have accumulated<br />

large cash balances<br />

available for acquiring new<br />

businesses," explains Tim<br />

Gee, Baker & McKenzie's<br />

global head of M&A. "Financial<br />

sponsors also have the<br />

potential to boost global<br />

transactions, with private equity<br />

firms sitting on a record<br />

US$1.1 trillion in uninvested<br />

capital. Cross-border transactions<br />

will play a significant<br />

role as companies look to<br />

gain market presence in<br />

high growth markets."<br />

The projections are part of<br />

a unique 6-year forecast of<br />

global transactional activity,<br />

developed in partnership<br />

with Oxford Economics. The<br />

comprehensive report, The<br />

Impact of Macro Trends on<br />

Future M&A and IPO Activity<br />

sets out predictions across<br />

regions, sectors and individual<br />

countries worldwide until<br />

2020, linking economic outlook<br />

with corporate activity.<br />

clients.’ He added: ‘That defence<br />

lawyers José Amalio<br />

Graterol, Thelma Fernández,<br />

and Juan Garantón be<br />

chastised publicly by Mr Cabello<br />

is unacceptable. The<br />

likely consequence of such<br />

action is to intimidate and<br />

subdue Venezuela’s wider<br />

Blackboard Acquires<br />

Nivel Siete<br />

Blackboard has acquired<br />

Nivel Siete, a leading Moodle<br />

provider operating in<br />

Latin America. By joining<br />

their forces, the two companies<br />

will be able to offer<br />

more services and solutions<br />

to organizations that<br />

leverage Moodle, one of<br />

the most widely used learning<br />

management systems<br />

(LMS) in the world, and<br />

support a greater number<br />

of learners to achieve their<br />

educational goals.<br />

Nivel Siete offers a variety<br />

of learning solutions,<br />

hosting, support and consulting<br />

services that help<br />

organizations succeed in<br />

their teaching and learning<br />

initiatives, especially those<br />

that focus on the use of e-<br />

learning for talent management<br />

and training. Headquartered<br />

in Colombia, the<br />

company serves over 200<br />

customers in Mexico, Colombia,<br />

Peru, Ecuador, Venezuela,<br />

Honduras and the<br />

Dominican Republic.<br />

"The addition of Nivel Siete<br />

to the Blackboard family<br />

testifies to our commitment<br />

to open source," said<br />

Matthew Small, senior vice<br />

president and managing<br />

director, international at<br />

Blackboard. "We are seeing<br />

strong momentum for our<br />

open source solutions and<br />

in particular for Moodlerooms,<br />

with the addition of<br />

more than 80 new customers<br />

around the world in the<br />

legal profession. As lawyers<br />

are hindered from carrying<br />

out their professional duties<br />

effectively, this in turn would<br />

lead to the undermining of<br />

public confidence in the administration<br />

of justice in the<br />

country.’<br />

last few months and a significant<br />

growth in Mexico,<br />

Colombia, Peru and Brazil.<br />

Our open source solutions<br />

play an integral part in our<br />

strategy and we will continue<br />

to support their growth. I<br />

am thrilled to work together<br />

with the team at Nivel Siete<br />

and improve the educational<br />

experience for learners<br />

in Latin America."<br />

"We are excited to join<br />

forces with Blackboard and<br />

help learners and organizations<br />

be successful," said<br />

José Diáz, CEO at Nivel Siete.<br />

"By working together<br />

with Blackboard we will be<br />

able to enhance the range<br />

of solutions and services<br />

we provide to institutions<br />

and businesses across Latin<br />

America. The local Moodle<br />

community will benefit from<br />

this acquisition, as it will<br />

open up new opportunities<br />

to share knowledge and<br />

best practices."<br />

This announcement marks<br />

the latest investment made<br />

by Blackboard in open<br />

source after the recent acquisitions<br />

of Remote-Learner<br />

UK and X-Ray Analytics<br />

technology. Since officially<br />

joining the open source<br />

community in 2012, Blackboard<br />

has been contributing<br />

to Moodle with code,<br />

quality assurance, platform<br />

integrations and bug fixes.<br />

It has also supported many<br />

community gatherings<br />

across the world.<br />

www.lawyer-monthly.com

16 Lawyer Moves<br />

ISSUE 64-15<br />

CAREY OLSEN ANNOUNCES<br />

THREE NEW PARTNERS<br />

LINDA KLEIN OF<br />

ATLANTA BECOMES<br />

PRESIDENT-ELECT OF<br />

AMERICAN BAR<br />

ASSOCIATION;<br />

WILL BE ABA<br />

PRESIDENT IN 2016-17<br />

MCDERMOTT ADDS PRIVATE<br />

EQUITY PARTNER KATHY<br />

SCHUMACHER IN CHICAGO<br />

www.lawyer-monthly.com

ISSUE 64-15 Lawyer Moves<br />

17<br />

DR. JÖRG KIRCHNER TO JOIN<br />

MUNICH OFFICE OF KIRKLAND<br />

& ELLIS INTERNATIONAL LLP AS<br />

CORPORATE PARTNER<br />

NEW CONSTRUCTION<br />

PARTNER FOR HOGAN<br />

LOVELLS IN SOUTH AFRICA<br />

DLA PIPER APPOINTS<br />

LEADING M&A LAWYER<br />

JAMES PHILIPS<br />

LAWYER MOVES<br />

www.lawyer-monthly.com

18 Lawyer Laywer Moves<br />

ISSUE 64-15<br />

DLA PIPER APPOINTS<br />

LEADING M&A LAWYER<br />

JAMES PHILIPS<br />

DLA Piper has appointed one of Australia's<br />

leading M&A lawyers, James Philips, as a partner.<br />

James joins the firm from Minter Ellison,<br />

where he was Co-Head of M&A.<br />

James has advised on transactions valued<br />

at more than AU$100 billion, spanning<br />

recommended and hostile takeover bids,<br />

schemes of arrangement, public to privates,<br />

redomiciles, privatisations and equity capital<br />

markets. He wrote the Takeovers chapter in<br />

'Australian Corporation Practice' and lectures<br />

in Corporate Fundraising at the University of<br />

Sydney.<br />

His appointment is the latest in a series of strategic<br />

partner hires made by DLA Piper, as part<br />

of the firm's transformation of its corporate<br />

capabilities across the Asia Pacific region.<br />

James is the sixth Corporate partner to join in<br />

the past four months, following the appointments<br />

of Grant Koch in Sydney (20 April), Michael<br />

Bowen, Scott Gibson and Marc Wilshaw<br />

and their teams in Perth (1 July) and David<br />

Hallam in Melbourne (3 August).<br />

DLA Piper Managing Partner in Australia, John<br />

Weber, commented: "This is a very exciting<br />

time for the firm and our clients. We have<br />

gained significant momentum in the Australian<br />

market, in particular with a focus on transactional<br />

corporate work, and we're delighted<br />

to welcome James to our growing corporate<br />

team."<br />

DLA Piper Head of Corporate, Asia Pacific, Bryan<br />

Pointon, commented: "James' appointment<br />

is a significant milestone for the firm. James is<br />

an outstanding practitioner and, together with<br />

the outstanding corporate partners who have<br />

joined DLA Piper in Australia over the last 18<br />

months, he exemplifies the breadth, depth<br />

and strength of the firm's capability in M&A,<br />

ECM and private equity in Australia and the<br />

Asia Pacific region."<br />

LINDA KLEIN OF ATLANTA BECOMES PRESIDENT-<br />

ELECT OF AMERICAN BAR ASSOCIATION; WILL BE<br />

ABA PRESIDENT IN 2016-17<br />

Linda Klein, the managing shareholder in Baker Donelson’s Georgia offices, assumed the role of president-elect<br />

of the American Bar Association this month at the conclusion of the ABA Annual Meeting<br />

in Chicago. She will serve a one-year term as president-elect then become ABA president in August<br />

2016.<br />

Paulette Brown, a partner and co-chair of the Diversity & Inclusion Committee at Locke Lord LLP in Morristown,<br />

N.J., became ABA president today and will serve until next August.<br />

Klein’s practice area includes most types of business dispute resolution, including contract law, employment<br />

law and professional liability, working extensively with clients in the construction, higher<br />

education and pharmaceutical industries.<br />

In June 1997, Klein became the first woman to serve as president of the State Bar of Georgia. During<br />

Klein's term, she devised a proposal and advocated for the state to allocate funding for Georgia Legal<br />

Services and Atlanta Legal Aid to hire lawyers to help indigent victims of domestic violence. She organized<br />

a state-wide group of community organizations and local and minority bar associations that<br />

together convinced the General Assembly to appropriate $2 million. Since then, the annual appropriations<br />

have helped thousands in Georgia with legal issues related to domestic violence.<br />

Klein was one of the first women to lead a prominent Georgia law firm. She served as managing<br />

partner of Gambrell & Stolz, beginning in 2001, and led the firm's 2007 merger with Baker Donelson,<br />

becoming a Baker Donelson board member and Georgia managing shareholder.<br />

She served as chair of the ABA's House of Delegates, the second highest office in the organization,<br />

from 2010-2012. She has also served as chair of the Tort Trial and Insurance Practice Section, chair of<br />

the Committee on Rules and Calendar of the House of Delegates, chair of the Coalition for Justice,<br />

and chair of ABA Day, the Association's outreach effort to Congress. She is a member of the Council<br />

of the ABA Section of International Law and also serves as a columnist and on the Board of Editors of<br />

Law Practice Management Magazine. In 2004, the American Bar Association honoured Klein with the<br />

prestigious Margaret Brent Women Lawyers of Achievement Award.<br />

NEW CONSTRUCTION PARTNER FOR HOGAN<br />

LOVELLS IN SOUTH AFRICA<br />

Philip van Rensburg has joined Hogan Lovells as a partner in the construction department and litigation<br />

team in Johannesburg. Joining with him is senior associate Waseeqah Makadam.<br />

Philip focuses on litigation and projects primarily within the construction, engineering and mining industries,<br />

but also advises clients in the energy and chemical sectors. His dispute resolution work includes<br />

civil litigation, arbitration under local and international rules (ICC), and adjudication (DAB)<br />

proceedings in local and international disputes.<br />

Philip advises contractors, engineers and plant owners in both contentious and non-contentious matters<br />

on all aspects arising from FIDIC, GCC, JBCC and NEC3 contracts. He has extensive experience<br />

in drafting EPC and EPCM contracts in the construction, energy, infrastructure, mining and telecommunications<br />

industries, as well as identifying, evaluating, formulating and defending claims in relation<br />

to construction and engineering projects.<br />

Michael Davison, global head of disputes, said: “Philip’s extensive experience will be a tremendous<br />

asset to our construction team, which counts some of the world's largest engineering and contracting<br />

companies among its clients.”<br />

Philip van Rensburg said: “The fully-integrated teams at Hogan Lovells provide clients with the opportunity<br />

to access industry knowledge and sector expertise with impressive geographic reach.<br />

"I look forward to working with my new colleagues at Hogan Lovells."<br />

Previously Philip was a director at Baker McKenzie, and prior to that he was with Fasken Martineau.<br />

www.lawyer-monthly.com

ISSUE 64-15 Lawyer Moves<br />

19<br />

MCDERMOTT ADDS PRIVATE EQUITY PARTNER KATHY<br />

SCHUMACHER IN CHICAGO<br />

Adding to its broad and international private equity practice, McDermott Will & Emery recently announced<br />

that Kathy Schumacher, an experienced finance lawyer who regularly represents private<br />

equity firms and portfolio companies in acquisition financings, has joined the firm in Chicago as a<br />

partner in the Corporate group.<br />

Ms. Schumacher has an extensive background in acquisition financing, particularly on the borrower<br />

side, and in other types of finance transactions, including infrastructure and project finance. In addition<br />

to structuring the financing of private equity deals, she advises public and private companies<br />

in general corporate debt financings and. She has represented many sponsors and issuers on transactions<br />

up and down the capital structure – including senior, first lien/second lien, mezzanine and<br />

subordinated debt financings. She has also negotiated large bridge loans and other facilities used in<br />

acquisitions.<br />

Ms. Schumacher arrives at McDermott from the Chicago office of Kirkland & Ellis, where she practiced<br />

in the Debt Finance Group.<br />

During her career, she has advised on numerous mid-market and large-cap financings. Frequently<br />

acting for private equity groups and their portfolio companies in acquisitions, Ms. Schumacher has<br />

structured transactions across many industry sectors, including hospitality and gaming, logistics, retail,<br />

building products, energy, refining and others.<br />

At McDermott, she joins a corporate practice with deep private equity deal experience and industry<br />

expertise, along with strength in all areas of corporate finance. The firm’s Private Equity group includes<br />

more than 70 lawyers worldwide.<br />

“Private equity remains a generator of significant transactional activity. Our group continues to be<br />

fully engaged, particularly in the middle markets,” said Harris Siskind, co-head of McDermott’s Private<br />

Equity practice. “Kathy Schumacher is a strong addition to our team, bringing significant experience<br />

handling debt financings of all sizes and complexities and across numerous industry segments. Her<br />

considerable range in handling complex debt financings will make her a valuable member of our<br />

group.”<br />

CAREY OLSEN<br />

ANNOUNCES THREE<br />

NEW PARTNERS<br />

Carey Olsen recently announced that three<br />

advocates in its Guernsey office - Elaine Gray,<br />

Natasha Kapp and Tony Lane - have been<br />

promoted to partners.<br />

Elaine Gray joined the firm's litigation and dispute<br />

resolution practice as counsel in 2012.<br />

She advises local and international clients on<br />

commercial litigation, employment and intellectual<br />

property matters and is recognised as<br />

a leading voice in employment, IP and complex<br />

trust disputes.<br />

Natasha Kapp joined the fiduciary practice as<br />

a senior associate in 2009. She deals with all<br />

aspects of fiduciary law and regulation as well<br />

as contentious and non- contentious trusts issues<br />

and non-contentious insurance matters.<br />

Tony Lane joined the corporate team in<br />

Guernsey as a senior associate in 2008. He<br />

advises on a wide range of corporate matters<br />

with particular expertise in mergers and acquisitions.<br />

Tony also advises on the establishment,<br />

regulation and operation of investment<br />

funds.<br />

Guernsey managing partner, John Greenfield,<br />

said: “Elaine, Natasha and Tony have contributed<br />

a great deal to their respective practice<br />

areas both within Carey Olsen and within their<br />

fields of law. Their appointment as partners is<br />

positive news for the firm and for our clients."<br />

DR. JÖRG KIRCHNER TO JOIN MUNICH OFFICE OF KIRKLAND & ELLIS INTERNATIONAL LLP<br />

AS CORPORATE PARTNER<br />

Kirkland & Ellis International LLP recently announced that Dr. Jörg Kirchner will join the Firm’s Munich office as a partner in the Corporate Practice Group. Dr.<br />

Kirchner focuses his practice on the full range of private equity and M&A transactions.<br />

“Jörg is one of the top private equity attorneys in Germany, with an excellent reputation as a dealmaker,” said Jeffrey C. Hammes, Chairman of Kirkland’s<br />

Global Management Executive Committee. “His experience advising on complex private equity and M&A transactions will further strengthen our robust international<br />

corporate practice.”<br />

Dr. Kirchner joins Kirkland from the Munich office of Latham & Watkins, where he was a founding partner and formerly acted as the office managing partner and<br />

vice chair of the global corporate department. He advises clients on private equity and M&A matters, handling both cross-border and national transactions,<br />

including LBOs, minority investments, joint ventures and carve-outs.<br />

“We couldn’t be more pleased to welcome Jörg to the Firm,” said Volker Kullmann, a partner in Kirkland’s Corporate Practice Group. “His proficiency in advising<br />

top-tier clients on their most significant transactions perfectly complements our international private equity and M&A teams as we continue to enhance<br />

our offerings in Europe.”<br />

Dr. Kirchner is top-ranked by a number of leading legal directories, including JUVE 2014/2015, where he is listed as a “leading name” in private equity and<br />

“recommended” in M&A. He is rated Tier 1 for private equity and M&A by Chambers & Partners, which notes that he is “…very strong from both a technical<br />

and commercial standpoint.” He is also recommended by The Legal 500, and IFLR1000, which praises him as a “leading lawyer” and a “highly experienced<br />

and adept partner.”<br />

Dr. Kirchner holds an LLM from George Washington University Law School and a Dr. jur. from the University of Munich.<br />

www.lawyer-monthly.com

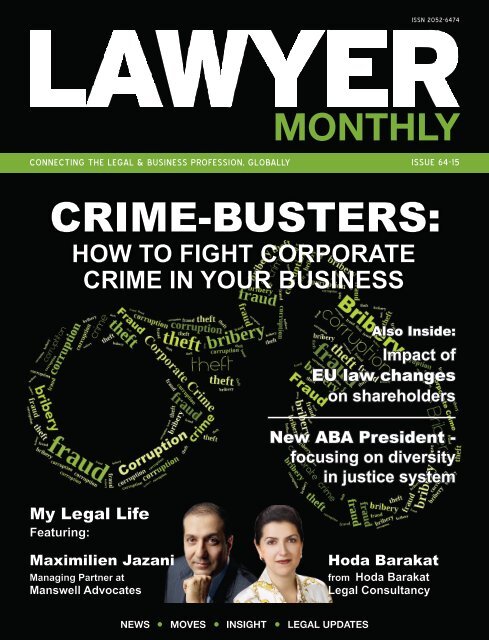

My<br />

Legal<br />

Life<br />

Featuring...<br />

Hoda<br />

Barakat<br />

From Hoda Barakat<br />

Legal Consultancy<br />

Maximilien<br />

Jazani<br />

Managing Partner at<br />

Manswell Advocates

22 My Legal Life<br />

ISSUE 64-15<br />

An Interview With...<br />

Hoda Barakat<br />

From Hoda Barakat Legal Consultancy<br />

Hoda Barakat Legal Consultancy, PO Box 334249, Dubai, UAE<br />

Tel: +971 4 3466411 | Email: hoda@hblegal.ae<br />

Can you begin by telling me a little about the<br />

typical types of case you deal with regularly?<br />

In my professional life, I have handled a<br />

number of contentious and non-contentious<br />

matters. While I am not a litigation lawyer, I<br />

have managed a lot of litigation matters over<br />

the years particularly in the IP and commercial<br />

fields. On the non-contentious side, I typically<br />

advise senior executives on legal matters<br />

and provide a strategy to resolve their legal<br />

issues. I then carry that through by managing<br />

the strategy to ensure implementation and<br />

resolution.<br />

You have been practising for over 20 years,<br />

how much has the legal landscape in Dubai<br />

changed during that time?<br />

Lawyer Monthly’s very special ‘My Legal Life’ feature prides<br />

itself on examining the work, background and opinions of<br />

some of the world’s leading legal practitioners. We look at<br />

what motivates them, what led them to where they are<br />

today, the types of issues they face on a regular basis and<br />

how their particular area of practice has evolved during<br />

their legal career. Here, as part of this month’s ‘My Legal<br />

Life’, we speak to Hoda Barakat from Hoda Barakat Legal<br />

Consultancy in Dubai.<br />

I arrived in Dubai in mid - 1995 with four years’<br />

work experience in London. My area of legal<br />

expertise at the time was intellectual property<br />

(IP). In 1995, the IP laws in the UAE were<br />

relatively new and implementation was just<br />

beginning. I was fortunate to be one of the<br />

first lawyers in the country with IP experience.<br />

I handled enforcement campaigns for<br />

several multi-national companies and industry<br />

groups. I worked closely with Government<br />

officials who were also keen to see the<br />

UAE rise as the leader in the region in the<br />

protection and enforcement of IP rights. With<br />

time, the legal market expanded and new<br />

areas of law became relevant too e.g. IT law.<br />

The legal landscape changed dramatically in<br />

almost every sector. The UAE has led the way<br />

in the region in most areas of the law. The DIFC<br />

legal jurisdiction is a first in the region as it is a<br />

Common Law jurisdiction with its own English<br />

language courts (vs Civil Law and Arabic<br />

language courts in Dubai and the rest of the<br />

www.lawyer-monthly.com

ISSUE 64-15<br />

My Legal Life<br />

23<br />

UAE). Judges are now trained in the UAE and<br />

abroad and cases referred to specialised<br />

judges.<br />

Your practice began life as an Intellectual<br />

Property firm – what led you to expand into IT<br />

and other issues?<br />

I began life in a specialised IP firm in London,<br />

and then I moved to a general practice law<br />

firm in the UAE with 10 lawyers in 1995. I was<br />

the only IP lawyer in the firm but then the<br />

practice grew and we became known for our<br />

IP work. The firm as a whole was growing in<br />

parallel. Expanding into IT law was a natural<br />

organic growth with the emergence of IT and<br />

internet legal issues. The firm opened a new<br />

branch in the Dubai Internet City, a business<br />

park specialised for IT companies. After 15<br />

years with the firm and after becoming the<br />

Managing Partner for five years, I left to take<br />

a break. Following a two year break, I set up<br />

my practice as it is today: a boutique firm that<br />

deals with a multitude of issues but all on a<br />

strategic trusted advisor basis.<br />

“<br />

Expanding into IT law was a natural<br />

organic growth with the emergence<br />

of IT and internet legal issues<br />

“<br />

Finding a solution to a problem<br />

is most rewarding to me especially if it can<br />

avoid the need for litigation<br />

On the flipside, what do you find most clients on legal strategy and management,<br />

rewarding about your work?<br />

in an almost in-house capacity. My aim is to<br />

provide the highest level of legal service while<br />

I love dealing with clients and solving ensuring accessibility by my select clients.<br />

problems. Finding a solution to a problem Each client should feel that they are my only<br />

is most rewarding to me especially if it can client.<br />

avoid the need for litigation. If however, no<br />

solution can be found and litigation is a must, What motivated you to become a lawyer?<br />

winning a case for a client is very fulfilling. I Why IP?<br />

also enjoy working with a team and growing a<br />

practice. Having recently started my own firm,<br />

Actually I started my University life as a science<br />

it is interesting to be involved in all aspects of<br />

student until I realised that labs were not for<br />

the legal practice.<br />

me and that I had a more natural affiliation<br />

to law. I transferred to study law while at<br />

University and I loved it. After University, the<br />

time came for specialisation and IP was<br />

“<br />

“<br />

perfect for a law graduate with a science<br />

background. My training and my first job were<br />

in London where I specialised in IP. When<br />

I moved to Dubai in 1995 I was in the right<br />

place at the right time. IP was in its infancy<br />

in the UAE, a law firm in Dubai was looking to<br />

hire an IP lawyer and there I was. It proved to<br />

be a good match.<br />

Is there anything else you would like to add?<br />

What are the biggest challenges that the IP<br />

world throws up and how do you navigate<br />

them?<br />

Inconsistency was the biggest challenge in<br />

the IP sector. However, it is always important<br />

to remember that the UAE is a young nation<br />

and until recently judges were not well-versed<br />

or trained in IP matters. Over time however<br />

judges were trained and specialised and now<br />

judgements have become more consistent<br />

and harsher in nature. Even at the level of the<br />

Prosecutors and Government departments,<br />

familiarity with IP has improved and so action<br />

is more consistent.<br />

You have built the firm up to be the largest<br />

leading UAE law firm with over 130 lawyers<br />

and 300 staff. How have you done this? Has<br />

it been tough?<br />

My former firm is a solid example of how a<br />

good hardworking team that kept its quality<br />

of service high, can succeed. Ensuring policies<br />

and procedures were in place as the firm grew<br />

was also an important factor as it allowed<br />

staff to feel fairly treated. When the firm grows<br />

so quickly it needs to run like a machine.<br />

We were also lucky to be in the UAE in the<br />

boom times. My new firm is a small, boutique<br />

practice where I work very closely with select<br />

I have thoroughly enjoyed my legal life and<br />

continue to do work that interests me and<br />

that helps others. It was great to be a woman<br />

in an Arab country leading a large local legal<br />

firm and breaking many misconceptions<br />

about age and gender. Now my practice is<br />

small but filled with interesting matters and it<br />

allows me the time to spend on the matters<br />

that I enjoy the most. LM<br />

www.lawyer-monthly.com

26 My Legal Life<br />

ISSUE 64-15<br />

An Interview With...<br />

Maximilien Jazani<br />

Managing Partner at Manswell Advocates<br />

153, BOULEVARD HAUSSMANN. 75008 PARIS – FRANCE<br />

Fax: + 33147205421 | Tel.: + 33145619341 | Email: maximilien.jazani@manswell.fr | Twitter: MaxJazani | Website: www.manswell.fr<br />

You began your career over twenty years ago;<br />

how has music law changed during that time?<br />

When I started, most tracks (phonograms) were<br />

produced by Major labels (Universal, Sony, EMI…<br />

”the Majors”) and they used to sign exclusive<br />

recording agreements with artists or bands and<br />

the tracks were generally manufactured and<br />

released in CD and vinyl.<br />

During the early 1990s, what I would call music.1<br />

period, mp3 audio files appeared and during<br />

this decade, free download and free streaming,<br />

while illegal, affected the Majors’ business<br />

model. Majors have been obliged to terminate<br />

most costly recording agreements, sometimes,<br />

giving back the record maters for 1 euro or 1 £<br />

to artists and the music production passed from<br />

Majors to Artists’ labels: artists created their own<br />

record companies, produced their phonograms<br />

and video-music and entered into distribution<br />

or license agreements with Majors. In the<br />

meantime, the Artists realised that live shows and<br />

concerts bring more exposure and money than<br />

the sale of records. They started managing their<br />

live performances themselves.<br />

Each month, Lawyer Monthly’s ‘My Legal Life’ feature<br />

looks at the work of experienced and highly skilled legal<br />

professionals, exploring the types of cases they work on,<br />

the challenges they face and what motivates them. This<br />

month, we speak to Maximilien Jazani from Manswell<br />

Advocates in Paris. Maximilien specialises in Music Law and<br />

has published many articles on the subject.<br />

In the 2000s started what I would call music.2<br />

period: legal downloading and legal streaming<br />

platforms started appeared and became<br />

significant (iTunes in 2003, Deezer in 2007, Spotify<br />

in 2008 …) and digital music became profitable<br />

but the music production business model<br />

remained lock-stepped and grew with artists<br />

labels producing their phonograms and live<br />

performances. In the meantime, the electronic<br />

music production and music production<br />

through music software became the main music<br />

production way.<br />

In 2010s began what I would call music.3 period:<br />

the social media started becoming more<br />

important than downloads and streaming. The<br />

www.lawyer-monthly.com

ISSUE 64-15<br />

My Legal Life<br />

27<br />

true chart of the artists is now based on their<br />

followers on social media (tweeter, Facebook,<br />

Instagram, snap chat…) rather than their sales or<br />

their streaming.<br />

Nobody can pretend to know what will be the<br />

next evolutionary step but I see in the current<br />

trend that a new business model may appear<br />

from social media and smartphone applications.<br />

What motivated you enter the legal profession<br />

and why did you choose the specialisms that<br />

you did?<br />

In the 90s, I started working with orchestra<br />

conductors and opera singers before working<br />

with electro music artists. I found the legal and<br />

tax challenges very interesting. I still advise<br />

major international opera singers and orchestra<br />

conductors. But, after some MIDEM meetings<br />

I 2000s, when I started working with electronic<br />

artists like Mirwais, David Guetta and Martin<br />

Solveig, I discovered a new area of music that<br />

I had no real idea about before. I said to myself<br />

that I had to know how it works. So, I got some<br />

lessons in a DJ school in Paris, called DJ Center,<br />

bought a Pioneer DJM and DJ Player 300 and<br />

Live and track record software and started to<br />

learn how it worked. Once I understood the<br />

basic mechanism of Electro music (without ever<br />

achieving to handle all tools because that’s a<br />

job in itself) I started assessing the legal bases of<br />

electronic music law. Thanks to a partnership with<br />

the magazine ONLY FOR DJs and then DJ Mag, I<br />

published a lot of articles on DJaying and electro<br />

music contracts and business model.<br />

Today it is delightful to see some managers,<br />

bookers and lawyers plagiarising the contract<br />

templates I made a decade before: some of<br />

my templates have become today standards of<br />

DJaying and producers agreements.<br />

If you could go back to the beginning of your<br />

career, what would you do differently and what<br />

would you tell your younger self?<br />

I spent five years, from 1995 to 2000 in so-called<br />

Big Five (i.e., Deloitte, PWC, Arthur Andersen,<br />

E&Y, Mazars) law and audit firms. I created my<br />

own law firm in November 2005, after 10 years as<br />

associate an then Of Counsel first in Deloitte and<br />

Robson Rhodes and then in Salans. That gave me<br />

knowledge of the financial matters and accounts<br />

which helps me today to render better services,<br />

not only legal, but global, integrating tax and<br />

finance in my advice. However, I think I spent too<br />

much time in these Big Five firms and that two<br />

years would have been enough and that I should<br />

have created my own law firm earlier, i.e., in 2002<br />

rather than 2005.<br />

I would tell younger lawyers to be aware and<br />

analyse your capacities and your limits and if you<br />

have the genuine ability, so jump and create your<br />

practice or your firm. Otherwise, you’d better be<br />

an in-house lawyer or a business manager.<br />

You have significant expertise in Music law and<br />

contracts, Media & Entertainment, International<br />

Taxation, and Business Law; what quirks do these<br />

sectors have that makes them unique?<br />

As I explained, nowadays artists now have their<br />

own labels and license their music to Majors. A<br />

music label in the current international context<br />

of social media and streaming needs more than<br />

a mere intellectual property lawyer but a lawyer<br />

who handles music law, as well as international<br />

taxation, business law and media.<br />

“<br />

Nowadays artists<br />

now have their own<br />

labels and license their<br />

music to Majors<br />

“<br />

For example, an endorsement agreement raises<br />

issues in terms of music licensing, trademarks,<br />

social media, commercial law, live performance<br />

and withholding taxes. With MANSWELL, the<br />

artists benefit from a global advice integrating<br />

all that issues in the negotiation and drafting of<br />

the contracts. I recently negotiated and drafted<br />

the Musical Ambassador agreement of David<br />

Guetta with UEFA for the football championship<br />

EURO 2016 with the legal Department of UEFA<br />

what has been a very exciting and enriching<br />

experience for all of us and we achieved a good<br />

deal in an international context.<br />

Finally, I would say that I am specialist of no<br />

matter but specialist of all matters: I’m used to<br />

say that I am the “Jim Phelps” of Lawyers, in<br />

reference with the legendary leader of TV series<br />

“Mission Impossible” to the extent that in addition<br />

to what I do myself with my partner and my<br />

associates, I have a know-how for finding the<br />

right strategy, as well as for negotiations than<br />

for litigation, planning worldwide missions and<br />

selecting the top-guns for the teams dedicated<br />

to each mission and leading them.<br />

What are the most common challenges you face<br />

within your role? How do you navigate them?<br />

I have a very clear position on conflict interest: I<br />

never advise Majors and I am still artist oriented.<br />

Of course, when your artist and his own label<br />

has licensed a Major or when he (she) entered<br />

into a publishing or co-publishing agreement<br />

with a Major publisher (SONY ATV, UNIVERSAL<br />

PUBLISHING, WARNER CHAPPELL…), you have to<br />

be aware of both the common interest and your<br />

artist’s interest and navigate saving your artist’s<br />

interest while saving the contractual balance.<br />

What motivates you?<br />

I am motivated by the challenges faced in the<br />

matters I deal with and to see the benefits of my<br />

work for my clients. Sometimes, I advise them<br />

against what their “affect” tells them to do but<br />

it may takes some time, may be 1 year or more<br />

before they tell me: you were right, fortunately I<br />

followed your advice.<br />

Is there anything else you would like to add?<br />

As a conclusion, I would say that my mission is<br />

often more than telling clients what is the law<br />

applied to your facts but rather anticipating,<br />

setting strategy and tactics, as well as in litigations<br />

and in negotiations: a true game of chess!<br />

Furthermore, advising artists and their labels in<br />

a sector in speed evolution is something very<br />

exciting and challenging, making you feel that<br />

tomorrow will be more exciting than today!. LM<br />

www.lawyer-monthly.com

30 WilmerHale<br />

ISSUE 64-15<br />

CORPORATE<br />

CRIME<br />

HOW TO IDENTIFY IT AND WHAT<br />

TO DO WHEN YOU DO<br />

In recent years, it has not been unusual to see, on a daily basis, a<br />

news report where a business has been either the victim, or the<br />

perpetrator, of crime. The financial services, engineering, mining<br />

and pharmaceutical sectors have all been the subject of high<br />

profile investigations which, in some cases, have resulted in multimillion<br />

pound fines. So what are the danger areas, and what<br />

should a company do if they suspect criminal activity within their<br />

business? We find out from an exclusive article by Christopher<br />

David, Counsel at WilmerHale.<br />

Before looking at these potential<br />

areas to be aware of, it is important<br />

to understand how a company can<br />

be guilty of a criminal offence. In<br />

general terms, a company is a legal<br />

person capable of being prosecuted for<br />

most criminal offences. At present, (although<br />

reform is currently being considered),<br />

corporate criminal liability is based on<br />

the identification principle, often called<br />

“directing mind” liability. This essentially<br />

means that the offence must be attributable<br />

to someone who, at the material time, was<br />

the ‘directing mind and will’ of the company.<br />

In reality, this means that it will normally only<br />

be senior officers of a company at, or close<br />

to, board level whose acts can be identified<br />

with the company in this way (as opposed<br />

to those acting merely as the company’s<br />

agent). That said, irrespective of the legal<br />

position of the company itself, other concerns<br />

arise if criminal conduct is confined to<br />

junior employees – these concerns include<br />

potential linked civil liability and reputational<br />

harm and mean that a company should be<br />

vigilant for any instances of criminality.<br />

The most common corporate criminal<br />

offences which arise are fraud and corruption.<br />

Fraud is a broad term which covers any act<br />

of deception intended for personal gain or<br />

to cause a loss to another party. Common<br />

examples include false accounting,<br />

insurance fraud, mortgage fraud, Ponzi<br />

www.lawyer-monthly.com

ISSUE 64-15<br />

WilmerHale<br />

31<br />

schemes, procurement fraud and pyramid<br />

schemes. Corruption is an agreement to<br />

directly or indirectly give, offer or promise,<br />

anything of value to influence someone so<br />

as to obtain or retain a business advantage.<br />

The UK Bribery Act prohibits the giving and<br />

receiving of bribes to both private individuals<br />

and public officials and, in addition, the law<br />

specifically criminalises a company who fails<br />

to prevent a person associated with it bribing<br />

someone with the intention of benefiting the<br />

company. This means that a company can<br />

be liable for the conduct of any third party<br />

who acts on their behalf. Third parties include<br />

agents, distributors, consultants, resellers<br />

and vendors. There is though a complete<br />

defence, if the company can show it had in<br />

place ‘adequate procedures’.<br />

This concept of ‘adequate procedures’, in<br />

addition to providing a legal defence under<br />

the Bribery Act, is also the tool by which<br />

a company can try and identify criminal<br />

conduct. For reasons of space, it is not possible<br />

to go into detail with regards to what systems<br />

and controls a company should have, but if<br />

only one thing is kept in mind it is that there<br />

is no point in having in place a complex set<br />

of policies and procedures if the end result is<br />

that no one from within the business reads or<br />

follows them.<br />

Each business will require its own clear and<br />

concise set of systems and controls that suit<br />

its particular industry and structure but there<br />

are two areas on which particular focus<br />

should be made – employee expenses and<br />

third parties. The reasons for a robust expenses<br />

policy are self-evident; this is an area where<br />

it is not unusual for employees to attempt<br />

to defraud the company, sometimes on a<br />

large scale. In addition to sensible oversight<br />

over expense claims, a good expenses policy<br />

(and associated controls) should ensure that<br />

there are suitable checks to identify unusual<br />

expense claim patterns which could identify<br />

fraud or corruption.<br />

The use of third parties to conduct business<br />

or act on behalf of a company is another<br />

notorious danger area, not least as a<br />

company can be liable under the Bribery Act<br />

for the acts of its third parties. It is, therefore,<br />

essential that appropriate due diligence is<br />

done on all new third parties so as to ensure<br />

that the company know who they are dealing<br />

with and can rely on them, as far as possible,<br />

to act in a legal and ethical manner.<br />

Unfortunately, no matter how robust a<br />

company’s systems and controls are, it<br />

is almost inevitable that at some point,<br />